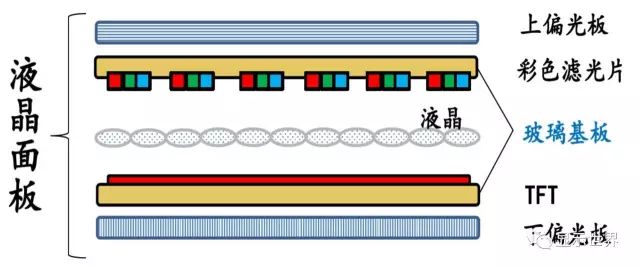

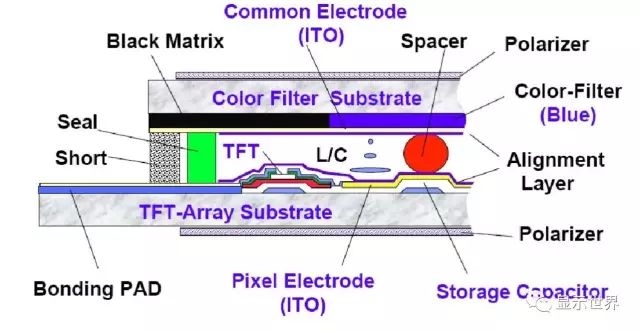

Substrate glass is one of the important raw materials that make up liquid crystal panels. The key structure of a liquid crystal panel is similar to a sandwich, with two layers of ‘bread’ (TFT substrate and color filter) enclosing the ‘jam’ (liquid crystal). Therefore, making a TFT-LCD panel requires two pieces of glass, used as the bottom glass substrate and the color filter bottom plate.

Substrate glass accounts for about 20% of the raw material costs in TFT-LCDs, and it has a significant impact on the performance of panel products. Indicators such as resolution, transparency, thickness, weight, and viewing angle of the finished panel are closely related to the quality of the substrate glass used. As an important foundational material, the significance of substrate glass to the TFT-LCD industry is comparable to that of silicon wafers to the semiconductor industry.

TFT-LCD Liquid Crystal Panel Structure

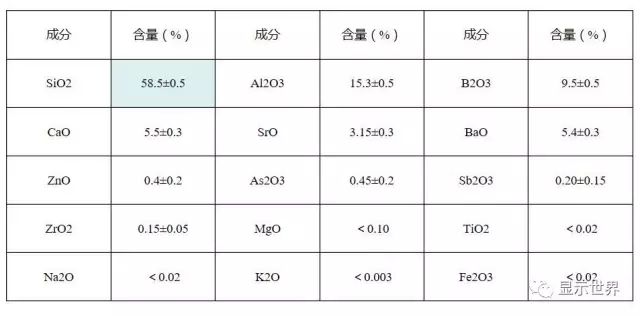

Substrate glass can be divided into alkaline and non-alkaline types. Alkaline glass is mainly used in TN/STN type liquid crystal panels, but for TFT-LCDs, the alkali metal ions in the glass can affect the stability of the gate voltage of thin-film transistors. Therefore, the manufacturing of the substrate must use a non-alkaline formula, which cannot contain components such as sodium oxide and potassium oxide. However, sodium oxide and potassium oxide can lower the melting temperature of glass, so the production of non-alkaline glass requires higher furnace temperatures. This is one of the reasons why the production technology of non-alkaline glass is more difficult than that of alkaline glass.

