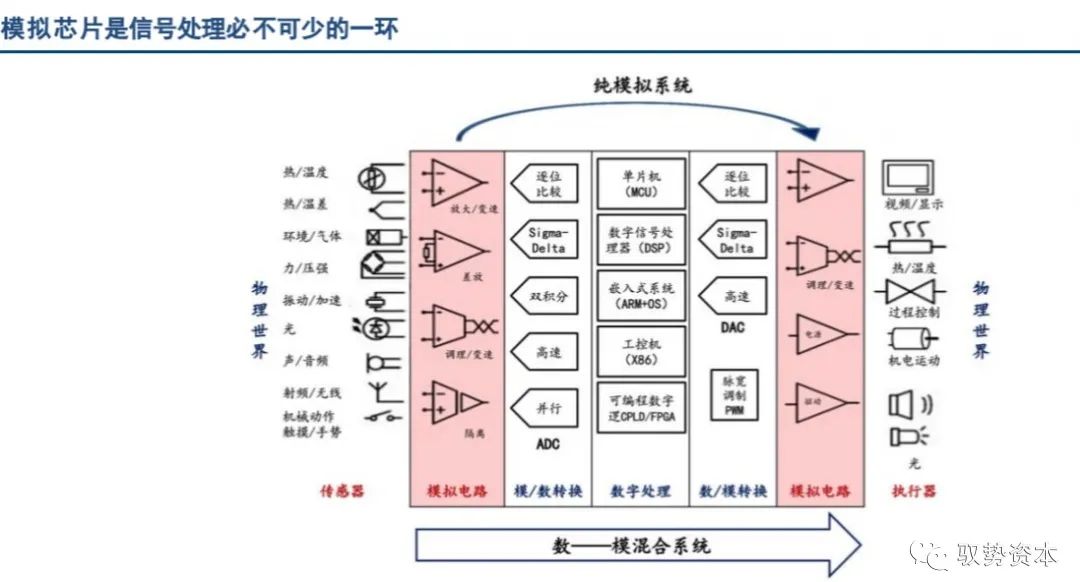

All data originates from analog signals. Analog chips are integrated analog circuits used to process analog signals. Analog signals are continuous in both time and amplitude, while digital signals are discontinuous in both time and amplitude. External signals are converted into electrical signals by sensors, which are analog signals, and further processed in systems composed of analog chips through amplification, filtering, etc. The processed analog signals can either be output to digital systems for processing via data converters or directly to actuators.

Common mixed-signal systems include: consumer electronics such as mobile phones, personal computers, digital cameras, microphones, speakers, etc.; industrial applications like temperature detectors, electrocardiograms, aircraft systems; and automotive applications like rear-view display devices. Analog chips are ubiquitous.

Signals are transmitted in electrical form, divided into two categories based on the strength of current/voltage: weak and strong signals. Signal chain products are responsible for processing weak signals. Power management products mainly deal with strong signals, but also handle weak signals.

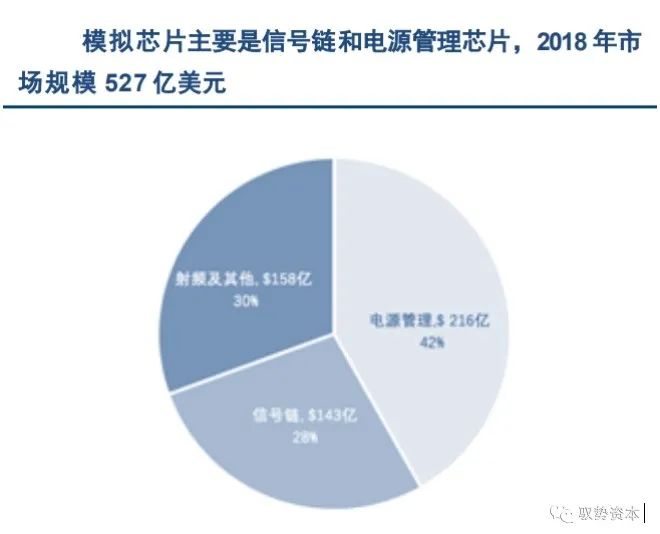

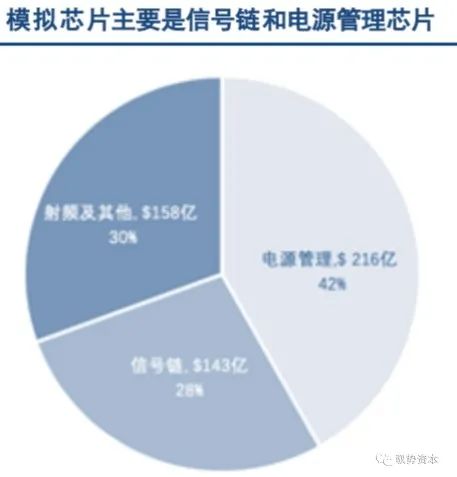

The global analog chip market space is nearly $60 billion. The global integrated circuit market is $340.2 billion, with analog circuits accounting for 15%. Within analog circuits, the signal chain market is $14.3 billion, and the power management market is $21.6 billion. Since the first integrated operational amplifier appeared in 1968, by 2018, analog chips have evolved into a nearly $60 billion global industry.

