Reviewing the development of humanoid robots: from the technology verification period to the commercial trial period, Tesla leads the exploration of commercialization.

The transition from the technology verification period to the commercial trial period shows a stark contrast in industrialization.

Humanoid robots have been born for more than 30 years, transitioning from the technology verification period to initial commercialization, with product mobility continuously improving as technology breakthroughs occur. The development of humanoid robots can be divided into three main stages: the first stage (1973-2000) is the technology startup period, represented by Waseda University’s Ichiro Kato team’s humanoid robots, where robots achieved bipedal walking but moved slowly; the second stage (2001-2015) is the technology breakthrough period, represented by Honda’s ASIMO, a stage of highly integrated system development, where the functionality and performance of robots saw significant breakthroughs, achieving initial mobility, during which the NAO robot achieved commercialization in higher education settings; the third stage (2016 to present) is the industrialization trial period, represented by Boston Dynamics’ Atlas, a stage of high dynamic motion development, where robotic technology has a certain foundation, enabling it to perform actions such as “parkour” and exploring human-robot interaction, transportation, and other practical scenarios.

By 2023, Tesla has evolved from a concept to a physical entity capable of completing complex movements, potentially leading the industry into a new development stage. From August 2021 to May 2023, in less than two years, Optimus has transitioned from concept to prototype, with the product evolving from needing human support and being unable to work to being able to walk flexibly, grasp objects, and drop eggs without breaking them, significantly improving torque control and safety in human collaboration. Tesla has quickly grown from an industry newcomer to a leader in product offerings. At the same time, Tesla’s robot has leveraged the experience of domestic automotive supply chains, providing a new idea for industrial mass production, and we are optimistic that Tesla will lead the industry into the next new development stage.

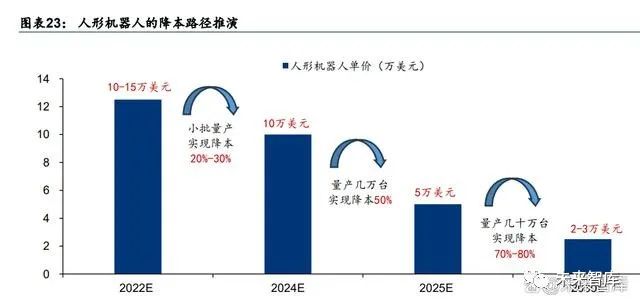

Market participants are mainly technology companies, with initial technological foundations but no unified solutions, resulting in a stark contrast in commercialization. Since Honda released the first humanoid robot ASIMO in the early 21st century, many technology companies and universities around the world have begun research and development of humanoid robots. Looking at global products, there are significant differences in practical scenarios and technological paths, with a large variance in commercialization. Currently, those progressing rapidly in commercialization include Tesla’s Optimus and UBTECH’s Walker, while successfully commercialized products include SoftBank’s NAO for children’s education, Boston Dynamics’ Spot for handling and filming, and 1X Technologies’ EVE robot for nighttime patrols, while some “veteran” products in the industry, such as Honda’s ASIMO and SoftBank’s Pepper, have been discontinued. Through analysis, we find that the success and failure of product commercialization share certain commonalities: products that fail to commercialize generally have the following characteristics: (1) Poor mobility or practicality, remaining in the exhibition stage, failing to find suitable commercialization scenarios, such as SoftBank’s Pepper, which is priced similarly to another robot product, NAO, but has weaker hardware and lower reliability, only used for exhibitions, leading to commercial failure, while NAO aimed at educational scenarios successfully achieved commercialization; (2) High costs. Honda initially hoped ASIMO would commercialize in elderly care scenarios, but its price reached 3-4 million USD, leading to ASIMO’s retirement in March 2022.

The degree of freedom of robots is positively correlated with mass production costs. The commonality among robots that have progressed rapidly in commercialization is that they target vertical scenarios and match corresponding degrees of freedom, with moderate costs acceptable to the market. For example, the EVE robot is specifically used for security and nighttime patrols, with a dual-wheel structure in its legs, which, while unable to overcome obstacles, meets the basic needs of nighttime patrols, priced at only 320,000 yuan. Meanwhile, Tesla’s Optimus balances the contradiction between robot freedom and mass production costs by leveraging advantages from the automotive supply chain, capable of completing clear commercial objectives such as walking, lifting objects, etc., with a target mass production price of only 20,000 USD, which is one-tenth the price of comparable robot products capable of walking and handling objects.

From the specific product solutions of mainstream humanoid robot manufacturers, besides Boston Dynamics’ Atlas, which uses hydraulic drive solutions to achieve high-level motion performance at a weight of 80kg and a speed exceeding 5km/h, most other manufacturers adopt servo motors + harmonic reducers or rotary motor solutions, with weights around 50-70kg and speeds around 3km/h:

(1) Boston Dynamics’ Atlas: Achieves high-level motion performance with hydraulic drive, but the high manufacturing costs hinder commercialization; currently at the laboratory stage: (a) Drive: Uses hydraulic drive solutions, with customized batteries + valves + hydraulic power units providing high power for all 28 degrees of freedom to complete high-load and more flexible movements. (b) Motion control: Autonomously selects and executes actions from a behavior library, adjusting details through a model predictive controller (MPC) during execution, currently capable of autonomous path planning. (c) Perception: Transitioned from a “lidar + stereo sensor” scheme to an “RGB camera + ToF sensor” scheme for constructing 3D maps. (d) Shortcomings: The manufacturing cost of hydraulic systems is high, with Atlas’s landing cost reaching 2 million USD, which severely restricts commercialization.

(2) Engineered Arts’ Ameca: Approaches human-like facial expressions and body movements, excelling in human-robot interaction, but lacks significant practical commercial use. Ameca focuses on human-robot interaction, achieving realistic facial expressions and body movements, further optimizing interaction effects after integrating GPT3/3.5/4. Ameca’s underlying system uses the Robot Operating System Tritium and the Engineering Arts system Mesmer, where the former is responsible for the linkage of mechanical structures, and the latter provides rich facial expressions and body movements, priced around 130,000 USD; however, it cannot walk and is only aimed at entertainment and performance scenarios.

(3) Agility Robotics’ Digit: Headless, mainly used for logistics and law enforcement, expensive with a small scale of commercialization. Digit has 16 degrees of freedom, can bend its knee joints backward, and supports most software APIs for user development, offering higher machine balance and more flexible application scenarios. This project is backed by Amazon, mainly used in logistics warehouse delivery scenarios and non-weapon scenarios in the military, delivering 2 units to Ford in 2020 and 40-60 thousand units in 2021, priced at 250,000 USD.

(4) UBTECH’s Walker: Focuses on entertainment scenarios for domestic robots. (a) Motion control: Uses purely motor-driven solutions (rotary motors, servo motors + harmonic reducers); (b) Environmental perception: U-SLAM visual navigation + hand force sensors + high-precision inertial navigation for knees + ultrasonic sensors at the navel; (c) Can achieve multi-modal emotional interaction, with outstanding entertainment performance, and can complete numerous high-explosive and fine work after pairing with high-performance servo drivers, priced at 600,000 USD.

(5) Unitree’s H1: The first full-size humanoid robot in China capable of running. (a) Motion control: The H1 humanoid robot has 19 degrees of freedom (10 for legs + 1 for waist + 8 for hands), using Unitree’s self-developed high-torque high-power M107 joint motors, paired with hollow shafts and dual encoders, with a peak torque of 360N·m, significantly improving mobility, speed, endurance, and load capacity; (b) Environmental perception: Equipped with 3D lidar and a depth camera to achieve 360° panoramic depth perception; (c) Application: The H1 humanoid robot stands 180cm tall, weighs 47kg, and can reach a speed of 5.4km/h (1.5m/s), priced at or below 90,000 USD.

