Introduction:

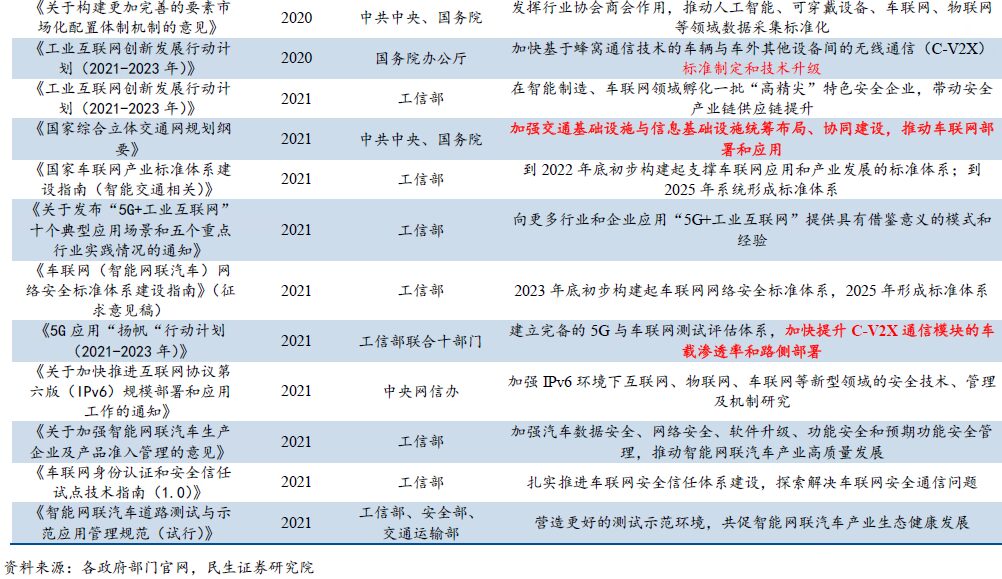

Smart connectivity continues to penetrate, with policies boosting the implementation of vehicle networking, leading to marginal changes:1. The penetration of smart connected vehicles is accelerating:We estimate that the retail sales share of smart connected passenger vehicles is showing an upward trend, with the monthly penetration rate exceeding 12%. Among them, the penetration rate of new energy vehicles remains above 30%, while the overall trend for fuel vehicles is also rising, currently nearing 10%.The recovery of the car market, combined with the accelerated penetration of smart connectivity, provides a broad foundation for the development of vehicle networking;2. Policy direction shifts towards promoting the implementation of vehicle networking:We have sorted out the relevant policies on vehicle networking in recent years, combined with recent statements from the Ministry of Industry and Information Technology and other departments, and believe that the policy guidance for vehicle networking has gradually shifted from setting goals, formulating standards, and developing core technologies to accelerating deployment and practical application. With policy guarantees in place and the establishment of vehicle networking demonstration zones, the overall layout of vehicle networking is expected to accelerate.

1.

Vehicle Networking is Still in the Early Development Stage, with Broad Downstream Application Space

Vehicle networking is a core area of the Internet of Things and is still in the early development stage.

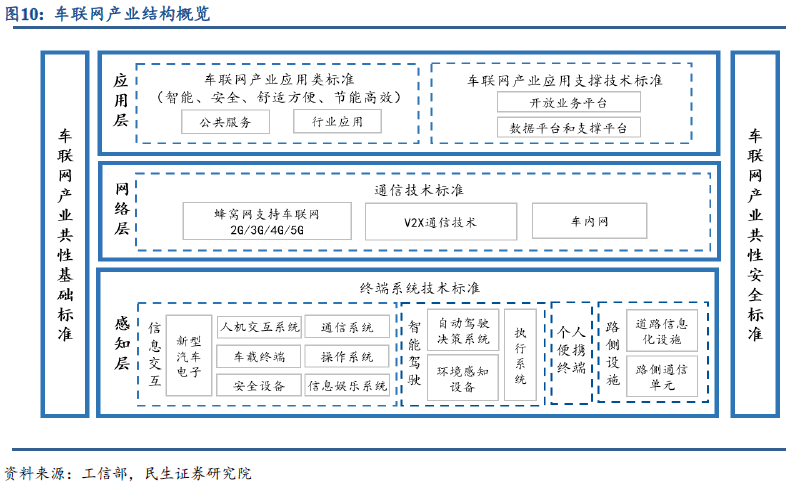

Vehicle networking is a core area of the Internet of Things and is one of the important dimensions defining smart connected vehicles. Vehicle networking originates from the Internet of Things and is a specific domain of the Internet of Things, connecting vehicles and road infrastructure, pedestrians, public telecommunications networks, and cloud service platforms related to in-vehicle services. Broadly, vehicle networking also includes in-vehicle networks, such as Controller Area Network (CAN), Ethernet, Wi-Fi, Bluetooth, etc. Currently, the level of vehicle connectivity has become a defining core dimension of smart connected vehicles.

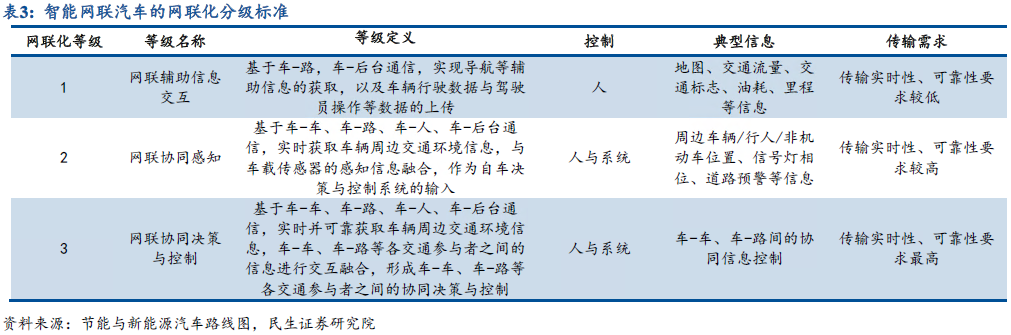

The development of the vehicle networking industry mainly relies on the evolution of mobile communication technology, which can be roughly divided into three stages:

The first stage: Voice and data communication capabilities based on 2G, 3G, and 4G LTE cellular networks, represented by remote information processing services such as automotive infotainment and eCall; The second stage: Based on C-V2X communication technology in 4G and 5G, providing V2V, V2P, V2I communication methods for connected vehicles, ensuring traffic safety, improving traffic efficiency, and reducing emissions;

The third stage: Based on 5G technology, connecting vehicle edge computing with the cloud in real-time, combined with high-precision location information, providing services such as autonomous driving and platooning, ultimately achieving fully autonomous driving. In the future, mobility cloud service providers may emerge, offering Transportation as a Service (TaaS). Currently, the industry is in a transition period from the first stage to the second stage.

