Power management chips are the heart of electronic devices.

Editor | Zhidx Insider

Power Management Integrated Circuits (PMICs) are chips responsible for the conversion, distribution, detection, and other management of electrical energy within electronic device systems. They primarily identify the power supply amplitude for the CPU, generate corresponding short pulse waves, and drive subsequent circuits for power output.

Power management chips are widely used in various fields, including mobile communications, consumer electronics, industrial control, medical instruments, and automotive electronics. With the development of emerging applications such as the Internet of Things (IoT), new energy, artificial intelligence, and robotics, the downstream market for power management chips continues to grow.

In this issue of Zhidx Insider, we recommend the report “Power Management Chip Research Framework” by Founder Securities. This report restores the power management industry from aspects such as the technical characteristics of power management chips, the current state of the industry chain, and growth logic. If you want to save this report, you can reply with the keyword “nc551” on Zhidx (WeChat official account: zhidxcom) to obtain it.

This issue’s insider source: Founder Securities

Original title:

“Power Management Chip Research Framework”

Author: Chen Hang

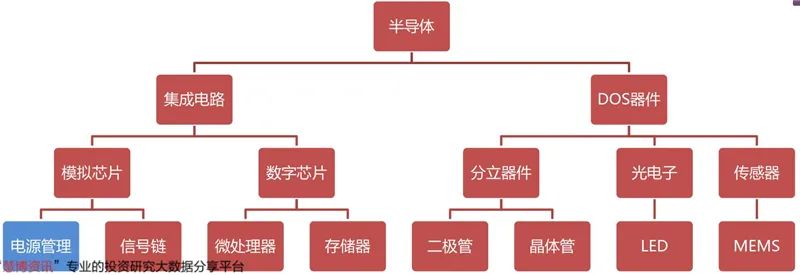

Power management chips belong to the category of analog chips and are the heart of energy supply for electronic devices, responsible for the conversion, distribution, and detection of electrical energy.

Power management chips are key components in electronic devices, and their performance directly impacts the performance and reliability of electronic products. They are widely used in various electronic products and devices and represent one of the largest sub-markets for analog chips.

▲ The position of power management chips in the semiconductor industry

▲ The position of power management chips in the semiconductor industryPower management chips can be divided into AC/DC (alternating current to direct current), DC/DC (direct current to direct current), driver ICs, protection chips, LDOs, load switches, PMICs, etc.

Common power supplies are mainly divided into automotive and communication series, general industrial and consumer series. The voltages used in the former generally are 48V, 36V, 24V, etc., while the latter typically operates below 24V.

Different application fields have different patterns. For example, in PCs, the commonly used voltages are 12V, 5V, and 3.3V. Analog circuit power supplies often use 5V and 15V, while digital circuits commonly use 3.3V and 2.5V. Current FPGA and DSP devices even use voltages below 2V, such as 1.8V, 1.5V, and 1.2V.

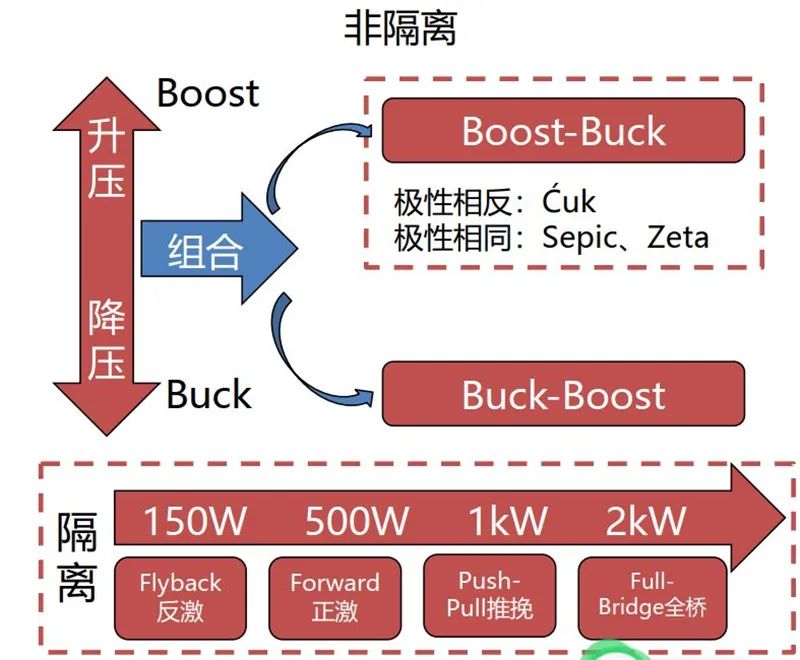

According to whether isolating devices (transformers) are used during the energy conversion process, circuit topologies can be classified into isolated and non-isolated types.

Isolated power supplies use transformers to separate input and output voltages, enhancing circuit safety. Isolation devices can increase circuit safety, and high voltage scenarios generally require isolation devices. For example, when powered by mains electricity, touching the output or ground of the power supply may pose a risk of electric shock. Without isolation, circuits may burn out during thunderstorms.

▲ Circuit topology

▲ Circuit topologyIsolated power supplies generally come in two forms: linear power supplies and switch-mode power supplies. Linear power supplies first step down the voltage through a transformer and then rectify it, but the transformer is difficult to miniaturize. Switch-mode power supplies first rectify the input and then use a switching transistor to increase the input voltage frequency, allowing for a smaller transformer and power supply size. Both types of power supplies require multiple power chips to achieve their functions.

Non-isolated power supplies do not use isolating devices (mainly transformers) between input and output. They control the duty cycle (D, 0<D<1, meaning the proportion of time the switch is on) to boost or buck the input DC voltage.

The switching transistors used in power supplies are mainly MOSFETs, which can output large working currents (from a few amps to dozens of amps). MOSFETs come in two types: N-channel and P-channel.

N-channel MOSFETs are mainly used in AC/DC power supplies, DC/DC converters, and inverter devices. P-channel MOSFETs are used mainly for load switches and high-side switches.

AC/DC chips can be divided into isolated and non-isolated types based on whether a transformer is used for isolation during the AC to DC conversion process: non-isolated AC/DC converters/controllers; isolated SR, PSR, SSR.

They can also be categorized based on whether they integrate MOSFETs: converters and controllers, with the former being integrated and the latter requiring external MOSFETs. In high-power scenarios, controllers with external MOSFETs are generally selected. Isolated AC/DC chips include secondary synchronous rectifiers (SR), primary feedback AC/DC converters (PSR), and secondary feedback AC/DC converters (SSR).

In the DC/DC chip category, mainstream DC/DC chips include Buck, Boost, and Buck-Boost. Other isolated DC/DC topologies include: Ćuk, Sepic, and Zeta. DC/DC chips are also divided into converters and controllers based on whether they integrate MOSFETs, with the former being integrated and the latter requiring external components.

Fast charging in mobile phones has become a significant development direction for power management chips in recent years. Traditional fast charging solutions include high voltage with low current and high current with low voltage. High voltage is simple and requires low specifications for components, but due to the need for bucking, efficiency is relatively low, and power cannot be improved significantly. High current has a high conversion rate but requires high specifications for components, especially cables. If the current is too high, the cost of cables rises sharply, or they cannot withstand the current, leading to bottlenecks. The trend towards high voltage and high current is an inevitable evolution of fast charging technology, and how to efficiently buck the voltage for battery charging has become key.

A key component needed here is called a charge pump, also known as an inductive-less DC-DC converter, which uses capacitors as energy storage elements. It can halve or double the output voltage. According to the conservation of energy, doubling the voltage will halve the current, while halving the voltage will double the current. Conversion efficiency can reach over 95%.

