PLC, or Programmable Logic Controller, is the brain of industrial production. As one of the industrial software for production control, PLC integrates computer technology, automatic control technology, and communication technology, serving as the core control device in production control and playing an extremely important role in the entire motion control system. However, it is also the most challenging component to manufacture within motion control systems. Recent statistics show that the localization rate of PLCs among all industrial control products is the lowest, currently below 20%, while DCS, general servos, and frequency converters range between 20-40%, and IPCs and dedicated servos exceed 80%. This indicates that there is significant potential for domestic PLC replacement.

The digital industrialization and industrial digitization are currently and will be the top priorities for industrial development in China. The digital transformation and intelligent upgrade of enterprises are trends that cannot be ignored, all of which rely on the upgrade of industrial control products represented by PLCs. In September 2023, General Secretary Xi Jinping proposed the development of “new quality productivity“, stating that “we must actively cultivate strategic emerging industries such as new energy, new materials, advanced manufacturing, and electronic information, and accelerate the formation of new quality productivity.” Advanced manufacturing demands higher standards for advanced manufacturing equipment and industrial software.

The government has shown strong support for the PLC industry. In December 2021, the Ministry of Industry and Information Technology released the “14th Five-Year Plan for the Development of Software and Information Technology Services”, placing “promoting the upgrade of the software industry chain” as the top priority, with the main goal of “focusing on programmable logic controllers (PLCs), distributed control systems (DCS), and other industrial control systems to carry out joint efforts in developing multi-point, low-latency, high-reliability, and low-energy consumption software products.”

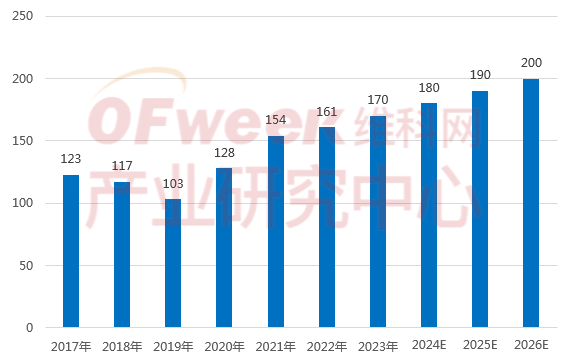

Since the pandemic, the PLC market size has been on the rise, growing from 12.8 billion yuan in 2020 to 17 billion yuan in 2023. However, most of the market share is still occupied by foreign brands, especially in the large PLC market, where domestic brands are still few. Domestic manufacturers such as Inovance Technology, Hollysys, and China Electronics Technology have already made their presence felt, but they have not yet significantly impacted established foreign brands like Siemens and Mitsubishi. Domestic manufacturers have captured a significant market share in the small and medium-sized PLC market, with Inovance Technology reporting that its small PLC products are only second to Siemens in competitiveness, achieving a market share of 15.3%, nearly double that of Mitsubishi (which has a market share of 8.8%).

Market Size Trend of China’s PLC Industry (2017-2026) (in billion yuan)

Source: OFweek Industry Research Center

The application of PLCs is continuously expanding, with significant demand in various industries related to national economy and security, including aerospace, military, water conservancy, and electricity. Therefore, the localization of PLCs plays a crucial role in ensuring the safety of China’s industrial infrastructure and national defense systems, reducing dependence on foreign technology, and enhancing the independent innovation capability of the industry.

Currently, domestic manufacturers are accelerating their layout in the PLC sector. In addition to traditional industrial control giants, a large number of new entrants are becoming disruptors in the PLC industry, and the prospects for domestic PLC replacement are promising.

Recently, the OFweek Industry Research Center has reviewed the competitiveness of Chinese PLC companies from different perspectives, such as market share and technological strength, with the specific rankings as follows:

Top 20 Chinese PLC Companies

|

Rank |

Company Abbreviation |

Company Overview |

|

1 |

Inovance Technology |

Leading in industrial control and robotics, mainly engaged in servo systems, frequency converters, PLCs, etc. |

|

2 |

Delta Electronics |

Established leader in industrial control, a Taiwanese company with high market share in Europe, America, and Taiwan. |

|

3 |

Xinje Electric |

New leader in industrial control, focusing on servos and PLCs. |

|

4 |

China Electronics Technology |

Leading PLC manufacturer, state-owned enterprise with strong R&D capabilities, focusing on large, medium, and small PLCs. |

|

5 |

Hollysys |

Leading in industrial control, listed in the US, with products popular in Europe, America, and domestic markets, covering large, medium, and small PLCs. |

|

6 |

Zhongkong Technology |

Leading in DCS, with early layout in PLCs, focusing on small and medium PLCs. |

|

7 |

Hechuan Technology |

Focusing on servo systems and small PLCs, leading domestic brands in general servo systems market share. |

|

8 |

ReiSai Intelligent |

Leading in industrial control, focusing on controllers, servo systems, PLCs, etc. |

