In the first quarter of 2025, the semiconductor industry saw a surge in merger and acquisition (M&A) activities driven by accelerated technological iterations and a restructuring of the international competitive landscape. Companies are increasingly using M&A to break through technological barriers and improve their industrial chain layout.

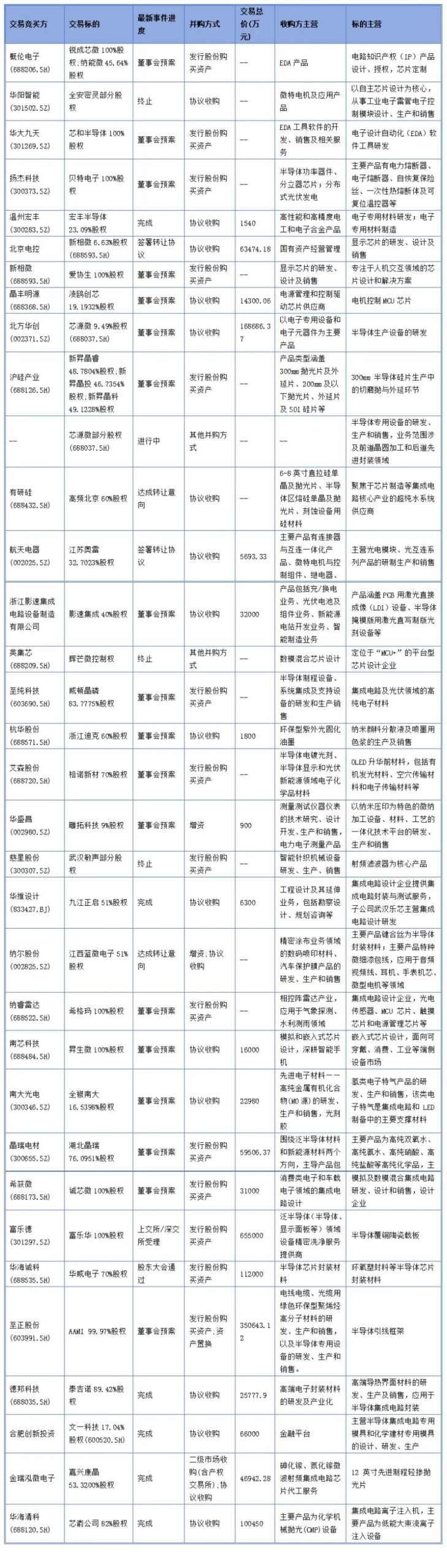

This article aims to provide strategic references for assessing industry M&A integration trends by reviewing typical cases. In the first quarter of 2025, there were 25 new semiconductor industry cases in the A-share market. Combined with 34 disclosed acquisition prices after September 24, 2024, we summarize the common characteristics of semiconductor industry M&A as follows:

1. Market preference favors targets with large revenue and positive profits. In the sample cases, 60% had revenues exceeding 100 million yuan, while only 10% had revenues below 10 million yuan. The largest revenue target was AAMI, acquired by Zhizheng Co., which is among the top five lead frame suppliers globally, with an annual revenue of 2.205 billion yuan in the most recent year.

Approximately 40% of the targets were in a loss state, while over 60% had achieved profitability, with the highest profit being 340 million yuan from the acquisition of Fulehua by Fulede, whose products mainly include semiconductor copper-clad ceramic substrates, achieving a net profit of 190 million yuan from January to September 2024.

2. The average acquisition valuation is 70% of the last round of financing valuation.

Acquisition valuations are generally lower than the last round of financing valuations, with an average multiple (acquisition valuation/financing valuation) of 0.7, indicating that acquisition valuations are 70% of the financing valuations. The discount in valuation is often implemented in conjunction with differentiated pricing, requiring the original founding team to cede certain benefits to institutional investors.

3. Relative to revenue, more emphasis is placed on net profit, and the completion of performance commitments is linked to payment ratios.

In disclosed cases with performance commitments, most chose net profit as the assessment indicator, while a few set operating revenue as the indicator. More often, the acquisition team and technology are emphasized, such as Huahai Qingke’s acquisition of Xinyu Company. The performance commitment period is generally three years. Acquirers typically link the completion of performance commitments to payment ratios to constrain the acquired party and ensure stable operations post-acquisition.

4. The average PE multiple in Q1 is 15.56, indicating a rational return in industry M&A.

Based on performance commitment data and the most recent annual operating data disclosed by the targets, both PE and PS values were calculated. It can be seen that the values calculated based on performance commitments are lower than those based on annual operating data, indicating that acquirers have high expectations for the performance growth of the targets. Additionally, the average PE multiple in the semiconductor industry based on performance commitments is 15.56, reflecting a gradual return to rationality compared to previous phases of exuberance.

5. The average assessment value-added rate of targets is 360%, with nearly half of the targets using the income method for valuation.

Current regulations do not restrict the assessment methods used for M&A restructuring, nor are there quantitative indicators for assessment value-added rates. According to disclosed information from sample cases, nearly half of the targets used the income method for valuation, about 30% used the market method, and 20% used the asset-based method. The average value-added rate is 360%, with the highest being 2181.35% for the acquisition of Shengsheng Micro by Nanchip Technology and 1562.87% for Huahai Qingke’s acquisition of Xinyu Company.

In the case of Nanchip Technology’s acquisition of Shengsheng Micro, both the asset-based method and market method were used for valuation, but the market method was ultimately chosen. This is mainly because the target company’s business model is fabless, a typical light-asset, high R&D investment model in the semiconductor industry, making it difficult for the asset-based method to accurately quantify the value of operational advantages. The core capabilities of the target company, such as talent teams, technical capabilities, customer relationships, and patents, have characteristics that are difficult to identify and quantify individually. The market method, compared to the asset-based method, can more objectively reflect the market value of the valuation object.

Huahai Qingke is a state-owned enterprise, and Xinyu Company was originally a subsidiary of Huahai Qingke. After this acquisition, Xinyu Company became a wholly-owned subsidiary of Huahai Qingke. Xinyu Company mainly engages in the R&D, production, and sales of integrated circuit ion implanters, with its main commercialized product being low-energy, high-current ion implantation equipment, which has been sent to clients for verification. This acquisition used both the market method and income method for valuation, ultimately choosing the income method for the assessment result.

The market method valuation is easily influenced by the characteristics of transaction cases, making it difficult to cover all factors affecting transaction prices in the adjustment and correction of value ratios. The income method considers factors affecting enterprise value more comprehensively and is less affected by short-term market fluctuations.

6. The number of cross-industry mergers and acquisitions is relatively small, with industry synergy M&A remaining mainstream.

In the sample cases, only three were cross-industry mergers and acquisitions, while the rest were industry synergy M&A. In the three cases, the acquirers were from relatively traditional industries, aiming to enter the semiconductor industry and explore a second growth curve.

7. About 30% of the cases were led by original shareholders or the same controlling party, with acquirers being relatively healthy, of which private enterprises accounted for 60%.

Acquirers are mainly private enterprises, accounting for about 60%, while state-owned enterprises account for about 17.6%. About 30% of the acquirers were original shareholders of the target company or had the same actual controller, mostly due to optimism about the future development of the industry, intending to increase their shareholding or inject quality assets into listed companies.

Acquirers are relatively healthy, with none being ST (special treatment) companies, and nearly half of the companies showing good growth in revenue and profits.

8. Changes in control within the semiconductor industry are gradually becoming active.

In the sample cases, there were two cases of changes in control of semiconductor listed companies, specifically Xinyuan Micro and Wenyike Technology. Xinyuan Micro has not disclosed the bidders, while the controlling shareholder of Wenyike Technology has changed to Hefei Innovation Investment Company, with the actual controller changing to the Hefei State-owned Assets Supervision and Administration Commission.

Wenyike Technology is the first listed company controlled by Hefei State-owned Assets through acquisition and is the tenth listed company controlled by Hefei State-owned Assets.

In the first quarter of 2025, the wave of mergers and acquisitions in the semiconductor industry continues to surge, with companies leveraging capital to break through technological barriers and reshape the industrial landscape. The selection of targets has shifted from “barbaric growth” to “strong players” with stable profitability, and the rational return of valuations reflects “careful budgeting” business wisdom. Performance commitments have transformed into “bet agreements,” and post-acquisition synergy effects are becoming more pragmatic. Industry synergy remains the main theme, with private enterprises flexibly leading 60% of transactions, while state-owned assets are quietly laying out their strategies. This intertwining game of technological breakthroughs and capital competition is not only about the survival of enterprises but also reflects the harshness and strategic acumen of the semiconductor industry moving towards high-level competition.

Attachment: Overview of Cases

Note: The above cases cover new semiconductor industry M&A cases in the first quarter of 2025 and those with disclosed acquisition prices after September 24, 2024. The information statistics are as of April 24, 2025, and the source of information is Wind.

Researcher: Lei Yu

Contact Email: [email protected]

Research Assistant: Guo Xinxin

Contact Email: [email protected]