(Report produced by: Everbright Securities, Liu Yuchen, Wang Kai, Yang Shuo)

1. 3D Printing – Projecting Digital Models into Reality

1.1 What is 3D Printing

3D printing is a technology that constructs objects based on digital model files using powdery metals, resins, plastics, and other adhesive materials through a layer-by-layer printing process. Compared to traditional material removal and machining technologies, 3D printing technology manufactures solid parts by gradually adding materials, which is why it is also known as Additive Manufacturing (AM).

1.2 Process Classification

According to the classification published by the American Society for Testing and Materials (ASTM) in 2012 under F2792-12A ‘Standard Terminology for Additive Manufacturing Technologies’, combined with the GBT35021-2018 ‘Classification of 3D Printing Processes and Raw Materials’ released in China in 2018, 3D printing technology is classified into seven basic processes based on the forming principles.

According to the data from ‘The Application of Metal Additive Manufacturing in Engine Turbine Design’ (Julien Pavillet), by 2020, 54% of the metal 3D printing market used Powder Bed Fusion (PBF) technology, while 16% of the market employed Directed Energy Deposition (DED) technology.

Each 3D printing technology has its strengths and weaknesses. In practical applications, the choice of suitable 3D printing processes is usually based on a comprehensive consideration of the mechanical properties of the formed parts, accuracy, forming efficiency, and cost. Taking the currently most widely used PBF process as an example, it has a high maturity level, good mechanical properties of produced parts, and high accuracy, but it also has issues like slow forming speed and relatively high costs. On the other hand, while the DED process has lower forming precision, it excels in cost-effectiveness and forming speed, occupying a niche in large components and part repair.

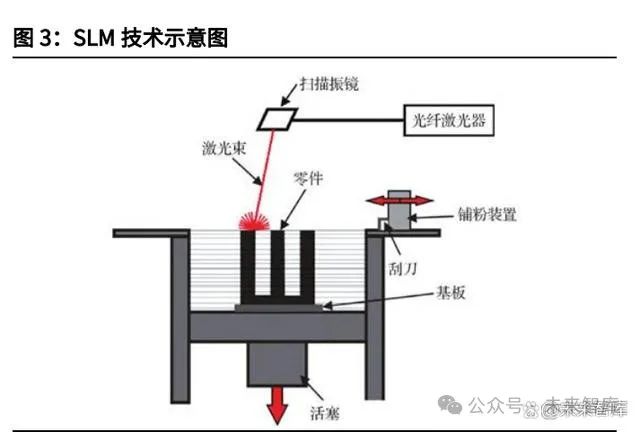

Powder Bed Fusion (PBF)

The Powder Bed Fusion process refers to a manufacturing technology that selectively melts or sinters a powder bed using thermal energy. The principle is to first lay a layer of metal powder onto a build tray, and then an energy source (laser or electron beam) selectively melts the powder on the tray according to the contour information of the current layer, forming the profile of the current layer. After lowering by the thickness of one layer, the next layer is processed. The Powder Bed Fusion process can be further divided based on the heating source and the materials used into Selective Laser Sintering (SLS), Selective Laser Melting (SLM), and Electron Beam Melting (EBM). Among these, the SLM process has become one of the mainstream metal 3D printing technologies due to its good mechanical properties and high accuracy of formed parts.

Directed Energy Deposition (DED)

Directed Energy Deposition technology refers to a 3D printing process that synchronously melts and deposits materials using focused heat. The raw materials for this process can be powder or wire, which are fed into an energy source (laser, electron beam, or arc) to form parts in the molten pool area generated by the energy source. Depending on the energy source used and the form of raw materials, Directed Energy Deposition can be divided into Laser Melting Deposition (LMD), Electron Beam Freeform Fabrication (EBF), and Wire Arc Additive Manufacturing (WAAM).

1.3 ‘Dimensionality Reduction’ Manufacturing, Immunity to Complexity

Since the core of 3D printing is based on digital models for layer-by-layer production, it has characteristics such as ‘immunity’ to product complexity, weak economies of scale, and mold-free manufacturing compared to traditional subtractive (machining) and formative (casting, forging) manufacturing processes. The ‘immunity to complexity’ feature also leads to shorter supply chains and higher lightweighting of parts.

