With the advancement of the wave of intelligence and electrification, the content of automotive chips has increased exponentially. The semiconductor content in electric vehicles is about twice that of fuel vehicles, while smart vehicles have 8-10 times more. In 2020, the global demand for automotive chips was approximately 43.9 billion units, and it is expected to grow to 128.5 billion units by 2035. In terms of value, the automotive chip market was valued at 33.9 billion USD in 2020, and it is projected to reach 89.3 billion USD by 2035. It is evident that chips will become a new profit growth point for the automotive industry and are expected to lead the new driving force for semiconductor development.

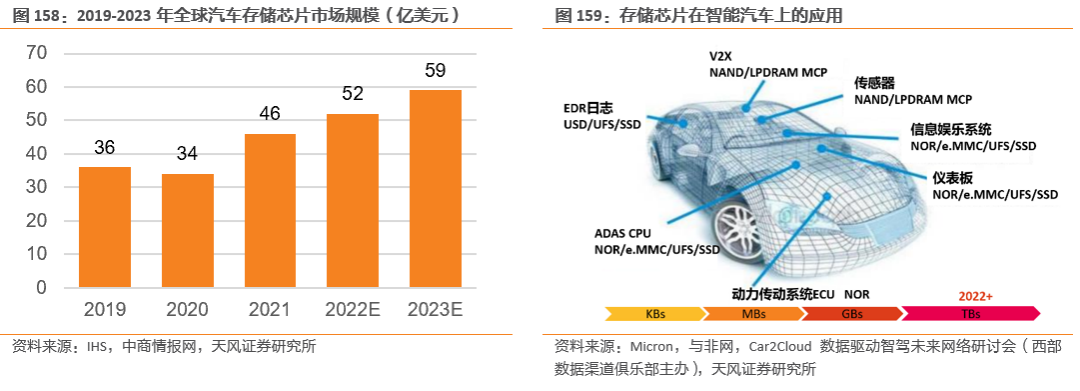

Automotive chips can be categorized into five types based on their applications: control chips, storage chips, power chips, analog chips, and sensor chips. Taking storage chips as an example, the global automotive storage chip market was approximately 5.2 billion USD in 2022, and there is significant growth potential in the domestic automotive storage chip market.

Driving Factors for Automotive Storage Chips

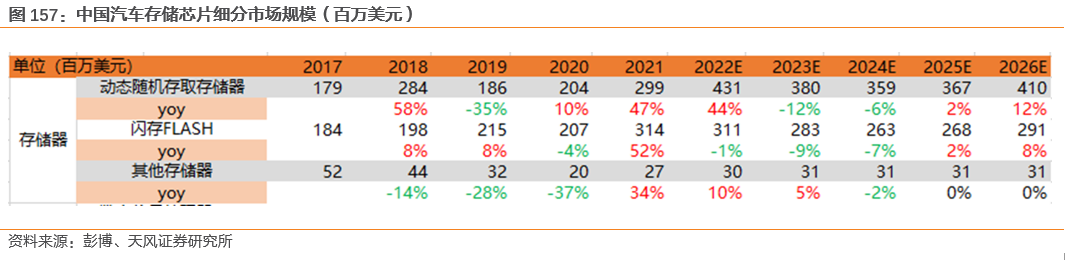

The main storage applications in the automotive market currently include DRAM (DDR, LPDDR) and NAND (e.MMC and UFS, etc.). According to IHS data, in 2019, the global automotive storage chip market was valued at 3.6 billion USD, with the LPDDR and NAND markets being approximately 800 million USD and 1 billion USD, respectively. In 2020, the global automotive storage chip market was around 3.4 billion USD, accounting for about 9% of the entire automotive semiconductor market. It is preliminarily predicted that by 2023, the global automotive storage chip market will reach 5.9 billion USD. In 2020, the Chinese automotive storage chip market reached 431 million USD, and it is expected to reach 732 million USD by 2026.

