The Internet of Things (IoT) refers to the internet that connects everything. The industry defines IoT as the connection of any item to the internet through information sensing devices such as RFID, infrared sensing, global positioning systems, and laser scanning, following agreed protocols to exchange and communicate information, achieving intelligent recognition, positioning, tracking, monitoring, and management.

IoT has two levels of meaning: first, the core and foundation of IoT is still the internet, which is an extension and expansion of the internet concept; second, its user end extends to any item for information exchange and communication.

IoT is gradually entering the lives of the public, manifesting in various forms such as smart Bluetooth wristbands, smart locks, and smart curtains at home. However, these are just the tip of the iceberg; in the future, IoT will be applied in almost every aspect of urban, work, and living environments, indicating that IoT is a trend for future development and will usher humanity into the next intelligent era.

Analysis of the Current Status of China’s IoT Market

China’s IoT is transitioning from basic hardware and sensing devices to software platforms and vertical industry applications, entering the second stage of development. The industrial ecosystem of interconnected everything is just beginning. It is estimated that by 2020, there will be 50 billion connections globally, which is 6-7 times the current number, and China’s IoT market size will exceed 2 trillion yuan, double the current scale of telecommunications operations. The factors driving the development of the IoT ecosystem are gradually maturing, including declining hardware costs, the integration of cloud computing and big data with industries, and the advancement of technologies like 5G and NB-IoT. The ecosystem is on the brink of an explosion.

With the widespread adoption of high-speed broadband networks, the development of big data and cloud computing, and the growth of platform-based IoT companies, the demand for the IoT industry has also upgraded, transitioning from basic item recognition and network information transmission to higher-level needs such as platform management and data analysis. This will help open the information closed loop of IoT’s cloud, management, and endpoints.

China, leveraging its unique industrial advantages and the strategic concept of Internet Plus, has quickly deployed domestic cloud computing servers, achieving an average growth rate of over 70%, accelerating the transformation of traditional electronics companies and facilitating cross-industry integration. Following the development of IoT, the focus is shifting towards China, and related service industries are also undergoing changes, such as smart homes, smart healthcare, smart cities, smart logistics, and smart wearable devices, which are important deployment directions in the domestic market. This presents new opportunities for Chinese companies to develop and expand IoT.

As the largest developing country by economic volume, China’s IoT penetration rate is less than 5%. In the next decade, the global IoT output value is expected to reach $8 trillion. Moreover, IoT will develop in a diversified direction; hardware will no longer be the primary source of profit. By 2020, the output value from applications and services will account for 70% of the total IoT output value, far exceeding the output values of semiconductors, communication technologies, and cloud platforms. It is anticipated that there will be 24 billion IoT devices connected globally by then, while Cisco, Huawei, and Ericsson estimate that the number of IoT connections will range from 50 billion to 100 billion, far exceeding the current number of over 7 billion mobile phones. Among these, wearable devices for fitness, leisure, and healthcare will become major applications.

Advantages of IoT in China

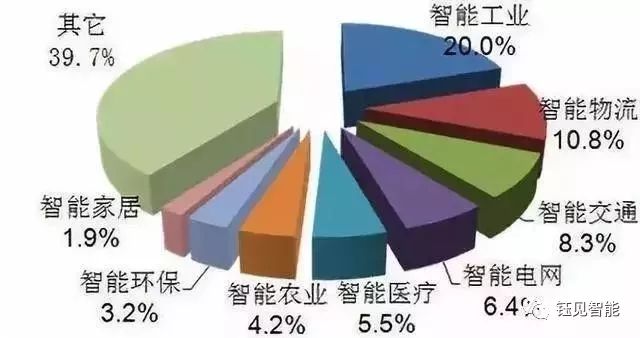

1. Wide Industry Coverage

China’s IoT covers a wide range of industries, from smart transportation, intelligent logistics, healthcare, agriculture, and energy sectors, to private applications like smart homes, personal use, and smart vehicles. Whether in terms of cost reduction, efficiency improvement, or enhancing the quality of life for Chinese residents, IoT will undoubtedly achieve great success in the Chinese market.

2. Manufacturing Hub

China is the world’s manufacturing center, producing smartphones, laptops, industrial vehicles, home appliances, and more, boasting a complete range of supporting industrial chains. Coupled with years of accumulated manufacturing and R&D experience, these can be distilled into data models and rapidly replicated in combination with applications, making China’s manufacturing more intelligent and personalized.

3. Full Network Coverage

China has nearly 800 million internet users, with a mobile network coverage rate of 98%. As of now, the number of 4G users exceeds 250 million, laying a solid foundation for the development of IoT, allowing connectivity anytime and anywhere. By fully leveraging these advantages and focusing on development, China can create a significant social benefit chain, propelling the country to become a global IoT powerhouse.