Immunity to Complexity

In traditional manufacturing systems (formative & subtractive), as the complexity of the final product design increases, the number of required processing and manufacturing steps also increases, and correspondingly, the processing costs rise with the complexity of the product. In contrast, 3D printing, based on digital models, slicing, and layer-by-layer printing (manufacturing), effectively achieves dimensionality reduction manufacturing of parts, avoiding the increase in manufacturing costs associated with product complexity. From the perspective of manufacturability: 1) The forging process in formative manufacturing is relatively limited in terms of processable complexity; although casting can complete the manufacturing of products with internal structures through methods such as adding cores, it is also limited by the design of flow channels; 2) Subtractive manufacturing does not have advantages for processing products with complex internal cavities. In contrast, 3D printing provides greater freedom in product design.

Suitable for Precision Small Part Production

Due to manufacturing speed limitations, the production capacity of a single 3D printing device is relatively limited compared to traditional manufacturing processes. Unlike the economies of scale brought by improved capacity utilization in traditional processes, the increase in 3D printing output often accompanies expansion (fixed asset investment), making traditional economies of scale less apparent. However, based on the characteristics of ‘additive’ manufacturing, 3D printing has advantages in producing relatively small components.

Mold-Free Production, Helping Improve Manufacturing Costs

In traditional automotive manufacturing, as project research and development progresses, the potential for cost improvement in product manufacturing gradually decreases. Especially at certain project milestones, traditional manufacturing requires mold opening, and subsequent changes to part designs inevitably lead to additional mold costs, offsetting the cost reduction effects of optimizing designs after mold opening. In contrast, the characteristics of 3D printing based on digital model production fundamentally eliminate dependence on molds in mass production, which is expected to help traditional manufacturing industries improve costs in their research and development planning.

Supply Chain Compression & Lightweight Manufacturing Capability

Based on the ‘immunity’ of 3D printing manufacturing costs to part complexity, compared to traditional forging, casting, and machining processes, 3D printing can enhance the integration level of parts. Taking GE Aviation’s CFM LEAP engine fuel nozzle as an example, traditional processes require brazing a series of complex components together to form the final product, resulting in low production capacity and poor durability. Moreover, constrained by the processing capabilities of traditional methods, engineers find it difficult to optimize designs to meet requirements. Through 3D printing technology, the previously over 20 components of the fuel nozzle were successfully ‘printed’ as a single piece. The integrated forming technology compresses the length of the supply chain, reduces supply chain management difficulties, and enhances supply chain safety.

In addition to the weight reduction effects brought by part integration, topology optimization can also help achieve part lightweighting. By definition, topology optimization is a mathematical method that optimizes material distribution within a given area based on specified load conditions, constraints, and performance indicators, maximizing material utilization. Due to limitations in processing capabilities and costs of traditional forming technologies, optimal designs derived from theoretical calculations cannot be fully realized in actual production. However, with the characteristics of 3D printing being ‘immune’ to part complexity, it is possible to maximize the lightweighting of products through part integration and topology optimization, aiding industries with high weight reduction demands such as aerospace and automotive in achieving secondary cost reductions.

2. High-End Market Supports Industry Development, Civilian Market Opens Up Vast Opportunities

Since the birth of 3D printing technology, its development has surpassed 30 years. However, the development of the domestic 3D printing industry has been relatively slow. With the expiration of core technology patents for SLS and SLM in 2014, the commercialization progress of metal 3D printing was promoted. From the perspective of domestic patent situations, the number of 3D printing-related patent applications has been increasing year by year since 2014, reaching a peak in 2020, followed by a trend of year-on-year decline in 2021 and 2022. We judge that the decline in the number of new patent applications may indicate that the technology has reached a certain level of maturity.