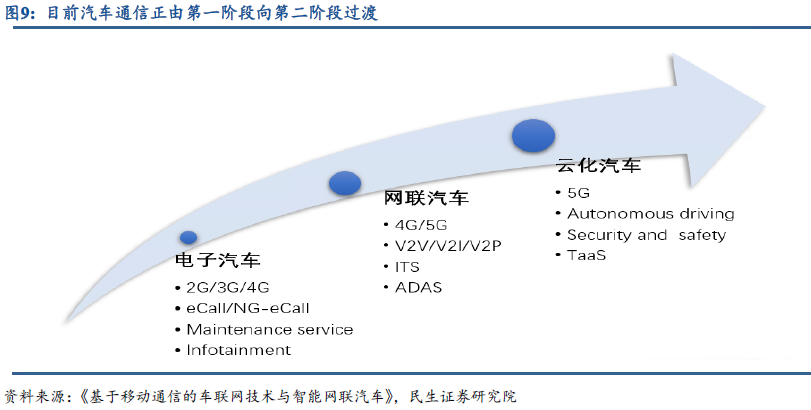

Constructing the Vehicle Networking Industry Architecture with “End + Pipe + Cloud”.The vehicle networking industry can be divided into five key areas: vehicles (smart connected vehicles), networks (information communication), roads (intelligent transportation related), plates (vehicle intelligent management), and electronic products and services, which can be categorized into three levels: perception layer (end), network layer (pipe), and application layer (cloud). The perception layer includes intelligent connected vehicles with sensing capabilities and various infrastructures, while the network layer addresses the interconnectivity between vehicles, roads, facilities, and people. The application layer is a comprehensive information platform primarily aimed at various applications in the vehicle networking industry, requiring the construction of data platforms, operational platforms, and support platforms.

2.

The Downstream Application Space of Vehicle Networking is Broad and Expected to Develop Rapidly in the Future

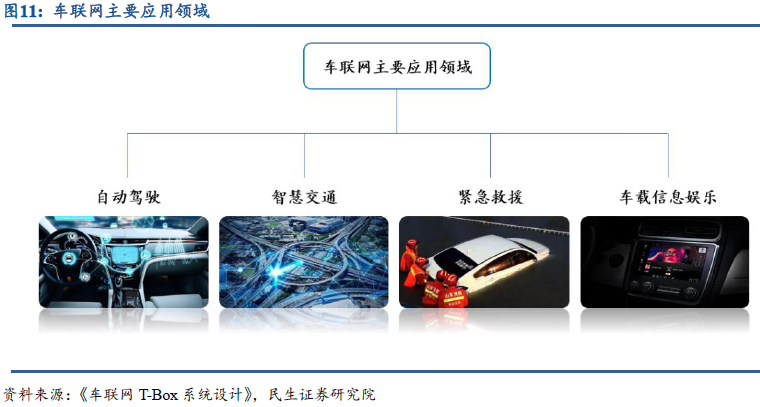

Intelligent driving, smart transportation, in-vehicle entertainment, and emergency rescue are the four core application areas of vehicle networking.

Intelligent Driving:Utilizing vehicle-road collaborative technology to analyze and process various road information collected by end systems, notifying drivers or autonomous vehicles to make timely and appropriate driving actions;

Smart Transportation: Collecting and publishing information through vehicle networking to help drivers understand the entire traffic situation, facilitating intelligent management by transportation authorities, covering remote command and scheduling, non-stop toll payment for roads and bridges, unattended parking management, and tracking of vehicles involved in accidents;

Emergency Rescue: In case of an emergency, the vehicle owner presses the emergency button installed in the vehicle to notify the service center with emergency signals and vehicle location information, allowing for precise rescue while also informing other vehicles of the accident information, enabling surrounding vehicles to make emergency evasive maneuvers or re-plan suitable driving routes;

In-Vehicle Entertainment: Realizing online music, movie watching, news browsing, and online gaming entertainment functions through in-vehicle terminals such as smart cockpit vehicle machines.

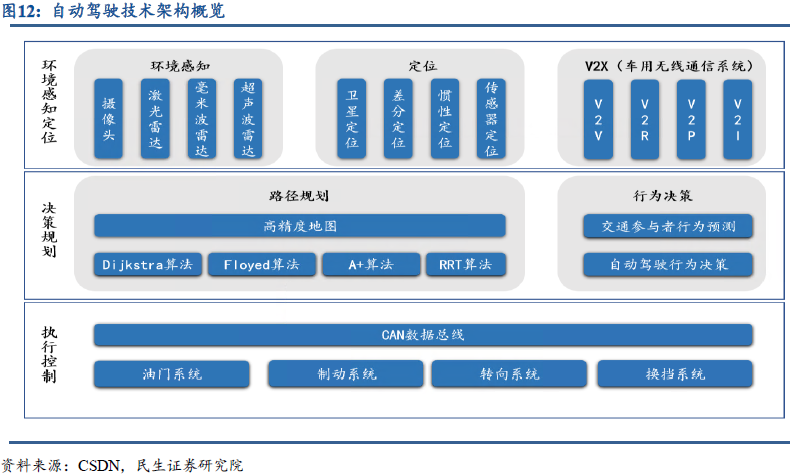

2.2.1 Empowering Autonomous Driving at the Perception End and Providing Redundancy for Single Vehicle Intelligence.

The Core Dimensions of Vehicle Networking Empowering Autonomous Driving:

1. Providing a Global Perspective for Autonomous Driving at the Perception End.From a technical and application scenario perspective, vehicle networking empowers autonomous driving in positioning, planning, and perception, providing accurate positioning information and relying on acquired road information for path planning. It also serves as a beneficial supplement to the perception end, covering longer distances and some blind spots that vehicle-mounted sensors cannot perceive, offering a global perspective for vehicles.

2. Providing Redundancy for Single Vehicle Intelligence.While vehicle networking provides a global perspective for autonomous driving at the perception end, it can also independently acquire and compute road information, operating in parallel with single vehicle intelligence. The computation results can serve as redundancy, providing effective references for decision-making in single vehicle intelligence.

