Skip to content

1. Definition and Core Modules of SoC Chips

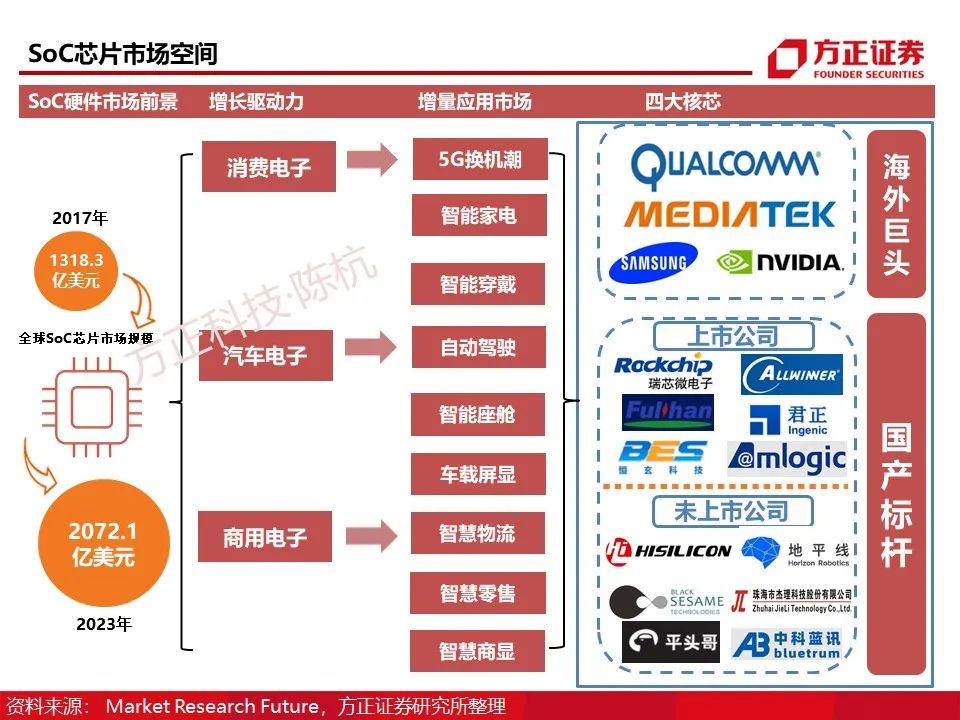

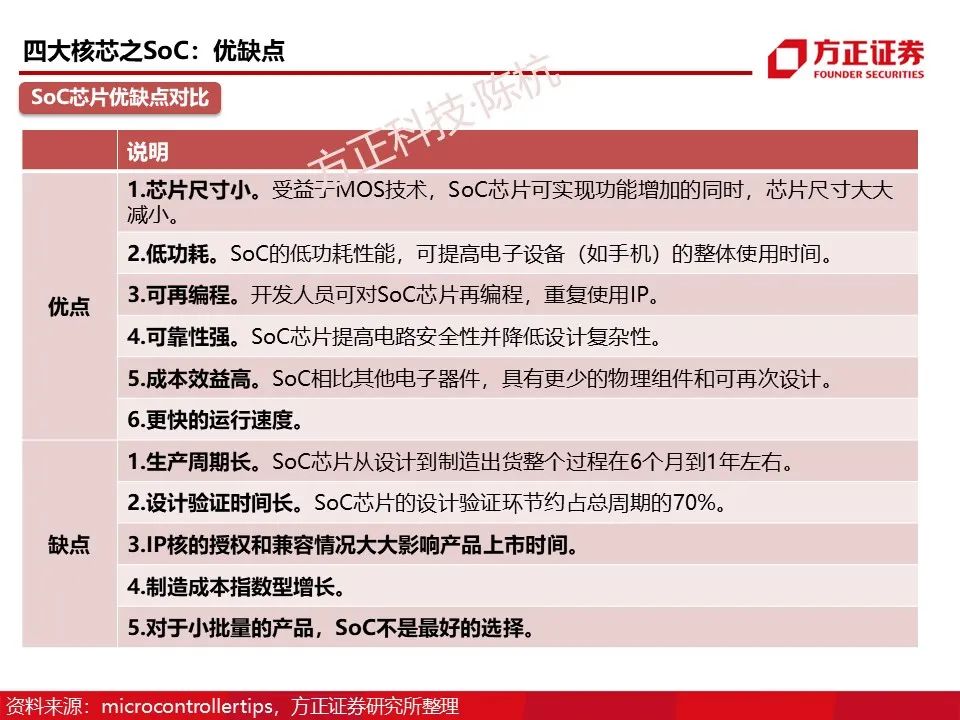

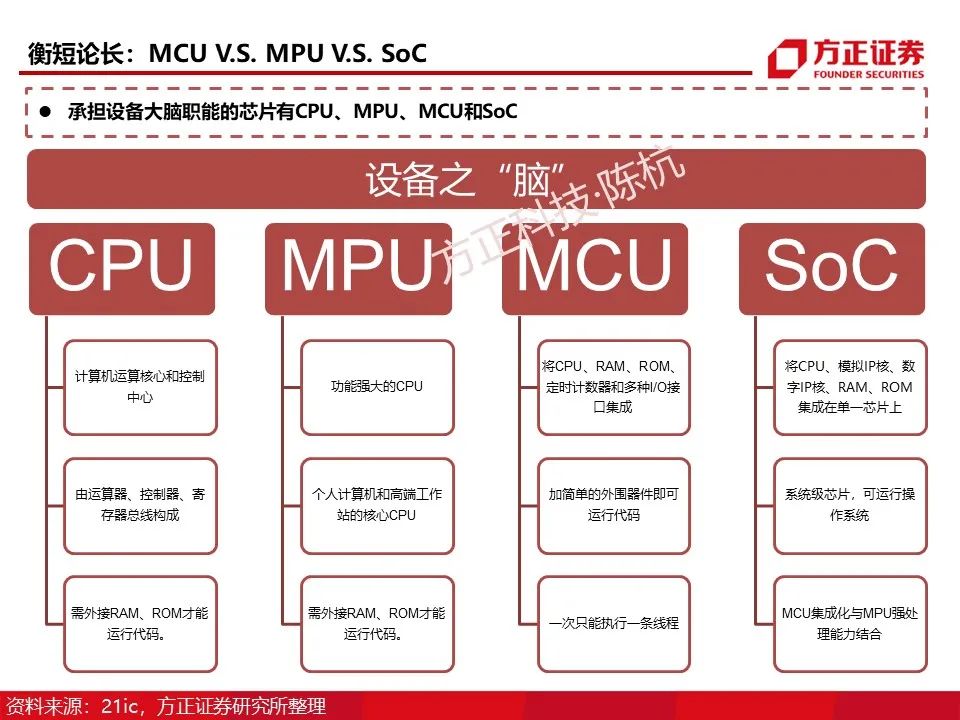

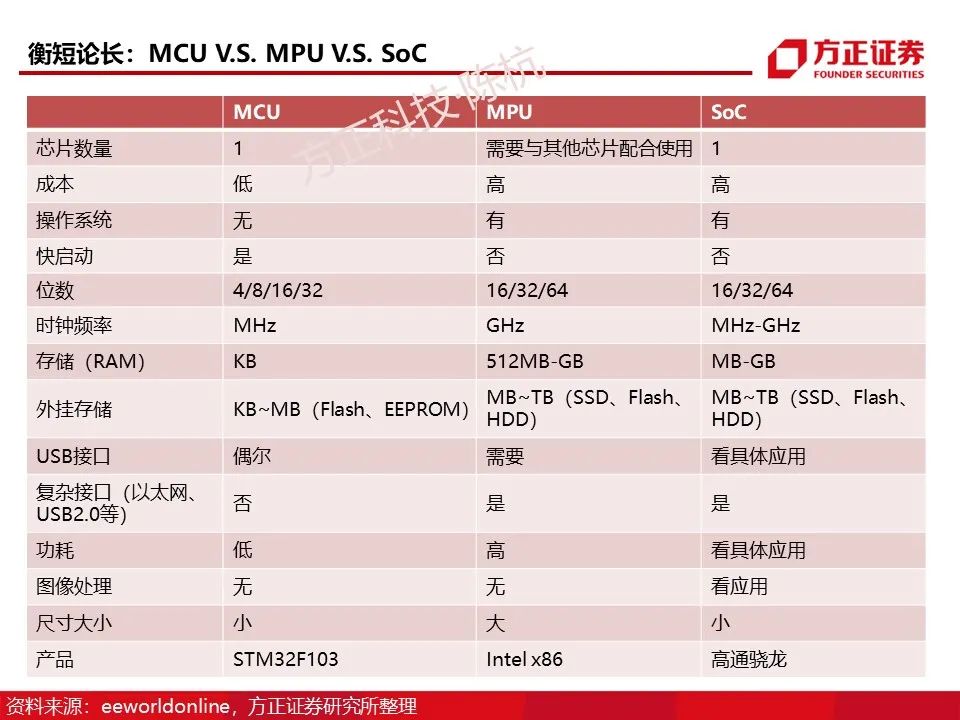

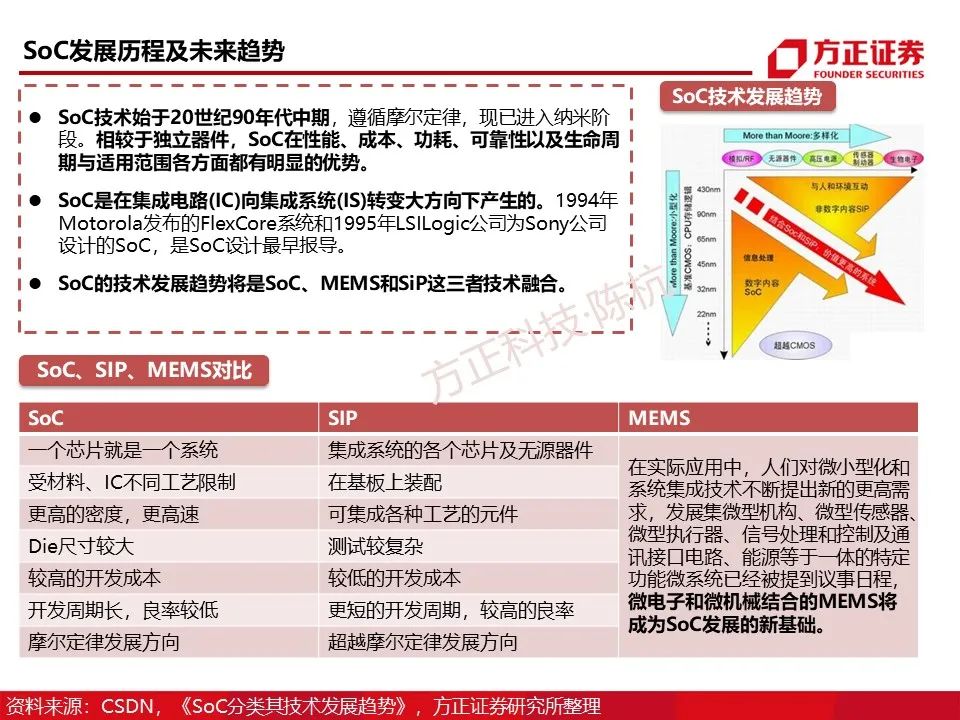

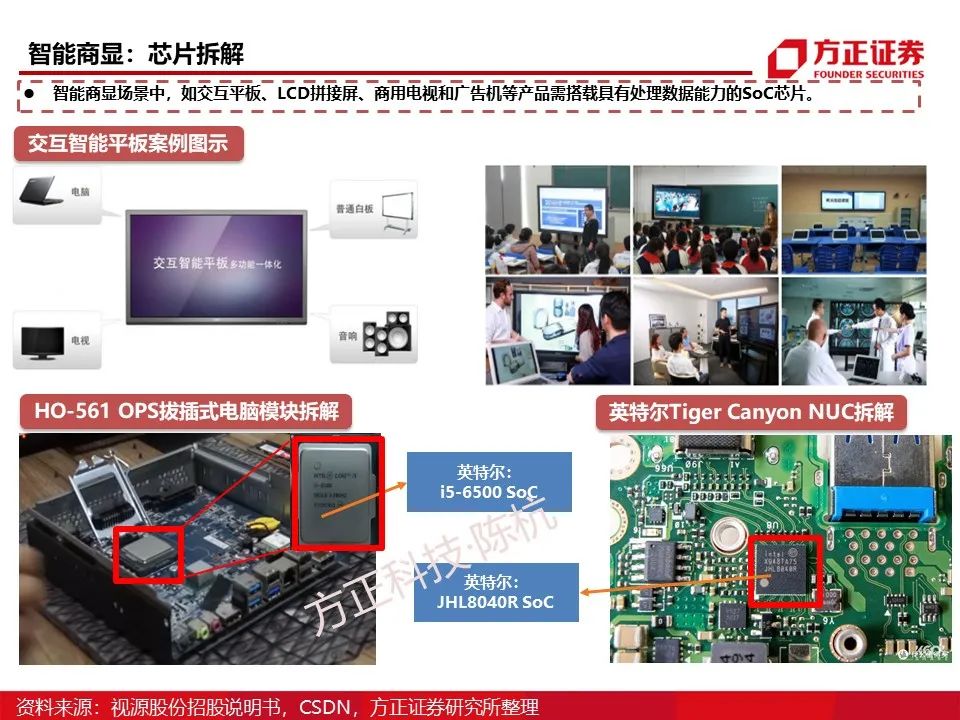

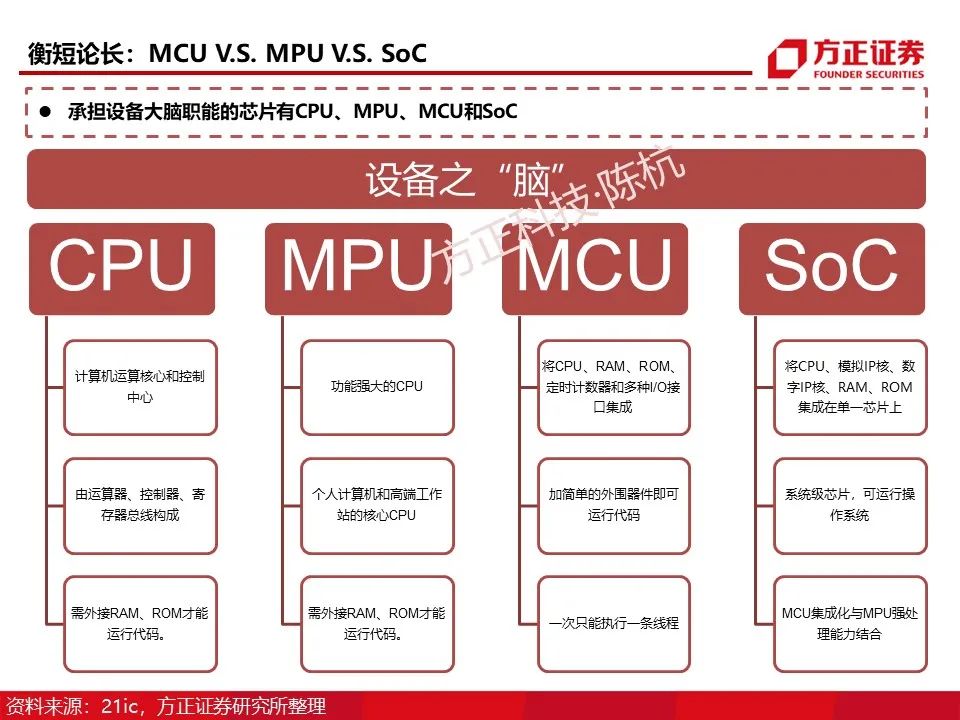

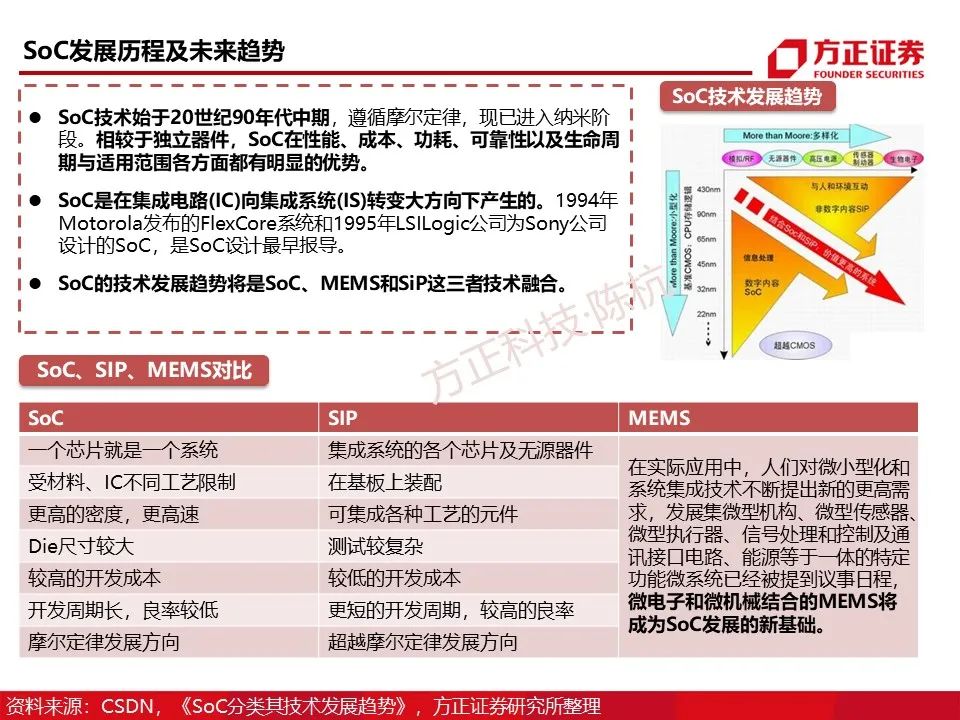

- Definition: SoC (System on Chip) integrates key components such as CPU, GPU, NPU, memory, and baseband into a single chip, achieving complete system functionality. It is the core of smart devices such as smartphones, smart home appliances, and automotive electronics.

