Author | Chen Kangcheng

Produced by | Yanzhi Auto

-

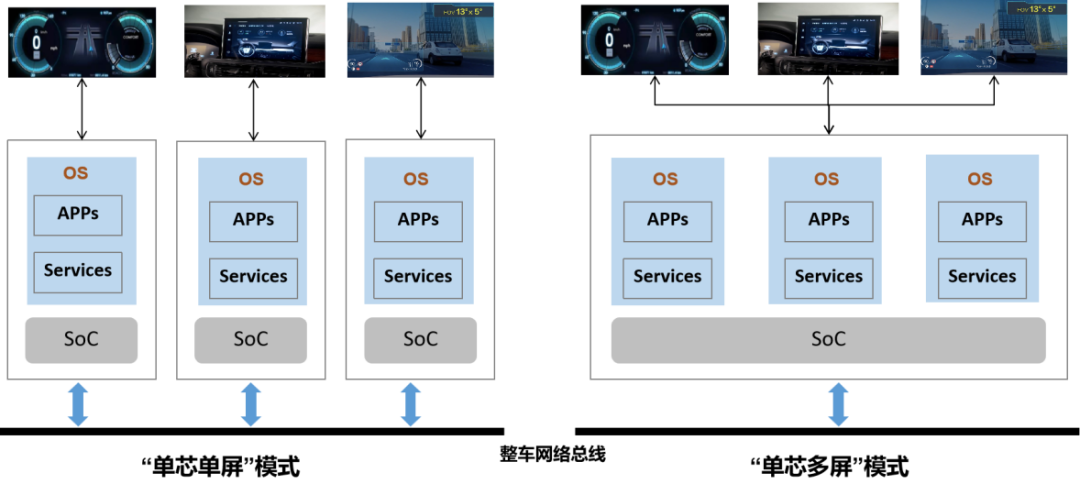

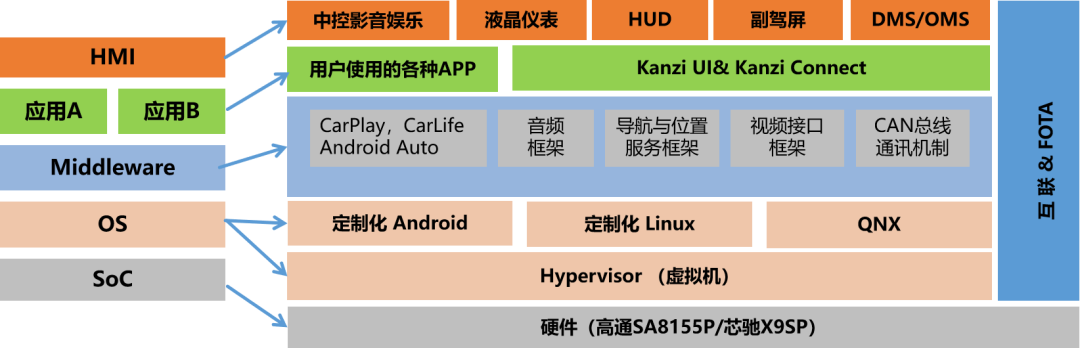

In-Cockpit Display: In the era of electronic cockpits, the cockpit featured small central control displays and physical pointer dashboards. Now, the central control screen and dashboard in the cockpit are basically large full-LCD digital screens. Some high-end cockpits even add AR-HUDs, streaming media displays, rear entertainment screens, etc. In short, the in-car display screens present multi-screen, large screen, and high-definition characteristics.

-

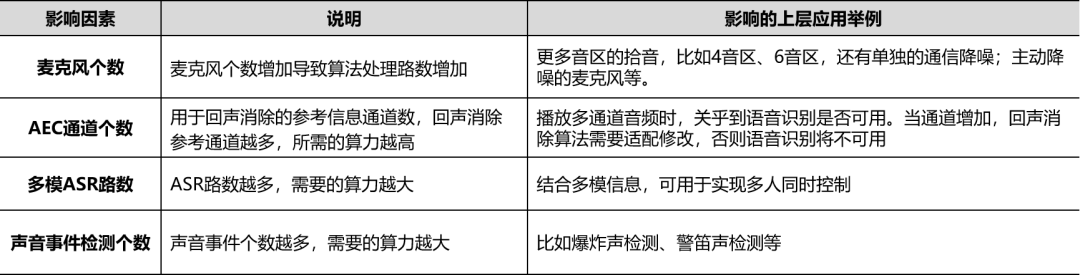

In-Cockpit Interaction: The interaction methods in the cockpit have become diversified. Traditional electronic cockpits mainly interacted through physical buttons, but now there are fewer physical buttons in the cockpit, and touch buttons, voice interaction, gesture control, and other multimodal interaction methods have become mainstream.