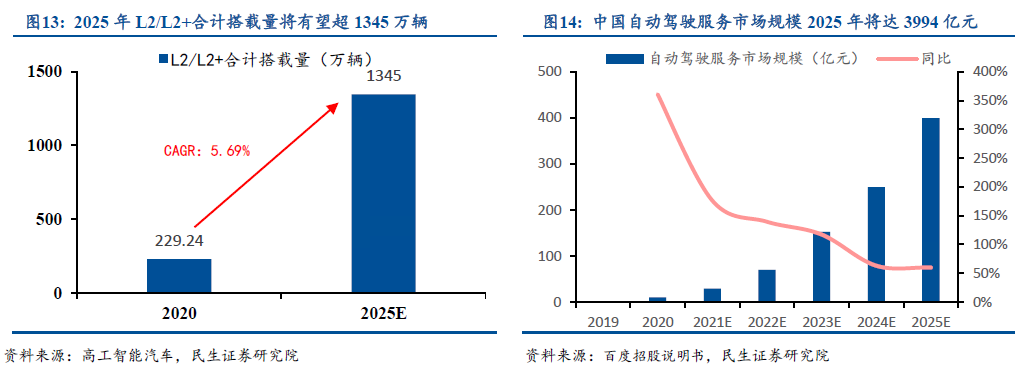

China’s Autonomous Driving Space is Vast and Growing Rapidly, with Short-Term Technology Applications Opening Up L2+ Growth Space.According to a report by Baidu’s prospectus citing Zhizhi Consulting, it is expected that by 2025, the market size of China’s autonomous driving service will reach 399.4 billion yuan, with a CAGR of 136.2% from 2019 to 2025. Currently, major autonomous driving service providers are gradually commercializing high-level technologies into the ADAS field: new car-making forces are refining L2+ level assisted driving technology based on full-stack self-research solutions from an L4 architecture and OTA perspective; traditional car manufacturers are mostly adopting the approach of collaborating with technology companies to jointly demonstrate L2+ autonomous driving capabilities, which have been standard in mid-to-high-end models, driving mass production of L2 level and below autonomous driving products.

According to data from the Gaogong Intelligent Automotive Research Institute, the actual insurance volume of domestic L0-L2 level new cars in 2020 was 6.578 million, with a penetration rate of 34.5%, of which L2 and above accounted for 2.2924 million, more than doubling compared to 2019. Gaogong Intelligent Automotive predicts that from 2021 to 2025, the number of new cars equipped with ADAS (L0-L2) in China is expected to reach 74.9201 million, with the total number of L2/L2+ expected to exceed L1/L0 in 2022, and the total combined number of L2/L2+ expected to exceed 13.45 million by 2025, with a CAGR of 42.5% from 2020 to 2025.

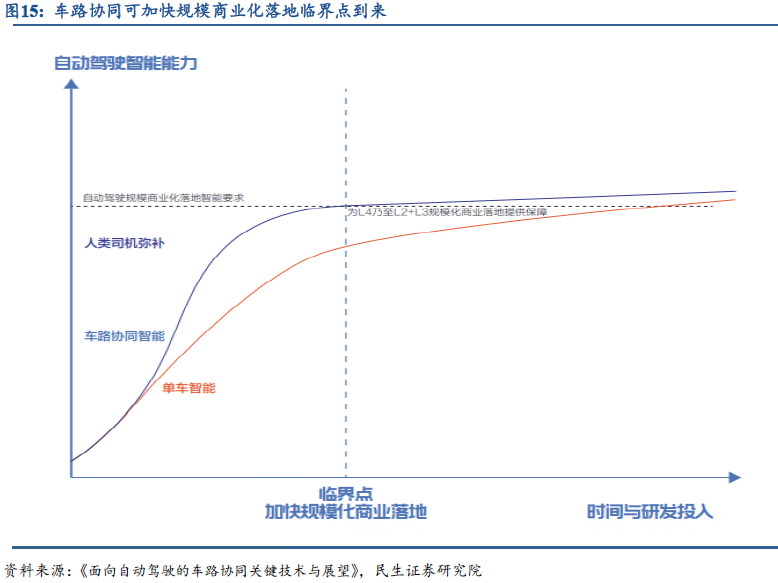

Vehicle-Road Collaboration Enhances Marginal Efficiency and Accelerates the Commercialization Process of Autonomous Driving.The vehicle-road collaborative roadside subsystem can provide new intelligent elements represented by high-dimensional data, effectively sharing the perception, decision-making, and control pressure of the vehicle-mounted autonomous driving system, thereby reducing system complexity.

As investment in autonomous driving research and development gradually increases, the input-output ratio shows a trend of diminishing marginal returns. Vehicle-road collaborative autonomous driving can transition the individual intelligence of single-vehicle autonomous driving to collaborative intelligence, rapidly improving autonomous driving levels and accelerating the arrival of the critical point for large-scale commercialization.

2.2.2 Controlling Smart Transportation Layouts, Improving Traffic Efficiency, and Enhancing Safety Levels.

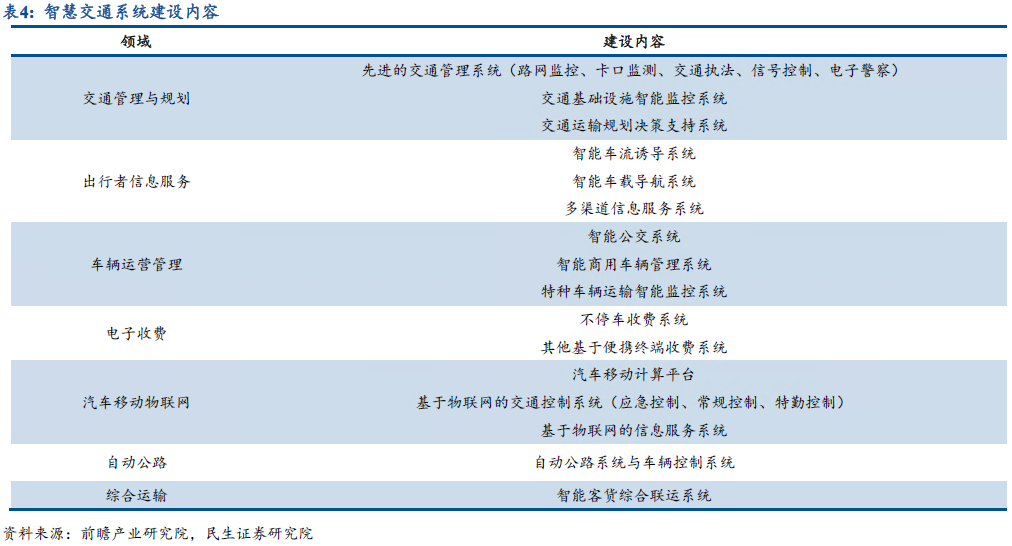

Smart transportation integrates communication, control, and information processing technologies into transportation systems, covering various aspects such as traffic management planning, traveler information services, vehicle operation management, electronic toll collection, intelligent vehicles, automotive mobile IoT, automated highways, integrated transportation, emergency events, and safety, effectively improving traffic efficiency and enhancing road traffic safety levels.