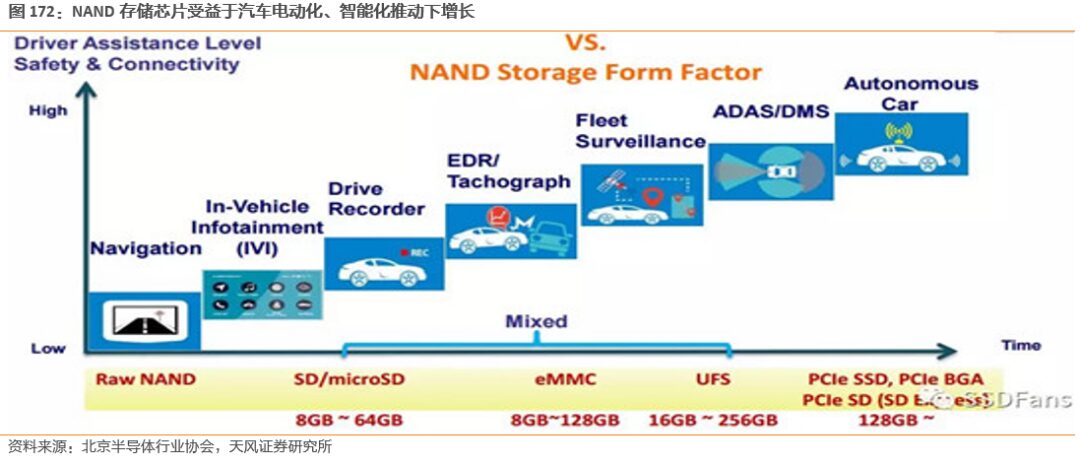

The development of electrification, informatization, intelligence, and connectivity is driving a revolution in automotive storage, with future automotive storage expected to transition from GB-level to TB-level. Currently, systems like ADAS and the new generation of central control systems require 5G connectivity technology, edge-cloud collaboration, and OTA updates, all of which serve as carriers for basic code, data, and parameter storage. Future entertainment systems, more powerful central computers, and digital cockpits, as well as comprehensive event recording systems and additional sensors, will all demand “TB-level” storage capacity.

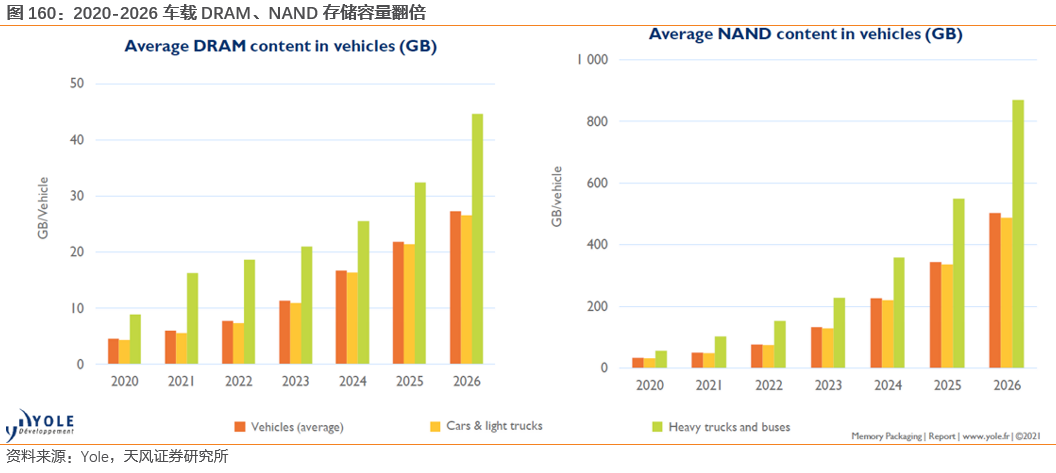

DRAM and NAND storage capacities in various vehicle types are doubling. According to Yole, the average DRAM storage capacity in cars, trucks, and buses is expected to grow at a compound annual growth rate (CAGR) of 35% (2020-2026), reaching approximately 27GB per vehicle by 2026, a sixfold increase. The average NAND storage capacity across vehicle types is expected to grow at a CAGR of 57% (2020-2026), exceeding 500GB by 2026, a fifteenfold increase.

Driving Factor One: Increasing Levels of Autonomous Driving Require Greater Storage Capacity and Performance

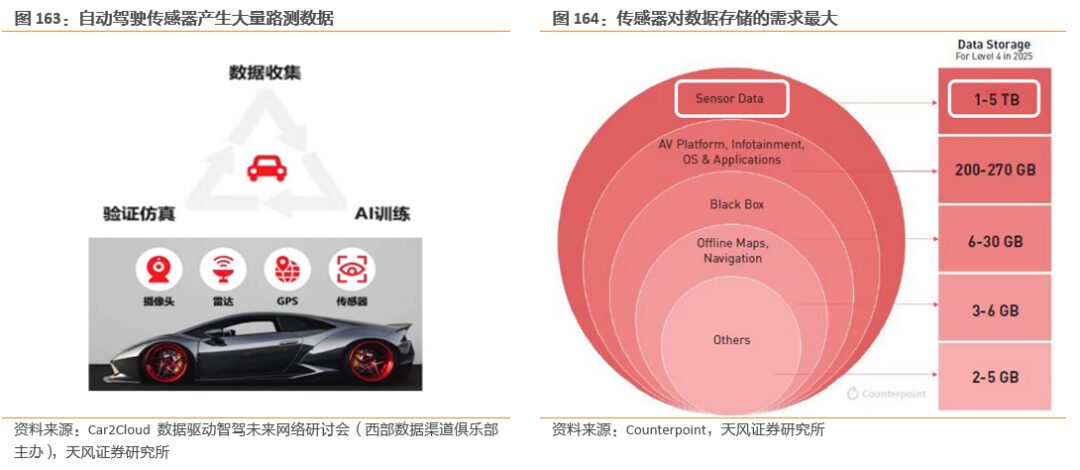

As the level of automation in smart vehicles increases, the volume of data generated grows exponentially. Currently, L1 and L2 level cruise control does not require much storage, only recording vehicle speed and engine parameters. However, L4 level autonomous driving requires algorithms to achieve accuracy that meets or exceeds human cognitive levels, necessitating the involvement of artificial intelligence and deep learning. By training on vast amounts of data and continuously optimizing it, all experiences can be distilled into code, enabling accurate judgments and scientific decisions in various driving scenarios. A single road test for an L4 autonomous vehicle can generate approximately 8-60TB of data, with total data generated during the entire R&D cycle reaching the EB level. L5 level vehicles do not require human intervention, necessitating large storage capacities for data collection, pre-storage, feedback, matching, and scientific judgment.

