Recently, it has been reported that AMD is preparing to acquire Xilinx. AMD has been gaining momentum in the processor field, and we believe this acquisition could be the most significant move for AMD since acquiring ATI.

The PC market is dead; the industrial market is the next big opportunity

First, we believe AMD’s purpose in acquiring Xilinx is to enter the industrial market—the PC market that AMD originally focused on is dead, and the industrial market is the next big opportunity.

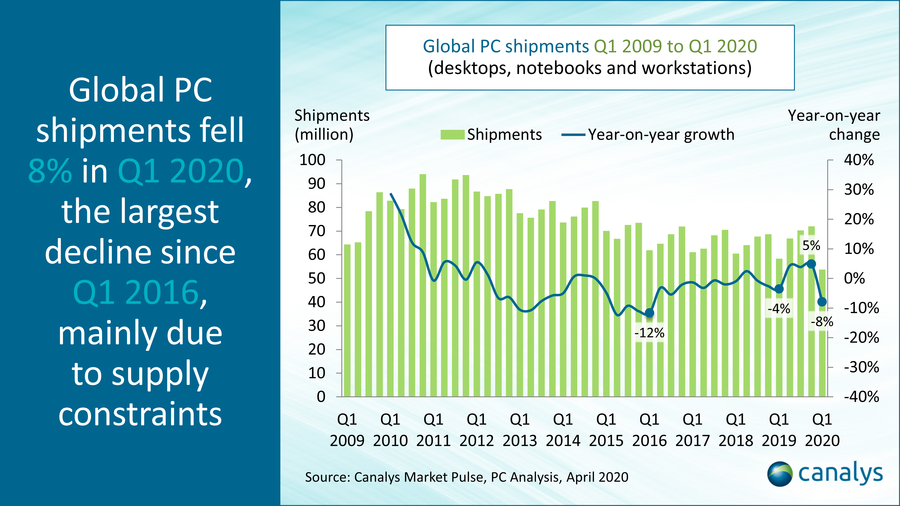

AMD has always been seen as the runner-up in the PC market, chasing Intel in CPUs and Nvidia in graphics cards. However, it is well-known that the PC market has been stagnant or even shrinking in recent years (with an 8% decline in shipments recorded in the first quarter of this year). Therefore, if AMD cannot explore new markets, its future growth potential is quite limited.

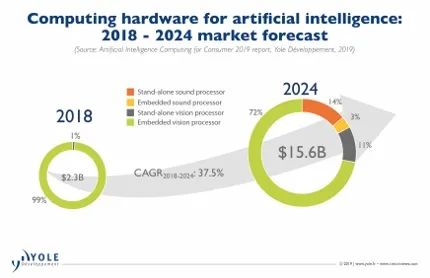

Currently, the best growth market is the industrial chip market represented by data centers/servers, especially the rapidly growing market for hardware related to artificial intelligence, which is expected to grow sevenfold from 2018 to 2024, with a compound annual growth rate of 37.5%.

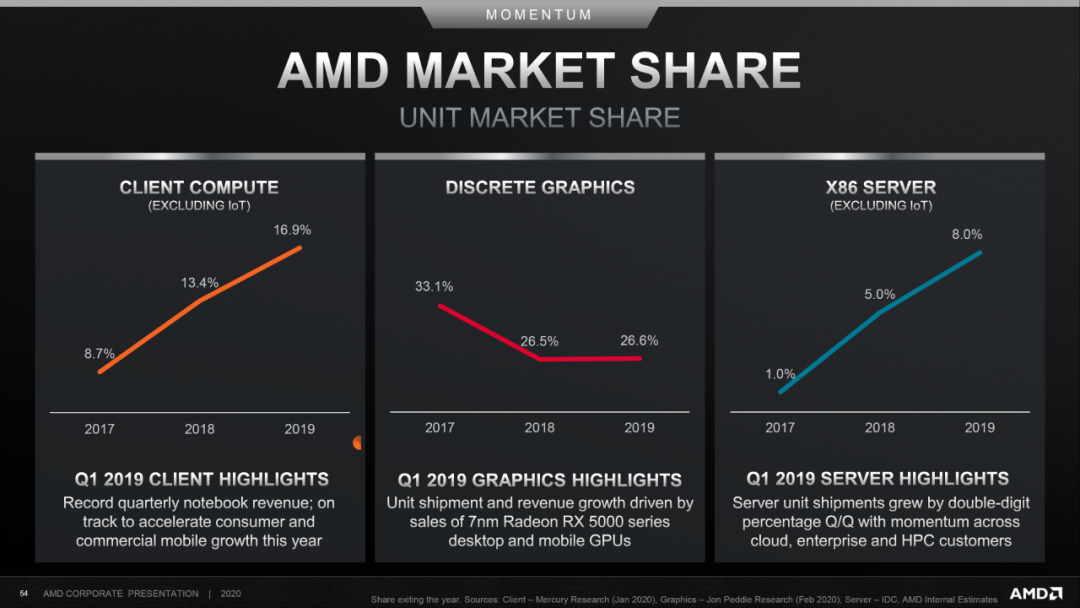

This is the market that offers growth potential, and in fact, AMD is also trying to expand into the server market. In the server market, AMD’s processor market share has increased from a negligible 1% between 2017 and 2019 to 8%, showing strong momentum.

However, AMD still lacks a foothold in the server and other industrial markets. Currently, most server customers view AMD as an alternative supplier, and it will take a long time for AMD to replace Intel in the processor field. In the booming field of artificial intelligence, although AMD has GPU technology, its development ecosystem is far behind Nvidia’s CUDA, and almost no AI models are deployed on AMD’s GPUs. The acquisition of Xilinx aims to leverage its FPGAs to enter the industrial market, especially the AI/server market. In fact, Xilinx has made extensive layouts in the AI field in recent years, and its product strategy has gradually shifted from traditional FPGAs to SoC structures based on FPGA + AI engines (for example, the recently launched Versal series products are a typical embodiment of this idea, which includes programmable FPGAs and fixed AI acceleration engines). Therefore, if AMD successfully acquires Xilinx, it will serve as a trumpet call for its entry into the industrial market.

How will the market landscape change?

If AMD successfully acquires Xilinx, we believe the short-term impact on the market landscape will not be significant; the main effects will be seen in the medium to long term. AMD’s acquisition of Xilinx is primarily aimed at entering the edge computing server market, while the cloud server market may be the second target. Xilinx FPGAs are strong in computing and signal processing fields, particularly in applications such as wireless base stations, industrial real-time processing, and automotive. Although there have been attempts in the cloud server field (for example, AWS offers servers equipped with Xilinx FPGAs), the cloud is not its most suitable scenario. This is because, in cloud servers, computing demands are often centralized, making standardized computing acceleration hardware (i.e., GPUs) that provide super strong computing power the most suitable. In contrast, FPGAs are highly programmable and flexible, making them more suitable for scenarios where demand is more decentralized, such as edge computing. As the demand for edge computing rises rapidly in the future, using Xilinx FPGAs paired with AMD processors for edge computing servers could be a highly competitive solution. However, currently, edge computing is still in its growth phase, so I believe it will not have a significant impact on the overall landscape in the short term—on the server side, AMD still needs to rely on CPUs to compete with Intel, and in the AI field of cloud servers, I believe that even if AMD successfully acquires Xilinx, it will still lack the strength to compete with Nvidia in the short term. In the medium to long term, as the edge market becomes increasingly important, the significance of AMD’s acquisition of Xilinx will gradually become apparent.

Silicon Insightsprovides in-depth analysis of the semiconductor industry and various benefits.Yoursupportisourdrivingforce. If youlikeourarticles, please scan the QR code below, and select “Identify the QR code in the image” from the pop-up menu to follow us!WeChat ID: