Author | Liu Lin

With the official commercialization of 5G, edge computing has also officially taken center stage.

Recently, GSMA released a report titled “Edge Computing in the 5G Era: Technology and Market Development in China,” co-authored with the Edge Computing Industry Alliance (ECC).

This report gathers profound insights from over 20 leading organizations and enterprises related to the edge computing ecosystem in the Chinese market, analyzing the current state and future development of the edge computing ecosystem from multiple perspectives, including technology, applications, market prospects, opportunities, business models, and policies and regulations.

If you want to obtain the full PDF of this report, please reply with the keyword “623 report” on the Leiphone WeChat public account (leiphone-sz).

1

The Background and Global Trends of Edge Computing Development

(1) Technical Driving Factors

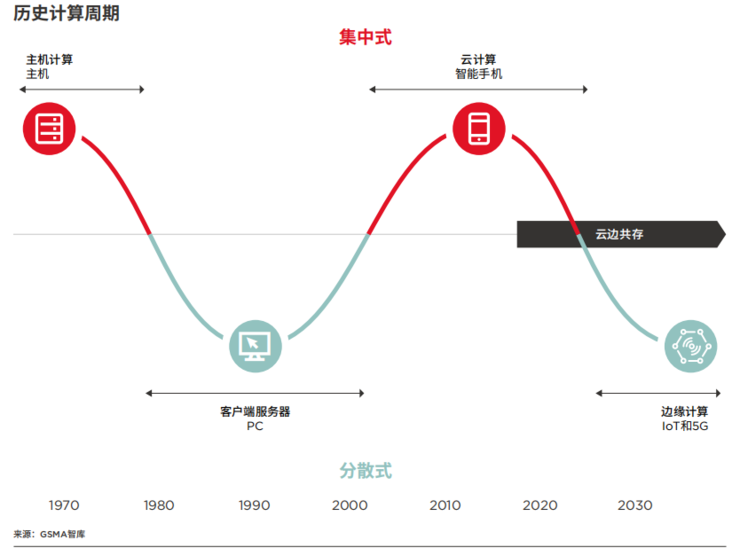

Over the past 40 years, computing power and processing have alternated between centralized and distributed architectures. In the 21st century, with the large-scale commercialization of the Internet, enterprise IT, and smartphones, a wave of cloud computing based on large centralized server clusters has emerged. Some companies have become leaders in this field, known as hyperscale cloud computing players, including Amazon, Microsoft, and Google. In recent years, other companies have also entered this market and are rapidly expanding, including IBM, Oracle, and China’s Alibaba and Tencent.

Although the boundaries are difficult to define strictly, credible signs indicate that a new wave of edge computing is developing, marking a trend toward distributing computing power and resources closer to customer deployment. Essentially, this signifies a shift in business models from network-centric to workload-centric, with localization becoming a primary principle. However, this is not an either-or situation; centralized cloud data centers will continue to exist, and overall capacity may continue to expand, but new demands (such as IoT and enterprise) and the potential for ultra-low-latency services in the 5G era are pulling computing closer to end users.

Therefore, the development of edge computing comprehensively considers the following aspects:

• Capacity—If a large amount of data generated by numerous connected devices is transmitted to more centralized cloud services, it requires ultra-large bandwidth and backhaul capacity. Edge computing and local data processing can reduce the amount of data that needs to be transmitted.

• Cost—In terms of bandwidth, transmitting large amounts of data over long distances can also incur costs. Additionally, much of the data generated by many devices may be irrelevant to business and therefore need not be transmitted to centralized processing.

• Analysis—Data is the foundational asset of the digital economy. To have the capability to convert data into real-time (or near real-time) analysis and operations, GSMA Intelligence predicts that by the end of 2025, there will be approximately 9 billion mobile connections (phones and devices supporting only data services) and nearly 25 billion IoT connections (both cellular and non-cellular).

• Security—Many companies may not want sensitive data to leave their premises or their own servers. National laws and regulations regarding data privacy are also influencing factors.

• Latency—Although 5G has lower latency than 4G, achieving ultra-low latency over long distances and multi-hop networks can be challenging.

• Resilience—Edge computing can provide more communication paths than centralized models. This distribution can better ensure the resilience of data communication.

(2) Definition of Edge Computing

Edge computing was initially referred to as Mobile Edge Computing (MEC). The European Telecommunications Standards Institute (ETSI) defines MEC as follows:

Mobile Edge Computing provides an IT service environment and cloud computing capabilities at the edge of mobile networks, within the Radio Access Network (RAN), and close to mobile users.

In 2017, the definition of MEC was revised to “Multi Access Edge Computing,” reflecting the fact that edge deployments can actually utilize a range of access technologies, including fixed networks. However, the prospects for edge applications are not limited to the future development of 5G. MEC brings network functions closer to end users, allowing operators to gradually open their networks to third parties, enabling businesses to build dedicated network environments in smart factories, smart ports, smart hospitals, and other locations. These business scenarios often involve multiple applications, requiring networks to provide ultra-low latency and robust processing, computing, and storage capabilities at the edge. 5G MEC technology also supports connectivity and computing integration, enhancing interaction efficiency with end users.

Compared to traditional cloud-based models, edge system architectures push cloud functions such as storage, computing, processing, and networking closer to the devices generating or using data. For mobile networks, “closeness” is a relative concept; it can refer to a relatively close location (i.e., within the transport network) or the location of the customer (whether inside the user device or at the user’s premises).