▲ Buck charge pump applied in Huawei’s 40W fast charging solution

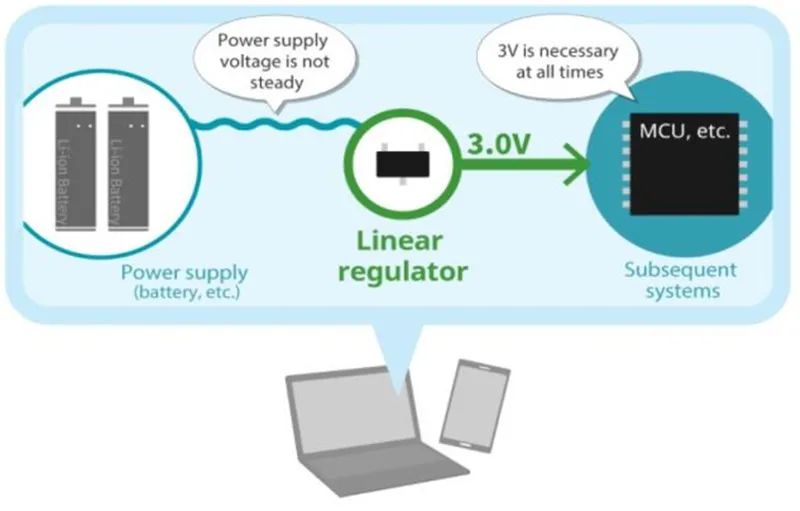

▲ Buck charge pump applied in Huawei’s 40W fast charging solutionAnother important power chip is the linear voltage regulator, mainly low-dropout linear regulators (LDOs), which are the most widely used power chips in IoT electronic products. Their role is to maintain a stable output voltage even when the input voltage or load current changes.

▲ LDO application scenarios

▲ LDO application scenariosToday’s power management chips generally integrate multiple functions, referred to as multi-channel power management ICs (PMICs). PMICs from mobile chip manufacturers like Qualcomm, MediaTek, and HiSilicon are generally sold in conjunction with SoC main controls, and currently, there are relatively few domestic PMIC products.

▲ Statistics of PMIC integration by power manufacturers

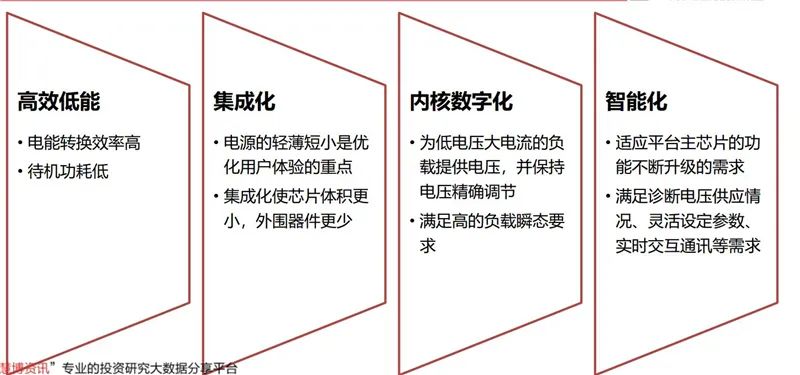

▲ Statistics of PMIC integration by power manufacturers ▲ Trends in the evolution of power chips

▲ Trends in the evolution of power chipsThe power management chip industry chain is divided into wafer manufacturing, chip design, distribution, and downstream applications, as shown in the diagram below.

▲ Overview of the power management chip industry chain

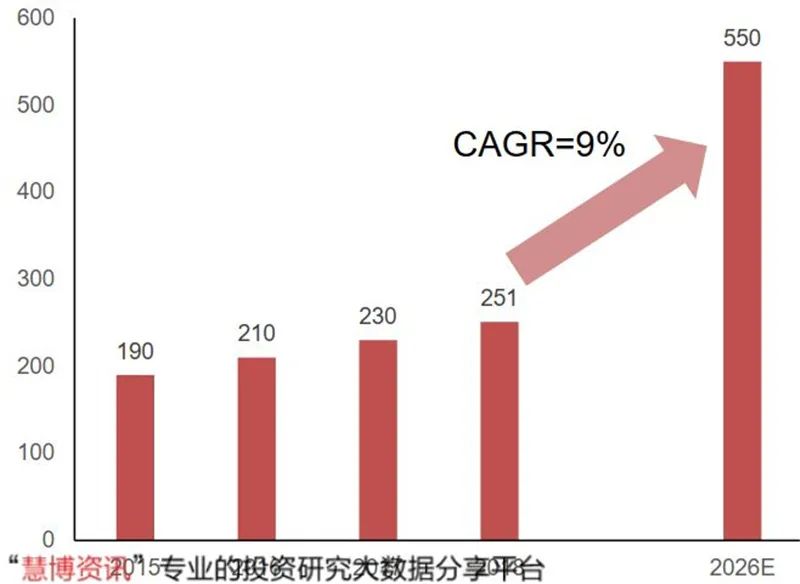

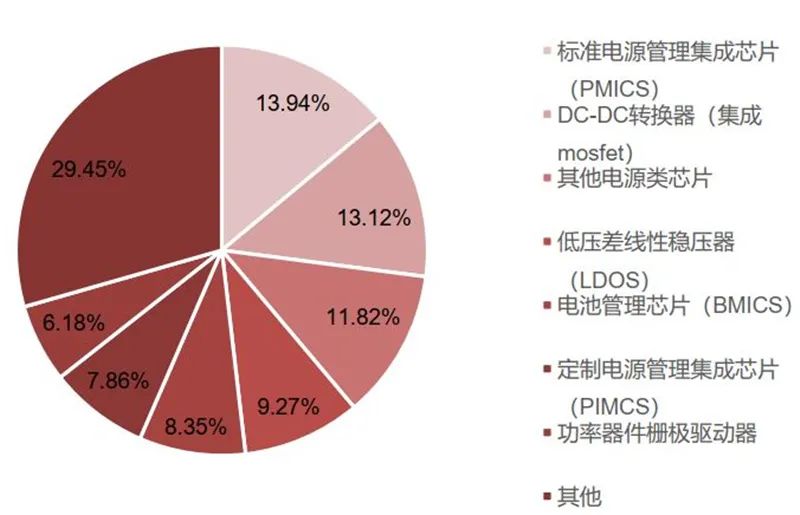

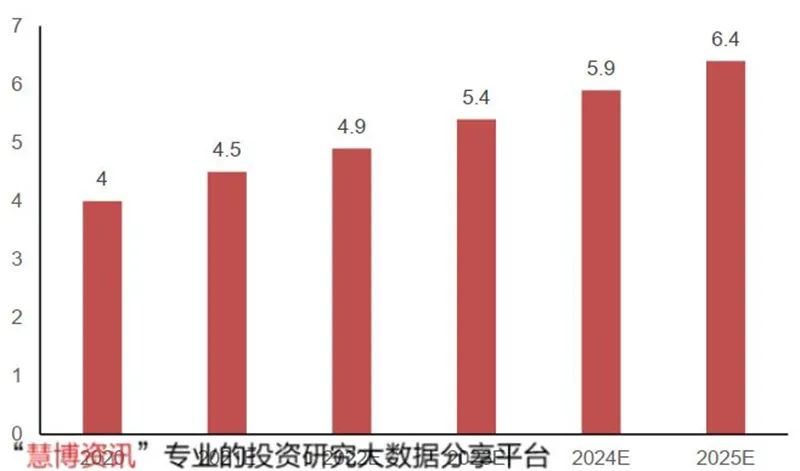

▲ Overview of the power management chip industry chainIn 2018, the global power management chip market was approximately $25.1 billion. Benefiting from the continuous expansion of application fields in the IoT and 5G era and the increasing demand, it is expected to expand to about $55 billion by 2026, with categories such as DC-DC, LDO, and PMIC accounting for a significant share.

▲ Global power management chip market size (in billions of dollars)

▲ Global power management chip market size (in billions of dollars) ▲ 2021 forecast of the scale of various power management chip categories

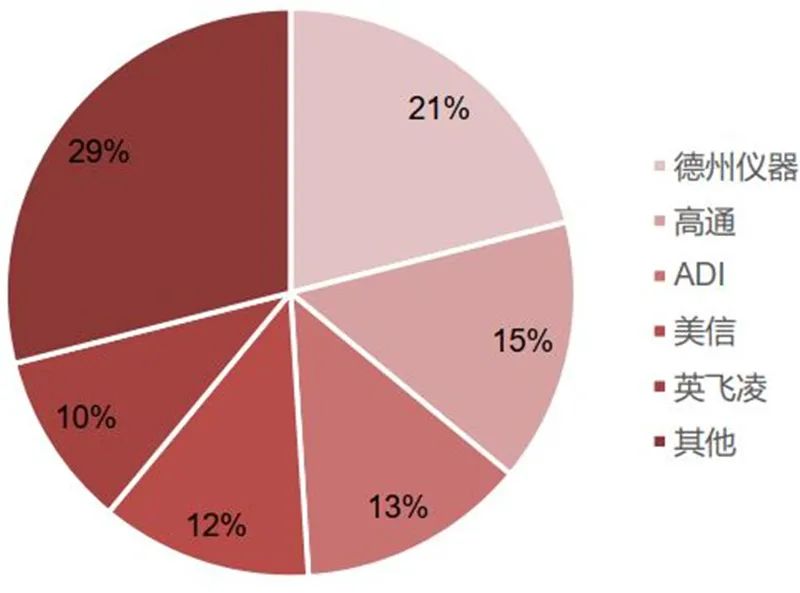

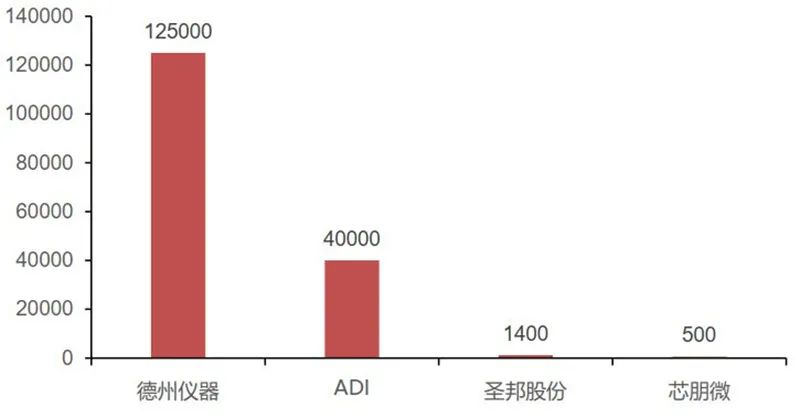

▲ 2021 forecast of the scale of various power management chip categoriesForeign manufacturers dominate the power management chip market, including Texas Instruments, Qualcomm, ADI, etc., with leading manufacturers accounting for over 70% market share.

Domestic manufacturers mainly include Shengbang Co., Sirepu, Jiehuate, Silan Micro, Nanxin, Yutai, etc., with a small market share and customers primarily being domestic related manufacturers.

Although foreign manufacturers have a complete range of products and strong competitiveness, domestic manufacturers have fewer product categories but strong competitiveness in niche areas.

▲ 2018 global power management chip market share

▲ 2018 global power management chip market share ▲ Comparison of product quantities between domestic and foreign manufacturers

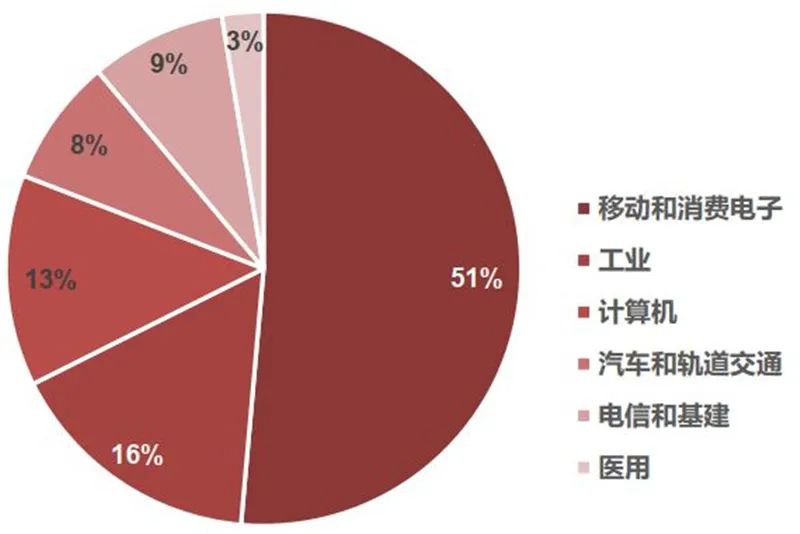

▲ Comparison of product quantities between domestic and foreign manufacturersThe downstream application fields for power management chips include mobile and consumer electronics, industrial control, automotive, telecommunications, and infrastructure. In 2018, the mobile and consumer electronics sector accounted for over 50%; with the continuous increase in consumer electronic varieties and the development of new energy vehicles, the share of power management chips used in consumer electronics and automotive sectors is expected to continue to rise.

▲ 2018 global power management chip downstream application situation

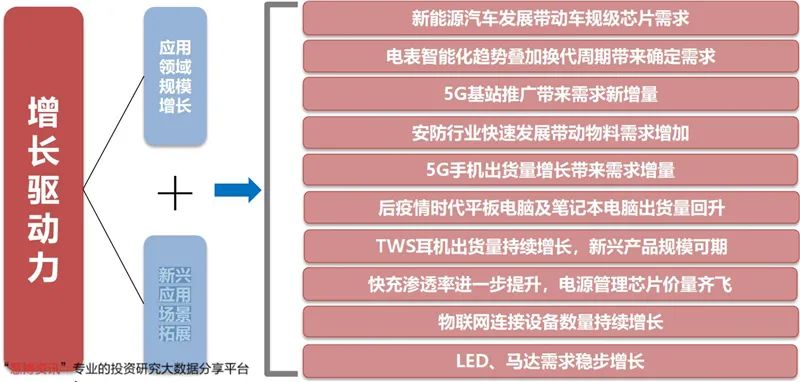

▲ 2018 global power management chip downstream application situationDue to the growth in application scale and the expansion of emerging application scenarios, it is expected that power management chips will experience explosive growth in the future. Below we will analyze the development trends of power management chips in seven major sub-fields.

▲ Growth drivers for power management chips

▲ Growth drivers for power management chips1. New Energy Vehicles

In new energy vehicles, power management chips are used for internal chip power supply and the charging and discharging of the power battery system. The number of chips used is significantly higher compared to traditional vehicles, leading to increased demand for power management chips;

Charging piles utilize high voltage DC-DC and AC-DC products. Due to the high requirements for automotive chips, and the need for automotive-grade certification, there are currently few domestic manufacturers capable of producing automotive-grade power management chips. Major manufacturers of automotive power management chips include TDK (Japan), Bosch (Germany), etc.