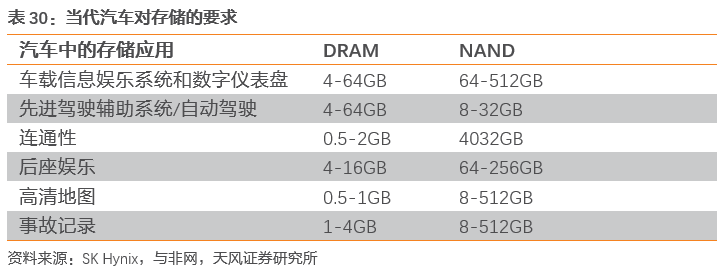

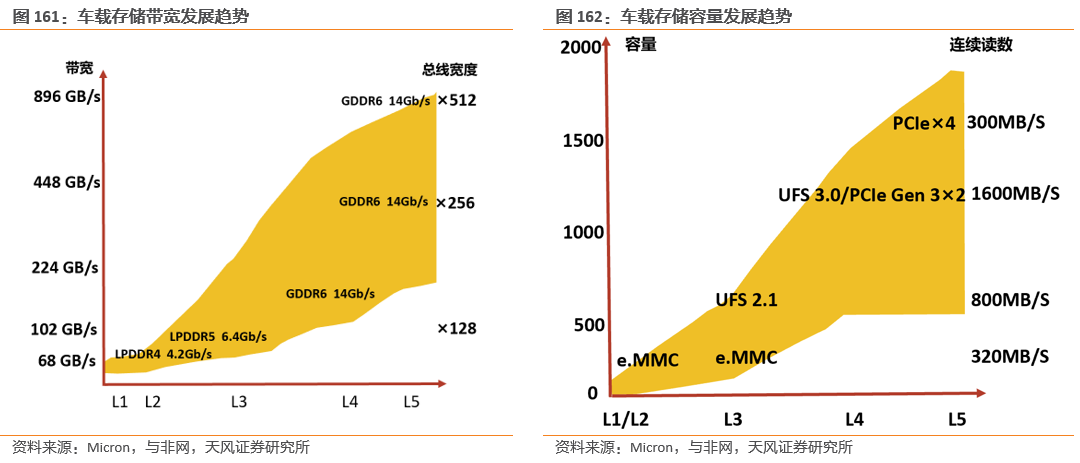

The massive data generated from autonomous driving will place higher demands on storage bandwidth and capacity, thereby increasing the value of automotive storage chips. According to Semico Research, for L1 and L2 levels, the demand for storage capacity is not significantly different, typically configured with 8GB DRAM and 8GB NAND. In contrast, L3 and higher levels of autonomous driving require large-capacity storage to support high-precision maps, data, and algorithms. A L3 autonomous vehicle will require 16GB DRAM and 256GB NAND, while a fully autonomous L5 vehicle is estimated to need 74GB DRAM and 1TB NAND. According to Micron Technology and Chinese flash memory forecasts, L2/L3 autonomous vehicles will require memory bandwidth of about 100GB/s, with average capacity needs of around 8GB and 25GB for DRAM and NAND FLASH respectively.

For L3 ADAS, using LPDDR5 will greatly simplify the system, requiring only 9 DRAM to provide a bandwidth of 224GB/s. For L4 ADAS, the bandwidth requirement increases to 300GB/s. At this level, LPDDR5 interfaces running at 6.4Gb/s will require 12 DRAM, which may cause layout issues for SoC, necessitating the design of GDDR6. Five GDDR6 DRAM running at 16Gb/s can provide over 300GB/s bandwidth, and eight GDDR6 DRAM devices can easily meet the L5 ADAS requirement of 500GB/s speed.