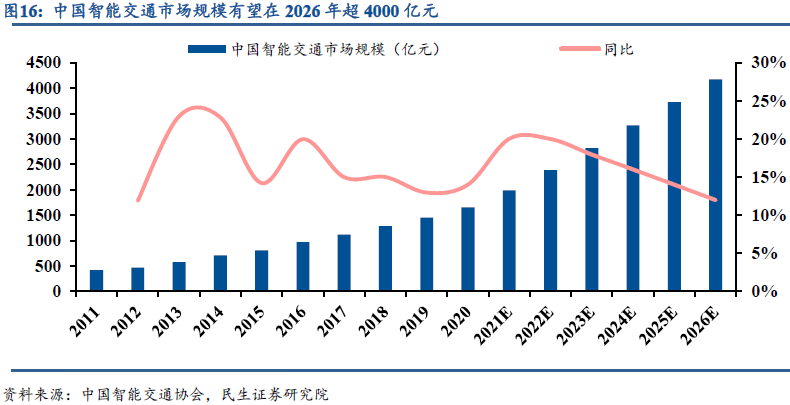

The Smart Transportation Market Size in 2026 is Expected to Exceed 400 Billion Yuan, with a CAGR of 16%.According to data from the China Intelligent Transportation Association, from 2011 to 2020, the total scale of China’s smart transportation market increased from 42 billion yuan to 165.8 billion yuan, showing a significant upward trend, with a CAGR of about 16.5%. The Forward Industry Research Institute predicts that driven by multiple factors such as policy support, technological advancement, urbanization, and the continuous rise in the number of motor vehicles, the demand for smart transportation is expected to maintain rapid growth, and the overall scale is expected to steadily rise, with the market size of China’s smart transportation industry expected to exceed 400 billion yuan by 2026, with a CAGR of about 16.0% from 2021 to 2026.

2.2.3 Supporting the Deployment of Emergency Rescue Systems, with China’s Market Expected to Deepen.

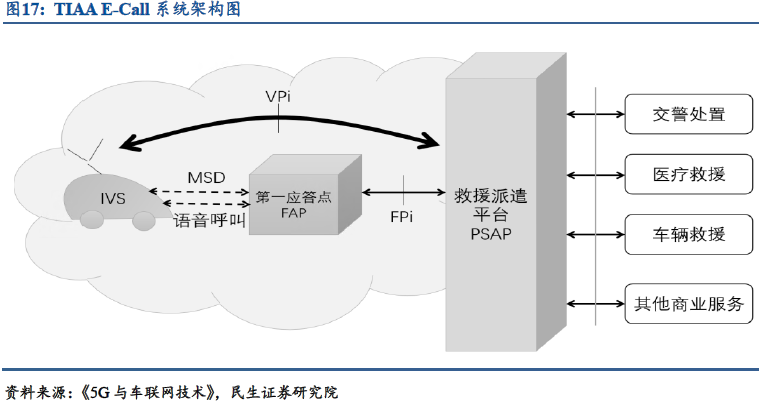

The development of vehicle networking technology is expected to drive the deployment of automotive emergency rescue systems. The China Automotive Information Service Industry Alliance (TIAA) established an emergency rescue working group in 2012, completed the system plan and experiments in 2014, and officially released the TIAA E-Call plan at the end of 2015. The automotive emergency rescue system can report the MSD to the FAP using packet data before establishing a voice channel after a traffic accident, and after the MSD transmission is completed, the IVS establishes a voice call link with the FAP, allowing the accident vehicle’s alarm person and FAP personnel to communicate. Based on the received MSD data and voice alarm information, the FAP contacts the verified PSAP rescue dispatch platform, which may call back the alarm person using the circuit domain voice service to obtain or confirm additional information.

China’s Vehicle Emergency Rescue Business Model is Not Yet Mature, but is Expected to Breakthrough in the Future.This field can be divided into two parts: communication and rescue, both of which can be commercially operated. Russia has mandated the installation of emergency rescue equipment since 2015, and the EU also legally mandated that all vehicles in Europe must be equipped with emergency automatic alarm devices starting March 31, 2018.

In EU countries and Russia, emergency rescue is enforced by the government, which is responsible for building and operating the rescue center PSAP and providing rescue services. Currently, China does not have a mandatory emergency rescue plan and is still in the exploratory stage. We believe that with the development of communication technology and the establishment of a final model, vehicle emergency rescue is expected to break through in the Chinese market.

2.2.4 Broad Vehicle Networking Covers In-Vehicle Information Entertainment, Opening Up Growth Space for Vehicle Machine Upgrades.

Broad vehicle networking covers in-vehicle information entertainment, among other content, with the vehicle machine as the main interaction entry point.

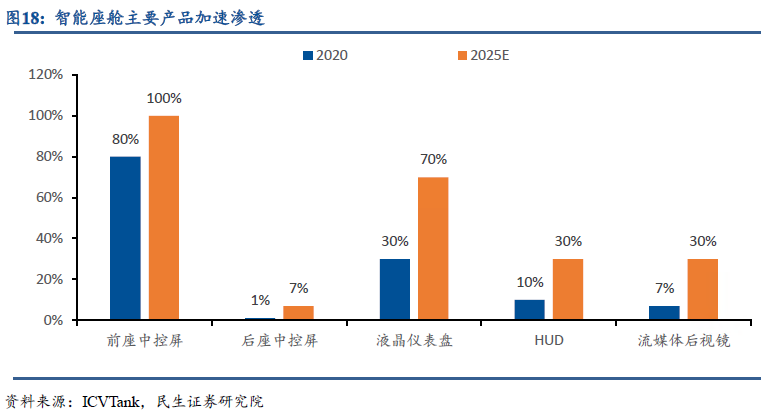

The penetration rate of major smart cockpit products is expected to continue to rise. According to ICVTank data, the penetration rate of major smart cockpit products is expected to increase in the future. Currently, the penetration rates of front seat central control screens, rear seat central control screens, LCD instrument panels, HUDs, and streaming media rearview mirrors are approximately 80%, 1%, 30%, 10%, and 7%, respectively. Under the acceleration of the automotive industry’s smart connectivity process, these figures are expected to reach 100%, 7%, 70%, 30%, and 30% by 2025.

