Industrial Internet of Things – the cornerstone of smart manufacturing.

【Smart Things AI, Automotive Technology Editor/Recruitment of Journalists and Interns,Join us to see the future!Send your resume to[email protected],For job details, reply with“Recruitment”or checkthe original link】

Compiled by Smart Things | Fourteen

The Internet of Things (IoT) has entered a new stage of deep integration with traditional industries. In the next decade, the global IoT will create over $10 trillion in value, accounting for about 1/10 of the global economy, and will form several sub-markets with scales exceeding hundreds of billions in urban management, manufacturing, automotive driving, energy conservation, and environmental protection.

Among them, the transformation and upgrading of the industrial manufacturing sector has become a significant driving force for the development of the Industrial IoT. Countries around the world are releasing relevant strategic measures to seize new opportunities for development. Some analyses suggest that by 2020, the Industrial IoT will account for 25% of the overall IoT industry, with a scale exceeding 450 billion yuan.

In this issue of Smart Insights, we recommend the Industrial IoT white paper from the China Electronics Technology Standardization Institute, which deeply explores the application prospects of IoT in the industrial manufacturing sector. It analyzes the current status of technology and industry from two dimensions: terminals and platforms, introduces the progress of standardization work, and lists innovative use cases. If you want to collect the full report of this article, you can reply with the keyword “nc188” on Smart Things (public account: zhidxcom) to download.

The following are the valuable insights organized by Smart Insights:

From Government-Led to Demand-Driven

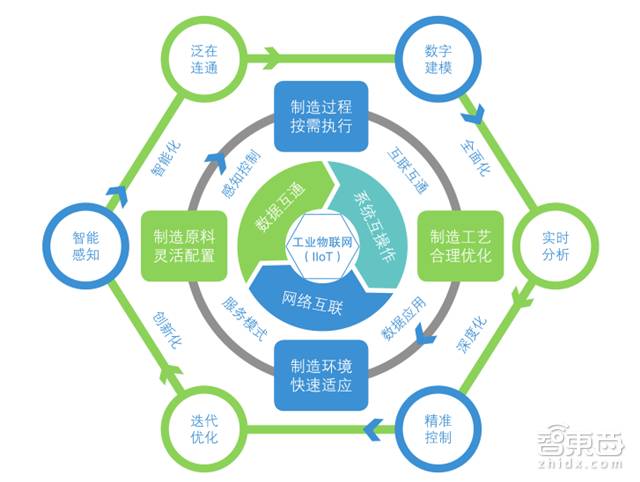

*The essence and six typical characteristics of Industrial IoT

With the rapid development of IoT technology, a series of national strategies such as Made in China 2025, the U.S. Advanced Manufacturing Partnership, and Germany’s Industry 4.0 have been proposed and implemented. Against this backdrop, the Industrial IoT has emerged as the cornerstone of smart manufacturing (supporting technology system) and has become an important driver of the intelligent transformation of the global industrial system.

The China Electronics Technology Standardization Institute points out that the Industrial IoT achieves flexible allocation of manufacturing raw materials, on-demand execution of manufacturing processes, reasonable optimization of manufacturing processes, and rapid adaptation to manufacturing environments through the interconnection of industrial resources, data communication, and system interoperability, thus achieving efficient utilization of resources and constructing a new service-driven industrial ecosystem.

Transforming traditional industries with the Industrial IoT will bring profound changes to enterprises’ production, operation, and management models, improve manufacturing efficiency, enhance the economic added value of industries, achieve energy conservation and emission reduction, and effectively promote the transition of China’s economic development model from production-driven to innovation-driven, facilitating the adjustment of China’s industrial structure.

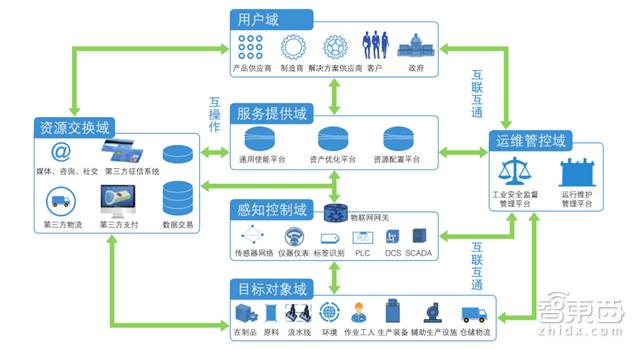

*Reference architecture of Industrial IoT

Currently, China’s Industrial IoT is shifting from government-led to application-demand-driven. Enterprises are beginning to apply the Industrial IoT to solve the actual problems they face, such as:

1. Real-time monitoring of production equipment, raw materials, work-in-progress, and staff status through sensor instruments to achieve intelligent execution of manufacturing processes, improving production efficiency and product quality;

2. Building smart warehouses through identification technologies like RFID and connecting them with the production process to enhance the efficient allocation of manufacturing raw materials;

3. Durable equipment products utilizing sensing technology to obtain data for predictive warnings, remote maintenance, and other services, enhancing the added value of equipment products.

The in-depth application of Industrial IoT in various aspects of industrial manufacturing helps improve issues like overcapacity and increased cost pressures.

Layout Route of Industrial IoT

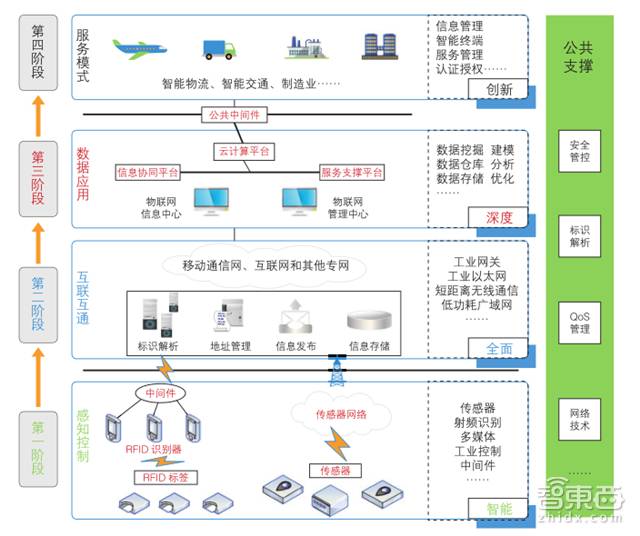

*Four implementation phases of Industrial IoT

The implementation of Industrial IoT generally includes four phases:

1. Intelligent Sensing and Control Phase

Utilizing end-based intelligent sensing technologies (sensors, RFID, wireless sensor networks, etc.) to collect industrial data and control equipment intelligently anytime, anywhere;

2. Comprehensive Interconnection Phase

Integrating common information technology and industry characteristics through various communication networks (industrial gateways, short-range wireless communication, low-power wide-area networks, and OPC UA, etc.) to transmit collected data in real-time, securely, and efficiently;

3. Deep Data Application Phase

Utilizing cloud computing, big data, and related technologies for data modeling, analysis, and optimization, extracting hidden predictive information from data warehouses, uncovering potential relationships between data, and quickly and accurately identifying valuable information to effectively enhance the decision support capabilities of the system;

4. Innovative Service Model Phase

Primarily using information management, smart terminals, and platform integration technologies to provide customized services, value-added services, operation and maintenance services, upgrade services, training services, consulting services, and implementation services, widely applied in smart factories, smart transportation, process reengineering, environmental monitoring, remote maintenance, equipment leasing, and other IoT application demonstration fields, comprehensively constructing an ecological circle of innovative service models for Industrial IoT, enhancing industrial value and optimizing service resources.

Analyzing Technical System and Development Trends

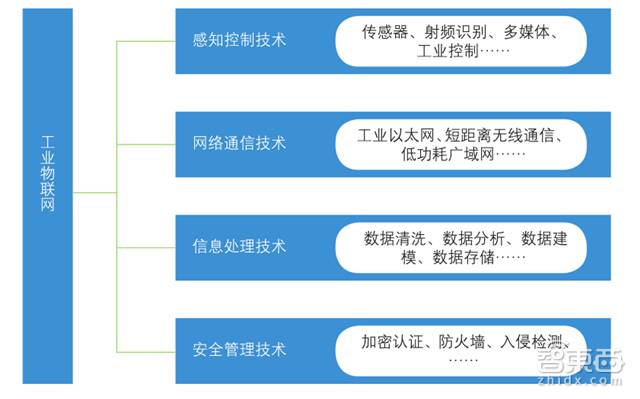

*Industrial IoT Technical System

The Industrial IoT technical system mainly consists of the following four parts:

1. Sensing and Control Technology

Includes sensors (which measure or sense the state and changes of specific objects and convert them into electronic signals or other forms of information that can be transmitted, processed, or stored), RFID (non-contact automatic identification technology), multimedia, industrial control (SCADA systems, DCS, and PLC), etc., which are the core of the deployment and implementation of Industrial IoT;

2. Network Communication Technology

The three main technologies are industrial Ethernet, short-range wireless communication technology, and low-power wide-area networks. Core technologies include time synchronization, deterministic scheduling, channel hopping, routing, and security technologies, which can significantly reduce the wiring costs of industrial sensors and facilitate the expansion of sensor functions, forming the basis for connectivity in Industrial IoT;

3. Information Processing Technology

Includes data cleaning, data analysis, data modeling, and data storage, providing support for Industrial IoT applications;

4. Security Management Technology

Includes encryption authentication, firewalls, intrusion detection, etc., which are critical for the deployment of Industrial IoT.

Currently, the development trends of Industrial IoT are:

1. Intelligent End Devices

Including the miniaturization and intelligence of underlying sensor devices and the gradual expansion of openness in industrial control systems, making collaboration between industrial control systems and various business systems possible;

2. Ubiquitous Connectivity

The industrial control communication network has undergone various industrial communication network technologies such as fieldbus, industrial Ethernet, and industrial wireless, connecting monitoring devices and systems with various sensors, transmitters, actuators, servo drivers, motion controllers, and even CNC machine tools, industrial robots, and complete production lines;

3. Edge Computing

Data no longer needs to be sent to remote clouds, making real-time data analysis and intelligent processing more suitable, with advantages of safety, speed, and ease of management, better supporting real-time intelligent processing and execution of local business, meeting the real-time needs of the network;

4. Network Flattening

Enabling intelligent flow of information between the real world and virtual space, a lot of research and exploration has been done for real-time control, precise management, and scientific decision-making in manufacturing;

5. Service Platformization

Enhancing flexible connectivity, expanding user scale, increasing data security, and simplifying application development, providing services such as remote management of devices, preventive maintenance, and fault diagnosis according to actual user needs.

Deep Dive into Industry Players

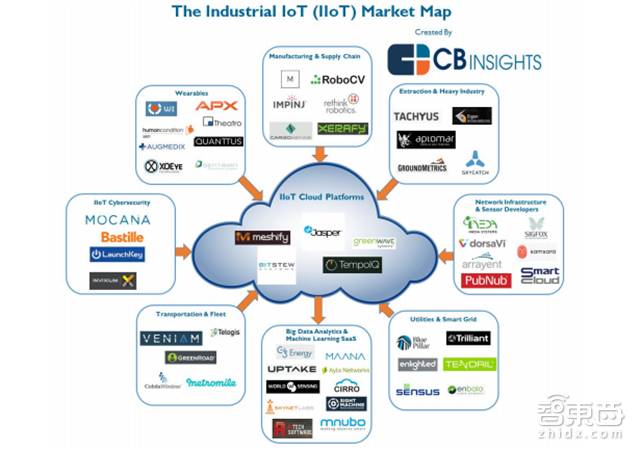

*Industrial IoT Industry Map (citing CB Insights)

Sensors: $190.6 Billion by 2021

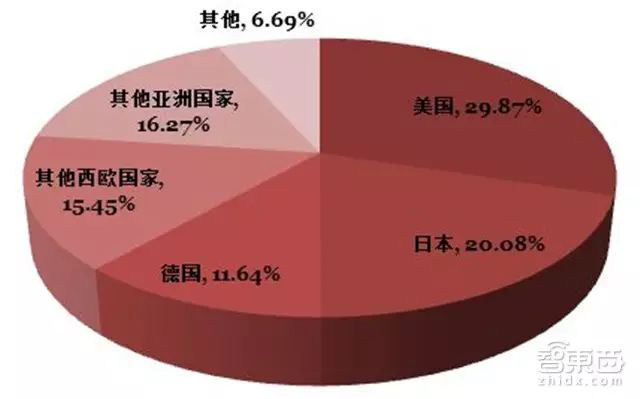

*Sensor market share (citing Huarun Consulting)

With the introduction of concepts like Industry 4.0 and smart manufacturing, the global sensor market space has been further expanded. It is predicted that from 2016 to 2021, the compound annual growth rate of sensors is expected to be 11%, with the market size reaching $190.6 billion by 2021.

Currently, the global sensor market is mainly dominated by companies from the U.S., Japan, and Germany, such as MEAS Sensor Company, Honeywell, Keller, Emerson Electric, and General Electric. However, the sensor market in the Asia-Pacific region is also showing rapid growth trends.

In recent years, China has increased investment in the sensor-related industry, raising the market share of state-owned sensors and instruments, particularly in high-end sensor categories. Currently, domestic sensor and instrument companies such as Shenyang Institute of Instrument Science, Shenzhen Tsinghua University Research Institute, and Henan Hanwei Electronics have made significant achievements.