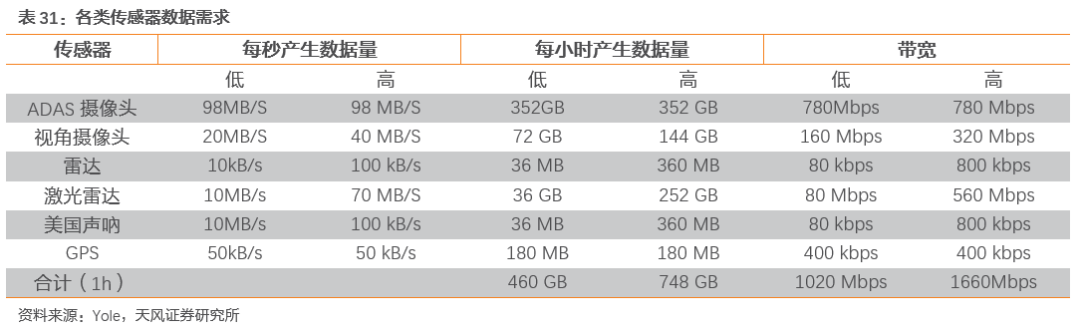

The largest share of onboard storage data in vehicles is generated by various sensors, primarily from ADAS systems and V2X functionalities. This includes GPS receivers, LiDAR, ultrasonic sensors, millimeter-wave radar, high-definition cameras, etc. Taking the ADAS as an example, it requires large-capacity storage and efficient computing to support quick system responses, especially for high-definition image transmission, which places increasingly higher demands on the capacity, performance, and reliability of storage products. During the R&D process of autonomous driving, road test data is uploaded to the R&D platform, where it is trained and validated on the ADAS platform, generating a large amount of process data that is stored in file or object formats for frequent reading and writing across platforms.

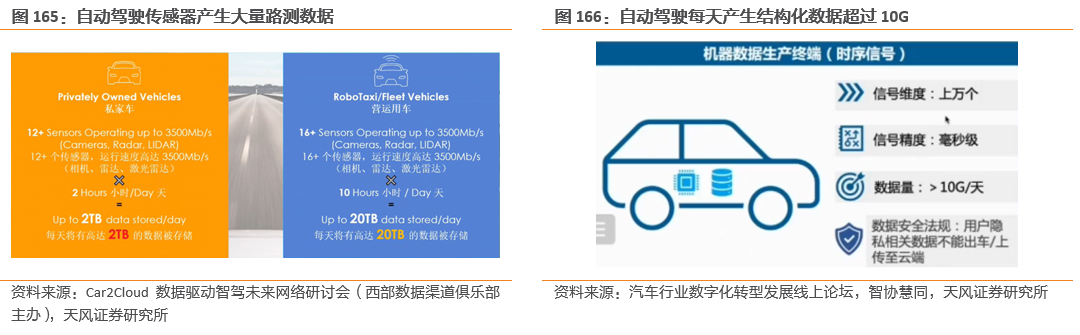

As the levels of autonomous driving progress from L1 to L5, the number of sensors and the volume of data collected significantly increase, leading to a rise in the demand for storage chips in terms of quantity and capacity. In autonomous driving applications, each camera and radar requires a dedicated storage chip. Cameras and radars write the perceived road information into the storage chip and use proprietary algorithms to compute and analyze the written data, enabling quick emergency maneuvers and braking. For L4 level, each autonomous private vehicle generates over 10GB of structured data during hours of driving each day, needing to store 2TB of scene recording data every 2 hours. An operational vehicle driving for 10 hours will generate 20TB of data. Currently, autonomous driving solutions like Baidu’s have already accumulated scene data exceeding 20TB from daily road tests. Existing bandwidth and cost constraints make it difficult to upload all data to the cloud, necessitating substantial on-board storage and computation capabilities.

Among various onboard sensors, the data production capacity of ADAS cameras is the highest, creating demands for more efficient processing and storage solutions. According to Yole, multi-task ADAS cameras generate data at a rate of 352GB per hour. With the increasing use of stereo or triple cameras by OEMs, this data volume is expected to increase by 1-2 times.

