SoC (System-on-Chip), also known as a system-level chip, is an integrated circuit solution that integrates all components required by the system onto a single chip. SoC chips embed functional modules such as a central processing unit, digital signal processor, power management system, memory, and input/output systems, making their internal structure complex and requiring high standards for research and development design, manufacturing processes, and hardware-software collaborative development technologies.

SoC chips integrate multiple specific functional modules, containing a complete hardware system and embedded software. Compared to single-function chips, SoC chips have high integration, low power consumption, and comprehensive performance, making them the mainstream direction in integrated circuit design and development, serving as the core components for computation and control in various electronic terminal devices.

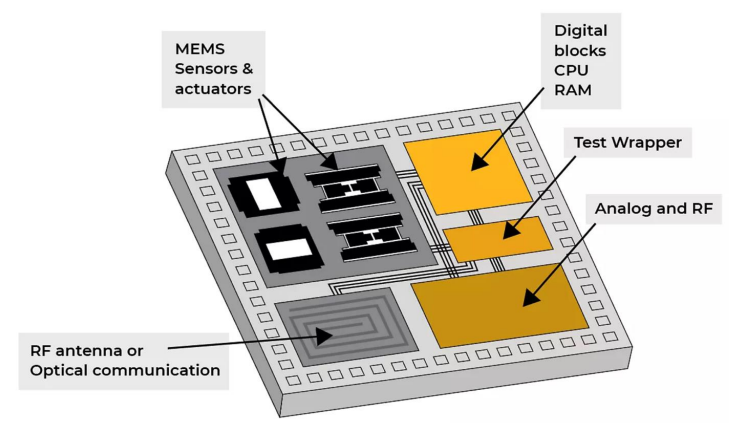

Diagram of a System-on-Chip

Source: Ansys, Dongxing Securities Research Institute, Sihan

IP cores are the fundamental units and core technological support for SoCs. An IP core (Intellectual Property core) refers to a chip design module in the integrated circuit design industry that is verified, reusable, and has specific functions, forming the core of SoC design technology based on IP modules. IP cores can be categorized by function into CPU, GPU, DSP, VPU, bus, and interface, with their reusability and reliability directly determining the efficiency and performance of SoC design, serving as the foundational support for SoC applications.

Common IP Cores

CPU The central processing unit of SoC chips runs system software/application software, working with other hardware modules within the SoC chip to realize various product functions.

GPU The graphics processing unit of SoC chips enables the rendering of various games, graphical UI interfaces, effects, and high-performance computing that can run on SoC chips.

DSP Used for running computationally intensive algorithm software or applications, such as video encoding/decoding, graphics/image processing, visual image processing, and speech processing.

VPU Video/image encoding and decoding unit, using hardware acceleration engines to implement video/image data encoding, compression, and decoding/playback of various video formats on terminal products.

Bus Used for data access and interconnection between master and slave devices within SoC chips, enabling high-performance simultaneous access to multiple slave devices.

Interface Connects SoC chips to other chips or peripherals, used for external memory, cameras, various displays (including TVs), USB devices, etc., or for implementing various high-speed data transmissions.

Process Physical Library Used to optimize the process unit library for high-performance IP cores like CPU/GPU to improve the design frequency of high-performance IP cores.

Currently, AI technology has become an important component of SoC architecture, providing more powerful intelligent processing capabilities for edge devices, with AI applications continuously penetrating various industries and multi-domain scenarios. As we enter the era of AI, 5G connectivity, and edge computing, SoCs continue to evolve to meet the growing complexity and processing requirements. For example, by integrating AI accelerators, neural network processors (NPU), and other dedicated hardware, SoCs can accelerate the execution of AI algorithms, improving processing speed and efficiency:

Supporting the operation of devices such as smartphones and tablets in the smart terminal field; enabling remote control and data interconnection of devices in smart home and IoT scenarios; assisting in autonomous driving and entertainment navigation systems in automotive electronics; completing precise control tasks in embedded systems in industries such as medical, aerospace, etc.; achieving efficient storage and routing functions in data centers and network devices; providing computing power support for video and audio processing and AI fields.

AI scenarioization has become an excellent opportunity for the accelerated development of the smart home industry, with the demand for complex calculations and decision-making on core chips continuing to rise. Smart homes are an important application scenario for AIoT devices, where smart appliances and other home devices can not only perform basic tasks but also independently handle complex AI tasks through built-in high-performance processors, providing a higher level of intelligent services. According to the China Business Industry Research Institute, the market size is expected to reach 784.8 billion yuan in 2024, and exceed 800 billion yuan in 2025. As the functions of smart home devices become increasingly complex and rich, such as robotic vacuum cleaners and smart locks, the computing power requirements for core chips continue to rise.

The localization process of smart cockpit SoCs is accelerating, with AI-oriented cockpit SoCs expected to become mainstream in the next 2-3 years. According to Zosi Automotive Research, the localization rate of smart cockpit SoCs is expected to exceed 10% by 2024, with domestic manufacturers like Chipone Technology, Huawei HiSilicon, and ChipQing Technology rapidly emerging.

Currently, smart automotive cockpit SoCs are entering a product replacement cycle, with AI-oriented cockpit SoCs expected to become mainstream in the next 2-3 years. Leading edge-side models are evolving from the current large language models of 1B-1.5B parameters to multimodal models around 7B-10B. For example, Chipone Technology released its next-generation AI cockpit chip X10 at the 2025 Shanghai Auto Show. This SoC adopts a 4nm advanced process and supports the edge-side deployment of a 7B parameter multimodal large model.

