This article is from Yanzhi Autonomous Driving

The intelligent connectivity of automobiles brings a significant increase in information flow, and the automotive electronic and electrical (EE) architecture will undergo an upgrade. This evolution is akin to the changes in the organizational structure of ancient Chinese society, from feudal lords to the five hegemons of the Spring and Autumn period, and finally to a unified empire. The automotive architecture is evolving from distributed to domain-centric to central computing, currently transitioning from distributed to domain-centric architecture, reducing from over 100 ECUs to 5 DCUs, rapidly centralizing control functions. The domain controller, as the “decision-making center of local warlords,” has stepped onto the historical stage.

The transition of vehicle electronic and electrical architecture from decentralized to centralized in the process of autonomous driving has spawned domain controllers!

The intelligent connectivity of automobiles brings a significant increase in information flow, and the automotive electronic and electrical (EE) architecture will undergo an upgrade. This evolution is akin to the changes in the organizational structure of ancient Chinese society, from feudal lords to the five hegemons of the Spring and Autumn period, and finally to a unified empire. The automotive architecture is evolving from distributed to domain-centric to central computing, currently transitioning from distributed to domain-centric architecture, reducing from over 100 ECUs to 5 DCUs, rapidly centralizing control functions. The domain controller, as the “decision-making center of local warlords,” has stepped onto the historical stage.

The Past, Present, and Future of Domain Controllers: ECU – Classic Five Domains – Central Computing Platform

ECUs are the predecessors of domain controllers, widely used in various underlying execution components such as vehicle engines, transmissions, and airbags, undertaking decision-making functions. Currently, most traditional automakers still use distributed ECUs; in the future, domain controllers with broader control ranges and stronger computing power will replace the independent decision-making functions of each ECU. Bosch’s classic five-domain classification divides the vehicle into power domain, chassis domain, cockpit domain/intelligent information domain, autonomous driving domain, and body domain, integrating all control functions of L3+ models comprehensively. They are applied in a very limited number of L3 level models (such as Changan UNI-T/Xpeng P7, etc.); further development of domain controllers leads to the Central & Zone Concept, represented by Tesla Model 3, which is the future trend of the industry.

Dissection of the Domain Controller Industry Chain

From the production process perspective, the automotive electronic controller industry chain mainly experiences: wafer production, (chip) packaging testing, and system application (MCUs and various controllers, etc.). The upstream core product chip determines the core computing capability of the domain controller. The chip design level is mainly monopolized by overseas companies, while most domestic semiconductor leading enterprises have the strength in wafer foundry and packaging testing; the midstream core product MCU (mainly overseas), PCB (high domestic rate), passive components (to a certain extent domestic); downstream controller assembly manufacturers are primarily global component giants leading the way. In recent years, some domestic listed companies and startups have gradually realized product R&D and order acquisition.

Risk Warning:L3 popularization risk, automotive sales downturn risk.

Domain Controllers Bring Software and Hardware Opportunities

As the regional “brain” of the vehicle, the DCU receives signals from the sensor side and sends decision information to the execution system. The popularization of DCUs will bring a series of investment opportunities in hardware and software. Software aspects include multi-fusion sensor algorithms, standardized software architecture AUTOSAR, system safety ASIL upgrades, in-vehicle Ethernet applications, and whole vehicle OTA upgrades, which may bring a series of development opportunities focused on algorithms, safety, and other computer and communication enterprises. In terms of hardware, it is recommended to focus on upstream chip manufacturing processes such as SMIC (covering overseas groups) and leading packaging and testing enterprises such as JCET (covering electronics groups); midstream PCB companies such as Huadian and Jingwang Electronics (both covering electronics groups); downstream controller assembly companies such as Desay SV and Kobot; execution end companies such as Berteli and Xingyu.

The Background of Domain Controllers

Autonomous Driving is Inevitable

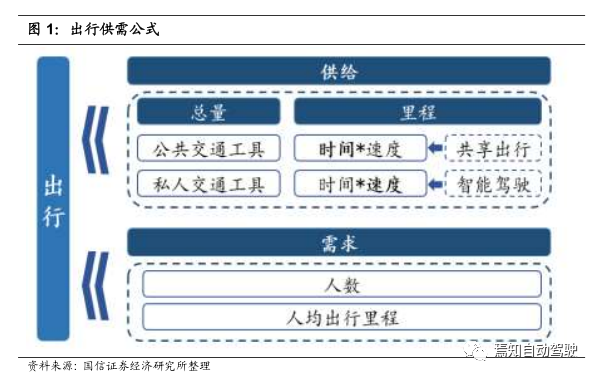

To understand the current autonomous driving (smart cars), one must consider the following formula: travel demand = total volume * mileage

On the left, travel demand = number of people * average travel mileage.

On the right, the first term, total volume = public transport + private transport.

On the right, the second term, mileage = time * speed.

In terms of demand, with the development of urbanization and modern commercialization in China, on the one hand, it has increased urban population, and on the other hand, the urban radius continues to expand (main urban radius > 25km), increasing the distance of residents’ daily commute. The travel demand on the left side of the equation is rapidly increasing.

