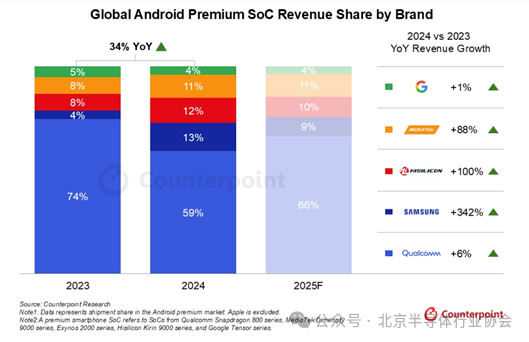

(Source: counterpointresearch)In 2024, revenue from high-end Android smartphone SoCs is expected to grow by 34% year-on-year, driven by increased demand for high-end smartphones and the launch of more powerful AI platforms.Qualcomm remains the market leader with a growth rate of 6%. Although Qualcomm lost market share to Samsung’s Exynos in the Galaxy S24 series, it is expected to regain market share in 2025 as the Galaxy S25 series has exclusively chosen the Snapdragon 8 Elite SoC.Samsung has seen a revenue rebound thanks to the design advantages of Exynos in the Galaxy S and A series, with an average annual growth of four times. However, revenue may decline again in 2025, highlighting the instability of Exynos’s performance.HiSilicon is making a strong comeback in the high-end market in China, with its revenue share reaching 12% in 2024, driven by a loyal customer base and deep integration with the Harmony operating system. By 2025, Huawei is expected to maintain its position as the third-largest brand in terms of revenue share in the Android high-end market.MediaTek’s revenue from high-end smartphone SoCs nearly doubled, thanks to the strong performance of the Dimensity 9300 series and the launch of the Dimensity 9400.According to the “Global Smartphone SoC Revenue and Forecast Tracking Report for Q4 2024” released by Counterpoint Research, revenue from high-end Android smartphone SoCs is expected to grow by 34% year-on-year in 2024, driven by strong consumer preference for high-end smartphones. The increase in shipment volume and average selling price also contributed to revenue growth. Overall Growth Trends and UncertaintiesCounterpoint Senior Analyst Parv Sharma commented on the global high-end smartphone SoC market, stating: “This segment accounts for 52% of the total revenue from Android smartphone SoCs in 2024. With the return of HiSilicon and the rise of MediaTek, competition is intensifying. The average selling price and revenue growth of SoCs are primarily driven by AI capabilities on devices, with strong NPUs and larger chip sizes pushing demand towards advanced nodes, which in turn leads to increased semiconductor content and wafer costs.”Regarding global trade dynamics, Sharma commented: “Despite strong growth in the high-end market, ongoing tariff uncertainties pose risks for brands that are active in China and seeking diversification. Apple is looking to diversify, but assembling Pro/ProMax models outside of China will take time. In the Android space, Google and Motorola are receiving more attention, while Samsung is in a more favorable position, as its diversified manufacturing base provides opportunities for Qualcomm to expand its share in the important U.S. market.”Qualcomm Maintains Leadership in the High-End Market, MediaTek Shows Strong GrowthWith the support of Samsung and Chinese OEM partners, Qualcomm dominates the global high-end Android SoC market. Meanwhile, MediaTek’s growth is currently focused on the Chinese market, primarily through promotions of high-end smartphones from vivo and OPPO.Commenting on the growth of Qualcomm and MediaTek, Counterpoint Research analyst Shivani Parashar stated: “By 2025, Qualcomm is expected to maintain its dominant position in the high-end Android SoC market, thanks to its exclusive collaboration with Samsung on the Galaxy S25 series and design wins with all Android OEMs except Google Pixel. Qualcomm has introduced custom Oryon cores in the Snapdragon 8 Elite, which excel at handling latency-sensitive tasks and distributing AI workloads. Qualcomm is well-positioned with its AI stack and partnerships across the ecosystem, providing a streamlined experience for deploying AI on devices through optimized models and software/APIs.”Parashar added: “Meanwhile, MediaTek has become a strong competitor in the high-end SoC market. It has established strategic partnerships with OEMs such as vivo, OPPO, and Xiaomi to co-develop high-end products and secure a foothold in the high-end SoC market. With the latest Dimensity 9400, MediaTek has demonstrated impressive CPU and AI performance, focusing on efficiency and value. To sustain growth, MediaTek must focus on global flagship brands, developer partnerships, and trust.”Samsung’s High-End Revenue Grows Exponentially, HiSilicon Returns to the Chinese High-End MarketDriven by strong sales of the Galaxy S24, Samsung’s revenue from high-end smartphones quadrupled in 2024, but revenue may decline in 2025 due to the Galaxy S25 series failing to win design awards. In 2024, HiSilicon made a strong comeback in China with the Pura 70 and Mate 70 series. By 2025, HiSilicon is expected to remain the third-largest high-end Android brand by revenue.Commenting on the performance of Samsung and HiSilicon, Counterpoint Research analyst Akash Jatwala stated: “The application of Exynos 2400 in the Galaxy S24 series helped Samsung achieve exponential revenue growth in 2024, while its share increase in other mid-to-high-end models also supported Samsung. However, foundry issues have affected the application of Exynos in high-end smartphones. The growth in adoption will depend on whether Samsung’s foundries can scale the next generation of high-end SoCs on the 2nm process with higher yields.”Jatwala commented on HiSilicon’s performance: “HiSilicon has a strong and loyal customer base in China, and the Pura 70 and Mate 70 series have helped it increase market share in 2024. By 2025, although HiSilicon will launch several SoCs based on older process nodes, it will still maintain its position as the third-largest brand by revenue share, as its high-end smartphone market is gradually closing in on MediaTek. However, due to supply chain uncertainties, adoption of leading process nodes, and limited geographic coverage caused by the lack of Google Mobile Services, HiSilicon’s long-term growth will still face uncertainties.”