|

9 |

Yonghong Electric |

Established industrial control company from Taiwan, early layout in PLC products, high recognition in the industry. |

|

10 |

Keyuan Smart |

Leading in automation control products in the energy sector. |

|

11 |

Weichuang Electric |

One of the new leading companies in small and medium PLCs, with layouts in frequency converters and servo systems. |

|

12 |

Invt |

Leading in frequency converters, with layouts in PLCs, servo systems, and control systems. |

|

13 |

MagnaChip |

Leading in home appliances and power control, with industrial automation products including frequency converters, servo systems, PLCs, encoders, etc. |

|

14 |

Aotuo Technology |

Focusing on PLCs, with strong technical capabilities in PLC technology, covering large, medium, and small PLCs. |

|

15 |

Huacheng Industrial Control |

One of the leading companies in robotic arms, with industrial automation products including dedicated servo systems, general PLCs, machine vision, etc. |

|

16 |

Juxing Technology |

Mainly engaged in large, medium, and small PLCs, aerospace-grade and special-grade PLCs, building control DDC, and development and manufacturing of control-related peripheral products. |

|

17 |

Ruien Technology |

Leading in electric control systems, recently transitioning to general automation products, deeply involved in the PLC field. |

|

18 |

Ankang Technology |

Industrial automation products include PLCs, DCS, SIS, industrial software, etc. |

|

19 |

Haide Control |

Focusing on edge controllers, with main products including PLCs, frequency converters, servo systems, etc. |

|

20 |

Zhenghang Electronics |

Main products and service series include general and dedicated automation controllers, motors and drive products, human-machine interfaces, automation software, automation control systems and solutions, industrial communication, and more. |

Source: OFweek Industry Research Center

1. The evaluation data for this ranking comes from self-reported data from companies and other publicly available legal channels, in compliance with the relevant provisions of the “Data Security Law of the People’s Republic of China” and the “Social Credit System Construction Law of the People’s Republic of China (Draft for Comments)”, adhering to business ethics and professional ethics, being honest and trustworthy, and fulfilling data protection obligations.

2. The initiators and partners of this ranking commit to adhering to the principles of objectivity, neutrality, and fairness in the integration, summarization, and presentation of information throughout the national process. The ranking is intended solely for reference in specific fields as an indicator of development status and does not constitute any decision-making conclusions, recommendations, or value judgments.

3. If there are any doubts regarding the content of this ranking, please contact the initiating unit. The initiators and partners of this ranking bear no responsibility for disputes arising from improper use.

OFweek Industry Research Center Ranking Series

Exclusive Ranking | Top 20 Listed and Scaled Enterprises in New Energy Vehicle Energy Management and Charging Services

Exclusive Ranking | Top 20 Listed and Scaled Enterprises in China’s Cloud Computing

Exclusive Ranking | Top 20 Listed Enterprises in China’s CNC Machine Tools

Exclusive In-Depth | Top 20 Listed Companies in China’s Laser Industry in 2023

Exclusive First Release | Top 100 Enterprises in China’s IoT Industry ChainExclusive First Release | Top 100 Listed Enterprises in China’s Hydrogen Energy Industry ChainExclusive Ranking | Top 100 Enterprises in China’s Digital Economy Industry ChainExclusive First Release | Top 100 Listed Enterprises in China’s Integrated Circuit Industry ChainExclusive First Release | Top 100 Listed Enterprises in China’s Energy Storage Industry ChainExclusive First Release | Top 100 Listed Enterprises in China’s Lithium Battery Industry ChainExclusive Ranking | Comprehensive Competitiveness and Subdivision Ranking of China’s Optical Communication Industry Chain in 2023Exclusive First Release | Top 100 Listed Enterprises in China’s Photovoltaic Industry ChainTop 50 Market Shares in China’s Intelligent Manufacturing in 2023Top 10 Competitiveness Rankings of China’s Industrial Control Enterprises in 2023Top 10 Competitiveness Rankings of China’s Photovoltaic Module Industry in 2023In-Depth! Top 10 Competitiveness Analysis of China’s Photovoltaic Cell Enterprises in 2023Top 10 Leading Enterprises in Sodium Battery in 2023 and Demand EstimationTop 10 Competitiveness Rankings of China’s Photovoltaic Silicon Wafer Enterprises in 2023