Increased travel demand will inevitably require improvements in total volume and efficiency of use. In terms of public transport,there are shortcomings in areas such as buses and subways. In 2017, the total length of subway lines in China was 3881.77 kilometers, still significantly behind the United States (heavy rail + light rail, 5799 kilometers). At the same time, the number of public taxis per 10,000 people in major cities is on a downward trend. In terms of private transport, by the end of 2019, the total number of motor vehicles in the country reached 348 million, with 260 million cars, resulting in a per-thousand ownership rate of 170 vehicles. Due to the shortage of land resources such as roads and parking lots, urban ownership growth faces bottlenecks.

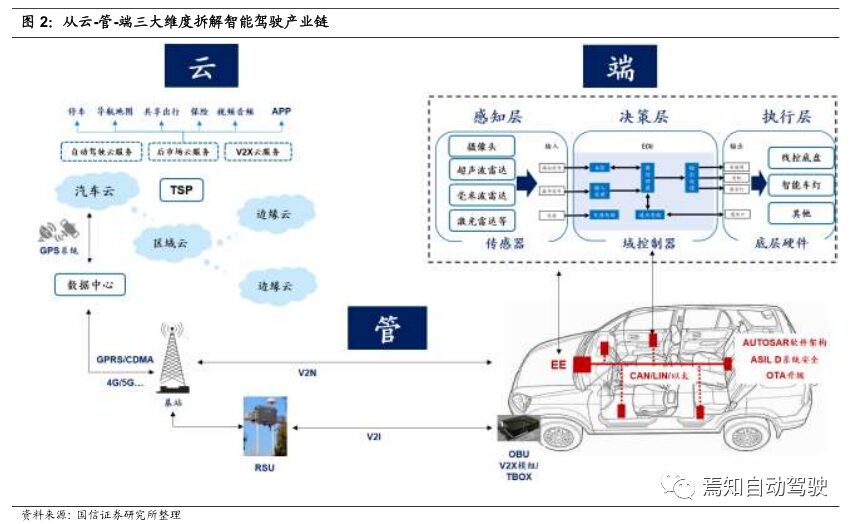

There is a gap between domestic residents’ travel demand and supply,which partially undermines residents’ travel quality, causing congestion on roads and subways. How to improve the efficiency of existing resource use is key to solving travel contradictions. Smart driving and shared mobility represent a supply-side revolution aimed at improving resource utilization (we published a special report on the shared mobility industry in December 2018 – “Shared Cars: A Model Discussion Under Non-Mature Conditions”; in July 2019, we published a special report on the smart driving industry – “ADAS + Vehicle Networking: The Path to Autonomous Driving”). In March 2020, we published a special report on Huawei’s automotive business – “Current Status, Competitive Landscape, and Industry Chain Opportunities of Huawei’s Automotive Business.” According to the breakdown of Huawei’s smart automotive solutions, the future smart driving industry chain will bring full industry chain opportunities from the cloud, management, and end levels. This in-depth report on domain controllers analyzes its core decision-making components from the “end” level.

Autonomous Driving Spawns New Opportunities in the Industry Chain

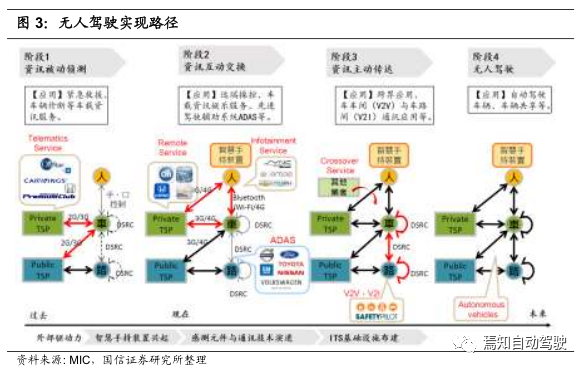

Achieving autonomous driving requires four steps.We believe that autonomous driving can be divided into four stages from the application perspective. Stage 1 is the passive detection of information, mainly applied in in-vehicle information services; Stage 2 is the interactive exchange of information, which is the current stage, mainly applied in ADAS, etc.; Stage 3 is the proactive delivery of information, mainly applied in V2V and V2I, integrating sensor technology to achieve vehicle-road collaboration; Stage 4 is the ultimate autonomous driving stage, where vehicle operational efficiency is expected to significantly improve under autonomous driving, with shared vehicles being a typical application.

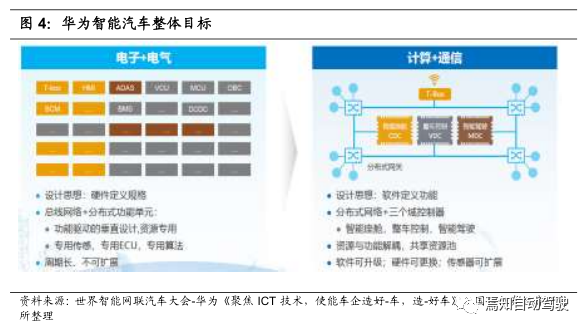

In the process of autonomous driving, the vehicle architecture has undergone significant changes — from EE (electronic and electrical) to “computation + communication”. This aims to realize software-defined vehicles, continuously creating value. In the traditional electronic and electrical architecture, vehicles are mainly defined by hardware, using distributed control units, dedicated sensors, dedicated ECUs, and algorithms, leading to low resource synergy and some waste. In the computation + communication architecture, the goal is to achieve software-defined vehicles, where domain controllers play a crucial role. Through the integration of domain controllers, dispersed vehicle hardware can achieve information interconnection and resource sharing, software can be upgraded, and hardware and sensors can be replaced and expanded in functionality.

In the process of autonomous driving, the vehicle electronic and electrical architecture transitions from distribution to centralization

The automotive electronic and electrical architecture lays the foundation for the vehicle’s underlying framework.The automotive electronic and electrical architecture (Electronic and Electrical Architecture, referred to as EEA in this article) is a set of integration methods defined by automakers. It is a macro concept similar to human anatomy and architectural blueprints, essentially constructing a framework that requires various “organs,” “blood,” and “nerves” to fill it, giving it vitality. Specifically, for automobiles, EEA perfectly integrates various sensors, ECUs (Electronic Control Units), wiring topology, and electronic and electrical distribution systems within the vehicle, completing the distribution of computation, power, and energy, and enabling various intelligent functions of the vehicle.

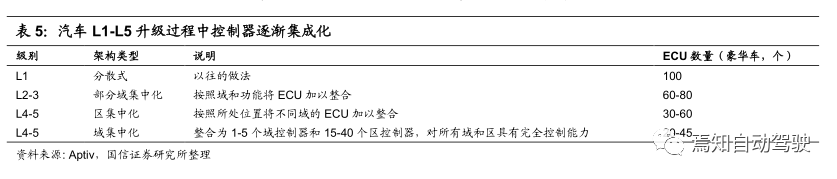

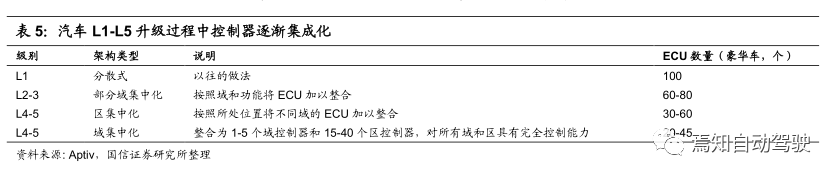

In the process of autonomous driving, the vehicle architecture evolves from distribution to centralization. Global component giant Bosch has previously divided the automotive electronic and electrical architecture into three major stages: distributed electronic and electrical architecture – [cross] domain centralized electronic and electrical architecture – vehicle centralized electronic and electrical architecture, each major stage contains two development nodes.

In total, there are six development nodes that detail the process of the electronic and electrical architecture evolving from distributed to vehicle centralized. As the degree of vehicle automation increases from L0 to L5, most traditional automakers’ electronic and electrical architectures are currently transitioning from distributed to [cross] domain centralized. The distributed electronic and electrical architecture is mainly used in L0-L2 level models, where vehicles are mainly defined by hardware, using distributed control units, dedicated sensors, dedicated ECUs, and algorithms, leading to low resource synergy and some waste; starting from L3, the [cross] domain centralized electronic and electrical architecture takes center stage, where domain controllers play an important role. Through the integration of domain controllers, dispersed vehicle hardware can achieve information interconnection and resource sharing, software can be upgraded, and hardware and sensors can be replaced and expanded in functionality; further development leads to the centralized electronic and electrical architecture, primarily developed by Tesla Model 3, which essentially achieves the ultimate ideal for vehicles—central control architecture at the level of an onboard computer.