- Core Modules: Includes CPU (computational control), GPU (graphics processing), NPU (AI computation), baseband chip (communication processing), ISP (image signal processing), etc. Each module collaborates to achieve data processing, image rendering, AI algorithms, and other functions.

2. Industry Chain Analysis

- Upstream:

- Design Tools and IP Licensing: EDA tools are monopolized by Synopsys and Cadence, with domestic company Huada Jiutian making breakthroughs in analog circuits; IP licensing is dominated by ARM, while the RISC-V architecture is rising, with the T-head Xuantie processor shipping over 2 billion units.

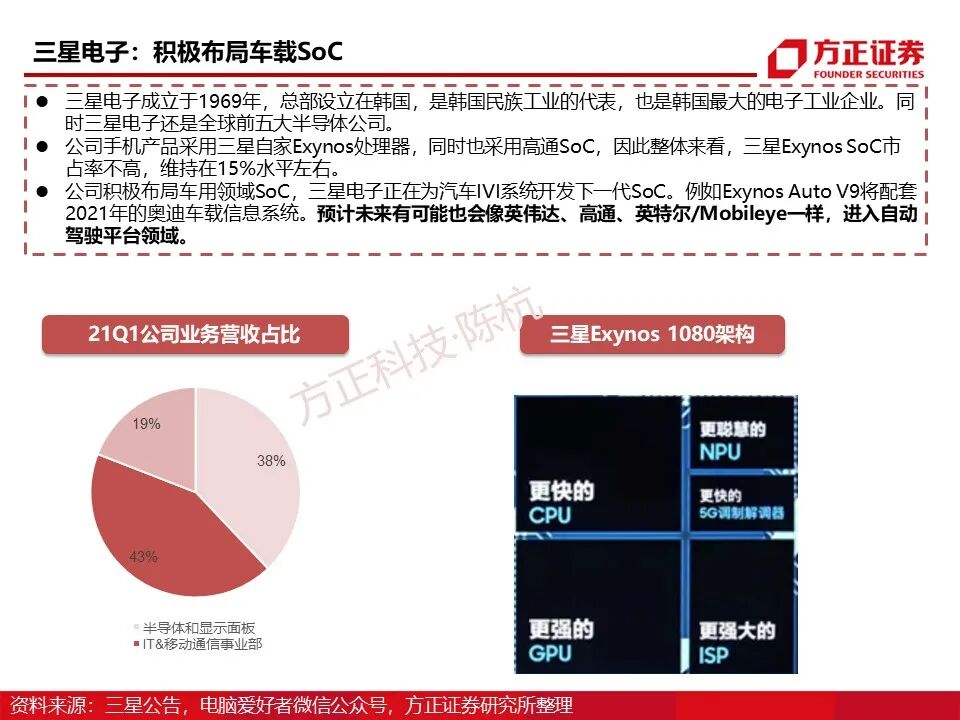

- Wafer Foundry: TSMC and Samsung lead advanced processes (such as 5nm/3nm), while SMIC holds 15% of global capacity in mature processes at 28nm, with a yield of 95% at 14nm.

- Midstream:

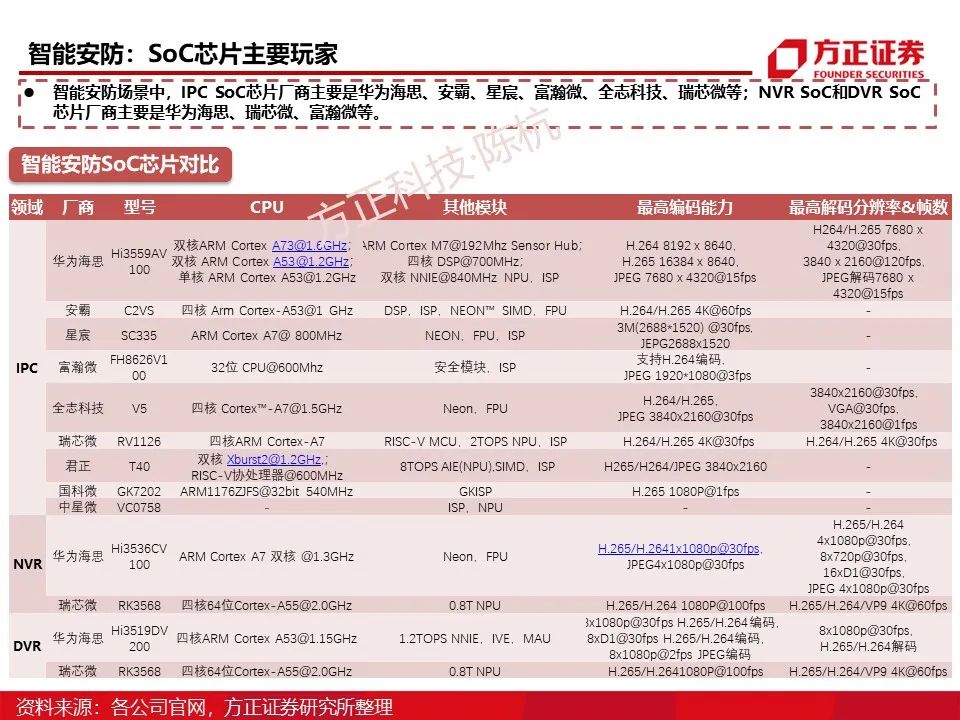

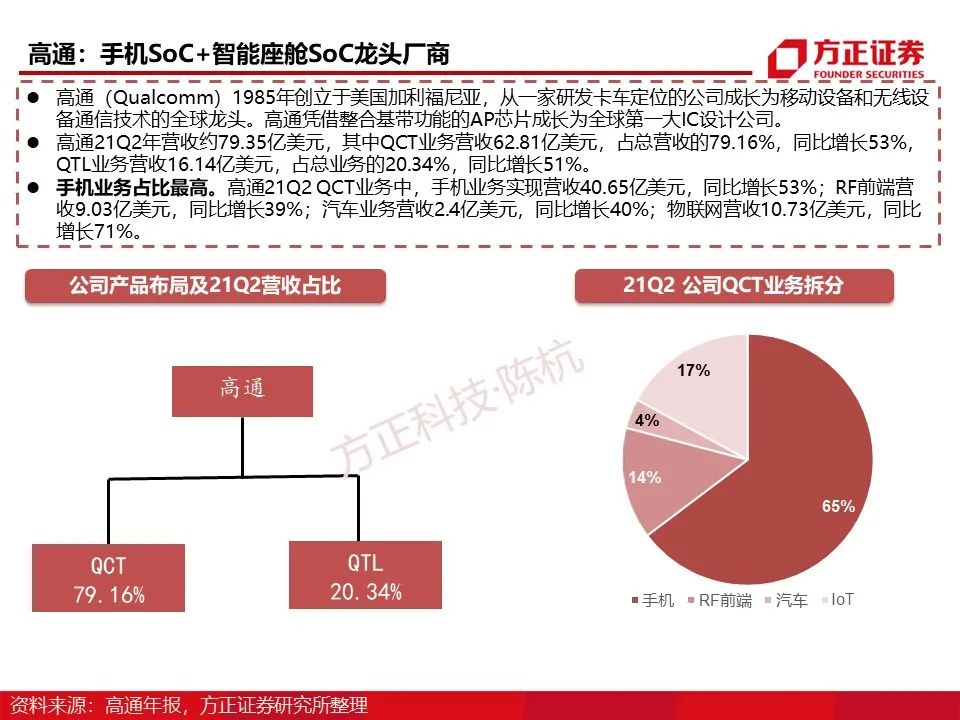

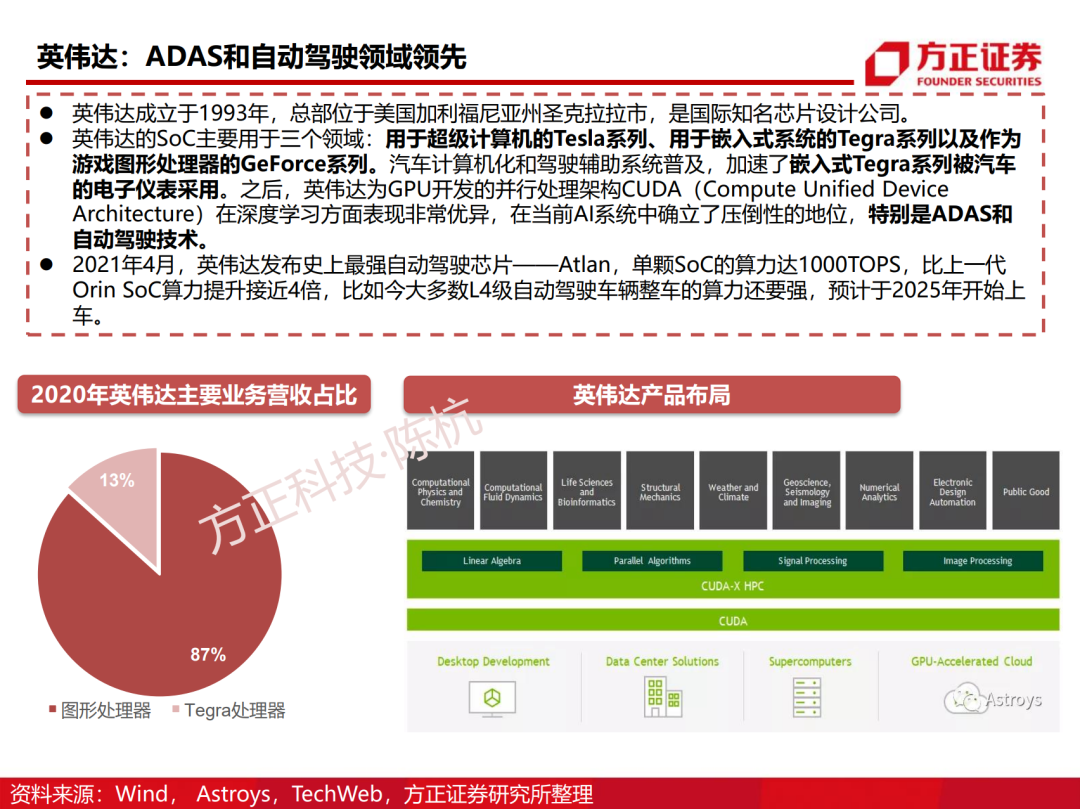

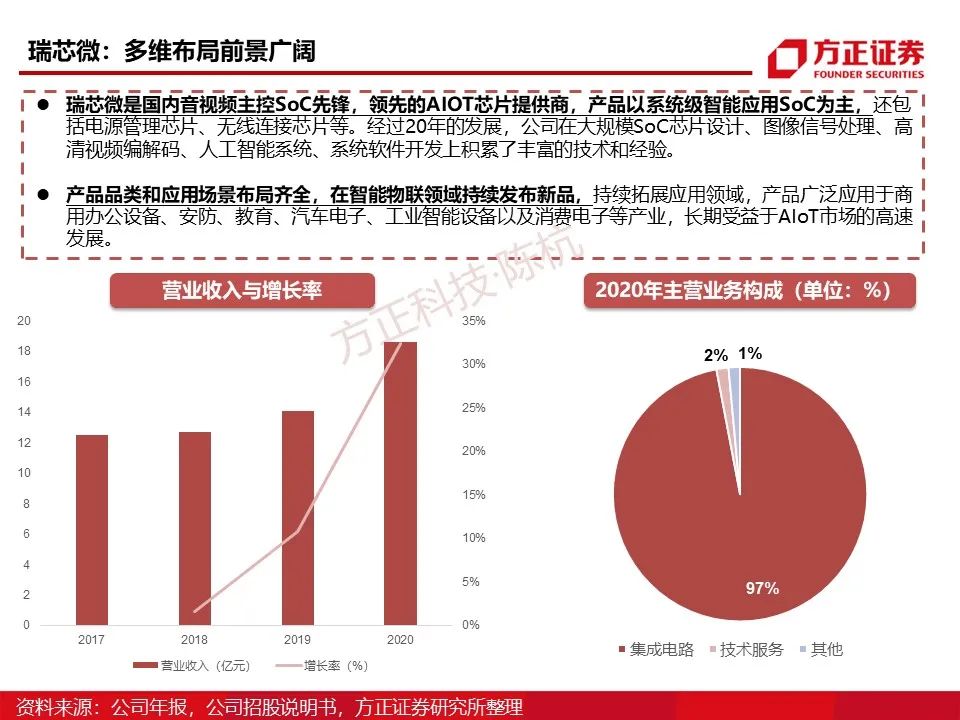

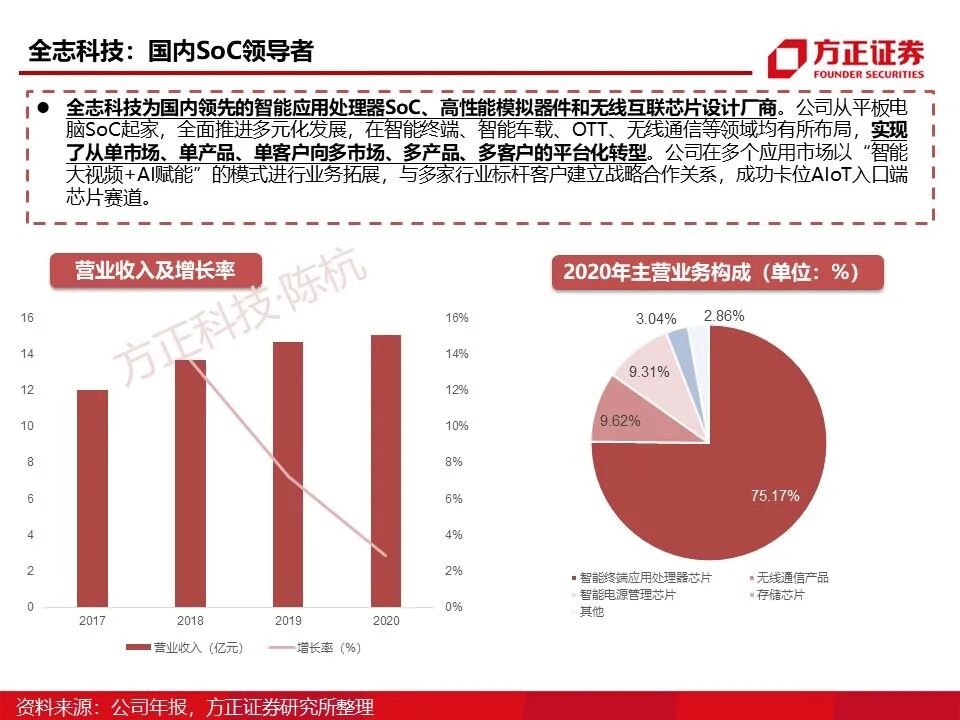

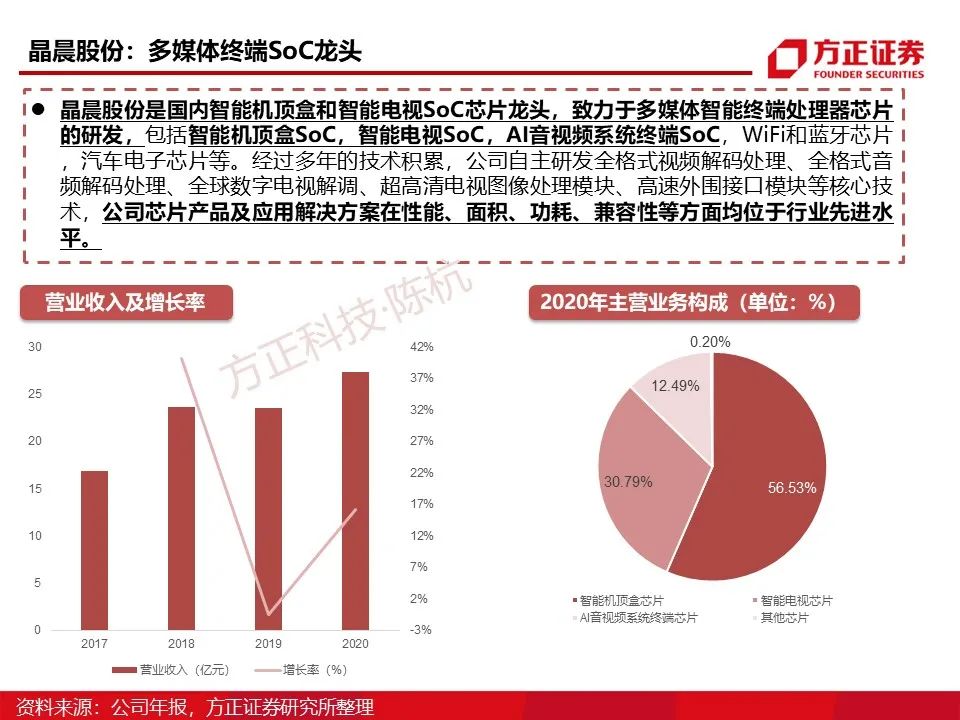

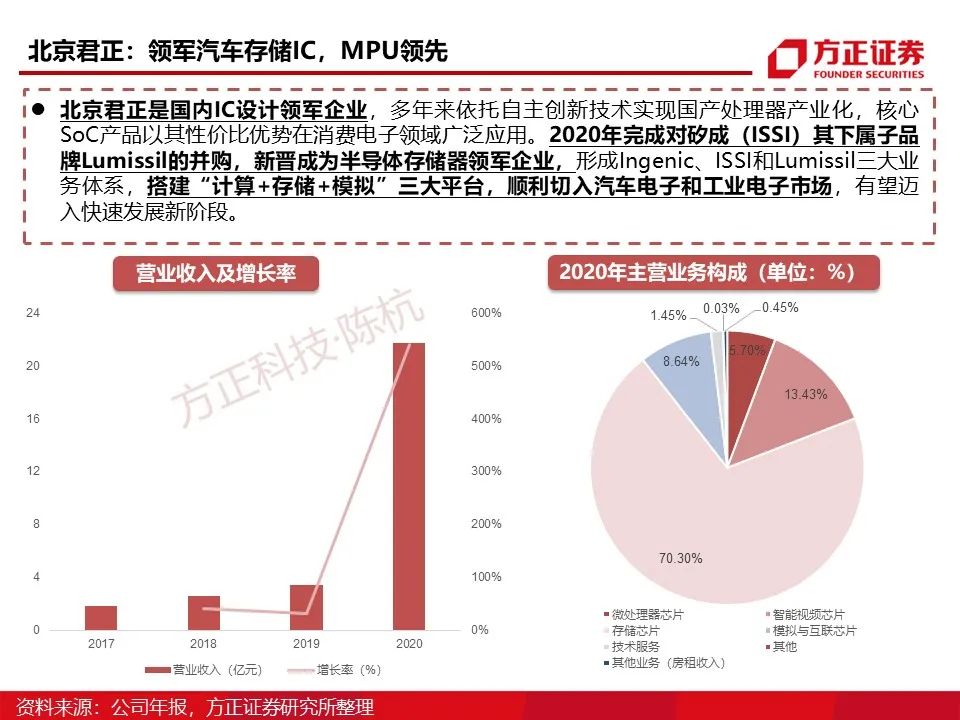

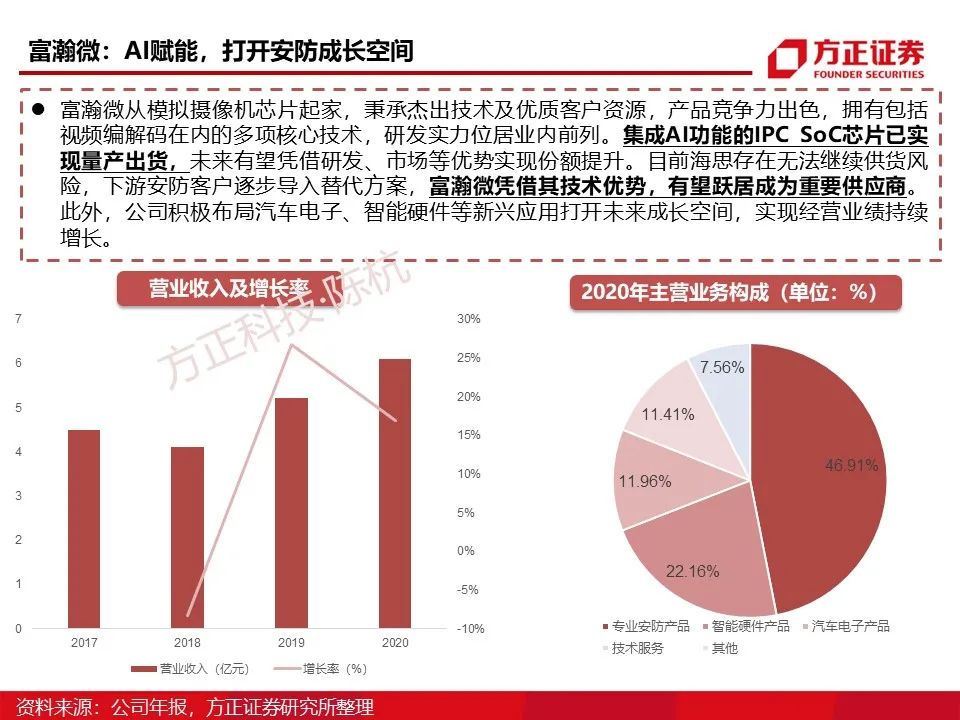