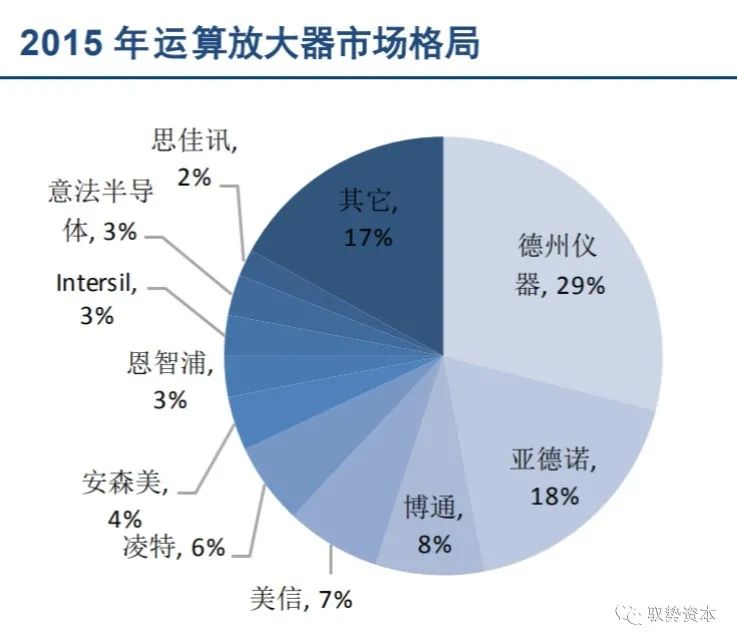

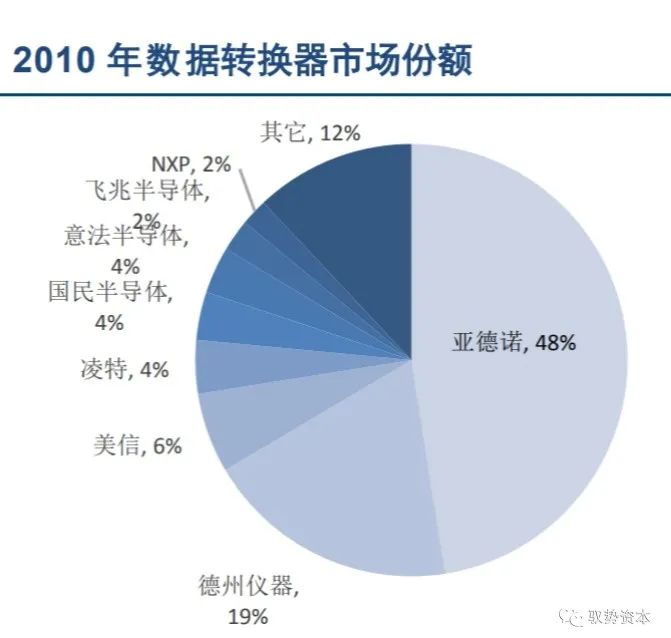

Currently, the top 10 analog chip companies occupy more than half of the market share. In 2018, the top 10 analog chip companies were Texas Instruments (TI), Analog Devices (ADI), Infineon, Skyworks, STMicroelectronics, NXP, Maxim, ON Semiconductor, Microchip, and Renesas. Among them, Texas Instruments excels in power management and is the leader in this field; ADI started with operational amplifiers and is the leader in data converters, holding a significant market share in operational amplifiers and power management. Infineon was spun off from the Siemens Group and is an independent semiconductor company listed on the stock market. The leading analog chip companies were mostly established in the early 1960s when integrated circuits were born and during the golden era of the 1990s, growing alongside the integrated circuit industry. This includes the current leader Texas Instruments (1930), the once leading National Semiconductor (1959), and the current runner-up ADI (1965), which have formed core competitiveness through the original accumulation of analog technology (Know-how).

Among the top ten analog chip companies, Texas Instruments was the first to manufacture integrated circuits, leading in power management and operational amplifiers, with downstream markets focused on industrial and automotive electronics. The runner-up ADI has been the leader in data converters for many years, currently focusing on industrial and communication markets. Infineon is a renowned automotive electronics manufacturer, ranking high in power management and power semiconductors. Skyworks specializes in the RF field and is one of the giants in RF chips, mainly supplying clients like Apple and other consumer electronics manufacturers, as well as communication equipment manufacturers. NXP, ON Semiconductor, and Renesas are also strong automotive electronics manufacturers, while Maxim focuses more on the industrial field, and Microchip leans more towards the digital domain of MCUs outside of analog products.

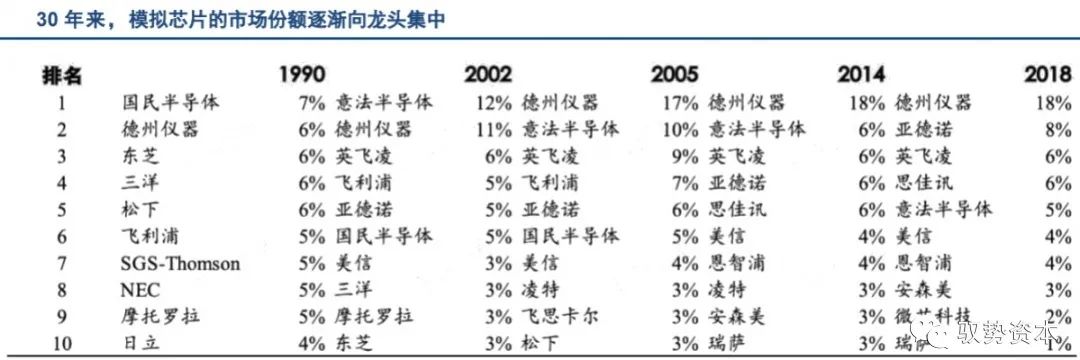

The industry pattern is characterized by “one strong leader and many strong competitors.” In the analog chip field, Texas Instruments is undoubtedly the leader, with an 18% market share, having maintained the top position since 2004. However, the market share of companies ranked second to tenth is only in single digits and is relatively close. Among them, the second place, ADI, surpassed Infineon to become the second in the industry through the acquisition of Linear Technology in 2017. Therefore, the competition in the analog chip industry is relatively dispersed, forming a pattern of “one strong (Texas Instruments)” and “many strong (ADI, Infineon, STMicroelectronics, etc.).”

The industry is experiencing continuous mergers and acquisitions, leading to a more concentrated competitive landscape. In 1990, Texas Instruments was not yet the leader in analog chips; the competition in the analog chip industry was highly fragmented, with the market share of the leading National Semiconductor at only 7%, similar to the remaining companies in the top ten. However, by 2002, STMicroelectronics rose to first place, capturing over 10% of the market. Starting in 2004, Texas Instruments began to firmly maintain its first position, with a significantly larger share. Meanwhile, the companies ranked lower have been continuously merging and acquiring to gain larger market shares. Notable acquisitions include National Semiconductor being acquired by Texas Instruments (2011), Freescale being spun off from Motorola and eventually acquired by NXP (2015), Fairchild Semiconductor being acquired by ON Semiconductor (2016), Intersil being acquired by Renesas (2016), and Linear Technology being acquired by ADI (2017). It can be seen that over the past 30 years, the entire analog chip industry has been continuously consolidating, with the leading market share constantly increasing, and the industry moving towards concentration.

Signal chains and power management: Two important types of analog chips

Signal chain products mainly include operational amplifiers and data converters, addressing the needs of information interaction. In mixed-signal systems, a complete signal processing process is as follows:

Sensors: Obtain raw physical signals from the external environment through sensors, typically including sound, images, temperature, humidity, pressure, etc., and convert them into continuous time analog signals corresponding to these physical signals, typically in the form of voltage/current.

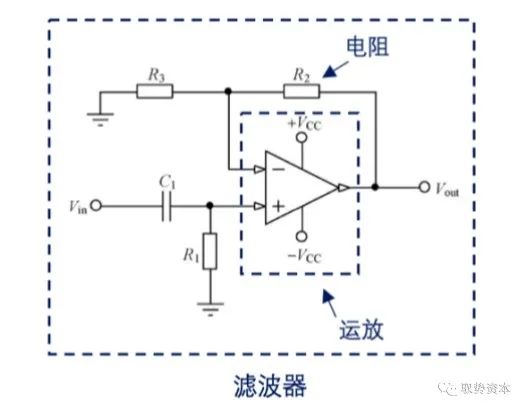

Amplifiers and Filters: Process the analog signals through a signal conditioning unit composed of amplifiers and filters. The role of the amplifier is to amplify weak analog signals to fit the full-scale input range of the ADC; the filter’s main function is to band-limit the signals to meet the requirements of the Nyquist sampling theorem.