(3) Global Trends

Overall, edge computing is still in its early stages. However, in developed markets such as the United States, China, Europe, and the Asia-Pacific region, relevant pilot projects and small-scale deployments are expanding.

Given the potential impact and transformative nature of edge computing, many companies in the mobile and cloud ecosystems are exploring edge computing in its early stages, announcing their respective pilot plans and projects.

More and more telecommunications operators worldwide are conducting edge computing pilot projects, while some are promoting edge commercial products and solutions. Although most current pilots are conducted on 4G or early 5G networks, the mobile industry hopes to leverage the gradual deployment of 5G to drive larger-scale edge deployments. Theoretically, edge computing can adapt very well to 5G networks deployed by operators and software-defined networking (SDN), network function virtualization (NFV), and other software control technologies, which operate certain virtual network functions (including at the network edge) in a distributed manner. As a result, edge technologies may also benefit from the network capabilities of virtual networks in the 5G era, fully tapping into the potential of distributed computing.

(4) Global Challenges

Since edge computing is still in its developmental phase, many pilot projects and initiatives are still focused on exploring the potential of edge computing. However, actual business models and practical application scenarios remain unclear in many cases. The complete definition of edge is still ambiguous, especially regarding the deployment location of computing resources and the scale of edge infrastructure, with no unified view.

Operators still need to fully determine their respective business models. One option is to provide co-located infrastructure to meet the needs of companies like Google, Amazon, and Microsoft. However, cloud practitioners have already been building their own edge infrastructures (or using third-party vendors’ facilities), while many small businesses and tower service providers are also developing their own edge computing solutions, often in collaboration, not only providing physical space and hardware but also business services. The boundary between infrastructure that traditionally focuses on network functions/capabilities and that which focuses more on computing and storage performance is often blurred, which may exacerbate competition among different participants in the edge ecosystem.

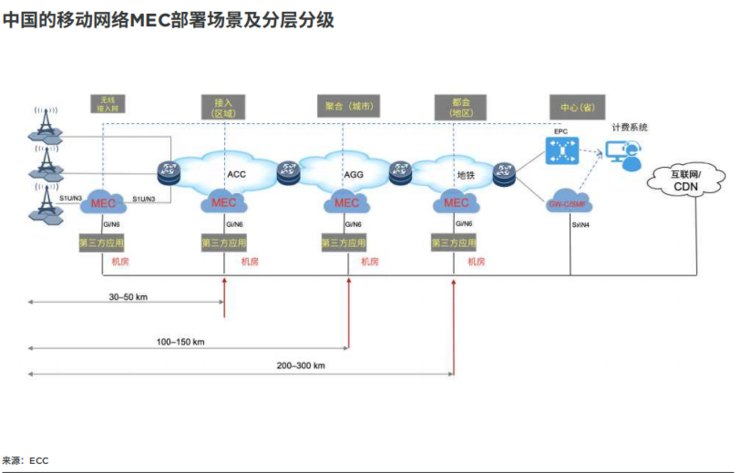

In addition to local concerns and regulations regarding data security and privacy, key factors determining edge locations also include the latency levels required for specific businesses or applications and the need for real-time or near-real-time processing and analysis. Some operators indicate that deploying limited edge equipment in selected major cities can keep latency control within 20ms across the entire coverage area. However, to ensure that the network latency for critical services does not exceed 5ms (theoretically achievable through 5G), it will inevitably require a broader deployment of edge nodes. Demonstrating that the required large-scale investment is justified also involves specific use cases and business model issues. Deploying edge infrastructure requires significant investment, but determining whether such investment is justified in the context of application scenarios and business models that remain somewhat ambiguous is a challenge for operators.

From edge interconnections to fully virtualized 5G networks, economic and strategic factors may need to be considered in tandem. Both require more distributed processing capabilities, and to realize the potential of ultra-low latency in 5G, computing power must be close to devices.

The development of edge computing may occur in multiple stages, and we are currently experiencing the initial phase of edge deployment. As demand and application scenarios evolve, regional and metropolitan data centers have been built more extensively in many markets and are gradually shifting to more edge locations.

As computing moves to the edge, several existing challenges need to be addressed, especially when target sites become more challenging, such as migrating to signal transmission towers rather than enterprise sites. These challenges include power supply, security, business assurance, and a lack of adequately skilled on-site personnel. Ironically, these are also the reasons why companies have migrated their servers and software from their own local data centers to remote server clusters.

While there are currently some initiatives to address these challenges, they may become the greatest obstacle to achieving fully distributed, truly localized edge infrastructure. However, it may also be an area where telecommunications operators (who have a large number of on-site personnel and a range of secure physical sites) can gain a significant competitive advantage.

2

China’s Edge Computing: Laying the Foundation for Global

Leadership

(1) The Momentum of Edge Computing Development Is Growing Strong in China’s Ecosystem

Although edge computing is still in its infancy in China, it is developing rapidly, especially in the past two years, making China a leader in pilot projects, early deployments, and ecosystem collaboration compared to other major countries and regions.

Momentum of Edge Computing Pilot Projects

Currently, domestic practitioners are actively engaged in the nascent field of edge computing, including the three major operators, network equipment providers (ZTE, Huawei, Nokia, and Ericsson), and large Chinese cloud service companies (Alibaba, Tencent, and Baidu), along with numerous small ICT companies, cloud and edge computing specialists, and vertical industries, all seeking opportunities for new edge business and solutions.

Chinese operators are among the most active participants in this field. China Mobile’s edge computing blueprint in 2019 encompasses 300 specific edge measures, including testing point evaluations, open API interfaces, and collaborating with partners to promote edge commercial applications. Since 2018, China Unicom has conducted over 60 MEC pilot and commercial projects across 20 provinces and cities. Data from the China Edge Computing Industry Alliance (ECC) shows that over 100 MEC pilot projects distributed across 40 cities cover multiple industries and application scenarios, including smart parks, intelligent manufacturing, AR/VR, cloud gaming, smart ports, smart mines, and smart transportation, fully confirming the rapid momentum of development.

Increasing Trend of Ecosystem Collaboration

ECC was established in 2016, with over 230 member units covering almost all major industries, while establishing working groups for technical standards, testing, security, and marketing. In September 2019, ECC signed a cooperation agreement with the Network 5.0 Industry and Technology Innovation Alliance (N5A) to jointly establish the Edge Computing Infrastructure Joint Working Group (ECNI) to promote the development of the edge computing industry.

Open-source projects are also on the rise. In November 2017, China Mobile, China Telecom, China Unicom, and other technology companies jointly released the Open Telecom IT Infrastructure (OTII) for telecommunications applications at the Open Data Center Standard Promotion Committee (ODCC), aimed at building an open and unified server solution suitable for 5G network edge computing deployment. OTII edge servers will be distributed across numerous edge sites and access centers and have already been put into use in some practical pilot projects.

In October 2018, China Mobile established the Edge Computing Open Lab to provide an industry cooperation platform and promote cross-industry development of the edge computing ecosystem. As of early 2019, the open lab had 34 partners and had conducted 15 testing platform projects with partners from various fields, including 4 smart city projects, 6 intelligent manufacturing projects, 4 live streaming and gaming projects, and 1 vehicle networking project. Akraino and StarlingX are two other major open-source edge computing projects, supported by an open community of operators, enterprises, and developers who pilot software and participate in community activities through documentation and use cases.

Chinese Enterprises’ Awareness of Edge Computing Is Increasing

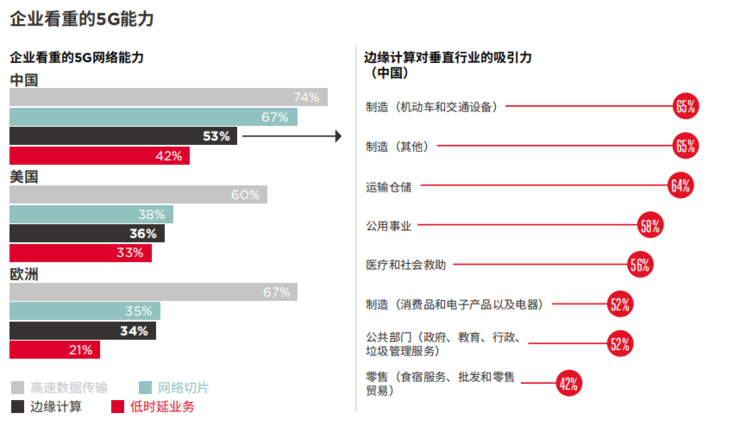

The GSMA Intelligence global enterprise IoT survey shows that 76% of Chinese enterprises plan to adopt 5G technology in future IoT deployments. While in many countries, the speed gain of 5G seems to be its most striking capability, Chinese enterprises (relative to other regions) have a stronger awareness of other network capabilities that 5G can provide (including network slicing, edge computing, low latency). The larger the Chinese enterprise, the more attractive the IoT capabilities of 5G become.

(2) Background

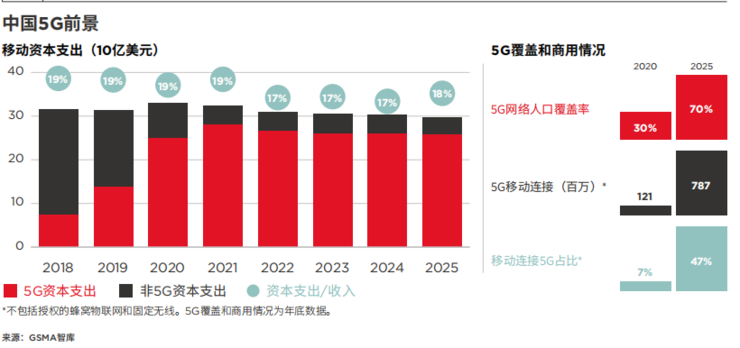

China regards 5G as a national priority, and the 5G network will drive a broader digital transformation of the economy. The three major Chinese operators obtained nationwide 5G mid-band spectrum (2.6GHz, 3.4-3.6GHz, 4.8-4.9GHz) at the end of 2018 and rapidly promoted 5G construction after obtaining commercial licenses in June 2019. By 2019, over 130,000 5G base stations had been built (China Mobile 50,000, China Unicom 40,000, China Telecom 40,000), covering more than 50 cities in China, with continuous coverage in core urban areas such as Beijing, Shanghai, and Guangzhou. In 2020, the three major operators will continue to expand 5G coverage to all cities.

GSMA Intelligence predicts that by 2025, China will have the world’s largest 5G consumer user market, with the number of 5G users approaching 800 million, accounting for 50% of the country’s mobile connections. To meet the network demands of 5G services, from 2018 to 2025, Chinese operators will invest $250 billion in mobile network capital expenditures, of which $180 billion will be for 5G networks. China will account for nearly 20% of global 5G network investment.

The three major operators have also explicitly stated that they will launch 5G SA networks to support a range of industry applications, positioning China as a leader in SA deployment and commercial markets, promoting the compatibility of global devices and terminals with SA.

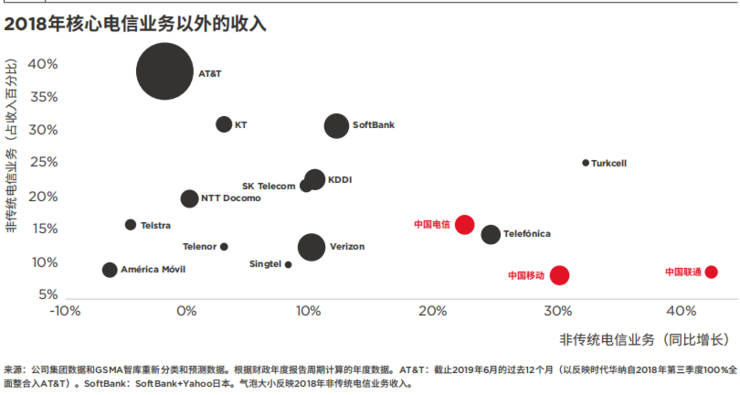

For most major operators globally, core mobile and fixed businesses account for 80-90% of revenue, while non-traditional telecom businesses account for 10-20% of revenue. There are exceptions, such as AT&T, Korea Telecom, and SoftBank (with non-traditional telecom business revenue accounting for approximately 40% and 30%, respectively, originating from acquisitions rather than organic growth).

Chinese operators are leading in the growth rate of non-traditional telecom business revenue. In 2018, non-traditional telecom businesses (consumer and enterprise) generated a total revenue of 144 billion yuan (approximately $22 billion) for the three major Chinese operators, with a year-on-year growth of about 30%. This includes paid television, programs and advertisements, IoT, enterprise solutions, and a broader range of digital business areas, including finance, payments, and lifestyle. China Mobile, China Telecom, and China Unicom all hope to leverage the digital transformation of industries and enterprises to increase future revenue beyond connectivity, positioning the integration of core networks, cloud, and edge as key technologies for enterprise digital operations and services.

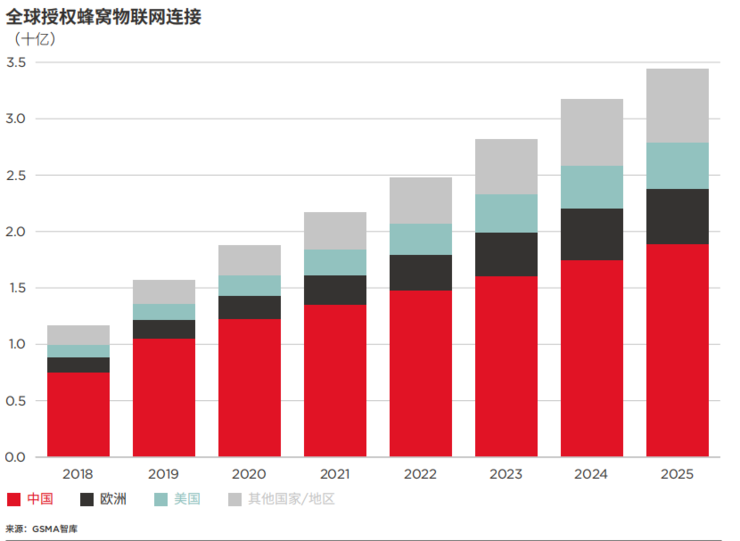

Moreover, China is currently the largest and most developed IoT market globally. Authorized cellular IoT connections in China account for about two-thirds of the global total (2019), exceeding 1 billion. In addition, three-quarters of Chinese enterprises have deployed IoT, the highest proportion globally. China is also a major supplier of the technologies needed to drive the development and growth of the global IoT market, including sensors, microchips, and other components.

In terms of revenue, in 2018, the three major Chinese operators generated a total of 11 billion yuan (approximately $1.7 billion) in IoT revenue, two-thirds of which came from China Mobile. IoT revenue grew by approximately 50% in local currency, primarily driven by continuous growth in connections and NB-IoT. Although this accounts for a small proportion of the total revenue for Chinese operators (around 1% in 2018), enterprise IoT is a significant driver for transcending connectivity boundaries. China’s leading position in the IoT and edge computing fields provides a favorable environment for deploying edge technologies, especially for IoT scenarios that require storing, processing, and analyzing large amounts of data closer to users to accelerate analysis and response.

