The emergence of domain controllers is merely a mid-battle shift.

Author | Anqi

To enrich the electronic functions of vehicles, manufacturers once made a grand effort to equip cars with various ECU components. From 1993 to 2010, the number of ECUs used in the Audi A8 model surged from 5 to over 100.

In stark contrast, in order to optimize the intelligent experience of vehicles, manufacturers are now working on “lightening the load” of ECUs, which has caused them considerable headaches and even led to significant organizational restructuring.

And the “culprit” behind all this is Tesla.

When the Tesla Model S debuted in 2012, it signified the impending end of the era of installing dozens or even hundreds of ECUs in cars, ushering in the age of ECU reduction. Today, the traces of ECUs in the Model 3 have significantly decreased.

A reputable Japanese media outlet, after dissecting and observing the internal architecture of the Model 3, exclaimed, “Tesla is six years ahead of Volkswagen and Toyota.” A Japanese automotive engineer bluntly stated, “We can’t produce this.”

However, reducing the number of ECUs is not as simple as it appears in terms of hardware physical integration. This process requires the gradual separation of hundreds of ECU modules’ hardware and software, followed by injecting the software into a centralized computing unit, ultimately giving rise to a “brain” for the vehicle.

How to simplify this complexity has been a major headache for many manufacturers. Yet, most of the secrets are hidden within a black box known as the domain controller.

The Decline of ECUs and the Emergence of the ‘Domain’ Concept

The so-called domain controller is actually a derivative of manufacturers simplifying ECUs.

In the past, ECUs (Electronic Control Units) were widely present in the vehicle’s engine, transmission, and other underlying components, with each function of the vehicle requiring one or more ECU modules for control, thus facilitating the transformation and processing of information throughout the vehicle. Consequently, the architecture composed of these distributed ECUs is referred to as distributed electronic and electrical architecture.

The more ECUs there are, the richer the vehicle’s electronic functions. However, this also leads to complex wiring layouts and increased vehicle weight, resulting in higher overall costs; on the other hand, due to the involvement of numerous suppliers, the software development of ECU modules has always been out of sync, making subsequent updates difficult, not to mention the currently hot topic of OTA upgrades.

In the era of automotive intelligence, this architecture clearly does not meet the needs of the digital transformation of vehicles, which require the ability to evolve continuously.

Thus, spurred by Tesla, a transformation towards “centralizing ECU functions” is actively underway: traditional ECU modules are beginning to separate hardware from software, with hardware gradually being phased out, and software being consolidated to control multiple functions through a single computing platform.

The domain controller is the black box that consolidates the discrete ECU software functions into a unified whole, and the electronic and electrical architecture based on the “domain” is beginning to emerge.

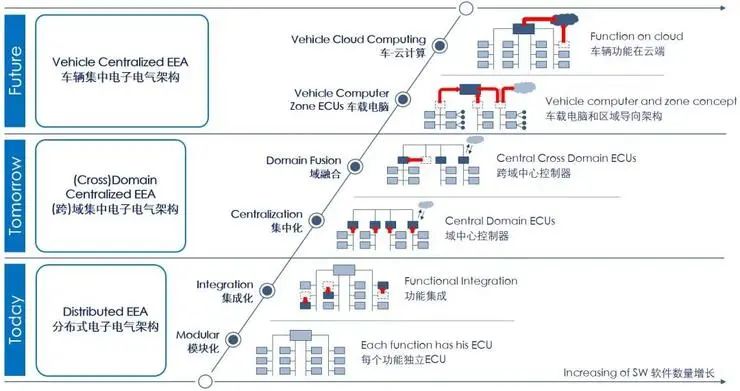

Bosch’s Evolution Diagram of Electronic and Electrical Architecture

Bosch’s Evolution Diagram of Electronic and Electrical Architecture

In this transformation, traditional ECU suppliers may be the first to feel the abrupt change of the times.

A widely circulated evolution diagram of electronic and electrical architecture in the industry comes from the international parts supplier Bosch. Almost all players’ research and development processes for electronic and electrical architecture can be roughly traced on this diagram, including Tesla.

According to Bosch, the progress of the vehicle’s electronic and electrical architecture can be roughly divided into three stages: distributed architecture, cross-domain centralized architecture, and centralized architecture.

So, what level are the industry players currently at in terms of actual progress?

Yu Qingzhou, an expert from local autonomous driving product and service provider Fureitech, told Xinzhijia: Currently, most manufacturers are still in the process of transitioning from distributed to cross-domain centralized architecture, while cutting-edge players like Tesla and Volkswagen have already delved deeply into the field of cross-domain centralized architecture.

However, within the cross-domain centralized electronic and electrical architecture, players can be divided into two categories: one led by Tesla, and the other led by Volkswagen, as stated by Duan Gong, the head of electronic and electrical architecture at Xiaopeng Motors, to Xinzhijia.

As the pioneer of cross-domain centralized architecture, Tesla’s electronic and electrical architecture has been rapidly evolving.

According to Xinzhijia, when the Model S rolled off the production line in 2012, the initial architecture divided the vehicle into distinct domains such as power domain, chassis domain, and body domain, integrating ECU software by functional attributes.

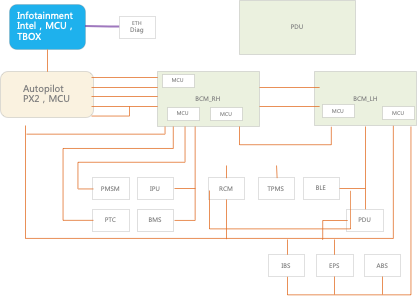

However, by the time the Model 3 was launched in 2017, the division of functional domains had become less distinct, showing signs of cross-domain integration. Its new architecture is divided into three main parts: Central Computing Module (CCM), Left Body Control Module (BCM LH), and Right Body Control Module (BCM RH).

Among them, the Central Computing Module integrates the ADAS domain, infotainment system domain, and communication system domain. In other words, the three major modules will “consume” the ECUs adjacent to their domains, leading to fewer ECU modules in the vehicle and higher integration.

Now, let’s look at Volkswagen.

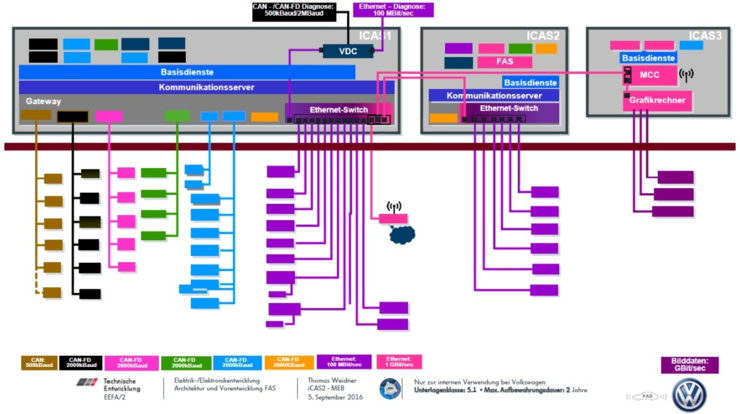

Currently, Volkswagen’s MEB platform has three major controllers, including Vehicle Control Domain (ICAS1), Intelligent Driving Domain (ICAS2), and Intelligent Cockpit Domain (ICAS3), and is still in the functional domain stage, with a relatively high number of distributed modules. More traditional automakers have even lower integration levels, divided into five major domains: autonomous driving domain, power domain, chassis domain, cockpit domain, and body domain.

Volkswagen’s Electronic and Electrical Architecture Diagram

Volkswagen’s Electronic and Electrical Architecture Diagram

Overall, Tesla has now developed to the “location domain,” while Volkswagen is still in the “functional domain” stage. The latter’s architecture is close to that of Tesla’s Model S, hence the statement that “Tesla is six years ahead of Volkswagen and Toyota” is not without merit.

However, Duan Gong from Xiaopeng Motors also stated that the two camps of Tesla and Volkswagen essentially represent a single evolutionary path, with Tesla ahead and Volkswagen slightly behind.

He believes, “Ultimately, the form of the domain controller may only leave a central domain, controlling all vehicle functions through a central computing unit, just like today’s computers and smartphones.”

This is also a common viewpoint in the industry regarding the evolution of electronic and electrical architecture.

After all, if ECU centralization can be gradually achieved, the vehicle communication wiring harness will also be significantly reduced, and the decrease in overall component costs will be evident, so why not?

In addition to Volkswagen, many players in the industry are also evolving towards cross-domain centralized electronic and electrical architecture: for instance, Audi had already equipped the A8 model with the zFAS domain controller for autonomous driving; General Motors has also launched the new generation electronic and electrical architecture Global B;

Domestic new car manufacturers like Xiaopeng Motors have equipped the P7 model with an autonomous driving domain controller based on the Nvidia Xavier chip; Li Auto has also stated that it will launch an autonomous driving domain controller based on the Nvidia Orin chip in 2022.

Similarly, parts suppliers are also actively transforming in this trend: Bosch stated at a media event that it has already secured its first local cockpit domain control project, which will achieve mass production in the fourth quarter of 2021, with the first global cockpit domain controller project set for mass production in the second quarter of 2022.

Previously, Huawei’s MDC intelligent driving computing platform is essentially an autonomous driving domain controller.

The War in a Nutshell:

The Soul of the Domain Controller Lies in Software

However, since Tesla appears to be on a more advanced path, why do other manufacturers seem to be lagging behind in their progress?

Several industry insiders who spoke with Xinzhijia indicated that the traditional automotive industry chain system is a significant obstacle. With the cancellation of distributed ECU modules, the traditional automotive supplier system will face tremendous disruption.

Wu Lihua, Director of the Intelligent Connected Center at BYD, told Xinzhijia: Once EUC is integrated into the domain, many quality suppliers may face the risk of elimination.

“Attractive interests are like the soul of others.” One industry insider lamented.

The old industry chain is difficult to shake, which determines that many manufacturers find it challenging to follow Tesla’s path.

But this is just one reason.

Duan Gong from Xiaopeng Motors also stated that even if some manufacturers are determined to undergo organizational and systemic changes, they will still face a daunting challenge: after “consuming” the distributed modules, with the separation of hardware and software, is there a dedicated supplier capable of integrating the software?

One industry insider pointed out directly: “Currently, there seems to be no mature software supplier within the existing supplier system.” Although everyone talks about software-defined vehicles, has a mature software business model been explored? In fact, no one has figured it out yet.

Because in the past, suppliers mostly provided integrated hardware and software services, and there are very few dedicated automotive software supply platforms that can adapt to various chip platforms.

Therefore, the software capabilities embedded in the domain controller have become the top priority pursued by various players.

Huawei MDC Intelligent Driving Computing Platform

Huawei MDC Intelligent Driving Computing Platform

This industry insider also clarified: Many people mistakenly believe that the domain controller is merely a box, but in reality, software is the soul of the domain controller (provided that the chip’s computing power keeps up).

Thus, the difficulty of transitioning from distributed architecture to centralized architecture does not lie in the cancellation of ECU physical modules, but in how to integrate the originally distributed software.

Taking the intelligent driving domain controller as an example, Yu Qingzhou from Fureitech told Xinzhijia that the software algorithms of the domain controller actually consist of three layers: the bottom layer includes algorithms for cameras and other sensors, the second layer consists of basic driving function algorithm software (including L2-level assisted driving functions), and the third layer encompasses advanced intelligent driving functions such as navigation-assisted driving.

Very few manufacturers can fully self-develop these three layers of functions, and they will inevitably need to collaborate with suppliers.

“In short, if manufacturers want to adopt domain controllers, they must throw away the original setup. But after discarding it, they will face high demands on their foundational capabilities.” said the aforementioned industry insider.

Therefore, against the backdrop of a traditional industry chain that is difficult to pivot and a new software ecosystem that is not yet mature, many traditional manufacturers are struggling to break the old and establish the new.

However, for players like Tesla and domestic new car manufacturers, without too much historical baggage and systemic burdens, as long as they are willing to invest heavily in self-development, the path to centralized electronic and electrical architecture may be somewhat easier.

The Era of Software-Defined Vehicles:

Will the Relationship Between Manufacturers and Tier 1 Suppliers Be Rebuilt?

Currently, there is a general consensus in the industry: this is the era of software-defined vehicles. There are many voices advocating self-development within manufacturers, and many manufacturers are aggressively recruiting for their software teams.

So, will software self-development become the only way out for manufacturers?

One industry insider bluntly pointed out: “Tesla is an exceptional outlier, but if all manufacturers follow Tesla’s lead, they will surely fail.” Because most manufacturers do not have Tesla’s genes, it is actually difficult for them to go all in.

Nevertheless, software capabilities are increasingly becoming the “Achilles’ heel” of players in the industry chain. The centralized control of software capabilities by manufacturers may lead to a reconstruction of industry chain relationships.

Wu Lihua from BYD stated that because BYD has accumulated considerable experience in ECU development, it is currently also engaged in the research and development of intelligent cockpit and autonomous driving domain controllers. Therefore, he believes that in the future, manufacturers will gradually take on the role of software contractors.

The traditional relationships and structures between manufacturers, Tier 1, and Tier 2 may undergo some changes. The traditional approach is for Tier 2 to empower Tier 1, which then empowers OEMs. However, as manufacturers centralize domains, they will need to master more software development capabilities and may communicate directly with Tier 2.

“Tier 1 may become purely hardware suppliers, or even contract manufacturers, although there may be some transitional phases where both parties engage in some software development,” Wu Lihua said.

It is evident that this presents a transformative challenge filled with uncertainties for parts suppliers.

However, the aforementioned industry insider stated that from an economic perspective, there are some common and mature functions that manufacturers do not necessarily need to develop themselves. What manufacturers need to do is to lead the trend in certain functions and differentiate themselves in that regard. But if manufacturers do not possess strong vertical integration capabilities from top to bottom, they may still need to rely on the capabilities of the ecosystem.

Therefore, in the era of domain controllers, how the industrial layout between manufacturers and Tier 1 will be rebuilt remains uncertain.

As Duan Gong from Xiaopeng Motors said, there is no right or wrong in the relationship between manufacturers and Tier 1, only suitable and unsuitable, ultimately depending on the capabilities of the manufacturers themselves.

How Far Are We From the ‘Central Brain’ of Automobiles?

With the emergence of domain controllers, the evolution of automotive intelligence is accelerating. The ideal future state is for vehicles to possess a complete computing platform—a central brain.

But this poses a significant challenge for everyone; even Tesla is still progressing towards a centralized electronic and electrical architecture.

So, what challenges might arise in transitioning from 3-5 domain controllers to a centralized electronic and electrical architecture?

This answer involves various aspects, such as whether the computing power of AI chips can support it, whether the vehicle’s operating system can keep up, and whether there are mature software suppliers, etc.

Duan Gong from Xiaopeng Motors emphasized: Because the central domain controller may take the form of a computer, the most critical capability will come from the vehicle’s operating system, which needs to connect with both upper-layer software applications and lower-layer hardware resources.

This is both a core highlight and a challenge.

Because the demands of the various “domains” such as cockpit domain, intelligent driving domain, power domain, and body domain on the operating system are not consistent. For instance, the cockpit system has high requirements for screen color processing and rendering, while intelligent driving functions have particularly high safety requirements.

He stated that currently, there is no chip or embedded hardware platform that can simultaneously support rich image processing with high computing power, high performance, high storage, and a very rich set of IO interfaces.

“If the vehicle truly reaches this point in the future, I believe whoever first develops this operating system will be able to create a platform and may even monopolize the industry.”

In addition to the challenges at the hardware level, the software industry chain in the automotive sector also faces the possibility of reconstruction.

“There must be software suppliers in the industry chain; otherwise, this cannot be accomplished,” said one industry insider. He believes that the industry may develop a few substantial software suppliers in the future, providing services for the automotive brain through software platforms.

Transitioning to a centralized architecture may take 3-10 years, according to Huang Li, Director of the Research Institute at Desay SV.

Conclusion

At the beginning of any industry transformation, there are always conflicts of interest and the establishment of new rules, and the transformation triggered by the decline of ECUs is no exception.

In the process of evolving the vehicle’s electronic and electrical architecture towards centralization, the trend of “software-defined vehicles” also conceals numerous opportunities for the rise of various tracks and enterprises.

The emergence of domain controllers is merely a mid-battle shift.

What is certain for the future is that the transformation of the automotive “central brain” and the competition for discourse power in the era of intelligent vehicles will drive various players in the industry chain to forge ahead.

Although Tesla stands at the forefront, there are many determined and resilient players among the latecomers. This transformation is far from complete, and the clashes among players are just beginning.

The best show has just begun.

END

Apple’s True or False Car Dream: Disruptor of the Automotive Industry or Barbarian of the Industry?

The Transformation of the Five Major German Automakers Towards “Electrification”: The Battle is Fierce, and the Show is Still Far From Over

Click to learn more information, and you can also “share”