Industrial Control: Dominated by US, EU, and Japan

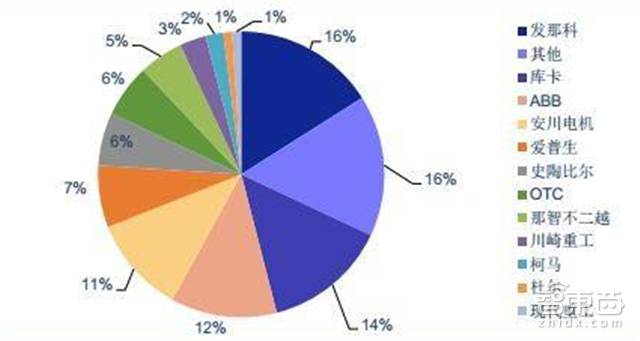

*Industrial control market analysis (citing Anxin Securities)

Industrial control aims to detect, control, optimize, schedule, manage, and make decisions regarding industrial processes, primarily manifested in the form of products like PLC and DCS.

Currently, the PLC market can be divided into three factions: the U.S. (A-B Company, General Electric, Modicon, etc.), Europe (Germany’s Siemens, AEG, and France’s TE), and Japan-Korea (Japan’s Mitsubishi, Omron, Panasonic, Fuji, and South Korea’s Samsung, LG), which occupy the main market share. China’s PLC market is still dominated by foreign products, and domestic PLC manufacturers need to improve in terms of product quantity and production scale.

DCS manufacturers are mainly concentrated in the U.S., Japan, and Germany. Foreign products (such as Honeywell and Yokogawa) have a certain market share in China’s DCS market. However, in recent years, the market share of domestic DCS has been rapidly increasing, with a number of excellent domestic DCS product companies emerging, such as Beijing Holley, Shanghai Xinhua, Zhejiang University Control, Zhejiang Weisheng, Aerospace Measurement and Control, and the Institute of Electronics.

Platforms: Traditional Giants vs. IT Titans

Industrial giants are actively laying out platforms, including Siemens’ MindSphere, GE’s Predix, Phoenix Contact’s ProfiCloud, as well as domestic enterprises like Santrong’s GenCloud, Haier’s COSMOPlat, XCMG Industrial Cloud, and CASIC’s INDICS.

At the same time, IT giants are leveraging their cloud platform advantages to collaborate with upstream and downstream enterprises to lay out the industrial IoT ecosystem. Examples include Microsoft’s Azure, Amazon’s AWS, IBM’s Watson, and SAP’s HANA. Domestic companies like Baidu, Alibaba, JD.com, and Tencent have also launched platforms aimed at the Industrial IoT.

In addition to independent layouts, expanding ecological circles through complementary cooperation is also a mainstream platform layout method. For instance, in 2016, GE announced that Predix would land on Microsoft’s Azure cloud platform; in 2017, ABB announced that it would provide industrial cloud services based on the Microsoft Azure platform and collaborate with IBM on industrial data computing and analysis; Siemens also stated that MindSphere has cooperated with Amazon AWS, Microsoft, and SAP in cloud services.

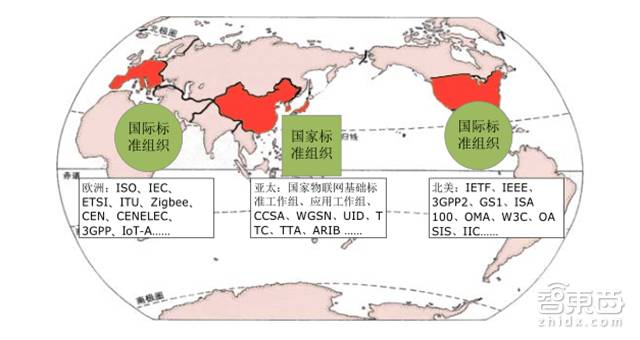

*Distribution map of global IoT-related standardization organizations

Under the promotion of technological and industrial development, standardization work for Industrial IoT has been carried out both domestically and internationally, including standards for sensors and instruments, control standards (DCS programming language and interface standards are yet to be formulated), industrial Ethernet standards (for interconnectivity), industrial wireless network standards (for ubiquitous connectivity), information integration standards, and information security standards.