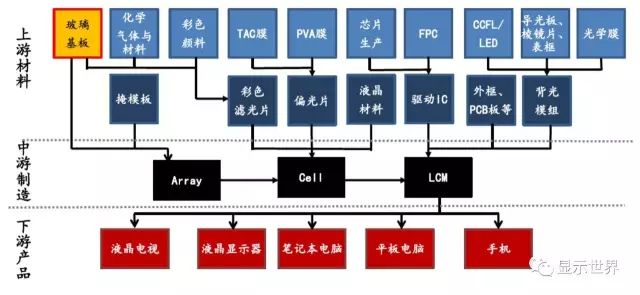

TFT-LCD Liquid Crystal Industry Chain

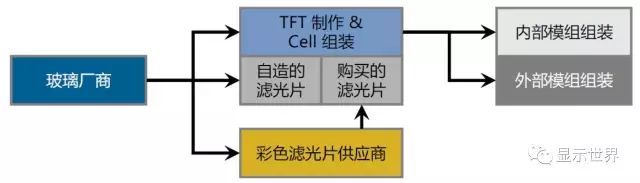

As one of the fundamental raw materials for liquid crystal panels, substrate glass occupies the top of the liquid crystal industry chain. The upstream raw materials are some of the most basic chemical materials such as quartz powder and aluminum oxide, while the downstream mainly consists of panel manufacturers and color filter suppliers, providing them with materials to produce TFT arrays and color filters, which are then filled with liquid crystal and assembled into Open Cell panels.

Substrate Glass Supply Chain

Introduction to Substrate Glass Characteristics

✦Chemical Properties

✦Main Physical and ChemicalParameters

(1) Strain Point

During the manufacturing process of TFTs, the substrate needs to undergo repeated heat treatments, with the highest temperature reaching 625°C. The substrate must maintain rigidity at this temperature without any viscous flow, otherwise, the glass will deform and cause thermal stress during cooling, leading to dimensional changes. Therefore, the strain point of the substrate glass must be above 625°C, plus a safety margin of 25°C, meaning the strain point of the glass must be at least above 650°C.

(2) Chemical Stability

The substrate glass must withstand various chemical treatments during the display manufacturing process. For example, α-Si active matrix LCDs have more than seven layers of thin-film circuits and the same number of etching steps, with etchants and cleaning agents ranging from strong acids to strong bases, such as over 10% NaOH, over 10% H2SO4, concentrated HNO3, 10% HF-HNO3, and concentrated H3PO4. The requirements for chemical stability in substrate glass are among the strictest in the glass varieties.

(3) Alkali Restrictions

Due to the requirements for printed circuits on the substrate glass, the glass cannot contain univalent alkali metals, meaning R2O content must be kept as low as possible, even at zero. If univalent alkali metals are present in the glass, they will migrate from the interior to the surface at high temperatures, causing short circuits or failures in the printed circuits. Therefore, the presence of univalent alkali metal ions in liquid crystal substrate glass is strictly prohibited.

Univalent alkali metals refer to univalent alkali metal ions, mainly including K+, Na, and Li.

(4) Coefficient of Thermal Expansion

Because a layer of silicon needs to be coated on the glass surface during the manufacturing of liquid crystal panels, the thermal expansion coefficient of the glass must match that of silicon. The glass must have a thermal expansion coefficient close to that of silicon, with the expansion coefficient of silicon dioxide being 5-7×10/°C.

On the other hand, since the manufacturing process of displays involves multiple rapid heating and cooling cycles, it will inevitably cause the glass structure to relax and change dimensions, leading to deviations in the electronic circuits of the photolithography process. Therefore, the overall shrinkage of the substrate components must be only a fraction of the narrowest width in the circuit diagram, meaning a few microns, and low thermal shrinkage remains a necessary condition.

Generally speaking, the thermal expansion coefficient of substrate glass is less than 40×10/°C within the temperature range of 0-300°C.

✦Glass Raw Materialsand Characteristics

The main raw materials for liquid crystal substrate glass include: quartz powder, strontium carbonate, barium carbonate, boric acid, boron trioxide, aluminum oxide, calcium carbonate, barium nitrate, magnesium oxide, tin oxide, zinc oxide, etc. These are the forming materials, adjusting materials, and intermediate components of the glass, constituting the main body of the glass and determining its physical and chemical properties.

Quartz Powder

The main component of quartz powder is SiO2, which is the primary oxide forming the glass. It forms an irregular continuous network structure of silicon-oxygen tetrahedra [SiO4], becoming the skeleton of the glass.