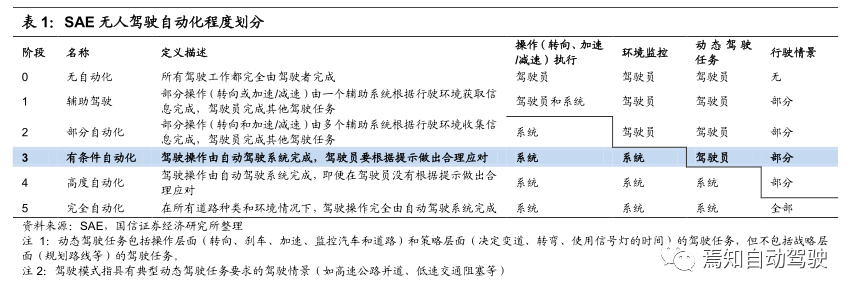

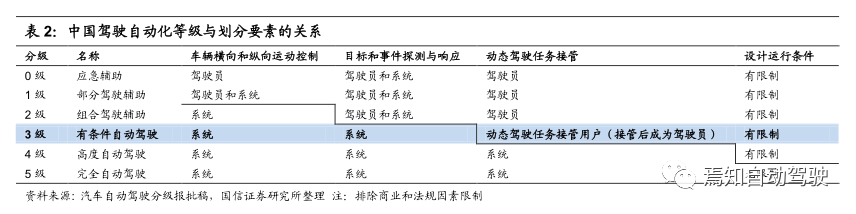

Vehicle automation levels are mainly referenced according to the 0-5 level classification.Currently, the globally recognized automotive autonomous driving technology grading standards are mainly two, proposed by the National Highway Traffic Safety Administration (NHTSA) and the Society of Automotive Engineers (SAE). China released its version of the “Automotive Driving Automation Level” in 2020, referencing SAE’s 0-5 level grading framework and making some adjustments based on China’s current situation, generally categorizing autonomous driving into levels 0-5.

L3 Level is a Leap in Automotive Automation.From both regulatory and technical dimensions, L3 level autonomous driving represents a significant leap in automotive automation. From a regulatory perspective, SAE and China’s “Automotive Automation Level” stipulate that levels L0-L2 are all human-driven, with vehicles only assisting. The differences between L0, L1, and L2 mainly lie in the number of ADAS functions equipped. Starting from L3, the role of humans in driving operations rapidly declines, and the vehicle’s autonomous driving system can complete all driving operations under permissible conditions (acting no less than the driver), with the driver taking over in the event of system failure or exceeding designed operating conditions; from a technical perspective, L0-L2 mainly utilize sensors such as cameras, ultrasonic radars, and millimeter-wave radars, while L3 and beyond see an increase in the number of original sensors, and the high-cost LiDAR solutions cannot be avoided. The requirements for collaboration between sensors increase, and multi-sensor fusion algorithms become increasingly complex, necessitating a significant increase in the computing power of controller chips.

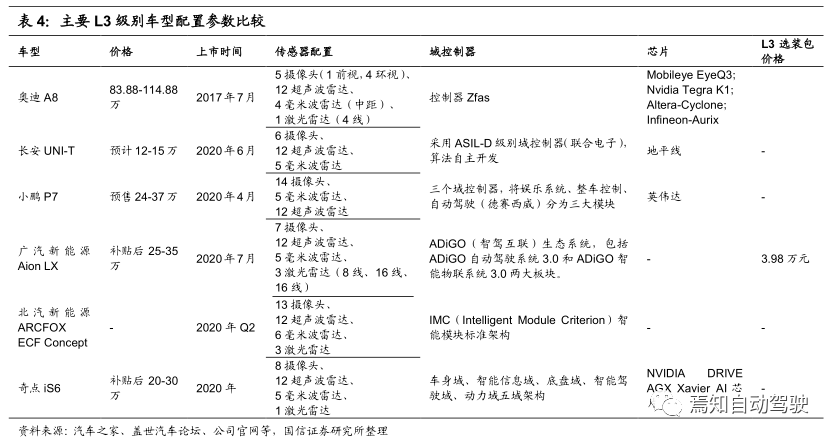

2020 is the Year of Mass Production for L3 Level Models.The Audi A8 was the first mass-produced vehicle equipped with L3 level hardware. Although due to legal and regulatory constraints, the A8 has never been able to deliver L3 level functionality to consumers, its mass production hardware scheme launched in 2017, featuring 5 cameras, 12 ultrasonic radars, 4 millimeter-wave radars, and 1 LiDAR, has always been a pioneer in the industry. Following Audi, most global automakers plan to officially mass-produce L3 level models between 2020 and 2021, such as BMW iNEXT, and the new S/C class from Mercedes-Benz.

China’s L3 mass production started with the launch of the UNI-T model by Changan in 2020. The year 2020 marks the year of mass production for L3 level models in China, with subsequent launches of models such as Xpeng P7, Changan UNI-T, BAIC New Energy ARCFOX ECF Concept, GAC New Energy Aion LX, and Singularity iS6.

Domain Controllers Entered the Market Starting from L3.Due to the increase in the number of sensors and fusion algorithms brought by L3 level “shared driving”, the existing widely used traditional distributed electronic and electrical architecture faces issues such as increased redundancy costs due to the rising number of ECUs, difficulties in coupling sensor data, increased wiring complexity, and increased wiring costs, making it challenging to support the realization of L3 functions. The [cross] domain centralized electronic and electrical architecture has entered the stage since L3. The core processing module of this architecture—the domain controller—has begun to enter the market. In the following sections, we will elaborate on the definition, role, principles, classification, structure, and industry chain of domain controllers.

Classification of Domain Controllers—Classic Five Domains Division

Core:According to Bosch’s classic five-domain classification, the vehicle is divided into power domain (safety), chassis domain (vehicle motion), cockpit domain/intelligent information domain (entertainment information), autonomous driving domain (assisted driving), and body domain (body electronics). These five domain control modules comprehensively integrate all control functions of L3 and above level autonomous vehicles.