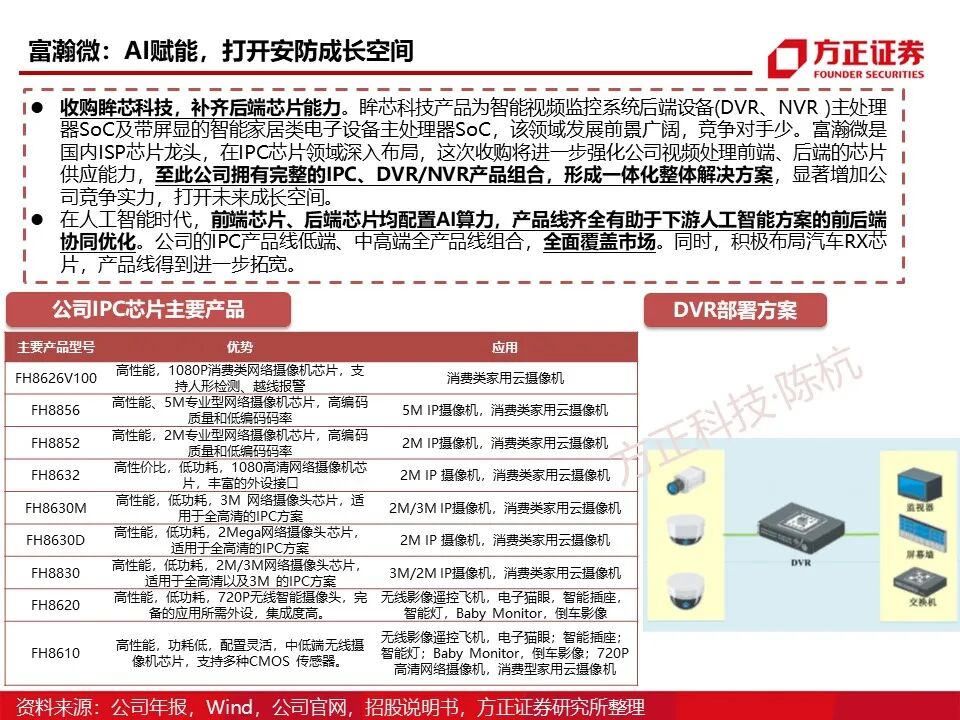

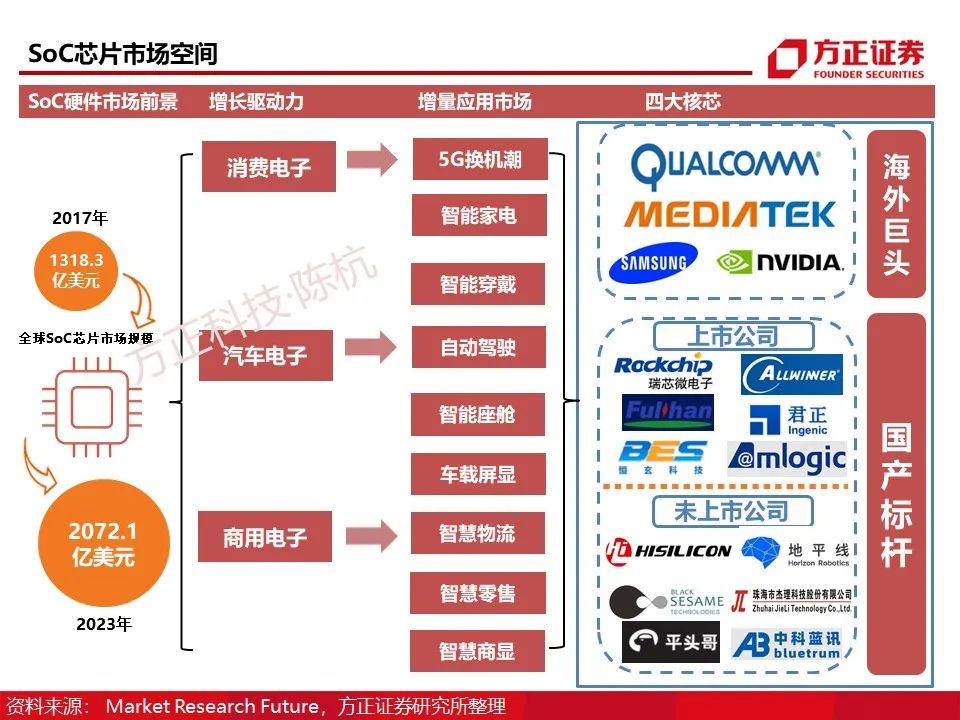

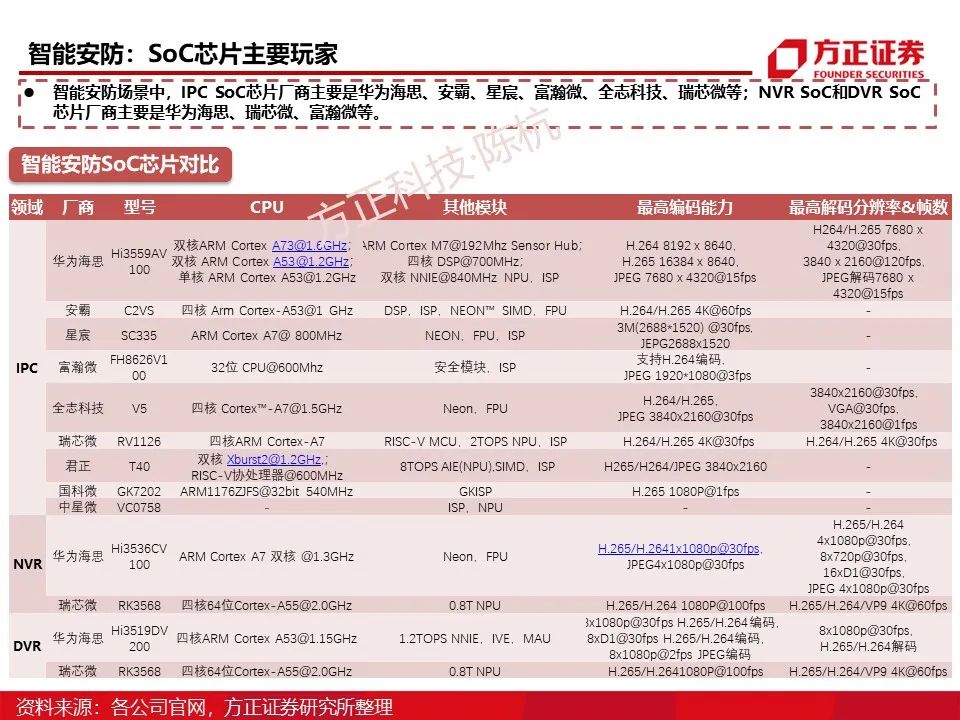

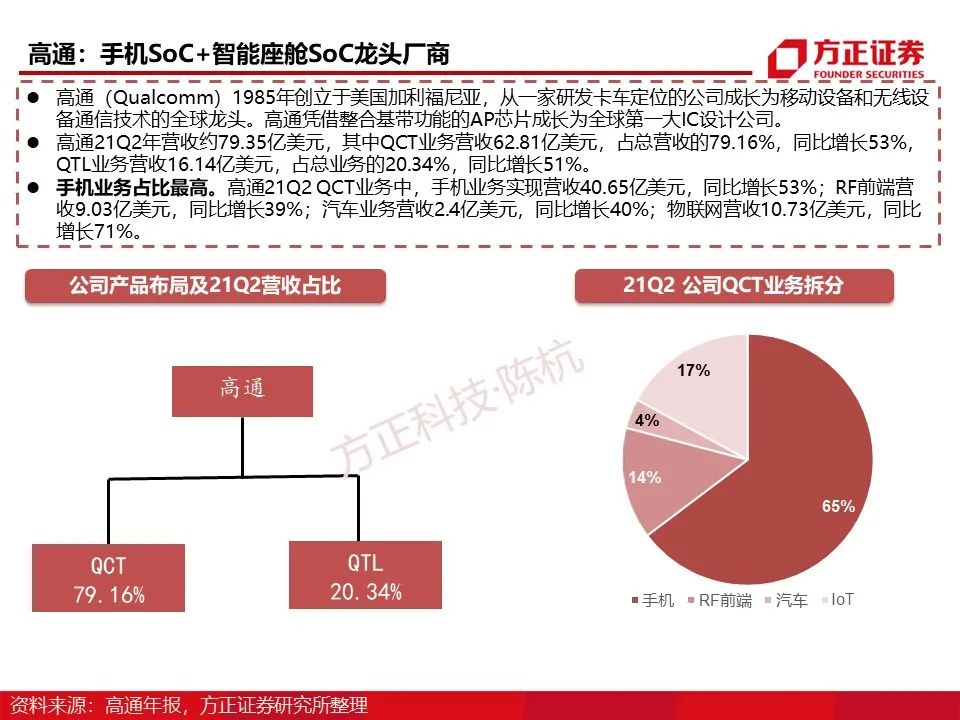

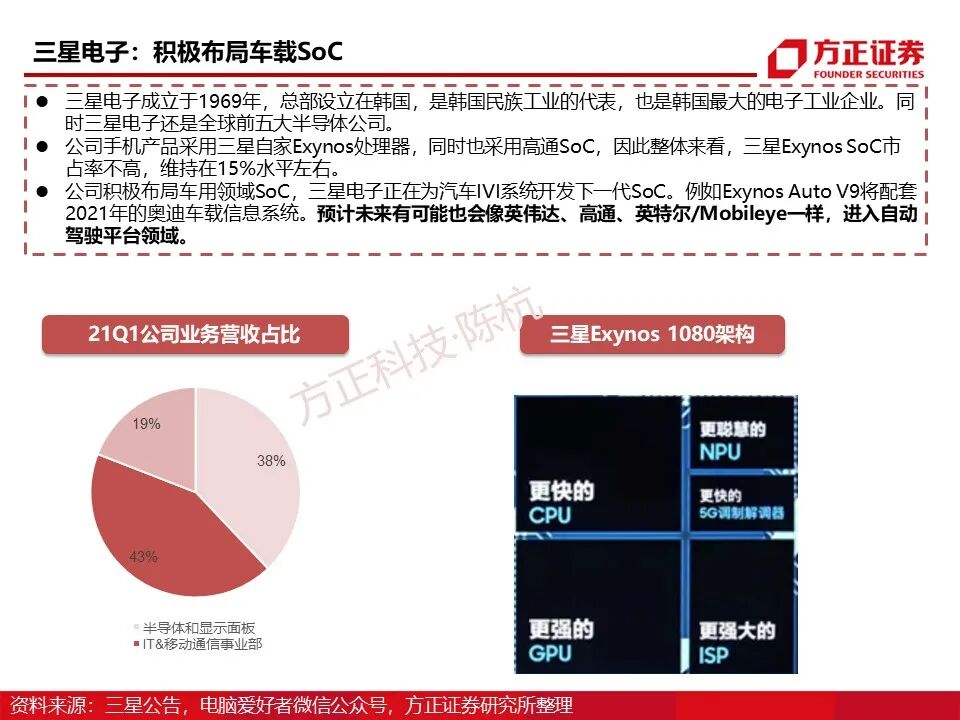

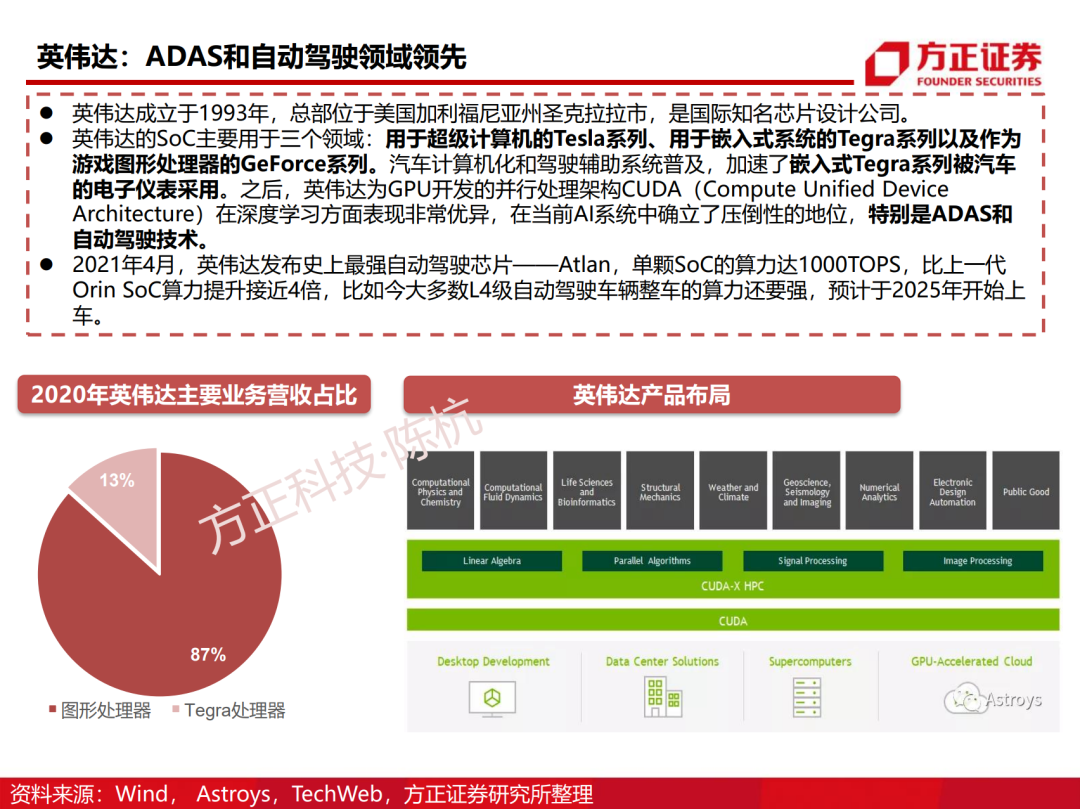

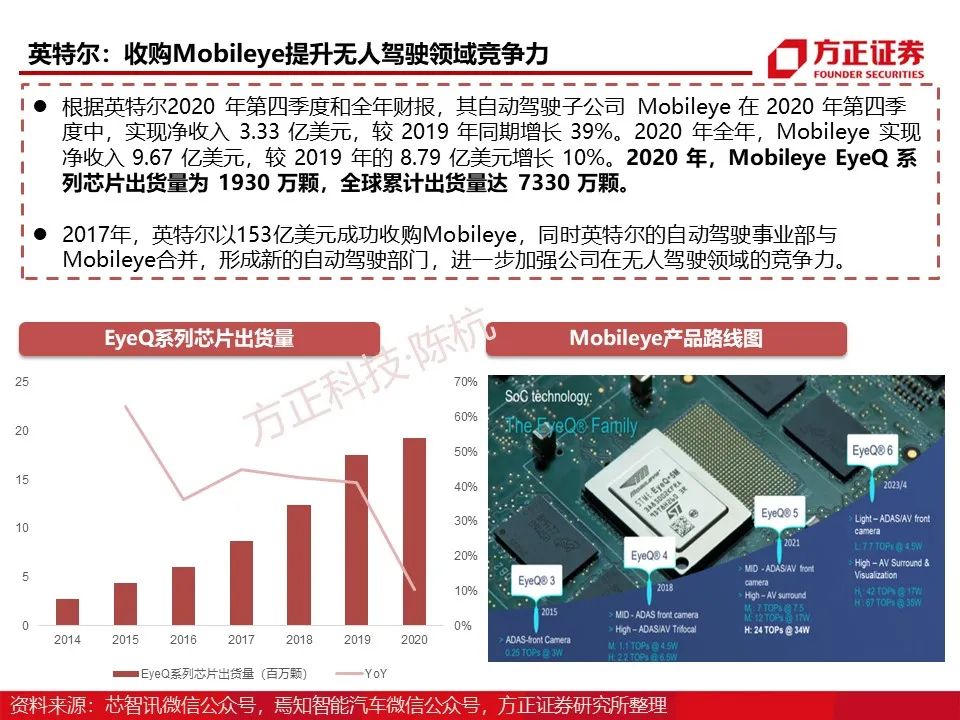

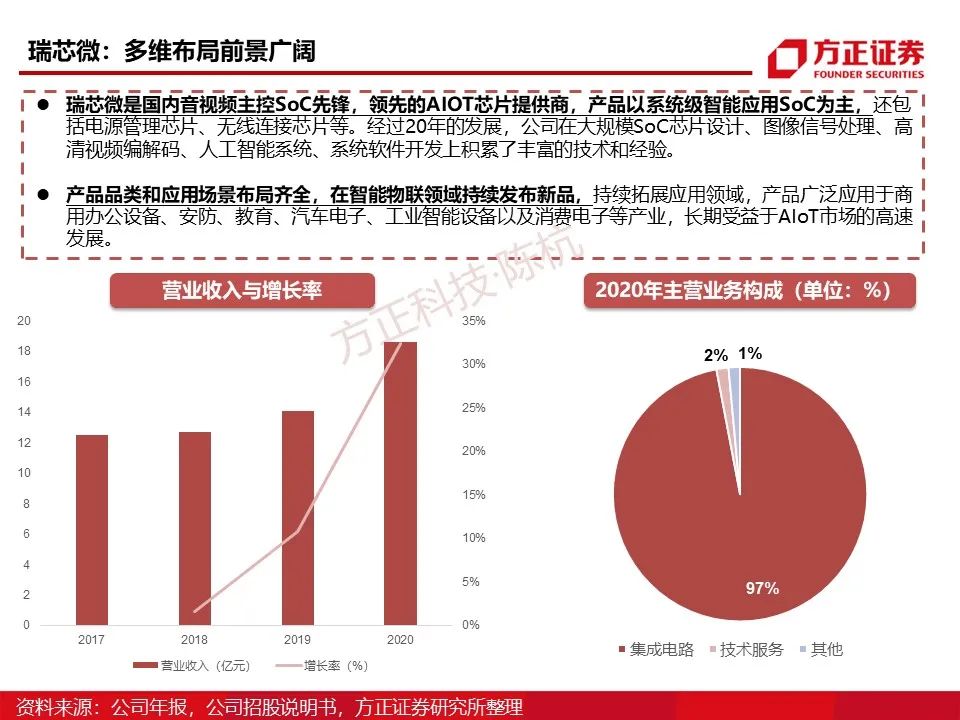

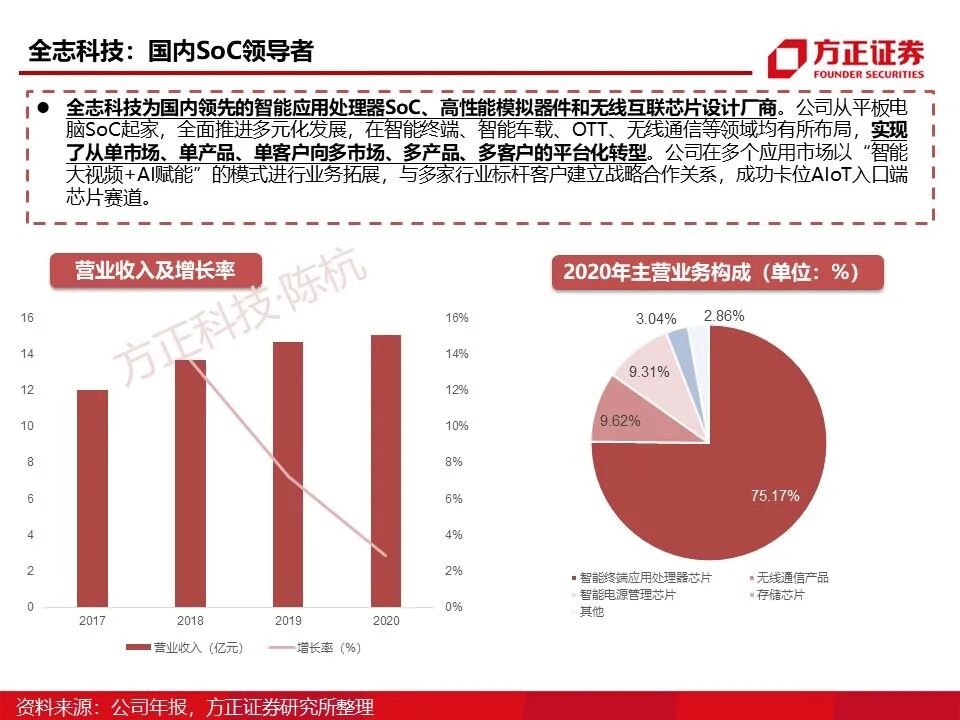