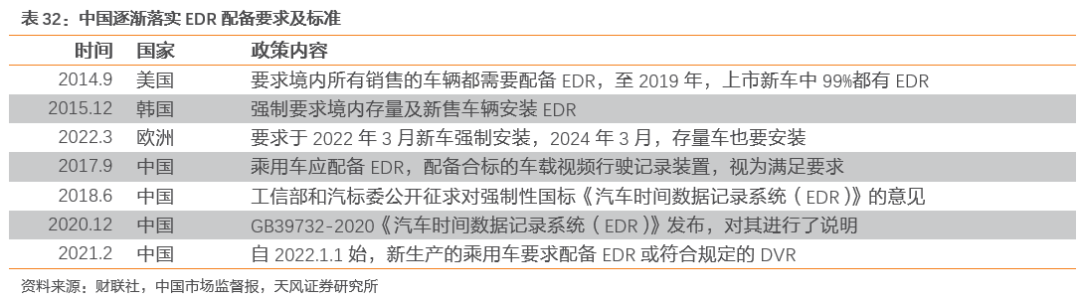

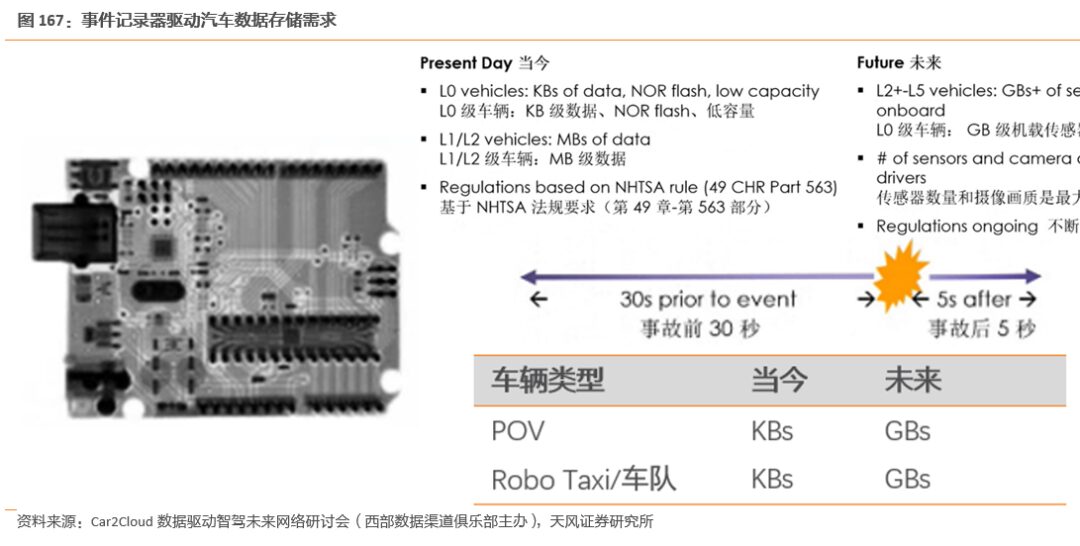

Driving Factor Two: Event Data Recorders (EDR) Generate GB-Level Storage Demand

Event data recorders are specialized safety storage devices mandated by regulatory bodies in various countries, requiring GB-level data storage. Legal regulations and insurance entities require event data recorders to capture data before and after vehicle accidents to determine liability in autonomous vehicles or external factors. Currently, Germany is leading in the EU by requiring vehicles to be equipped with black boxes that record every action and environmental detail of the vehicle for legal liability reference. China’s 1.0 version standard has already been implemented, requiring new energy vehicles to be equipped with driving recorders.

Compared to traditional driving recorders, event data recorders have intelligent sensing capabilities and more comprehensive recording and storage requirements. Event data recorders can perceive changes in driving patterns based on speed, turning, braking, and other behaviors. They can start detailed recording of vehicle dynamics 30 seconds before an accident occurs and continue to capture detailed images and conditions for 5 seconds after the accident, aiding in determining responsibility. Traditional driving recorders only capture data at the KB level, while L0 autonomous vehicles already require GB-level event recorders.

Driving Factor Three: Electrification, Software-Defined Vehicles, Centralized Electronic Architecture, and Edge-Cloud Collaboration Further Enhance Storage Demand

Software-defined architectures for advanced smart electric vehicles further increase automotive storage requirements. In the future, electric vehicles will gradually replace fuel vehicles, featuring powerful algorithms and comprehensive surrounding perception capabilities without the burden of traditional mechanical transmission. They will evolve into a “giant smart phone” composed of batteries and management systems, incorporating more functions, being more energy-efficient, and having stronger human-machine interaction capabilities. This requires the development and installation of numerous storage-intensive applications, leading to higher storage space demands.

By 2030, the code volume for autonomous vehicles is expected to be about 12 times that of current smartphones. According to Western Digital, both smartphones and F16 fighter jets have approximately 25 million lines of code, while Windows 7 and social media software have about 50 million lines. Currently, the code volume for autonomous vehicles is around 100 million lines, and it is projected that by 2030, commonly used models of autonomous vehicles will reach 300 million lines, showing the significant impact of software on automotive technology.

The trend of software-defined vehicles is driving collaboration and integration across technology companies and original manufacturers. The implementation of each new technology and function in electrification requires continuous validation and training from automotive manufacturers, promoting the integration of different business models within the supply chain. In June 2020, automotive giant Mercedes-Benz and chip powerhouse NVIDIA initiated the development of onboard computing systems and AI computing infrastructure, with plans to launch in Mercedes’ next-generation models by 2024.

Under the influence of electrification, the electronic architecture of vehicles (E/E) is transitioning from a distributed model to domain integration and centralized control units. The trend for automotive-grade storage in the future will also be based on a centralized control architecture. Many modules in electric vehicles, such as TBOX, assisted parking, central entertainment systems, and EDR, are based on distributed storage architectures, where each module has its own storage device. However, the current distributed storage is still chaotic, with each module serving a single function.

Under the hood of modern vehicles is a network of Electronic Control Modules (ECMs) with many different functions. Sensors connect to these ECMs, which are interconnected. The Controller Area Network (CAN) serves as the central data path, running various application protocols. Advanced Driver Assistance Systems (ADAS) rely on different types of sensors installed on vehicles to collect the data needed for decision-making.

The future definition of vehicles will develop towards five domain integrations, with centralized distribution based on definitions, and storage space shared accordingly. For example, information terminals and navigation control systems are specifically designed to store GPS navigation data and upstream/downstream cloud communication data, merging driving recorders into autonomous driving functions, thus sharing high-speed storage modules. Such a distributed system will have clearer definitions and complete functionalities.