SiO2 can lower the thermal expansion coefficient and density of glass, increase the strain point of the glass, and if the SiO2 content is too low, it will reduce the acid resistance and chemical stability of the glass, making it difficult to obtain low expansion, low density, and high strain point glass, leading to difficulties in melting the glass and easily causing stone (quartz) defects.

Aluminum Oxide

Aluminum oxide is an intermediate oxide. When there is insufficient oxygen in the glass, the coordination number of Al is 6, forming an octahedron [AlO6] with O in the network gap; when there is excess O in the glass, the coordination number of Al is 4, entering the glass network and forming a tetrahedron [AlO4], playing a role in network compensation, increasing the stability of the glass, and lowering the expansion coefficient of the glass. At the same time, due to the larger volume of the [AlO4] tetrahedron, it can reduce the density of the glass. Al2O3 can significantly improve the strain point and elastic modulus of the glass, increasing its chemical stability.

The contents of silicon oxide and aluminum oxide are interdependent, with their sum needing to be greater than 70% of the total raw materials.

Boric Acid (Boron Trioxide)

Boric acid acts as a flux, and boron trioxide can lower the melting viscosity of glass without increasing the expansion coefficient. An appropriate amount of boron trioxide can increase the resistance to hydrofluoric acid, making it easier to process. However, when the concentration of boron trioxide is too high, it will damage the acid resistance of the glass, and the strain point will be too low.

The B in glass mainly forms boron-oxygen triangles [BO3] with O, and if there is sufficient O in the glass, it can form tetrahedra [BO4], lowering the thermal expansion coefficient of the glass.

Boron oxide reduces the melting point and facilitates melting. However, it also lowers the transition temperature and is very harmful to chemical durability, so it is best to keep the boron oxide content below 10%.

Because boron trioxide is easily affected by moisture during the production process, the main control indicators for boron trioxide are its main content and moisture content. Generally, during use, attention should be paid to moisture prevention in warehouses and the drying of material silos.

Strontium Carbonate

Strontium carbonate mainly introduces strontium oxide. Strontium oxide has the characteristics of not increasing density, not raising the linear expansion coefficient, and not excessively lowering the strain point, while also improving solubility. If the content is too high, it will lead to the degradation of transparency, acid resistance, and the durability against alkaline and etching solutions. Strontium oxide also has the effect of absorbing X-rays.

Zinc Oxide

Zinc oxide (ZnO) is an intermediate oxide. Generally, it acts as an external oxide with a zinc oxide octahedron [ZnO6]. When there is enough free oxygen in the glass, it can form zinc oxide tetrahedra [ZnO4], entering the glass structure network, making the structure of the glass more stable. ZnO4 can lower the thermal expansion coefficient of the glass and improve its chemical stability, thermal stability, and refractive index.

Tin Oxide

Tin oxide is a raw material used to replace toxic arsenic oxide as a clarifying agent.

Mainstream Manufacturing Processes of Substrate Glass

The manufacturing processes of substrate glass mainly include float glass, down-draw method, and overflow melting method. Currently, the mainstream process is the overflow melting method.

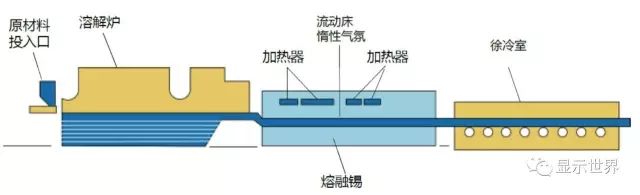

✦Float Glass Manufacturing Process

The float glass manufacturing process is the most widely used and has the longest history among flat glass manufacturing processes. This method involves transferring molten glass to a trough filled with molten tin, utilizing the density difference between tin and glass, allowing the glass to spread naturally under the influence of surface tension and gravity, and then entering a cooling chamber to solidify. Float glass requires further grinding and polishing in the later stages. The advantages of float glass are high production capacity, ease of expanding the area size of substrate glass, and lower costs compared to other processes. However, the expenses incurred during post-processing offset part of the cost advantage. Float glass was initially mainly used for TN/STN substrate glass, but later Asahi Glass successfully used the float method to produce non-alkaline substrate glass, becoming a representative manufacturer of float glass for TFT substrate glass.

