The Programmable Logic Controller (PLC) is a real-time embedded computer designed for industrial control, capable of implementing various logic and process control through dedicated control languages. Centered around PLCs, automated control systems can be constructed for fields such as national defense, manufacturing, rail transportation, electric power, water conservancy, and municipal services. PLC systems have become the “brain” of modern digital industrial systems, capable of comprehensively mastering various core process data and operational data, directly determining and ensuring the safe and healthy operation of the national industrial system and defense equipment system.

1 Current Status of Domestic PLC Development

Since the advent of PLCs nearly 60 years ago, there has been a leap from relay wiring logic to stored logic in the field of industrial control, with functions evolving from weak to strong, and progress from logic control to digital control. The application domains have expanded from simple control of individual devices to complex motion control, process control, and distributed control tasks.

1.1 History of Domestic PLC Development

The research and application of PLCs in China began in the 1970s. Based on development characteristics, it can be divided into four periods: the initial development period, the introduction and application period, the domestic development period, and the deep localization period, as shown in Figure 1. During the initial development period, China developed its first practical domestic PLC in the mid-1970s for industrial production control. This period mainly focused on importing, digesting, and secondarily developing foreign products. For example, a joint venture was established to introduce foreign PLC production lines, such as the Siemens S5 series PLC production line introduced in 1986 and the AB company PLC production line established in 1988. In terms of imported complete equipment, integrated imported PLC systems replaced traditional relays for logical process control in fields like steel and water conservancy, such as over 200 PLCs introduced in the first phase of the Shanghai Baosteel project for conveyor belt control, and the imported PLCs used in the No. 4 blast furnace of Shougang for loading, adding materials, and batching control. Concurrently, in the 1980s, under the organization of the Ministry of Machinery Industry, research institutes like the Beijing Institute of Automation began developing the first generation of domestic PLCs, resulting in series products like MPC-20, MPC-85, DJK-S-480.

Figure 1 Four Stages of Domestic PLC Development

During the introduction and application period in the early 1990s, domestic industrial automation was relatively low, and the PLC market was small. The R&D of PLCs required significant investment in funds and manpower with no short-term returns. Some research institutes shifted to system integration, using imported PLC products for control system engineering applications, leading to a significant market share of imported PLC products from brands like Siemens from Germany, AB from the USA, and other well-known brands entering the Chinese market, with imported PLCs capturing a market share of up to 99%.

After 1995, the PLC market in China formed a pattern where large PLCs were dominated by Europe and the USA, small PLCs by Japan, and medium PLCs shared between Europe and Japan. The technological development and promotion of domestic PLCs were relatively slow, but the systematic development of PLCs in the country gradually gained attention. In 1991, the PLC application branch of the China Electromechanical Integration Application Association was established to promote PLC technology and product development, production, and application. In 1993, the National Technical Committee for Standardization of Industrial Process Measurement and Control established the SAC/TC124/SC5 to create a standard system for programmable controllers and systems in China, laying the foundation for the development of PLC technology and industry in the country.

During the domestic development period, in the 21st century, with the rapid development of domestic manufacturing, the demand for PLCs surged. Some enterprises seized market opportunities and began to enter this field, developing and producing domestic PLC products, achieving large-scale applications in manufacturing, non-standard machinery, and power equipment. However, during this period, domestic PLCs were mainly small products lacking core technologies, with basic components all imported, resulting in smaller industrial scales compared to foreign manufacturers. For instance, in 2013, the domestic PLC market size was 7.8 billion yuan, with local company Wuxi Xinjie entering the top ten with a 1.6% market share due to its cost-effective small PLCs.

In the deep localization period, influenced by factors such as the Stuxnet virus in Iran, the Prism scandal, the Ukrainian power grid blackout incident, the US Entity List, and changes in the international situation, during the 13th Five-Year Plan, the country prioritized key information infrastructure as a critical aspect of network security, with control systems like PLCs included in the management of key network devices, initiating a journey towards deep localization of control systems for critical infrastructure. Domestic enterprises conquered key core technologies of PLCs, developing self-secure PLC products based on domestic hardware and software platforms, and promoting applications in energy sectors such as power generation, rail transportation, and petrochemicals. For instance, the IM30 series PLC developed by the Electronic Sixth Institute in 2020 was applied in thermal power, wind power, and municipal natural gas sectors, achieving deep localization of critical infrastructure.