OFweek Industry Research Center Robotics Industry Report Series

2024 China Industrial Robot Industry Research Report

2024 China Industrial Robot Reducer Industry Research Report

2024 Industrial Robot Servo System Industry Research Report

2024 China Industrial Robot Controller Industry Research Report

2024 China Industrial Robot Body Industry Research Report

2024 China Mobile Robot (AGV) Industry Research Report

2024 China Forklift AGV Industry Research Report

2024 China Autonomous Mobile Robot (AMR) Industry Research Report

2024 China SCARA Robot Industry Research Report

2024 China Mobile Service Robot Industry Research Report

2024 China Industrial Robot System Integration Industry Research Report

2024 China Intelligent Warehousing Industry Research Report

2024 China Machine Vision Industry Research Report

2024 China Medical Robot Industry Research Report

2024 Top 10 Lithium Battery Manufacturers Supply Chain Report

2024 China Robotics Subsector Investment Analysis Report

2024 China Motion Controller Market Research Report

2024 China Photovoltaic Industry Robot Market Research Report

2024 China 3C Industry Robot Market Research Report

2024 China Collaborative Robot Market Analysis Report

2024 China Precision Reducer Market Analysis Report

2024 China 5G Related Industry Robot Market Research Report

2024 China AGV Mobile Robot Market Research Report

2024 China AMR Mobile Robot Market Research Report

2024 China MOMA Mobile Robot Market Research Report

2024 China Mobile Robots with Different Navigation Methods Market Research Report

2024 China Industrial Field Mobile Robot Market Research Report

2024 China Logistics Industry Mobile Robot Market Research Report

2024 China Commercial Field Mobile Robot Market Research Report

CONTACT USContact Information for OFweek Industry Research Center

For inquiries regarding industry report purchases, customized reports, and corporate consulting services, please contact | [email protected]

Consultation Phone | 18028710492 | 0755-26905193Recommended Past Articles:

New Energy Lithium Battery/Storage/Sodium Battery

In 2023, China’s lithium battery anode material shipments exceeded 1.7 million tons, accounting for 94% of the global market.

Why is the 4680 battery considered the optimal solution?

Energy Storage Battle: Understand lithium batteries, sodium batteries, and all-vanadium flow batteries in one article.

Understand the competitive landscape and trends of the global power battery industry in 2022 in one article.

New Energy Photovoltaics

Photovoltaic Industry Auxiliary Material Series Report – Photovoltaic Glass (IV) – In-Depth Analysis of First Solar.

Photovoltaic Industry Auxiliary Material Series Report – Photovoltaic Glass (III) – Analysis of Core Competitive Factors in the Industry.

Photovoltaic Industry Auxiliary Material Series Report – Photovoltaic Glass (II) – Analysis of Supply and Demand Patterns of Photovoltaic Glass.

Photovoltaic Industry Auxiliary Material Series Report – Photovoltaic Glass (I) – An Introduction to Photovoltaic Glass.

Photovoltaic Industry Auxiliary Material Series Report – Inverters (II) – Exploring Supply and Demand of Photovoltaic Inverters.

Photovoltaic Industry Auxiliary Material Series Report – Inverters (I) – An Introduction to Photovoltaic Inverters.

Analysis of the Competitive Landscape of China’s Photovoltaic Silicon Wafer Enterprises: Can the Oligopoly between Longi and Zhonghuan Continue?

Photovoltaic Industry Auxiliary Material Series Report – Adhesive Films (III) – Exploring Supply of Photovoltaic Adhesive Films.

Photovoltaic Industry Auxiliary Material Series Report – Adhesive Films (II) – Exploring the Upstream and Downstream of the Photovoltaic Adhesive Film Industry Chain.

Photovoltaic Industry Auxiliary Material Series Report – Adhesive Films (I) – An Introduction to Photovoltaic Adhesive Films.

Lasers

CT Analysis of Laser Marking Control Card Industry.

Market Analysis of Laser Optical Devices – Galvanometer.

Special Topic on Additive Manufacturing – An Introduction to Metal Additive Manufacturing.

Optical Communications

Outlook for Optical Fiber and Cable in 2023: Three Major Drivers Supporting Continued Industry Prosperity.

“14th Five-Year” Planning for Offshore Wind: Over 60GW, Leading Submarine Cable Companies Accelerate Capacity Expansion.

Intelligent Manufacturing Robotics

Research Topic on Surgical Robots (Part I).

Disclaimer:

This subscription account (WeChat ID: gh_bfe43c76afc9) is the only subscription account operated by the research team of OFweek Industry Research Center.The content contained in this subscription account is derived from OFweek Industry Research Center’s tracking and interpretation of industry dynamics, technological trends, and industrial chain patterns. Subscribers using the materials may misunderstand key assumptions, data forecasts, etc., due to a lack of understanding of the complete report. For the complete version of related research reports, please contact OFweek Industry Research Center using the contact information at the end of this article.OFweek Industry Research Center does not guarantee the accuracy, reliability, timeliness, or completeness of the materials contained in this subscription account, whether express or implied. The materials and opinions in this subscription account only represent the judgments made by OFweek Industry Research Center based on the data collected from the date of publication to the date of release, and relevant research views may be changed without notice based on reports written by OFweek Industry Research Center.The content published in this subscription account is owned by OFweek Industry Research Center. Without prior written permission from OFweek Industry Research Center, no organization or individual may forward, reproduce, copy, publish, or quote all or part of the content published in this subscription account in any form, nor may they receive, reproduce, copy, or quote all or part of the content published in this subscription account from any organization, individual, or media platform not authorized by OFweek Industry Research Center. All rights reserved, and violators will be prosecuted.