This article is sourced from: Global IoT Observer

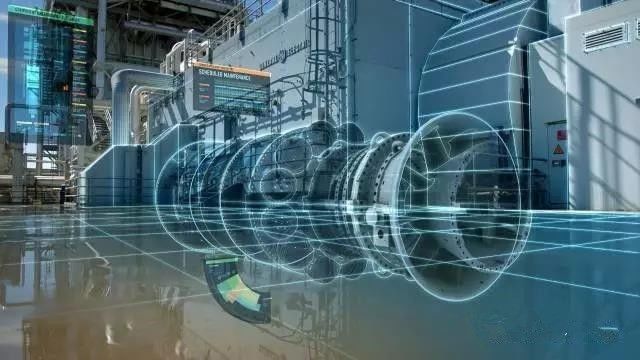

The logic behind Industrial Internet of Things (IIoT) is the increasingly mature sensor technology and information technology, which allows industrial applications to transform into intelligent systems.

When mentioning the Internet of Things (IoT), most people first think of smart homes, smart cars, wearable devices, and other fields closely related to daily life.

The term Consumer IoT is rarely mentioned, yet its products are deeply ingrained in our lives. Its sibling, Industrial IoT, is often brought up, but due to its lack of direct consumer-facing applications and complex, hard-to-understand concepts, the “truth” is only grasped by a few.

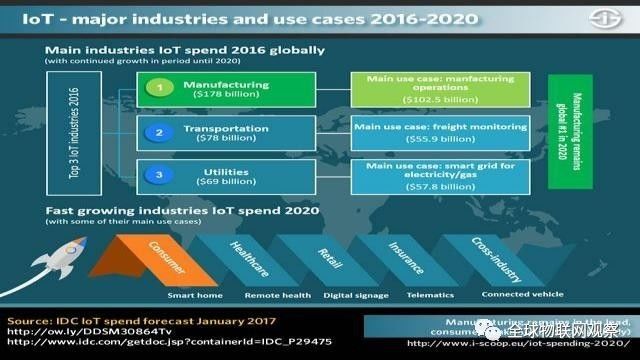

On one hand, it is difficult to understand; on the other hand, it is highly regarded. According to IDC’s 2017 IoT investment expenditure forecast, the three major industries preparing to invest globally before 2020 are all part of the Industrial IoT market. According to data from CCID Consulting, the market size of China’s Industrial IoT was 189.6 billion yuan in 2016. By 2020, the Industrial IoT will account for 25% of China’s overall IoT industry, with a scale surpassing 450 billion yuan.

What exactly is “Industrial IoT”, and how can we quickly clarify the industry context and establish a knowledge framework? This is what this article aims to discuss.

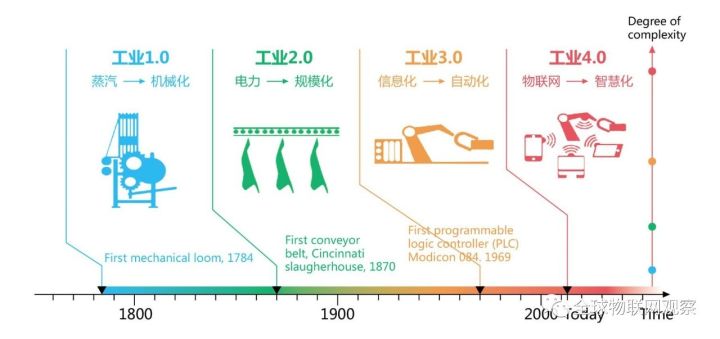

In the past two hundred years, there have been three industrial revolutions, and we are currently in the fourth, also known as Industry 4.0.

The evolution of the industrial revolution

Industry 1.0: Watt invented the steam engine, ushering in the mechanical manufacturing era.

Industry 2.0: The widespread use of electricity enabled mass production of products.

Industry 3.0: The application of integrated circuits achieved automated production.

The concept of Industry 4.0 was first proposed by the German government in 2013 and has risen to a national strategy.