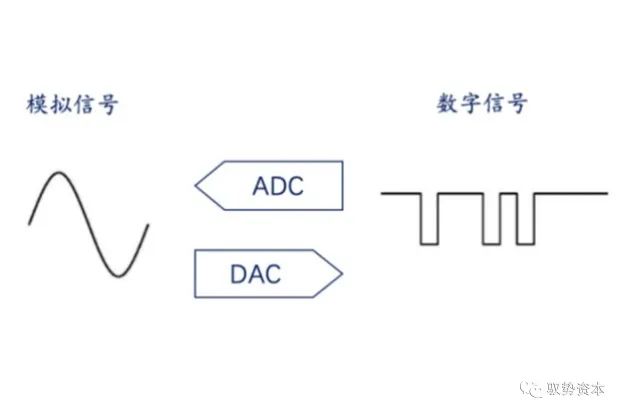

Data Converters: Convert the processed voltage/current signals into corresponding discrete digital quantities through ADC, providing them to subsequent digital units for processing.

Digital Processing: The discrete digital quantities processed by the digital processing system (MCU, DSP, or FPGA) undergo digital processing, typically used to implement digital signal processing algorithms.

Data Converters: The discrete digital quantities processed by the digital processing system are sent to the DAC. Through it, they are converted back into continuous analog signals.

Filters: Since the signals output by the DAC contain “step”-shaped high-frequency components, a reconstruction filter is needed for further processing to filter out high-frequency noise, ultimately obtaining the reconstructed analog output signal.

Among these, the most important are operational amplifiers and data converters.

Operational amplifiers are the “building blocks” of analog circuits and are widely used. An operational amplifier is an amplification circuit that performs operations such as addition and integration on analog signals, commonly used to amplify weak signals into larger signals. At the same time, operational amplifiers are fundamental components of many analog devices; data converters, current-to-voltage converters, filters, comparators, linear regulators, etc., all require operational amplifiers. It can be said that operational amplifiers are the “building blocks” of analog circuits.

Data converters are the bridge connecting analog and digital systems and are indispensable. Analog-to-digital converters (ADC) are responsible for converting analog signals into digital signals, while digital-to-analog converters (DAC) convert digital signals back into analog signals. Sensors convert real-world temperature, pressure, sound, etc., into electrical signals, most of which are analog signals that cannot be recognized and processed by digital systems. Only through the conversion of ADC can they be collected and processed by the MCU. Moreover, devices like speakers require analog signal inputs to operate, so DAC is needed to convert the digital signals output by digital systems back into analog signals. Therefore, whenever digital processing is involved, data converters are essential.

Operational amplifiers are the foundation for many analog devices; for example, filters are made up of operational amplifiers and resistors.

Data converters include digital-to-analog converters (DAC) and analog-to-digital converters (ADC).

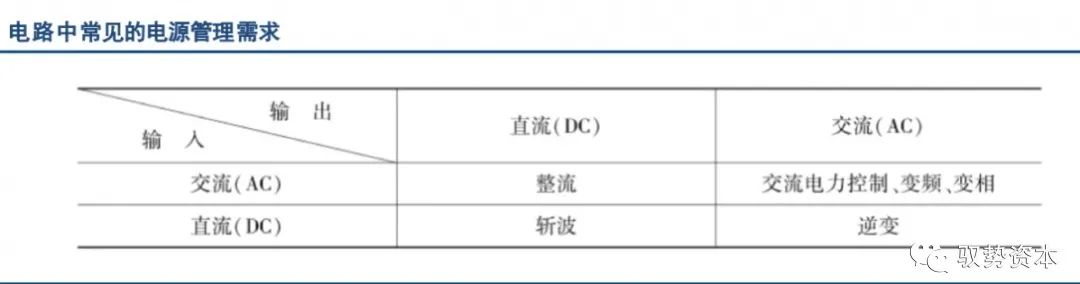

Power management is a necessary requirement for electronic circuits. Any electronic system requires power supply, with common power sources including power adapters, batteries, etc. Based on the types of input and output current, we can divide power managers into four main types: AC-DC (rectification), AC-AC (frequency conversion, etc.), DC-DC (chopping), and DC-AC (inversion).

Switching Rectifiers (AC-DC) are primarily responsible for converting AC to DC, commonly found in laptop power adapters.

AC-AC Converters are responsible for converting AC of a certain frequency into another constant or variable frequency AC.

DC-DC Converters convert DC into another DC with different frequency, phase, current, and voltage characteristics.

Inverters (DC-AC) are switching converters that convert DC into AC, sometimes referred to as current converters, and are key components of AC output switching power supplies and uninterruptible power supplies (UPS).

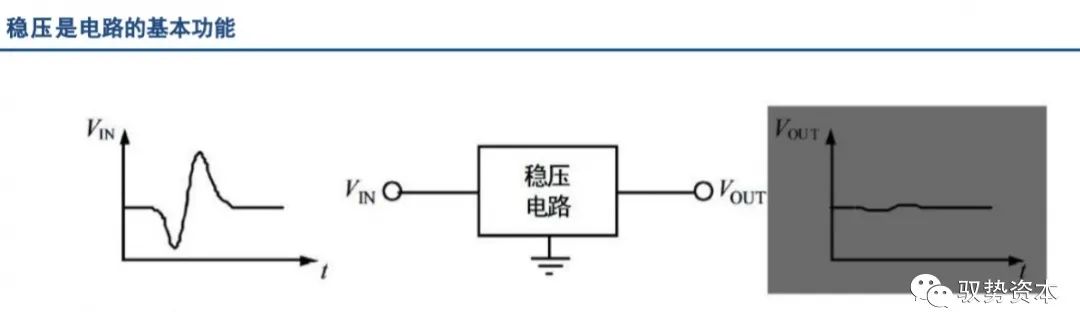

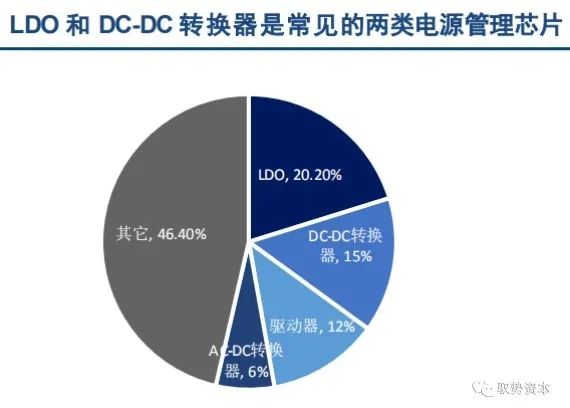

Power management chips are integrated power management circuits, primarily responsible for voltage regulation, boosting, maintaining current, AC-DC conversion, etc., divided into linear voltage regulators (LDO), charge pump chips, DC-DC converters, AC-DC converters, LED driver chips, etc. Typical applications include chargers for consumer electronics like mobile phones and laptops, as well as LED drivers. For example, voltage regulators reduce the voltage of 220V mains electricity and output stable low DC voltage for laptops; LED drivers boost the internal power supply of mobile phones to drive camera flashlights.