(6) Xiaomi’s Cyberone: Achieves perception of human emotions and three-dimensional space, creating efficient human-robot interaction. (a) Motion control: Stands 177cm tall, weighs 52kg, with a speed of 3.6km/h, has 21 degrees of freedom, and uses a fully mechanical joint module, with upper limb joints using efficient motors rated at 30N·m, and hip joints using motors with a peak torque of 300N·m, combined with self-developed humanoid biped control algorithms for smoother walking posture. (b) Perception module: Equipped with the Mi-Sense depth vision module, combined with AI algorithms, capable of perceiving 3D space and recognizing individuals, gestures, and expressions. (c) Application: Cyberone achieves human-robot interaction, emotion perception, and three-dimensional space perception, priced at 600,000-700,000 yuan, not yet mass-produced, equipped with MiAI environmental semantic recognition engine and MiAI voice emotion recognition engine, capable of recognizing 85 types of environmental sounds and 45 types of human emotions, while its facial OLED module can display real-time interaction information.

(7) Zhiyuan Robotics’ Expedition A1: Adopts a modular design for upper and lower limbs, with BYD as a shareholder. (a) Motion control: Stands 175cm tall, weighs 55kg, with a single arm load of 5kg, walking speed of 7km/h, core joint motors using collinear drive solutions, adopting radial flux, low-tooth slot design external rotor motors, with planetary transmission reducers with high torque transparency, achieving 49 degrees of freedom. The dexterous hand has 12 active degrees of freedom and 5 passive degrees of freedom, allowing for flexible tool changes at the end. (b) Perception module: A1 is equipped with Zhiyuan’s self-developed robot runtime middleware system AgiROS and language task model WorkGPT, enabling complex semantic multi-level reasoning capabilities, while utilizing Zhiyuan’s embodied intelligent architecture EI-Brain, capable of continuous self-learning and reinforcement during task execution. (c) Application: A1’s industrialization path may be industrial intelligence manufacturing → home → research, and its upper and lower limb modular design is expected to expand more commercial scenarios. In August 2023, Zhiyuan added several shareholders, including BYD, BlueChips Venture Capital, and Wofu Venture Capital, with BYD’s subscribed capital contribution of about 1.915 million yuan, holding a 3.76% stake.

(8) Fourier Robotics’ GR-1: Focuses on rehabilitation robots, initially capable of bipedal walking. GR-1 stands 1.65 meters tall, weighs 55 kilograms, with a speed of 5KM/h, and has 40 degrees of freedom, using electric drive solutions and 40 self-developed FSA high-performance integrated actuators, among which the integrated actuators combine motors, drives, reducers, and encoders. The maximum torque of the joint module can reach 300N·m, while employing a linkage method in the transmission system, providing strong and flexible motion performance. Currently, GR-1 is applied in research education, AI embodied intelligence ontology, security patrols, and other scenarios.

Underlying Logic of Development: Approaching Human-like Mobility is a Prerequisite for Landing; Suitable Costs and Vertical Scenarios are Prerequisites for Commercialization

Looking at the iteration history of robot products, we believe the industry follows the iterative path of “achieving certain degrees of freedom → increasing degrees of freedom → longer operational time,” from “being able to move → performing well in movement → longer movement time.” Outstanding product capability only reflects the robot’s degrees of freedom approaching humans, which does not mean successful industrialization. We believe humanoid robots currently operate in a “supply determines demand” market, where the broadening of commercialization scenarios relies on the supply capacity boundaries of market players, where software capability directly impacts the robot’s operational control performance, which may be the determining factor for product capability ceilings, while mass production costs are key to the robot’s successful transition from the laboratory to the market, locking in feasible commercialization scenarios. In summary, we believe the underlying logic of humanoid robot industrialization can be summarized as: lock in deep/broad scenarios → match and increase degrees of freedom → ensure mass production costs are acceptable to the market.

Product Capability: Software Capabilities Determine the Product Capability Ceiling, Hardware Degrees of Freedom Ensure Human-like Movement Functions

Software capabilities constitute the underlying technology of robots, determining the height of the product capability ceiling, while hardware serves as the execution mechanism of the brain’s decision-making layer, determining the extent to which robots can achieve human-like movement capabilities. The design idea of humanoid robots is to first reduce the dimensions of dynamics, simplifying human structures into dozens of degrees of freedom; then perform control dimension reduction, using motion control algorithms, visual perception algorithms, language models, etc., to control the robot’s movements, with hardware over-specifying high-precision joints, combined with software-level planning control to achieve high-performance motion capabilities; finally, select suitable batteries, thermal management, and hardware loss solutions to extend the robot’s usage time. Among these, we believe the underlying technology of robots lies in software capabilities for operational control and perception algorithms as well as language models, akin to the human brain area, while the hardware side is responsible for executing commands from the brain’s decision-making layer (software side), ensuring the realization of human-like movement functions. From a technical progress perspective, perception algorithms and language models have developed rapidly, and the next leap in robot product capability may hinge on operational control algorithms and joint capabilities. Specifically:

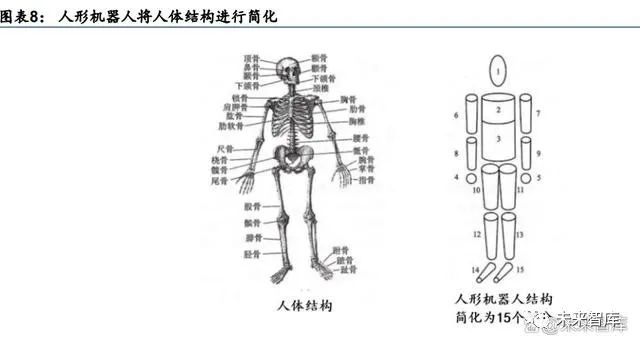

(1) “Can Move”: Dimensionality Reduction of Dynamics. The human body controls 244 degrees of freedom through approximately 630 muscles and 230 joints, while humanoid robots simplify human structures into several parts and dozens of degrees of freedom, creating a high-degree-of-freedom and strongly non-linear dynamic system that continuously approaches human movement capabilities, i.e., performing dimensionality reduction of dynamics. Generally speaking, the number of degrees of freedom is positively correlated with the robot’s working ability and cost; currently, robots capable of certain movement functions have degrees of freedom ranging from 30 to 60, corresponding to high prices. For example, Tesla Optimus has achieved 28 degrees of freedom, with the upper body comprising 6 degrees of freedom for shoulders + 4 degrees for elbows + 2 degrees for wrists + 2 degrees for the waist, and the lower body comprising 2 degrees for hips + 2 degrees for thighs + 2 degrees for knees + 2 degrees for calves + 2 degrees for ankles, with a total of 11 degrees for the hands.

(2) “Moves Well”: Dimensionality Reduction of Control. On the basis of being able to move, robots need to perform dimensionality reduction of control for human-like movement performance. Humanoid robots typically adopt a combination of over-specifying hardware (equipping precise joints and actuators) + software assembly (including using operational control algorithms, visual perception algorithms, language models, etc. Currently, AI technology has introduced simulation schemes to optimize control capabilities); we believe this area is a key focus for various manufacturers. Software capabilities determine the ceiling of the robot’s product capability, while the degree of hardware matching and response determines the extent of the product’s landing. The typical operational control process of hardware is: CPU sends commands to the controller → the controller performs motion planning & sends signals to the driver → the driver sends control signals to the motor → the executing motor completes the corresponding command, where the controller needs to ensure the synchronization of algorithm output inputs, and the embedded control algorithms also need to shorten delays. Currently, perception algorithms and language models have achieved certain technical breakthroughs, while control algorithms for hands and lower limbs still have room for improvement.

(3) “Moves for Long”: Reducing Losses, Extending Lifespan. Important factors affecting robot performance and lifespan include thermal management and battery systems, mainly because the robot’s joint modules integrate numerous components, and during normal operation, heat sources such as transmission systems, motor windings, and brake coils within the joint housing can increase component wear and reduce lifespan; for example, the total power loss from the heating of harmonic reducers can reach 30%. Meanwhile, the current operational time of humanoid robots is around 2 hours, and generally, batteries are built-in, requiring the battery system to maximize power endurance within limited space and weight constraints. However, considering that the current industry is in the commercial trial period, we believe that enhancing the robot’s movement capabilities takes priority.

Commercialization: Depth and Breadth of Scenarios Determine Commercialization Probability; Breaking Through Depth is a Prerequisite for Expanding Breadth

We believe the ultimate goal of humanoid robots is to approach human-like degrees of freedom, but high degrees of freedom correspond to high manufacturing costs. In the current early development stage of the industry, manufacturers must balance scenario breadth (commercialization space) and scenario depth (commercialization difficulty, including product capability and mass production costs) to achieve commercialization. At the same time, we believe that robots breaking through scenario depth is a prerequisite for expanding scenario breadth. Robots may first lock in vertical application scenarios, continuously enhance technical capabilities, and reduce mass production costs, thereby covering more extensive scenarios to expand the market. Based on the breadth and depth of scenarios, we divide the commercialization of humanoid robots into four quadrants: (a) Large commercial space + low commercialization difficulty: represented by household service robots like vacuum cleaners, which have a lower product capability ceiling than humanoid robots and have already achieved commercialization; (b) Small commercial space + low commercialization difficulty: such as human-robot interaction, education, exhibition delivery, and shopping guide robots; (c) Large commercial space + high commercialization difficulty: such as logistics transportation, warehouse management, factory collaboration, and care robots; (d) Small commercial space + higher commercialization difficulty: typically for special needs robots, such as nuclear facility maintenance and firefighting rescue. We believe that the currently promising development potential lies in scenarios with both breadth and depth, such as logistics transportation, factory collaboration, and security services, which are expected to achieve breakthroughs in mass production under the combined efforts of supply and technology.

The Constraints of General Scenario Commercialization Lie in the Slow Product Iteration Due to Soft-Hard Coupling and High Mass Production Costs Due to Hardware Over-specification

Taking the development and commercialization process of Boston Dynamics’ Atlas as an example, its actual iteration speed has been relatively slow. Between 2017 and 2020, it completed stable and rapid movements over obstacles, aerial turns, backflips, etc., before introducing model predictive control technology to smooth action transitions, and only then introduced algorithms for autonomous navigation. We believe Atlas epitomizes the difficulties in commercializing humanoid robots, where the surface issue is inadequate operational control capabilities and a lack of large-scale application scenarios downstream. The essence lies in:

(1) Both soft and hard capabilities have shortcomings, with soft-hard coupling leading to slow product performance iteration. In terms of technical capabilities, the software robustness of robots is relatively poor, and often adopts hardware over-specification strategies under the dimensionality reduction of dynamics and control, where high-precision hardware is more prone to damage. In scenarios where both software and hardware have shortcomings, humanoid robot development requires continuous debugging, while traditional soft-hard coupling forms significantly slow down overall development progress, leading to slow product performance iteration.

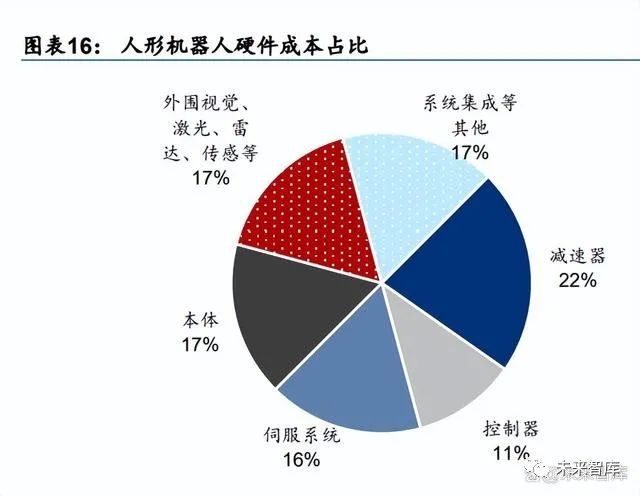

(2) Hardware over-specification leads to high mass production costs. The dimensionality reduction of dynamics and control in humanoid robots drives product over-specification hardware to enhance operational control capabilities. The high-precision and easily consumable hardware leads to high mass production costs. In industrial robots, reducers + servo systems + controllers account for 61% of hardware costs, while humanoid robots add external sensors and other system integrations on top of actuators, further increasing total hardware costs and restricting mass production. For example, larger robots such as ASIMO and Atlas have individual costs of 2.5 million and 2 million USD, respectively; smaller products like NAO have mass production costs below 10,000 USD but have limited capabilities.

Following the First Principles: Decoupling Software and Hardware + Reducing Costs through Domestic Supply Chains + Deepening Scenario Exploration May Be Effective Paths for Commercialization

Technical Model: Referencing the Automated Driving Model of Fixed Hardware Embedding + Software OTA, Robots May Adopt a Soft-Hard Decoupling Approach

Under the hardware-defined robot paradigm, the realization of robot functionality = N*soft-hard solutions; under the software-defined robot paradigm, the robot may adopt a development model of N*embedded hardware + software upgrades. We believe the evolution of humanoid robot technical solutions mirrors that of intelligent driving, where both robots and smart cars follow the path of perception → planning → movement. The industrial experience of software-defined cars and soft-hard decoupling in intelligent driving is likely to be transplanted from four-wheeled vehicles to two-wheeled robots. From the industrialization experience of smart vehicles, soft-hard coupling prevents the main manufacturers from independently upgrading hardware or software, and any iteration or change of functionality requires coordinated development with hardware, making performance upgrades relatively slow. However, under the soft-hard decoupling + software-defined robot paradigm, robots can adopt hardware-first approaches, utilizing AI, large models, and simulation technologies to optimize algorithms to match and enhance hardware movement capabilities, thus accelerating performance upgrades. Additionally, the use of standardized and fixed hardware also facilitates the landing of general-purpose robots. Looking ahead, the technical model of humanoid robots may evolve from “N*soft-hard coupling solutions” to “N*fixed hardware + software upgrades.”

Cost Reduction Path: Tesla May Use New Processes + Domestic Supply Chains to Reduce Costs, While Other Manufacturers May Use AI + Reconstructing Supply Chains to Shorten Return Periods

The core software self-research + hardware outsourcing for operational control modules may be the main production model for robots. The core components of humanoid robots can be divided into battery systems, actuators, sensors, intelligent AI systems, and other structural units, involving technologies that can be simply divided into algorithm AI and other software types and operational control module hardware types. We believe software capabilities are the technical core of humanoid robots, including visual algorithms, NLP, motion planning algorithms, etc., which the main manufacturers may primarily develop in-house; while in the operational control module, mechanical transmission technology and high-performance servo system technology are relatively less important hardware design technologies, which manufacturers may mainly outsource. The value of joint hardware is high, which may spur strong cost reduction demands. From the perspective of hardware value, the joint execution part (reducer + controller + servo system) accounts for 49% of total hardware costs. Taking Tesla’s Optimus’s unproduced hardware scheme as an example, we estimate that the total cost of joints in the early unproduced stage is about 330,000 yuan, leaving about 58% cost reduction space to achieve the target price of 20,000 USD. We believe the key to Tesla’s cost reduction lies in reusing the automotive supply chain and high-cost-effective domestic supply chains, first achieving cost reductions for some high-value components, then releasing economies of scale through volume production to further lower overall manufacturing costs. The joint part accounts for 49% of total hardware costs, with high single-machine value, which we believe could be an early cost reduction area. According to our estimates, the BOM’s ultimate view shows that the joint part may have 84% cost reduction space: (1) Rotary joints: core components of frameless torque motors + harmonic reducers + torque sensors are estimated to account for 57% of costs, looking towards BOM’s ultimate view, we estimate single-machine prices have 50%/25%/100% reduction space, with rotary joints having 64% reduction space. (2) Linear joints: core components of motors + planetary roller screws + ball screws account for 60% of linear joint costs, looking towards BOM’s ultimate view, we estimate single-machine prices have 50%/150%/200% reduction space, with linear joint prices having 95% reduction space. (3) Finger joints: composed of miniature linear actuators, currently hollow cup motors, turbines, and other components are in the early stages of mass production, with single-machine prices expected to achieve 67% reduction after mass production, with overall single-machine prices having 88% reduction space.

Tesla Achieves a Closed Loop of Software-Hardware-Scenarios, Likely to Lead Commercialization

Based on the previous analysis, we believe the core constraint of humanoid robot commercialization lies in costs, while Tesla’s FSD industrial resource advantages are likely to empower Optimus’s commercialization: humanoid robots and FSD share high commonality in key capabilities such as data scheduling, data processing, and algorithm models, for instance, Optimus’s hardware production can share Tesla’s automotive supply chain; the software architecture of Optimus can apply FSD’s perception algorithms and planning control models (the regulatory control scenarios for robots are more complex), while robots involve indoor environmental modeling, drawing on FSD’s 3D map construction experience. In summary, we believe the mature software and hardware capabilities that FSD can migrate may accelerate the commercialization of humanoid robots. (1) Migration of vehicle-side algorithms: Optimus is equipped with Tesla’s self-developed chip (with single-chip computing power reaching 362TFLOPs), also sharing Tesla’s automotive autonomous driving software platform. We are optimistic that Tesla’s own autonomous driving technology will empower the robot’s machine vision algorithms, and the data accumulation and training models from FSD and Dojo will accelerate the optimization of robot functions, thus achieving cost reduction and efficiency enhancement. Specifically, in terms of algorithms, in November 2022, the AP team added Occupancy Network and Lane Network to the original perception algorithm model, further improving the accuracy and coverage of the perception model for corner cases. Optimus will use the same Occupancy Network as FSD to identify actionable areas, which may generate better 3D maps to compensate for Tesla’s lack of high-precision maps and radar in addressing long-tail issues. In terms of infrastructure, the Dojo supercomputer center is key for FSD big data training, characterized by high stability and high parallel computing power, providing more efficient data labeling and algorithm iteration, likely strengthening the robot’s algorithmic advantages. (2) Migration of supply chains: Due to the high over-specification of hardware and the large number of joints, humanoid robots have high mass production costs, but the robot supply chain has significant overlap with the electric vehicle supply chain. For instance, humanoid robots can share automotive chips, batteries, etc., and can adaptively modify and reuse motors, electronics, thermal management, etc. We are optimistic about Optimus’s connection with FSD’s supply chain and the sharing of Tesla’s domestic supply chain advantages, achieving large-scale cost reduction.

Technical Routes Yet to Be Determined: Software Determines the Product Capability Ceiling, Hardware Solutions Flourish

Taking Tesla Optimus as an example, the technical solution of humanoid robots includes both software and hardware layers, with the latter divided into control modules, perception modules, motion modules, power modules, and thermal management assembly modules. We believe that software capabilities determine the ceiling of robot product capabilities, while hardware capabilities determine the extent of robots’ landing. Currently, AI technologies and large models, such as ChatGPT, PaLM-E, etc., are helping robots approach embodied intelligence. The hardware technical solutions are like a building block process, where the core lies in the manufacturer’s balance between cost and performance. The control module is similar to the human “brain”; in terms of perception modules, Tesla’s pure vision route and autonomous driving lidar route clarify the technical route for robot manufacturers, while the ultimate solution’s landing may depend on the development progress of visual AI technology and the slope of the cost reduction curve for lidar. The segments with the most significant technical variability are the motion modules, specifically the screws for linear joints, reducers for lower limb rotary joints, and connecting rods. The motion module includes driving/executing devices and transmission devices, where Tesla Optimus integrates the motion module and some perception modules into a unified joint, with a total of 40 actuators achieving 57 degrees of freedom (with 14 actuators for rotary joints + 14 for linear joints in the body, and 12 for hands).

Innovations in Software Capabilities Help the Industry Overcome Technical Pain Points; 2023 May Be the Year for Humanoid Robots

At this current moment, we believe humanoid robots have preliminarily broken through some technical constraints in the software domain, and 2023 may be the year for industrialization: AI and large models deeply empower the perception and planning layers of robots, helping them approach embodied intelligence. For instance, in November 2022, OpenAI launched ChatGPT, planning to empower robots with zero-shot task planning, human-robot interaction, visual assistance, and logical judgment capabilities to control robots using language and text; in March 2023, Google released the PaLM-E model, integrating the capabilities of ViT Vision Transformer with 22 billion parameters and PaLM’s 540 billion parameters, which can control the robot’s vision and language; in May 2023, NVIDIA launched the multi-modal embodied intelligent system NVIDIA VIMA, marking another significant advancement in AI capabilities, which is expected to significantly enhance robots’ intelligence levels, human-robot interaction capabilities, and self-compilation capabilities.

Hardware Solutions Flourish, Tesla’s Solutions Discussed More Frequently in Terms of Joints

The joint capabilities of the motion module may determine the degree of industrialization of robots. Robots with high-level motion capabilities require a high degree of matching between hardware joint capabilities and software motion trajectory planning. Currently, breakthroughs in AI algorithm technology have driven the development of the motion planning layer, raising higher requirements for the operational control capabilities of joints. However, the current technical solutions are diverse, and the ultimate solution has yet to be finalized, requiring continuous tracking of the latest developments.

Tesla’s Joint Solutions: Integrating Motion Modules and Some Perception Modules into Unified Joints, Compact and Efficient Load

Taking the technical solution of Tesla’s Optimus motion module as an example, from its press conference, Optimus integrates the motion module and some perception modules into one, with the body using 14 actuators for rotary joints + 14 for linear joints, and 12 for hands. Based on its press conference, we speculate on the current hardware solutions of existing joints as follows: (1) Rotary joints (using rotary actuators) = permanent magnet brushless motors + harmonic reducers + torque sensors + position sensors + cross roller bearings + radial thrust ball bearings + structural components. The subsequent potentially variable parts include reducers, which may have incremental components such as IMUs. (2) Linear joints (using linear actuators) = permanent magnet brushless motors + ball screws or planetary roller screws + torque sensors + position sensors + deep groove ball bearings + four-point contact ball bearings + structural components. The subsequent potentially variable parts include screws, with torque sensors possibly using six-dimensional torque sensors, and potentially having incremental components such as IMUs. (3) Dexterous hand joints = hollow cup motors + precision planetary gearboxes + position sensors + torque sensors.

Reducers: Academia Proposes High Load + Low Cost Planetary Reducer Solutions, While the Industry Innovatively Uses Linkage Methods to Replace Planetary Roller Screws

Reducers serve as the transmission devices between power sources and actuators, applying different types of products based on load and volume requirements. Reducers are purely machined parts with high technical barriers, and humanoid robots mainly use precision reducers. The more flexible a robot is, the more joints it has, and the more reducers it uses, while different parts’ load requirements apply different products: (a) For low-load parts like hands and forearms: harmonic reducers, which are small in size and low in load, where the reduction ratio determines output force, with fingers possibly using diameters of 20mm, elbows using 30-40mm, and shoulders using 50-60mm. Tesla’s Optimus uses harmonic reducers for rotary joints. (b) For heavy-load parts like hips and shoulders: RV reducers, which are large in size and heavy in load. (c) For some endpoints with limited force requirements, manufacturers may use planetary reducers as substitutes.