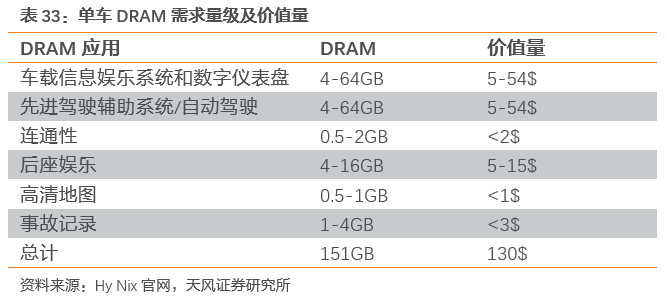

DRAM: Single Vehicle Value Exceeds 130 USD

In terms of DRAM, we refer to Hynix’s assessment of automotive DRAM demand, which estimates that a single car may require up to 150GB of DRAM, with a value exceeding 130 USD, with global annual production of approximately 80-100 million vehicles. If we multiply by penetration rates or consider further increases in usage, the overall DRAM demand will continue to rise, potentially forming a trillion RMB market scale in the long term.

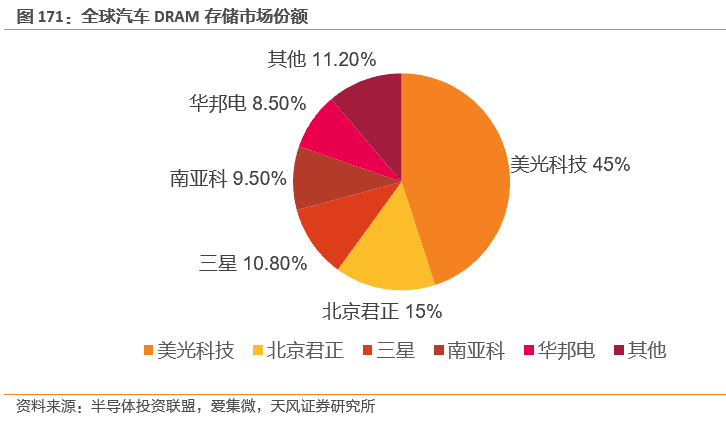

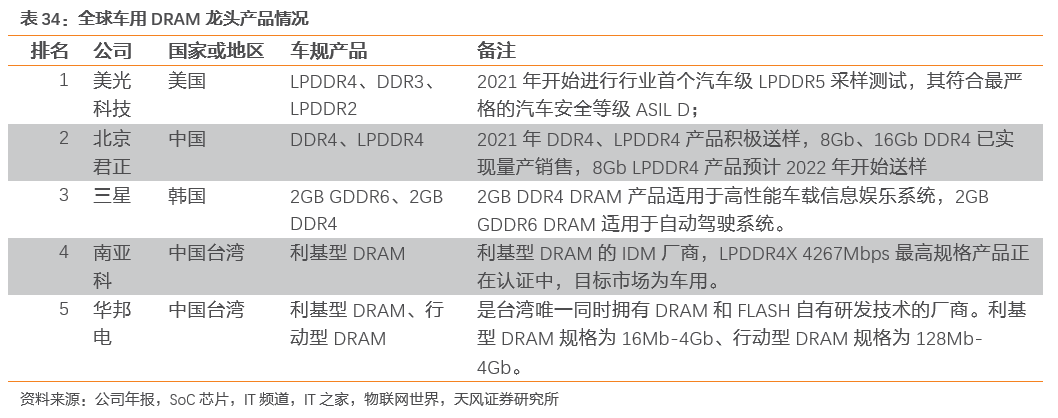

Micron Technology Holds Nearly Half the Market Share, Technology is Leading; Domestic Storage Leader Beijing Junzheng Ranks Second in Market Share, Followed by Samsung, Nanya Technology, and Winbond. From the competitive landscape, Micron Technology is the absolute leader with a market share of 45%. In 2021, it conducted LPDDR5 sampling tests, leading the industry. After Beijing Junzheng acquired Beijing Xicheng, it entered the automotive storage chip field, establishing close cooperation with downstream automotive companies like Bosch and Continental Group. The increasing intelligence of vehicles and continuous upgrades in related technologies will also drive demand growth for various onboard chips beyond storage chips. Beijing Xicheng’s years of chip R&D experience in automotive and industrial fields will see new development prospects in the era of smart driving.

NAND: Single Vehicle Demand Increases to 2TB

CAGR Up to 37%

The new four modernizations drive NAND storage towards high capacity and reliability, with demand capacity and value increasing simultaneously. According to Western Digital’s forecast, the required NAND capacity for a single vehicle will increase from 1TB to 2TB by 2022 and 2025.