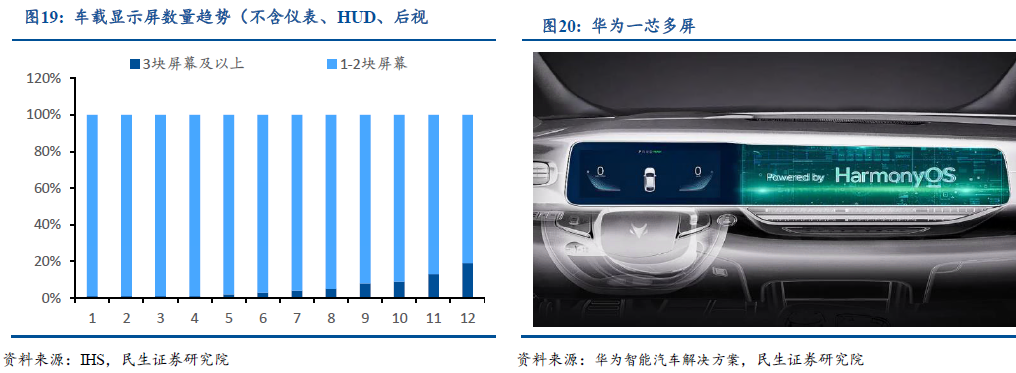

The Future Development Direction of Cockpit Electronics: One Chip, Multiple Screens + Intelligent Upgrades.With the increasing demand for improved driving experiences, the number of in-vehicle display screens is expected to continue to rise. According to IHS data, in 2020, the proportion of vehicles with 1-2 screens reached 99%, while those with three or more screens accounted for less than 1%. This is expected to accelerate penetration, with the proportion of vehicles with three or more screens expected to increase to 19% by 2030.

At the same time, future smart cockpits will gradually integrate central information systems, instrument panels, HUDs, streaming media rearview mirrors, and vehicle networking modules into a complete solution, supported by a single chip, enabling multi-screen collaborative operations, reducing the number of redundant ECUs, and enhancing information interaction efficiency.

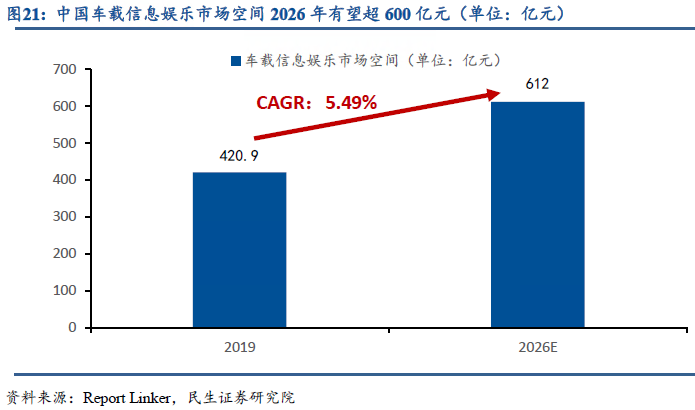

Upgrades of Smart Cockpit Products and Increased Penetration Rates are Expected to Fully Open Up the In-Vehicle Information Entertainment Market Space.According to Report Linker data, the market size of China’s IVI system was 42.09 billion yuan in 2019, with a penetration rate of about 69%. It is expected that by 2026, the penetration rate will reach 95%, with the market size potentially reaching 61.2 billion yuan, and a CAGR of 5.49% from 2019 to 2026, maintaining a steady growth trend.

3.

The Overall Share of Smart Connectivity is Rising, and New Energy Vehicles Accelerating Penetration Provide Broad Space

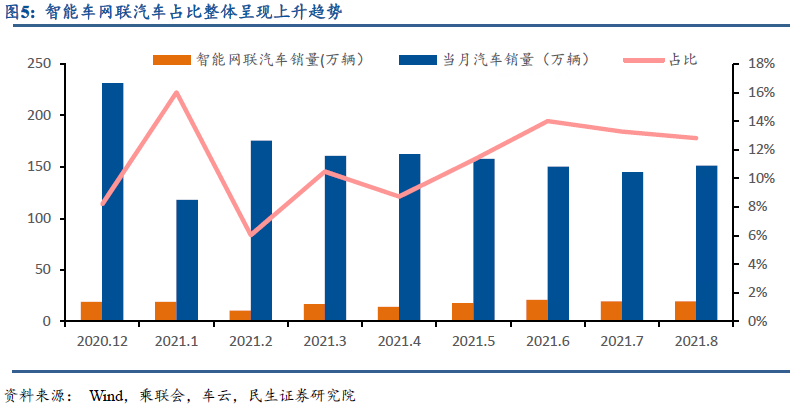

The share of smart connected passenger vehicle sales is showing an upward trend, with the monthly penetration rate now exceeding 12%.Currently, according to statistical standards, smart connected passenger vehicles must be equipped with L2 or higher driving assistance capabilities and also have vehicle networking and OTA upgrade functions. Although the sales share of smart connected passenger vehicles has fluctuated, it is still showing an upward trend. According to our calculations, the retail terminal penetration rate of smart connected passenger vehicles in August has exceeded 12.8%.