-

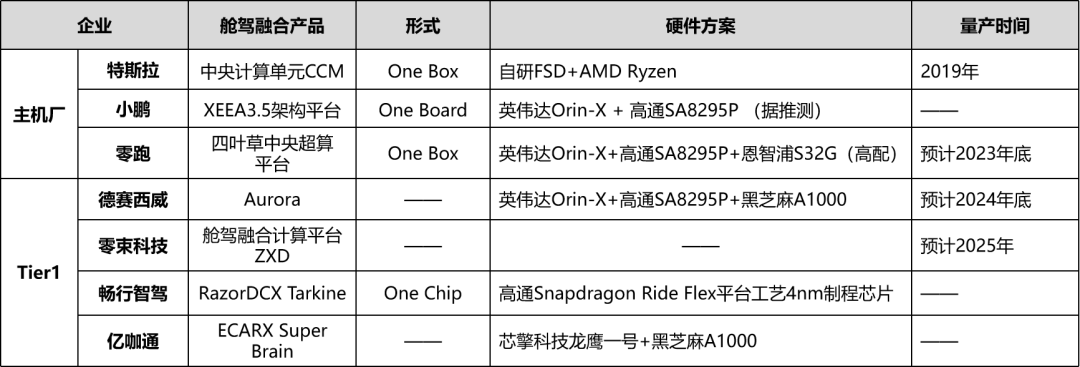

Integration of Cockpit and Driving: The cockpit and intelligent driving were originally two independent parts, but now the integration between the cockpit and intelligent driving is increasing, gradually evolving from “cockpit-parking integration” to “cockpit-driving integration”.

-

Voice Interaction

-

Visual Interaction

-

3D Gesture Recognition: ToF technology can obtain depth information of target objects, and combined with pattern recognition algorithms, it can accurately recognize a person’s three-dimensional gestures. Therefore, the driver can intelligently interact with multimedia, air conditioning, seats, windows, and other systems in the cockpit through different gestures.

-

Face-ID Identity Recognition: ToF technology can classify people based on the obtained depth information, track facial and bodily features, and can distinguish between real people and photos, ensuring the accuracy and reliability of driver identity recognition and authentication.

-

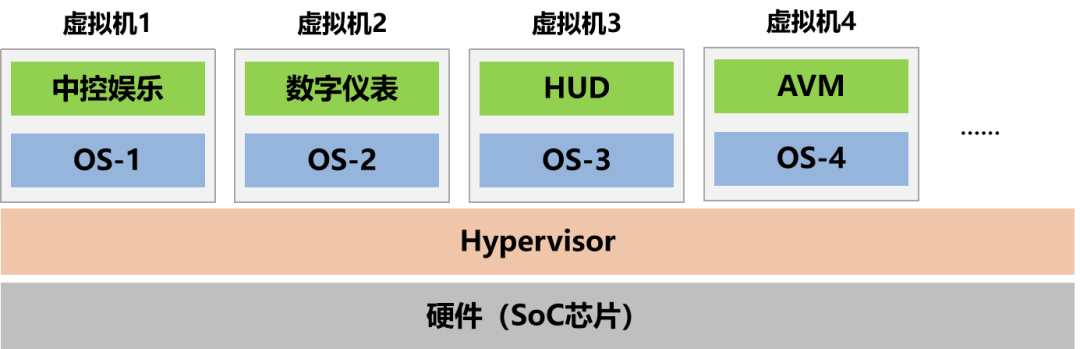

Cost Optimization: In terms of hardware, compared to multiple SoC solutions, a single SoC chip solution has higher integration and uses fewer materials, thus saving BOM costs to some extent; in terms of software, all software operates under a unified software architecture, which can save development validation and functional expansion costs.

-

Improved System Response: Compared to inter-board switch communication or inter-chip PCIe interconnection, using in-chip communication with shared memory directly within the chip results in shorter communication delays and faster system responses.

-

Facilitates New Function Iteration: After the integration of cockpit and driving, the platform’s integration level is higher, and the software is reasonably layered and partitioned, which is more conducive to the deployment and update of new functions.