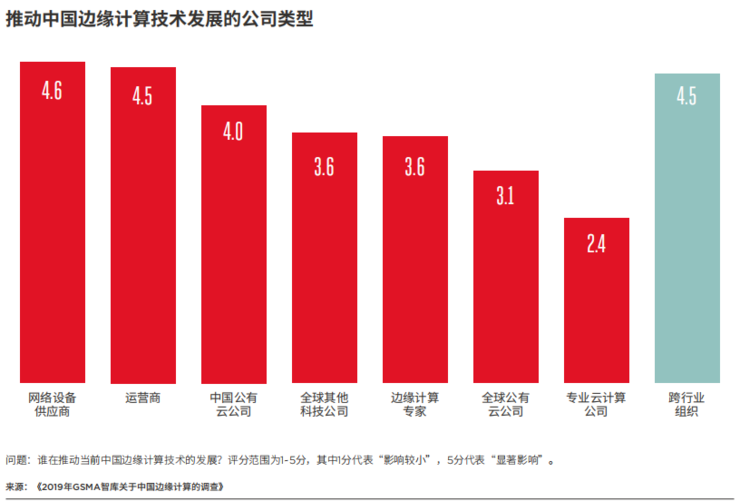

Due to the close relationship between 5G and edge computing, network equipment suppliers (Huawei, ZTE, Nokia, Ericsson, etc.) and the three major Chinese operators have played a significant role in the early stages of edge computing.

Taking the three major Chinese operators as an example.

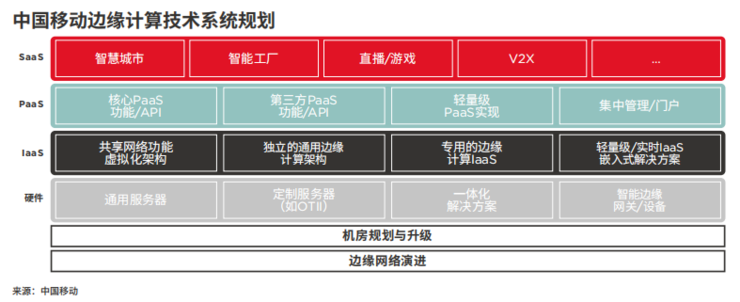

China Mobile’s edge computing system planning includes services and applications (SaaS), PaaS capabilities, IaaS facilities, hardware devices, site planning, and edge network evolution. The PaaS, IaaS, and hardware platforms for edge computing need to be designed to be compatible with two application ecosystems, namely public cloud applications and native edge applications. For different locations of edge computing deployment, the above areas are expected to allow customizable selection of the technologies used.

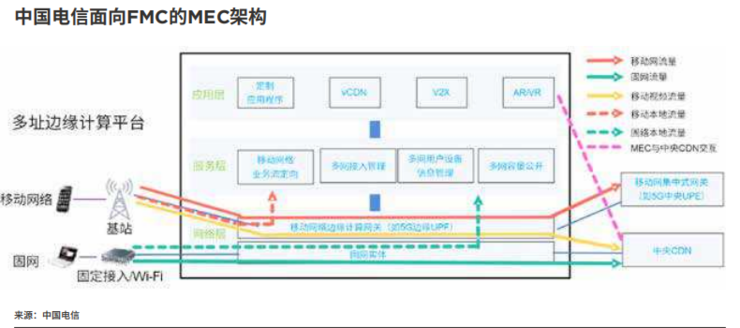

China Telecom provides a wide range of mobile and fixed services (both generating similar revenues) and plans to apply edge computing to both mobile and fixed services. More specifically, to alleviate the backhaul pressure caused by network traffic and ensure a consistent user experience for fixed and mobile network users, China Telecom is building a unified MEC by leveraging the advantages of existing fixed network resources, achieving edge integration of fixed and mobile networks (transmission and content delivery networks – CDN). The platform can flexibly allocate traffic to different networks based on service type or demand, thereby enhancing user experience through shared edge CDN resources across multiple networks and achieving intelligent content distribution.

China Unicom is involved in edge-related projects and initiatives across multiple industries, from intelligent manufacturing to smart cities and ports, and has established edge partnerships with companies such as Baidu, Tencent, ZTE, and Intel. In 2018, China Unicom launched MEC edge cloud pilot projects in 15 provinces and cities in China, including Beijing, Shanghai, Zhejiang, Fujian, Guangdong, Hubei, Chongqing, Shandong, Henan, Hebei, Jiangsu, Sichuan, Tianjin, Liaoning, and Hunan. Since 2018, over 60 pilot and commercial projects of MEC have been launched in 20 provinces, aiming to collaborate with more industry partners across all 31 provinces in China.

(3) Key Issues in Deploying Edge Computing in Mobile Networks

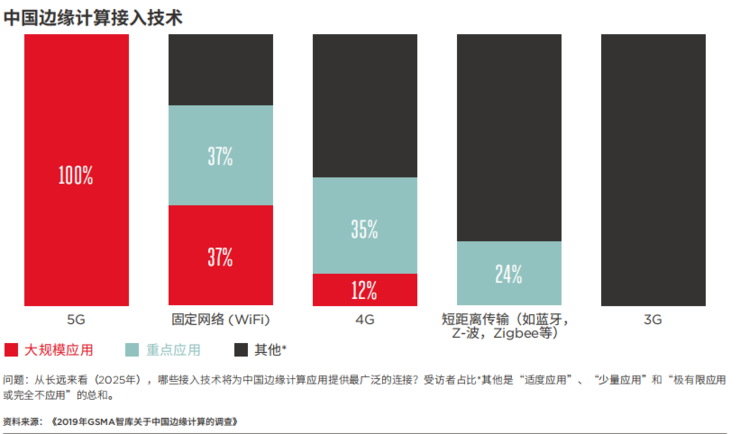

In the survey, 5G is regarded as the access network most closely related to edge computing. 5G will be widely applied in edge use cases, with a support rate far exceeding that of other network access technologies. The GSMA Intelligence global edge computing survey (2018) also emphasized that 5G is the leading technology for edge use cases, but the differences compared to 4G and fixed networks are minor. This survey result reflects not only the rapid deployment of 5G networks in China but also China’s ambition to leverage 5G technology to drive the digital transformation of industries and enterprises.