1.2 Current Status of the Domestic PLC Market

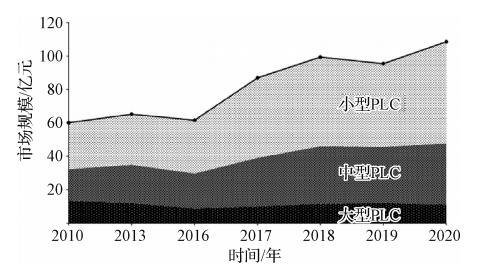

With the steady advancement of China Manufacturing 2025, the demand for automation systems continues to grow. As the core device for discrete control, the domestic PLC market size has been increasing year by year, as shown in Figure 2, from 6.024 billion yuan in 2010 to 12.43 billion yuan in 2020 (excluding distributed IO products, the PLC market size is 10.85 billion yuan), with an average annual growth rate of 7.51% over the decade.

Figure 2 Trend of Domestic PLC Market Size from 2010 to 2020

Analyzing by PLC model, the market for large PLCs has not changed much over the past ten years, fluctuating around 1.1 billion yuan/year. However, with the trend towards increased medium-sized PLCs, their performance continues to enhance, leading to some applications of large PLCs being replaced by medium PLCs, resulting in a slight decline in the large PLC market. The medium PLC market has seen stable growth, with the market size increasing from 1.889 billion yuan in 2010 to 3.660 billion yuan in 2020, with an average annual growth rate of 6.84%. Due to the rapid growth in demand in niche sectors such as electronic manufacturing equipment, lithium battery equipment, photovoltaic equipment, semiconductor equipment, and packaging machinery, the market size for small PLCs has significantly increased in recent years, growing from 2.733 billion yuan in 2010 to 6.070 billion yuan in 2020, with an average annual growth rate of 8.31%.

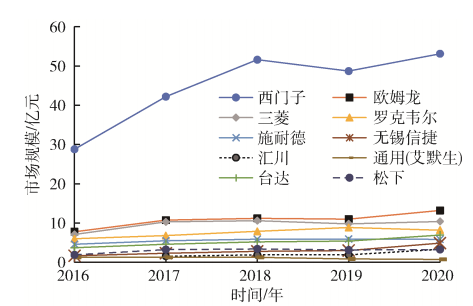

With the vertical integration of the industrial internet across the supply chain, PLCs are widely used in industries such as automotive manufacturing, electrical and electronics. The domestic PLC market is expected to maintain stable growth in the coming years with the continuous advancement of intelligent manufacturing, with the PLC market size projected to reach 14.460 billion yuan by 2022. Analyzing the PLC market size by brand, as shown in Figure 3.

Figure 3 Trend of PLC Manufacturer Market Size from 2016 to 2020

Siemens has maintained a market size and growth rate far exceeding other brands, consistently ranking first. Japanese brands Omron and Mitsubishi, along with American Rockwell, have long held the 2nd to 4th positions, with the top four rankings remaining relatively stable. With the increase in the small PLC market size, Delta and Xinjie have shown an upward trend in market rankings, with Delta entering the top five in 2020.

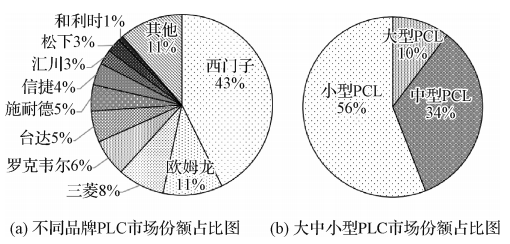

Figure 4 Market Share of Domestic PLCs in 2020

In 2020, the market size of PLCs in China was 12.43 billion yuan, with the market share structure of various brands shown in Figure 4 (a). Siemens ranked first with a market size of 5.31 billion yuan and a market share of 43%, followed by Omron, Mitsubishi, Rockwell, Delta, Schneider Electric, and others, collectively occupying about 90% of the market share. Domestic companies Xinjie, Huichuan, and Holystar made it into the top ten.