▲ Demand diagram for power management chips in new energy vehicles

▲ Demand diagram for power management chips in new energy vehicles2. New Infrastructure

In smart electric meters, power management chips mainly regulate voltage and current to supply power to internal chips. Under the national trend of promoting grid intelligence, the coverage of smart meters is continuously increasing, and the usage of related chips is also rising. The replacement cycle for electric meters is usually 8 years. In 2009, the State Grid released a smart grid plan, leading to large-scale installation of smart meters. Starting in 2018, smart meters will enter a replacement cycle. Based on past bidding changes for smart meters, it is expected that the total bidding volume for smart grids in the next 3-5 years will exceed 300 million units.

▲ Bidding volume for smart electric meters by the State Grid

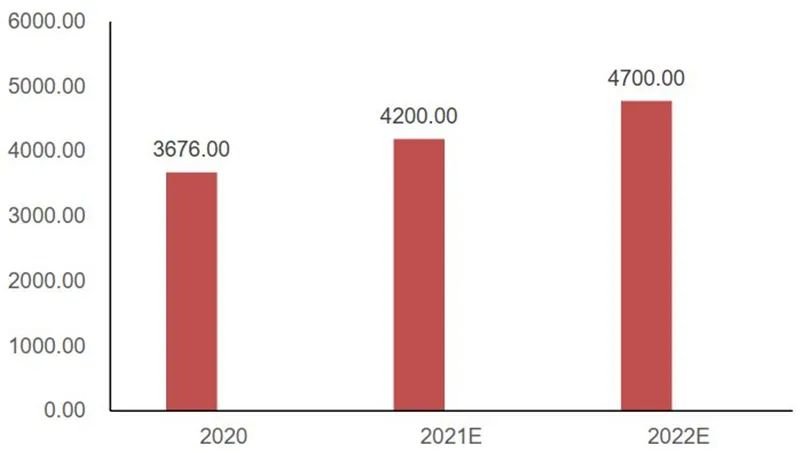

▲ Bidding volume for smart electric meters by the State GridIn terms of communication base stations, benefiting from the rapid development and popularization of 5G, communication base stations are expected to bring new growth to the power management chip market. 5G base stations mainly include macro base stations and small base stations. Macro base stations have a large coverage radius, while small base stations are flexible and precise, making them easy to deploy. According to predictions from the Forward Industry Research Institute, nearly 4 million macro base stations will be built in China over the next five years.

Macro base stations: JP Morgan estimates that the cost of power management chips for each macro base station is about $50-100. Based on the median calculation, the market size for power management chips for macro base stations is expected to exceed 500 million yuan by 2022; Small base stations: According to SCF predictions, the demand for small base stations globally will grow to 7 million units by 2025. Based on Nikkei’s breakdown of Huawei’s small base station costs, the market size for power management chips for small base stations is expected to exceed 150 million yuan.

▲ Number of newly built 5G macro base stations in China and the market size for power management chips

▲ Number of newly built 5G macro base stations in China and the market size for power management chips ▲ Breakdown of some costs for Huawei’s 5G small base station

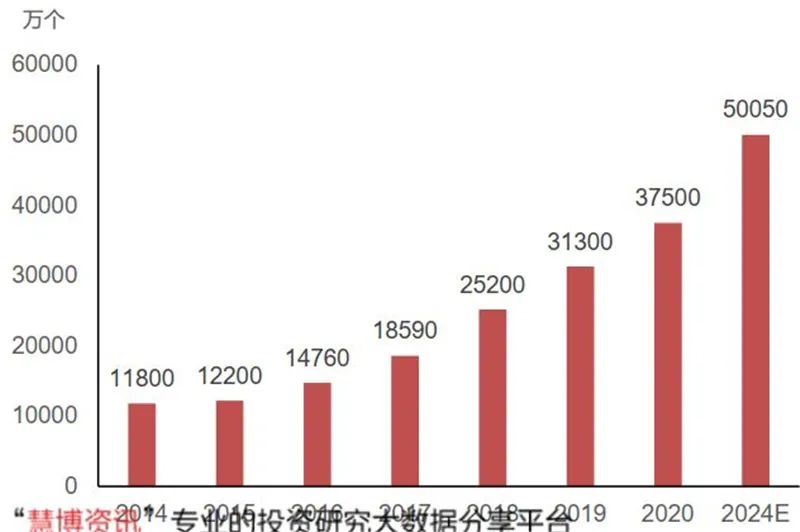

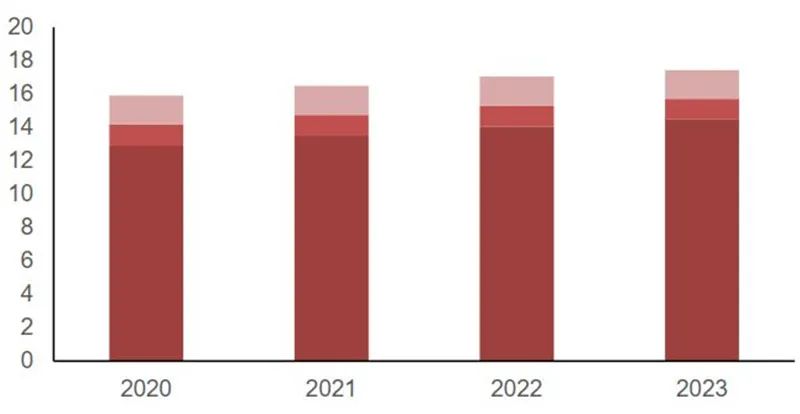

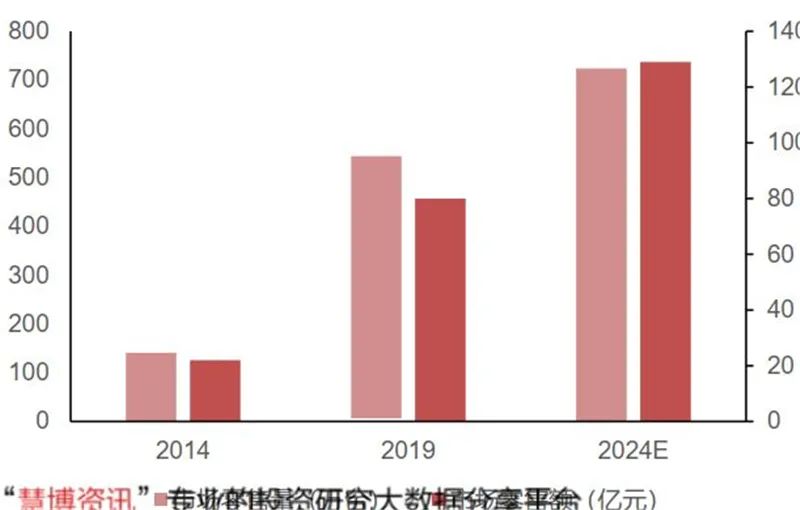

▲ Breakdown of some costs for Huawei’s 5G small base stationAnother area of new infrastructure is security. In 2019, the market size of China’s security industry exceeded 800 billion yuan, with the shipment of security cameras, an essential component, continuously increasing. It is expected that by 2024, the global shipment of security cameras will reach approximately 500 million units, corresponding to a demand for about 2 billion power management chips.

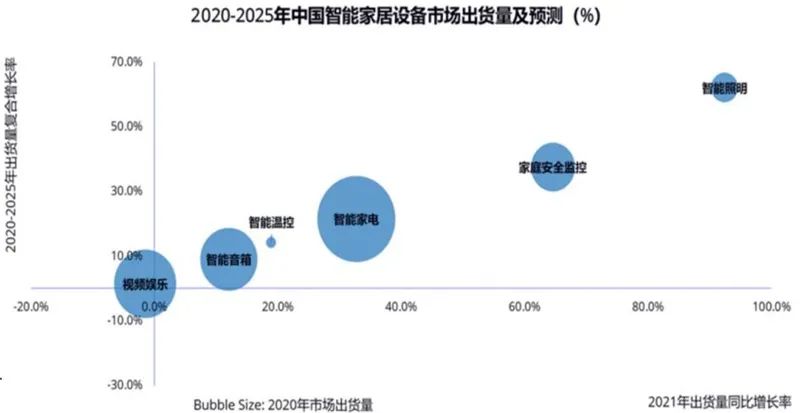

According to IDC predictions, the shipment volume of home security monitoring devices is expected to exceed a compound growth rate of 40% over the next five years, making it one of the critical growth areas for power management chips.

