Sensors serve as the perception layer of the information age, acting as the entry point for receiving and transmitting vast amounts of data, and are a crucial foundation for the Internet of Things.

Some analyses suggest that in the coming years, sensors, particularly MEMS (Micro-Electro-Mechanical Systems) products, will be the most promising technology in the semiconductor market.

In recent years, the global sensor market has maintained rapid growth, driven by new demands from many emerging downstream applications (consumer electronics, automotive electronics, industrial electronics, and medical electronics).

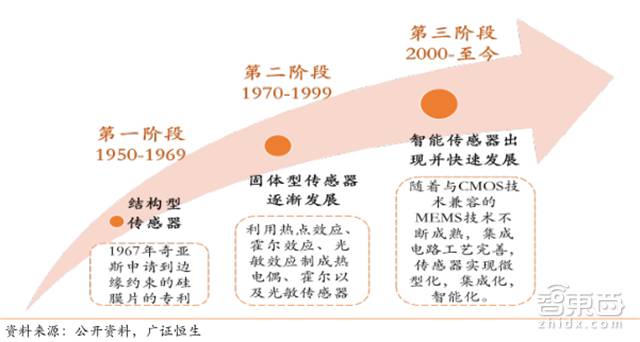

At the same time, under the call of policies such as “Made in China 2025,” the domestic smart sensor industry ecosystem is steadily upgrading to mid-to-high-end levels.

In this article, we will support our discussion with the smart sensor industry report from Guangzheng Hengsheng, introducing the technological evolution of sensors, the market share of domestic sub-sectors, and four major emerging demand points.

Advancing Sensors: Intelligence, Integration, Miniaturization

Development History of Sensor Technology

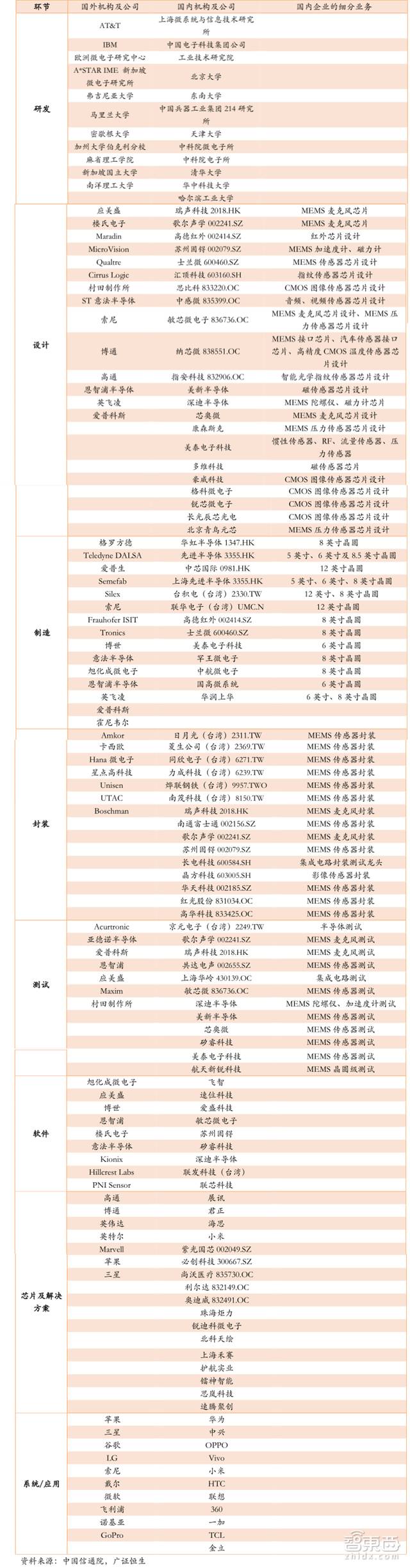

The development history of sensors can be roughly divided into three generations:

The first generation is structural sensors, which utilize changes in structural parameters to sense and convert signals.

The second generation is solid-state sensors developed in the 1970s, which are composed of solid components such as semiconductors, dielectrics, and magnetic materials, utilizing certain properties of materials.

The third generation of sensors began to gradually develop in 2000 and is known as intelligent sensors.

