On April 16, 2025, the White House announced a maximum tariff of 245% on imported goods from China, a policy that directly impacts China’s 3D printing industry. As a major producer of 3D printing equipment and materials globally, China exported 1.38 million 3D printers to the U.S. in 2024, accounting for 36% of total exports, valued at approximately 3.05 billion RMB (including materials and parts worth 3.57 billion RMB). The high tariffs will increase costs, compress profits, and may lead to a contraction of the U.S. market, threatening the survival of many enterprises. However, crises often breed opportunities. Traditional response strategies such as price reductions, shifting production lines, or exploring emerging markets have their merits but yield limited results due to fierce competition and long cycles. The Chinese 3D printing industry needs to break out of conventional thinking and adopt non-mainstream strategies to reshape competitiveness through three main approaches: navigating the “gray market,” reverse exporting to attract orders, and delving into niche markets.

1. Navigating the “Gray Market”: A Curveball for Exports

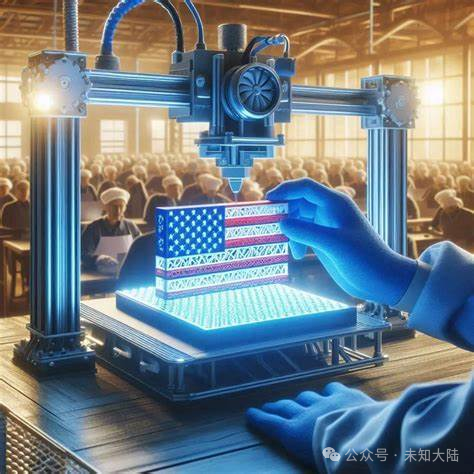

The 245% tariff makes exporting complete machines to the U.S. nearly unprofitable, but the “gray market” offers a flexible way to circumvent this. Companies can disassemble 3D printers into parts and ship them directly to U.S. consumers as “DIY kits” or “upgrade components” through cross-border e-commerce platforms (like Amazon and eBay). This approach not only bypasses the strict tariffs on complete machines but also reduces costs by leveraging the lower regulatory characteristics of personal packages. In 2024, sales of 3D printing accessories and consumables on Amazon surged by 30%, indicating a strong demand from U.S. consumers for low-cost 3D printing solutions.

In practical terms, companies can optimize their supply chains by packaging high-value core components (like motherboards and nozzles) separately from low-cost casings to disperse risks. Additionally, targeted marketing through social media and forums (such as Reddit’s 3D printing community) can attract U.S. DIY enthusiasts and small businesses to place orders directly. Furthermore, companies can collaborate with local U.S. logistics providers to establish “front warehouses,” shortening delivery times and enhancing user experience. While this “breaking down into smaller parts” strategy may not be a long-term solution, it can maintain market share in the short term and buy time for subsequent transformations.

2. Reverse Exporting: From Selling Products to Selling Services

Rather than struggling with hardware exports under high tariffs, it is better to reverse attract U.S. orders and transform into “service output.” Chinese 3D printing companies have global advantages in cost and scale and can undertake customized orders from U.S. clients through remote service models. For instance, lightweight parts in the aerospace sector, prototype molds in the automotive industry, and even 3D printed modules in construction can be completed through online design and remote production, with finished products manufactured in China and delivered to global supply chain nodes in the U.S., thus avoiding physical export tariffs.

In 2024, the global 3D printing service market is expected to grow by 18%, with particularly strong demand for customization in aerospace and medical fields. Chinese companies can leverage their existing technological accumulation (such as metal 3D printing and multi-material printing) to connect with U.S. clients via cloud platforms, providing one-stop services from design to production. Some companies have already begun experimenting, such as optimizing printing processes for U.S. clients remotely using “digital twin” technology to reduce their local production costs. This “reverse exporting” not only circumvents tariff barriers but also enhances the technological and service premium of enterprises, shedding the label of low-end OEM.

3. All-in on Niche Markets: Breaking Through from Red Ocean to Blue Ocean

The consumer-grade 3D printer market is fiercely competitive, and the 245% tariff further compresses profit margins. Instead of battling in the red ocean, Chinese companies should decisively shift to high-barrier, high-value niche markets. Medical 3D printing (custom implants, prosthetics, dental models), construction 3D printing (modular houses, bridge components), and aerospace 3D printing (high-temperature alloy parts) are three potential fields. In 2024, the global medical 3D printing market is expected to grow by 25%, and construction 3D printing projects (such as the 3D printed bridge in the Netherlands) are entering the commercialization stage, indicating significant growth potential.

Chinese companies are not starting from scratch in these areas. In 2024, domestic enterprises achieved breakthroughs in bioprinting and space-grade 3D printing technologies, such as bio-inks for bone repair and metal printing for spacecraft components. These technologies can directly meet global high-end demands, bypassing the price sensitivity of the U.S. market. For example, companies can collaborate with U.S. medical institutions to develop customized implants, entering the market through technology licensing or service outsourcing rather than relying on hardware exports. Additionally, the cost advantages of construction 3D printing can attract infrastructure projects in countries along the “Belt and Road” initiative, indirectly reducing dependence on the U.S. market.

4. Supporting Measures: Strengthening Technology and Ecosystem

The success of the above strategies relies on technological and ecological support. First, companies need to increase R&D investment to overcome core technological bottlenecks, such as high-precision photopolymerization and composite material printing, to support the high-end demands of niche markets. Second, a global digital ecosystem should be built, integrating design software, cloud printing platforms, and supply chain management to enhance the efficiency of service output. Data from the China 3D Printing Network in 2024 shows that domestic companies have begun to provide remote printing services through SaaS platforms, with significant results. Finally, industry associations and the government should work together to enhance the global competitiveness of enterprises through export subsidies, technology funds, and the establishment of international standards.

5. Conclusion: From Crisis to Reshaping the Global Landscape

The 245% tariff marks the darkest hour for the 3D printing industry, yet it is also an opportunity for reshuffling and rebirth. Traditional paths such as price cuts, relocating factories, or blindly exploring new markets are no longer sufficient to cope with such severe shocks. Chinese 3D printing companies must find alternative paths to maintain cash flow through the “gray market,” seize the service market through reverse exporting, and reshape technological advantages by delving into niche markets. By 2025, the Chinese 3D printing market is expected to exceed 63 billion RMB, with a continuously expanding global market share, demonstrating the resilience and potential of the industry. As long as these non-mainstream paths are grasped, the Chinese 3D printing industry can not only weather the storm but also hope to achieve a leap from “manufacturing” to “intelligent manufacturing” in the global value chain, redefining the future landscape of 3D printing.