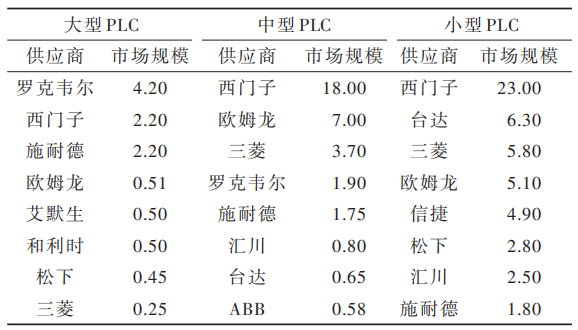

In 2020, the large PLC market size was 1.12 billion yuan, accounting for 10%; the medium PLC market size was 3.66 billion yuan, accounting for 34%; and the small PLC market size was 6.07 billion yuan, accounting for 56%, as shown in Figure 4 (b). Among large PLCs, European and American manufacturers dominate, with Rockwell, Siemens, and Schneider ranking as the top three, holding 76.8% of the large PLC market share, as shown in Table 1.

Table 1 Market Size of Each Brand of PLC in 2020 (Billion Yuan)

In the medium PLC market structure, Siemens leads with a market share of 49.2%. Omron and Mitsubishi have market sizes above 200 million yuan, forming the second tier, collectively occupying a 29.2% market share. Rockwell and Schneider make up the third tier, accounting for 10% of the market share. The small PLC market has low technical barriers and numerous suppliers, but the top five manufacturers still hold 74.3% of the market share, presenting a competitive landscape of one large (Siemens) and four small (Omron, Mitsubishi, Delta, Wuxi Xinjie). Overall, domestic PLC manufacturers have gained certain competitiveness in the small PLC sector and have entered the medium and large PLC markets.

1.3 Current Status of Domestic PLC Products

There are over 40 domestic PLC manufacturers, with leading companies including Xinjie, Huichuan, and Holystar. After years of effort, domestic PLCs have achieved significant results in technology, products, and market aspects. Xinjie has developed PLCs including XD/XC small PLCs and XL thin card-type PLCs, mainly used in solar energy, tunnel engineering, textile machinery, power equipment, coal mine equipment, and central air conditioning for medium and small control scenarios. Huichuan has developed high-performance H3U, general-purpose H2U-XP, and economic H1U-XP series PLC products, with supporting drive execution products mainly applied in elevators, air compressors, robotic arms, and 3C manufacturing. Holystar has developed LE small PLCs, LK medium and large PLCs, and LKS safety PLCs, mainly used in packaging machinery, machine tools, and project-oriented industries such as municipal, tunnels, and rail transportation. In addition to these companies, other domestic enterprises have developed distinctive PLC products, such as Zhongkong Technology, Hexin, and Yiwei. However, these companies mostly rely on imported hardware and software to develop PLC products, facing self-sufficiency issues during special periods. To address this, companies like the Electronic Sixth Institute have developed self-secure PLC products based on domestic hardware and software platforms, such as the IL40, IM30, and IS20 series self-secure PLC products developed using Feiteng CPU processors, which have achieved mass applications in critical infrastructure areas such as national defense and energy, and municipal services.

Although domestic PLCs have achieved certain accomplishments, they still present a “small, weak, and scattered” state overall. The market scale of each manufacturer is small, with low market share; products mainly consist of small PLCs, lacking a complete product spectrum; most products are based on imported hardware and software or developed using foreign control software, lacking core technology and advanced control software; the overall solution capability for industries is weak; and there has not been a cohesive technical and market force for domestic PLCs, resulting in weak competitiveness against foreign PLC manufacturers.

1.4 Domestic PLC Related Standards

The standardization work in the domestic PLC and system fields is overseen by the National Technical Committee for Standardization of Industrial Process Measurement and Control, specifically the Technical Committee for Programmable Controllers and Systems (TC124/SC5), with business guidance from the China Machinery Industry Federation.

The main domestic PLC-related standards are the GB/T15969 series, which were first published in 1995 under the guidance of the Ministry of Machinery Industry and equivalent to the international standard IEC61131. As of 2022, the officially released GB/T15969 includes nine parts. The first part covers general information, defining the main functional characteristics of PLC systems. The second part outlines equipment requirements and testing, specifying the requirements for PLCs and related tests. The third part discusses programming languages, detailing the syntax and semantics of PLC programming languages. The fourth part serves as a user guide, providing basic normative rules for information exchange between PLC users and PLC suppliers. The fifth part addresses communication, defining communication between PLCs and other electronic systems. The sixth part focuses on functional safety, including the safety lifecycle management of functional safety PLCs, allocation of functional safety requirements, and development planning. The seventh part covers fuzzy control programming, defining programming languages for fuzzy control. The eighth part provides guidelines for the application and implementation of programming languages defined in the third part. The ninth part specifies the single-point digital communication interface for small sensors and actuators. The tenth part is the open XML exchange format for PLCs, specifying an XML-based exchange format for the export and import of GB/T15969.3 projects, which has completed the opinion solicitation and is under review.

In addition to the GB/T15969 series standards, other related standards have been established in areas such as PLC functional evaluation, information security, and engineering integration. GB/T36009 specifies the performance indicators, testing, and evaluation methods for PLCs, providing a basis for the performance assessment of PLCs. GB/T36011 outlines the sampling inspection methods for environmental adaptability tests of PLCs before leaving the factory and routine testing methods for appearance, IO functions, communication, etc. GB/T37391 specifies the usage conditions and functional requirements for complete PLC control equipment. For the information security capabilities of PLCs, GB/T33008.1 and the pending “Information Security Technology for Programmable Logic Controllers (PLC) Safety Technical Requirements and Testing Evaluation Methods” specify the network security requirements and testing methods for PLCs, with GB/T33008 and GB/T33009 forming a series of standards for the network security of industrial automation and control systems; GB/T41274 describes the goals of intrinsic security for PLC systems and the security requirements for each module from the perspective of intrinsic security.

In terms of industry applications for PLCs, GB/T40329 specifies the syntax and semantics for the programming language of PLCs in CNC equipment and systems within industrial electrical equipment. GB/T37761 outlines the relevant requirements for PLC control devices in power transformer cooling systems. In terms of national military standards, the first PLC military standard, “General Specification for Military Programmable Control Systems,” began drafting in 2020 and is currently in the approval stage.

1.5 Domestic PLC Related Policies

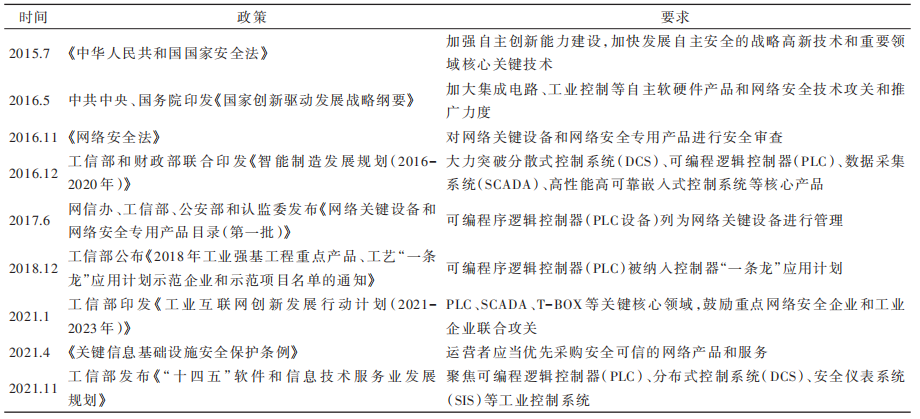

In recent years, with the gradual expansion of the US Entity List and frequent industrial safety incidents, the country has placed high importance on the innovation of information technology applications in the industrial control sector, issuing a series of supporting policies and project plans to achieve self-sufficiency in key core technologies. The national focus on the safety and controllability of PLCs has also increased, with terms like “self-sufficiency” and “network security” becoming key phrases. The issuance of corresponding policies has promoted the healthy and orderly development of the domestic PLC industry, with some policies listed in Table 2.

Table 2 PLC Related Policies

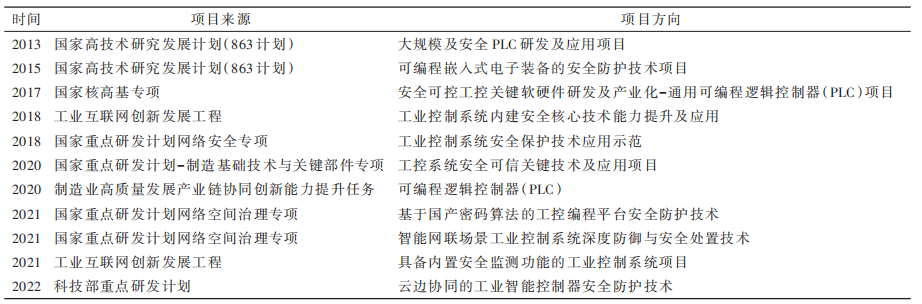

In line with these policies, the country has placed great emphasis on research investment in industrial control systems, establishing PLC projects in major initiatives such as the National High Technology Research and Development Program (863 Program), National Key R&D Program (network security special, manufacturing technology and key components special, etc.), focusing on improving capabilities in areas such as large-scale PLC systems, security protection, and safety control, promoting the breakthrough and application of key PLC technologies, and accelerating the self-reliance and strength of the PLC industry. Some PLC-related technology projects are listed in Table 3.

Table 3 PLC Related Technology Plans and Major Projects

2 Analysis of the Gap Between Domestic and Foreign PLCs

With the promotion and application of domestic PLCs in various fields, certain breakthroughs have been achieved in application technology, but shortcomings still exist. Compared to foreign PLCs, there are still significant gaps in functional performance, usability, and reliability.

In terms of functional performance, foreign mainstream PLC manufacturers typically use custom SoCs and real-time operating software for their high-performance PLC products, enhancing instruction processing, data storage, data exchange, and control output performance from the underlying platform. In contrast, domestic PLC products often rely on general-purpose information system processors and general-purpose embedded systems, mostly adopting a low-performance, low-cost design scheme of “general CPU + software.” Due to the general processors being designed for information computing and conventional embedded systems, the systems tend to be cumbersome, with many unnecessary functions in the underlying hardware and software, and lack the underlying support for real-time performance and advanced control algorithms, making it difficult to develop and upgrade dedicated PLC functions, thus limiting optimization and improvement opportunities, leading to low control efficiency and overall weak performance.

Regarding logic programming software, foreign PLC logic programming software usually integrates monitoring, driving, and execution functions, achieving engineering integration design capabilities, strong usability, and high engineering development efficiency. In contrast, domestic PLC logic programming software mostly uses foreign general products like CoDeSys, KW-Software, or OpenPCS as their core, focusing only on the programming and development requirements of the PLC itself, making it difficult to achieve integrated development with other control systems, resulting in a high workload for third-party system integration and poor usability, leading to low engineering development efficiency. For example, Siemens’ logic programming software TIA Portal integrates PLC programming software Step7, PLC simulation software PLCSIM, and monitoring software WinCC, allowing efficient configuration of control and monitoring points, with control variables available throughout the project. In contrast, domestic PLCs require frequent import and export of control variable points and monitoring variable points in logic programming software for interaction and communication with other systems, resulting in lower engineering efficiency.

In terms of communication protocols, foreign mainstream PLC products mostly use self-developed communication protocols, achieving compatibility and interconnectivity between upper monitoring layers and field instruments and actuators through a comprehensive ecosystem. Foreign manufacturers only form IEC international standards or open-source codes for conventional protocols, without disclosing protocols and codes for complex applications. Domestic PLC manufacturers lack capabilities in self-developing communication network protocols, mostly using IEC standards or industrial field buses based on open-source codes directly. Domestic PLCs are constrained by established standards, making it difficult to modify and optimize protocol indicators, and custom development is challenging. Connecting actuators often requires additional conversion interfaces, increasing system response time, frequently leading to insufficient functionality or performance during complex control applications, thus greatly limiting product scalability and adaptability.

In terms of product profiles, foreign mainstream manufacturers provide a complete range of upstream and downstream automation products in addition to PLC products, allowing for rapid formation of integrated solutions covering sensing, execution, control, and monitoring core products. Domestic PLC manufacturers typically only offer PLC products, with a single product line, lacking supporting upstream and downstream automation products, resulting in incomplete profiles and difficulties in providing system-level overall solutions. The overall solutions in China generally involve products from different manufacturers, leading to discrepancies in product interfaces, functional definitions, and quality standards, resulting in lower compatibility between products compared to those from the same foreign manufacturer, thus being unable to optimize overall performance, control efficiency, and reliability from a system level, while also increasing system design complexity and debugging difficulty. Additionally, control system engineers find it challenging to achieve one-stop procurement when selecting domestic products.

In terms of standardization, foreign PLC manufacturers have formed a large industrial scale through decades of accumulation and development, dominating the market and leading the establishment of a comprehensive standard system covering automation systems, including control technology, information security, functional safety, and other international or industry standards, thus possessing industry discourse power. Currently, although some PLC technical standards have been established in China, existing standards are largely equivalent to foreign standards, lacking top-level planning, and have not formed a standard system. They are constrained by established foreign technical standards, resulting in limited domestic PLC innovation and an inability to lead technological development through standards, leading to weak competitiveness in the market and limited industry discourse power.

3 Development Ideas for “Chinese System” PLCs

Currently, PLCs can be divided into three major factions based on region: European, American, and Japanese, each with distinct characteristics in product positioning, functional performance, logic programming, and market layout. European PLCs are represented by Siemens and Schneider, American PLCs by Rockwell and General Electric, and Japanese PLCs by Mitsubishi and Omron.

In response to the gaps in domestic and foreign PLC development, and considering the current status of domestic PLCs, this article proposes the development idea of “Chinese System” PLCs. Corresponding to the three major PLC factions, “Chinese System” PLCs are domestic products based on the characteristics of the domestic market and application scenarios, developed with indigenous hardware and software, possessing native security capabilities, conforming to the usage habits of domestic engineers, and meeting the diverse industrial control application needs in China.

3.1 Overall Situation

The R&D backgrounds, application requirements, and market positioning of European, American, and Japanese PLC products differ significantly, resulting in distinct product characteristics and market distributions. European and American PLCs are innovation-driven, powerful, and well-known for their medium and large PLCs, with comprehensive product lines. European PLCs are functionally strong, with rigorous programming methods, but slightly weaker usability. American PLCs focus on functional practicality, with many functional blocks and relatively simple programming methods.

European and American PLCs are mainly applied in major equipment and critical infrastructure fields, with a high market share in project-based markets. Japanese PLCs are market-driven, known for small PLCs, with high product integration and generally average functionality. Japanese PLCs mainly serve medium and small electromechanical automation devices, with a high market share in the OEM market. “Chinese System” PLCs should primarily target applications in national defense and key infrastructure, benchmark against European PLCs, while also considering the economic strength and high integration of Japanese PLCs, thereby establishing a domestic PLC ecosystem through the driving force of major equipment and key areas, and gradually promoting applications in other fields.

3.2 Market Situation

From the perspective of overall market scale, in 2020, European PLCs accounted for about 47.4% of the market share, being the largest, while American PLCs accounted for about 7%, and Japanese PLCs about 21.6%. Among them, European and American PLCs dominate the medium and large PLC markets, while Japanese PLCs maintain a high share in the small PLC market. American Rockwell, European Siemens, and Schneider occupy 76.8% of the large PLC market share. European Siemens stands out in the medium PLC market, with a market share exceeding 50%, while Japanese Omron and Mitsubishi dominate the small PLC market with a 56% share. Considering the goal of deep localization of critical infrastructure, “Chinese System” PLCs should first target the medium and large PLC product market.

In terms of product pricing, European and American PLCs primarily focus on medium and large PLCs, with more powerful functionalities and higher product added value, thus commanding higher prices. Particularly, American brand AB PLCs are priced higher. Japanese PLCs, focusing on small PLCs, are positioned as economical products with a high cost-performance ratio and relatively lower prices. Considering the current characteristics of domestic hardware and software ecosystems, product capability indicators, and application scenario characteristics, “Chinese System” PLCs should be priced moderately, lower than European and American systems, but slightly higher than Japanese PLC products.

In terms of industry distribution, European and American PLCs mainly serve project-based markets, with PLC products integrated into control system projects designed and implemented alongside overall automation systems. Japanese PLCs primarily serve the OEM market, assembling PLCs into devices and selling them in bulk with the equipment. European PLCs have complete product lines, reliable quality, mature channel networks, and excellent solution capabilities, with applications across almost all user industries, maintaining strong competitiveness and high market shares in major fields such as electric power, metallurgy, rail transportation, and automotive manufacturing. For instance, in the hydropower sector, it is almost monopolized by Schneider PLCs from France. American PLCs, leveraging their powerful performance and the support of leading system integrators in various industries, have a high market share in municipal, oil and gas, metallurgy, electric power, pharmaceuticals, and food markets. Japanese PLCs, with their outstanding cost-performance ratio, constantly innovating product series, and high functional integration, are widely used in nearly all OEM sectors requiring small PLC products, including food machinery, packaging machinery, textile machinery, machine tools, electronic manufacturing equipment, HVAC, etc. “Chinese System” PLCs should focus on key areas involving national livelihood, including military equipment, military manufacturing, and critical infrastructure sectors such as electric power, water conservancy, petrochemicals, metallurgy, and municipal services.

