Welcome to follow the public account belowAbao1990, this public account focuses on autonomous driving and smart cockpits, providing you with automotive insights daily. We start with cars, but we are not limited to them.

In the wave of terminal AI transformation, Allwinner Technology, as a leading domestic smart application processor SoC manufacturer, cannot be overlooked.

This issue brings the fourth installment of the “Top 100 Chips” series – Allwinner Technology.

This article aims to provide a multi-dimensional analysis of Allwinner Technology, covering its growth history, product matrix, financial data, strategic planning, and the opportunities and challenges the company faces, offering valuable references for readers to understand the company comprehensively.

Click the business card below to follow Eefocus,

We will bring you more industry news and analyze the logic behind events.

01

Growth History

Allwinner Technology currently focuses on smart application processor SoCs, high-performance analog devices, and wireless interconnect chips, with products meeting various application needs in industrial, automotive, and consumer fields.

Founded in 2007 in Zhuhai, China, the company has undergone a strategic transformation from consumer electronics chips to smart industrial, automotive electronics, and AIoT, with its growth history divided into three key stages:

1. Early Startup: Tablet Chips, Glorious Days

(2007-2013)

Allwinner Technology was established in 2007 in Zhuhai, China, by a core team from the former Zhuhai Jieli (a giant in MP3 chips), led by Zhang Jianhui, inheriting Jieli’s technological genes in multimedia chips. Initially, the focus was on high-definition video, analog chips, and network applications;

In 2009, the first-generation power management chip AXP186 was released, and in 2010, the full-format decoding F series chip was launched, with annual sales exceeding 100 million yuan;

In 2011, Allwinner Technology released its first tablet processor A10, seizing the opportunity presented by the tablet market boom led by Apple’s iPad in 2010.

In 2012, Allwinner Technology launched the first quad-core tablet chip A31 to be listed in China. According to Digitime statistics, the total shipment of tablet computers in mainland China in 2012 was nearly 60 million units, and Allwinner Technology became the biggest winner with a chip supply of 22 million units. The company’s revenue surged by 413% in 2012, reaching 1.339 billion yuan.

In 2013, Allwinner Technology was awarded the “2013 Global Android Tablet Processor Shipment Volume First” honor by ARM, with the company’s operating income reaching 1.65 billion yuan, enjoying a moment of glory.

2. IPO and Transformation: From Tablets to Diversified Exploration

(2014-2019)

However, in 2014, tablet chip revenue plummeted, with Allwinner Technology’s tablet chip revenue dropping from 1.045 billion yuan in 2013 to 437 million yuan in 2014. At the same time, the company established an automotive division and released the industrial and automotive platform processor T2.

After going public on the Shenzhen Stock Exchange’s Growth Enterprise Market in 2015, facing a shrinking tablet market, the company began implementing a marketing BU (Business Unit) strategy, proposing a future direction MANS strategy (Multimedia, Analog, Network, Service), fully embracing the big video strategy, complementing the “SoC+” operational strategy.

In 2016, the mass-produced smart cockpit platform processor T3 was released; the fully integrated WIFI chip XR819 was launched, targeting the smart home and portable device markets.

In 2017, the high-performance tablet processor A63 was launched, integrating a quad-core A53 architecture, becoming one of the mainstream solutions for mid-to-high-end tablets; the first virtual reality dedicated chip VR9 was introduced, pioneering the use of hardware acceleration to achieve ATW, anti-distortion, and anti-dispersion algorithms.

In 2018, the company implemented comprehensive industrial-grade chip standards, began systematic layout in the smart industrial market, and released A40i; the first smart cockpit processor T7 certified by AEC-Q100 for automotive applications was launched, with mass production for pre-installed vehicles before 2019; in the OTT (Internet TV) market, the strongest 4K set-top box SoC H6 was released, featuring 6K decoding, HDR technology, and smart interaction, becoming a strategic product in its OTT market.

In 2019, the highly integrated smart voice dedicated processor R328 was released, achieving AI technology industrialization, gaining recognition from numerous brand customers in the AI field, with the company’s smart speaker processor sales ranking first in the country in 2019.

3. AI Era: Technical Deepening and Ecological Cooperation

(2020 to present)

In 2020, the first high-performance, low-power AI voice dedicated chip R329 equipped with Arm China’s AIPU was released; the automotive-grade high-performance AI cockpit processor T5 was launched; the AI robot processor MR813 compatible with SLAM/VSLAM intelligent recognition technology was released; and the AI application processor A133 using self-developed NSI bus was launched.

In July 2020, Allwinner Technology and Alibaba’s Pingtouge officially signed a strategic cooperation agreement, with the company developing new computing chips based on Pingtouge’s Xuantie processor, with the initial cooperation product being the general-purpose computing chip developed by Allwinner Technology based on Pingtouge’s Xuantie 906 and 902 processors. In 2021, the world’s first chip equipped with Pingtouge’s Xuantie 906 RISC-V 64-bit application processor D1 was released, providing a new intelligent key chip for the AIoT era of the Internet of Everything.

In 2022, the industrial-grade high-performance AI chip T527 was released, featuring an 8-core Arm Cortex-A55, 2 Tops (INT8) NPU, and RISC-V Xuantie E906, up to 200MHz, applicable in smart industrial, smart power, automotive electronics, and other fields; the high-performance, low-power processor V853 aimed at the smart vision field was launched, widely used in smart locks, smart attendance access control, network cameras, dash cameras, smart desk lamps, and more.

In 2023, the A523/A527 series high-end octa-core architecture platform was launched, serving as a high-performance platform processor for mid-to-high-end tablets and interactive display applications.

In 2024, the high-performance smart industrial dedicated chip T536 will be released, featuring a 4-core Arm Cortex-A55, 3 Tops (INT8) NPU, and MCU using RISC-V Xuantie E907, up to 600MHz, applicable in smart industrial, smart power, and other fields.

Allwinner Technology initially started with tablet chips and, benefiting from the rapid growth of the tablet market, became the world’s number one in Android tablet processor sales for two consecutive years. As the tablet market gradually peaked and industry competition intensified, the company completed a comprehensive strategic transformation from consumer electronics chips to smart industrial, automotive electronics, and AIoT. Currently, Allwinner Technology continues to iterate and refine its technology field with the SOC+ big video + product package strategy.