Unlike the previous three revolutions, Industry 4.0 is not driven by a single invention, such as steam power or integrated circuits, but rather by the integration of technological advancements. It marks the era of the merging of the physical world and the virtual network world, including technologies like 3D printing, virtual reality, and cloud computing.

The concepts of IoT and Industry 4.0 have both intersections and differences. As the deep integration of industrialization and informatization progresses, the demand for interconnection within enterprises increases. The need to connect to networks to enhance product quality and operational efficiency becomes more pronounced, leading to the emergence of Industrial Internet of Things (IIoT).

Industrial IoT transforms every link and equipment in the production process into data terminals, collecting fundamental data comprehensively and conducting deeper data analysis and mining to improve efficiency and optimize operations.

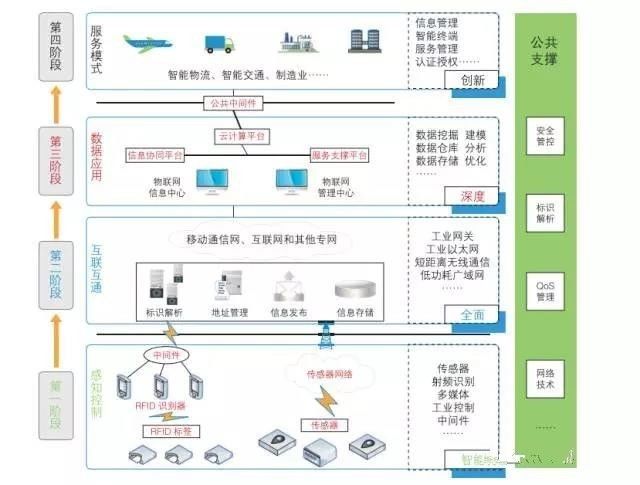

Of course, Industrial IoT is a gradual process of development and maturation, which includes four stages:

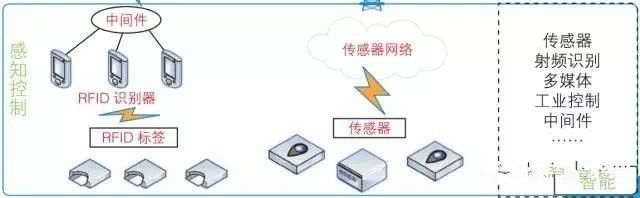

1. Intelligent Perception and Control Stage

This involves utilizing end-based intelligent perception technologies, such as sensors, REID, and wireless sensor networks, to intelligently collect industrial data and control equipment anytime, anywhere.

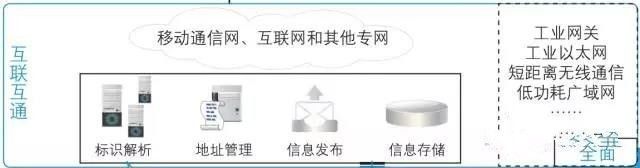

2. Comprehensive Interconnection Stage

This stage integrates common information technologies and industry characteristics through various communication networks, such as industrial gateways, short-range wireless communication, low-power wide-area networks, and OPC UA, to transmit collected data accurately and in real-time.

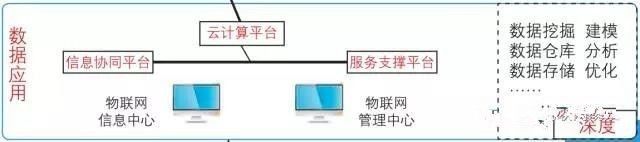

3. Deep Data Application Stage

This stage utilizes cloud computing, big data, and other related technologies to model, analyze, and optimize data, achieving deep development and application of multi-source heterogeneous data. It extracts hidden predictive information from data warehouses, uncovers potential relationships among data, and quickly and accurately identifies valuable information, thereby effectively improving the system’s decision support capabilities.