Chipone Technology’s next-generation AI cockpit chip X10

Source: Eefocus, Chipone Technology, Dongxing Securities Research Institute

It is expected that by 2025, the global and Chinese passenger car smart cockpit solution market sizes will reach 429.6 billion yuan and 156.4 billion yuan, respectively, with smart cockpit SoC demand expected to increase simultaneously. As consumer demand for intelligent, connected, and immersive driving experiences continues to grow, it drives the global smart cockpit market size to expand continuously. According to Sihan Industry Research Institute, the global passenger car smart cockpit solution market size is expected to reach 366.8 billion yuan in 2024 (a year-on-year increase of +16.30%), with the Chinese market size at 129 billion yuan (a year-on-year increase of +22.27%). It is expected that by 2025, the global and Chinese market sizes will reach 429.6 billion yuan and 156.4 billion yuan, respectively, with smart cockpit SoC demand expected to increase simultaneously.

“SoC + Smart Wearables”: AI functions initiate a revolution in portable smart devices. Since the launch of Meta’s smart glasses in 2023, companies like Google and ByteDance have launched wearable devices equipped with AI functions, accelerating the iteration of edge-side SoCs towards advanced processes. Small size and low power consumption have become the core technologies, and through integrated design and energy efficiency optimization, SoCs are fully empowering the smart wearables field, leading to breakthroughs in both device form and function. As the core interaction entry point, the global smart wearables market is entering a rapid growth period, with the market size expected to reach 431.74 billion dollars by 2034, with a compound annual growth rate of 19.59% during the forecast period.

Smartwatch AI becomes the focus of major manufacturers, with high-end and energy efficiency becoming key competitive factors. Manufacturers are exploring ways to combine products with AI. Since 2023, companies like Zepp Health, Google (Fitbit), Samsung, Apple, and 360 Group have announced the integration of cloud generative AI into their smartwatches. Smartwatch chips are moving towards low power consumption and high computing power, making multi-core structures the direction of technological iteration as AI large models gradually penetrate smartwatches. The global smartwatch market size is expected to reach 138.7 billion dollars by 2033, with smartwatches combining AI algorithms expected to continue to penetrate.

AI smart glasses accelerate iteration, with SoC solutions determining product differentiation competitiveness. AI smart glasses are currently developing towards the integration of AI and AR: AI enhances the interactive intelligence of AR (such as gesture recognition, eye tracking, etc.), while AR provides a display carrier for the fusion of virtual and real, with the main control SoC becoming the core of differentiation. Currently, AI/AR glasses chips mainly fall into three categories: (1) System-level SoC, such as Qualcomm AR1 Gen1; (2) MCU-level SoC + ISP, such as Hengxuan Technology BES2500YP, BES2700, BES2800, and Zhanrui W517; (3) MCU, such as Fuhang Micro MC6350, Rockchip RK3588 and RK356X, and Juxin Technology ATS3085.

Smart glasses connecting to large models and multimodal interactions (voice, gesture, eye tracking) have become a trend. According to Wellsenn XR, it is expected that by 2025, more major manufacturers will enter the competition, driving the development of AI smart glasses towards maturity. After 2030, the development of AI + AR technology will reach a mature stage, and the AI + AR smart glasses industry will enter a period of rapid development; by 2035, the penetration rate of AI + AR smart glasses is expected to reach 70%, with global sales of AI + AR smart glasses reaching 1.4 billion pairs, becoming the next generation of general computing platforms and terminals, with the rapid growth of smart glasses expected to accelerate the demand for SoCs.

The global SoC market continues to expand, with the global SoC market size expected to reach 20.597 billion dollars by 2029. The growing demand for energy efficiency and compact size in mobile devices, IoT devices, and wearables is driving the popularity of SoCs in the market. SoCs can provide higher processing power in smaller sizes, accelerating their application in wearable and connected devices. With the continuous advancement of artificial intelligence (AI) and machine learning algorithms, the development momentum of AI-optimized SoCs is rapid. AI-optimized SoCs provide edge processing capabilities, enhancing privacy protection levels and extending battery life even in areas with limited network connectivity.

The automotive sector’s demand for SoCs supporting advanced driver assistance systems (ADAS), autonomous driving, and in-vehicle infotainment systems is continuously rising, significantly driving the growth of the SoC market. According to MarketandMarket, the global SoC market size is expected to grow from 138.46 billion dollars in 2024 to 205.97 billion dollars in 2029, with a compound annual growth rate (CAGR) of 8.3% from 2024 to 2029.

For more industry research analysis, please refer to the official website of Sihan Industry Research Institute, which also provides industry research reports, feasibility reports (project approval, bank loans, investment decisions, group meetings), industrial planning, park planning, business plans (equity financing, investment promotion, internal decision-making), special research, architectural design, overseas investment reports and other related consulting service solutions.

About Us

About Us  Sihan Industry Research Institute Chinasihan.comLeader in Chinese Industry ResearchInnovating for the Future CityContact for Customized Report Orders: · Phone:4008087939 0755-28709360 · Customer Service WeChat:g15361035605 · Customer Service QQ:454058156 · Email:chinasihan@126.com

Sihan Industry Research Institute Chinasihan.comLeader in Chinese Industry ResearchInnovating for the Future CityContact for Customized Report Orders: · Phone:4008087939 0755-28709360 · Customer Service WeChat:g15361035605 · Customer Service QQ:454058156 · Email:chinasihan@126.com

· Official Website: Chinasihan.com