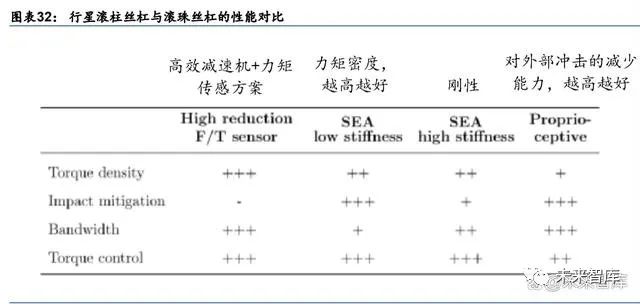

Tesla’s current joint solutions have shortcomings in cost reduction and motion performance, which may spur alternative technical solutions. Its shortcomings include: (1) The value proportion of core hardware such as linear drives, motors, torque sensors, and joint torque sensors is relatively high, requiring significant cost reductions to achieve the target price of 20,000 USD. (2) The harmonic reducer + torque sensor solution can only achieve relatively slow and stationary movements and is easily impacted, making it difficult to adapt to high-performance movement capabilities. (3) The processing difficulty of planetary roller screws used in legs and calves exceeds expectations. Recent research results from academia provide marginal technical increments that may offer new commercialization ideas for the industry. Recently, UCLA’s Zhu Taoyuanmin’s doctoral thesis, “Design of a Highly Dynamic Humanoid Robot,” proposed a robotic leg using air gap radius motors + ordinary planetary reducers + four-bar linkage solutions, providing marginal incremental commercialization solutions for the industry. In terms of design, the current robot joint solutions can be divided into rigid/elastic/collinear drive joints, using “external rotor torque motors + one-stage/two-stage planetary reducers + torque encoders” as collinear drive joint solutions, which compared to other solutions, have performance and cost advantages. Specifically:

1. Rigid joints: torque-less frame motors + high transmission ratio reducers (mostly harmonic reducers, rarely cycloidal needle wheels) + torque sensors, optional brakes + torque sensors (Tesla’s rotary joints include brakes and torque sensors). Traditional robots’ actuators generally consist of high gear reducers (harmonic reducers) + torque sensors, where this solution has high sensitivity and accuracy for measuring and controlling torque, but its limitations include: (1) High reduction ratios, allowing only slow and relatively stationary movements; (2) Performance is relatively fragile and easily impacted; (3) The high inertia and low efficiency of gearboxes prevent them from absorbing impact loads when the robot lands.

2. Elastic joints: Series type is torque-less frame motors + harmonic reducers + elastic encoders; parallel type adds energy storage units on top of rigid joints, with various forms. Other proposals from academia include series elastic actuators (placing an elastic element, i.e., a spring, between the gearbox and load), which have significant potential as springs can buffer external impact forces. The second type is the body executing mechanism (composed of high torque motors and efficient low reduction ratio gearboxes), which controls torque by measuring the current of robot motors, but has lower sensitivity. The third type employs hydraulic drives, but the complexity of hydraulic pumps and valve hoses is high. In the industry, linear actuators are generally used in the robot’s lower limbs, where ball screws are often the preferred solution due to their efficiency, ease of use, and packaging options. However, we have also observed that Fourier Robotics has recently employed linkage systems in their transmission systems, indicating that planetary roller screws are not the only solution, and subsequent technical solutions still need continuous tracking.

3. Collinear drive joints: external rotor torque motors + one-stage/two-stage planetary reducers + torque encoders, without torque sensors, with a relatively simple structure, balancing performance and cost advantages. UCLA’s thesis proposes using air gap motors + planetary reducers for the robot’s lower body, where the low reduction ratio design can bear impact forces and transmit them back to the motor without damaging the gear system. According to experimental results, using the air gap motor + planetary reducer solution offers better performance in low reduction ratios, and due to friction and reflection inertia, traditional actuators can easily be damaged by impact loads, while the low reduction ratio design can withstand impact forces and transmit them back to the motor without damaging the gear system. In summary, we believe the significant advantages of air gap motors + planetary reducers include: avoiding damage from impact loads; being easy to scale; and having cost advantages (the batch production price of planetary reducers is about 200 yuan/unit, while the unproduced price of harmonic reducers is about 1000 yuan/unit).

Sensors: Academia Proposes New IMU Ideas to Improve Robot Walking Stability

IMUs (Inertial Measurement Units) can optimize the stability and balance of robot walking. An IMU consists of accelerometers, gyroscopes, and magnetometers, providing information on the robot’s posture, direction, position, speed, acceleration, and rotation speed, which can provide continuous navigation data and high-frequency stable measurement data without relying on external information. For robots that need to achieve autonomous navigation, they must construct their own position in real-time, and IMUs can assist robots in achieving instant positioning and map construction, generally complementing the navigation systems of robot SLAM solutions and laser SLAM solutions. Currently, IMUs have integrated MEMS devices such as accelerometers, gyroscopes, and magnetic sensors, achieving smaller sizes and lower costs. UCLA’s thesis proposes adding a 6-axis IMU to the foot sensors. Traditional foot sensors use six-axis torque sensors to feedback the robot’s reaction force and contact state, but six-axis torque sensors are relatively fragile and cannot withstand the large impact forces on the foot, while adding an IMU can further enhance the state estimation of the foot, helping to improve landing detection.

Screws: Accelerating the Replacement of Planetary Roller Screws with Ball Screws and Hydraulic Drive Routes

Screws are responsible for converting the rotational motion of joints into linear motion, constituting about 70% of the cost of linear actuators. Screw solutions include sliding screws, ball screws, and planetary roller screws, among which planetary roller screws convert the load-bearing components of ball screws into threaded balls, capable of withstanding loads of thousands of hours in harsh working environments, bearing static loads three times that of ball screws, and having a lifespan 15 times that of ball screws, thus becoming an effective alternative. Tesla Optimus uses planetary roller screws for linear joints. The reverse roller screw achieves integrated design of the motor and screw, being compact and smaller in size, primarily used in scenarios of small to medium loads and high-speed travel, applied in linear actuators of humanoid robots, with strong performance and integrated structure expected to accelerate the replacement of ball screws.

Perception + Interaction + Drive + Control + Thermal Management Technical Routes Are Relatively Clear

Perception Module: Multi-modal Perception Likely to be the Mainstream in Visual Perception, Visual AI Technology Assists Camera Solutions in Accelerating Application

We believe robots will likely use embedded self-developed algorithms for visual sensors externally and encoders internally, with variables including the six-dimensional torque sensor scheme for linear joints and incremental components like IMUs. According to our previous analysis, among the joint links of robots, the value of sensors is second only to that of motors, with a total price of 56,000 yuan, and the price of six-dimensional torque sensors exceeding 10,000 yuan. Considering that general-purpose robots may be equipped with visual, auditory, and force control sensors to cover most work scenarios, sensors also represent an important opportunity track. They can be divided into software and hardware parts (including external and internal sensors).

(1) Software: Obstacle Avoidance → Recognition → Assisting Precise Execution, Visual Perception Technology has undergone three generations of upgrades to assist in more precise execution.

Current visual perception technology has undergone three generations of upgrades, initially meeting the perception needs for obstacle avoidance and basic object recognition, then progressing to more accurate identification and measurement of objects, and currently integrating multi-sensor combinations to achieve functions such as obstacle avoidance, target recognition, and path planning, enabling precise execution operations in conjunction with motion systems.

(2) External Sensors: Laser Radar Solutions and Camera Solutions May Coexist; the Ultimate Solution’s Landing Depends on the Progress of Visual Perception AI Technology.

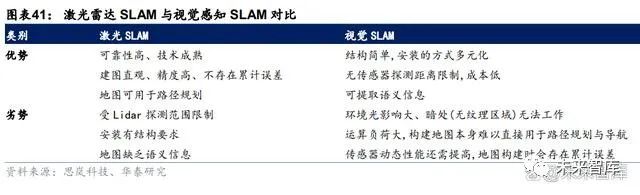

The sensors of humanoid robots can be divided into internal sensors that detect the robot’s own state and external sensors that detect environmental conditions, achieving functions similar to human hearing, vision, touch, and force. We believe the hardware route for the perception module of humanoid robots may present a coexistence of laser radar and camera solutions, with the ultimate solution depending on the progress of visual perception AI technology: (1) With the rapid development of current visual perception AI technology, third-party companies in machine vision and AI are likely to enter the market, where advancements in software capabilities may compensate for the shortcomings of visual SLAM, thus increasing the likelihood of camera solutions landing in mass production. (2) Laser radar can assist in constructing high-precision maps and achieving high-level environmental perception. In the field of autonomous driving, laser radar serves as high-performance perception hardware that compensates for the shortcomings of visual perception algorithms. Currently, it has become the preferred perception hardware for sweeping robots and service robots, being configured in early versions of humanoid robots like Atlas and Pepper. We believe laser radar may become the preferred solution for some manufacturers with limited AI technology accumulation and poor software capabilities.