Although 5G is the most relevant access technology, distributed edge also has its role beyond cellular networks. Over 70% of surveyed companies believe that fixed networks will also be (widely) used in edge computing scenarios. Due to the diversity of access technologies and application scenarios, fixed networks, short-range access technologies (such as Zigbee, LoRa), time-sensitive networks (TSN), and other Ethernet technologies (PROFINET IRT and EtherCAT) can serve as important alternatives or complements to 5G access technologies. Access technologies may also not be exclusive; for specific edge computing nodes, different access technologies can share the same IT resources.

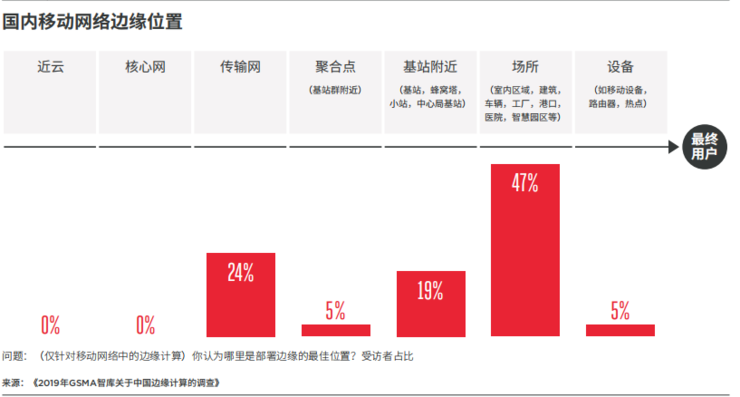

There is no one-size-fits-all answer for the best edge location in mobile networks. Different network equipment suppliers (and operators) have varying views on the best locations, reflecting the diversity of scenarios. Numerous influencing factors include the specific requirements of edge computing applications (latency, bandwidth, real-time analysis, data transmission volume, security) and technology (edge configuration, distance to cloud and devices) and business (practical needs, economics).

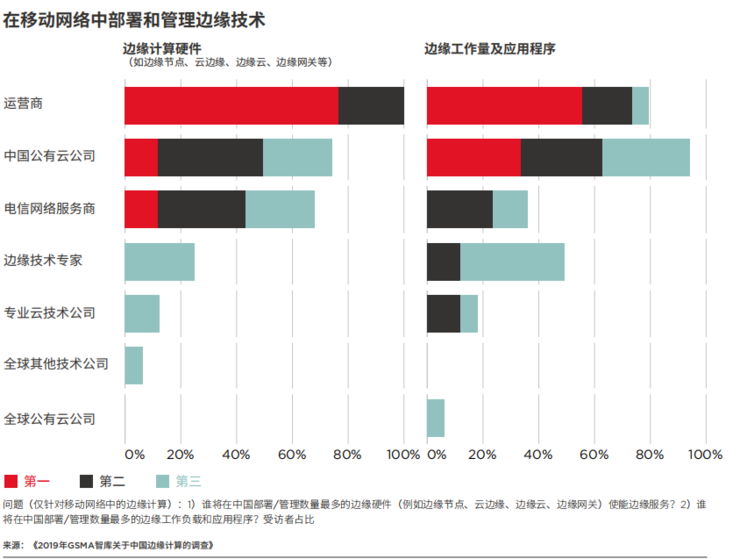

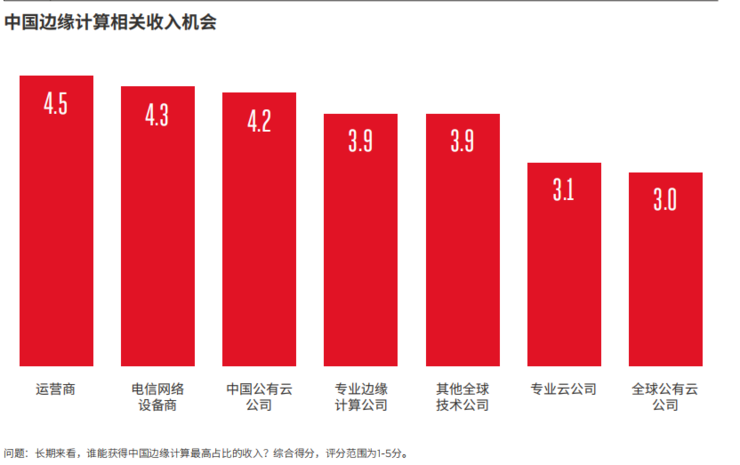

Chinese operators and public cloud companies are viewed as the best candidates for deploying and managing edge workloads and applications, which balances the situation. For operators, fulfilling this responsibility and providing end-to-end solutions will be a natural extension of deploying edge nodes. Chinese cloud providers (Alibaba, Tencent) are already de facto enterprise cloud service providers, possessing numerous advantages, such as rich cloud assets, past experience in providing services from central cloud, and a large number of enterprise users.