▲ Global shipment volume of security cameras

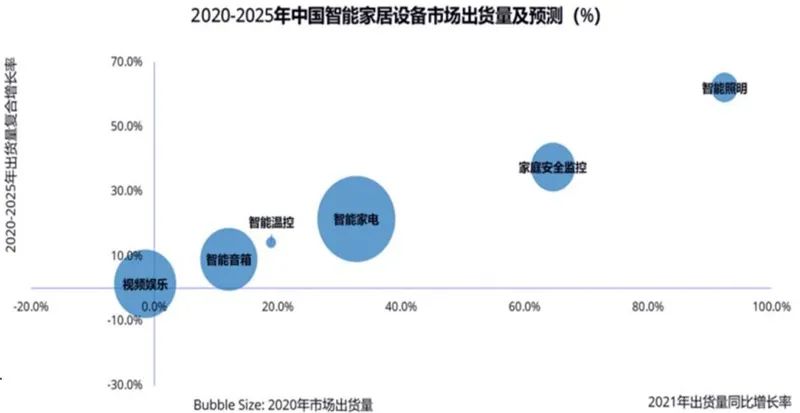

▲ Global shipment volume of security cameras ▲ Shipment volume of smart home devices in China

▲ Shipment volume of smart home devices in China3. Consumer Electronics

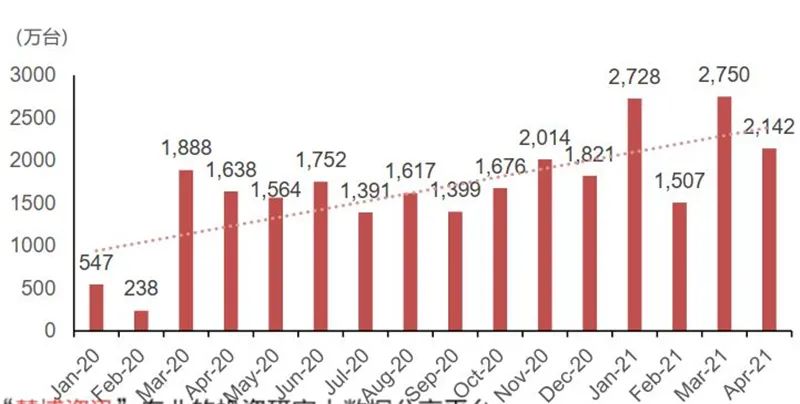

Since the commercial use of 5G, the shipment volume of 5G devices in China has shown a significant upward trend. In April 2021, the shipment volume of 5G mobile phones in China reached 21.42 million units, nearly a tenfold increase compared to the same period last year.

5G mobile phones are compatible with 2G, 3G, and 4G networks, leading to a significant increase in the use of RF front-end chips, which drives the growth of power chip shipments. The penetration rate of multi-camera mobile phones continues to rise, increasing the demand for power chips such as LDOs. Larger screens and higher power consumption in 5G lead to the rise of fast charging, driving the growth of shipments for fast charging AC/DC, DC/DC, and charge pump chips.

▲ Monthly statistics of 5G mobile phone shipments in China

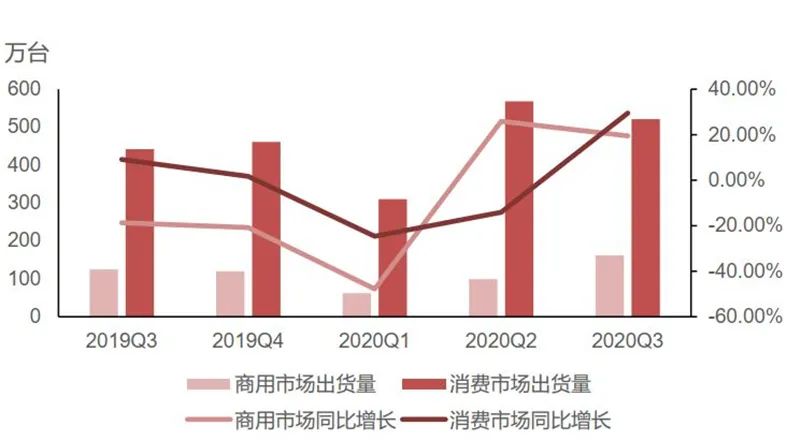

▲ Monthly statistics of 5G mobile phone shipments in ChinaBenefiting from the online work and learning model caused by the pandemic, the shipment volume of portable terminal devices such as laptops and tablets has significantly increased, breaking through the low growth bottleneck of previous years. In 2020, the global shipment volume of laptops reached 201 million units, a year-on-year increase of over 20%. The shipment volume of tablets also saw a notable increase before and after the pandemic.

In the post-pandemic era, benefiting from changes in work methods and the demand for device upgrades, the shipment volume of laptops and tablets is expected to continue to rise. With the enhancement of human-computer interaction functions and the increasing demand for low power consumption and long standby time, the demand for power management chips in this field is expected to continue to grow.

▲ Global shipment volume of laptops

▲ Global shipment volume of laptops ▲ Comparison of tablet shipment volume before and after the pandemic in China