Relevant Policies for the Sensor Industry in China Since 2011

Since the launch of the “12th Five-Year Plan for the Development of the Internet of Things” by the state in 2011, the development of the smart sensor industry has welcomed a wave of favorable policies.

According to the latest data from the China Academy of Information and Communications Technology, smart sensors replaced traditional sensors as the market mainstream in 2015 (accounting for 70%). The global market size for smart sensors reached $25.8 billion (171 billion RMB) in 2016, and it is expected to reach $37.85 billion by 2019, with an average annual growth rate of 13.6%.

Additionally, the Americas region holds the largest share of the global market (45% in 2015, expected to maintain this advantage until 2022); the Asia-Pacific region (China, Japan, South Korea, India, Australia) ranks second (23%), but is growing the fastest due to downstream industries such as automotive and consumer electronics.

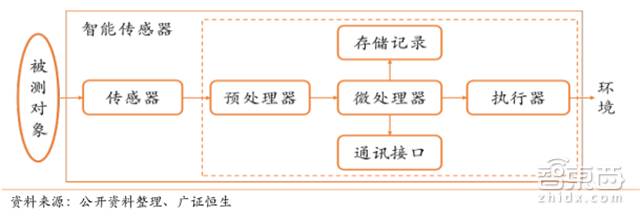

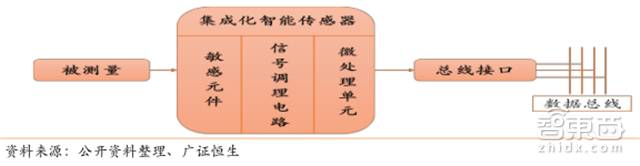

Basic Principle Structure Diagram of Smart Sensors

There is currently no standardized unified definition of smart sensors in the scientific community. In simple terms, smart sensors are equipped with microprocessors, capable of collecting, processing, and exchanging information, and are the product of the integration of sensors and microprocessors.

Since microprocessors can fully utilize various software functions, they can accomplish tasks that hardware finds difficult, significantly reducing the difficulty of sensor manufacturing, improving sensor performance, and lowering costs.

Sensors as the Perception Layer of the Internet of Things

In today’s information age, many application scenarios for sensors require faster access to more accurate and comprehensive information.

Taking the Internet of Things as an example, sensors are located at the most critical perception layer, not only serving as the entry point for receiving and transmitting information like traditional sensors but also needing to analyze, process, remember, and store vast amounts of data.

Smart sensors can fully meet these requirements, with specific advantages including self-compensation and self-diagnosis functions, information storage and memory functions, self-learning and self-adaptive functions, and digital output functions.

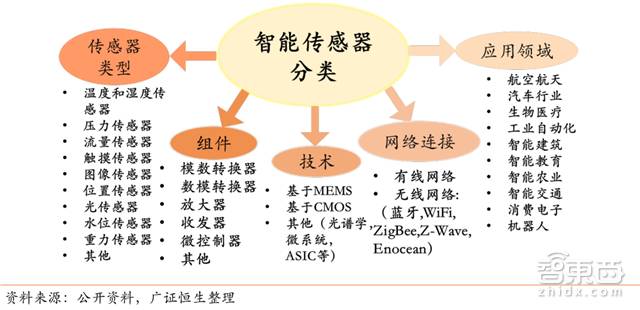

Classification of Smart Sensors Under Different Standards

There are many types of smart sensors, which can be classified into three categories based on how intelligence is achieved:

Non-integrated smart sensors, hybrid smart sensors, and integrated smart sensors. The technical difficulty of these three types of sensors increases in order, with higher integration levels corresponding to higher degrees of sensor intelligence.

1. Non-Integrated Smart Sensors

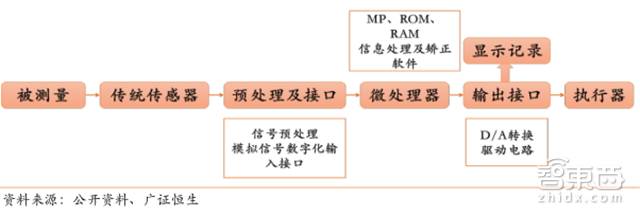

Principle Block Diagram of Non-Integrated Smart Sensors

This type of sensor is constructed from traditional sensors followed by signal processing circuits and microprocessors with data bus interfaces, featuring lower integration and technical barriers, and is not suitable for miniaturized products, thus not classified as a new type of smart sensor.