Overall Growth Trends and UncertaintiesCounterpoint Senior Analyst Parv Sharma commented on the global high-end smartphone SoC market, stating: “This segment accounts for 52% of the total revenue from Android smartphone SoCs in 2024. With the return of HiSilicon and the rise of MediaTek, competition is intensifying. The average selling price and revenue growth of SoCs are primarily driven by AI capabilities on devices, with strong NPUs and larger chip sizes pushing demand towards advanced nodes, which in turn leads to increased semiconductor content and wafer costs.”Regarding global trade dynamics, Sharma commented: “Despite strong growth in the high-end market, ongoing tariff uncertainties pose risks for brands that are active in China and seeking diversification. Apple is looking to diversify, but assembling Pro/ProMax models outside of China will take time. In the Android space, Google and Motorola are receiving more attention, while Samsung is in a more favorable position, as its diversified manufacturing base provides opportunities for Qualcomm to expand its share in the important U.S. market.”Qualcomm Maintains Leadership in the High-End Market, MediaTek Shows Strong GrowthWith the support of Samsung and Chinese OEM partners, Qualcomm dominates the global high-end Android SoC market. Meanwhile, MediaTek’s growth is currently focused on the Chinese market, primarily through promotions of high-end smartphones from vivo and OPPO.Commenting on the growth of Qualcomm and MediaTek, Counterpoint Research analyst Shivani Parashar stated: “By 2025, Qualcomm is expected to maintain its dominant position in the high-end Android SoC market, thanks to its exclusive collaboration with Samsung on the Galaxy S25 series and design wins with all Android OEMs except Google Pixel. Qualcomm has introduced custom Oryon cores in the Snapdragon 8 Elite, which excel at handling latency-sensitive tasks and distributing AI workloads. Qualcomm is well-positioned with its AI stack and partnerships across the ecosystem, providing a streamlined experience for deploying AI on devices through optimized models and software/APIs.”Parashar added: “Meanwhile, MediaTek has become a strong competitor in the high-end SoC market. It has established strategic partnerships with OEMs such as vivo, OPPO, and Xiaomi to co-develop high-end products and secure a foothold in the high-end SoC market. With the latest Dimensity 9400, MediaTek has demonstrated impressive CPU and AI performance, focusing on efficiency and value. To sustain growth, MediaTek must focus on global flagship brands, developer partnerships, and trust.”Samsung’s High-End Revenue Grows Exponentially, HiSilicon Returns to the Chinese High-End MarketDriven by strong sales of the Galaxy S24, Samsung’s revenue from high-end smartphones quadrupled in 2024, but revenue may decline in 2025 due to the Galaxy S25 series failing to win design awards. In 2024, HiSilicon made a strong comeback in China with the Pura 70 and Mate 70 series. By 2025, HiSilicon is expected to remain the third-largest high-end Android brand by revenue.Commenting on the performance of Samsung and HiSilicon, Counterpoint Research analyst Akash Jatwala stated: “The application of Exynos 2400 in the Galaxy S24 series helped Samsung achieve exponential revenue growth in 2024, while its share increase in other mid-to-high-end models also supported Samsung. However, foundry issues have affected the application of Exynos in high-end smartphones. The growth in adoption will depend on whether Samsung’s foundries can scale the next generation of high-end SoCs on the 2nm process with higher yields.”Jatwala commented on HiSilicon’s performance: “HiSilicon has a strong and loyal customer base in China, and the Pura 70 and Mate 70 series have helped it increase market share in 2024. By 2025, although HiSilicon will launch several SoCs based on older process nodes, it will still maintain its position as the third-largest brand by revenue share, as its high-end smartphone market is gradually closing in on MediaTek. However, due to supply chain uncertainties, adoption of leading process nodes, and limited geographic coverage caused by the lack of Google Mobile Services, HiSilicon’s long-term growth will still face uncertainties.”