02

Multi-Dimensional Product Layout

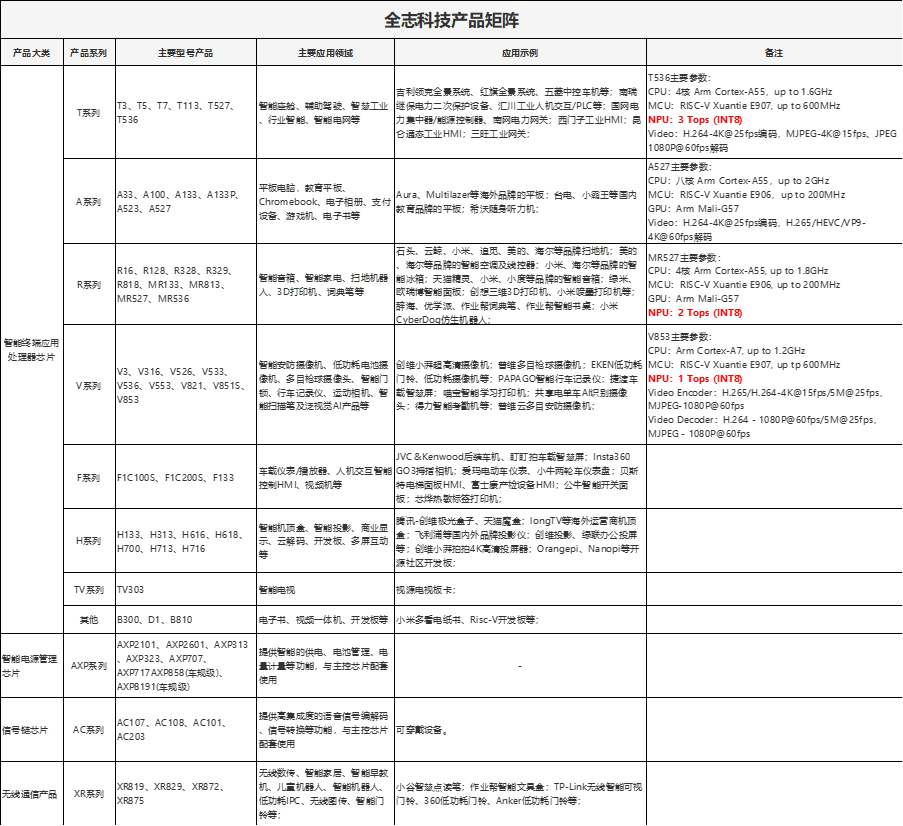

Allwinner Technology’s main business focuses on smart terminal application processor SoCs, including T series, A series, R series, V series, F series, H series, TV series, and some high-performance analog devices and wireless interconnect chips. The company’s product matrix can meet the computing power needs of mainstream smart terminal products in automotive, industrial control, and consumer electronics.

Image source: Organized by Eefocus

With the rapid development of artificial intelligence technology, the demand for high computing power, heterogeneous computing power, and high energy efficiency in various terminals is increasing. Allwinner Technology is building a serialized general heterogeneous computing platform to promote comprehensive intelligence across various fields. The following focuses on Allwinner Technology’s smart terminal application processors in the T/A/R/V series.

T Series: A high-performance, high-reliability intelligent processing platform mainly aimed at industrial and automotive fields, focusing on multi-task processing, AI computing power integration, and industrial-grade stability in complex scenarios, applicable in smart cockpits, assisted driving, smart industry, industry intelligence, smart grid, and other fields. The T536 adopts a 22nm process, integrating a 4-core Arm Cortex-A55 (up to 1.6GHz), 3 Tops NPU, and MCU using RISC-V Xuantie E907 (up to 600MHz), as well as industrial-grade interfaces (4 CAN-FD, LocalBus), supporting a wide temperature range of -40℃ to 85℃, meeting the needs of PLC, industrial HMI, industrial all-in-one machines, charging piles, etc., emphasizing real-time performance, data security, and a lifespan of over 10 years.

A Series: A cost-effective core processing platform mainly aimed at consumer-grade smart terminals, focusing on lightweight intelligent scenarios, with low power consumption, multimedia performance, and cost advantages at its core, covering diverse needs from entry-level to mid-to-high-end. Mainly applied in tablet computers, educational tablets, Chromebooks, payment devices, game consoles, e-readers, etc. The A527 integrates an octa-core Arm Cortex-A55 (up to 2GHz), with MCU using RISC-V Xuantie E906 (up to 200MHz), and GPU using Arm Mail-G57, featuring powerful hardware encoding and decoding capabilities and a rich array of screen and camera interfaces, supporting common interfaces such as PCIe, SDIO, USB, GMAC, SPI, TWI, UART, GPADC, LRADC, PWM.

R Series: A chip platform focused on smart voice and IoT fields, widely applied in smart speakers, smart home control, smart appliances, and other fields. The MR527 integrates a 4-core Arm Cortex-A55 (up to 1.8GHz), with MCU using RISC-V Xuantie E906 (up to 200MHz), 2 Tops NPU, and GPU using Arm Mail-G57, featuring powerful hardware encoding capabilities and a rich array of sensor interfaces, supporting common interfaces such as GPIO, PCIe, SDIO, USB, SPI, TWI, UART, GPADC, LRADC, PWM, suitable for products like robotic vacuum cleaners, lawn mowers, service robots, quadruped robots, etc.