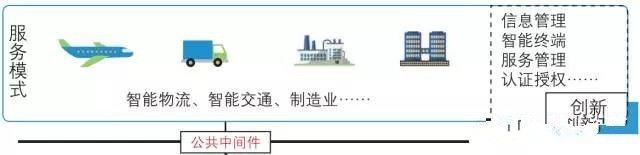

4. Innovative Service Model Stage

This stage utilizes information management, intelligent terminals, and platform integration technologies to provide customized services, value-added services, operational services, upgrade services, training services, consulting services, and implementation services, thus achieving the intelligent transformation of traditional industries, enhancing industrial value, optimizing service resources, and stimulating industrial innovation.

The panoramic view of the implementation stage of Industrial IoT

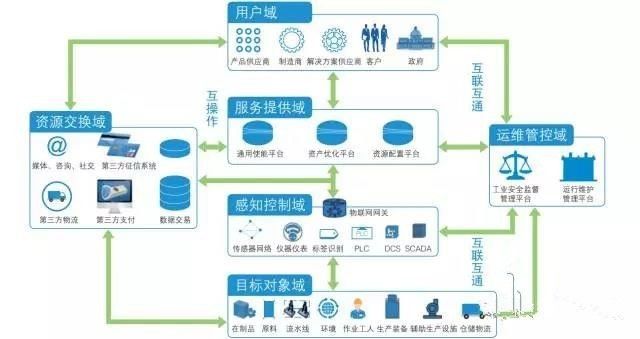

From a system perspective, the composition model of Industrial IoT, the main entities in various functional modules, and the relationships among modules are illustrated in the following diagram:

Industrial IoT reference architecture

Raw materials, machinery and equipment, environment, and workers are perceived, identified, and controlled by sensors and tags in the perception control domain. Information from various stages of production, processing, transportation, circulation, and sales is collected. The collected data is ultimately transmitted to the service provision domain, enabling remote monitoring, energy management, safety production, and other services.

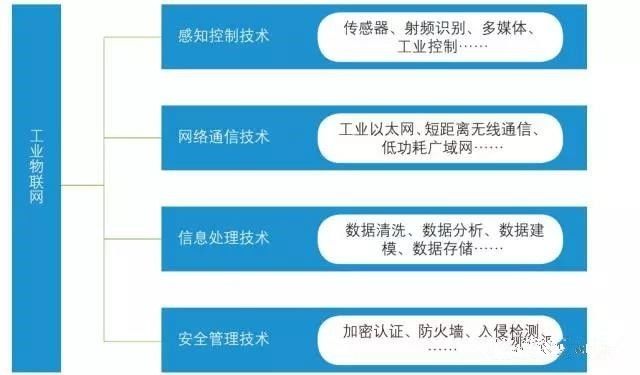

The key technologies required for Industrial IoT mainly include four major areas.

Industrial IoT technology system

Technology is not static but is evolving. Currently, the technology of Industrial IoT is developing in five directions.

1. Intelligent Terminals

This includes the miniaturization and intelligence of underlying sensor devices, as well as the gradual expansion of the openness of industrial control systems, enabling collaboration between industrial control systems and various business systems.

2. Ubiquitous Connectivity

Industrial control communication networks have experienced various industrial communication technologies such as field buses, industrial Ethernet, and industrial wireless, connecting monitoring devices and systems with various sensors, transmitters, actuators, servo drives, motion controllers, and even CNC machine tools, industrial robots, and complete production lines.

3. Edge Computing

Data no longer needs to be transmitted to distant cloud servers, making real-time data analysis and intelligent processing more suitable, with advantages of security, speed, and ease of management, better supporting local business’s real-time intelligent processing and execution, meeting real-time network demands.

4. Network Flattening

The architecture of Industrial IoT is being simplified, improving system performance while reducing software maintenance costs. Establishing a network flattening technology system allows for intelligent flow of information between the real world and virtual space, achieving real-time control, precise management, and scientific decision-making in production manufacturing.

5. Platformization of Services

Industrial IoT platforms face challenges such as a massive number of connected devices, complex application environments, and diverse users. Enhancing connection flexibility, expanding user scale, and simplifying application development while providing remote management, preventive maintenance, and fault diagnosis services based on actual user needs is essential.

The main players in Industrial IoT include sensor manufacturers, industrial control enterprises, and platforms.