(3) Internal Sensors: Tesla Innovatively Integrates Position + Torque + Force Sensors into Unified Joints

Force control sensors provide tactile feedback, with robots generally applying single-axis torque sensors at joint parts, and six-dimensional force sensors at the ends of actuators (the technical barrier for six-dimensional force sensors is higher, capable of sensing forces and torques in six dimensions). Tesla has configured single-axis torque sensors at the joints of the torso and six-dimensional force sensors at the feet; other force control sensors include current loop force control, which, while not requiring additional sensing devices and has lower costs, has low accuracy and slow response, limiting its application scenarios. Position sensors (encoders) are responsible for feeding back the motion parameters of servo motors to servo drivers and can be divided into photoelectric encoders and magnetic encoders, with the former being more commonly used currently.

Interaction Module: ChatGPT Leads Breakthroughs in NLP Technology, Optimizing Core Interaction Modules with Voice and Semantic Analysis

Voice semantic analysis is the core interaction module of humanoid robots, including voice recognition and semantic analysis. Complete dialogue interaction requires voice recognition (ASR) technology, natural language processing (NLP) technology, and voice synthesis (TTS) technology. Currently, OpenAI’s new model ChatGPT represents a revolutionary advance in NLP technology, and we are optimistic about its future potential to optimize humanoid robots’ interaction modules. Currently, the AI company Levatas has collaborated with Boston Dynamics to integrate ChatGPT and Google voice synthesis technology into the Spot robot dog; the Ameca robot manufactured by Engineered Arts has achieved language capabilities through integrating GPT-3.

Drive Devices: Frame Torque Motors for the Torso + Brushless Hollow Cup Motors for the Hands + Motor Drives as the Mainstream Solutions

The motion module constitutes the main hardware cost, with the servo system being the core of the motion module. The servo system = servo motor + servo driver + encoder (encoders are usually embedded in servo motors). The barrier for servo motors lies in their miniaturization capabilities, while the barrier for servo drivers lies in algorithms. Generally, servo systems are designed according to the application scenarios of robots, specifically, motors are designed based on the power output of the power system, while drivers are designed based on the force required by joints.

Control Module: Tesla Migrates FSD’s Full-Stack Self-Research Capability to Optimize Controllers, While Other Manufacturers May Use Open Source + Secondary Development

The controller’s role is to process feedback information in the servo loop, applying specific commands to driver components, with servo drivers providing voltage and current to motors based on the controller’s commands. Industrial robots generally adopt integrated drive control solutions, where manufacturers independently develop controllers. Humanoid robots have dozens of servo drivers, generally having a separate controller independent of the servo motors and servo controllers, placed in the head, and due to the large number of sensors and varied data sources, they need to process a massive amount of data, making it difficult for a single manufacturer to create a general-purpose humanoid robot for all scenarios. We believe a possible future solution is for manufacturers to produce the body while adopting open-source solutions for the control part, with secondary development tailored to different scenarios.

Thermal Management Module: Tesla Robots May Reference Mature Solutions from the Automotive Industry, with Potential for Technological Innovation

Thermal management is a crucial operational module for robots, ensuring normal operation. In 2011, during the rescue operation of the Fukushima nuclear accident, the robot Quince automatically reported a stop due to overheating of the motor driver. The mechanical components of robots generally undergo heat and thermal insulation treatment using suitable high-temperature-resistant materials and structural designs, with humanoid robots’ thermal management primarily focusing on temperature-sensitive batteries, motors, and electronic components. Theoretically, thermal control technology includes cooling technologies (including air cooling, liquid cooling, phase change cooling technologies), heat generation control and optimization, and thermal protection structure design (including insulation structures, heat absorption structures, and integrated structures). Considering that Tesla’s automotive industry thermal management system has gone through four generations, the technology is relatively mature, and humanoid robots have strong commonalities with the automotive industry, we believe Tesla’s thermal management solutions may reference existing mature solutions.

Grasping Investment Mainline: Closely Following Tesla’s Industrialization Process, Optimistic about Domestic Substitution Opportunities in the Core Value Chain

Market Scale Outlook: The Market Space Ceiling for Tesla’s Robots May Reach 24.5 Billion USD

We believe the industrial space for humanoid robots mainly anchors on the replacement of existing labor. According to Tesla’s goal of applying robots in factories and service life, we analyze the potential application scenarios for humanoid robots in Tesla’s factory settings, non-Tesla factory settings (such as potential applications for robots in mining and nuclear facility sites), and life service scenarios (robots may replace human labor in warehouse logistics, delivery services, intercity logistics, shopping guide services, caregiving services, firefighting services, etc.), estimating the upper and lower limits of the replacement ratio of robots for human labor, ultimately calculating the market lower limit at 11.5 billion USD and the upper limit at 24.5 billion USD. From the perspective of component cost composition, FSD is self-produced by Tesla, assuming a cost ratio of 40%, while the remaining components are all outsourced. According to our estimates, the upper market space for servo motors, linear actuators, and reducers may reach 4.6 billion, 3.7 billion, and 3.4 billion USD, respectively, making these segments worth paying attention to.

Grasping Economic Trends and Ceilings is Paramount; Optimistic about the Replicability of Domestic Substitution Paths in the Era of Electric Vehicles

Breakthroughs in software-side technology singularities are expected to accelerate the convergence of hardware-side solutions, with mass production nodes and hardware performance releases worth looking forward to. We believe the iteration of large models will accelerate the industrialization process of humanoid robots, where the iteration and upgrade of control algorithms may weaken some of the hardware’s assembly. For instance, looking at the results of Tesla’s robot over the past year, its control functions have continuously iterated while the hardware solutions have remained largely unchanged. In the demonstration video on September 24, Optimus only used visual sensors and position encoders for positioning, which we believe reflects the optimization of Tesla’s end-to-end algorithm capabilities for control functions.

Looking ahead, as technological singularities continue to break through, we believe hardware investment mainlines are likely to shift from point-like dispersed investments to core hardware-focused mainline investments. At this current moment, grasping the investment opportunities in humanoid robots hinges on: firstly, confirming the certainty of breakthroughs in industrialization from 0 to 1, i.e., the feasibility of suppliers’ technical solutions and the probability of commercial landing; secondly, identifying component manufacturers in niche segments that have technological leadership, are poised for volume and price increases, have high ceilings, and have opportunities to enter the humanoid robot segment. Moreover, the electric vehicle era initiated by Tesla has given rise to many high-quality domestic component manufacturers, accelerating domestic substitution in the core component industry. We believe the development logic of humanoid robots shares commonalities with electric vehicles, and we are optimistic about the opportunities for domestic substitution in the core components of humanoid robots.

Best

Best: Leading Domestic Turbocharger Parts Manufacturer, Multi-Dimensional Layout Opens Up Growth Potential

Leading domestic turbocharger parts enterprise, lightweight + industrial mother machine opens up multi-level growth

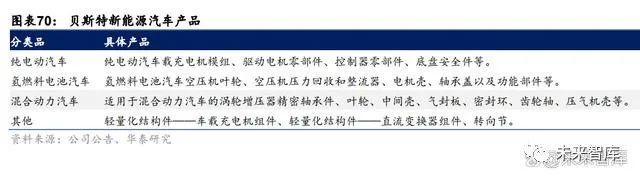

Established in 1997, the company started with tooling fixtures and entered the manufacturing of aluminum alloy precision components in 1999, and turbocharger precision parts in 2002. Currently, it focuses on turbocharger parts and tooling fixtures, with business depth expanding into application fields. Tooling fixtures have expanded from motorcycles to intelligent manufacturing equipment, while turbocharger parts have expanded from fuel vehicles and commercial vehicles to new energy vehicles. In recent years, the company has leveraged its know-how in tooling fixtures to enter the production of high-precision ball/roller screws and high-precision linear guides, establishing subsidiaries such as Yuhua Precision Machinery in 2022 to expand its new energy vehicle parts business layout.