2. Hybrid Smart Sensors

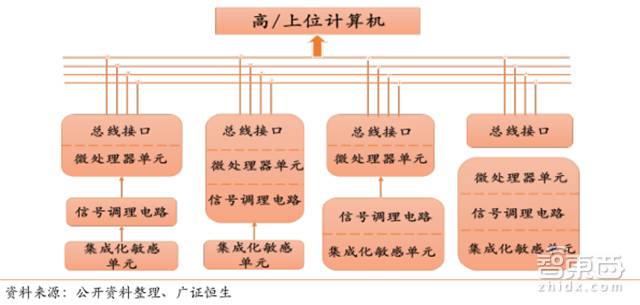

Principle Framework Diagram of Hybrid Smart Sensors

This method integrates various components of the system (sensitive elements, signal conditioning circuits, digital bus interfaces) in different combinations on different chips based on demand, packaged within a single shell, and is the main type of smart sensor widely used.

3. Integrated Smart Sensors

Principle Block Diagram of Integrated Smart Sensors

This type utilizes micro-mechanical processing technology (MEMS) and large-scale integrated circuit (IC) technology, using silicon as the basic material to create sensitive elements, signal conditioning circuits, and micro-processing units, integrating them onto a single chip.

These sensors have multiple functions, are integrated, highly accurate, suitable for mass production, compact, and easy to use, representing the direction of continued development for smart sensors.

MEMS sensors are currently the most intelligent sensors available. MEMS technology combines sensors, mechanical components, actuators, and electronic components on a silicon wafer within a micron operational range, representing the mainstream solution for cutting-edge micro sensors.

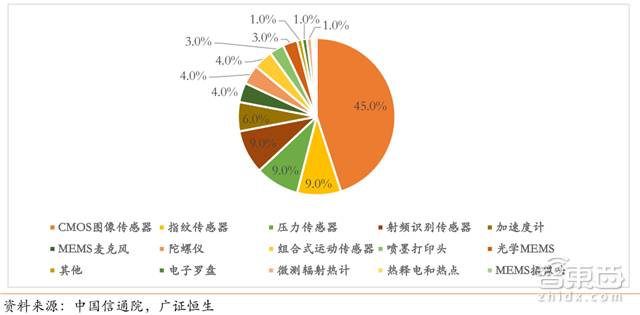

Global Market Share of Smart Sensor Products in 2016 (Units: %)

Smart sensor products are diverse and complex in technology, with no completely identical standards. This characteristic means that if R&D investment is too high, the inability to scale production of a single type of product can lead to losses.

Among the many products in the global market, CMOS image sensors have the highest market share, accounting for nearly 45% of the global market, followed by fingerprint sensors, pressure sensors, and RFID sensors, each with a market share of 9%.

Industry Status: Long Supply Chain, High Technical Barriers

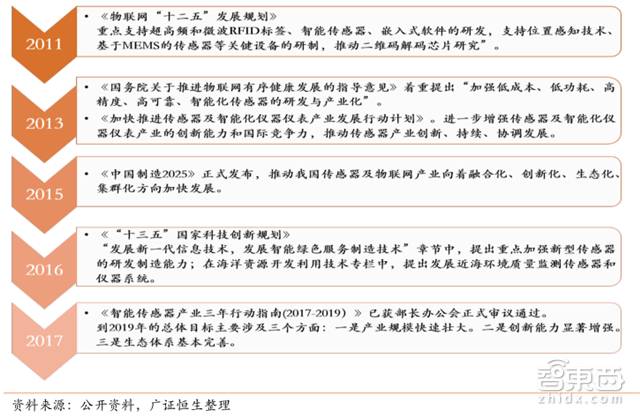

According to the industrial map of smart sensors released by the China High-End Chip Alliance and the China Academy of Information and Communications Technology, the supply chain specifically includes eight links: R&D, design, manufacturing, packaging, testing, software, chips and solutions, and systems/applications, all of which have high technical barriers.

In terms of processes and technology, the design, manufacturing, packaging, and testing of smart sensors have many similarities with the corresponding links in the semiconductor integrated circuit industry.