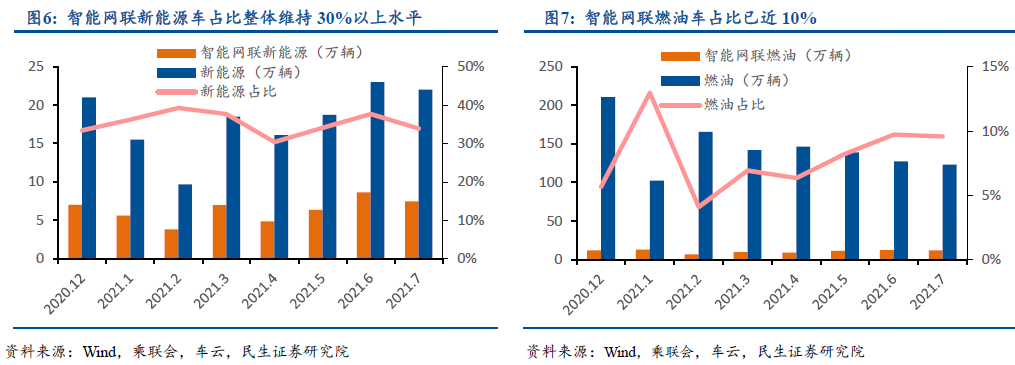

The share of new energy vehicles in smart connected vehicles exceeds 30%, with a clear upward trend in fuel vehicles. We have broken down the retail sales situation of smart connected vehicles by power type, where the penetration rate of new energy vehicles in smart connected vehicles has remained above 30%, while fuel vehicles have fluctuated but overall maintain an upward trend, reaching 9.6% by July 2021.

The Accelerated Penetration of New Energy Vehicles Provides Broad Space for the Advancement of Smart Connectivity.Since 2021, the penetration rate of new energy vehicles in China has continued to rise, increasing from 9.1% in December 2020 to 20.4% in September 2021, showing significant growth. From January to September 2021, sales of new energy passenger vehicles in China reached 1.987 million, with a penetration rate of 13.6%, significantly higher than 5.9% in 2020. We believe that with the continuous increase in new energy vehicle sales and the rising penetration rate, there is broad growth space for the advancement of smart connected vehicles, relying on the transformation of electronic and electrical architectures of new energy vehicles.

3.1 The Focus of Vehicle Networking Policies Shifts Towards Promotion and Implementation, with Major Cities Gradually Establishing Demonstration Zones.

1. On October 14, 2021, national leaders attended the opening ceremony of the second United Nations Global Sustainable Transport Conference via video and emphasized the need to vigorously develop smart transportation and smart logistics, promoting the deep integration of new technologies such as big data, the Internet, artificial intelligence, and blockchain with the transportation industry, ensuring smooth travel for people and goods.

2. On October 12, 2021, the Ministry of Industry and Information Technology stated that it would adhere to the strategy of promoting intelligent and connected development simultaneously, accelerating the tackling of key core technologies, strengthening the construction of connected infrastructure, deepening testing demonstrations and pilot projects, and promoting the high-quality development of China’s automotive industry. In response to policy suggestions related to the new energy vehicle industry, the Ministry of Industry and Information Technology stated that in promoting the development of the intelligent connected vehicle industry, it always adheres to the development strategy of “single vehicle intelligence + network empowerment.” The Ministry also stated that it would accelerate the release and implementation of the “Management Specifications for Road Testing and Demonstration Applications of Intelligent Connected Vehicles (Trial)” to support industry organizations and enterprises in conducting road tests on a larger scale and carrying out demonstration applications in various scenarios, further promoting data sharing and mutual recognition of results, and encouraging the exploration of commercialization development models.

3. On September 27, 2021, eight ministries issued the “Three-Year Action Plan for New Infrastructure Construction of the Internet of Things”: requiring the number of connections to exceed 2 billion, specifically mentioning the smart transportation field: building a comprehensive monitoring platform for vehicle networking (smart connected vehicles) collaborative services, accelerating the construction of applications such as smart parking management and autonomous driving, and promoting the interconnected and collaborative development of urban transportation infrastructure, transportation tools, and the environment.

We have sorted out the relevant policies on vehicle networking in recent years and believe that the policy guidance has gradually shifted from setting goals, formulating standards, and developing core technologies to accelerating deployment and practical application. We believe that as one of the core layouts and development directions, vehicle networking is expected to welcome new development opportunities under policy encouragement and support.

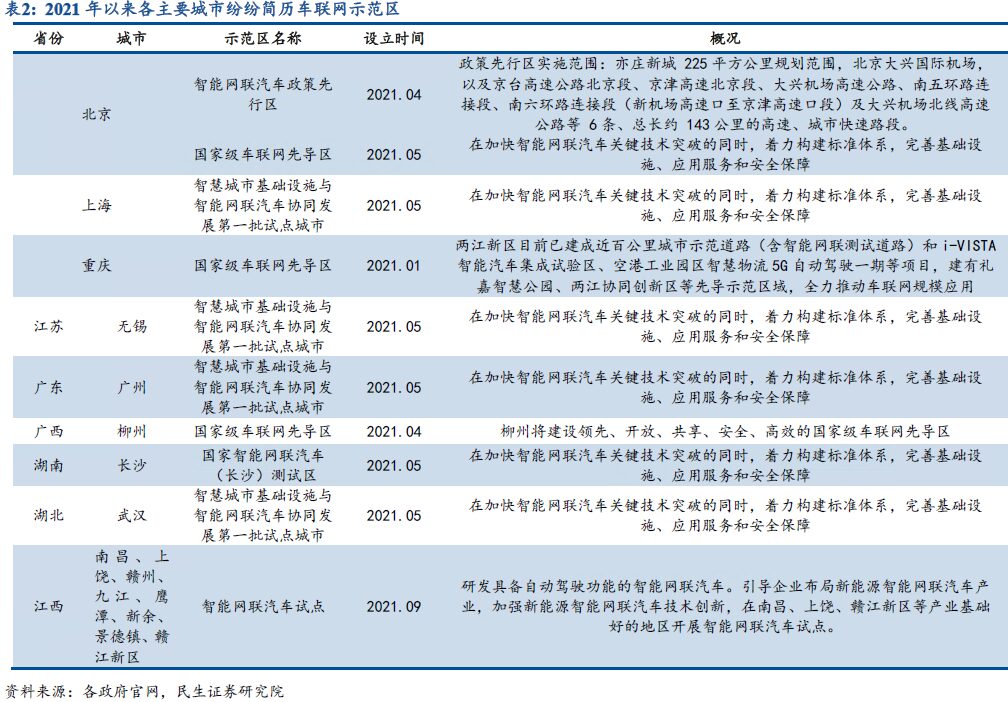

Since 2021, major cities have been establishing demonstration zones to promote the implementation of smart connected vehicles.Since January 2021, major municipalities such as Beijing, Shanghai, and Chongqing, as well as key cities like Guangzhou, Wuxi, Changsha, and Wuhan, have successively established intelligent connected vehicle demonstration zones under policy guidance, leading the development and implementation of smart connected vehicles. We believe that with the gradual establishment of demonstration zones, the smart connected vehicle industry has taken a key step forward, and the combination of policy guidance and practical demonstration zones is expected to accelerate the advancement of smart connected vehicles.