On the revenue side: automotive parts serve as the ballast for growth, with overall revenue growth being steady. In the first half of 2023, automotive parts/fixtures/other parts accounted for 91.80%/4.60%/2.03% of the company’s revenue, with automotive parts being the main source of the company’s revenue. From 2013 to the first half of 2023, the revenue proportion of this segment increased from 76.24% to 91.80%, with revenue of 582 million yuan in the first half of 2023. Specifically, in the automotive business, 96.19% of the revenue in 2022 came from turbocharger parts and new energy vehicle parts, with new energy vehicle parts generating 91.53 million yuan in revenue, accounting for 9.09% of automotive parts revenue (compared to 4.6% in 2021). The company’s clients are mainly top-tier domestic and foreign Tier 1 suppliers, including Garrett, Cummins, Mitsubishi Heavy Industries, Pierburg, BorgWarner, and Boma Technology. The company typically enters the domestic supply chains of clients before extending to global supply chains, further increasing its supply share for specific clients.

To further expand the scale of its new energy business, the company has increased fundraising and accelerated its layout in the new energy vehicle industry, expanding its customer base. From 2013 to 2022, the company’s revenue increased from 376 million yuan to 1.097 billion yuan, with a CAGR of 14.3%. The growth rate in 2022 was relatively weak, mainly due to the appreciation of the RMB and rising raw material prices. From 2013 to 2022, the net profit attributable to the parent company rose from 65 million yuan to 229 million yuan, with a CAGR of 17%. In the first half of 2023, overseas demand improved, and the company’s revenue increased by 29.42% year-on-year to 634 million yuan, with net profit attributable to the parent company rising by 62.08% to 130 million yuan. In the third quarter of 2023, the company continued to deepen its traditional turbocharger parts business while achieving good growth in lightweight structure parts for new energy vehicles and core components for hydrogen fuel cell vehicles, driven by both new and old businesses. The company achieved revenue of 373 million yuan in Q3 2023, a year-on-year increase of 22.45% and a quarter-on-quarter increase of 14.81%; net profit attributable to the parent company was 80.31 million yuan, a year-on-year increase of 9.2% and a quarter-on-quarter increase of 5.46%. From Q1 to Q3 of 2023, the company achieved a total revenue of 1.007 billion yuan, a year-on-year increase of 26.7%, and net profit attributable to the parent company of 210 million yuan, a year-on-year increase of 36.73%.

On the profit side: the company’s profitability has declined in recent years, mainly due to rising raw material prices, increased market competition, and low gross profits for new products. In 2022 and the first half of 2023, the gross profit margin fell to 34.27% and 33.37%, respectively. In the face of adverse external factors, the company has enhanced its intelligent manufacturing levels, strictly controlling various costs, such as tool consumption, tool inventory, the number of outsourcing processes, and energy consumption. The gross profit margin for Q3 2023 was 34.53%, up 0.53 percentage points year-on-year; the period expense ratio was 13.07%, down 0.72 percentage points year-on-year. Meanwhile, the company’s net profit margin improved from 18.6% in 2021 to 20.9% in 2022, remaining at 20.9% in the first three quarters of 2023, with further improvement in Q3 2023. The company’s period expense ratio has been steadily controlled at 15-16% since 2017, and in the first three quarters of 2023, it was further controlled at 13%. The company’s management expense ratio has declined year by year since 2014, from 18.10% in 2014 to 7.44% in 2020. The increase in the management expense ratio in 2022 was due to the inclusion of stock payment expenses from the equity incentive plan in management expenses. With the adverse factors of upstream material prices lifting, combined with the company’s strong cost control capabilities, we believe there is further improvement space for the company’s profit side. In Q3 2023, the company’s R&D expenses were 12.7049 million yuan, up 34.32% year-on-year, increasing R&D investment and efforts to solidify its new energy vehicle parts business and linear rolling function parts business. The first set of the company’s precision ball screw pairs and linear guide pairs has successfully rolled off the production line, and they are currently undergoing sample verification. The rolling function parts are widely applicable, and after completing verification, they are expected to see volume releases, targeting high-end machine tool fields, semiconductor equipment, automation industries, and the robot field.

Turbos: A Stable Growth Base Business, Deeply Supporting Leading Domestic and Foreign Enterprises is Expected to Outperform the Industry

Emission policies are tightening, promoting the stable increase in the proportion of turbochargers in fuel vehicles, and the rapid increase in hybrid vehicles contributes the main market increment, while the commercial vehicle market is expected to stabilize and recover. We are optimistic about the stable expansion of the automotive turbocharger market. The role of turbochargers is to utilize exhaust energy to drive the turbine’s rotation, providing the cylinder with air to improve fuel efficiency, such as increasing gasoline engine fuel efficiency by 20% and diesel engine fuel efficiency by 40%, while also reducing carbon emissions. Looking ahead, we believe the turbocharger market may maintain a stable upward trend, mainly due to:

(1) Stricter emissions policies for passenger cars promote the widespread use of turbochargers with high fuel efficiency and low emissions in fuel vehicles. According to GaiShi Automobile, the proportion of turbochargers in fuel vehicles rose from over 40% to over 68% from 2017 to 2022. Looking ahead, while the current penetration rate of turbochargers is relatively high, considering that the National VI B emission policy is stricter (the limits for carbon monoxide, non-methane hydrocarbons, nitrogen oxides, and PM particulate matter are reduced by 30%-50% compared to National VI A, making it the strictest emission standard), we expect the ratio of turbochargers in fuel vehicles to stabilize and rise to 100%. Referencing data from GaiShi Automobile, we assume that by 2025, the penetration rate of turbochargers in fuel vehicles will increase to over 71%, and the stable rise in the proportion is expected to offset the negative impact of the weak overall fuel vehicle market. Assuming that fuel vehicle sales will decline at a CAGR of -7.5% from 2023 to 2025, and the single vehicle value of turbochargers is 1500 yuan, with an annual decline of about 1%, the corresponding market scale CAGR for 2023-2025 is projected to be -7.8%.

(2) The rapid increase in the penetration rate of plug-in hybrid vehicles, with an average annual growth rate of 148% from 2020 to 2022 according to the China Association of Automobile Manufacturers, contributes significantly to the incremental market for turbochargers. According to GaiShi Automobile, the proportion of turbochargers in hybrid vehicles rose from over 40% to over 71% from 2017 to 2022. Considering that plug-in hybrid vehicles require smaller engines than fuel vehicles and have higher fuel efficiency requirements, turbochargers can effectively improve the fuel efficiency of internal combustion engines, and we expect their application in hybrid vehicles to accelerate. We assume that by 2025, the proportion of turbochargers in hybrid vehicles will rise to 88%, with the single vehicle value of turbochargers around 2260 yuan, and the annual decline pressure may be lower than that of fuel vehicles. We expect the market space in this field to achieve a CAGR of 35% from 2023 to 2025.

(3) Turbochargers are essentially standard for commercial vehicles, and the space in this segment mainly depends on the commercial vehicle market’s prosperity. Considering that commercial vehicles, represented by heavy-duty trucks, have emerged from the industry cycle’s bottom, with stable upward sales since 2023, the recovery trend has been established. Looking ahead, with emissions policies accelerating and intensifying enforcement, steady economic growth, and sustained high prosperity in exports, along with the calculation of the replacement cycle for heavy-duty trucks being 7-9 years, the next round of replacement cycles in the industry is expected to occur in 2024-2025. We believe heavy-duty truck sales will maintain a stable upward trend during 2024-2025, assuming the single vehicle value of turbochargers is 2300 yuan, with an annual decline of about 1%, we expect the market space for heavy-duty truck turbochargers to achieve a CAGR of 11% from 2023 to 2025.

Lightweight New Energy Vehicles: Internal and External Procurement Parallel in Cutting into Lightweight Components, Convertible Bonds Effectively Supplement Capacity

Lightweighting is one of the trends with strong certainty in automotive development. According to the International Aluminum Association and Huajing Industry Research Institute, the demand for aluminum castings per vehicle in China increased from 90kg in 2018 to 101kg in 2022, with a projected CAGR of 3.3% for demand for aluminum castings per vehicle from 2023 to 2025. The company is seizing the lightweight opportunities in new energy vehicles through both internal layout and external acquisitions. Internally, the company entered the production of aluminum alloy components for new energy vehicles in its fifth-phase factory in 2019, and in 2020 raised 530 million yuan through convertible bonds to further expand production capacity. In March 2022, the company completed the construction of capacity for 1.4 million lightweight functional components for new energy vehicles and 560 turbocharger components, including 600,000 on-board charger components, 100,000 DC converter components, 60,000 steering knuckles, and 10,000 hydrogen fuel compressor components. The company also established a wholly-owned subsidiary, Anhui Best, in 2022 to further solidify its layout in the new energy vehicle parts business.

With a comprehensive product layout, sufficient capacity preparation, and accumulated know-how in precision components, the company has established a solid customer base for lightweight components, already supplying major clients such as Meida and Polaris, with its new energy vehicle products ultimately sold to international brands like PSA (Peugeot Citroën Group), DFM (Dongfeng Motor Group), and General Motors. The products cover on-board charger modules, drive motor components, controller components, chassis safety components, etc. According to the company’s convertible bond fundraising prospectus in 2020, after reaching full production in 2025, the lightweight business is expected to generate 350 million yuan in revenue. We are optimistic about the company’s capacity ramp-up further releasing its order performance, while the company is likely to continue leveraging its accumulated experience in precision parts to expand its customer base in new energy vehicle components, achieving volume growth.

Rolling Functional Components: Breaking Foreign Monopolies through Business Synergy, Industrial Mother Machines + Robots May Open Up a Third Growth Pole

Machine tools use ball screws, while robots use planetary roller screws and trapezoidal screws. Screws are mechanical devices that convert rotational motion into linear motion, achieving high precision and efficiency in linear displacement through the transmission principle of screw pairs. They can be divided into trapezoidal screws, ball screws, and planetary roller screws. Trapezoidal screws are common in traditional industries. Ball screws have high transmission efficiency and precision, suitable for machine tools and medical equipment, while planetary roller screws, due to their high load capacity, small size, and high precision, are mainly used in robots and other high-precision, high-speed, and high-load environments.

The technical barriers are high, and foreign enterprises have a first-mover advantage, with domestic brands holding a low market share. Ball screw pairs consist of 1 screw + 1 nut + multiple balls forming a rotating body, which is the core component of machine tools. In recent years, industries such as aerospace, automotive, and optical instruments have driven the demand for high-quality and precise manufacturing, leading to increased market demand for mid-to-high-end ball screws. Globally, mid-to-high-end ball screws are primarily monopolized by foreign companies. According to Metal Processing, domestic manufacturers account for about 30% of the mid-range ball screw market share and about 5% of the high-end market share. The low domestic rate is mainly due to the high precision, lubrication, rigidity, and thermal stability manufacturing requirements for screws, where foreign companies have a first-mover advantage in process accumulation and production experience, while domestic manufacturers mainly focus on the production segment, with high-precision grinding machines and mother machines required for processing mostly monopolized by foreign companies, resulting in significant gaps in precision retention and reliability for domestic products, with most competitors falling into the P3-P5 level, while domestic products generally remain below P2 level.

Leading Customer Resources, Optimistic About the Company’s Positioning in Domestic Substitution Winds. On the one hand, as the core component of machine tools, ball screws can convert the company’s existing machine tool suppliers into downstream customers. On the other hand, due to the synergy between tooling fixtures and industrial mother machines in the production process, the collaboration with the company’s existing tooling fixture clients makes it easier for the company to enter the industrial mother machine market. From the perspective of the domestic industry, there is a supply-demand gap for ball screws. According to Huajing Industry Research Institute, the production of ball screws (ball screw pairs) in China reached 9.83 million sets in 2021, while the demand was 14.06 million sets, with an estimated production-demand gap of 4.55 million sets in 2022. In the field of industrial mother machines, most high-end CNC machine tools rely on imports, with the import amount in the metal cutting machine tool field reaching about 31.2 billion yuan in 2021, with an import dependence of about 35.3%. While over 65% of domestic mid-to-low-end machine tools, the localization rate of high-end CNC machine tools is only about 6%. The import cycle for industrial mother machines is long, and supply is insufficient, allowing the company to leverage its proximity and service advantages to enter the industrial mother machine track, gaining customers early. At the same time, both industrial mother machines and mid-to-high-end ball screws are “bottleneck” technologies in domestic production, which have undergone years of specialized research and have a complete evaluation standard system. Moreover, as ball screws are industrial consumables, there is a large demand for existing stock. Continuous policy support accelerates the domestic substitution process. According to the “Third User Survey and Analysis Report on Rolling Functional Components,” 85% of enterprises are willing to use domestic mid-to-high-end rolling components under policy guidance. We are optimistic that the company can seize opportunities, gaining market replacement and incremental space.

Ball screws have wide downstream applications + policies guiding domestic substitution accelerate, with the company’s long-term growth potential expected. Ball screws are core components in automotive, lithium battery equipment, and robots, among other fields. For instance, in humanoid robots, ball screws are critical parts of robot joints, and given their consumable nature, the future market demand is substantial. The company has already entered Tesla’s supplier system, and in terms of business expansion, it has a “first-mover advantage” in the humanoid robot market. Once Optimus is put into production, the company is expected to quickly connect to the supply of important components for Tesla’s humanoid robots, positioning itself to capture the growth dividend of humanoid robots.

BlueDai Technology

BlueDai Technology: Riding the Wave of Electric Intelligence, Multi-Dimensional Diversification is Timely

Power Transmission and Touch Display Dual-Drive, Quality Customers Continue to Accumulate

Founded in 1996, the company has long focused on the automotive power transmission field and has recently entered the touch display market, currently forming a diversified business layout driven by dual main businesses. In the power transmission field, the company has rich production and R&D experience, with products expanding from initial motorcycle transmission parts to automotive transmission parts, including manual transmission assemblies, automatic transmission assemblies, automotive balance boxes, and supporting transmission gears and shafts. The company is currently accelerating its focus on the new energy transmission field, gradually expanding into high-value-added transmission parts such as new energy vehicle motors and reducers while continuing to upgrade and iterate. The company focuses on top-tier manufacturers as key customers, and through years of accumulation, has established stable partnerships with mainstream traditional and new energy OEMs, including SAIC Group, FAW Group, Toyota, Great Wall Motors, Beiqi Foton, BYD, GAC, NIO, and Hozon, as well as high-quality power transmission parts suppliers like Nidec, Valeo, BorgWarner, and Wolong Electric.

Entering the Touch Display Field, Short-Term Pressure Does Not Change Long-Term Growth Logic

Out of consideration for the contraction of traditional transmission business and the wave of intelligence, the company has actively expanded its business in recent years. After acquiring Shenzhen Taiguan Technology in 2019, the company officially entered the touch display field, injecting new momentum. After entering the touch display market, the company benefited from multiple positive factors, including the completion of business integration, the disappearance of impairment losses on original customer assets, and the smooth advancement of large-size touch display products such as vehicle-mounted touch screens. From 2020 to 2022, the company’s revenue increased from 2.41 billion yuan to 2.87 billion yuan, with net profit attributable to the parent company recovering from about 5.2 million yuan to 186 million yuan, and the touch display business’s revenue share rapidly increasing, now becoming the company’s largest business, contributing 57% of the company’s revenue and 63% of its gross profit in 2022. At the same time, profitability has significantly improved, with gross and net profit margins recovering from 13%/0% in 2020 to 18%/7% in 2022.

Currently, the company has a quality customer base in the touch display field, having established a good reputation. It has already supplied to well-known industry players such as Corning, Innolux, BOE, Quanta Computer, Compal, Foxconn, Huawei, and Huarong Electronics, with products ultimately applied in high-end products of international brands like Amazon, Lenovo, Acer, and Microsoft. Overall, the company’s rich product line and solid customer base lead us to believe that the short-term pressure on the company’s performance does not alter its long-term growth logic. With the recovery of downstream demand in automotive intelligence and consumer electronics, along with the continuous expansion of the new customer matrix and the ramp-up of fundraising projects, the touch display business is expected to return to a stable growth channel under the injection of new development momentum.

END

Click “Read Original”