In the segmented market of analog chips, the leaders are far ahead.

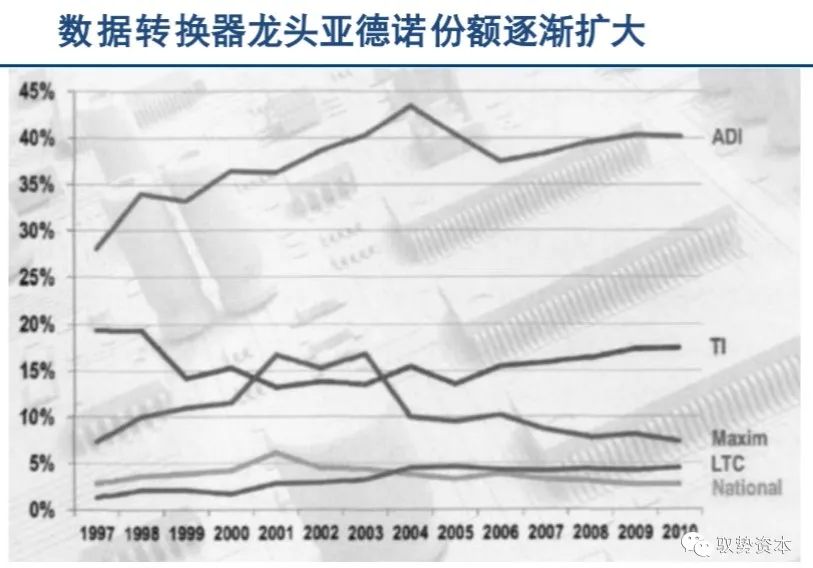

In analog integrated circuits, power management is the largest market, approximately $21.6 billion, accounting for 42%; the signal chain market is $14.3 billion (28%), and the RF and other product markets are about $15.8 billion, accounting for 30%. In the amplifier sector, Texas Instruments holds nearly one-third of the market (29%), with ADI in second place (18%). In the data converter sector, ADI is the absolute leader, currently holding half of the data converter market (48%), consistently ahead of competitors. In the power management sector, the leader Texas Instruments occupies over one-quarter of the market share (21%), with Qualcomm (15%), ADI (13%), Maxim (12%), and Infineon (10%) having similar shares.

Growth Logic: Demand Development Drives Three Major Changes in Analog Chips

Downstream Changes: Consumer Electronics’ Proportion in Signal Chain Decreases

The downstream markets for analog chips mainly include industrial, communication, consumer electronics, and automotive. The industrial market consists of industrial control and aviation, while the communication market mainly includes base stations and other communication devices. Consumer electronics encompass markets like mobile phones, laptops, MP3 players, digital cameras, etc.

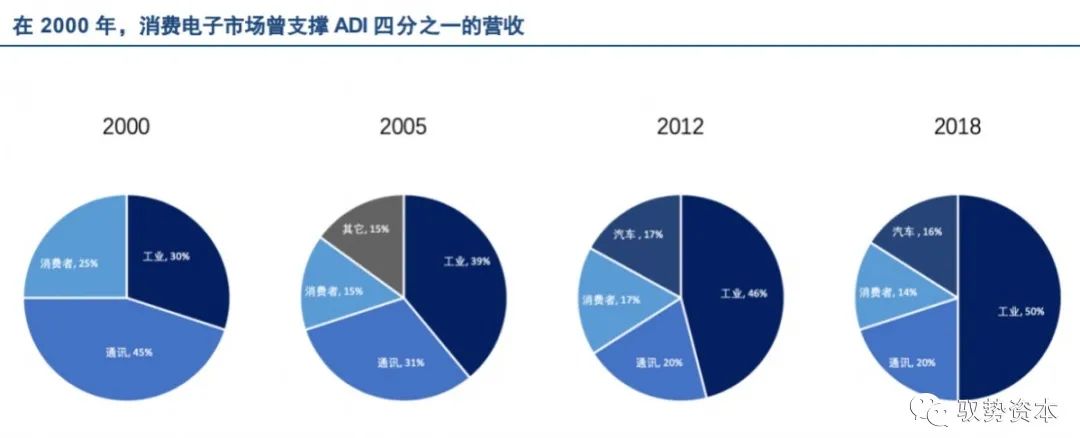

In the late 1980s, ADI rapidly developed by relying on consumer electronics. In the early development of ADI during the 1960s and 70s, its business was largely focused on industrial and military equipment. Starting in 1985, driven by mobile communications, the consumer electronics market emerged, and ADI shifted its focus to consumer electronics, with its revenue share reaching 25% in 2000, driving overall revenue to increase sevenfold. However, by 2018, the revenue share from consumer electronics decreased to 14%.

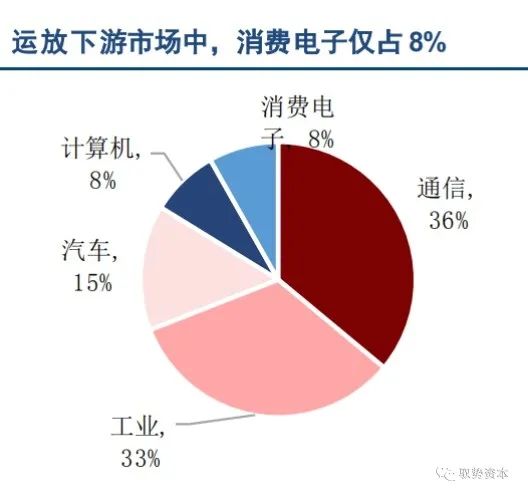

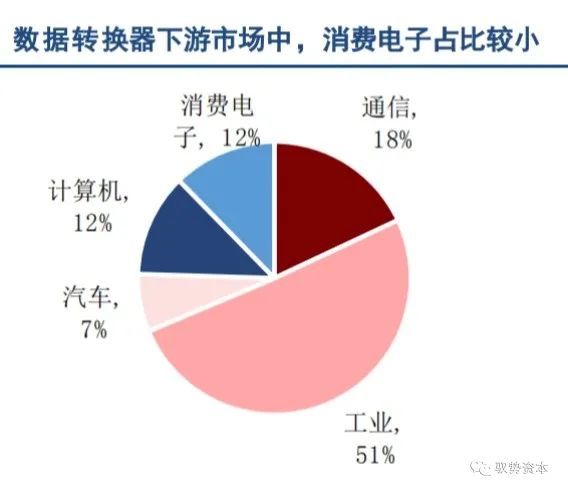

Today, the proportion of consumer electronics in the downstream market for signal chains is already very small. In 2015, the downstream market for operational amplifier chips was primarily communication (36%) and industrial (33%), with consumer electronics accounting for only 8%. Similarly, for data converters, over 50% of sales went to the industrial sector, while consumer electronics accounted for only 12%.