Companies with IC experience have inherent advantages and are increasingly entering the sensor field.

The market scale of the design, manufacturing, packaging, and testing links of smart sensors has not yet been thoroughly statistically analyzed by segment, but based on the industrial similarities, the design link of smart sensors has the largest market space, while the packaging link is expected to be the fastest-growing segment in the domestic market.

Although there is still a certain gap between the overall technical level in China and the top foreign technologies, the independent R&D capabilities of technology companies that entered the niche field early have accumulated over the years and can now compete with foreign counterparts, cultivating a stable customer base, with some products even achieving exports.

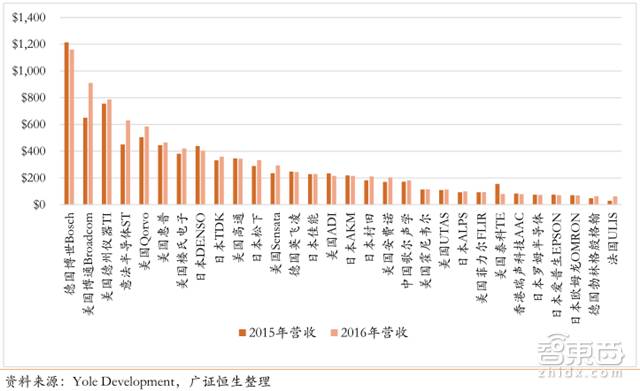

Top 30 Global MEMS Sensor Companies by Revenue in 2016

The key downstream application areas for smart sensors are consumer electronics, automotive electronics, industrial electronics, and medical electronics, with corresponding market shares decreasing in that order.

Considering both the size of the market scale and the growth rate, Guangzheng Hengsheng believes that rapidly developing emerging applications such as fingerprint recognition and intelligent driving will become the main driving forces for the growth of the smart sensor market, while initially developing emerging applications such as intelligent robots and smart medical devices will also contribute.

Global Market Size of Smart Sensors in Four Major Application Areas from 2016 to 2019 (Units: Million USD)

Consumer Electronics: Growing Demand for Fingerprint Recognition

Main Types of Fingerprint Sensors and International Manufacturers

In the subfield of consumer electronics, fingerprint sensors (including optical fingerprint sensors, capacitive fingerprint sensors, thermal fingerprint sensors, and ultrasonic fingerprint sensors) are experiencing the fastest market growth.

According to data from the China Academy of Information and Communications Technology, the average annual compound growth rate from 2016 to 2019 is expected to reach 14.84%, with the domestic market size exceeding 3.1 billion RMB in 2017, and the global market size expected to reach $4.7 billion by 2022.

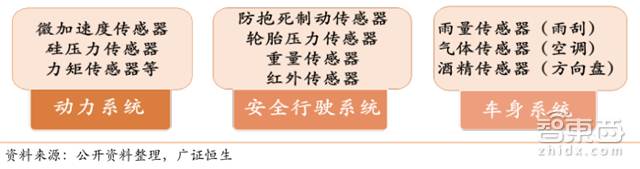

Automotive Electronics: High Requirements for In-Vehicle Intelligence

Common Smart Sensors in Automotive Systems

Automotive sensors often operate in very harsh environments, requiring high stability, resistance to environmental interference, and self-adaptive and self-compensating capabilities.

At the same time, to ensure that electronic components and modules can be mass-produced, costs also need to be reduced. New smart sensors can meet these requirements in terms of both technology and cost.

Smart sensors are already widely used in automotive applications, such as in power systems, safety driving systems, and body systems.

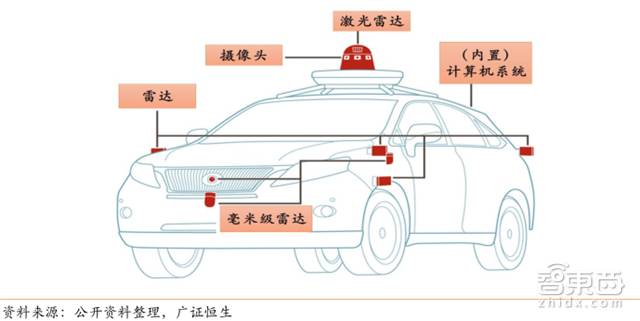

Sensor Systems in Autonomous Vehicles

As autonomous driving technology matures, smart sensors are no longer limited to the traditional automotive market but are moving towards the smart vehicle market.