4.

The Acceleration of Smart Connectivity in Vehicles is Expected to Bring Opportunities in Multiple Fields

The acceleration of smart connectivity in vehicles is expected to bring opportunities in multiple fields:In the field of single vehicle intelligence and vehicle-road collaboration, it is recommended to pay attention to leading companies like Baidu Group that are comprehensively laying out vehicle-road cloud maps; the smart connectivity of vehicles is expected to increase the demand for in-vehicle electronic products, and it is recommended to focus on upstream copper-clad laminate leaders such as Shengyi Technology; in the field of in-vehicle information entertainment and the advancement of passenger vehicle autonomous driving, it is recommended to focus on leading companies in smart connected vehicles like Desay SV;

In the field of commercial vehicle networking and intelligent assisted driving, it is recommended to pay attention to companies like Hongquan IoT and Ruiming Technology; with the accelerated deployment of OBU and RSU, it is recommended to pay attention to V2X terminal product manufacturers such as Gaoxin; and to focus on vehicle-mounted module manufacturers like Quectel and Guanghetong; at the same time, it is also recommended to pay attention to vehicle-mounted M2M terminal manufacturers like Weiyun Communication.

3.1. Baidu Group: Comprehensive Layout in Multiple Fields with Apollo Vehicle-Road Cloud Map.

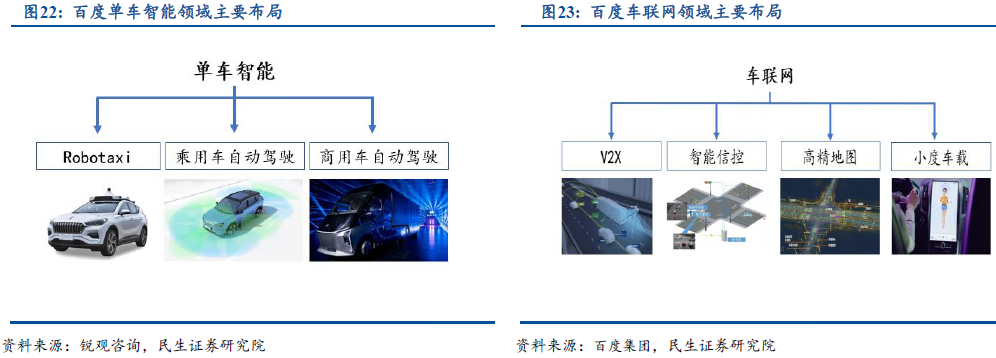

Baidu’s subsidiary Apollo has comprehensively laid out in the two core dimensions of single vehicle intelligence and vehicle networking:

In the field of single vehicle intelligence, the main layouts include:

1. The platform has launched the operating platform “Radish Fast Run,” and the product side has introduced the fifth-generation Robotaxi Apollo Moon and autonomous driving robots, aiming to expand in the shared mobility field;

2. L4 level unmanned driving technology Apollo Lite is being applied to passenger vehicles AVP and ANP, currently achieving mass production with WM Motor W6;

3. Continuing efforts in the commercial vehicle sector, DeepWay is entering the trunk logistics freight market, while other autonomous logistics vehicles, minibuses, and mining trucks have opened up application scenarios in closed parks, scenic areas, and mines.

Main Layouts in the Field of Vehicle Networking:

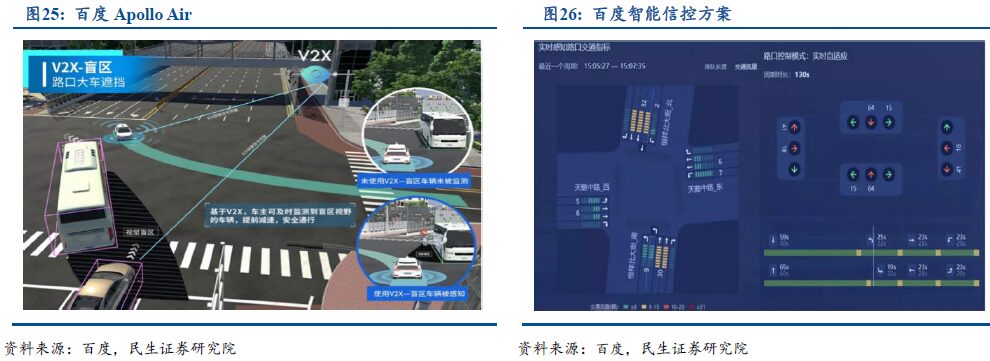

1. V2X can provide additional perception and redundancy for autonomous driving;

2. Intelligent traffic control can effectively adjust road traffic conditions, improving traffic efficiency;

3. High-precision maps provide reliable support for autonomous driving and vehicle networking;

4. Xiaodu OS enriches in-vehicle information entertainment functions.

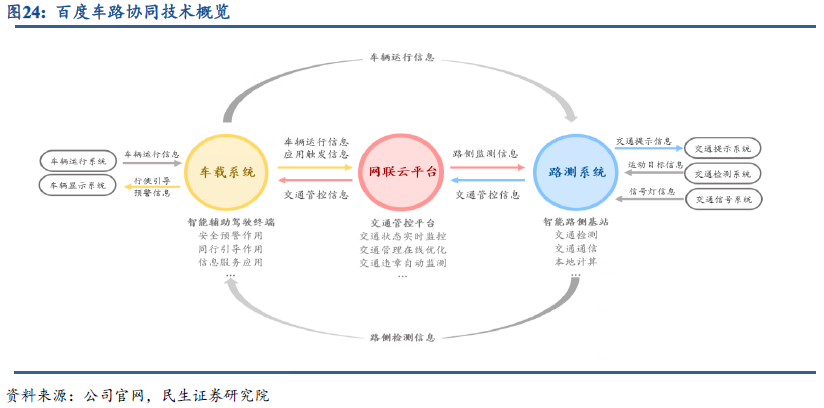

Baidu’s Vehicle-Road Cloud Collaborative Solution:Empowers road traffic through cloud platforms, providing vehicles with a global perspective. The Baidu solution transmits data to the cloud, where information is analyzed and fed back to each traffic participant, empowering autonomous driving and smart transportation.

Currently, Apollo has deployed intelligent devices for road testing at some intersections in Beijing, enabling more precise perception, smarter predictive decision-making, and real-time cloud adjustment, providing global dispatch and comprehensive empowerment for smart transportation, assisting autonomous driving vehicles in obtaining a global perspective, avoiding visual blind spots, and preventing congestion in advance.

Apollo Air Provides Redundancy for Autonomous Driving Based on V2X, and Intelligent Traffic Control Improves Traffic Efficiency Addressing Pain Points.In May 2021, the Tsinghua University Intelligent Industry Research Institute (AIR) and Baidu Apollo announced the world’s first technology that can achieve closed-loop L4 autonomous driving on open roads using roadside perception: Apollo Air, which can achieve L4 level autonomous driving relying only on lightweight roadside perception, utilizing V2X, 5G, and other wireless communication technologies.

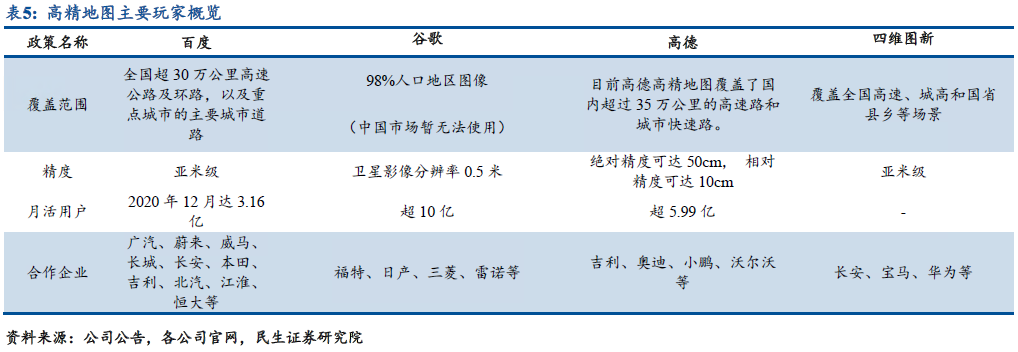

Intelligent traffic control integrates multi-source traffic perception data such as video, geomagnetism, radar, and the Internet, and uses AI capabilities to analyze current traffic conditions in real-time, allowing for global control of traffic operation congestion indices, traffic flow, travel speed, etc., and providing a comprehensive real-time display of traffic conditions, real-time road conditions, signal control status, and signal control modes.

High-Precision Maps are a Core Supplement for Autonomous Driving/Vehicle Networking and Have Entered Multiple Core OEM Clients.Baidu has been laying out in the high-precision map field for many years and has developed a complete process for high-precision map production, publishing, and updating. Currently, Baidu’s high-precision maps cover over 300,000 kilometers of highways and ring roads nationwide, as well as major urban roads in key cities, with minute-level updates. Baidu has collaborated with major automotive companies such as GAC, NIO, Great Wall, WM Motor, and Changan to provide navigation and assisted driving services for equipped models.

Xiaodu Vehicle Based on Five Digital Bases Empowers Vehicle Networking in Multiple Dimensions.Xiaodu Vehicle in 2021 includes five digital bases: ecological base, AI base, LBS base, data base, and system base.

The ecological base includes highly information-driven and rich ecological content and services, naturally adapting to in-vehicle scenarios, forming a complete voice loop; the AI base applies Baidu’s powerful AI capabilities to automotive products, such as in-vehicle Baidu search; the LBS base builds a rich LBS service infrastructure in the vehicle field based on Baidu Maps for automobiles;

The data base is based on Baidu’s accumulation in the fields of transportation and big data, forming a complete data platform specifically for automotive and mobility services. Through the integration of in-vehicle and cloud data and big data analysis, it drives data-driven transformation; the system base will provide the underlying system support needed for future smart vehicles, including system security guarantees and necessary OTA channels for upgrades.

3.2. Desay SV: Leading in Autonomous Cockpit, Smart Driving + Vehicle Networking Opens Up New Space.

The company inherits the quality of joint ventures and deeply cultivates the automotive smart connectivity field. During the period of foreign investment, the company cooperated with internationally renowned giants such as Philips, Mannesmann, and Siemens, inheriting the quality of global first-line products. After transitioning from joint ventures to self-reliance, the company’s products have consistently maintained a leading position in the mid-to-high-end market of automotive original equipment manufacturers, becoming a leading enterprise in China’s automotive electronics industry.

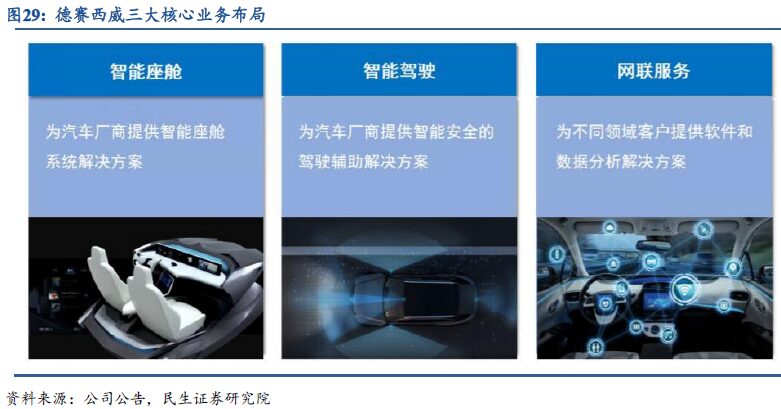

The company focuses on three core business areas: smart cockpit, intelligent driving, and connected services.In October 2019, the company gradually adjusted and focused from its original businesses such as in-vehicle information entertainment systems, air conditioning controllers, driving information display systems, and EMS to smart cockpit, intelligent driving, and connected services, continuously promoting technological progress in these three core business areas and enhancing the capabilities of downstream customers, supporting the process of automotive intelligence and connectivity. The smart cockpit is the company’s flagship product, intelligent driving is currently a performance increment, and connected services are the company’s long-term layout.

The company’s smart cockpit products integrate in-vehicle information entertainment systems, driving information display systems, display terminals, and body information and control systems (air conditioning controllers); in the field of intelligent driving, products such as autonomous driving domain controllers, automatic parking systems, 360-degree high-definition surround view systems, and driver monitoring systems have been supplied in bulk to numerous mainstream automotive manufacturers in China; the vehicle networking service business has launched OTA, Blue Whale OS 3.0 terminal software, network security, and other connected service products, which have been gradually commercialized.