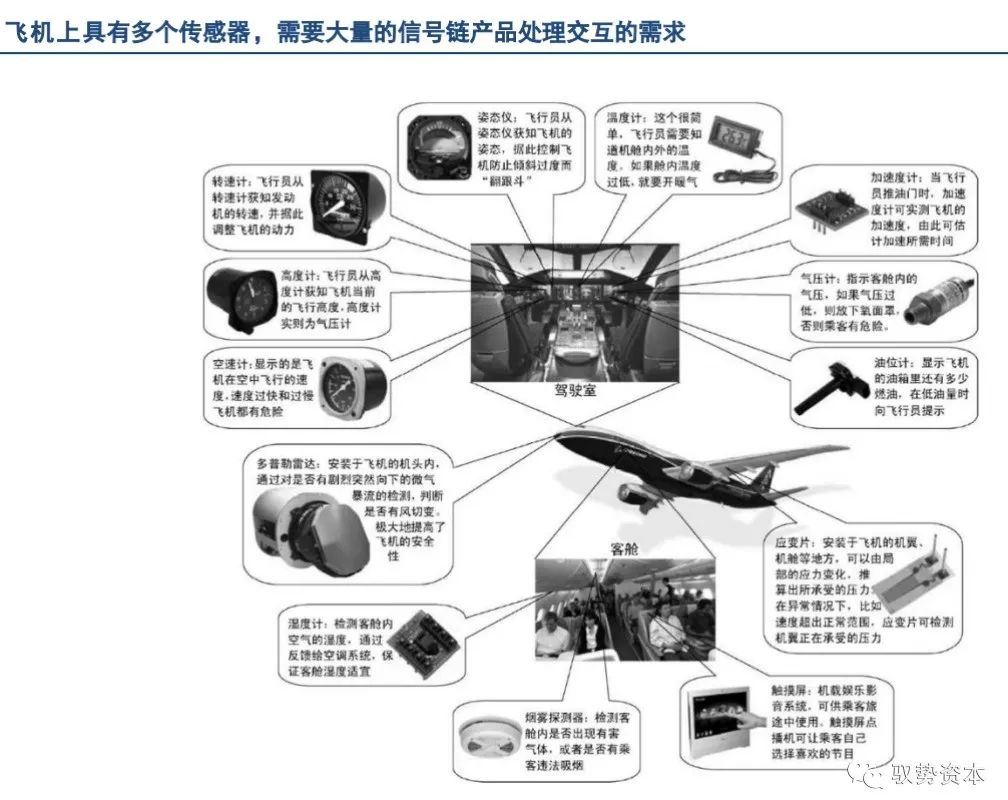

We believe that the electronics industry has traditionally been driven by demand for technological growth. The main demand for signal chains is interaction. In the early development of analog chips in the 1960s and 70s, signal chains were primarily used in the industrial downstream, connecting industrial equipment to computers and aircraft’s avionics systems, fulfilling the function of interaction between industrial equipment, flight equipment, and the outside world. For example, there are numerous sensors on aircraft to assist in flying, and before reaching digital systems, signal chain products are needed for processing. Moreover, integrated products can reduce size and cost. Therefore, the demand for signal chains in the industrial sector in the 1960s and 70s drove the early growth of analog giants like ADI and Texas Instruments. From 1980 to 2000, the demand for interaction in consumer electronics evolved from non-existence to existence, similarly driving the growth of signal chains in the downstream of consumer electronics.

The characteristics of the consumer electronics market are rapid product changes and cost priority, thus compared to the high precision pursued by the industrial market and the high speed pursued by the communication market, the demand in the consumer electronics market is for lower costs and shorter design cycles, making integrated signal chain products more capable of meeting these needs than discrete ones. In the past decade, the demand for interaction in consumer electronics has had limited impact on the continued increase in the complexity of signal chains. In other words, 1) in terms of performance, microcontrollers that integrate data converters can already meet most performance requirements for consumer electronics. 2) In terms of cost, as mobile phone functions increase, higher integration can reduce energy consumption. 3) In terms of design cycles, while discrete data converters have higher performance, they require greater complexity in system design, and consumer electronics manufacturers need to consider a range of issues including speed, resolution, and power consumption. If discrete signal chain chips are used, it becomes difficult to adapt to rapidly changing market demands. Therefore, in the past decade, signal chain products for consumer electronics have increasingly been integrated into microcontrollers/SoCs, resulting in a relatively flat growth in this downstream market statistically.

Product Structure Changes: Power Management Clearly Benefits from Growth in Consumer Electronics and Industry

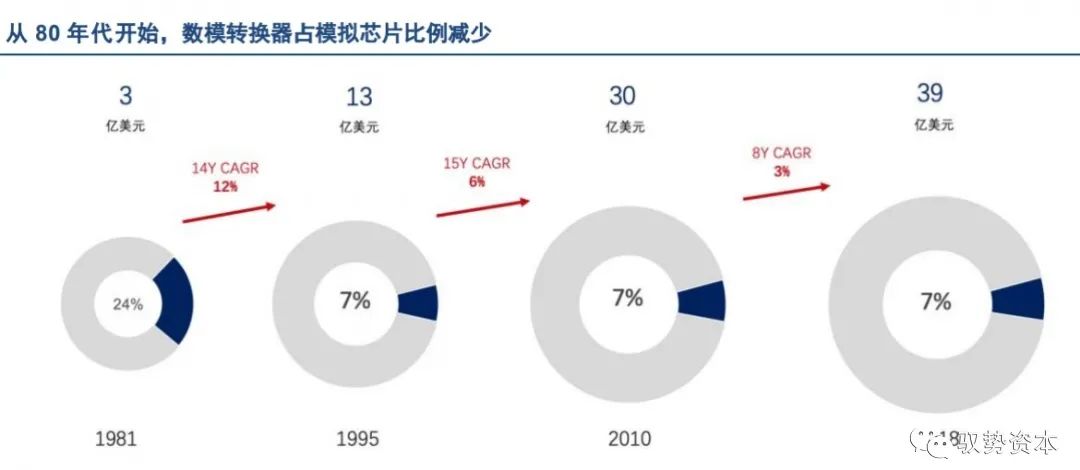

Since the 1990s, the share of signal chain products has gradually decreased. In 1981, the operational amplifier market accounted for 19% of analog chips, while in 2018 this number decreased to 6%, with the market size growing from $200 million to $3.5 billion. The share of digital-to-analog converters also decreased from 19% in 1981 to 6% in 2018, with the market size increasing from $300 million to $3.9 billion.