-

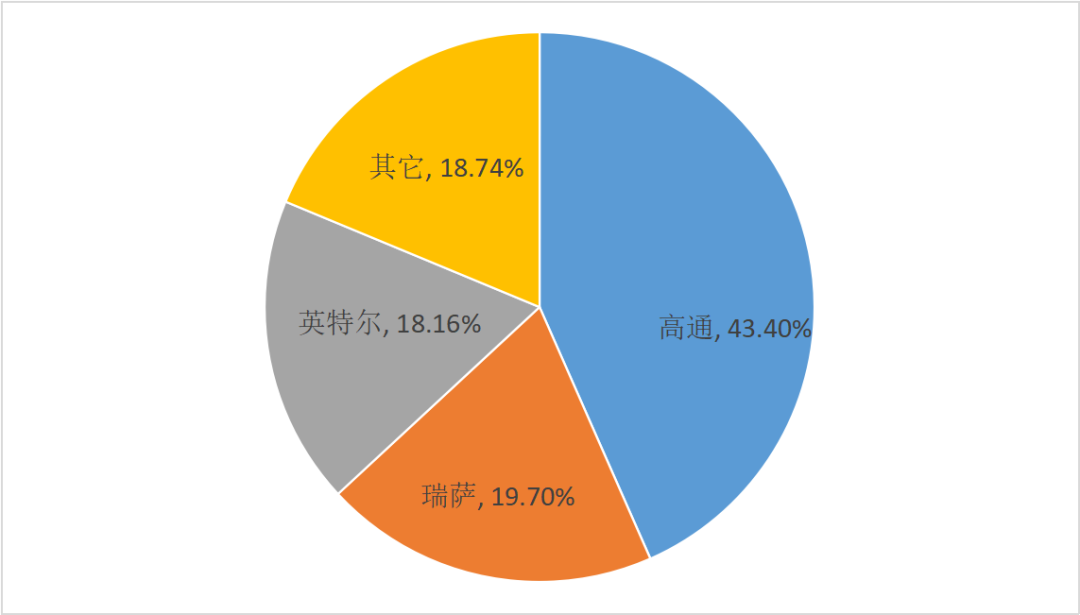

How Mature is the Chip?

-

Is the Chip Roadmap Continuous?

-

Does It Offer High Cost-Effectiveness?

-

How is Localized Service?

-

Identify Product Positioning and Target Market Demand

-

Collaborate to Build a Chip Ecosystem

Reference Articles:

1. Chipone Technology: Intelligent Chips for Smart Vehicles, Building Core Technological Foundations

https://mp.weixin.qq.com/s/G_dsmCiFSfhcVxtDh42Nqw

2. Overview of China’s Smart Cockpit SoC Market

https://mp.weixin.qq.com/s/WxrOTAZtFvvl88OnMhigZg

3. A Brief Discussion on Smart Cockpit SoC Chips

https://mp.weixin.qq.com/s/95reTd6OOuM7wNxxbb4rgA

4. Smart Cockpit and Intelligent Driving SoC

https://zhuanlan.zhihu.com/p/604216936

5. Smart Cockpit Architecture and Chips – (11) Software Part

https://zhuanlan.zhihu.com/p/653813480

6. Auto “Smart Cockpit”: A Brief Discussion on the “One Chip Multiple Screens” of Smart Cockpits

https://www.dongchedi.com/article/7048259965034791427

7. Understanding Multimodal Interaction in Smart Cockpits

https://www.bilibili.com/read/cv22775555/

8. Smart Cockpit – Voice Interaction System

https://mp.weixin.qq.com/s/ifasITZeQ2mD3G5iFcjMIA

9. Multimodal Voice Interaction in Smart Cockpits

https://zhuanlan.zhihu.com/p/473755090?utm_id=0

10. Challenges and Difficulties in Cockpit-Driving Integration

https://zhuanlan.zhihu.com/p/658862370

11. Meng Liming from Changxing Intelligent Driving: Breakthrough Upwards or Dig Deeper Down? Exploring Single SoC Cockpit-Driving Integration Solutions

https://baijiahao.baidu.com/s?id=1769111931866318198&wfr=spider&for=pc

12. Analysis of the Development Trends of “Cockpit-Driving Integration” Technology

https://mp.weixin.qq.com/s/-K568fn3h5ToHJs2enyT3A

Author WeChat

Author WeChatWelcome to Discuss and Exchange