The future number of edge nodes to be deployed (which also depends on the edge locations analyzed earlier) is a key factor in determining the overall ecosystem investment in edge computing. As this technology is still in its early stages and the required number of edge hardware ultimately depends on the development of edge computing application scenarios, China (compared to other major countries) currently lacks clear data information.

(4) Opportunities and Challenges

By Company Type

For major cloud providers, edge technology is very suitable for extending their cloud capabilities and products to serve certain scenarios.

From a technical perspective, cloud-edge collaboration is one of the new challenges. Cloud providers need to join a decentralized ecosystem that drives distributed storage/processing and more localized data access. High-level collaboration between cloud and edge is necessary to extend cloud processing to different edge sites, which poses a challenge to cloud providers’ ability to provide seamless experiences to end users.

Network Equipment Suppliers

For leading equipment vendors in the Chinese telecom market, edge computing provides new opportunities to enhance their market position in the 5G ecosystem, adding an additional layer of technology to future network architectures.

The challenge for equipment vendors is to design truly seamless, end-to-end network transformation solutions applicable to all cloud and edge scenarios and to develop larger-scale B2B device new models to facilitate collaboration between the ICT industry and vertical industries.

Operators

Chinese operators are core participants in exploring edge computing. To a large extent, the partial migration of computing power from cloud to edge can be seen as a technology shift centered on operators. If the expectations for the ecosystem are realized, the three major Chinese operators will deploy and manage the largest number of edge hardware and undertake the majority of edge workloads, giving operators the opportunity to play an increasingly significant role in the edge value chain. Edge computing also aligns well with the ongoing network cloudification strategy, enhancing the position of Chinese operators in the cloud market.

Finding suitable business models for edge computing is one of the biggest challenges facing Chinese operators.

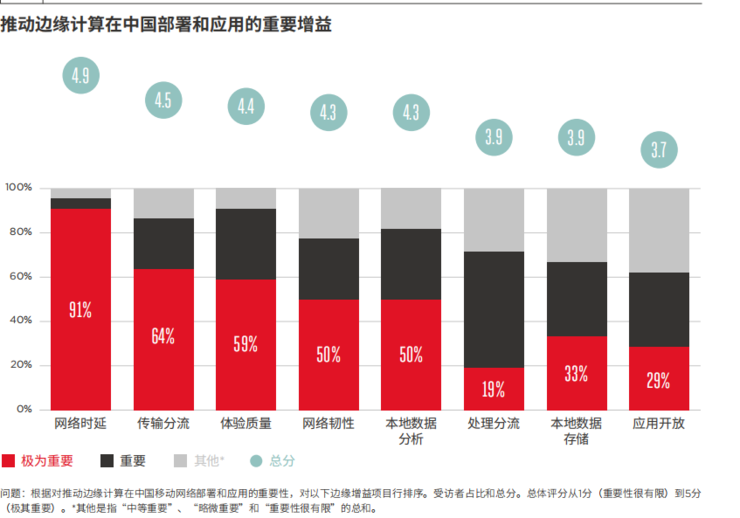

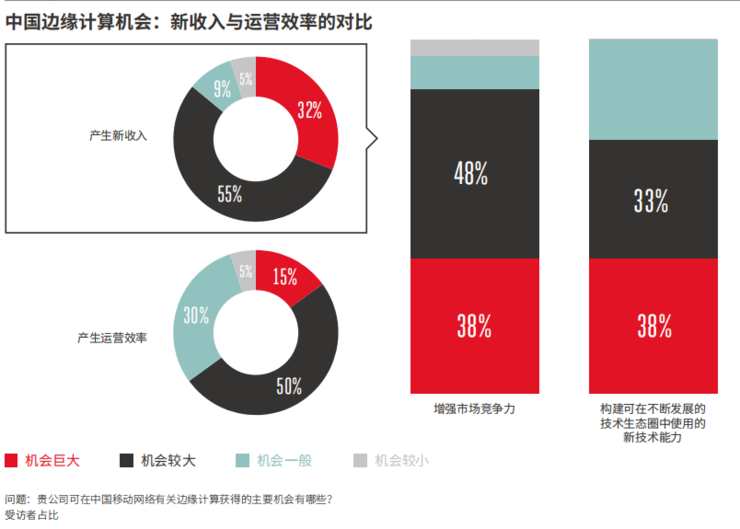

In China’s considerations regarding edge technology, new revenue dominates, with nearly 90% of surveyed companies viewing edge computing as an opportunity to create incremental revenue in the 5G era. Most companies expect to generate new revenue by providing edge services and applications to end users through the edge technologies (hardware, software, and platforms) required for edge computing. In addition to directly contributing to new revenue, edge computing also has indirect benefits for traditional core businesses, whether in cloud or telecom. The technological ecosystem is continuously evolving, and by building applicable new technological capabilities and providing a wider range of services, it helps reinforce market competitiveness.

In-depth analysis of the scale of the Chinese cloud computing market and the viewpoints and data shared by surveyed companies shows that by 2025, the annual revenue scale of China’s edge computing industry may reach 7-13 billion yuan (approximately $1-2 billion), accounting for less than 5% of cloud computing revenue. In the long term, one surveyed company believes that in the best-case scenario, annual revenue generated by edge computing could reach 30% of cloud computing annual revenue. Assuming this scenario is realized in 15-20 years, it can be speculated that edge revenue could reach 40-50 billion yuan (approximately $6-7 billion) by the early 2030s.

(5) Three Stages of Edge Computing Deployment

First Wave (2018-2020): Experimentation and Small-Scale Custom Deployments

China Mobile, China Telecom, and China Unicom conducted a large number of edge computing experiments from 2018 to 2019, laying an important foundation for further commercialization. In 2020, the verification of edge computing deployments in various industries increased, and some tests transitioned to small-scale deployments. During this phase, edge computing deployments were mostly private and customized applications designed specifically to meet enterprise needs, such as smart ports, smart parks, or smart factories, with edge technology primarily deployed locally. Public applications like live broadcasts (smart stadiums) will also see testing and demonstration during this phase, although on a limited scale.

Second Wave (2021-2023): Initial Commercial Scale Phase

During this phase, the coverage of 5G networks is expected to increase significantly (with over 60% population coverage by the end of 2023), and the deployment of private edge computing facilities from the first phase will begin to yield benefits on a larger scale. In addition to locally customized edge computing applications, public applications such as autonomous driving, sporting events, and gaming will also see more exploration, with edge computing infrastructure deployed regionally or in cities, close to base stations or aggregation base stations. During this phase, the costs of edge computing applications are higher due to the need to operate numerous micro data centers with few available tenants for distributed computing loads.

Third Wave (2024 and Beyond): Becoming Mainstream

By the end of 2025, China’s 5G population coverage is expected to exceed 70%. The maturity of 5G technology, the reduction in 5G device costs, and strong cooperation between the mobile industry and enterprises will drive the expansion of edge computing deployment scale. As the number of 5G base stations increases, edge computing can be deployed more widely and increasingly used in public edge computing application scenarios.

3

The Future Vision: Promoting Large-Scale Development of Edge Computing in China

The latest progress in edge computing, along with the clear intention of the Chinese industry to stay at the forefront of new technologies, provides a solid foundation for future development.

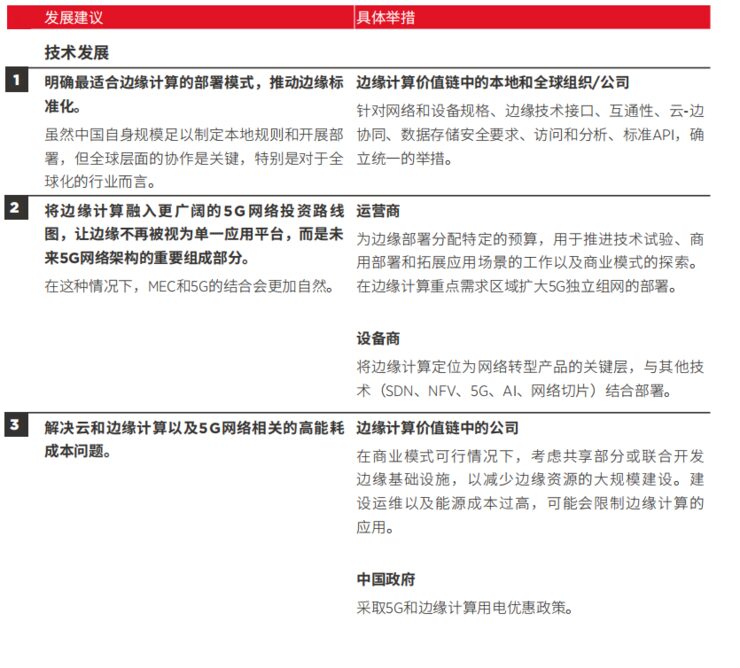

However, realizing the long-term potential of edge computing requires collective efforts from various companies and the entire Chinese industry. Combining the main development barriers analyzed earlier and the views of GSMA Intelligence, seven key initiatives have been identified. Implementing these seven key initiatives will help promote the development and application of edge computing in China over the next five years. Many of these initiatives are relevant to most stakeholders in edge computing, while some are targeted at specific types of companies. These initiatives can be categorized into three main areas: technological development, market acceptance, and policies and regulations.

The latest progress in edge computing, combined with China’s clear goal of positioning new technologies at the forefront, lays a solid foundation for further development of edge computing. However, to unlock the long-term potential of edge computing, extensive work needs to be carried out.

GSMA has identified the following seven key measures in the report:

-

Clarify the best deployment models for edge computing and promote edge standardization.

-

Integrate edge computing into broader 5G network investment planning.

-

Address high energy cost issues related to cloud/edge computing and broader 5G networks.

-

Further deepen industry collaboration and expand discussions between edge computing and vertical industries.

-

Leverage enterprises’ awareness of edge computing to promote new pilots and deployments.

-

Enhance the media, entertainment, and smart city industries’ focus on edge computing.

-

Establish industry policies that are clear, focused on edge computing, and consider the unique nature and challenges of edge deployment.

If these measures are implemented, they will promote the development and application of edge technology in China over the next five years. Many of these measures involve the entire edge computing ecosystem, while some target specific types of companies.

If the first decade of cloud computing development was mainly technology-driven, as more IT professionals accept the concept of cloud computing and seek to make this technological idea more aligned with practical scenarios, application gradually becomes the driving force behind the development of cloud computing; while the shortcomings of traditional centralization become significant opportunities for the development of edge computing. To achieve interconnection and interaction between edge computing nodes and cloud computing centers, many technical issues need to be resolved.

Previous Recommendations