If you have been following the semiconductor chip industry, you may know that in the past year or two, “mergers and acquisitions” have become a prominent keyword in this field. For example, Intel acquired enterprise chip giant Altera for $16.7 billion, AMD acquired another enterprise chip giant Xilinx for $35 billion, and NVIDIA recently completed the acquisition of high-end network chip manufacturer Mellanox for $6.9 billion, while preparing to acquire the globally renowned architecture design firm ARM for an astonishing $40 billion.

Against this backdrop, Qualcomm’s acquisition of a small company—NUVIA, which was founded less than two years ago—for a mere $1.4 billion may not have garnered much attention. However, when we delve deeper into this “small company” and assess the potential impact of this acquisition on the entire industry, we must say that Qualcomm’s acquisition could be a significant move.

-

Who is NUVIA? Its team is quite impressive.

Interestingly, many people (including us at Sanyi Life) initially mistook the name “NUVIA” for “NVIDIA” when they first saw the news about Qualcomm’s acquisition, which surprised them. Of course, NUVIA is not NVIDIA; they do not produce GPUs and do not have the same scale or long history as the latter. However, this startup, which has only been around for a little over a year, has a remarkable background.

First, let’s take a look at NUVIA’s current team. Its CEO, Gerard Williams III, served as Apple’s Chief CPU Architect for ten years before starting this venture, overseeing the development of most of the self-developed chips from A7, A8, A9, to A14. Prior to that, he worked at ARM for 12 years, participating in the development of a series of classic CPU architectures from ARM9 to Cortex-A15. He has essentially witnessed the majority of the development of mainstream consumer mobile device CPUs and has even led the technological mainstream in this area. Meanwhile, NUVIA’s Vice President, Manu Gulati, was the Chief SoC Architect at Google and also served as Chief SoC Architect at Apple for eight years, responsible for the design of several “big core” processors such as A5X, A9, A11, and A12X. Additionally, he has extensive R&D experience with PC and mobile processors from his years at Broadcom and AMD.

Furthermore, another senior vice president at NUVIA, John Bruno, is also a notable figure in the industry. He worked at ATI for seven years, AMD for eight years, and Apple for five years, developing one of ATI’s earliest mobile graphics cards and was responsible for the development of the first generation of APU designs at AMD (note that this was before the Bulldozer architecture, and the first generation of APUs performed quite well). It is clear that even though NUVIA is a startup, its core team consists of individuals with rich experience, having been core members of R&D teams for PC, mobile, and even enterprise-level products. With such a “star leadership team,” NUVIA has attracted many top talents in the industry, becoming a significant new force in the chip sector.

-

What does NUVIA do? They aim to revolutionize CPUs.

Clearly, a group of industry-recognized top teams coming together to form a “startup” is focused on CPUs. However, NUVIA does not intend to simply design higher-performance CPUs; their goal is to disrupt the existing CPU design philosophy. To this end, NUVIA has chosen ARM’s latest, yet-to-be-commercialized next-generation instruction set, ARM v9, as their compatibility target. This means that CPUs developed based on this instruction set will at least directly compete with other manufacturers’ products from 2021 or even 2022.

NUVIA’s laboratory

NUVIA’s laboratory

Secondly, NUVIA has pointed out that there are two major misconceptions in current mobile CPU design: one is relying on extending the pipeline to achieve high frequency (which is an old mistake made by Intel during the Pentium 4 era); the other is heavily promoting “turbo boost” to make the processor’s peak frequency appear very high for marketing purposes, but in reality, it cannot maintain high performance during prolonged use. Therefore, when designing their first self-developed CPU architecture, NUVIA first considered a “comprehensive review” of the pipeline architecture of existing mainstream CPUs. According to their own words, NUVIA’s first self-developed CPU architecture, “Phoenix,” is a “clean design” (implying the use of a short pipeline and no turbo boost), focusing on maximizing memory bandwidth, CPU utilization, and sustained performance output during long-term use.

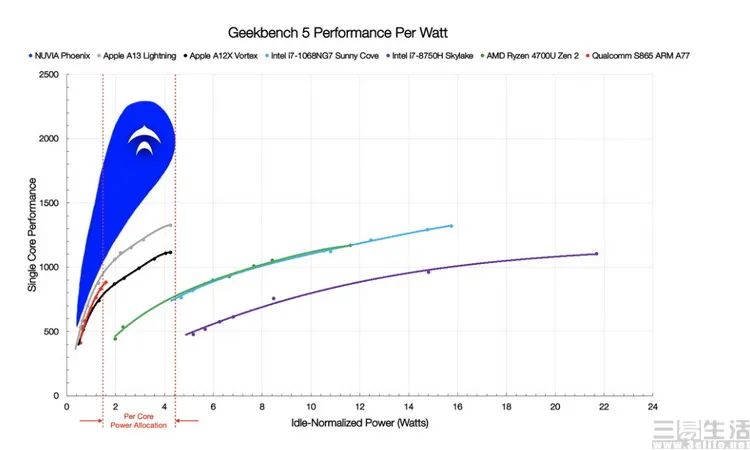

So how powerful is the CPU designed by NUVIA? On their official website, we can find an article specifically discussing the performance and power consumption comparison between “Phoenix” and other competitors. According to NUVIA’s own precise testing and simulation results, the “Phoenix” architecture outperforms all competitors’ peak performance by 50%-100%, while its power consumption is less than 5W. Moreover, because it does not have the issue of other CPU architectures where performance growth slows significantly as power consumption increases, NUVIA’s CPU architecture can actually be applied across a very wide power consumption range. From compact smartphones to personal computers, and even to large servers and supercomputers, “Phoenix” can handle it all, providing unprecedented high performance and high energy efficiency.

-

The acquisition of NUVIA may stem from Qualcomm’s dissatisfaction with ARM.

Having clarified NUVIA’s impressive team and the power of their first self-developed CPU architecture, it is not difficult to understand Qualcomm’s intention behind acquiring NUVIA at this time, as well as the impact NUVIA could have on Qualcomm and the entire industry.

Self-developed Kryo CPU architecture, allowing the quad-core Snapdragon 820 to outperform many contemporaneous octa-core processors.

Self-developed Kryo CPU architecture, allowing the quad-core Snapdragon 820 to outperform many contemporaneous octa-core processors.

As is well known, during the early Cortex-A8, A9, and A15 eras, Qualcomm had already launched its self-developed CPU architecture Scorpion based on the ARM instruction set. Later, in the classic Snapdragon 600 and Snapdragon 800, it was updated to the Krait architecture and achieved success. As smartphones entered the 64-bit era, Qualcomm also introduced the highly self-developed Kryo architecture in Snapdragon 820/821, but starting from Snapdragon 835, they gradually shifted from fully self-developed architectures to semi-custom designs based on ARM’s existing designs, such as Kryo280 (based on Cortex-A73) used in Snapdragon 835 and Kryo585 (based on Cortex-A77) used in Snapdragon 865, which are products of this semi-custom approach.

ARM’s public version development samples

ARM’s public version development samples

The benefits of semi-custom CPU design are obvious: it can shorten the R&D cycle, reduce product costs, and also help lower software adaptation difficulties. However, its drawbacks cannot be ignored. On one hand, semi-custom R&D means that the baseline performance of the processor is difficult to differentiate significantly from other competitors; on the other hand, it also means that Qualcomm’s mobile platform is constrained by ARM’s R&D capabilities in terms of product rhythm and performance. If ARM’s new architecture performs well, that’s fine, but if ARM’s products encounter issues (for example, if NVIDIA acquires them, or if some other “accident” occurs), then all mobile platforms based on ARM’s existing architectures or semi-custom designs will be affected to some extent.

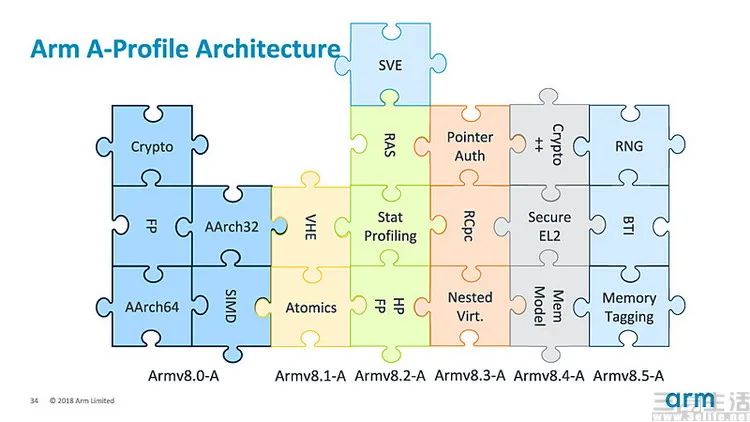

ARM has actually been making minor adjustments to the V8 instruction set.

ARM has actually been making minor adjustments to the V8 instruction set.

Moreover, you may not know that the latest public mobile processor architectures, such as Cortex-X1 and Cortex-A78, are still using the outdated ARM V8.2 instruction set. The latest Apple A14 also uses a version of the ARM V8.6 instruction set that is not the newest. So the question arises: what is the latest version of ARM’s instruction set? The answer is the ARM V8.7 instruction set, which was just announced in December 2020. However, according to the information we have obtained, ARM is preparing to launch a new CPU architecture called “Matterhorn” in 2021, which will likely still use the ARM V8.6 instruction set released in 2019, and it may not be until 2022’s “Makalu” that a true overhaul will occur, adopting the new (expected to be released in 2021) ARM V9 instruction set system. In other words, ARM’s new public architecture for 2021 may have a bit of a “toothpaste squeezing” feel to it.

-

Qualcomm is expected to regain self-development, with ARM potentially becoming the biggest loser.

This means that if Qualcomm continues to adopt the existing “semi-custom” strategy, they will not be able to utilize the ARM V9 instruction set as soon as it is officially announced, but will have to wait another year. However, if they decide to abandon the semi-custom architecture based on ARM and directly develop processors based on the new instruction set, Qualcomm could significantly differentiate itself from other competitors in 2021.

After Snapdragon 888, Qualcomm’s next flagship may target a new self-developed solution.

After Snapdragon 888, Qualcomm’s next flagship may target a new self-developed solution.

At this point, you may have understood. Yes, Qualcomm’s decision to acquire NUVIA at this moment is likely due to its ability to directly develop high-performance and high-energy-efficiency CPU architectures based on the new generation ARM V9 instruction set. Imagine if Qualcomm can quickly integrate NUVIA’s existing technology and launch a new generation of CPUs based on self-design by the end of 2021, it would mean they would be a generation ahead of competitors still using ARM’s public architecture (i.e., Matterhorn). The performance advantages this would bring are self-evident. Furthermore, do you remember one of the key features of NUVIA’s self-developed architecture “Phoenix” mentioned earlier? When further increasing power, Phoenix does not quickly experience performance degradation; instead, it shows a performance curve that continues to increase with power consumption. This means it could potentially be made into versions with just a few watts for smartphones, while also producing versions with dozens of watts for PCs and hundreds of watts for high-performance servers. High-performance PC processors based on the ARM instruction set are currently a hot topic in the industry, not to mention that server CPUs were once an important part of Qualcomm’s product line. Therefore, after acquiring NUVIA, Qualcomm is likely to see significant returns in these two potentially larger and more profitable markets.

Of course, if Qualcomm truly relies on the acquisition of NUVIA to return to the path of highly self-developed processors, it will undoubtedly deal a significant blow to ARM’s custom architecture business. Furthermore, if Qualcomm can indeed be the first to launch new processors based on the ARM V9 instruction set in 2021, will competitors like Samsung and MediaTek be willing to continue using ARM’s outdated “Matterhorn” architecture?

【Images in this article are sourced from the internet】

What Everyone is Watching:

After a hard year, “workers” should consider treating themselves to a phone based on AnTuTu & Zhuangzhuang rankings!

This app is magical! It can make both Apple and Android users unable to live without it.

Starting at 3999 yuan! The cost of Xiaomi 11 is exposed: similar to iPhone 12.

Not just iOS! Apple has another operating system for internal use.