Float Method Schematic

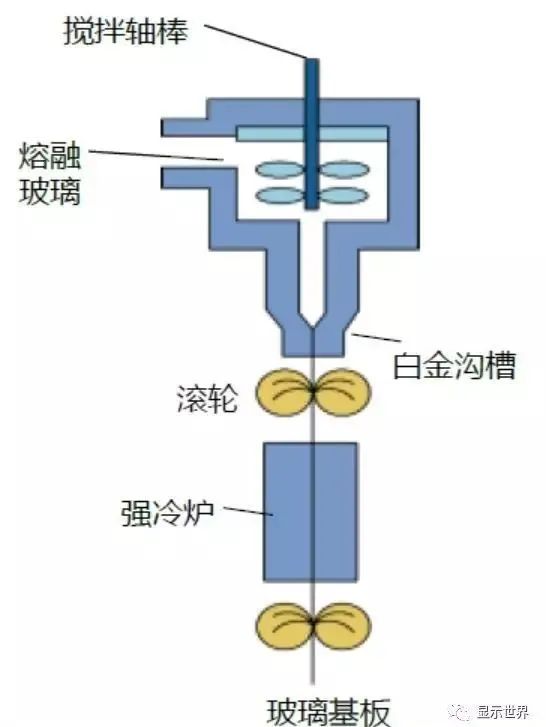

✦Down-Draw Method

The down-draw method involves directing molten glass into a flow hole leak plate made of platinum alloy. Under the influence of gravity, the glass solution flows out, and then it is rolled and cooled in a solidification chamber. The size of the flow hole and the down-draw speed determine the thickness of the glass, while the temperature distribution determines the flatness of the glass. The role of the flow hole in this process is crucial, as its stability affects key indicators such as glass thickness and surface flatness. However, due to external forces, the flow hole may deform, leading to fluctuations in yield. Additionally, since the glass surface contacts the rollers, flatness may also be affected, so the down-draw method also requires post-polishing processing. The main manufacturer using this process is Nippon Electric Glass. However, due to the lack of significant advantages, this process has gradually been phased out.

Down-Draw Method Schematic

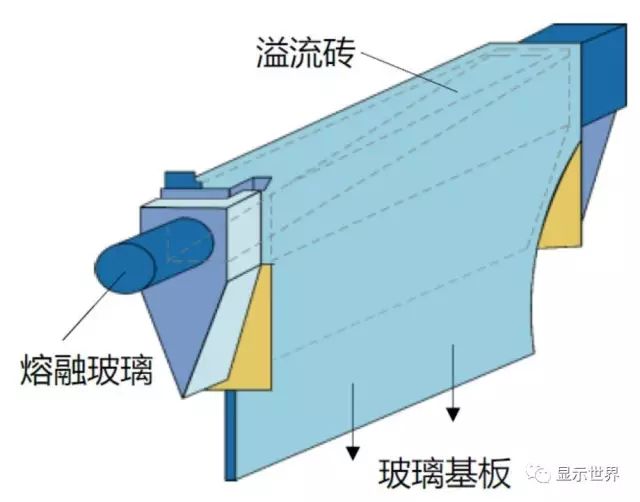

✦Overflow Melting Method

The overflow melting method involves directing molten glass into a conduit, and once the glass reaches the upper limit of the volume, it overflows from both sides along the wall of the conduit, forming a sheet-like substrate below, similar to a waterfall. The overflow melting method is led by famous glass manufacturers such as Corning. Because this process does not require the glass to contact any medium during forming (the float method contacts liquid tin, and the down-draw method contacts metal rollers), it does not produce issues related to differences in glass surface properties due to contact with a medium, thus eliminating the need for post-polishing and other processes. This has now become the mainstream manufacturing process for TFT-LCD substrate glass.

Overflow Melting Method Schematic

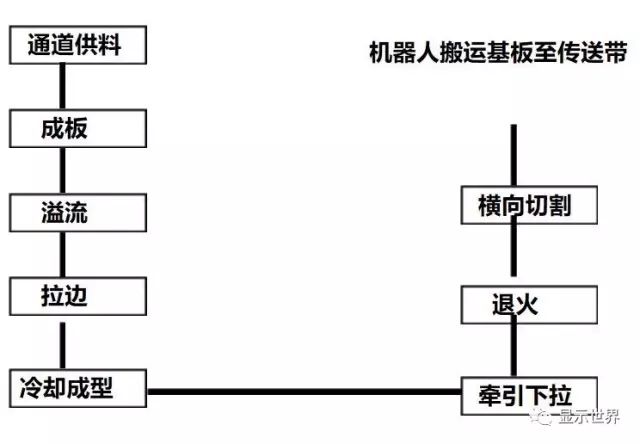

Forming Process Flow

The forming process involves melting the glass in a pool furnace, clarifying, homogenizing, and cooling the glass liquid through platinum passageways, then forming it through overflow bricks in the forming zone, cooling down in the annealing furnace to remove product stress, and finally cutting, weighing, and checking the thickness of the glass plates to ensure a smooth surface and uniform thickness before sending the semi-finished substrate glass to the BOD (semi-finished processing) process.

Comparison of Three Substrate Glass Manufacturing Processes

Trends in Substrate Glass Development

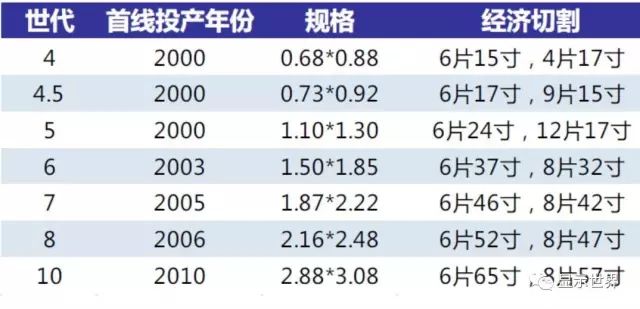

Due to the need to match downstream panel manufacturers, the glass substrate production lines are divided into generations based on the output area of the glass, with larger areas corresponding to higher generations. Currently, the highest generation line in production is the 10th generation line, with dimensions reaching 2880x3130mm. The trend of panel production lines towards higher generations dictates a similar development trend for substrate production lines. Currently, international substrate glass giants have shifted their focus to the construction of high-generation lines, with no new capacity being added for medium and low-generation lines. High generation and lightweight design have become the development trends for substrate glass.

Evolution of Substrate Glass Generations (Specifications in meters)

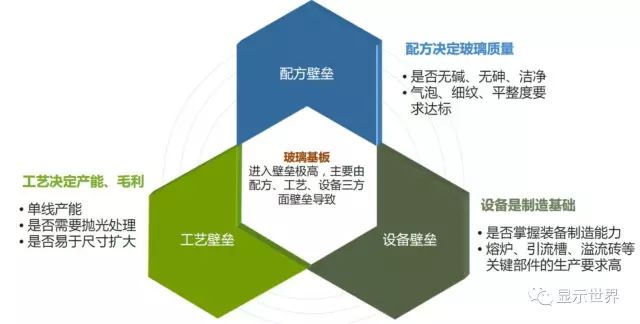

Three Major Technical Barriers in the Substrate Glass Industry

Substrate glass may seem easy, as it appears to just require making the glass thin, flat, and clean. However, the technical barriers are extremely high. The technical barriers in substrate glass manufacturing are mainly reflected in three aspects:

✦Process BarriersSubstrate glass for TFT-LCDs has electronic-grade requirements for surface flatness and impurity content. The general float process cannot meet such high flatness requirements, and post-processing grinding and polishing may introduce new surface impurities due to contact with media. Currently, only Asahi Glass has successfully used the float method to manufacture substrate glass. The mainstream process for substrate glass remains the overflow melting method, which has higher process barriers than the float method, requiring precise adjustments of temperature, flow rate, and other parameters, making it difficult to master.