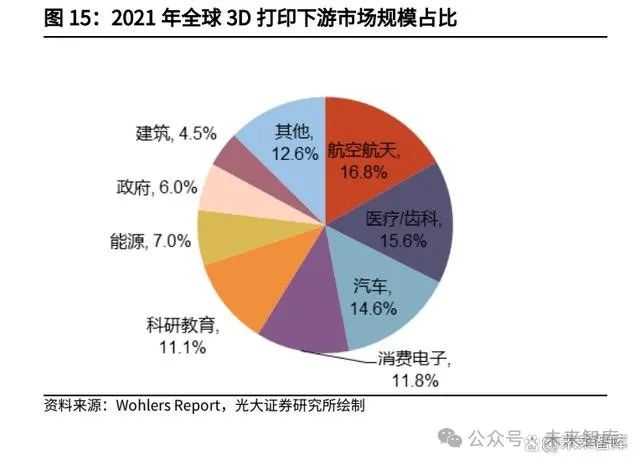

From the analysis of downstream application fields, according to statistics from the Wohlers Report, in 2021, the highest proportion of the global 3D printing market was in aerospace (16.8%), followed by medical dentistry (15.6%) and automotive (14.6%); in the 2022 global statistics, the top three fields were automotive (15.8%), customized products (14.5%), and aerospace (13.9%).

2.1 High-End Fields: From 1 to N, Weight Reduction and Cost Reduction Are Expected to Further Enhance Penetration Space

Current Application Status

With technological advancements, 3D printing is gradually changing the production methods of the aerospace industry, including commercial and military aircraft, space applications, and missile satellite systems. In the aerospace field, with the continuous improvement of flight requirements and design levels, new aerospace products are developing towards high performance, long life, low cost, and high reliability, leading to an increasing complexity and integration of aerospace parts. Metal 3D printing, with its short processing cycles, high material utilization, and greater design freedom, can meet the low cost and short cycle demands of aerospace part manufacturing. The technological characteristics of metal 3D printing give it a natural advantage in the aerospace field, and the development of 3D printing technology will provide a huge opportunity for the transformation and upgrading of traditional aerospace manufacturing.

Aerospace parts are complex in shape, with high requirements for material hardness, strength, and other performance indicators, making them difficult to process and costly. Moreover, new aircraft are trending towards high performance, long life, high reliability, and low cost, with integrated structures and large-scale complexity being a development trend. Based on this trend, 3D printing technology is increasingly favored by aerospace manufacturers.

PBF Process Application

Parts such as aircraft engine fuel nozzles, bearing housings, control casings, and blades have complex internal oil and gas paths and cavities that require structural innovation design to improve efficiency, further adding to the complexity and manufacturing difficulty of the structures. Components such as the inlet and exhaust valve grille structures of the aircraft engine compartment and the door support of the weapon bay have very complex structures, and there is an urgent need for PBF 3D printing technology to form these new complex components.

DED Process Application

Various structures of aircraft engines, such as casings, compressors, and turbine disks, are complex in shape and may require the use of heterogeneous or gradient material structures to improve efficiency. Components such as ultra-high-strength steel and stainless steel joints, sliding rails, landing gear, aluminum alloy load-bearing frames, beams, titanium alloy frames, supports, sliding rails, pulley frames, and ribbed plates must undergo topology optimization structural innovation design to improve weight reduction and load-bearing efficiency, increasing the complexity of the structure and the difficulty of manufacturing, leading to a clear demand for DED 3D printing technology. Additionally, part repair is also an important application point for DED technology.

Composite Process Application

Moreover, load-bearing components of aircraft and engines with special structures such as local protrusions and ear pieces cannot guarantee local organization and performance using forging processes; large aircraft’s ultra-large titanium alloy load-bearing frames exceed the processing capabilities of existing forging equipment, creating a clear demand for composite manufacturing technology that combines forging with 3D printing/additive surface connections.

Industry Logic Analysis and Deduction

Why is aerospace advancing faster? Looking at the domestic and international markets, early on, high-end fields such as aerospace contributed the majority of market share due to the following three reasons: 1) With the high-end development of aerospace equipment, the internal design requirements for parts have become increasingly demanding, and the processing capabilities of traditional methods may not support the processing of complex parts; 2) Aerospace equipment has a high demand for weight reduction; for example, in fighter jets, every pound reduced brings about an economic benefit of 4 million dollars. The application of 3D printing can further assist in weight reduction of aerospace equipment through part integration and topology optimization design; 3) Compared to traditional automotive manufacturing, consumer electronics, and other industries that measure annual production in millions or tens of millions, the annual production scale of aerospace-related products is relatively small, making it more suitable for the weak economies of scale characteristic of 3D printing.

Whole Life Cycle Cost Reduction, Further Opening Application Space

In the entire life cycle of flight equipment, the research and design phase accounts for about 20% of total costs, while the production and testing phase accounts for approximately 30%, with the remaining 50% being usage and maintenance costs. However, according to the Pareto principle, 70% of the overall life cycle costs are determined during the concept design phase, and by the time the preliminary design phase is completed, 85% of the overall life cycle costs have already been determined. It can be seen that excellent design plays a key role in controlling the overall costs and usage expenses of the equipment. However, early design itself has certain limitations regarding the feasibility of technology: 1) Traditional processes are constrained by bottlenecks in the production capacity of complex parts, limiting the freedom of design solutions; 2) The validation in the digital model phase sometimes requires actual testing of samples, and traditional industrial preparation of samples comes with high costs and long cycles. However, these issues have been well addressed with the application of 3D printing: 1) 3D printing processing parts are not restricted by part complexity, aiding product design innovation; 2) Mold-free production capabilities promote cost reduction and efficiency increase in the research and development phase.

Highly Integrated Supply Chain, Ensuring Safe Production

Supply chain safety is crucial for the manufacturing industry, especially for the defense and military industry. Completeness, controllability, and stability are essential to ensure resilience and safety. In important fields related to the national economy, people’s livelihood, and national security, the ability to produce basic materials, manufacture equipment, supply components, and provide energy raw materials must be established; it is necessary to occupy key core links and hold decision-making power, legislative power, and leading power over the industrial chain and supply chain; effectively withstand shocks from domestic and international unforeseen factors, emergencies, and adverse impacts without easily blocking, disrupting, dropping, or even breaking the chain. The demand for supply chain safety may further drive the application of 3D printing in the defense and military field: 1) 3D printing helps improve the integration level of parts, thereby reducing supply chain links; 2) Regarding 3D printing manufacturing itself, only raw materials + equipment + post-processing are needed to obtain formed components, and the mold-free manufacturing characteristic enhances the manufacturing flexibility of 3D printing.

2.2 Civilian Fields: From 0 to 1, Cost is King, Seeking Differentiated Competitive Advantages

Where are the high costs? Compared to the high-end application market’s insensitivity to costs and high requirements for part complexity, the civilian field is more concerned about the impact of costs. Currently, the value of 3D printing equipment is relatively high, and the production capacity of a single device is limited, resulting in high costs, which is the main constraint for the expansion of 3D printing in the civilian field. The high costs are mainly due to two aspects: 1) The low production capacity of a single 3D printing device results in less economies of scale than traditional manufacturing processes; 2) Is it necessary to redesign parts? When assessing the costs of using 3D printing processes, the comparison is made against the costs of traditional processes under traditional part configurations, without considering the cost reductions brought by optimized part designs (through topology optimization and other design weight reductions). Through topology structures and lattice designs, optimized parts can achieve weight reduction (lower raw material costs), and more importantly, the essence of 3D printing processing is layer-by-layer accumulation, making processing time highly correlated with the volume of parts. Therefore, weight reduction is expected to lead to an increase in 3D printing manufacturing efficiency, thus achieving a ‘reverse scale effect.’

What parts will 3D printing start to apply? How will the expansion rhythm be?

1) Products with high manufacturing cost ratios

Due to the current high prices and low production capacity of 3D printing equipment, the increase in manufacturing costs is quite apparent. Therefore, for small parts and complex components with high added value (manufacturing costs), the promotion of 3D printing has more advantages. Additionally, compared to traditional processes such as casting and stamping, where the manufacturing time for a single piece varies little with volume, 3D printing has a comparative advantage in producing small items.

2) Products with high raw material processing difficulty and high unit prices

Compared to traditional machining, 3D printing has a higher material utilization rate and does not have to consider the increased processing difficulty due to excessive hardness of raw materials. Therefore, for components made from high-value raw materials such as titanium alloys and high-temperature alloys, there is strong potential for substitution.

3) Expansion Rhythm

We judge that the large-scale penetration of 3D printing is a gradual process. By considering the processing capabilities of 3D printing during the part design phase, it is possible to achieve ‘3D printing parity’ for certain components. Subsequently, as equipment costs decrease and the production capacity of single devices increases, the range of ‘3D printing parity’ can be gradually expanded. Additionally, considering that the large-scale application of 3D printing will 1) to some extent replace traditional machining and casting processes; 2) require disruptive adoption of optimal designs suitable for 3D printing manufacturing during the research and development phase. We believe that 1) industries with short research and development cycles and quick product iterations will find it easier to promote 3D printing; 2) asset-light industries (especially those in the OEM model) will find it easier to advance 3D printing progress without being held back by existing assets.

Secondary Cost Reduction May Aid ‘Parity’

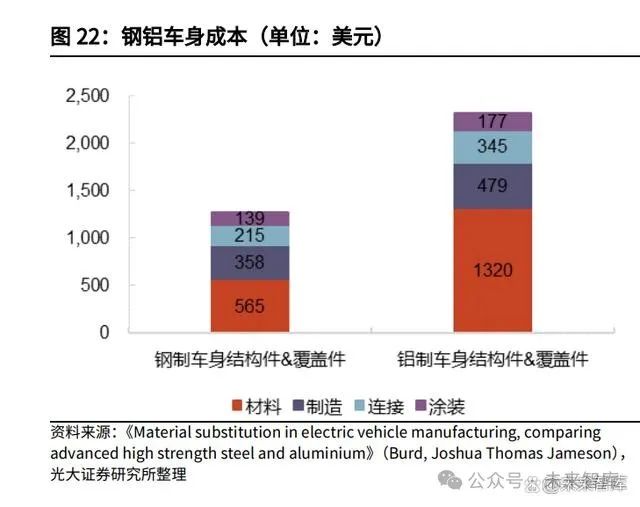

Taking new energy vehicles as an example, we discuss the secondary cost reduction benefits brought by weight reduction. Compared to steel-bodied vehicles, aluminum-bodied vehicles do not have advantages in material, manufacturing, connection, and painting costs. According to data in ‘Material substitution in electric vehicle manufacturing, comparing advanced high strength steel and aluminum’, the cost of an all-aluminum body is almost twice that of a steel body ($2,321 vs. $1,277). However, considering the secondary cost reduction effects brought by the weight reduction of aluminum bodies (the paper states that the weight of a steel vehicle is 1,433kg, while the aluminum body brings a weight reduction of 191.5kg), the costs of steel and aluminum vehicles become nearly equal ($20,672 vs. $21,011, with the price difference shrinking from $1,044 to $339), and costs will further decrease with increasing range. Additionally, considering that the costs of new energy vehicle batteries and motors are high, the weight reduction of the vehicle body reduces the demands on the three electric systems, leading to lower overall vehicle costs. Furthermore, the subsequent upgrades of manufacturing processes (such as integrated die-casting processes) will further reduce the manufacturing costs of aluminum bodies. The application of 3D printing can, in essence, also aid in the weight reduction of new energy vehicles, differing from the weight reduction of all-aluminum bodies, as 3D printing primarily relies on process and design to achieve weight reduction. At the same time, weight reduction itself creates a ‘reverse scale effect’ for 3D printing processes, further aiding the industry in cost reduction and achieving a positive cycle that promotes the healthy expansion of 3D printing applications in the automotive sector.