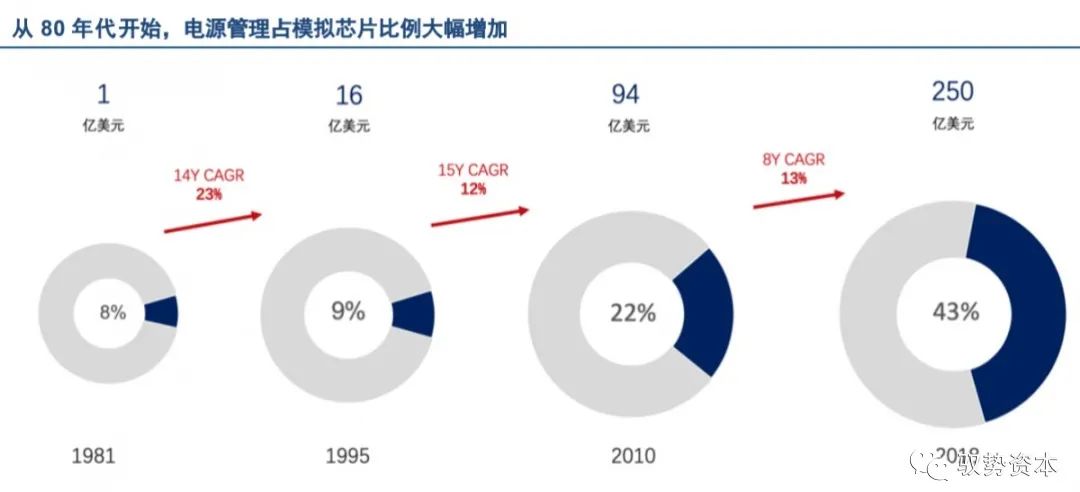

Power management chips have rapidly developed since the 1990s, growing into an important industry within the analog chip sector. In 1981, the power management chip market was only $100 million, but has now developed into a $25 billion industry. The proportion of power management chips in the analog chip market has increased from 8% in 1981 and 9% in 1995 to 43% today (2018).

We believe that this is because power management has continuous new demand driven by consumer electronics. The development of low-power, low-quality, and portable devices has led to constant advancements in power conversion efficiency technology and requirements.

The demand for low-power savings in consumer electronics drives the growth of the power management chip industry. As consumer electronics add new functions such as audio and video, they become increasingly complex, leading to a rise in both power consumption and the number of supported voltages. This objectively requires power management chips to improve energy conversion efficiency and increase standby time while enhancing integration to support multiple voltages. Additionally, as the power density of lithium batteries develops more slowly, breakthroughs can only be sought from power management chips. Thus, the growth of consumer electronics continually drives analog chip manufacturers to launch more complex, higher efficiency, and smaller power management chips, promoting the growth of the entire power management chip industry.

The demand for energy savings in high-power devices in the industrial sector also drives the growth of the power management chip industry. The energy consumption in the industrial sector mainly comes from motors and lighting, with motors (such as pumps, fans, compressors, and conveyors) consuming nearly 80% of industrial electricity. Therefore, the energy-saving requirements in the industrial sector prompt continuous improvements in power management chip conversion efficiency. For instance, using variable speed motors can save 40% of energy, and using efficient switching power supplies can save 35% of energy, all supported by more advanced power management chips.

In the future, new demands will continue to drive the development of power management. LED lighting has evolved from simple logic control to more personalized requirements like dimming and color-changing, demanding more complex intelligent control from power chips. Additionally, some devices are shifting from adapter power supply to battery power supply to adapt to portability trends, leading to a significant demand for battery-powered system chips.

Changes in Business Models: The Rise of Application-Specific Chips Reduces the Importance of Building Own Factories

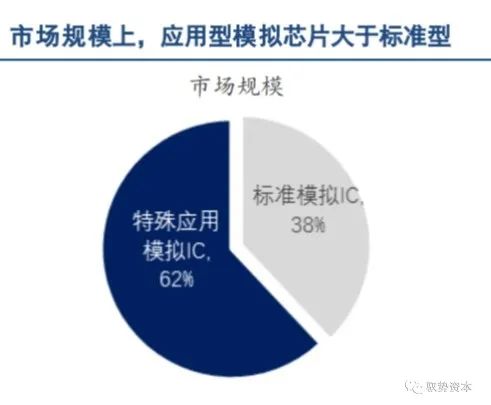

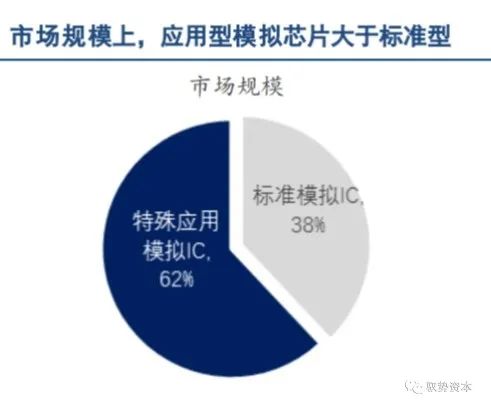

Standard and application-specific analog chips have completely opposite structures in terms of shipment volume and market size. In terms of shipment volume, standard analog chips account for a much higher proportion (64%) than special application analog chips (36%), but in market size, special application analog chips (62%) exceed standard analog chips (38%).

We believe that application-specific analog chips face customized demands with higher added value. Process and structural design are the two main methods for improving the performance of analog devices. Standard analog chips are generalized, and the designs of various manufacturers are not significantly different, resulting in lower added value. Competition among manufacturers relies heavily on processes and techniques, necessitating a significant requirement for building own factories.

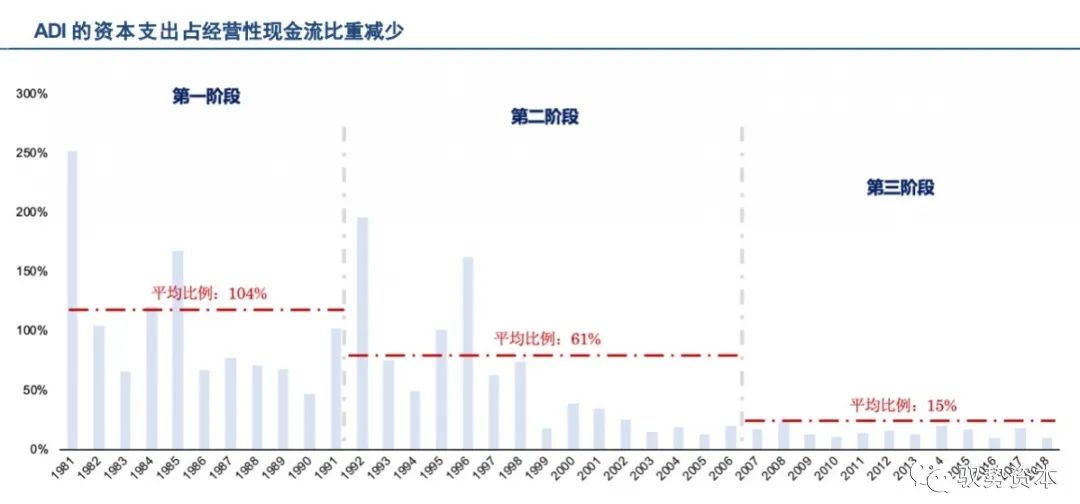

Standard analog chips cater to low-cost, low-volume generalized demands, thus focusing more on processes. Achieving low costs is primarily accomplished by shortening chip processes to reduce line width, enabling smaller sizes and lower costs for the same performance. Early analog chips primarily demanded standardized general chips, for example, ADI rapidly invested in factories in the 80s and 90s, accumulating a significant process advantage.

Application-specific analog chips address diverse demands, thus emphasizing design and offering higher added value. In later stages, as the complexity of electronic systems increased, it became more important to customize for specific sub-industries, especially in the industrial sector, where many customers have inconsistent requirements for speed, precision, integration, cost, and volume, requiring analog chip manufacturers to make trade-offs to achieve overall optimization, necessitating experienced R&D personnel for design. The importance of building own factories to improve processes has diminished, hence after 2000, ADI’s capital expenditure as a proportion of operating cash flow significantly decreased, with most chips being outsourced to TSMC.

In the future, application-specific analog chips will drive the vigorous development of fabless companies. With the emergence of foundries like TSMC and SMIC, chip companies can avoid the heavy burden of building factories and focus on chip applications themselves, leading to the birth of a number of excellent fabless companies. The output value of IC design in mainland China has grown from $5.66 billion in 2010 to $24.75 billion in 2016, with a compound annual growth rate of 28%, and the number of fabless companies increased from 569 in 2012 to 1,362 in 2016. In the future, as the demand for application-specific chips increases across industries, fabless companies with excellent design and R&D capabilities are expected to stand out.

Valuation Logic: How to Value Analog Chip Companies?

Indicators: Historically, PEG is relatively better

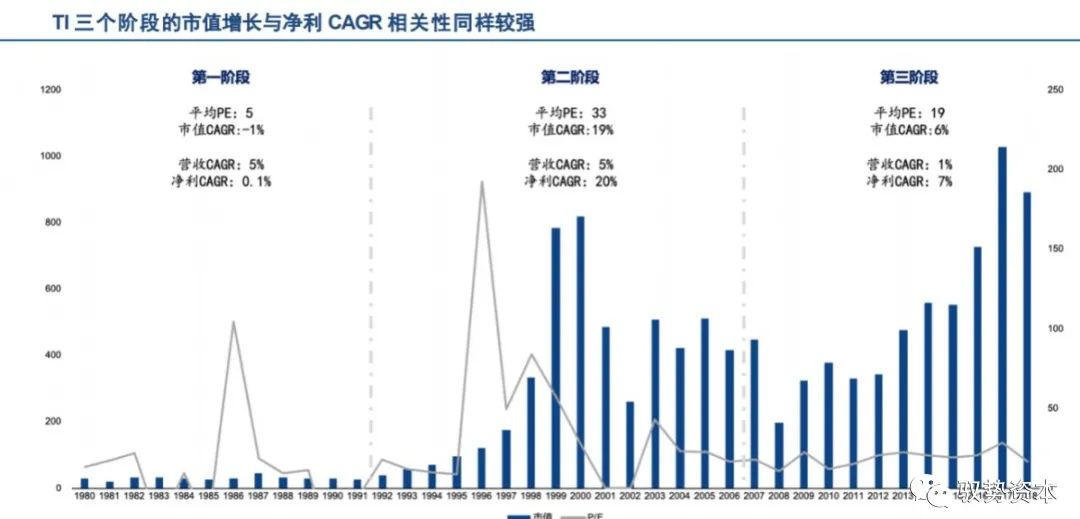

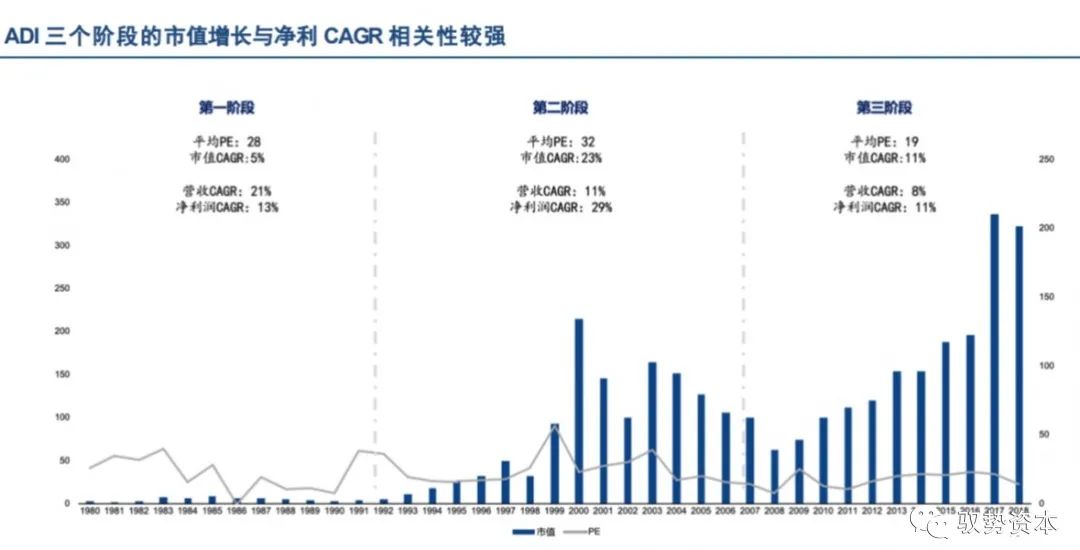

Historically, PEG is a more suitable valuation metric for analog chip companies compared to PE. Looking at the market value changes of the top two analog chip companies globally, we find that net profit CAGR is closely related to market value growth, while PE has relatively low reference value. For instance, the analog chip leader TI had a PE of 5 times in the 80s and 90s, but its market value did not increase, which is close to the net profit CAGR of 0.1%. In the second and third stages, only the market value CAGR (19% in the second stage; 6% in the third stage) was relevant. Similarly, ADI also showed a close relationship between net profit CAGR and market value CAGR.

Which Companies Are Worth High Valuation?

We believe that for high-growth, stable downstream analog chip companies, a higher valuation can be justified. For example, MPS (Monolithic Power System), which focuses on the industrial sector, primarily produces rapidly growing power management chips, has maintained a high valuation.

The industrial market is highly stable, with strong customer stickiness and broad prospects. Users in the industrial market are dispersed, but they place great importance on product quality and engineering technical support. The design cycle for products in the industrial market is long, but once a circuit design is completed, the product has a long lifespan. Typically, once a certain analog circuit product is developed, manufacturers tend to continue using it in future designs. Therefore, the industrial market is characterized by high stability and strong customer stickiness. Additionally, due to the high application technology in the industrial field, product gross margins are often relatively high. In the coming years, as the automation level in industrial applications increases, the analog chip market for industrial applications is expected to experience rapid growth.

Looking Forward: Can China Produce the Next Texas Instruments?

The technology gap is expected to narrow.

The progress of analog chip technology relies on accumulated experience. Unlike most digital chips, the development of analog chip technology does not depend on Moore’s Law; instead, it is primarily based on the number of experiments and the accumulation of technical experience with materials. Therefore, the level of experience accumulated by analog chip designers is crucial to the technical level and overall performance of the products designed, generally requiring 5 to 10 years of design experience to independently complete chip design. Established analog chip giants like Texas Instruments and ADI have accumulated a wealth of R&D experience, and there is an objective gap between Chinese analog chip companies and foreign giants.

The engineer advantage in China will help narrow the technology gap between China and foreign countries. China’s integrated circuit industry essentially started in the 1990s. Although there is still a gap with foreign giants, China has achieved in nearly twenty years what took foreign companies four to five decades of technological development, with overall strength advancing rapidly. Simultaneously, China’s engineering workforce continues to grow; in 2017, around 200,000 graduates in chip-related fields were trained in higher education institutions, with about 20,000 graduates in fields closely related to integrated circuits such as microelectronics science and engineering, microelectronics and solid-state electronics, integrated circuit design and integrated systems, and integrated circuit engineering, providing an important talent reserve for the development of China’s chip industry. Furthermore, in terms of cost, the average annual salary for analog engineers in the US is 500,000 to 600,000 RMB, with chief designers earning over a million RMB, while in China, the salary is only one-third to half of that in the US, providing a significant cost advantage for R&D.

A massive market provides opportunities for domestic alternatives.

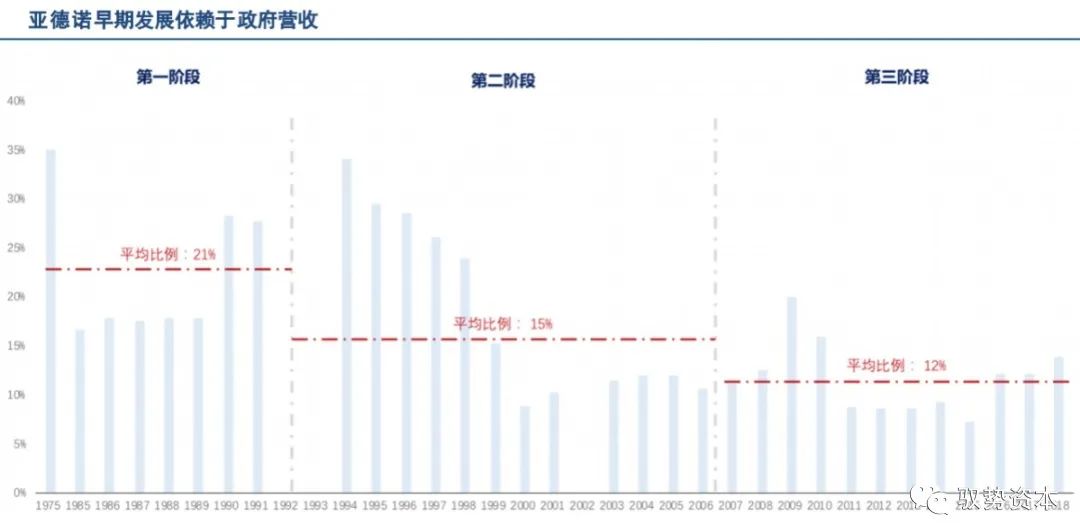

Historically, leading analog chip companies have grown from massive markets. Companies like Texas Instruments and ADI benefited directly from the enormous demands of US industry and defense in the 1960s to 80s. For example, before the 1990s, nearly 21% of ADI’s revenue came from the government, rapidly growing into a leading analog chip manufacturer due to the US government’s substantial defense spending.

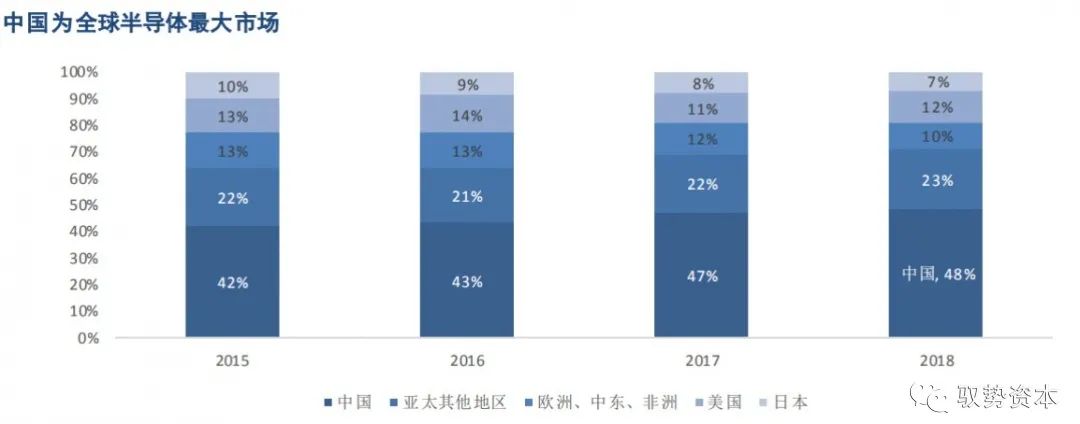

Currently, China has the largest semiconductor market and the highest growth rate, likely replicating the conditions for rapid growth experienced by ADI in the past. In 2018, China’s semiconductor market accounted for 48% of the global total, surpassing other regions in Asia-Pacific (23%), the US (12%), Europe, the Middle East, and Africa (10%), and Japan (7%), making it the world’s largest semiconductor market. In terms of growth rate, according to WSTS data, China’s semiconductor market is growing at 20.5%, also exceeding the global average growth rate of 6.8%, and the US (16.4%), Europe (12.3%), Japan (9.3%), and other regions in the Pacific Rim (6.1%). Although China’s semiconductor market is the largest and in a rapid growth phase, the analog integrated circuit products used in China account for about 45% of the world’s output, while China’s production of analog chips only accounts for about 10% of the global share, with the localization rate of analog chips being less than 1%. Therefore, there is vast room for improvement for Chinese analog chip companies in the future.