✦Formula Barriers

This is the core barrier, which is a key technology that allows giants like Corning to monopolize the substrate industry. The overflow melting method requires the correct glass liquid formula to stabilize the forming process, and the glass liquid formula also affects the optical and chemical properties of the substrate glass. Furthermore, arsenic oxide is used as a chemical clarifying agent in traditional substrate glass manufacturing formulas to accelerate the removal of bubbles in molten glass. However, arsenic is a toxic metal that does not meet environmental protection requirements in some countries and regions, so arsenic-containing glass faces restrictions in exports and downstream customer development. Using arsenic-free formulas requires other methods to eliminate bubbles, which increases technical difficulty. In summary, the formula is the core technology in the manufacturing of substrate glass, affecting the yield of the finished substrate glass.

✦Equipment Barriers

For example, in the overflow melting method, the production equipment is mostly developed and produced by the glass manufacturers themselves, making it difficult for new entrants to purchase ready-made equipment in the market; they all need to redesign and produce production equipment. Additionally, due to the high requirements for the production of key components such as furnaces, drainage troughs, and overflow bricks, any failure to meet precision and characteristics will directly affect the yield of the final product, resulting in significant barriers in the manufacturing of substrate glass production equipment.

Three Major Entry Barriers in the Substrate Glass Industry

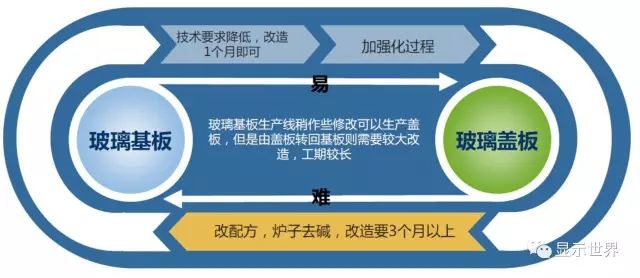

Transition Between Substrate Glass and Cover Glass

The entry barriers for the substrate glass industry are high, but exiting is relatively easy, mainly reflected in two aspects: the single-line investment amount for substrate glass production lines is not high, and it is easy to switch to cover glass production.

Unlike the investment in a panel production line, which often exceeds billions, the investment for a 6th generation substrate glass production line is about 700 million yuan, of which 200-300 million yuan for platinum can be sold for recovery. Therefore, the financial pressure for exiting is not significant.

Substrate glass manufacturers have the capability and motivation to switch to cover glass production.

Cover glass is a layer of strengthened glass that serves as the outer layer of touch-enabled mobile devices such as smartphones, tablets, and ultrabooks. Since the requirements for surface flatness and thickness of cover glass are not as high as those for substrate glass, and there is no need to use non-alkaline glass, the manufacturing difficulty of cover glass is lower than that of substrate glass. Transitioning a substrate glass production line to a cover glass production line is not technically difficult; the investment in strengthening treatment in the later stage is also not high. As long as the formula is mastered, the transformation can be completed in a month. However, switching back from cover glass to substrate glass is much more challenging, as it requires not only changing the glass liquid formula but also eliminating alkali contamination caused by cover glass production in the furnace and modifying to higher temperature-resistant equipment. This process is technically difficult, time-consuming, and the overall conversion period takes more than three months, with few practices in the industry.

