“The unclear model and lack of alliance spirit among enterprises are significant constraints on the development of China’s automatic transmission industry, in addition to the technical level,” said Li Shengqi, Secretary-General of the China Automotive Automatic Transmission Innovation Alliance.

Source: Economic Observer

Author: Gao Feichang

Recently, the news that Japan’s Aisin has formed joint ventures with two domestic car manufacturers, GAC and Geely, to produce 6AT transmissions has sparked controversy in the automotive industry. Some experts engaged in automatic transmission research believe that this will dampen the enthusiasm for R&D in China’s automatic transmission sector and hinder the growth of the domestic transmission supply chain, posing significant risks. However, a more rational perspective suggests that Aisin’s joint venture with domestic automakers is a market behavior driven by mutual needs, and that independent R&D of automatic transmissions will not cease but will be compelled to work harder.

Automatic transmissions have always been a weak point in domestic automotive technology. To break through the technological blockade imposed by foreign companies, domestic enterprises have made sustained and substantial investments in the automatic transmission field over the years, progressing from importing foreign products to digesting and absorbing technology, and finally to independent R&D. A typical case is Geely’s acquisition of Australia’s DSI automatic transmission company in 2009, with a grand vision: DSI’s 6AT transmissions would not only meet Geely’s own needs but also supply other domestic automakers, thereby collectively expanding the domestic automatic transmission industry.

However, contrary to expectations, DSI did not perform well under Geely’s management. Consequently, in 2014, Geely sold the majority of its shares in DSI to Ningbo Shuanglin Group. After Shuanglin Group took over, DSI’s performance gradually improved. This case reflects a question: should the R&D and production of automatic transmissions in China be independently managed by automakers, or should it be a collaboration between transmission companies and automakers, or should transmission companies develop independently?

Internationally, there are three models in the automatic transmission industry: in the United States, large automotive groups lead R&D and production; in Germany, transmission manufacturers develop independently; in Japan, several automakers support a single transmission manufacturer, fostering cooperation between automakers and transmission manufacturers. However, in China, multiple models coexist, with each enterprise fighting its own battle. “The unclear model and lack of alliance spirit among enterprises are significant constraints on the development of China’s automatic transmission industry, in addition to the technical level,” said Li Shengqi.

Geely and DSI’s Five-Year Relationship

In recent years, Geely has been actively acquiring overseas companies. Under Geely’s management, whether it is the revival of the London Taxi Company or the flourishing of Volvo, it demonstrates Geely’s exceptional global integration capabilities. However, compared to its acquisitions of complete vehicle companies, Geely has not shown the same level of performance in the automatic transmission field.

When Geely fully acquired Australia’s DSI automatic transmission company for 70 million Australian dollars in 2009, the industry was quite excited. At that time, DSI was touted as the world’s second-largest automatic transmission company, with its 6AT front and rear drive automatic transmission technology already quite mature, supplying companies like Ford and South Korea’s Ssangyong, and also having relevant R&D reserves in 8AT and DCT dual-clutch transmissions. At that time, public opinion remarked: “Geely’s introduction of DSI’s automatic transmission products and technology to China will enable Chinese automotive companies to obtain world-class automatic transmission products, and the Chinese automatic transmission industry will thus develop and grow.”

After bringing DSI to China, Geely established the Shandong Transmission Factory in Jining and the Hunan Jisheng Automatic Transmission Factory in Xiangtan, both producing 6AT transmissions with a total capacity of 300,000 units. Subsequently, the domestically produced DSI 6AT transmissions were successively installed in Geely’s GX7, Haoqing, Borui, and Boyue models.

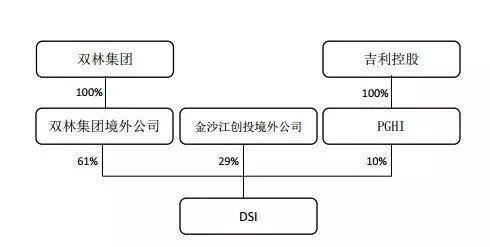

However, this situation lasted only five years before it came to a hasty end. In 2014, Geely transferred 90% of its stake in the DSI project, with 61% going to Shuanglin Group and 19% to Jindongjiang Venture Capital. Shuanglin Group is a domestic company engaged in the manufacturing of automotive components and automotive electronics, and taking over DSI marked its first foray into the automatic transmission field.

What were the reasons behind Geely’s five-year ownership of DSI? Firstly, financial indicators were a significant factor. Initially, after Geely acquired DSI, it reported profits of 3.1 million Australian dollars and 2 million Australian dollars in 2010 and 2011, respectively, but by 2012 and 2013, it incurred losses, and by the end of 2014, only the Hunan Jisheng factory was operational, while the Shandong factory had not yet commenced production, indicating that DSI faced difficulties in its domestic development.

There are also more speculations from the outside. For example, some analyses pointed out that DSI’s 6AT transmission was “not suitable” for China, as it was primarily used in large displacement vehicles like pickups in Australia, while domestic automakers mainly produce small displacement vehicles, making it difficult to achieve a good match, which could lead to increased fuel consumption.

In response, Geely’s official statement indicated: “As Geely’s competitors, other car companies are cautious about procuring DSI transmissions.” In other words, because Geely owns DSI, no other company is willing to risk being led by Geely in the future. Geely also stated: “We will continue to maintain R&D in automatic transmissions in the future,” suggesting that the sale of DSI was still aimed at promoting the technology, just in a different way.

Coincidentally, in April 2015, Geely also sold its manual transmission production company, “Geely Fada,” to Wanliyang, an independent transmission manufacturer in China. In the same year, Wanliyang also took over Chery’s CVT transmission technology and production equipment. Chery’s explanation at that time was also that “Chery independently owning CVT is not conducive to other domestic automakers’ procurement.”

It seems that it is more appropriate for independent automatic transmission companies to handle domestic automatic transmissions. According to Shuanglin Group’s (300100.SZ) financial report, DSI had already turned a profit by 2017, with a 276% increase in value. Wanliyang also achieved a profit of 643 million yuan in 2017, with significant contributions from its passenger car automatic transmission business.

Searching for a Path in the Automatic Transmission Industry

Although automakers have packaged their automatic transmission businesses and sold them to independent automatic transmission companies, not all independent transmission companies are thriving. Shuanglin DSI’s clients include global companies like Ford and Ssangyong, but domestically, its main client remains Geely, and other automakers are not very enthusiastic about procurement. For example, Geely’s Borui model, which originally used DSI’s 6AT transmission, has switched to the HPT transmission under South Korea’s Hyundai, while the latest Borui model is equipped with Geely’s independently developed DCT dual-clutch transmission. In other words, DSI is being “abandoned” by Geely.

In the domestic 6AT transmission industry landscape, besides Shuanglin Group, there are also two other companies, Shengrui Transmission and Dong’an Mitsubishi. Dong’an Mitsubishi has shifted to independent R&D through technical cooperation with Mitsubishi and launched its independently developed 6AT transmission in 2017, which is used in domestic models from brands like Changan and Zotye. Shengrui Transmission’s 8AT is also matched with models from Jiangling and FAW Haima, and it currently has cooperation intentions with GAC, BYD, BAIC, Great Wall, Changan, Zotye, and Lifan.

However, whether it is Dong’an Mitsubishi or Shengrui Transmission, the current scale of their support is still quite small. In 2017, Shengrui Transmission sold only 70,000 transmissions. Relevant data shows that the total installation of domestic independent automatic transmissions (including AT and CVT) is about 2 million units, with a market share of about 12%. Meanwhile, the market share of independent brand vehicles is about 43.9%, indicating that more independent models are using foreign automatic transmissions.

The small scale of support and the immature supporting industrial chain are the current dilemmas faced by domestic independent automatic transmissions, which urgently need more support from independent automakers. This is also the sense of crisis brought by Aisin’s joint ventures with GAC and Geely to independent automatic transmission companies, as Aisin, with its more stable technology, has taken away leading domestic automaker clients.

“Aisin has chosen the most mainstream enterprises among Chinese independent brands, and this joint venture has caused our independent transmission automakers to lose the ability to achieve industrial breakthroughs. Moreover, it adopts a Japanese-style supporting system, which poses a significant challenge to the automatic transmission industry that we have cultivated with hundreds of billions of investments over the past decade. Thirdly, Aisin’s cooperation threatens not only domestic AT companies but also all technological routes of domestic AT companies, posing a threat to automakers as well. Fourth, I must emphasize the damage to energy-saving and the upgrading of the new energy vehicle industry, as well as the harm to competition in the new generation of the automotive industry,” said Xu Xiangyang, Deputy Director of the Automotive Engineering Department at Beihang University.

However, from the perspective of automatic transmission technology streams, Aisin’s threat seems limited to AT transmissions and does not involve DCT and CVT technologies. In recent years, due to the high difficulty of overcoming AT and CVT technologies, many domestic companies have chosen to invest heavily in the development of DCT dual-clutch transmissions, which have lower technical difficulty and broader matching ranges. Currently, companies like Changan, Great Wall, FAW, SAIC, GAC, and Jianghuai have relevant plans, and some automakers, like Great Wall, have already achieved mass production. Therefore, the mainstream technology for independent automatic transmissions in the future will likely be dominated by DCT dual-clutch transmissions. However, the industrial landscape of DCT dual-clutch transmissions remains fragmented, with each company fighting its own battle, making it difficult to form a collective effort.

Compared to abroad, the development of automatic transmissions in China is too fragmented, with multiple models coexisting. There are independent transmission manufacturers like SAIC Group, which can support millions of vehicles a year, similar to the American model; there are independent supporting companies like Shengrui Transmission and Wanliyang seeking support from automakers, akin to the German and Japanese models; but more companies, like Jianghuai, Great Wall, and BYD, are developing DCTs while hoping to sell their technology to other companies. However, as demonstrated by Geely and DSI’s five-year relationship, this path has proven to be unviable.

The fundamental issue lies in the excessive fragmentation of domestic automakers, where competitive relationships far outweigh cooperative ones, allowing foreign companies to exploit gaps and further exacerbate the hollowing out of domestic automatic transmissions. “We can connect automakers, transmission companies, core component manufacturers, as well as some material and equipment manufacturing companies, along with government industry associations. We are not just solving the issue of Aisin; we need to fundamentally address the problem of our technological hollowing out,” said Xue Dianlun, a professor at Hunan University’s School of Mechanical and Vehicle Engineering.

— END—