V Series: A chip platform focused on the smart vision field, widely applied in smart security cameras, low-power battery cameras, multi-lens ball cameras, smart locks, dash cameras, action cameras, smart scanning pens, and general vision AI products. The V853 adopts Arm Cortex-A7 (up to 1.2GHz), with MCU using RISC-V Xuantie E907 (up to 600MHz), 1 Tops NPU, self-developed encoding and decoding engine, and high-performance ISP image processor, supporting up to 4K@15fps or 5M@25fps H.264/H.265 encoding, providing users with professional-grade image quality.

03

Accelerated Revenue Growth in 2024, but Low Gross Margin

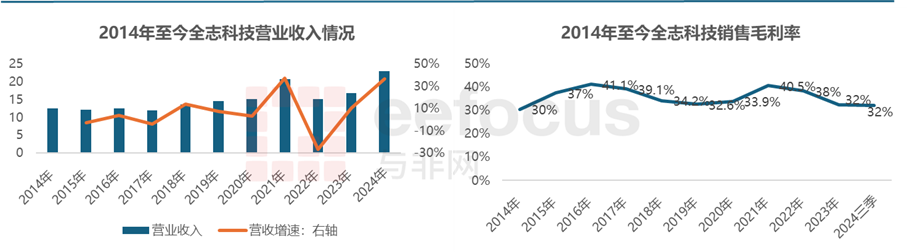

Allwinner Technology’s operating income is primarily derived from smart terminal application processor chips, accounting for 80% of revenue in 2023. During the same period, the revenue share of the company’s smart power management chips and wireless communication products was 8.8% and 8.6%, respectively.

Allwinner Technology’s performance report disclosed an operating income of 2.287 billion yuan for 2024, a year-on-year increase of 36.76%, setting a new historical high. In 2024, the company actively seizes the opportunity of recovering downstream market demand, improves its product matrix, and vigorously expands its automotive, industrial, and consumer product line businesses, with significant increases in shipments represented by robotic vacuum cleaners, smart projectors, and general security.

However, looking at the time dimension, Allwinner Technology’s growth over the past decade has not been high. The company’s compound annual growth rate (CAGR) from 2014 to 2024 is only 6.3%, even with the substantial growth of 36.76% in 2024. Additionally, apart from the chip industry’s boom in 2021, Allwinner Technology’s performance has shown significant fluctuations, while revenue growth over the past decade has remained relatively stable.

Over the past decade, Allwinner Technology’s gross margin level has averaged around 36%, reaching cyclical peaks of 41.1% and 40.5% in 2016 and 2021, respectively.

It is worth noting that despite the significant revenue growth in 2024, the gross margin for that period does not seem to show an effective rebound, with the gross margin for the third quarter of 2024 being 30.83%, continuing to hit new lows for the past decade. In contrast, domestic competitor Rockchip’s quarterly gross margin has been rising for three consecutive quarters.

04

“Intelligent and Big Video” Strategy

Allwinner Technology adheres to the strategic direction of intelligence and big video, deeply cultivating customer needs and application scenarios, providing integrated SoC+ solutions that include chips, hardware, software, algorithms, and services. The company regards “leading technological competitiveness” as an important strategic task, continuously laying out and investing in technology fields around the MANS strategic route, laying a solid foundation for product innovation and market promotion.

At the market and customer level, the company continues to expand its application scope in consumer, home appliances, industrial, and automotive sectors, with a growing customer base. It will build strategic and ecological partnerships to create a unique application development ecosystem for Allwinner, providing differentiated, scenario-based, and customized product packages and services for industry brand customers while offering a more complete and open development ecosystem for various niche customers, covering and nurturing more new applications.

At the product and technology level, the company will increase investment in advanced processes, efficient bus architectures, AI computing power, high-definition video processing, high-speed mixed-signal design, wireless network communication, efficient power systems, and software design platforms, continuously developing high-performance, highly integrated, and high-quality chip products and supporting SoC+ solutions across multiple fields, including general intelligence, industrial automotive, smart display, smart decoding, smart vision, IoT, network connectivity, and power supply. With rich technical reserves and a unified product integration development model, the company can quickly launch high-quality products such as SoC, PMU, WIFI, ADC, etc., paired with self-developed general operating systems Melis and Tina, as well as rapid adaptation and optimization for Android and OpenHarmony systems, providing customers with SoC+ chip combination solutions that significantly reduce R&D costs.

05

Opportunities and Challenges

Opportunities: With the continuous development of AI, IoT, and other technologies, the market for smart terminal devices continues to grow, and the demand for Allwinner Technology’s smart terminal chip products will further expand. Leveraging years of deep cultivation in the SoC field, Allwinner Technology will fully benefit from the intelligent development across various industries.

It is noteworthy that Allwinner Technology maintains a close cooperative relationship with Alibaba’s Pingtouge Semiconductor, with both parties conducting multiple collaborations based on RISC-V processors, with several chips already in mass production, widely applied in smart video, smart vision, voice AI, and other fields. This not only helps Allwinner Technology accelerate its layout and development in the RISC-V ecosystem but also allows its related chip products to be applied in more fields.

Challenges: Currently, competition in the chip industry is extremely fierce, with strong competitors such as domestic manufacturers Rockchip, Diguo Robotics, Amlogic, and Black Sesame Intelligence, in addition to overseas giants. In terms of chip processes, Allwinner Technology’s T536 adopts a 22nm process, while many domestic competitors have already mass-produced products with more advanced processes. Allwinner Technology needs to continuously strive to improve its market competitiveness in terms of product performance and differentiation.

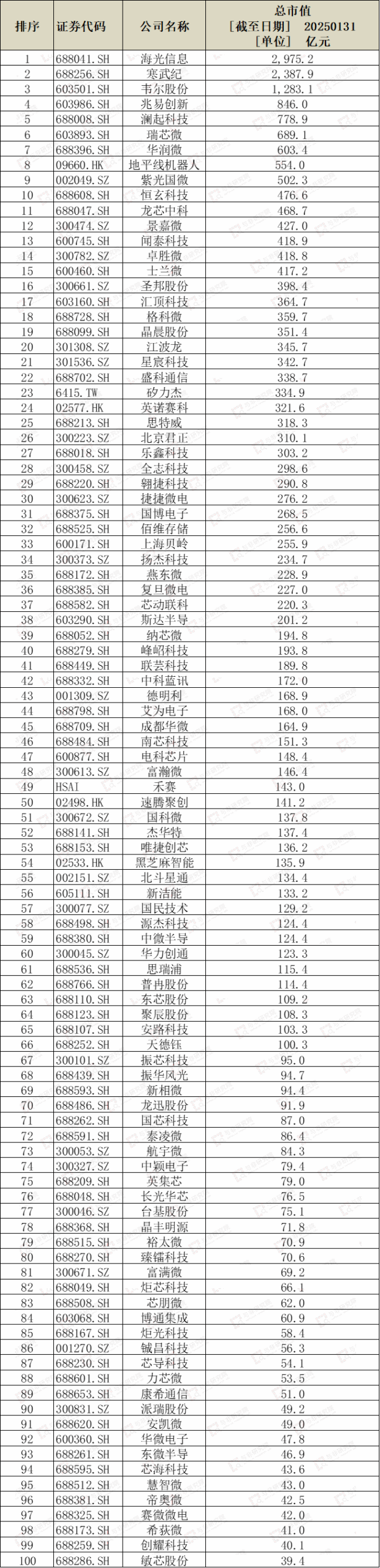

Appendix: Top 100 Chips List

END

Note: The cover image of this article comes from various sources, including authorized media and self-made by the author.

A group of like-minded friends gather in the Knowledge Star Sphere

Join the “Abao Talks Cars” Knowledge Star, and you can obtain related learning materials for these modules (currently including research reports, online expert sharing, and offline closed-door meetings), covering 16 major sections, detailed list as follows: