The overseas disperse dye giant, Huber, has filed for bankruptcy.

This is mainly due to being unable to compete with the prices of Chinese disperse dyes; foreign companies simply cannot match our costs.

A certain photovoltaic company has also driven others out of business, including its own peers, resulting in a significant drop in its stock price and massive losses. The same fate awaits the new energy vehicle sector. But is it really good to force others into a corner in such a cutthroat market?

——————

There are rumors that public funds are significantly reducing salaries, with a cap of no more than 1 million annual salary.

Since the year before last, rumors about salary caps in the public fund industry have been swirling, with increasingly exaggerated versions, from a ceiling of 50 million, shrinking to 15 million, 10 million, 5 million, 3 million, and now the latest version is a mere 1.2 million annual salary.

In fact, the core issue of salaries among public funds is not that the average salary is too high, but that there is too much internal disparity; a very small number of people have taken the lion’s share of the profits during the bull market cycle, while most practitioners do not enjoy the glamorous image that outsiders imagine.

Of course, the current predicament of public funds is also self-inflicted; they manage investors’ money to trade stocks, and they still collect management fees even when losing money, engaging in risk-free transactions. The situation has reached this point because of their own actions, and even if salaries are reduced, it is a consequence of their own making.

Although an annual salary of 1 million is astronomical for ordinary people, for those who originally earned 50 million a year, now only receiving 1 million is unbearable, so many top fund managers are likely to turn to private equity.

Private equity is also not easy. When public funds lose money, investors can only accept their fate; if you dare to confront them, security will throw you out, while private equity can directly face criticism, and fund managers can only smile at you.

Of course, even with a salary reduced to 1 million, there are still many who want to work in this field, as it offers risk-free returns.

————–

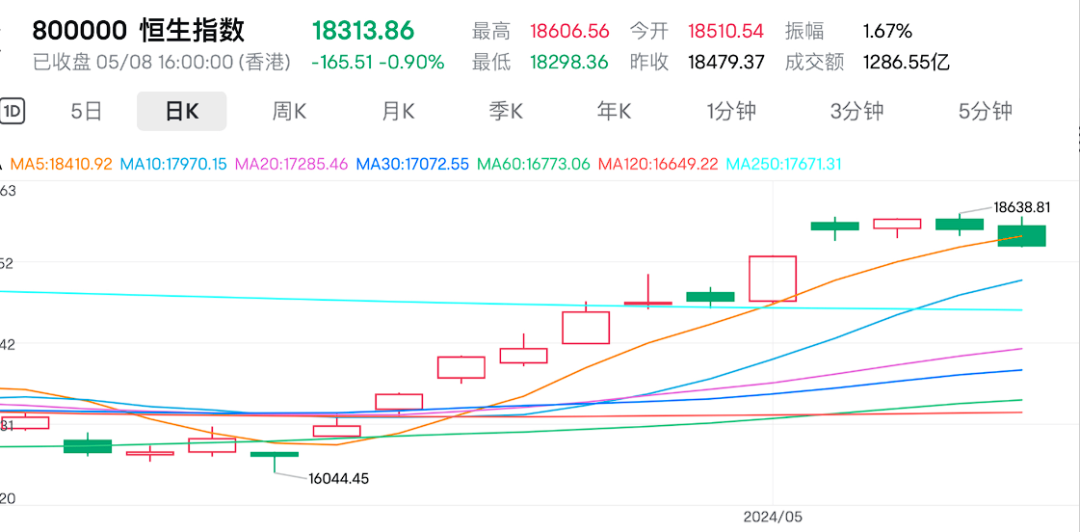

1: Morgan Stanley subtly suggests: The recent surge in Chinese stocks may weaken, recommending to focus on individual stocks rather than chasing index gains.

In fact, the recent foreign capital influx into Hong Kong stocks is influenced by two factors: the depreciation of the Japanese yen and expectations of relaxation in domestic real estate policies. However, the latter is still hesitating to loosen restrictions, and the underperforming real estate sector has indeed faced heavy blows, with Vanke’s limit-up stock price quickly plummeting.

After this report was released, Hong Kong stocks declined, and without strong foreign support, domestic capital in A-shares continues to sell off, remaining lackluster. Recently, funds in the technology AI sector have been flowing out at an accelerated pace, and it is advisable to exit this sector at high points.

My brother has sold off most of his earlier AI tech stocks, and even the continued U.S. sanctions on domestic chips have not spurred any interest; after institutions repeatedly harvested profits, the “four major losers” of A-shares are now not even attracting buyers.

2: The Saudi AI fund states: If the U.S. has demands, they will withdraw their AI investments from a certain country.

Saudi Arabia has been striving to establish its semiconductor industry, but the U.S. requires them to choose between U.S. and Chinese technology, which has also affected the recent decline in tech stocks.

Domestic capital in A-shares has always been watching the face of foreign capital; once foreign capital stops flowing in, the index will drop. This situation has persisted for many years.

3: Offshore RMB at 7.23

————-

Tomorrow’s Observations:

Throughout the day, about half of the 800 billion is likely active quantitative funds, which maintain index stability by frequently boosting dozens of sectors while also selling off many others.

My brother has always believed that this year’s index peak will not exceed 3400 points, and if it can touch 3200 in May, it will be a blessing.

Many sectors are artificially inflated; the previous hype around flying cars, and now the price increases in synthetic biology and chemicals are all due to these quantitative funds mixed with speculative capital violently impacting market attention. Every month there seems to be a new artificial concept, and today there’s a new one on gene therapy for diabetes, and it’s hard to keep up with the learning.

Currently, stocks with a 10% limit-up, everyone should avoid chasing; these industrial chains are very dirty, you won’t be able to buy in line, and if you do, you’ll end up in a pit with consecutive limit-downs.

A few days ago, the real estate stock Nanguo surged to its limit, and after opening yesterday, it faced a massive limit-down today, causing many who rushed in to suffer losses.

Trend Arbitrage Model: Chip Sector: Eager to try Military Industry Sector: Crossing the river by feeling the stones Liquor Sector: Drowning sorrows in alcohol Innovative Pharmaceuticals: Policy Support Lithium Battery Sector: Adding insult to injury Photovoltaic Sector: Going with the flow Real Estate Sector: Policy Support Tourism and Hotels: Come back in summer Artificial Intelligence: Approach with caution Coal Sector: High double tops Non-ferrous Metals: High position selling Special Valuation: Halo effect Securities Sector: Even the floating corpses have their spring

PS: Today, the market only had two sectors, synthetic biology and chemical price increases, which still yielded profits, while there were signs of over 4000 collective declines.

Before the U.S. confirms interest rate hikes, the A-share index will be firmly held down by invisible hands. The battle between high blood pressure and low blood sugar has reached its final critical six months.

The index remains stable, and it is estimated that in May it will fluctuate between 3050 and 3150 points. Typically, the market rises for three days and then falls for one, using this method to adjust the amplitude and speed of the rise.