3.3 Product Characteristics

European and American PLC products emphasize process control and communication control, while Japanese PLCs focus more on discrete control and motion control. The medium and large PLC products of “Chinese System” PLCs should prioritize process and discrete control, while small PLCs should emphasize motion control.

From the perspective of process control, European PLCs support complex floating-point operations, with advantages in analog accuracy, enabling simple control logic programs to quickly and easily implement closed-loop control PID algorithms, demonstrating clear advantages in process control. Japanese PLCs primarily utilize integer calculations, making the programming of analog processes complex, requiring dedicated control modules for complex control, which increases costs.

From the perspective of motion control, Japanese PLCs typically feature dedicated positioning instructions for servo control and stepping motion, making it easier to achieve complex motion control, such as robotic arm control. In contrast, European and American PLCs lack dedicated motion control instructions, requiring complex programming with lower control accuracy.

From the perspective of communication capabilities, European and American PLCs often adopt open industrial communication protocols or provide communication protocol chips, facilitating connections with third-party devices. Japanese PLCs typically have more closed network protocols, supporting only products from their own company, making it difficult to connect with third-party devices.

3.4 Control Logic Programming

Programming for European and American PLCs is closer to computer programming thinking. Treating PLCs as specialized industrial computers, PLC programming draws upon general and simple methods of computer programming and the straightforward approach to data operations, resulting in concise and clear programming. European and American PLCs primarily employ structured programming, with more complete hierarchy and structure, featuring rich function blocks, program blocks, and organization blocks for easy calling and reuse, with high readability and ease of fault location and debugging. Some European and American PLCs also support high-level language programming, such as C language, providing significant advantages in writing large-scale control programs. However, PLC instructions can be abstract, posing a certain threshold for programming, requiring engineers to have some computer knowledge.

Japanese PLCs often feature more graphical programming concepts, with data processing mostly departing from the basic storage area concepts and formats of computer data processing, resulting in intuitive programming that is easy to grasp. Japanese PLCs typically adopt a top-down single vertical structure, including main programs and subprograms, with weak hierarchy and structure, often requiring many programs to be grouped together. The programming efficiency of PLCs is relatively low, and the results interpretation is cumbersome. Therefore, Japanese PLCs are suitable for medium and small control systems, but in large systems, programming and debugging become cumbersome and complex, making it difficult to achieve efficient and rapid programming and manufacturing. “Chinese System” PLCs should primarily reference the programming software characteristics of European and American PLCs while also incorporating the graphical programming concepts of Japanese PLCs to achieve requirements for complex control scenarios while enabling intuitive programming and configuration.

Considering the characteristics of the domestic PLC market and user habits, in terms of product spectrum, product features, and product applications, “Chinese System” PLCs, based on indigenous hardware and software development, should benchmark against European PLC products, with the following characteristics: first, in terms of product spectrum, a complete range of large, medium, and small PLC products, with a focus on medium and large high-end PLCs; second, in terms of product features, possessing high-end functions such as hot backup redundancy and advanced control algorithms, with nanosecond-level instruction processing speed and microsecond-level synchronization accuracy, meeting the needs of complex application scenarios; third, in terms of product applications, initially leveraging key sectors involving national defense and key infrastructure to establish a certain ecosystem before gradually promoting applications in other fields.

4 Conclusion

This article reviews the four stages of domestic PLC development, introducing the current status of domestic PLC development from the perspectives of market status, product status, standards, and relevant policies and plans issued by the state. Subsequently, this article analyzes the gaps between domestic and imported PLC products and presents the “Chinese System” PLC development ideas in line with the current domestic situation, benchmarking against European, American, and Japanese PLCs.

Authors: Lin Hao, Yang Zhenghou, Huo Yuxian

Source | Hubei Industry and Information Technology