1. Power Domain (Safety) The power domain controller is an intelligent powertrain management unit that utilizes CAN/FLEXRAY to manage transmission, engine, battery monitoring, and alternator regulation. Its advantages include calculating and distributing torque for various power system units (internal combustion engines, motors/generators, batteries, transmissions), achieving CO2 reduction through predictive driving strategies, communication gateways, etc., primarily used for optimizing and controlling the powertrain, while also featuring electrical intelligent fault diagnosis, intelligent energy saving, and bus communication functions.

The mainstream system design solutions for the future are as follows:

-

An intelligent power domain controller hardware and software platform centered around Aurix 2G (387/397), integrating the basic functions of ECUs for sub-controllers within the power domain, and integrating advanced domain-level algorithms for VCU, Inverter, TCU, BMS, and DCDC aimed at collaborative optimization within the power domain.

-

Aiming for ASIL-C safety level, equipped with SOTA, information security, and communication management functions. Supported communication types include CAN/CAN-FD, Gigabit Ethernet, and provide SHA-256 encryption algorithm support for communication.

-

Targeting CPU/GPU development, requiring support for Adaptive Autosar environments, main frequency needs to be raised to 2G, and must support Linux systems, currently supporting POSIX standard interface operating systems.

On January 16, 2020, the power domain controller developed by the team led by Deng Xiaoguang, Vice President of Hozon Auto Engineering Research Institute, was successfully equipped in Nezha vehicles and passed vehicle testing on the first attempt, marking the official mass production application stage of Hozon PDCS (Powertrain Domain Control System) power domain controller. The Hozon power domain controller system adopts Infineon’s multi-core processor with a main frequency of 200MHz, featuring DSP digital signal processing and floating-point computation capabilities, making it the high-speed processor of Hozon PDCS. Meanwhile, the Hozon PDCS’s three-core main chip with lock-step core achieves higher functional safety, developed according to ASIL C functional safety level, second only to the D level for aircraft, effectively ensuring user travel safety. The V-model development allows for verification at every step, with a software failure rate lower than 0.3%, and incorporates AUTOSAR architecture + MBD modeling and control, effectively improving software reliability. It can monitor the electronic control system in real-time, intelligently coordinate and monitor power output, enhancing driving performance and safety, while also ensuring battery safety, synchronously optimizing energy distribution based on system requirements, and increasing range.

2. Chassis Domain (Vehicle Motion) The chassis domain is related to vehicle driving and is composed of the transmission system, driving system, steering system, and braking system.The transmission system is responsible for transmitting the engine’s power to the drive wheels and can be divided into mechanical, hydraulic, and electric types. Among them, the mechanical transmission system mainly consists of clutches, transmissions, universal joints, and drive axles; the hydraulic transmission system mainly consists of torque converters, automatic transmissions, universal joints, and drive axles; the driving system connects various parts of the vehicle as a whole and supports the entire vehicle, such as the chassis, suspension, wheels, and axles; the steering system ensures that the vehicle can travel in a straight line or turn according to the driver’s wishes; the braking system applies a certain external force opposite to the vehicle’s direction of travel on the vehicle’s wheels, implementing a certain degree of forced braking, which serves to slow down, stop, and park.

Intelligentization drives the development of steer-by-wire chassis. With the advancement of automotive intelligentization, in the three core systems of sensing, decision-making, and control execution, the control execution end, which includes driving control, steering control, and braking control, is closest to the automotive component industry. It requires the traditional chassis to be modified for steer-by-wire to be suitable for autonomous driving. The steer-by-wire chassis mainly consists of five major systems: steer-by-wire, brake-by-wire, shift-by-wire, throttle-by-wire, and suspension-by-wire, with steer-by-wire and brake-by-wire being the most core products for the execution end of autonomous driving, among which braking technology poses a greater challenge.