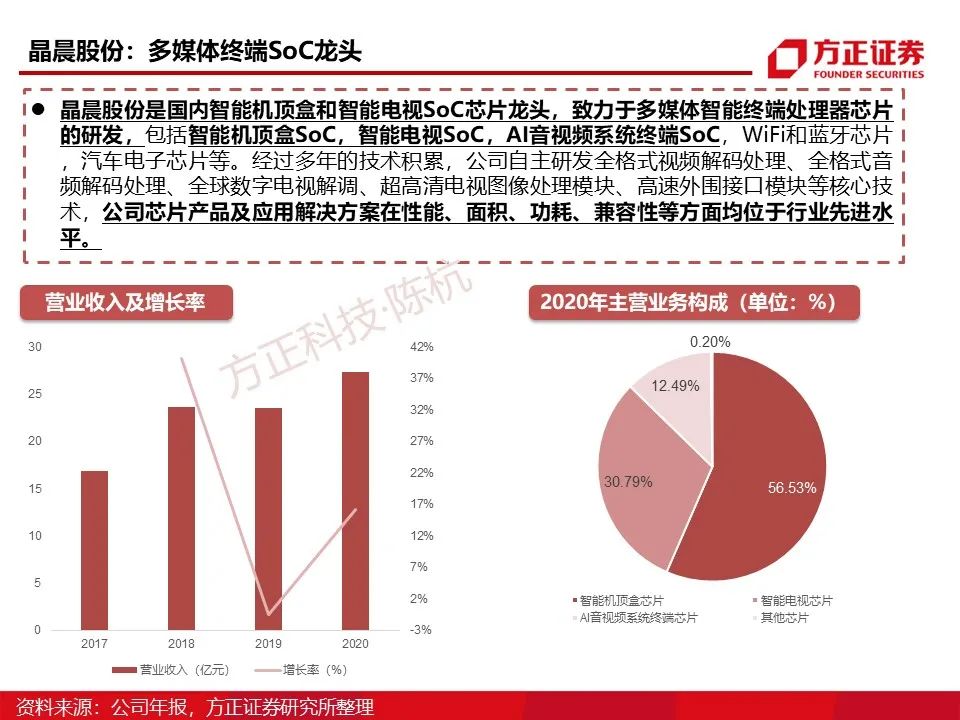

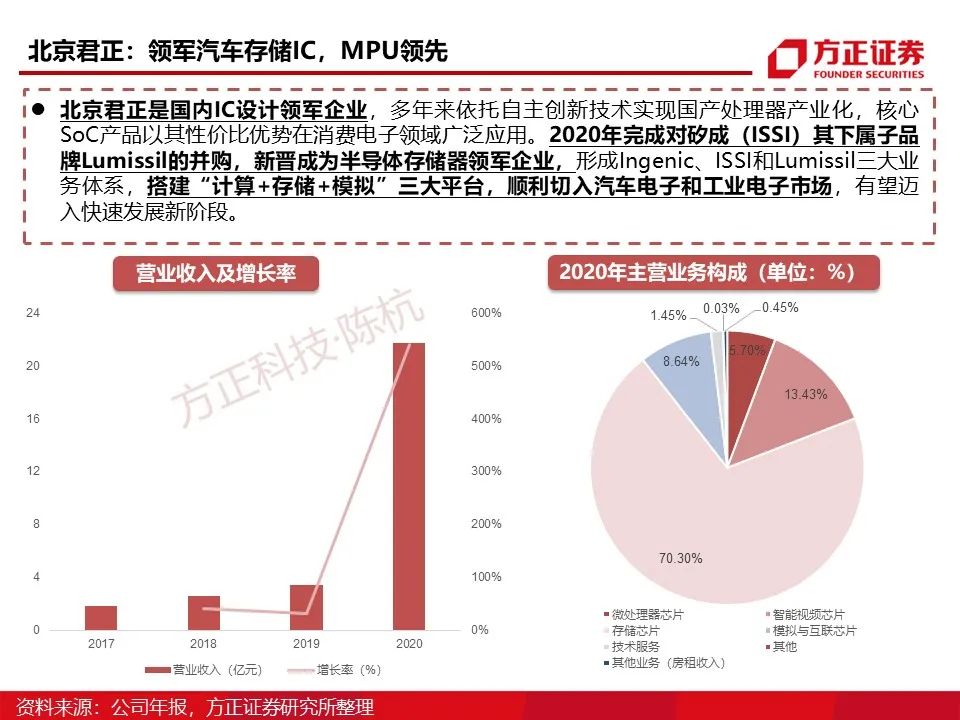

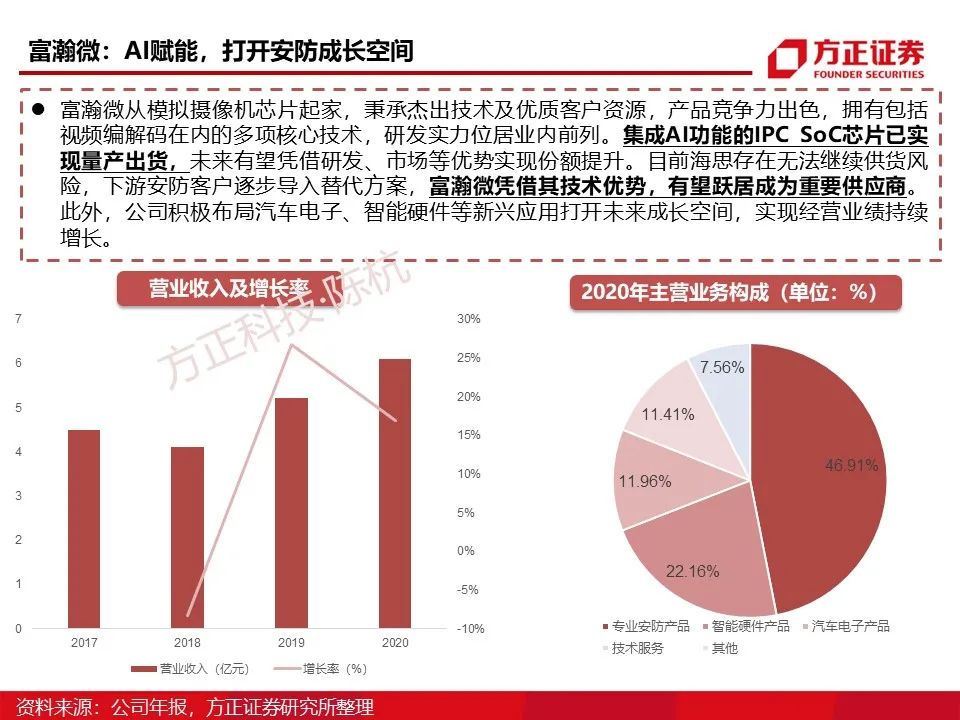

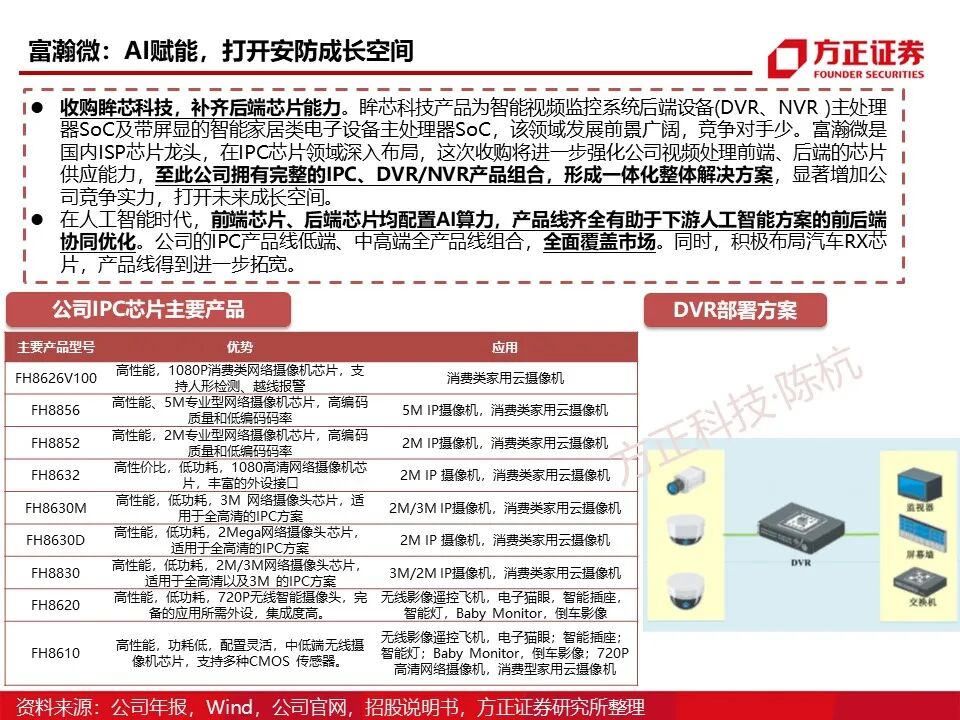

- Chip Design: International giants include Qualcomm (mobile SoC), NVIDIA (AI/automotive SoC); domestic manufacturers such as Huawei HiSilicon (Kirin series), Rockchip (AIoT SoC), and Allwinner Technology (smart terminal SoC) are rapidly emerging.

- Packaging and Testing: Changdian Technology and Tongfu Microelectronics are catching up to international levels in advanced packaging (such as Chiplet, 3D IC), with Changdian Technology’s XDFOI™ technology supporting chiplet integration.

- Downstream:

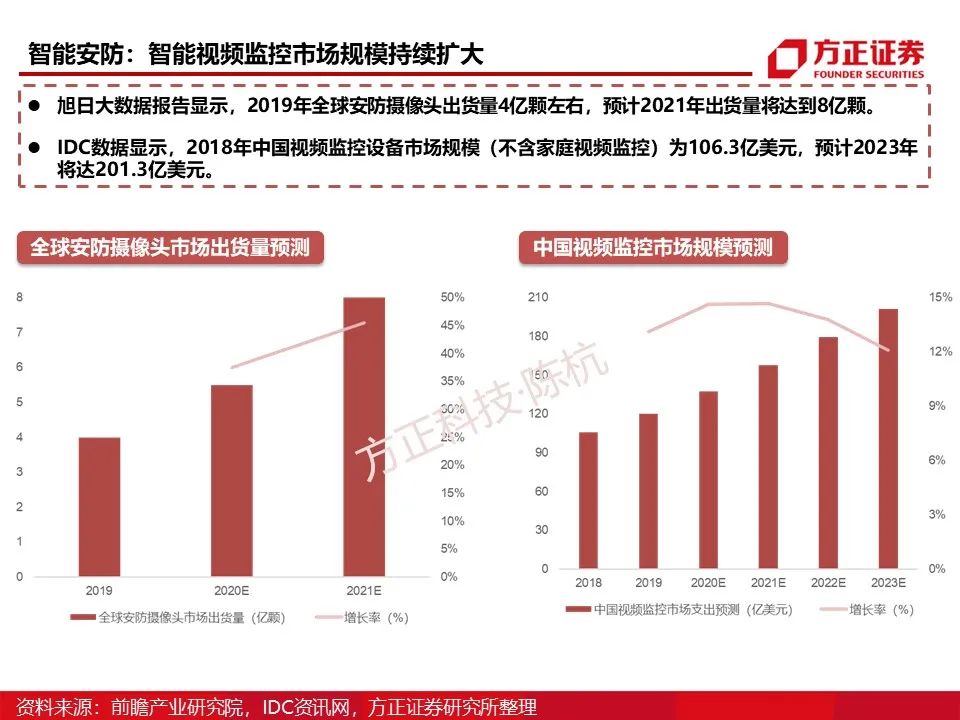

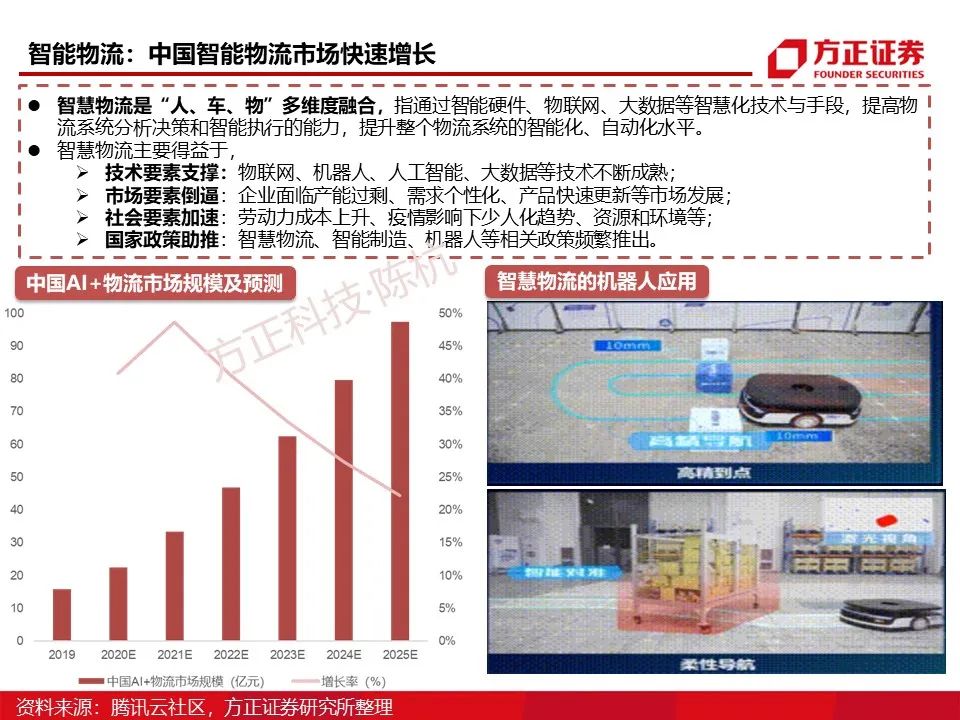

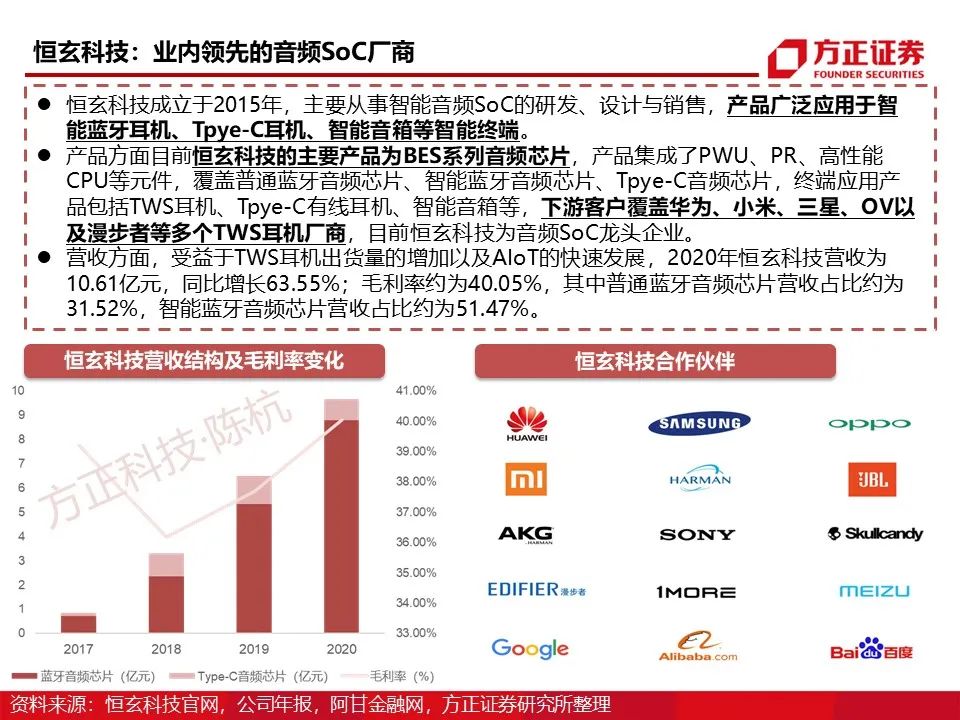

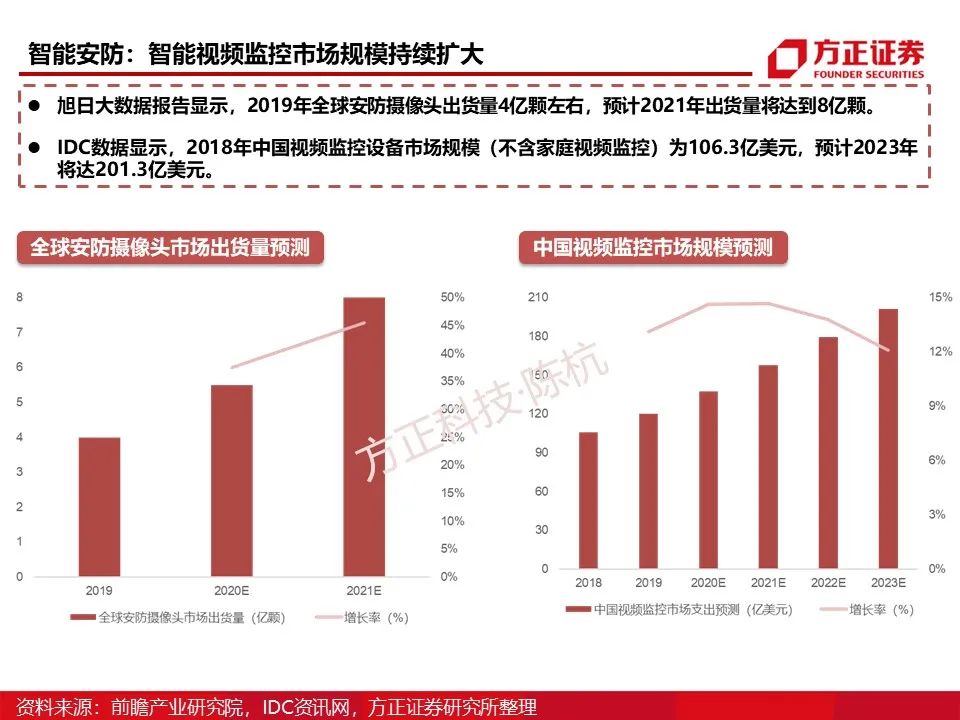

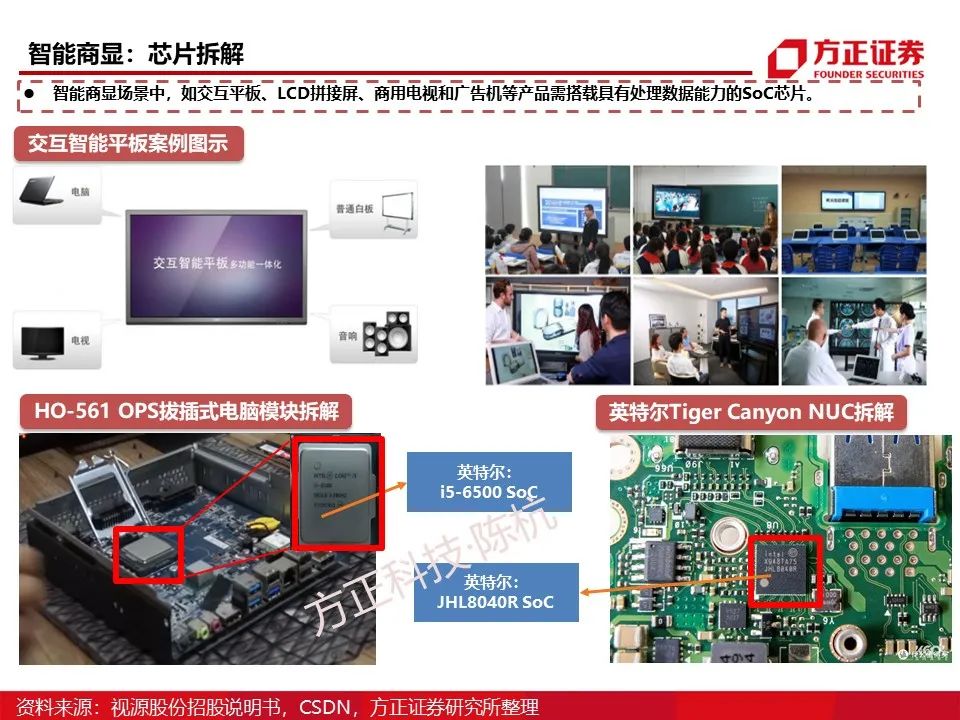

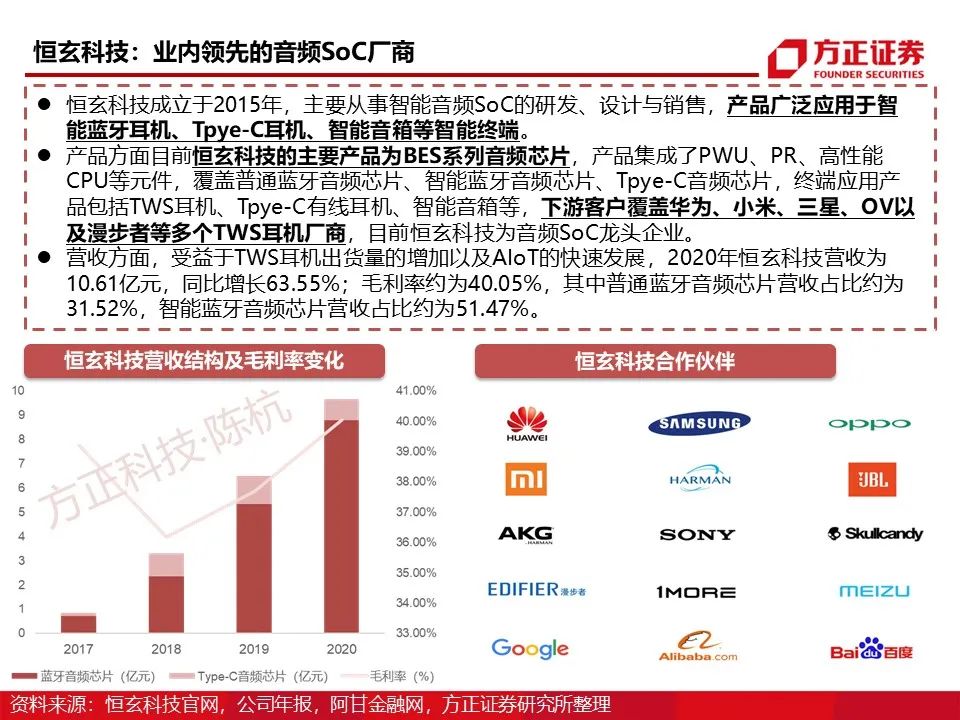

- Consumer Electronics: Smartphones (5G replacement wave), smart wearables (TWS earbuds, smartwatches), and smart home devices (smart speakers, robotic vacuums) are the main markets, with global smart home device shipments reaching 260 million units in 2020, a year-on-year increase of 26.7%.