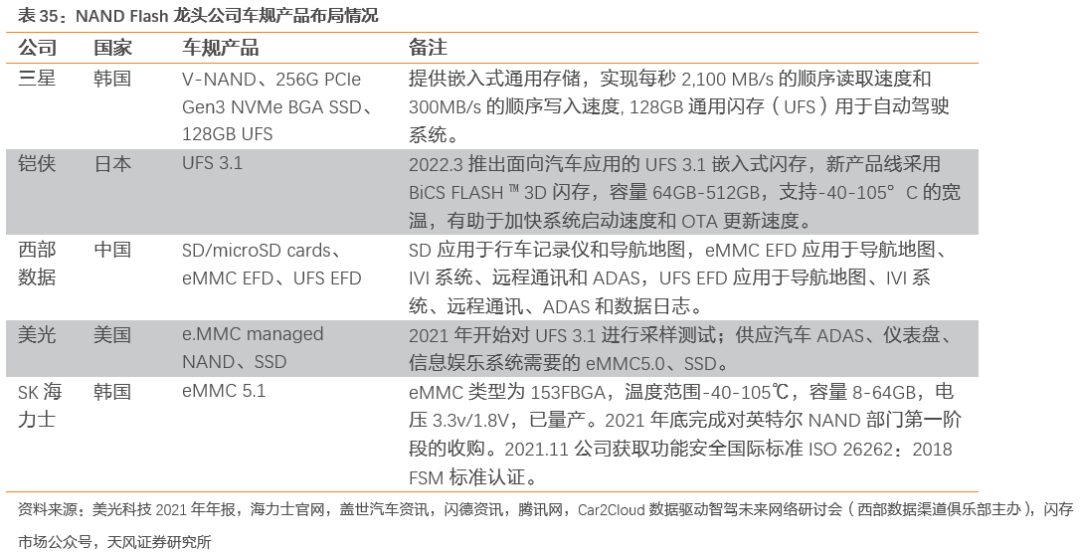

Intense Competition Among China, the US, Japan, and South Korea; Information Entertainment and ADAS Systems Drive the Entire Automotive Industry’s Demand for High-Capacity, High-Performance NAND. Samsung’s 256GB BGA SSD controller and firmware are developed in-house and have completed customer evaluations, now entering mass production, achieving sequential read speeds of 2,100 MB/s and sequential write speeds of 300MB/s, which are seven times and twice that of current eMMC, respectively. The domestic leader, Western Digital, has already implemented UFS storage in applications for navigation maps, IVI systems, remote communication, ADAS, and data logging.

NOR FLASH: Demand from Various Vehicle Systems is Rising

Chinese Companies Account for 70% of the Market

Structural growth drives the demand for NOR Flash products, which have diverse applications in automotive electronics. Currently, the automotive storage industry presents the following structural growth opportunities: on one hand, the increasing complexity of systems demands higher external storage; on the other hand, more application scenarios are based on high-performance processing units, driving the storage needs of MCUs, GPUs, MPUs, SoCs for programs and parameters, and FPGAs for structured data. From the application scenario perspective, automotive ADAS systems, instrument systems, cruise systems, and SOTA upgrades all require reliable NOR Flash storage.

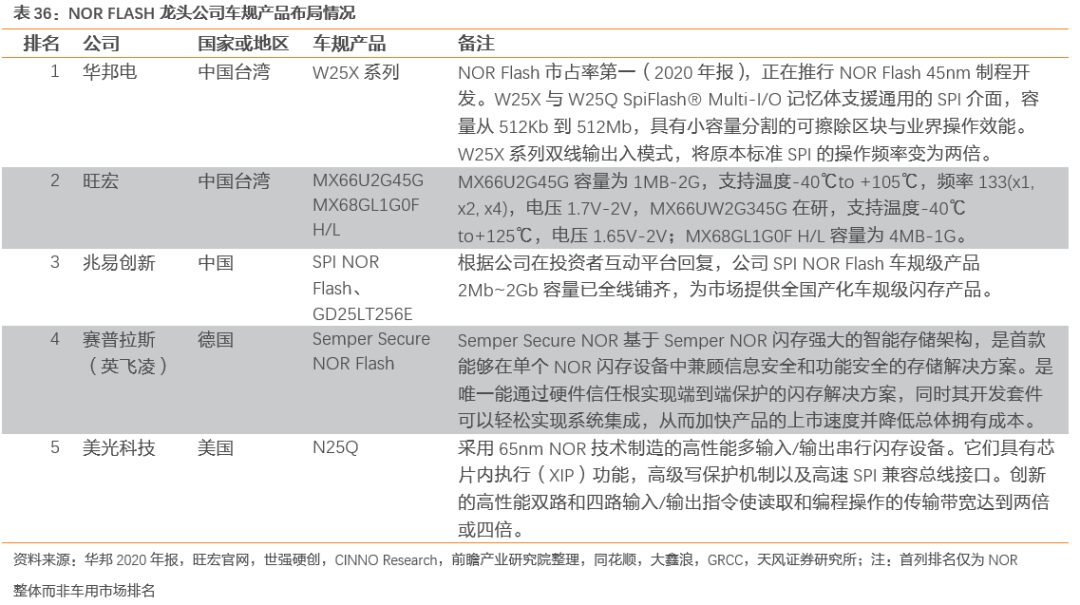

Compared to DRAM and NAND Flash, NOR Flash has a smaller scale. In terms of the competitive landscape, Chinese companies Winbond, Nanya Technology, and Gigadevice occupy the vast majority of the market share. In 2016 and 2017, Micron Technology and Cypress announced their exit from parts of the NOR Flash market, gradually fading out. The market share of NOR Flash chips is now predominantly controlled by Winbond, Nanya Technology, and Gigadevice from mainland China, with Winbond, Nanya Technology, and Gigadevice ranking first, second, and third in market share respectively in 2020, with shares of 25.4%, 22.5%, and 15.6% respectively.

Gigadevice’s GD25 SPI NOR Flash fully meets the automotive-grade AEC-Q100 certification, and the entire series of GD25 automotive-grade storage products have been adopted in bulk by multiple automotive companies, mainly applied in onboard assistance systems, onboard communication systems, onboard information and entertainment systems, battery management systems, etc., providing domestically produced automotive-grade flash memory products to the market.

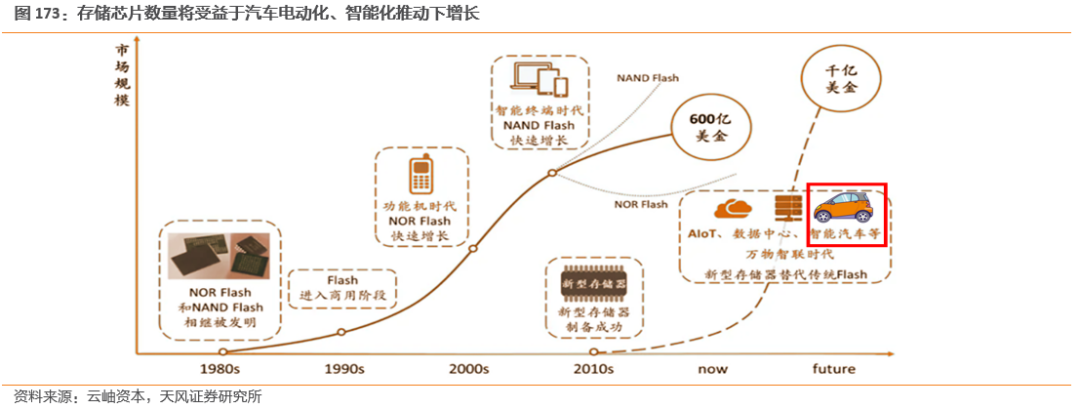

It is expected that automotive storage systems will achieve rapid growth in capacity and performance as the level of intelligence increases, making vehicles a core factor in the storage industry entering the trillion-dollar market. Since the 1970s, DRAM has entered the commercial market and has become the largest branch market in the storage field due to its extremely high read and write speeds. The emergence of feature phones led to the explosion of the NOR Flash market. With the advent of the PC era, the demand for storage capacity has grown significantly, with low-cost, high-capacity NAND Flash becoming the best choice.

In the era of intelligence, with everything interconnected, the market space for the storage industry will further expand, placing higher demands on data storage in terms of speed, power consumption, capacity, and reliability. While DRAM is fast, it consumes a lot of power, has low capacity, and high costs, and cannot retain data when power is off, limiting its usage scenarios. NOR Flash and NAND Flash have lower read and write speeds, and their storage density is limited by process technology. The market urgently needs storage products that can meet the new scenarios of automotive applications, with new types of memory that show breakthrough progress in performance set to experience rapid growth.

In terms of storage, Beijing Junzheng and Gigadevice have already entered the automotive market. After Beijing Junzheng’s acquisition of Beijing Xicheng, it entered the automotive storage chip field and has established close cooperation with downstream automotive companies like Bosch and Continental Group. The increasing intelligence of vehicles and continuous upgrades in related technologies will also drive demand growth for various onboard chips beyond storage chips. Beijing Xicheng’s years of chip R&D experience in the automotive and industrial fields will see new development prospects in the era of smart driving.

Gigadevice’s GD25 SPI NOR Flash fully meets the automotive-grade AEC-Q100 certification, and the entire series of GD25 automotive-grade storage products have been adopted in bulk by multiple automotive companies, mainly applied in onboard assistance systems, onboard communication systems, onboard information and entertainment systems, battery management systems, etc., providing domestically produced automotive-grade flash memory products to the market.

We welcome angel and A-round companies from the entire automotive industry chain (including the electrification industry chain) to join the group (Friendly connections include 500 automotive investment institutions, including top-tier institutions; We will select some high-quality projects for themed roadshows to existing institutions);There are communication groups for leaders of science and technology innovation companies, as well as dozens of groups related to the automotive industry, such as complete vehicles, automotive semiconductors, key components, new energy vehicles, smart connected vehicles, aftermarket, automotive investment, autonomous driving, and vehicle networking. Please scan the administrator’s WeChat to join (please specify your company name).