Author | Yan Xi

Author | Yan Xi

As NVIDIA’s GB200 chip creates a billion-dollar frenzy in data centers, another revolution in computing power concerning trillion-dollar IoT terminals is quietly unfolding.

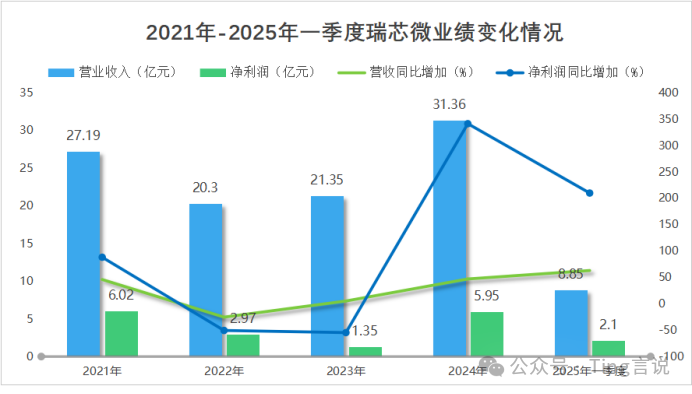

Under the LCD dashboard of BYD’s smart cockpit, within the laser radar of Xiaomi’s robotic vacuum, and in the image processors of industrial quality inspection cameras, domestic ASIC chips are efficiently interpreting the real world. In this industrial upheaval known as the “Great Migration of Inference Computing Power,” Rockchip, with a gross margin of 40.95% and a net profit growth rate of 341% for its RK3588 chip, is becoming the fiercest sniper on the edge AI battlefield.

—

The resurgence of ASICs: New rules of computing power in the inference era.

The prediction that global inference computing power will exceed 70% by 2027 reveals a structural shift in the AI industry.

Once large model training is completed, the true value of intelligence begins to fall towards the application end. Rockchip’s founder, Li Min, asserted as early as 2019, “The next decade belongs to edge inference, just as the past decade belonged to cloud training.”

The secret weapon of process leap:

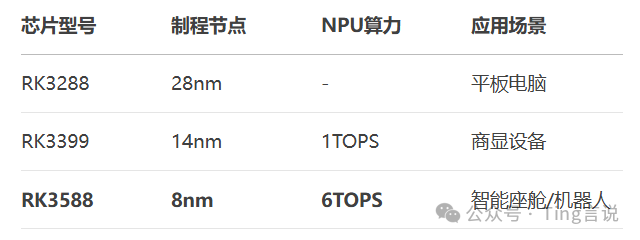

This decade-long technological expedition has enabled Rockchip to make a critical leap in 2024. The energy efficiency ratio of the 8nm RK3588 chip reaches 4.6 TOPS/W, surpassing Amlogic’s A311D (2.1 TOPS/W) by 120%, and it has entered over ten models of BYD with automotive-grade certification.

With Tesla’s Optimus robot nearing mass production, this “Chinese chip” has seized control of humanoid robot motion.

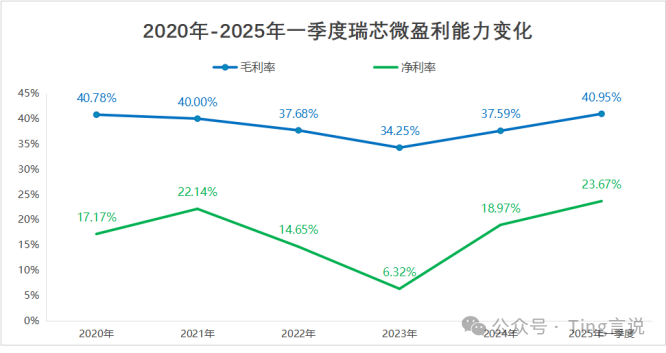

From price mud to technological premium. The 40.95% gross margin revealed in the Q1 2025 financial report marks the most shocking resurgence of domestic chips. The gross margin curve shows a low point in 2023 (31.2%) → recovery in 2024 (37.59%) → peak in Q1 2025 (40.95%). The net profit margin during the same period is 21.3%, crushing Amlogic (15.1%) and Allwinner Technology (12.4%). The R&D conversion rate of 564 million in R&D investment leverages a 341% net profit growth, achieving the industry’s peak efficiency ratio.

Behind this set of counterintuitive data is the customization magic of ASIC chips—while NVIDIA’s A100 GPU consumes 800W of power in data centers, Rockchip’s RK3588 completes autonomous driving image recognition with only 5W of power. The choice made by terminal manufacturers through their votes has driven the chip price from 39 yuan (RK3399) to 127 yuan (RK3588).

A sharp blade piercing through trillion-dollar scenarios.

Rockchip’s ambition is hidden in three major scenario layouts. The smart cockpit blitz, with RK3588M capturing popular models like BYD’s Seal and Destroyer 05. The shipment volume of smart cockpit chips is increasing by 300% annually, with potential orders exceeding 3 billion yuan for 20 targeted projects.

AIoT ecosystem.

✓ IoT connected devices are expected to grow from 3.6 billion to 8 billion (2019-2025).

✓ RK3566 chips embedded in Midea air conditioners achieve a 30% energy consumption optimization.

✓ The gross margin of edge computing modules reaches 45.7%.

Robot Dawn Project, humanoid robot joint controllers delivered to Yushu Technology. Visual processing latency reduced to 8 milliseconds (industry average 20 milliseconds). Revenue from robot chips is expected to exceed 800 million by 2025.

A more secret weapon is the software ecosystem. The Rockchip NPU SDK toolchain compresses algorithm deployment time from 3 weeks to 3 days, which is the key reason Xiaomi chose it as the main control chip for its robotic vacuum—on the edge AI battlefield, integrated hardware and software is the true moat.

Creating light under NVIDIA’s shadow.

“NVIDIA is the sun, and we wish to be the stars—but countless stars can also illuminate the night sky.” This metaphor by Li Min at a technical closed-door meeting subtly hints at Rockchip’s survival philosophy.

Displacing competition by abandoning the thousand-card cluster, focusing on single-device inference performance. Deeply optimizing scenarios for industrial cameras to enhance ISP image processing capabilities by 40%. The 8nm process meets automotive reliability without chasing the 3nm arms race.

This approach shows astonishing efficiency in financial reports. In Q1 2025, the management expense ratio dropped to 4.2% (Amlogic 7.1%), and inventory turnover days compressed to 87 days (Allwinner Technology 121 days). While peers are battling in the advanced process red sea, Rockchip extracts extreme cost performance using mature processes.

Rockchip’s rise coincides with a moment of geopolitical fracture:

1. Technological blockade: US bans imports of equipment below 14nm.

2. Replacement window: Domestic equipment supports 8nm mass production (SMEE etching machine + North Huachuang PVD).

3. Ecological counterattack: RISC-V architecture’s share rises to 35%, avoiding ARM licensing risks.

“Our RK3588 has achieved 100% domestic tape-out.” CTO Li Shiqin’s declaration is backed by the overnight debugging of Shanghai Jita Semiconductor’s 8nm production line. Although the transistor density still lags behind TSMC, stability meeting the 20℃ to 105℃ conditions for smart cockpits is becoming a more valued metric for car manufacturers.

The ant army of the inference era.

In Rockchip’s Shenzhen laboratory, engineers are testing the next-generation RK3588S chip—this silicon piece, only 10mm² in size, can process 4500 industrial images per minute.

It is about to be equipped in CATL’s battery defect detection line, reducing the missed detection rate from 0.05% to 0.0001%. This micro-level computing power revolution may not be as shocking as a thousand-card cluster, but it is genuinely reshaping the precision of Chinese manufacturing.

As the slogan on the production line wall states: “Let every kilowatt-hour generate more intelligence.” While tech giants chase billion-parameter large models, Rockchip has chosen a more pragmatic path.

Embedding AI into car trunks, factory assembly lines, and living room vacuum cleaners. In this great migration of inference computing power, these “ant armies” hidden in terminals may ultimately prove that true intelligence is never in the cloud, but among the people.

Note: (Disclaimer: The content and data of this article are for reference only and do not constitute investment advice. Investors operate at their own risk based on this.)

– End – Hope to resonate with you! @Following and sharing is the greatest support@To prevent losing contact, please add the author’s WeChat:zbyzby_233 (Please state your identity and purpose)

@Following and sharing is the greatest support@To prevent losing contact, please add the author’s WeChat:zbyzby_233 (Please state your identity and purpose)