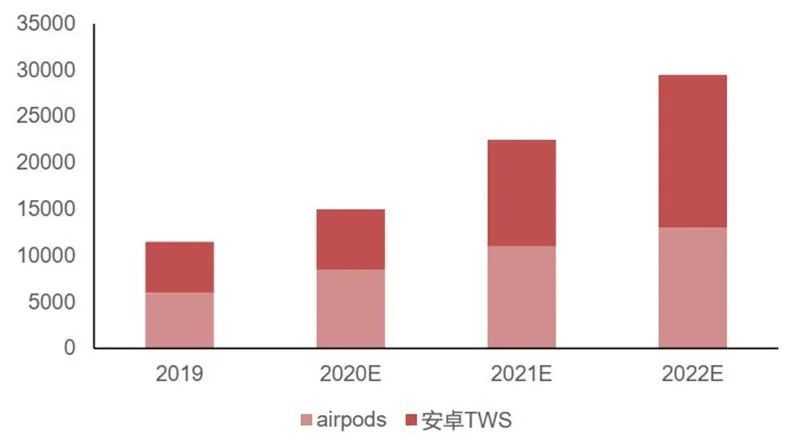

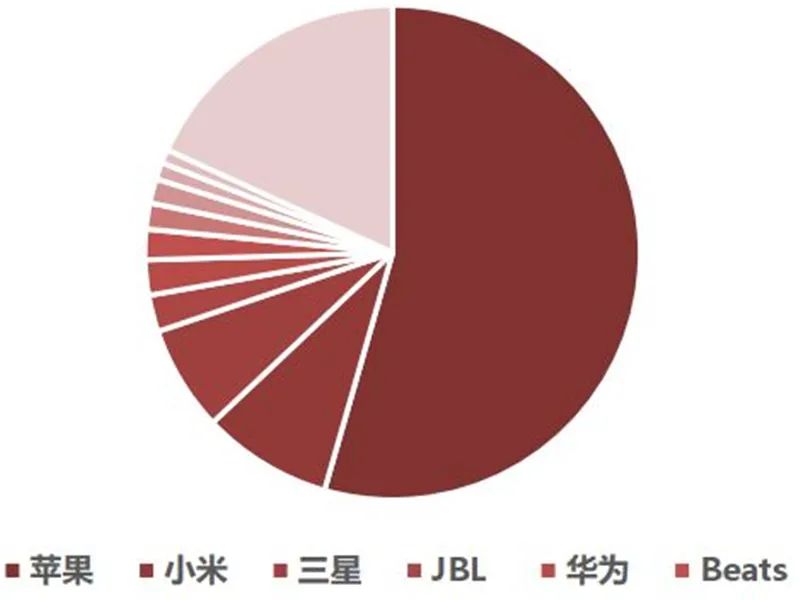

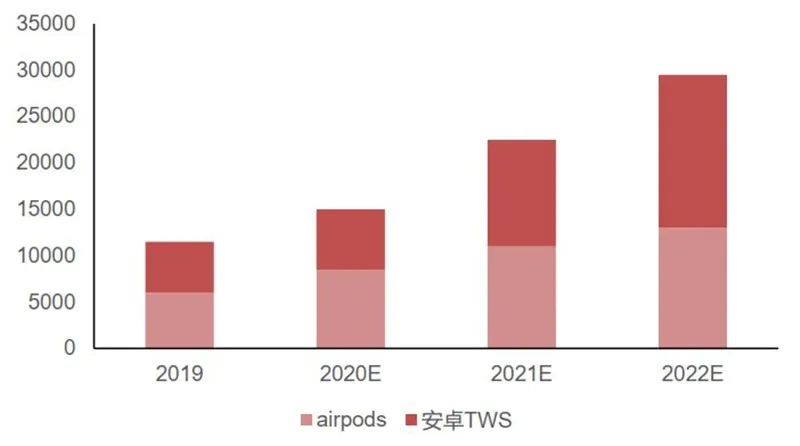

▲ Comparison of tablet shipment volume before and after the pandemic in ChinaAnother important consumer electronic product is TWS (True Wireless Stereo) earphones. Most power management chips in Apple’s AirPods series come from Texas Instruments, with limited opportunities for domestic manufacturers to enter. However, there are many brands of Android TWS earphones, including Huawei, Xiaomi, and Edifier, which have a high market share, providing relatively large opportunities for domestic chip production.

Power management chips from manufacturers such as Yutai, Shengbang Micro, Silan, and Weir have been widely used in Android TWS earphones. As the shipment volume and market share of Android TWS earphones continue to rise, this field will provide significant opportunities for domestic substitution of power management chips.

▲ Global competitive landscape of TWS earphones in 2019

▲ Global competitive landscape of TWS earphones in 2019 ▲ Comparison of shipment volume of Android and Apple TWS earphones (in thousands)

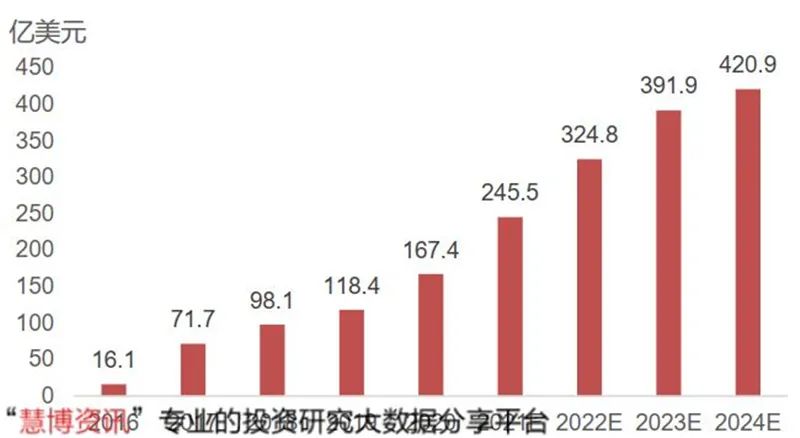

▲ Comparison of shipment volume of Android and Apple TWS earphones (in thousands)In audio transmission devices, power chips mainly supply power to internal chips and drive audio amplifiers, with application fields including TWS earphones and Bluetooth speaker devices. The market size of TWS earphones has been rapidly growing, from $1.61 billion in 2016 to $11.84 billion in 2019, and is expected to reach $42.09 billion by 2024.

The trend towards long battery life and intelligence in TWS earphones will also raise the requirements for power management chips, increasing their cost share in TWS earphones.

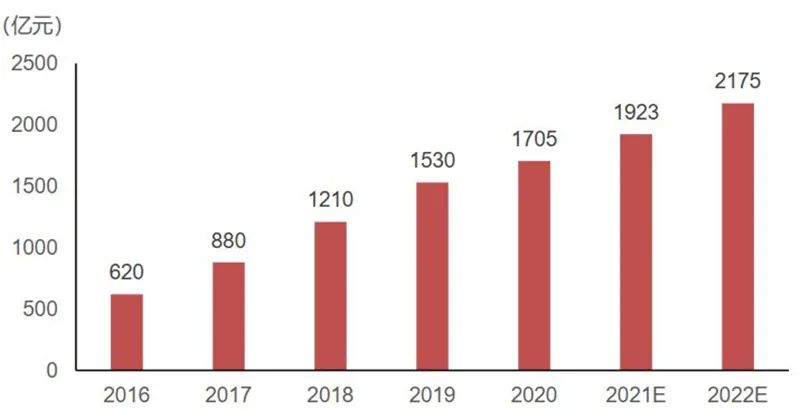

▲ Market size of TWS earphones from 2016 to 2024

▲ Market size of TWS earphones from 2016 to 2024Power management chips used in Bluetooth speakers include LDOs, DC-DC, etc., primarily for charging, powering internal chips, and driving audio amplifiers. According to the Bluetooth Technology Alliance, the global shipment volume of Bluetooth devices reached 400 million units in 2020, and it is expected to exceed 600 million units by 2025. Bluetooth devices are mainly divided into categories such as ordinary Bluetooth speakers, smart speakers, and Bluetooth earphones, with ordinary Bluetooth speakers focusing on sound quality and smart speakers emphasizing human-computer interaction experience.

According to IDC data, the shipment volume of smart speakers in China was 36.76 million units in 2020, with the overall shipment growth rate slowing down. Currently, major players in this market for power management chips include MPS, TI, Jiehuate, Silan, etc.

▲ Global shipment volume of Bluetooth devices (in hundreds of millions)

▲ Global shipment volume of Bluetooth devices (in hundreds of millions) ▲ Shipment volume of smart speakers in China (in thousands)

▲ Shipment volume of smart speakers in China (in thousands)The largest growth point for power management chips in consumer electronics comes from fast charging technology. The increased power consumption of multi-camera setups, high-refresh screens, and 5G RF has made it challenging to achieve revolutionary breakthroughs in battery capacity, making fast charging the preferred solution for alleviating battery anxiety. 5W chargers typically use Schottky diodes for rectification, while fast charging often employs secondary synchronous rectification and uses an AC/DC chip.

The largest component by volume in chargers is the transformer. To miniaturize chargers, the key is to reduce the size of the transformer, which depends on increasing the switching frequency of the switching transistors. The higher the frequency, the smaller the transformer needed. The frequency of traditional silicon materials has reached its limit; exceeding this would lead to severe heat loss. Third-generation semiconductor materials like GaN can achieve higher switching frequencies, further reducing the size of chargers.

Major terminal brands are launching GaN charger accessories (after market). GaN fast charging costs more than ordinary fast charging, and only a few high-end brands will include charging heads (in-box), releasing space for third-party domestic charging heads.