Regional Structure Forecast of China’s IoT Industry

The domestic IoT industry has initially formed a spatial structure of clustered development in four major regions: Bohai Rim, Yangtze River Delta, Pearl River Delta, and the central and western regions. Among these, the Yangtze River Delta region ranks first in industrial scale among the four regions. In the future, the spatial evolution of China’s IoT industry will present three major trends:

a. “Blossoming” of industry development, with hotspots continuously emerging.

b. “Spreading like wildfire,” with second- and third-tier cities actively engaging in IoT industry development.

c. “Connecting and collaborating,” with regional divisions of labor becoming more apparent.

It is predicted that in the future, 60% of connections will be achieved through wide-area low-power cellular technologies, with NB-IoT targeting this 60% market. Additionally, 30% of the market will require moderate assurance, such as smart homes, which need to be implemented through technologies like sensors, WiFi, low-power Bluetooth, and Zigbee. The remaining 10% of high-assurance services, such as smart driving, smart healthcare, and virtual reality, will require large-capacity, real-time transmission, and intelligent processing, relying on high-speed mobile cellular technologies like 5G/LTE.

Analysis of IoT in the Industrial Sector

Industrial IoT refers to the application of IoT in the industrial sector, playing a crucial role in energy, transportation (railways and stations, airports, ports), and manufacturing (mining, oil and gas, supply chain, production).

The IoT process involves various types of suppliers, mainly including equipment manufacturers, system integrators, network operators, and platform providers. Given that China’s industrial IoT industry chain is still in its formative stage, the definition and division of the industry chain are not entirely clear. However, with the rapid enhancement of overall industry competitiveness, the industry is on the verge of an explosion. Each link must develop well.

1. Equipment Manufacturers

Equipment manufacturers primarily cover the main equipment manufacturers at various levels of the industrial IoT, including the perception layer, transmission layer, field management layer, and application layer. The perception layer includes companies in chips, RFID, sensors, industrial instruments, industrial cameras, QR codes, PLCs, etc.; the transmission layer mainly includes companies in chips, communication modules, and communication devices, with key technologies including industrial field buses, industrial Ethernet, and wireless sensor networks (5G, NB-IoT, LoRa, BLE); the field management layer mainly includes industrial control computers, DCS, SCADA, FCS, etc.; the application layer includes servers, smart equipment, etc.

2. Platform Providers

Platform providers primarily support industrial IoT applications, offering terminal monitoring and fault location services for equipment manufacturers, billing and customer services for system integrators, reliable and comprehensive services for end-users, and unified, convenient, and low-cost development tools for application developers. They mainly include industrial IoT platforms, industrial data platforms, and industrial cloud platform providers.

3. Network Operators

Network operators primarily provide data transmission and are the main body of the industrial IoT network layer, connecting sensor data and terminal applications. Operators focus on two levels: connection and application. Connection is the area where operators excel, while platforms are the key to their future breakthroughs.

In terms of network deployment, there will be two typical application scenarios in the future: on one hand, enterprises will connect their industrial IoT to mobile operators’ IoT networks, such as mobile IoT, NB-IoT networks, and 5G networks, aggregating data in the public cloud; on the other hand, if enterprises prioritize data security, they may prefer to establish their own industrial IoT networks and data centers first, then aggregate some low-security data into the public cloud.

4. System Integrators

System integrators are primarily dedicated to resolving interfaces, protocols, system platforms, application software, and integration related to subsystems, usage environments, construction coordination, organizational management, and personnel allocation. Relevant companies include automation companies, industrial control system companies, and various industrial system solution providers.

Current Issues in Industrial IoT

1. Weak Basic Support

At this stage, China lags behind developed countries like the US, Europe, and Japan in common technologies such as key sensor technologies, computer system design technologies, and communication network technologies, failing to provide strong support for the country’s industrial transformation.

2. Need for Enhanced Talent and Financial Support

Currently, the development of industrial IoT in China is in its infancy, requiring substantial financial support for technological R&D, enterprise cultivation, and product promotion. However, funding support is still limited to national science and technology programs, with limited total funding and coverage, restricting the development of industrial IoT in China.

3. Industry Still in Its Infancy

According to “Made in China 2025,” China’s manufacturing industry faces a situation of low informatization and insufficient integration with industrialization. Currently, most enterprises in China’s manufacturing sector are at an initial to intermediate level of informatization, with narrow coverage of informatization departments and fragmented internal systems, indicating that the country is still in the early stages of industrial IoT development.

4. Challenges for Small and Medium Enterprises

In the promotion of industrial IoT applications, large enterprises can leverage their scale effects and strong financial backing to overcome cost limitations and effectively apply industrial IoT in practical production. However, for some small and medium-sized industrial enterprises, traditional system integration and custom development concepts cannot be applied, making the cost of constructing industrial IoT prohibitively high.

The development of industrial IoT is increasingly approaching that of an ecological chain, with closer integration between various links. As IoT continues to develop, the issues faced will be further addressed, ushering in another explosive period for IoT development.

Source: Yujian Intelligent