The global sensor market has been introduced in detail in the article: The Most Comprehensive! Global Smart Sensor Industry Chain Company Directory, so it will not be repeated here.

Industrial Control: Aiming to detect, control, optimize, schedule, manage, and make decisions regarding industrial processes, mainly represented through products like PLCs and DCS.

DCS: Distributed Control System

PLC: Programmable Logic Controller

DCS is a control “system”, while PLC is merely a control “device”; the two represent the distinction between “system” and “device”. A system can implement any function and coordination of devices, while devices can conceptually form a system.

Currently, the PLC market can be divided into three factions: American, European, and Japanese, which hold significant market shares. China’s PLC market is still dominated by foreign products, and domestic PLC manufacturers need to improve in terms of product quantity and production scale.

Main manufacturers include:

USA: A-B Company, General Electric, Modicon, etc.;

Europe: Siemens (Germany), AEG (Germany), TE (France), etc.;

Japan: Mitsubishi, Omron, Panasonic, Fuji, etc.

DCS manufacturers are mainly concentrated in the USA, Japan, and Germany. Foreign DCS products hold a certain market share in China. However, in recent years, the market share of domestic DCS products has been rapidly increasing, with a number of excellent domestic DCS companies emerging, significantly increasing the variety and quantity of products, and achieving or nearing international advanced levels in terms of product technology.

Main manufacturers include:

Foreign: Honeywell, Yokogawa, etc.

Domestic: Beijing Haili, Shanghai Xinhua, Zhejiang University Control, Zhejiang Weisheng, Aerospace Measurement and Control, Institute of Electronics, and Beijing Kangtuo Group, etc.

Platforms: Industrial giants are actively laying out their platforms, including Siemens’ MindSphere, GE’s Predix, Phoenix Contact’s ProfiCloud, as well as domestic platforms like Sany Heavy Industry’s Genyun, Haier’s COSMOPlat, XCMG Industrial Cloud, and CASIC’s INDICS.

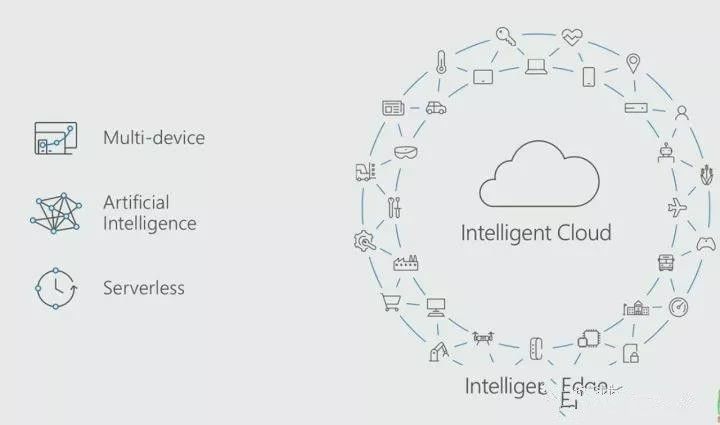

At the same time, IT giants are leveraging their cloud platform advantages to collaborate with upstream and downstream enterprises, laying out the industrial IoT industry ecosystem. This includes Microsoft’s Azure, Amazon’s AWS, IBM’s Watson, SAP’s HANA, and domestic companies like Baidu, Alibaba, JD, and Tencent, which have also launched platforms targeting Industrial IoT.

In addition to independent layouts, complementary cooperation to expand the ecosystem is also a mainstream platform layout approach. For example, in 2016, GE announced that Predix would land on Microsoft’s Azure cloud platform; in 2017, ABB announced it would provide industrial cloud services based on Microsoft’s Azure platform and collaborate with IBM on industrial data computing and analysis; Siemens also stated that MindSphere has cooperated with Amazon AWS, Microsoft, and SAP in cloud services.

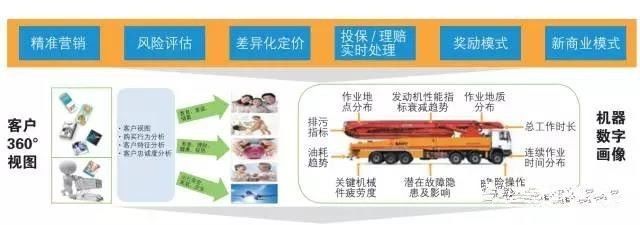

1. Innovative Insurance Model

Sany Heavy Industry is the largest engineering machinery manufacturer in China and the fifth largest globally. Its equipment is highly valuable, often priced at hundreds of thousands to millions of yuan. Due to the high construction risks faced by construction machinery during operation, insurance is typically purchased to transfer these risks, but insurance companies often have limited understanding of the situation.

RootCloud’s “Genyun” platform, in collaboration with Jiulong Insurance and Sany Heavy Industry, integrates talents and technologies from equipment manufacturing, industrial internet, and finance to explore and attempt the closed-loop business model of “equipment + data + insurance” for the first time. This involves deeply mining and applying the IoT data and operational data of Sany’s equipment to develop IoT-based insurance products, uncovering the financial value of industrial big data and exploring innovative business models for industrial big data.

By predicting loss probabilities based on equipment data, each piece of equipment’s operational data (working condition data) can be considered a pricing variable in determining pricing, allowing for more accurate, fair, and dynamic pricing for each individual piece of equipment, assisting insurance companies in risk selection and precise pricing.

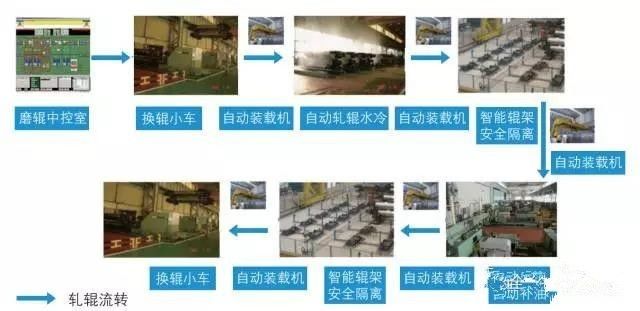

2. Production Process Optimization

Baosteel Group is known as a product of China’s reform and opening up. The day after the closing of the Third Plenary Session of the 11th Central Committee in 1978, it laid the first pile on the northern bank of the Yangtze River in Shanghai. After more than 30 years of development, Baosteel has become the largest steel joint enterprise in China. However, the standardized process of Baosteel’s grinding shop has issues such as low labor efficiency, high safety risks, significant quality fluctuations, and poor environmental performance.

Baosteel has implemented technologies such as industrial internet, RFID, information interaction, and intelligent control to achieve lifecycle management of rollers.

By applying RFID technology to rollers, identity information and data can be automatically identified, and relevant applications can be used for logistics, inventory, and on-site management, greatly improving production efficiency and significantly reducing the error rate that may arise from manual identification in the standardized process dominated by manual operations.

Through intelligent perception, human-computer interaction, decision-making, and execution technologies, Baosteel has deeply integrated information technology and intelligent technology with equipment manufacturing process technology, creating an unmanned automated grinding shop that enhances the level of intelligent manufacturing. This has greatly improved the supply capacity of the rolling line, avoided safety risks, reduced production costs, and improved energy-saving and environmental protection levels.

The logic behind Industrial IoT is the increasingly mature sensor technology and information technology, which enables industrial applications to transform into intelligent systems. As perception control and interconnectivity are realized, data will be further mined, expanding the coverage in the field of industrial manufacturing and shaping a more diverse ecosystem that provides personalized services, stimulating industrial innovation. From an industrial perspective, companies related to sensors, industrial control, and platforms will directly benefit.

Recommended Articles

-

Important! The US research report reveals 20 technology development trends to watch

-

Everyone claims to be involved in cloud computing; let’s look at the six major costs essential for cloud computing

-

After watching Google’s press conference, I feel other manufacturers have lost hope

-

Gartner releases a nearly 40-page PPT detailing the top ten strategic technology trends for 2017

-

245 innovative projects; startups are accelerating the IoT explosion