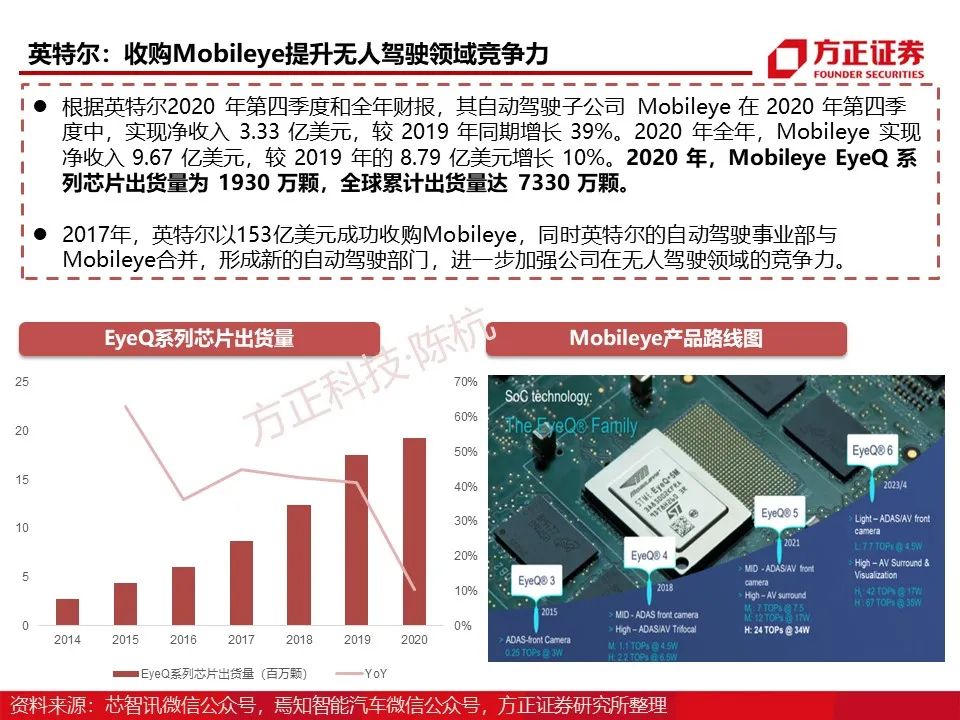

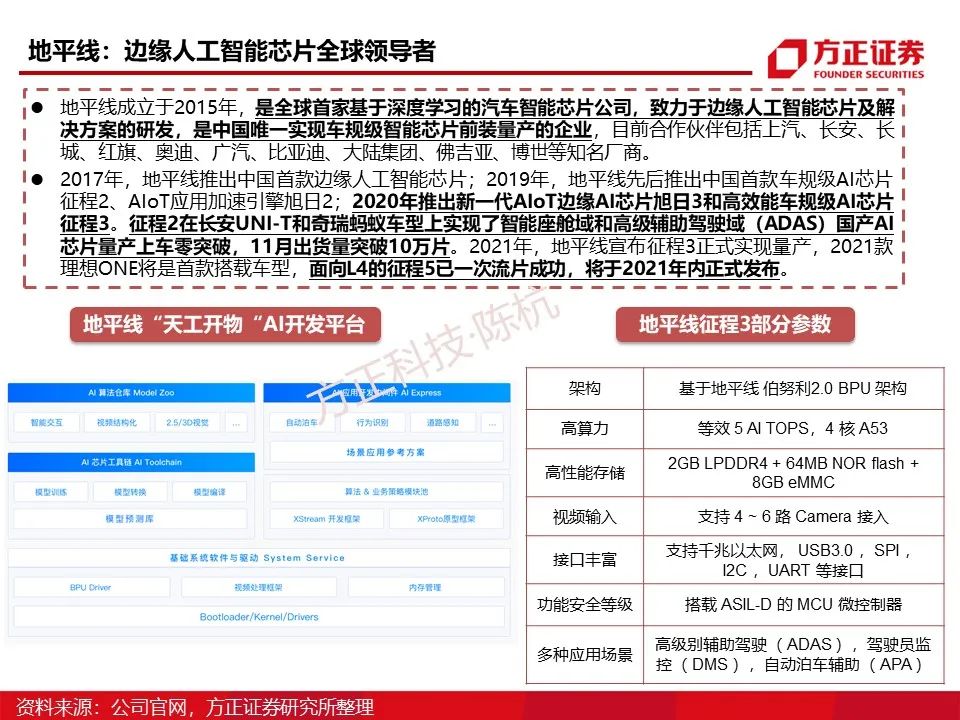

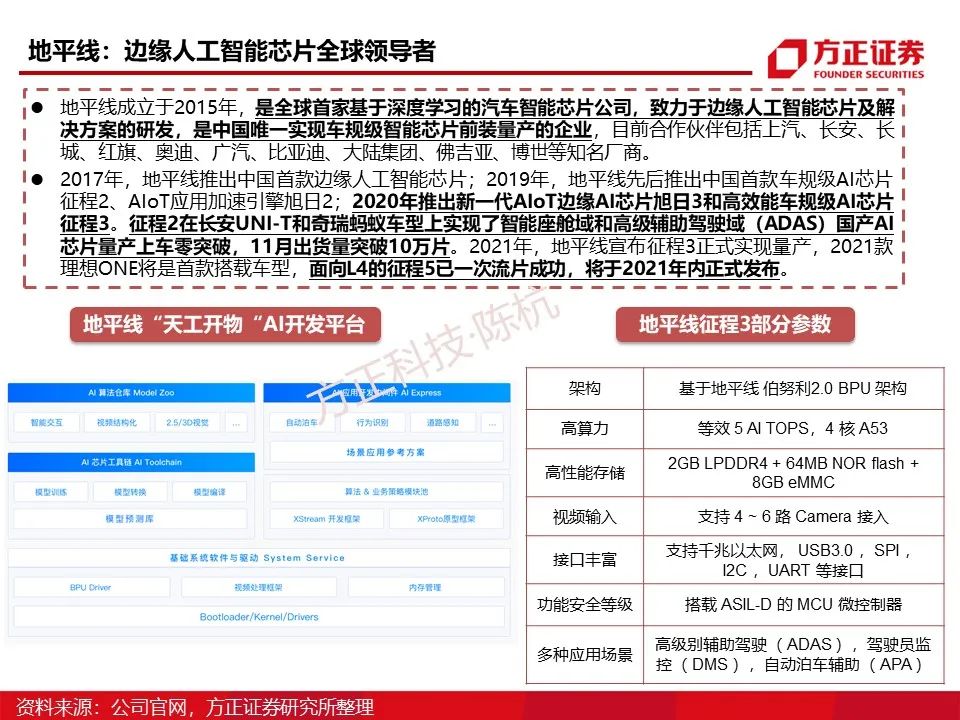

- Automotive Electronics: Smart cockpits (the market size in China will reach 103 billion yuan by 2025) and autonomous driving (increasing penetration rates for L2/L3 levels) drive the demand for automotive-grade SoCs, with Horizon’s Journey 3 chip achieving mass production for vehicles.

- AI and Data Centers: AMD EPYC APU and Huawei Ascend chips are used for AI servers, with the HBM market expected to account for 20% of total DRAM revenue by 2024.

3. Market Size and Growth Drivers

- Global Market: The market size was $131.83 billion in 2017, expected to reach $207.21 billion by 2023, with a CAGR of 8.3%.

- Growth Drivers:

- Technological Upgrades: 5G, AI, and IoT are driving SoC to replace MCUs, such as smart home appliances upgrading from MCU solutions to SoC.

- Emerging Scenarios: AI servers, autonomous driving, and edge computing are creating demand for high-performance SoCs, such as HBM3E chips with bandwidth reaching 1.2TB/s.

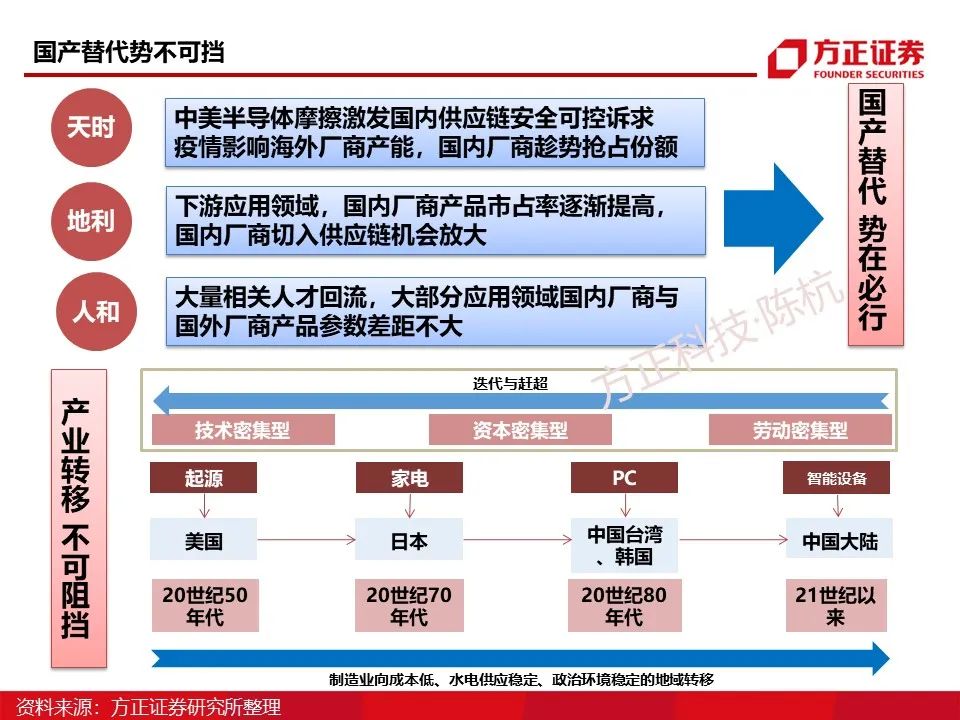

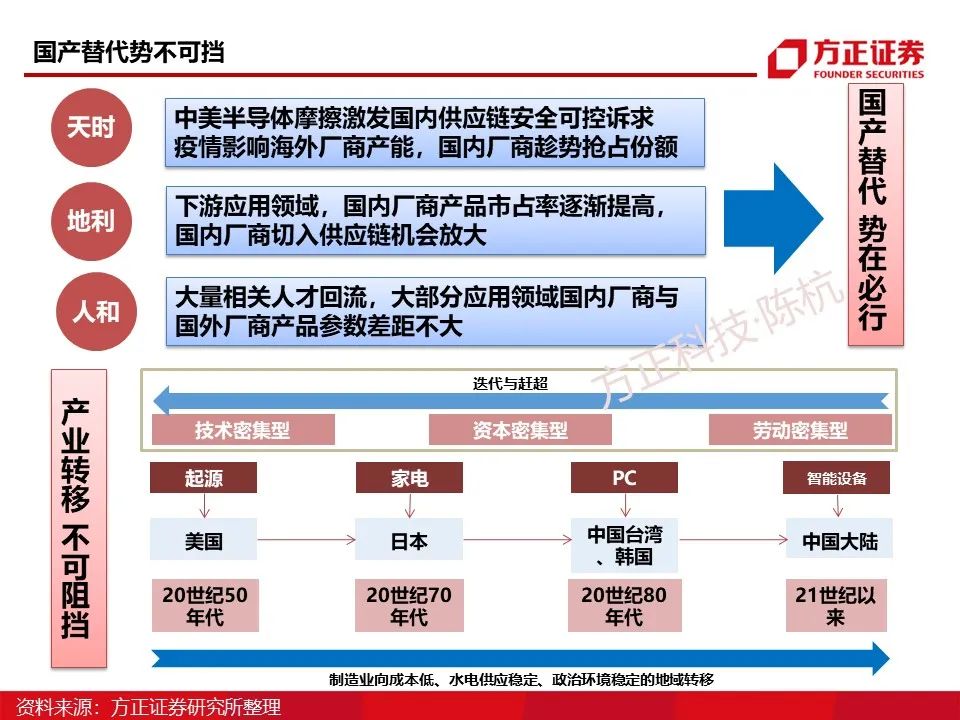

- Policy Drivers: China’s “New Infrastructure” and “Xinchuang” policies accelerate the replacement of domestic SoCs, with the National Big Fund’s third phase of investment supporting advanced process R&D.

4. Progress and Challenges of Domestic Substitution

- Design Phase: Huawei HiSilicon’s Kirin 9000S (7nm) performance is close to international levels, with GigaDevice’s automotive-grade NOR Flash shipments exceeding 100 million units.

- Manufacturing and Equipment: SMIC’s 14nm yield reaches 95%, and North Huachuang’s ALD equipment achieves High-K dielectric deposition, with domestic equipment’s penetration rate in mature processes exceeding 30%.

- Challenges:

- Supply Chain Risks: EUV lithography machines and high-end photoresists rely on imports, and U.S. export controls affect advanced process R&D.

- Ecological Barriers: x86/ARM architecture licensing restrictions, and the RISC-V ecosystem is not yet mature, requiring a reconstruction of the software adaptation system.

5. Key Manufacturers and Investment Opportunities

- International Manufacturers: Qualcomm (mobile/automotive SoC), NVIDIA (AI/autonomous driving SoC), TSMC (advanced process foundry).

- Domestic Manufacturers:

- Design: Huawei HiSilicon (all-scenario SoC), Rockchip (AIoT SoC), Horizon (automotive-grade AI chips).

- Manufacturing/Testing: SMIC (mature processes), Changdian Technology (advanced packaging).

- Equipment/Materials: Huada Jiutian (EDA), Shanghai Silicon Industry (large silicon wafers).

- Investment Themes: Focus on clearly defined sub-sectors for domestic substitution, such as automotive-grade SoCs, AI acceleration chips, and advanced packaging equipment.

6. Technical Trends

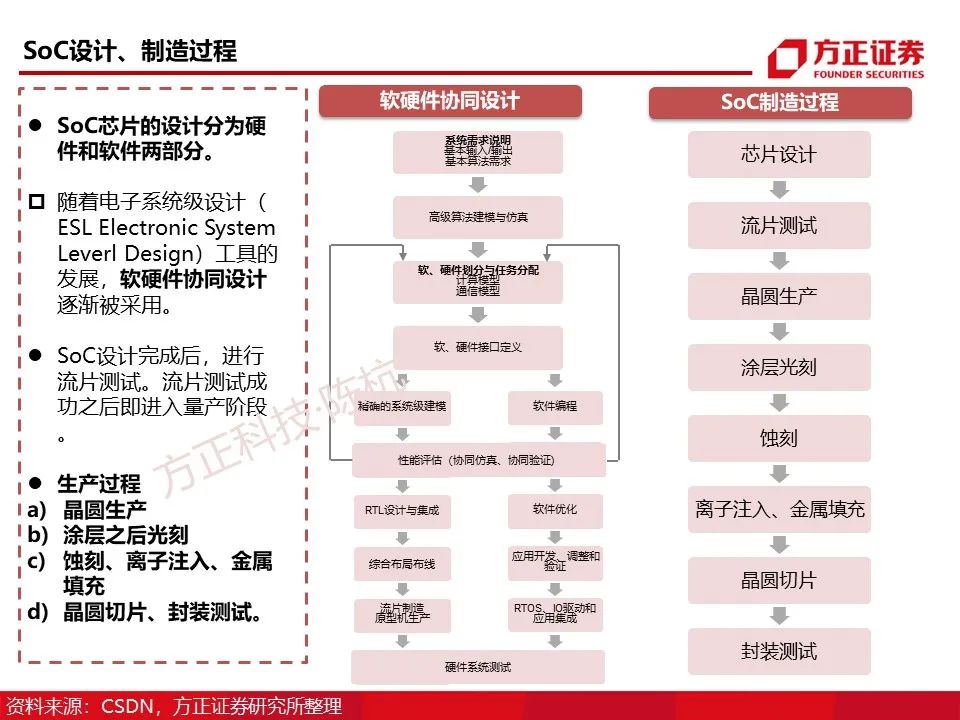

- Advanced Processes and Heterogeneous Integration: 3nm GAA process (Samsung), Chiplet technology (TSMC CoWoS) enhance performance and reduce costs.

- AI and Low-Power Design: Edge-side large models drive NPU computing power improvements, such as MediaTek’s Dimensity 9400 integrating a 10TOPS NPU.

- Optoelectronics and Quantum Integration: Silicon photonic engines (Intel), quantum computing chiplets (IBM) explore future computing architectures.