The main terminal applications for fast charging heads are smartphones, tablets, and laptops. It is expected that total sales of smartphones, tablets, and laptops will reach 1.743 billion units in 2023, with a compound growth rate of 3.31% from 2020 to 2023.

As major smartphone brands stop including charging heads, the unified Type-C interface for smartphones, tablets, and laptops is expected to gradually lower the shipping ratio of chargers to devices to 1:0.8 by 2023, with fast charging head sales expected to be 1.394 billion units.

GaN fast charging power controllers are more expensive than ordinary fast charging ones. As people pursue smaller chargers, GaN fast charging is expected to penetrate further. Based on the estimated market share of ordinary fast charging to GaN fast charging being 1:1 by 2023, the market size for AC/DC chips in charging heads is expected to be $836 million.

▲ Global shipment volume of smartphones, tablets, and laptops (in hundreds of millions)

▲ Global shipment volume of smartphones, tablets, and laptops (in hundreds of millions) ▲ Cost comparison between 65W ordinary fast charging and GaN fast charging

▲ Cost comparison between 65W ordinary fast charging and GaN fast chargingAccording to GSMA data, the number of global IoT devices reached 9.1 billion in 2018, with a compound growth rate of 20.9% from 2010 to 2018. It is expected that the number of global IoT devices will reach 25.2 billion by 2025. IoT devices utilize Bluetooth chips, Wi-Fi chips, MCUs, sensors, etc., to achieve networking and interactive functions. With the increase in various chips in IoT devices and the demand for low power consumption, the demand for power management chips in this field is expected to continue to grow.

▲ Global number of IoT device connections and forecast

▲ Global number of IoT device connections and forecast ▲ Market size of smart home devices in China

▲ Market size of smart home devices in China4. Internet of Things

Under the trend of consumption upgrading, the shipment volume of smart home products such as robotic vacuum cleaners continues to rise, and the market size is expanding. Retail sales have grown from 2.2 billion yuan in 2014 to 8 billion yuan in 2019, and it is expected to reach 12.9 billion yuan by 2024. Currently, robotic vacuum cleaners have entered a price reduction phase, and consumer willingness to purchase is expected to further increase, leading to continued growth in shipment volume;

Power management chips are mainly applied in robotic vacuum cleaners for power management, and the market space is expected to continue to grow.

▲ Market size of robotic vacuum cleaners in China

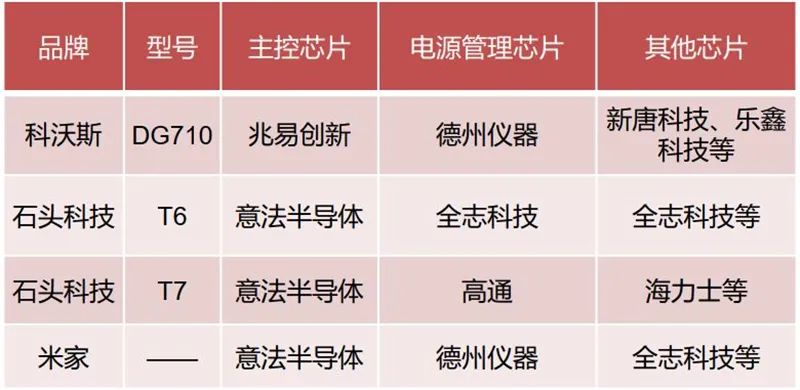

▲ Market size of robotic vacuum cleaners in China ▲ Statistics of power management chip suppliers for robotic vacuum cleaners

▲ Statistics of power management chip suppliers for robotic vacuum cleanersRobotic vacuum cleaners contain various components such as main control chips, Wi-Fi, audio chips, and sensors. As the demand for intelligence continues to rise, the demand for power management chips in robotic vacuum cleaners is expected to grow significantly.

The domestic substitution rate for power management chips in robotic vacuum cleaners is not high, but as the competitiveness of domestic manufacturers increases, there is expected to be considerable room for domestic substitution in this field.

▲ Statistics of chips in robotic vacuum cleaners

▲ Statistics of chips in robotic vacuum cleaners5. White Goods

In the fields of consumer electronics, home appliances, and mobile terminals, the recognition of Chinese brands is gradually increasing, giving rise to a number of world-class home appliance and consumer electronics companies.

The technical threshold for power management chips is not high, and the market potential is considerable, leading domestic chip manufacturers to gradually enter the market, with significant potential for domestic substitution.

Currently, several domestic power management chip manufacturers have entered the supply chain of relevant domestic brands, gradually showing a trend of substitution, and the degree of domestic substitution is expected to deepen further in the future.

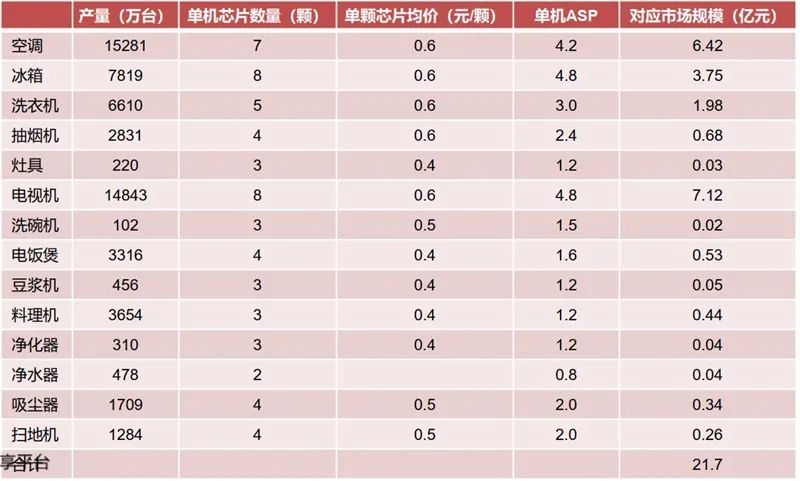

Typically, a home appliance contains 1-8 power management chips. Most home appliances use multiple types of power management chips, including AC/DC, DC/DC, gate driver chips, etc. The market size for home appliance power management was estimated to be 2.17 billion yuan in 2019.

▲ Estimated market size of home appliance power management in 2019

▲ Estimated market size of home appliance power management in 20196. LED Driver Power Chips

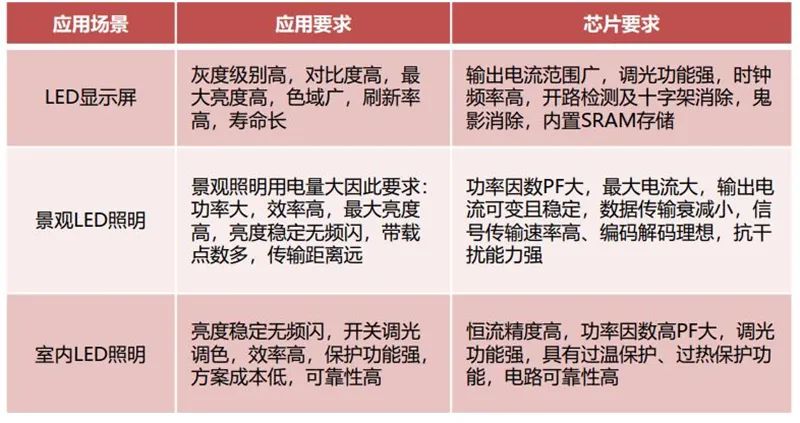

LEDs are mainly divided into: LED display screens, landscape LED lighting, and indoor LED lighting; different application scenarios have different requirements for LED driver chips.