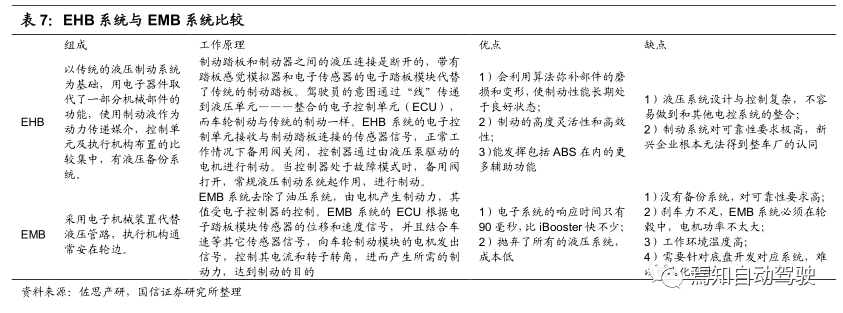

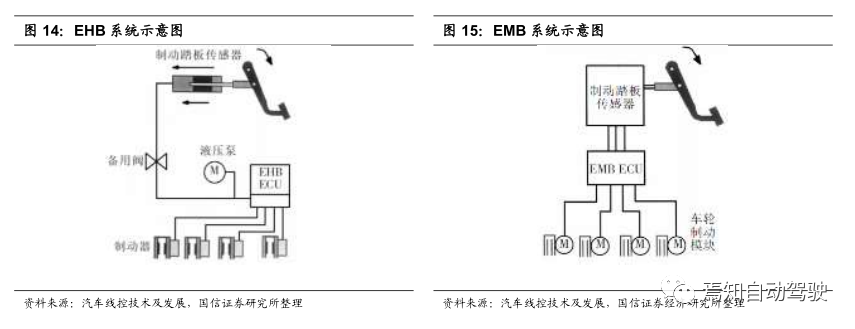

(1) Brake-by-wire is the future trend of automotive braking systems.The automotive braking system has evolved from mechanical to hydraulic and then to electronic (ABS/ESC), and will develop towards brake-by-wire in the future. In the L2 era, brake-by-wire can be divided into three categories: fuel vehicles, hybrids, and pure electric vehicles. Fuel vehicles generally use ESP (ESC) for brake-by-wire. Hybrids mainly use indirect EHB (electro-hydraulic braking) centered around high-pressure accumulators. Pure electric vehicles primarily adopt direct EHB, which directly drives the master cylinder piston via the motor. Given the importance of response time for braking systems in L3 and above autonomous vehicles, brake-by-wire systems transmit execution information via electrical signals, resulting in faster responses and shorter braking distances, making it a long-term trend in automotive intelligentization.

The brake-by-wire system can be divided into hydraulic brake-by-wire EHB and mechanical brake-by-wire EMB types. The EHB system has a backup braking system, making it safer; therefore, it is more widely accepted and is currently the main scheme for mass promotion. Due to the lack of a backup braking system and technical support, it is unlikely to be applied in large quantities in the short term, but it is the direction for future development.

Brake-by-wire is a high-threshold area in automotive technology, with major global brake-by-wire manufacturers including Bosch, Continental, and ZF. The technology of EHB has matured among foreign manufacturers, but it is still not strictly suitable for L4 autonomous driving. Domestic technology is striving to catch up; EMB is still in the research stage and currently faces challenges for breakthroughs. Among them, Bosch’s iBooster is a typical direct EHB. The iBooster is usually used in conjunction with ESP, which takes over when the iBooster fails. However, since ESP is also an electro-hydraulic system, it may also fail, and since ESP was initially designed only for AEB emergency braking scenarios, it cannot be used for regular braking, so after the launch of the second-generation iBooster, Bosch began to design a brake-by-wire system for L3 and L4.

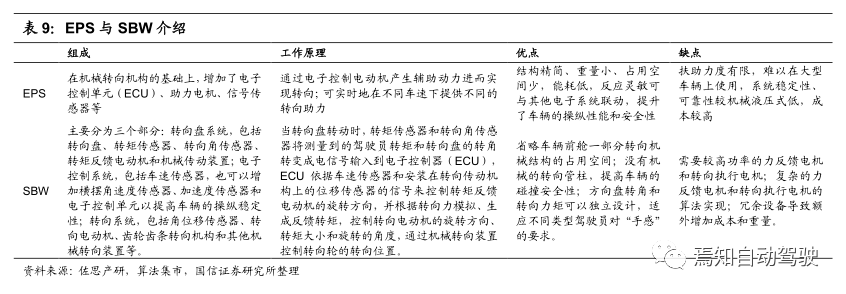

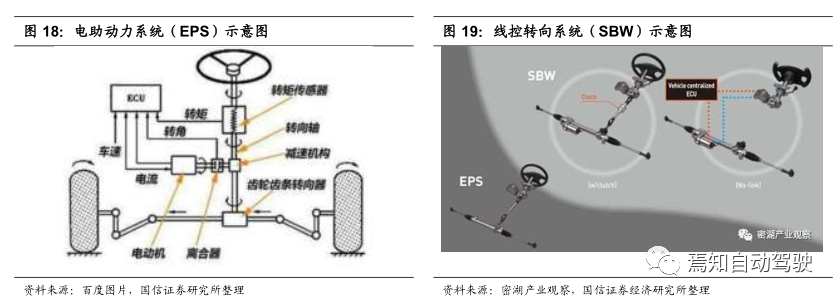

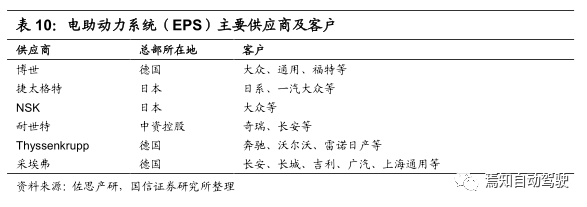

(2) The development of intelligentization has prompted the emergence of steer-by-wire.The steering system has evolved from the initial mechanical steering system (MS) to hydraulic power steering systems (HPS), then to electronic hydraulic power steering systems (EHPS) and electric power steering systems (EPS). Currently, EPS is mainstream in passenger vehicles, while HPS is mainstream in commercial vehicles, and EHPS is more common in large SUVs, with less prevalence in other areas. Under the trend of intelligentization, L3 and above level smart vehicles require some or all driving operations to be detached from driver control, necessitating higher precision and reliability requirements for the steering system, prompting the emergence of steer-by-wire (SBW). The steer-by-wire system refers to a system where the connection between the driver input interface (steering wheel) and the execution mechanism (steering wheel) is through wire control (electronic signals), meaning there is no direct hydraulic or mechanical connection between them. The steer-by-wire system controls the steering system by sending electrical signal commands to the assist motor. The development of SBW is a continuation of EPS, requiring redundancy features compared to EPS.

Currently, there are two methods for SBW systems:1) Cancel the mechanical connection between the steering wheel and the steering execution mechanism, increasing the system’s redundancy through multiple motors and controllers; 2) Add an electromagnetic clutch between the steering wheel and the steering execution mechanism as a backup for failure, increasing the system’s redundancy.

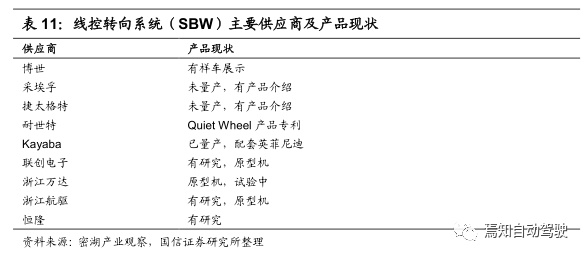

From the manufacturer’s perspective, the main global EPS manufacturers include Bosch, JTEKT, NSK, and Nexteer, among others. Japanese manufacturers mostly started with precision bearings and expanded downstream into the EPS field; American manufacturers are tier 1 suppliers that horizontally expand into the EPS field; European manufacturers are similar to American ones but are much stronger in upstream precision machining. In contrast, domestic companies are mainly represented by three: Zhuzhou Yilida, Hubei Henglong, and Zhejiang Shibao, but they are all relatively small in scale and lagging in technology.

The steer-by-wire system (SBW) faces high requirements in technology, capital, and safety, with the technology primarily held by overseas component giants, creating high entry barriers. Currently, domestic companies such as Lianchuang Electronics and Zhejiang Wanda are beginning to venture into the SBW field, with domestic enterprises expected to explore new SBW business opportunities in the future.

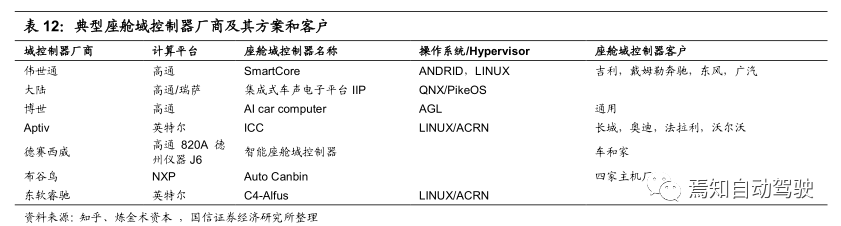

3. Cockpit Domain/Intelligent Information Domain (Entertainment Information) The traditional cockpit domain consists of several dispersed subsystems or individual modules,this architecture cannot support complex electronic cockpit functions such as multi-screen linkage and multi-screen driving, thus giving rise to the cockpit domain controller, a centralized computing platform. The intelligent cockpit mainly includes full LCD instrument panels, large central control systems, in-vehicle information entertainment systems, heads-up display systems, and streaming media rearview mirrors, with the core control component being the domain controller. The cockpit domain controller (DCU) integrates heads-up displays, instrument panels, navigation, and other components through Ethernet/MOST/CAN, not only incorporating traditional cockpit electronic components but also further integrating intelligent driving ADAS systems and vehicle networking V2X systems, thus optimizing intelligent driving, in-vehicle connectivity, and information entertainment functionalities. The intelligent driving assistance system mainly consists of three core parts: perception layer, decision layer, and execution layer. The main sensors in the perception layer include in-vehicle cameras, millimeter-wave radars, ultrasonic radars, LiDAR, and intelligent lighting systems. The vehicle’s motion information is mainly obtained through speed sensors, angle sensors, inertial navigation systems, and other components on the vehicle. Through the cockpit domain controller, “independent perception” and “interaction mode upgrades” can be achieved.

On one hand, vehicles have the ability to “perceive” people.The intelligent cockpit system can obtain sufficient perception data through an independent perception layer, such as in-vehicle vision (optical), voice (acoustic), and chassis and body data from the steering wheel, brake pedal, throttle pedal, gear shift, and seat belt, using biometric technology (mainly face recognition and voice recognition in the cockpit) to comprehensively assess the physiological state (image, facial recognition, etc.) and behavioral state (driving behavior, voice, body language) of the driver (or other passengers), and then push interaction requests based on specific scenarios. On the other hand, in-vehicle interaction methods have upgraded from “physical button interaction” to a state where “touch screen interaction,” “voice interaction,” and “gesture interaction” coexist. In addition, multi-modal interaction technology integrates perception data from “vision” and “voice” modalities to achieve more precise, intelligent, and humanized interactions.