Four Use Cases Analysis

Leasing Based on Machine Tool IoT

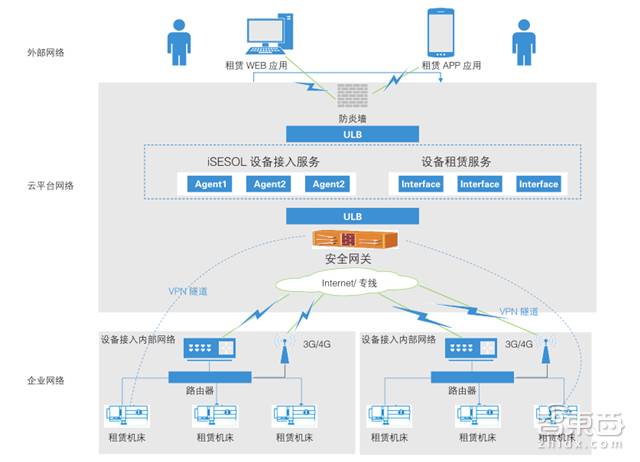

*Leasing application network architecture

This use case comes from Smart Cloud Technology, utilizing the iSESOL platform to position productivity sharing. Users can monitor equipment operating status in real-time, view historical operating data, and understand equipment cost details through tools such as the iSESOL platform, leasing business backend, and leasing client APP. They can also rely on the big data intelligent analysis tools provided by the iSESOL platform to help enterprises make better business decisions.

New Insurance Model

*New insurance model overall scheme diagram

This project comes from Root Five Alliance, based on the Industrial IoT platform, achieving data collection access, data storage, data management, data cleaning, data mining analysis, data services, and data products, providing insurance big data solutions, generating comprehensive state assessments of equipment, as well as models of the operating conditions and credit risks of equipment owners and enterprises.

Automated Grinding Roll Transfer

*Automated grinding area workflow

The standardized process of traditional grinding workshops faces issues such as low labor efficiency, high safety risks, significant quality fluctuations, and poor environmental protection effects. Baosteel has achieved automatic identification of grinding, intelligent hoisting of cranes, intelligent grinding of grinding machines, automatic water cooling of grinding, automatic oil replenishment of grinding, and intelligent matching of grinding processes through technologies such as industrial internet, RFID, information interaction, and intelligent control, significantly improving the supply capacity of the grinding line, avoiding safety risks, reducing production costs, and enhancing environmental protection and energy-saving levels.

Logistics Automation

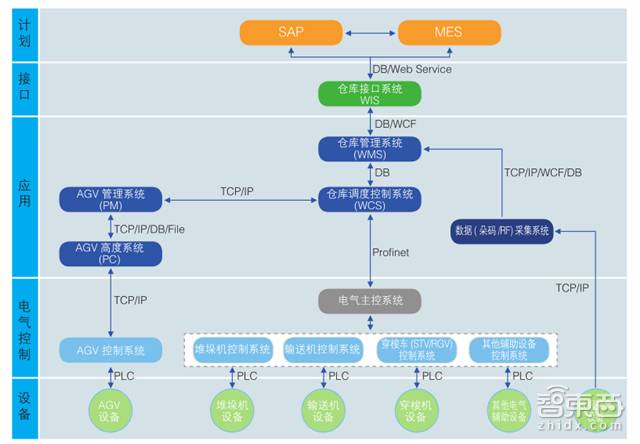

*Project system framework

Through the application of industrial internet technology, tire manufacturing enterprises can timely grasp information on raw material procurement, inventory, and sales. Through big data analysis, they can also predict trends in raw material prices and supply-demand relationships, helping to improve and optimize the supply chain management system, enhance supply chain efficiency, reduce costs, and create a fully optimized production, logistics, and service process, achieving true smart manufacturing.

Smart Things believes that the logic behind the Industrial IoT is the increasingly mature sensor technology, data/information computing processing technology, and the automation/robotics technology of the “execution end,” which allows function-oriented and process-defined industrial applications to transition towards intelligence. Once perception control and interconnectivity are realized, the functionality of data models will be further explored, and the coverage of the industrial manufacturing sector will expand further, shaping a more diverse ecosystem that provides personalized services and stimulates industrial innovation. From the perspective of the industry, companies related to sensors and industrial control will directly benefit, although the domestic foundation of these two sectors is not thick, they are looking to rise.

Appendix:

Top Ten Trends in IoT for 2017 (Cross-Industry Use Cases, LPWA, Security First, Service Solutions, M&A, AI+, Business Service Models, Cloud Computing, Radar)

IoT Industry Map (CB Insights)

Download Reminder: If you want to collect the full report of this article and the complete list of current global unicorn companies, you can reply with the keyword “nc188” on Smart Things (public account: zhidxcom) to download.

【Heavy Preview】Next week, a series of automated driving courses will be launched in the