Welcome to follow 【Cheyun Network】

“ How strong is Israel’s chip strength, with 15 companies acquired by giants and 4 AI chip startups?”

Israel is a small country, smaller than the combined area of Beijing and Tianjin, with a population of less than 8.8 million and resources so scarce that it has nothing but sand.

Israel is a strong country, ranking second in the global innovation index, with a per capita GDP exceeding $40,000, and is known as the country with the smartest minds in the world.

Israel is also a chip kingdom, nurturing over 160 chip companies, with annual export revenues accounting for more than 22% of Israel’s total exports.

Intel, Qualcomm, Samsung, Broadcom… Almost all leading international semiconductor companies have extended a friendly hand to Israel, and establishing a presence here has almost become a “trend” pursued by these large companies.

From the information and communication field to the global computer boom, and now to the current trend of artificial intelligence (AI), Israel’s chip industry has achieved world-renowned accomplishments in these high-tech fields, with the chip technology behind almost all electronic devices around us having an Israeli presence.

In the increasingly competitive semiconductor industry, Israel has a large number of excellent chip companies being sought after for acquisition by many international semiconductor giants, along with a large number of emerging chip startups attracting the attention of more and more international investors, including those from China.

Chip Giants Gather in Israel

This is a country with astonishing innovation and research capabilities, where prototypes of QQ, the first mobile phone “Big Brother” from Motorola, USB flash drives, Google’s search algorithm, and communication technology for sending text messages were all born.

Today, heavyweight players in the chip industry ecosystem, such as Intel, Qualcomm, NVIDIA, Apple, Broadcom, Samsung, CEVA, Marvell, KLA-Tencor, Texas Instruments, LG, and Hitachi, have all set up their research institutions in Israel, a fertile ground for chip companies.

Israel’s chip technology has entered every aspect of people’s lives worldwide. Communication field’s Motorola baseband chips, sensor field’s Texas Instruments Bluetooth chips, PC field’s Intel high-end processors, and storage field’s Sandisk flash memory chips are all developed in Israel.

▲ Intel’s four R&D centers in Israel

▲ Intel’s four R&D centers in Israel

Among them, Intel is one of the multinational chip companies that favor Israel the most. Since 1974, Intel has built four R&D centers in Haifa, Yakum, Jerusalem, and Petah Tikva, employing about 11,000 people, with approximately 60% of employees engaged in chip R&D work. The first computer processors, Pentium, Celeron, Core, SNB, Ivy Bridge, and other major CPUs were all completed at these R&D centers in Israel.

Since starting operations in Israel, Intel has invested approximately $35 billion in the country. According to Intel’s data, in 2017, Intel exported about $3.6 billion from Israel, accounting for 8% of Israel’s high-tech exports and 1% of Israel’s GDP.

It is said that employees at Intel’s Israel R&D centers nurture an average of 30 innovative companies each year, creating 250 jobs, making it a veritable training ground for Israel’s semiconductor industry.

Amir Faintuch, Intel’s Senior Vice President and Global Director of Strategic Investments and Transactions, stated that its Israel team ensures “hundreds of billions of dollars in revenue” for Intel. There are also reports that Intel plans to invest $5 billion in 2020 to expand its chip manufacturing plant in Kiryat Gat, Israel.

▲ Intel’s Kiryat Gat chip manufacturing plant

▲ Intel’s Kiryat Gat chip manufacturing plant

NVIDIA has also been active in Israel for the past eight years, both selling processors locally and acquiring stakes in startups while establishing R&D departments.

In October of this year, NVIDIA announced plans to establish a new research center in Israel focused on AI, which will be led by Gal Chechik, a former executive from Google’s AI department, and will recruit a dedicated research team for AI.

Additionally, NVIDIA stated in a press release that it plans to significantly expand its team of deep learning engineers in Israel.

Apple also has three R&D centers in Israel, the largest of which is located in Herzliya, covering an area of 180,000 square feet, making it Apple’s largest research center outside the United States.

▲ Apple’s new Herzliya R&D center

▲ Apple’s new Herzliya R&D center

Apple’s Senior Vice President of Hardware Technologies, Johny Srouji, stated at the end of last year that what is done in Israel is “crucial to everything we ship to any device,” citing examples such as the A11 emulation system on chips powering the new iPhone X, integrated WiFi Bluetooth chips, Apple Watch, and storage components for every Apple device.

The strength of Israel’s chips lies not only in the gathering of chip giants and the construction of facilities but also in the fact that many Israeli chip companies with outstanding innovative thinking and R&D capabilities are being acquired by tech giants from both home and abroad.

15 Israeli Chip Companies Acquired by Tech Giants

▲ 15 Israeli chip companies that have been acquired or are about to be acquired

▲ 15 Israeli chip companies that have been acquired or are about to be acquired

1. Communication chip company ColorChip is set to be acquired by Sanan Optoelectronics

Chinese chip design and manufacturing company, LED leader Sanan Optoelectronics plans to acquire Israeli communication chip company ColorChip for $300 million, and this acquisition is currently underway.

It is reported that ColorChip mainly develops hybrid integration technology based on the so-called SystemOnGlass, using glass material wafers to produce optical devices, thus bringing semiconductor manufacturing technology into the optical communication field. The company has raised $112 million in private funding.

2. Company Orbotech was acquired by KLA-Tencor

KLA-Tencor, according to its president AMI Applebaum, stated that without their machines, companies like Apple, Samsung, and LG would not be able to produce chips and develop new devices. In March of this year, the American semiconductor company KLA-Tencor acquired Israeli company Orbotech for $3.4 billion, hoping to gain new opportunities in high-growth markets such as printed circuit boards, flat panel displays, semiconductor manufacturing, and packaging through this acquisition.

Almost all precision electronic devices closely related to our lives, such as computers, smartphones, tablets, and smartwatches, are associated with Orbotech’s production and testing equipment. It is said that 90% of the printed circuit boards (PCBs) used in mobile phones are inspected using automatic optical inspection (AOI) systems produced by Orbotech or another Israeli company, Camtek.

3. Advanced driver assistance technology company Mobileye was acquired by Intel

Mobileye was founded in 1999 by Professor Amnon Shashua and Ziv Aviram from the Hebrew University of Israel. In addition to providing pre-installed advanced driver assistance systems (ADAS) from level L1 to L3, it launched the EyeQ chip based on ASIC architecture in 2004, along with its customized visual perception algorithms.

In March 2017, Intel spent $15.3 billion to acquire Israeli Mobileye, seizing the opportunity to improve its algorithm + CPU + cloud computing autonomous driving platform and directly entering the autonomous driving field.

4. Toga Networks was acquired by Huawei

In January 2017, Huawei confirmed that it had acquired Israeli company Toga Networks. Toga claims to be a database security company providing products such as switches, routers, and cloud storage systems for the IT and telecommunications markets.

Toga and Huawei have been long-term R&D partners, although the specific nature of the cooperation is not clear. It is rumored that the transaction price may be $150 million.

5. Rocketick was acquired by Cadence

Cadence has a star product in the Verilog RTL simulator market – the emerging accelerated verification simulation engine RockSim, which comes from Cadence’s acquisition of Israeli chip startup Rocketick for $40 million in April 2016. This startup had received two rounds of investment from NVIDIA and Intel.

Because Rocketick’s software tools can accelerate EDA simulation speed, Cadence CEO Lip-Bu Tan told Zhidx that their clients suggested they acquire this startup and integrate it into Cadence’s own company. (He is a chip investment guru, having invested in 104 listed companies! Looking at China for the next 10 years)

6. Leaba was acquired by Cisco

Cisco, as a hardware manufacturer hoping to develop in software fields such as cloud computing, has invested heavily back into the foundational hardware sector. In March 2016, Cisco announced the acquisition of Israeli chip manufacturer Leaba, whose products will become part of Cisco’s core hardware.

However, due to inconsistent media reports, the acquisition amount has been reported as either $320 million or $380 million. Leaba will report to Ravi Cherukuri, Cisco’s Senior Vice President and head of Cisco’s hardware division.

7. Altair Semiconductor was acquired by Sony

In January 2016, Sony announced it would acquire Israeli chip manufacturer Altair Semiconductor for $212 million. Altair has baseband chip technology suitable for LTE and related software, and its baseband chip products are highly sought after due to their low power consumption, high performance, and competitive cost.

By acquiring Altair, Sony will combine its sensor technology and imaging sensors with Altair’s baseband chip technology to further develop new generation sensing technologies to meet the ongoing expansion of the wearable and IoT device markets.

8. Sansa Security was acquired by ARM

In August 2015, British semiconductor company ARM acquired Israeli chip security system provider Sansa Security for $90 million.

Sansa Security, founded in 2000, mainly engages in mobile security systems and memory chip R&D. Its advantage lies in providing information protection security platforms for IoT devices, and ARM’s move may be to enhance its position in the IoT field.

9. Annapurna Labs was acquired by Amazon

Annapurna Labs is an Israeli chip manufacturer founded in 2011, mainly developing low-power microprocessors. Its founder, Avigdor Willenz, also founded another chip company, Galileo Technologies, which was acquired by Marvell Group for $2.7 billion in 2000.

In January 2015, Amazon reached an acquisition agreement with Annapurna, and the cloud server chips Graviton and cloud AI chips Inferentia recently launched by Amazon are both products of Annapurna.

10. Wireless communication company Wilocity was acquired by Qualcomm

Israeli fabless chip manufacturer Wilocity was founded in 2007, mainly developing WiGig chips. WiGig is a new wireless transmission technology standard that uses 60GHz transmission technology to achieve a maximum wireless transmission speed of 7Gbps over short distances of 10-20 meters.

In July 2014, Qualcomm announced the acquisition of Wilocity for $300 million. Subsequently, Wilocity’s CEO Tal Tamir became the Vice President of Product Management at Qualcomm’s Atheros division.

At last year’s CES, Qualcomm showcased multi-gigabit wireless WiGig chipsets produced in collaboration with Wilocity. The ultra-fast system can even transmit high-definition video over distances of up to 40 meters, with speeds more than 10 times faster than the current average Wi-Fi transmission rate.

11. 3D sensor company PrimeSense was acquired by Apple

Israeli company PrimeSense started as a developer of 3D sensing software and camera systems, later successfully transforming into a chip manufacturer and was an early technology supplier for Microsoft’s Kinect motion control. In November 2013, Apple acquired PrimeSense for $345 million.

It is rumored that Apple is very interested in the mobile chipsets developed by this Israeli company, as its chips and corresponding software can help Apple enhance various technologies such as identity recognition, indoor mapping, and 3D tracking. Currently, PrimeSense’s technology has been used in the “3D touch” feature, and it is speculated that this technology will also be used in Apple TV.

12. BroadLight was acquired by Broadcom

Last year, Broadcom, which had previously attempted to acquire Qualcomm but ultimately failed, has a special affection for Israel. From 2007 to 2016, Broadcom acquired over 13 semiconductor companies in Israel, spending nearly $2 billion.

In March 2012, Broadcom announced the acquisition of Israeli chip developer BroadLight for $195 million. BroadLight was founded in 2000, mainly providing semiconductors and software for fiber optic communication networks, and had raised $55 million before the acquisition.

This was Broadcom’s tenth acquisition in Israel, and prior to this, Broadcom had acquired another Israeli chip developer, Provigent, for $313 million in April 2011.

13. Anobit was acquired by Apple

In December 2011, Apple spent about $400-500 million to acquire Israeli flash memory design company Anobit, marking Tim Cook’s first acquisition as Apple’s CEO and Apple’s first acquisition of an Israeli company. Anobit’s flash technology helped Apple create the largest storage capacity on the iPhone – 256GB.

In the past 20 years, Apple has only acquired pure hardware companies such as NeXT, the image chip manufacturer Raycer Graphics, chip design company Intrinsity, and processor manufacturer P.A.Semi, which was founded by Steve Jobs.

14. TransChip was acquired by Samsung

In November 2007, Samsung announced the acquisition of Israeli chip design company TransChip for $70 million. TransChip developed high-quality CMOS image sensor chips, capturing a large market share of CMOS sensors in mobile phones.

This was Samsung’s first acquisition outside since 1997, and the company stated it would use TransChip as its research and development center in Israel, hoping to expand its market share in CMOS sensors through this acquisition.

15. Galileo Technology was acquired by Marvell

In 2000, Marvell spent $2.7 billion to acquire the LAN chip provider Galileo Technology, which was founded by chip veteran Avigdor Willenz, who also founded Annapurna Labs, which created cloud CPUs and cloud AI chips for Amazon.

Galileo mainly designs and sells complex semiconductor devices in the communications field. Some believe that Marvell’s move was to establish customer relationships with Intel.

International giants acquiring Israeli chip companies are far from limited to the above companies. For example, Applied Materials spent $175 million and $110 million in 1996 to acquire two Israeli chip companies, Texas Instruments acquired three Israeli chip companies in succession in 1999, Broadcom has acquired more than a dozen Israeli chip companies, and Qualcomm has also made multiple acquisitions in Israel. However, due to space constraints, we will not elaborate on them here.

Four Israeli AI Chip Startups

With the wave of artificial intelligence (AI) sweeping the globe, AI chips have quickly become one of the hottest focuses. Chip giants like NVIDIA and Intel have successively launched products, while Google, Apple, and Huawei have crossed into self-developed chips, and Facebook, Alibaba, and Amazon have also announced chip plans or products, leading to a proliferation of AI chip startups. Israel, always at the forefront of technology, is not falling behind, and a new batch of Israeli AI chip startups is rising.

▲ 4 Israeli AI chip startups

▲ 4 Israeli AI chip startups

1. Hailo Technologies

Founded in 2017, Hailo’s founding team has backgrounds in the Israeli Ministry of Defense and commercial engineering. The company announced in June that it had completed $12 million in Series A funding.

Hailo claims to have mastered revolutionary processor architecture technology that can provide real-time high-resolution sensor data suitable for edge computing, achieving PPA points for neural network processing acceleration.

Its deep learning chip samples are expected to enter the market in the first half of next year, and these chips can be used in drones, autonomous vehicles, IoT (Internet of Things), as well as smart home appliances and cameras.

2. Habana Labs

Just last month, Israeli fabless semiconductor company Habana Labs secured $75 million in funding, with investments from Intel, WRV Capital, Bessemer Venture Partners, and Battery Ventures. The company has raised a total of $120 million to date.

In September of this year, Habana Labs announced the release of the world’s highest-performing AI inference processor samples, claiming that its AI processor’s performance exceeds that of half of the solutions currently deployed in data centers by one to three orders of magnitude. The PCIe card based on its Goya HL-1000 processor can achieve a throughput of 15,000 images per second under the ResNet-50 inference benchmark, with a latency of 1.3 milliseconds and a power consumption of only 100 watts.

It is reported that this new round of financing will be used to implement product development plans for inference and training solutions, as well as the next-generation 7nm AI processor. The company plans to launch Gaudi(TM) training processor solution samples in the second quarter of 2019.

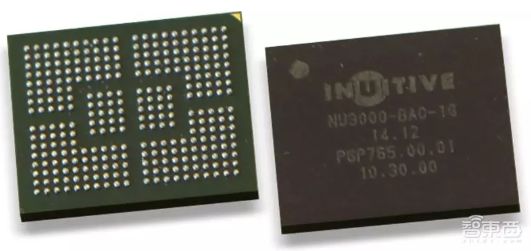

3. Inuitive

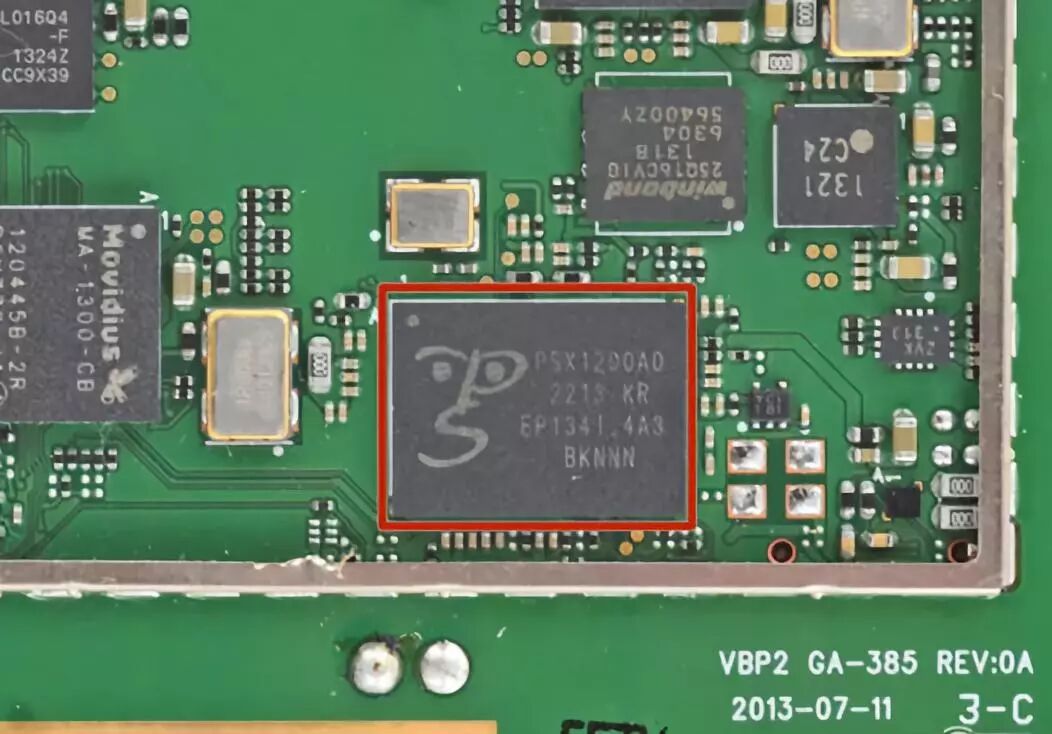

Israeli semiconductor startup Inuitive was founded in 2012, and its products NU3000/NU4000 are ASIC chips supporting 3D image processing and computer vision (CV) processing. Inuitive is said to be the first and only company to provide dedicated and complete 3D image processing and CV co-processors.

On December 5 last year, Inuitive reached a cooperation agreement with SoftBank Corp., a subsidiary of Japan’s SoftBank Group, stating that SoftBank’s future IoT (Internet of Things) projects will use the chips developed by this startup. According to Inuitive’s founder and CEO Shlomo Gadot, Inuitive will assist SoftBank in preparing for the 2020 Tokyo Olympics project.

In addition to SoftBank, Inuitive has also collaborated with Baidu and Tencent in robotics, and the company has established a team in Shenzhen for customer support.

4. Vayyar Imaging

Another Israeli company collaborating with SoftBank is Vayyar Imaging. Founded in 2011, Vayyar is a 3D sensor company with three co-founders who have strong backgrounds, having held key positions in high-tech companies like Intel and have 20-30 years of R&D experience in their respective fields, with two of the founders having been entrusted with important roles in the Israel Defense Forces.

Vayyar not only provides sensors for applications such as breast cancer screening, leak detection, and safety monitoring but also develops system-on-chip (SoC) for microwave-level 3D imaging. Its chips cover imaging and radar frequency bands from 3GHz to 81GHz, with a single chip containing 72 transmitters and receivers.

The cooperation between the two parties will combine SoftBank’s AI technology advantages with Vayyar’s 3D sensor advantages, deeply collaborating in the fields of smart transportation, building monitoring, and elderly care.

Chinese Investment in Israel’s High-Tech Industry

As a small country with only 8 million people, despite the flourishing high-tech industry, including chip companies, it is still somewhat constrained by funding. At this time, external funding becomes a key factor for the success of Israeli startups.

Many countries around the world recognize and appreciate the innovative capabilities and development potential of Israeli high-tech companies and are eager to invest here, and China is no exception.

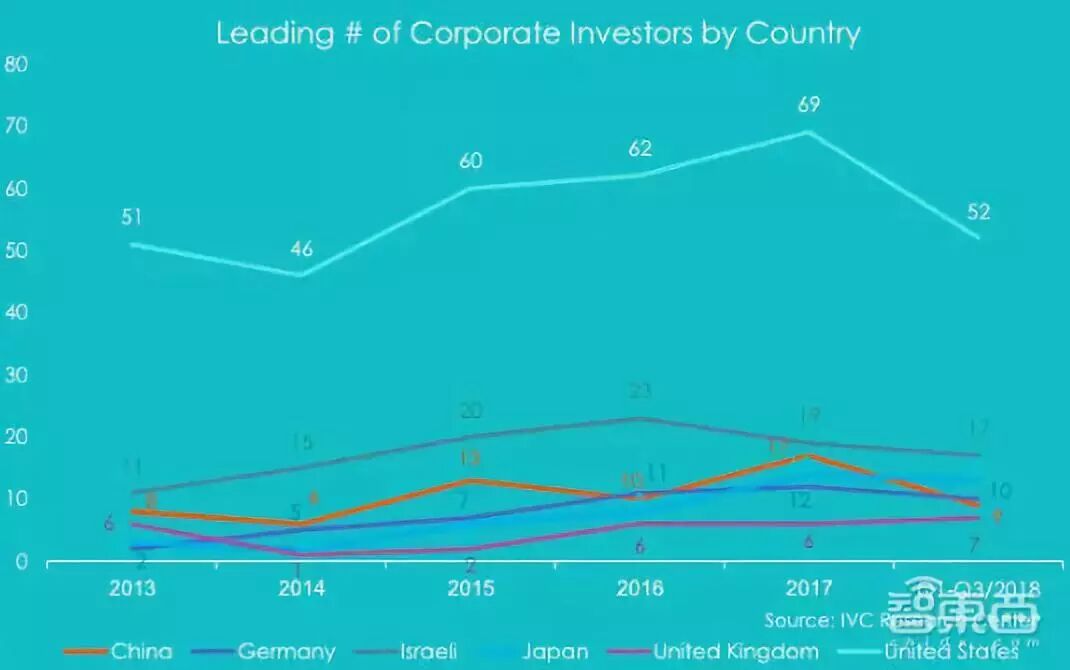

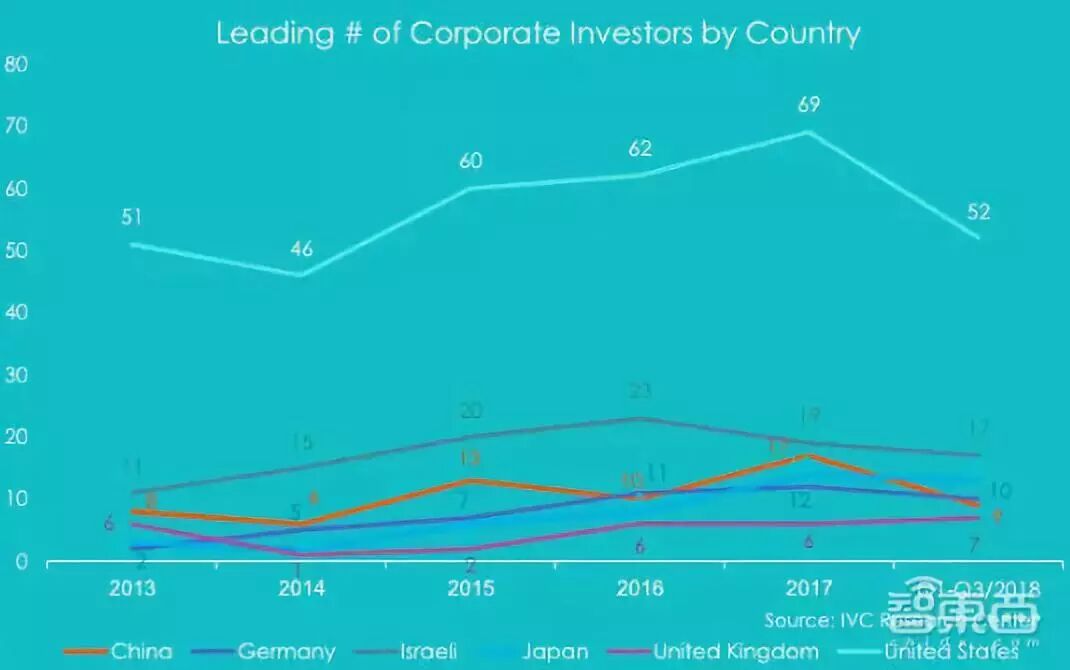

According to a report from the IVC Research Center, the number of investments from China in Israeli companies has shown a slight upward trend over the past five years, ranking third in the number of investments last year, only behind the United States and Israel itself.

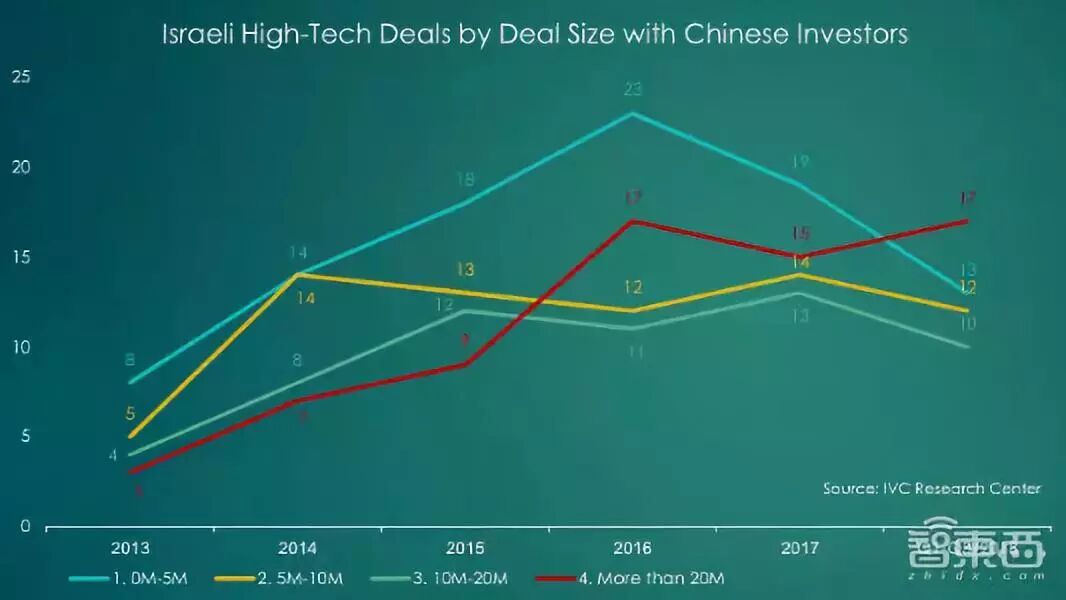

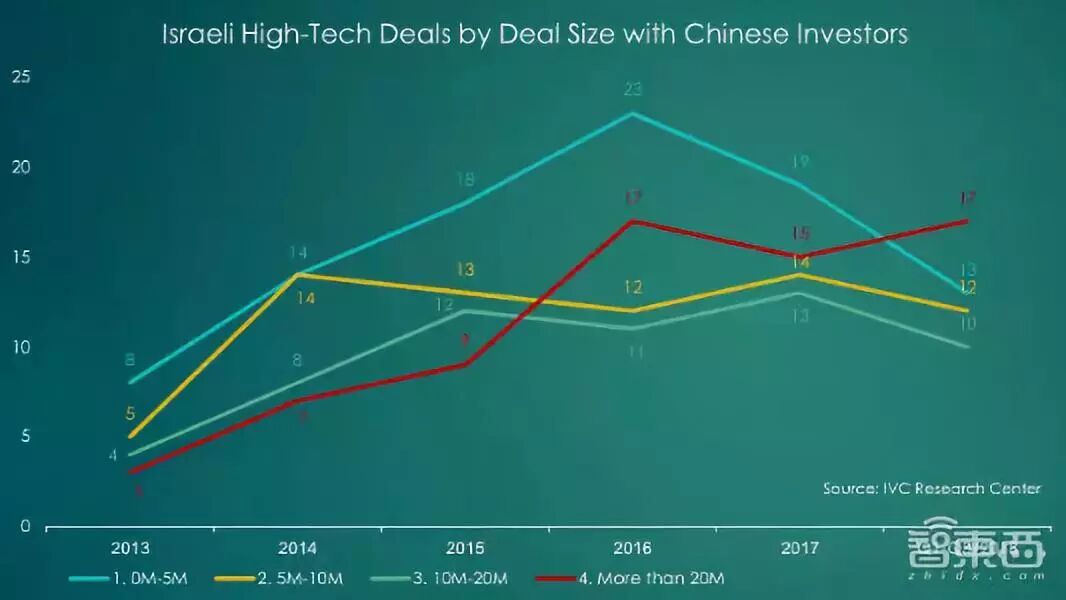

From the above chart, it can be seen that in the past two years, the number of transactions between Chinese investors and Israeli companies has ranged from 11 to 24 per quarter. This year, the transaction amount between Chinese investors and Israeli companies has significantly exceeded that of the past four years, with the third quarter reaching nearly $174 million, accounting for 25% of the total transaction amount in Israel for that quarter.

Since 2016, the number of single transactions exceeding $20 million from Chinese investors in Israeli high-tech companies has significantly increased. The report states that in the first three quarters of this year alone, there have been 17 transactions from China in Israel exceeding $50 million, and Chinese investors have participated in 6 of the largest transactions in Israel to date.

In the past five years, the most active investors in Israel have been Hillhouse Capital (32 transactions), ZhenFund (19 transactions), Ocean Link (18 transactions), Huike Capital (13 transactions), and Alibaba Capital (12 transactions).

The “Gravity” of Israel’s Chips

Why are there so many excellent chip companies in Israel? What attracts global giants to them? Years of historical accumulation, long-term policy support, a tripartite combination of industry, academia, and incubators, along with the participation of social capital, have nurtured a large number of high-quality talents in the semiconductor industry.

1. Sense of Crisis, Everyone is a Soldier

The irreconcilable religious conflicts, the long-standing wars in the surrounding areas, and the lack of resources have kept the Jewish people living in Israel constantly courageous, loyal to their homeland, and acutely aware of the crisis. They realize that only by relying on the smartest minds can they create a world in international competition.

How astonishing is Israel’s investment in education? It is reported that since 2000, nearly half of Israelis have received 13 years of schooling, with 140 scientists and engineers per 10,000 Israelis, a ratio that is twice that of the United States and Japan.

All Israeli young people who reach the age of eighteen must serve in the military, and among these young people, the outstanding individuals selected will receive the most advanced training in physics, mathematics, computer science, and defense technology.

The pressure of competition and the allure of honor have inspired a passion for struggle among many Israeli youth. After rigorous training in the military, most of them will flow into various technology industries, either becoming the backbone of companies or directly rushing into the wave of entrepreneurship.

2. Policy Encouragement, Diversity and Openness

The rigorous military service has shaped Israelis’ stronger comprehensive qualities and excellent self-management abilities, while the founding fathers’ governance philosophy and the foresight of successive governments in the high-tech field have provided an environment for innovation to thrive.

Market-oriented, building high-tech zones like “Silicon Wadi”, providing economic support, implementing “angel laws”, supporting scientific research, increasing employment supply, expanding the employee base, and establishing dedicated venture capital funds… A series of government measures, combined with the Israeli people’s desire for national self-improvement, have created a harmonious chemical reaction, resulting in not only chip companies but also many IT companies in Israel achieving remarkable success, making this small country shine with technological brilliance.

While realizing their self-worth, Israeli startups are also contributing to government revenue. Taking Intel’s $15.3 billion acquisition of Mobileye as an example, as part of this transaction, Intel is required to pay nearly $1 billion in taxes to the Israeli government. According to Professor Avi Simon, head of the Israeli National Economic Council, the long-term revenue from this transaction will reach about $2.6 billion (10 billion shekels).

Countries like China, which are bound by the Wassenaar Arrangement, find it difficult to obtain truly advanced overseas high-tech technologies, while Israel is not one of the 33 countries under this arrangement, which, to some extent, is also a reason why Israel can race ahead in the high-tech field.

3. Innovative Thinking, Daring to Dream and Do

The dual reasons of history and policy have made innovative genes almost embedded in the blood of the Israeli people. Even one of the semiconductor giants, Samsung, has conducted a series of internal activities called “Learning Innovation from Israel”, encouraging employees to learn the innovative spirit of Israel and cultivate genius thinking.

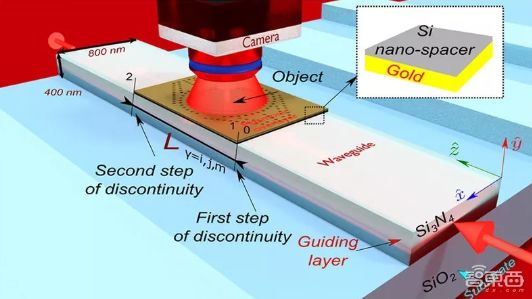

Their thinking does not even limit itself to the chips themselves. The “invisibility cloak” from Harry Potter is so wonderful, but can you imagine using chips to make this sci-fi scene a reality?

Last year, scientists at Ben-Gurion University of the Negev (BGU) published a study in the journal Nature, detailing how to use artificial materials on chips to bend light around objects, making them invisible to the human eye.

4. Rapid R&D, Timely Delivery

For any semiconductor company, having innovative talent is crucial, but top-notch R&D strength and the ability to deliver products on time are also key.

With rich knowledge and experience across multiple fields, and a strong ability to learn and grow quickly, Israeli engineers are relatively adept at meeting the increasingly high demands for chips (high efficiency, low power consumption, small size, etc.).

The high quality and efficiency of their completed products have earned them increasing trust, thereby attracting more international semiconductor companies to establish R&D centers, invest, and acquire.

Conclusion: The Revelation of Israeli Chips

Israel is truly admirable, born in a barren land and suffering from the pains of war, yet shedding its mottled past and donning a holy light, developing into a veritable “second Silicon Valley”. At a time when our country is suffering from a “chip” pain, we can not only absorb the passion and strategies for “chip-making” from Israel but also hope to accelerate the filling of the gap in domestic “chip-making”.

On one hand, we can see the power of talent, the good cooperation between industry and academia, the advanced R&D strength and execution capabilities, and the energy generated by open innovation among the populace.

On the other hand, we also see opportunities. Even chip giants like Intel, Qualcomm, and Samsung are leveraging the strength of Israeli chip companies to rapidly enhance their competitiveness.

China has the largest chip market, while Israel is the cradle of chip startups. Establishing research centers, acquisitions, investments, technology licensing, and commercial cooperation, or engaging with excellent Israeli R&D teams, may be worth a try for our country to rapidly enhance R&D strength and master advanced technologies.

After 40 years of reform and opening up, China’s rise has created a historical miracle that spans centuries in the history of modern civilization. This year is a year filled with thorns, but also a year of hope. By embracing and learning from others, perhaps China’s next exciting story will be “Chinese Chips”.

*This article is reprinted with permission from Zhidx (id: zhidxcom)

Cheyun Push Recommendation

Cheyun Push Recommendation