Transition Between Substrate Glass and Cover Glass Production Lines

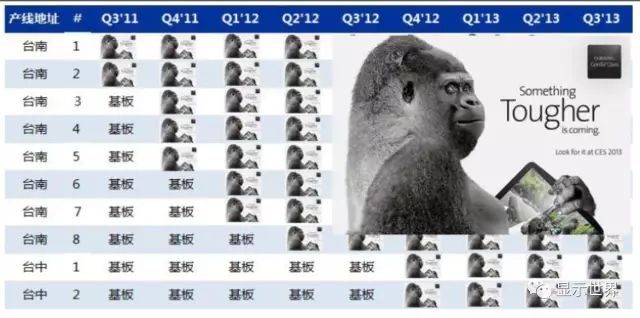

With the explosive growth of smartphones and tablets, the demand for cover glass has also increased, leading to a temporary supply shortage. Among them, Corning’s developed Gorilla Glass has been favored by many brand manufacturers, including Apple, becoming the preferred cover glass for flagship phones like the iPhone. With the hot sales of Gorilla Glass, combined with the higher profitability of cover glass compared to substrate glass, Corning has converted all its production lines in the United States to cover glass. In 2011 and 2012, it also successively converted ten substrate production lines in Taiwan to produce Gorilla Glass.

From Corning’s ‘Gorilla Road’, it can be seen that substrate glass manufacturers, due to occupying a technological high ground, have low technical barriers to transition to other glass products, with the barriers mainly reflected in the formulas. Currently, the demand for cover glass is still rising, and as competition in the substrate industry intensifies, manufacturers may exit the substrate market and switch to cover glass for potentially higher profits. Currently, industry leader Corning is gradually converting its low-generation production lines to cover glass.

Taiwan Corning’s Original Substrate Glass Production Line Converted to Gorilla Glass

|

Manufacturer |

Country |

Cover Glass Product |

Type |

Launch Year |

|

Corning |

USA |

Gorilla |

Overflow Method High-Alumina Glass |

2010 |

|

Asahi Glass |

Japan |

DragonTrail |

Float Method High-Alumina Glass |

2011 |

|

Nippon Electric Glass |

Japan |

CX-01 |

Overflow Method High-Alumina Glass |

2011 |

|

Schott |

Germany |

Xensation |

Float Method High-Alumina Glass |

2011 |

|

China Star Optoelectronics |

China |

Panda King |

Float Method High-Alumina Glass |

2014 |

|

Rainbow |

China |

Rainbow Kelly |

Overflow Method High-Alumina Glass |

2016 |

Global Major Cover Glass Manufacturers

Among domestic glass manufacturers, Dongxu has also launched high-strength ultra-thin aluminosilicate glass using the float method, while Rainbow has launched high-alumina cover glass using the overflow method.

Asahi Optoelectronics’ high-strength ultra-thin touch screen glass production line has an annual production scale of 7.8 million square meters, ranking second globally in single-line production capacity, just behind Japan’s Asahi Glass.

Rainbow CG01 overflow down-draw 6th generation high-alumina cover glass has a production capacity of 100,000 to 120,000 square meters per month, with specifications of 1520x1497mm and thickness ranging from 0.5 to 1.0mm.

Main Raw Material Situation of High-Alumina Glass

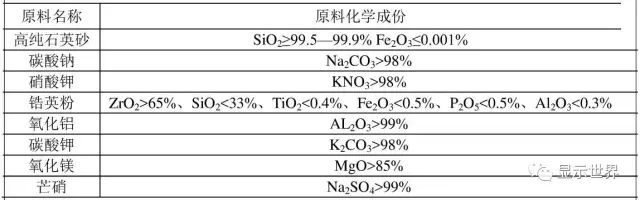

The main raw materials for high-alumina glass include: high-purity quartz sand, sodium carbonate, potassium nitrate, zircon powder, aluminum oxide, potassium carbonate, magnesium oxide, and mirabilite.

Unlike the panel manufacturing industry, which is a ‘money-burning’ industry, the glass substrate industry is one that relies on technology. The high entry barriers lead to favorable supply and demand conditions, oligopolistic monopolies, and high profit margins as industry characteristics. Those who can produce qualified products can participate in sharing the high-profit cake; the three major barriers in glass substrate manufacturing have blocked many entrants, maintaining a long-standing oligopolistic situation dominated by Corning and Japanese glass manufacturers.

(Source: Display World)

Previous Review

Industry Focus | Understanding Mini LED and Micro LED in One Article

Industry Focus | Understanding the Display Panel Industry Chain in One Article

Understanding Core Enterprises in Apple’s Industry Chain