▲ Requirements for LED driver chips in different scenarios

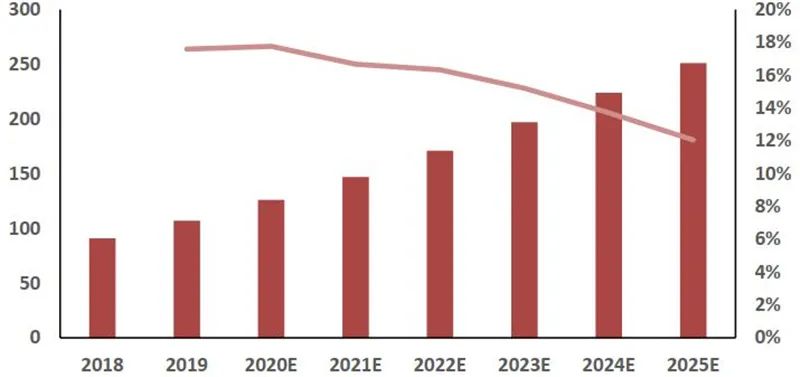

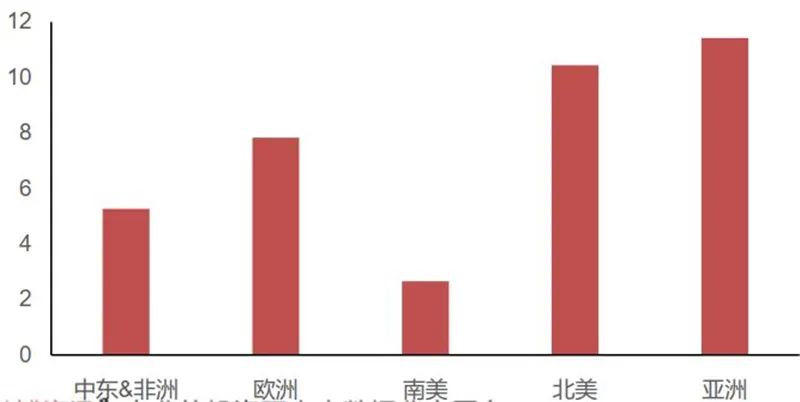

▲ Requirements for LED driver chips in different scenariosAccording to TMR data, the market size for LED driver ICs was $3.8 billion in 2018, with the Asian market holding the highest share at 30%. As the global LED lighting manufacturing industry continues to shift to China, the output value of LED driver power ICs in China is expected to further increase.

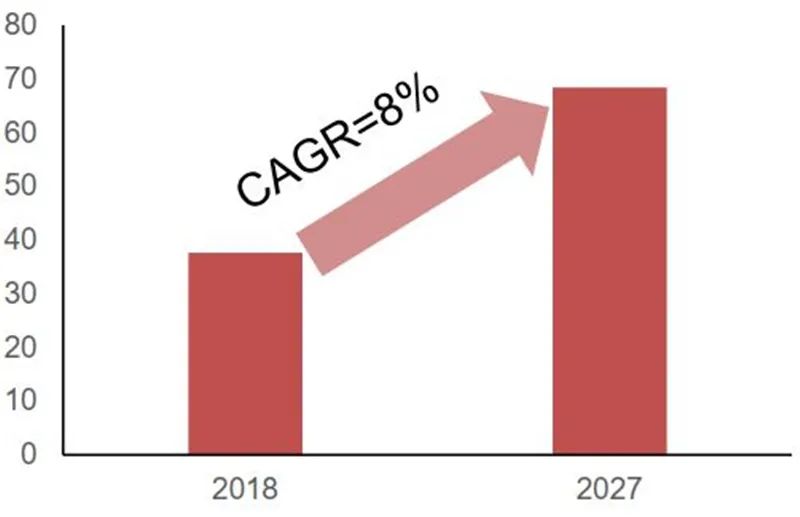

The global demand for LED lighting solutions is rapidly growing, and with the emergence of smart LED solutions, the adoption rate of LEDs is expected to rise further. According to TMR forecasts, the market size for LED driver ICs is expected to grow at a compound annual growth rate of 8% from 2018 to 2027, reaching $6.842 billion by 2027.

▲ Regional market share of LED driver ICs in 2018 (in billions of dollars)

▲ Regional market share of LED driver ICs in 2018 (in billions of dollars) ▲ Market size of LED drivers (in billions of dollars)

▲ Market size of LED drivers (in billions of dollars)7. Motor Driver IC: Market Size

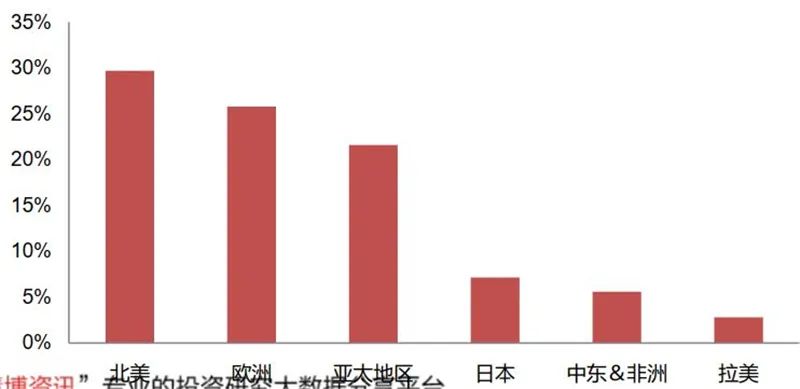

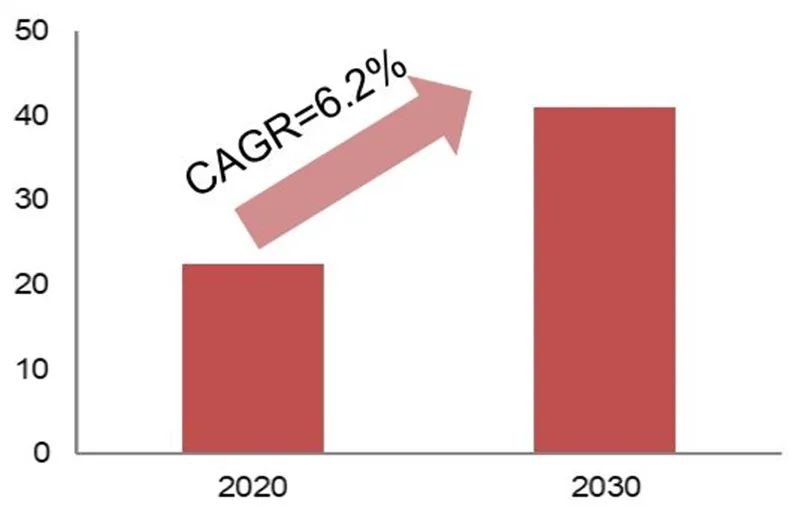

According to FMI data, in 2018, the North American market held the largest share of the motor driver IC market at 29.7%, followed by Europe at 28.3% and the Asia-Pacific region at 21.6%. According to Fact.MR forecasts, the market size of motor driver ICs reached $2.25 billion in 2020, with a compound growth rate of 6.2% from 2020 to 2030, and the total market size for motor driver ICs is expected to reach $4.11 billion by 2030.

▲ Market share of motor driver ICs by region in 2018

▲ Market share of motor driver ICs by region in 2018 ▲ Market size of motor driver ICs (in billions of dollars)

▲ Market size of motor driver ICs (in billions of dollars)Zhidx believes that with the development of downstream markets such as 5G communication, new energy vehicles, and the Internet of Things, the number and variety of electronic devices will continue to grow. The management of energy applications for these devices will become increasingly important, driving the demand for power management chips. Furthermore, the application scope of power management chips will become wider, and their functions will become more refined and complex, leading to a broad market space for power management chips globally.