In the cockpit electronic domain controller field, the manufacturer using the Visteon Smart Core solution is the most common, followed by Aptiv’s Integrated Cockpit Controller (ICC) solution. Among them, Visteon’s Smart Core aims to integrate information entertainment, instrument panels, information display, HUD, ADAS, and networking systems. According to Visteon, it has a high degree of scalability and network security, enabling independent functional domains. Aptiv’s Integrated Cockpit Controller (ICC) uses the latest Intel automotive processor series, supporting up to four high-definition displays, scalable, and can cover both entry-level and high-end products. The ICC provides substantial improvements in graphics (10x) and computing power (5x), utilizing a single-chip central computing platform to drive multiple cockpit displays, including the instrument panel, HUD, and central stack.

4. Autonomous Driving Domain (Assisted Driving) The domain controllers applied in the autonomous driving field enable vehicles to possess multi-sensor fusion, positioning, path planning, and decision control capabilities, typically requiring external devices such as multiple cameras, millimeter-wave radars, and LiDAR to complete functions including image recognition and data processing. There is no longer a need to equip external industrial control computers, control boards, and other hardware, and it is necessary to match powerful core processors to provide support for different levels of autonomous driving computing power. The core lies in the chip’s processing capability, with the ultimate goal being to meet the computing power requirements for autonomous driving, simplifying equipment, and significantly enhancing system integration. In terms of algorithm implementation, autonomous vehicles use onboard sensors such as LiDAR, millimeter-wave radars, cameras, GPS, and inertial navigation systems to perceive the surrounding environment. Through sensor data processing and multi-sensor information fusion, along with appropriate working models, corresponding strategies are developed for decision-making and planning. After planning the path, the vehicle is controlled to travel along the desired trajectory. The inputs for the domain controller are data from various sensors, and the algorithm processing covers perception, decision-making, and control at three levels, ultimately outputting to the execution mechanism for vehicle lateral and longitudinal control.

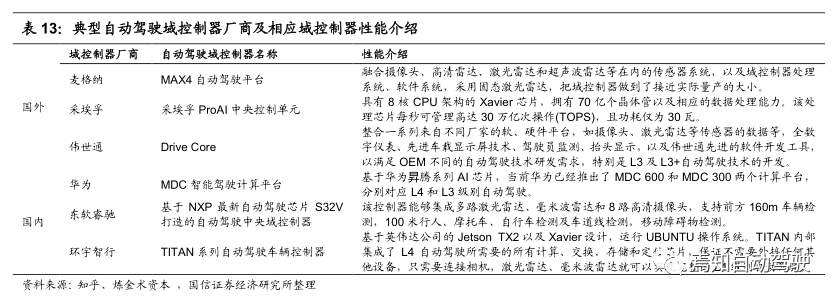

Due to the need for extensive computations, domain controllers typically require a powerful core processor that can provide support for different levels of autonomous driving computing power.Currently, there are multiple solutions in the industry such as NVIDIA, Huawei, Renesas, NXP, TI, Mobileye, Xilinx, Horizon, etc. However, there are some commonalities; for example, in autonomous driving systems, the highest computing power demand is for image recognition, followed by multi-sensor data processing and fusion decision-making. For instance, the zFAS from Austrian company TTTech (applied for the first time on the 2018 Audi A8) is a product designed based on a domain controller provided by Delphi, integrating NVIDIA’s Tegra K1 processor and Mobileye’s EyeQ3 chip, with each part handling different modules. The Tegra K1 is used for processing four surround view images, while the EyeQ3 is responsible for forward recognition processing. In the context of rapid development in autonomous driving technology, more and more Tier 1 suppliers and vendors both domestically and internationally are beginning to engage in autonomous driving domain controllers.

5. Body Domain (Body Electronics) With the development of the entire vehicle, the number of body controllers is increasing,to reduce controller costs and vehicle weight, integration is needed to connect all functional devices from the front part, middle part, and rear part of the vehicle, such as rear brake lights, rear position lights, tailgate locks, and even dual supporting rods, into a single main controller. The body domain control system transitions from a decentralized functional combination to integrating all body electronics such as basic driving, key functions, lighting, doors, and windows into a large controller. The body domain control system comprehensively develops and designs lighting, wipers, central locking, window control; PEPS smart key, low-frequency antennas, low-frequency antenna drives, electronic steering column locks, IMMO antennas; gateways for CAN, expandable CANFD and FLEXRAY, LIN networks, Ethernet interfaces; TPMS and wireless receiving modules.

There are dozens of groups related to the automotive industry, including complete vehicles, key components, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, and vehicle networking. To join a group, please scan the administrator’s WeChat (please specify your company name).There is also a startup financing group, welcome to angel round and A-round companies to join.