Sensors for environmental perception include cameras (long-range cameras, surround cameras, and stereo cameras) and radars (ultrasonic radars, millimeter-wave radars, and laser radars).

Currently, domestic and foreign companies are adopting two types of solutions for achieving autonomous driving: one is the camera + millimeter-wave radar solution (Tesla), and the other is the laser radar solution (Google and Baidu).

Global Market Size of Sensor Modules for ADAS Systems from 2005 to 2030 (Units: Million USD)

The market size of sensor modules in global smart vehicles reached $2.6 billion in 2015; Yole Development predicts that the market size will exceed $5 billion in 2017 and reach $36 billion by 2030.

In terms of sensor types, ultrasonic sensors, 360-degree panoramic cameras, and front cameras will remain the mainstream sensors in the market, with expected market sizes of $12 billion, $8.7 billion, and $6.9 billion respectively by 2030;

Radar has been applied in the autonomous driving field since 2015, with high technical barriers, and is expected to experience explosive growth from “zero to one” over the next 13 years, reaching $12.9 billion by 2030, including $7.9 billion for long-range radar and $5 billion for short-range radar.

Industrial Electronics: The Rise of Machines

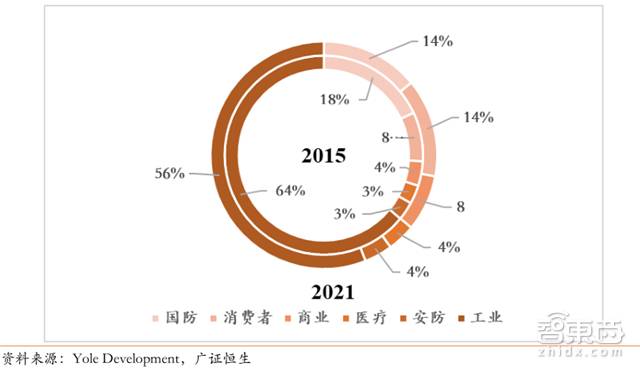

Revenue Share of Drones and Robots in Subfields from 2015 to 2021 (Units: %)

In recent years, the technology for manufacturing robots has matured, and the commercial process has accelerated, expanding the market space for their core components, smart sensors.

According to Yole Development data, the market size for robots is expected to grow from $27 billion in 2015 to $46 billion in 2021, with an average annual growth rate of 9.4%.

Among all types of robots, those used in defense, industry, and consumer sectors are the most numerous, and their revenue shares are also the highest.

Medical Electronics: Significant Space for Import Substitution

National Medical Device Market Size from 2008 to 2016 (Units: Billion RMB)

Driven by the medical device industry, the demand for smart sensors is expected to expand. Medical sensors can be classified into four categories based on their application forms:

Implantable sensors, in vitro sensors, temporarily implantable cavity sensors, and sensors for external devices.

According to a new data analysis report from market research firm Grand View Research, the global medical sensor market size reached $9.8 billion in 2015 and is expected to grow to $18.5 billion by 2024.

Currently, China’s layout in this field is minimal, with most relying on imports and still in the early stages, but as technology matures, the market is expected to experience explosive growth.

Intelligent devices believe that smart sensors are the result of technological evolution, meeting the requirements of the perception layer for the Internet of Things, and are expected to experience rapid growth alongside emerging concepts such as smart consumer electronics, (industrial) IoT, vehicle networking/autonomous driving, smart cities, and smart medical devices.

From an industry perspective, the high technical barriers and the many fragmented sub-segments of smart sensors are conducive to the development of domestic small and medium-sized enterprises. Coupled with the frequent introduction of favorable policies related to semiconductors and integrated circuits, accelerating the integration of production and research, and under sufficient funding conditions, the temporarily lagging independent smart sensor industry is expected to rise, achieving mid-to-high-end upgrades and seizing the emerging application market.

Appendix: Representative Institutions and Companies in the Eight Links of the Smart Sensor Industry Chain

[Click to view larger image]