Click the blue text above to follow Serious Listening Awards, and let’s explore the world together.

Seeing this title, many people might be shocked.

Indeed, it is that stimulating!

A recent report from a reputable semiconductor research institution in Japan shows that Chinese chip manufacturing equipment has quietly captured 40% of the global market share, leaving traditional giants uneasy.

Technology is not the primary productive force, but a barometer of national fortune.

This report has caused a strong shock in the global semiconductor circle, especially among those countries that have been trying to curb the development of China’s chip industry through technological blockades.

When the U.S. sanctioned Huawei, they confidently believed that without advanced processes, China’s chip industry would fall into a predicament.

Who would have thought that just a few years later, Chinese companies not only survived but carved out a bloody path in the semiconductor equipment field, becoming a force that cannot be ignored globally.

This is not a coincidence, but the inevitable result of China’s years of insistence on independent innovation.

From zero to one: The arduous rise of China’s chip industry

The development history of China’s chip industry can be described as “full of ups and downs”.

In 1956, the 13th Research Institute of China Electronics Technology Group Corporation was established in Beijing, marking the starting point of semiconductor research in China.

In 1965, the 13th Research Institute in Shijiazhuang successfully developed integrated circuit samples independently, marking a key step for China.

In 1975, the Beijing 109 Factory of the Chinese Academy of Sciences produced China’s first 1K DRAM memory chip.

Although this was four to five years later than the U.S. and Japan, it was four to five years earlier than South Korea and Taiwan.

After the reform and opening up, the pace of development of China’s chip industry lagged behind that of South Korea and Taiwan.

In 1990, China launched the “908 Project” to introduce 0.9-micron technology at Wuxi Huajing Electronics.

Unfortunately, due to lengthy approval and introduction times, it took a total of eight years, resulting in the production in 1998 being outdated capacity.

True innovation lies not in following but in overtaking.

The turning point came in 2000.

Zhang Rujing came from Taiwan to Shanghai and founded SMIC, bringing the world’s most advanced integrated circuit manufacturing equipment and mainstream process technology to the mainland.

In just three years, SMIC established four 8-inch and one 12-inch production lines, becoming the third-largest chip foundry in the world.

As early as 2008, the State Council approved the implementation of the “Large-Scale Integrated Circuit Manufacturing Equipment and Complete Process” project.

At that time, the most advanced mass production process in China’s chip manufacturing was still at 130 nanometers.

After nine years of hard work, China’s mainstream process level improved by five generations, with successful R&D and mass production of three generations of complete processes at 55, 40, and 28 nanometers.

In 2015, the implementation of the “National Integrated Circuit Industry Development Promotion Outline” and the “02 Special Project” further accelerated the pace of independent innovation in China’s chip industry.

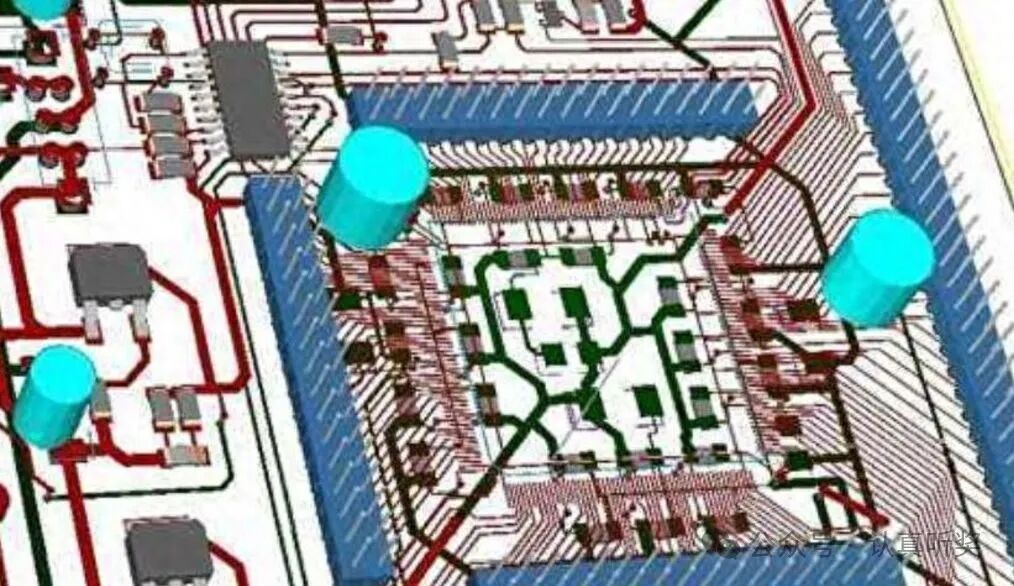

Today, in some key areas, Chinese companies can provide complete solutions from materials, equipment to manufacturing.

The shocking truth behind the numbers

Here’s an interesting comparison: According to SEMI (the global semiconductor industry association), global chip equipment sales are expected to grow by 3.4% to $109 billion in 2024.

China is expected to reach a historic high of $35 billion, accounting for more than 30% of the global market.

More critically, over 40% of the revenue of semiconductor equipment companies in the U.S., Japan, and Europe comes from the Chinese market.

Take the lithography machine giant ASML, for example, where the revenue from China accounts for as much as 49%!

This is awkward.

On one hand, they are trying to restrict the development of China’s chip industry through export controls, while on the other hand, they are highly dependent on the Chinese market.

The market never lies; only politics is good at self-deception.

China’s chip production capacity has increased from less than 10% of the global share in 2015 to 17% in 2023, and is expected to reach 19% in 2024 and exceed 22% by 2027.

Notably, the production capacity of mature process technology of 28 nanometers and above in mainland China has increased from 19% in 2019 to 31% in 2023.

According to professional institutions, this ratio is expected to exceed 45% by 2026.

Intel CEO Pat Gelsinger once admitted in an internal meeting: “China’s rapid rise in mature process technology has exceeded our expectations.”

The industrial strength behind the price advantage

The report from the Japanese chip agency specifically points out that the progress of Chinese companies in the traditional chip field makes it difficult for international competitors to match.

The world’s largest silicon carbide substrate manufacturer, Wolfspeed, has a market price of $1500 per piece for its mainstream 6-inch silicon carbide wafers.

However, Chinese suppliers offer similar products at prices as low as $500 or even lower.

This price advantage is not achieved through simple price cuts, but relies on a complete industrial chain and an efficient production system.

For example, Zhongwei Company, established in 2004, has now become one of the world’s leading semiconductor equipment manufacturers.

Its plasma etching equipment has reached international advanced levels in the 28-nanometer process field and is used in mainstream wafer fabs such as SMIC and Hua Hong Semiconductor.

Chinese companies have also made significant progress in auxiliary materials such as silicon wafers, photomasks, and chemicals.

In 2023, China’s share of the global market for compound semiconductor substrate materials has exceeded 20%, more than five times the growth since 2015.

True competitiveness lies not in low prices, but in cost-effectiveness.

The Financial Times once reported that an anonymous executive from a European semiconductor equipment manufacturer stated: “Chinese suppliers’ equipment is not only 30%-40% cheaper, but the quality is also getting closer to international standards, which puts us under unprecedented pressure.”

Historical mirror: The double loss outcome of trade protectionism

Interestingly, this situation bears a striking resemblance to the semiconductor friction between China and Japan 40 years ago.

In the 1980s, Japan surpassed the U.S. with high cost-performance DRAM chips, becoming the world’s leading chip producer.

From 1980 to 1986, the U.S. share of the global chip market fell from 61% to 43%, while Japan’s rose from 26% to 44%.

The U.S. then launched the so-called “semiconductor war,” using trade sanctions and other means to suppress the Japanese chip industry.

What was the result?

Japan did indeed suffer a setback, but the U.S. chip industry did not benefit from it; instead, it accelerated the transfer of capacity to South Korea and Taiwan.

By 1990, among the top ten chip companies globally, Japan accounted for six, with NEC, Toshiba, and Hitachi ranking in the top three.

However, by 2021, Japan’s share of the global semiconductor market was only 6%, while the U.S. held 54%, South Korea 22%, and Taiwan 9%.

History is always surprisingly similar.

Today, the U.S. and its allies’ suppression of China’s chip industry essentially attempts to replay the script of the past.

But the world has changed.

China not only has the largest semiconductor market in the world but has also established a complete industrial chain from materials, equipment to manufacturing.

Suppression will only accelerate innovation; restrictions will only force breakthroughs.

Mature processes: The underestimated strategic value

According to reports from Japanese media Nikkei Asia, China has made significant progress in non-advanced semiconductor fields, including the mature process market of 28 nanometers and above.

These seemingly “unremarkable” fields actually cover more than 75% of global chip application scenarios, including automotive electronics, home appliances, and medical equipment.

According to market research firm IC Insights, chips with mature processes of 28 nanometers and above accounted for over 70% of global semiconductor market sales in 2023.

Moreover, this ratio is not expected to decline significantly in the next five years.

Why?

Because these chips have unique advantages in reliability, cost, and energy efficiency, making them particularly suitable for applications such as IoT and industrial control.

Former Intel CEO Andy Grove once said: “Not all applications require the most advanced processes; finding the right process is the optimal solution.”

An often-overlooked fact is that Chinese semiconductor companies have massively expanded their production capacity during the 14th Five-Year Plan period.

While the U.S. is busy building high walls, Chinese companies have maximized what they can do under existing technological conditions.

Huawei’s founder Ren Zhengfei predicted in 2019: “The more the U.S. suppresses us, the stronger we will become.”

Today, this prediction is becoming a reality.

Challenges and opportunities coexist

Challenges still exist.

In the advanced process field below 14 nanometers, there is still a significant gap between China and the global leading level.

Key areas such as high-end EUV lithography machines, advanced packaging equipment, and high-purity chemicals still have shortcomings.

However, just like Huawei still launched the Kirin 9000S under sanctions, technological blockades will only delay but cannot stop the development pace of China’s chip industry.

The true core competitiveness lies not in temporary leadership but in the ability to innovate continuously.

From this perspective, the recent decision of the U.S. government to impose tariffs on traditional Chinese chips is indeed a contradictory one.

Two-thirds of American products contain Chinese chips, but in terms of value, traditional Chinese chips account for only 1.3% of the U.S. market share.

This means that the direct consequence of imposing tariffs is to raise production costs for American companies, weakening their international competitiveness.

John Neuffer, president of the Semiconductor Industry Association, clearly stated at a congressional hearing: “Imposing tariffs on Chinese chips will harm the competitiveness of American companies and raise costs for American consumers.”

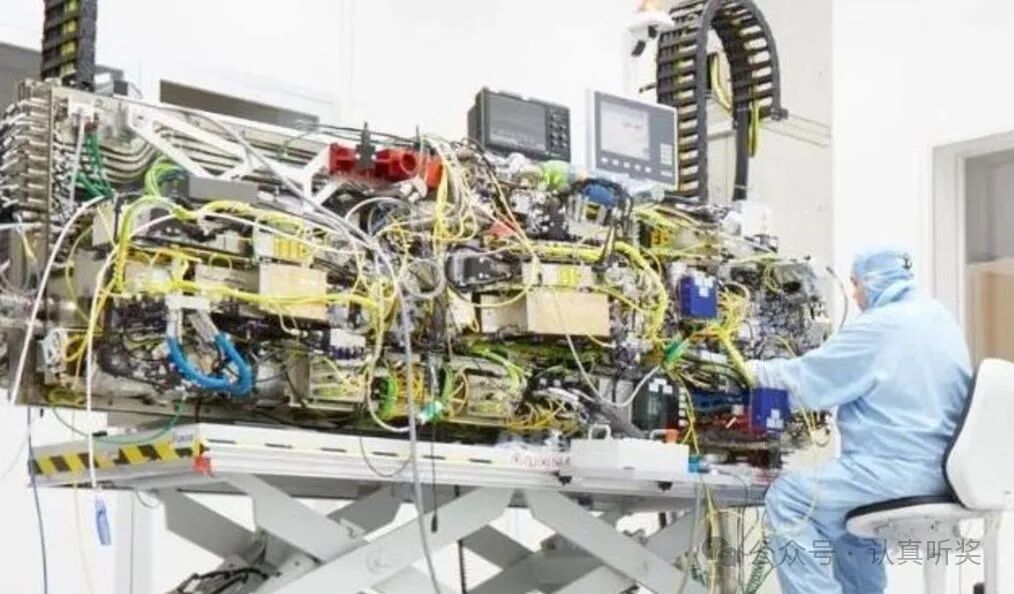

The essence of the chip industry is globalized; a chip often requires the participation of hundreds of companies across dozens of countries from design to application.

Forcibly severing the supply chain will only cause losses for every participant.

The future: Collaborative development is the only way to win

Experts point out: “From 1990 to 2020, mainland China built 32 super factories for chip production, while the rest of the world combined built only 24 super factories.”

This data reflects China’s firm determination and continuous investment in the semiconductor industry.

In 2023, China’s integrated circuit industry sales reached 1.15 trillion yuan, a year-on-year increase of 18.3%, far exceeding the global semiconductor industry’s average growth rate of 4.7%.

Ultimately, chip competition is not a sprint but a marathon.

China’s chip industry may have started late in this marathon, but it is running more steadily and rhythmically.

In the world of technology, today’s curve may be tomorrow’s overtaking point.

The chip industry is a typical “high-tech, high-investment, high-risk, and fiercely competitive” sector.

Faced with such a track, Chinese companies choose not to blindly sprint but to steadily advance and gradually break through.

First, establish advantages in mature processes, then launch attacks on advanced processes.

This strategy has already begun to show results.

The global semiconductor industry is undergoing a profound transformation, and Chinese companies are playing an increasingly important role in it.

True competition is not a zero-sum game but a catalyst for the common progress of the entire industry.

Professor Albert Pisano of the University of California, Berkeley, pointed out in his book “The Semiconductor Wars”: “Any attempt to exclude a country from the global semiconductor supply chain will ultimately harm the innovation capacity of the entire industry.”

Perhaps, in the near future, we will see more “Made in China” chip equipment appearing in major fabs around the world.

This is not a threat but a new opportunity for the common prosperity of the global semiconductor industry.

The ultimate goal of competition is not to eliminate opponents but to promote the advancement of the entire industry.

The rise of China’s chip industry will prompt traditional giants to pay more attention to innovation and develop more disruptive technologies that lead the future.

This is undoubtedly a good thing for global consumers.

Only healthy competition can bring about true technological progress and a better digital future.

In the future chip competition, cooperation and win-win is the only correct choice.

As Intel’s current CEO Pat Gelsinger said: “The semiconductor industry needs global cooperation; no single country can complete all stages from design to manufacturing alone.”

Great innovations often come from open environments and fierce competition.

The Chinese chip industry is proving this to the world in its own way.

Light up 【Like】 + 【Looking】 + 【Share】, your recognition is my motivation to continue moving forward.

THE END