3. Vast Space, Opening Cost Reduction from the Design End

3.1 Industry Upstream and Downstream, Equipment Manufacturers as the Core

After over 30 years of development, 3D printing has formed a complete industrial chain. The upstream covers companies involved in 3D scanning equipment, 3D software, raw materials, and manufacturing of 3D printing equipment components; the midstream is primarily composed of 3D printing equipment manufacturers, most of whom also provide printing services and raw material supply. 3D printing equipment manufacturers occupy a dominant position in the entire industrial chain: 1) Equipment needs to be compatible with raw materials, thus determining the application range of different raw materials; 2) Currently, large equipment is highly customized according to downstream applications, giving equipment manufacturers more bargaining power; the downstream applications have covered various fields such as aerospace, automotive industry, healthcare, mold manufacturing, and cultural creativity.

Upstream

The upstream of the 3D printing industrial chain mainly includes 3D modeling tools and raw materials. Correspondingly, the companies clustered in the upstream of the industrial chain include 3D software developers and consumables manufacturers. Raw materials mainly include metals, inorganic non-metals, organic polymers, and biomaterials.

Midstream

The midstream of the 3D printing industrial chain is primarily composed of equipment manufacturers, which can be divided into desktop-level printers and industrial-level printers. In recent years, as patents for desktop-level printers abroad have expired, technological barriers have decreased, leading to a sharp increase in the number of domestic desktop-level printer manufacturers, increasing competition in the domestic desktop-level 3D printing market. Compared to the desktop printer market, industrial printers have high technological barriers and substantial capital investment. However, with strong support from national policies for the current industrial-level 3D printing industry, the entire market is currently showing rapid growth. The core patents for 3D printing are mostly held by equipment manufacturers, thus they occupy a dominant position in the entire industrial chain. In recent years, the 3D printing industry has seen increased consolidation through mergers and acquisitions of 3D printing software companies, material companies, service suppliers, etc., transforming equipment manufacturing companies into comprehensive solution providers, enhancing their overall control over the industrial chain.

Downstream

The downstream of the 3D printing industrial chain is primarily focused on aerospace, automotive industry, healthcare, mold manufacturing, and cultural creativity, with current applications mainly fitting the characteristics of ‘small batch’ production.

3.2 Global 3D Printing Market Continues to Grow Rapidly

According to statistics from the Wohlers Report, the total global output value of 3D printing reached $18.2 billion in 2022, a year-on-year increase of 18%, maintaining a high growth rate. In terms of structure, the output value of 3D printing services reached $10.738 billion in 2022, of which the output value of independent 3D printing service providers was $7.508 billion, and that of comprehensive service providers was $3.230 billion, accounting for 41.2% and 17.7% of the total output value, respectively. The total output value of 3D printing services has grown at a rate higher than that of equipment and materials in recent years. The output value of 3D printing equipment was $3.797 billion, and the output value of materials was $3.260 billion, respectively accounting for 20.8% and 17.9% of the total output value.

Equipment and Materials

In 2022, the global sales volume of industrial-grade 3D printing equipment reached 29,000 units, a year-on-year increase of 12.08%. Among these, 3,049 metal 3D printing devices were sold, a year-on-year increase of 27.20%, accounting for approximately 10.35% of total equipment sales, an increase of +1.23 percentage points year-on-year. The prices of metal 3D printing equipment are significantly higher than those of non-metal 3D printing equipment. According to the Wohlers Report, the average price of industrial-grade 3D printing equipment globally in 2021 was $93,000, with prices stabilizing in recent years; the average price of metal 3D printing equipment in 2022 was $449,400, marking the first decline in average prices in recent years (with prices of $467,600, $501,800, and $514,800 in 2019-2021), which may be related to market scale growth and competition from Chinese manufacturers.

In 2022, the total output value of global 3D printing materials reached $3.260 billion, a year-on-year increase of 25.45%, with materials experiencing rapid growth in recent years, except for a relatively low growth rate in 2020 due to the international public health event. In terms of structure, the largest value of 3D printing materials in 2022 was polymer powders, with an output value of $1.236 billion, accounting for 37.90% of total material value, and this proportion has been continuously rising in recent years. The output value of metal materials in 2022 was $593 million, accounting for 18.18% of total material value, with a slow annual increase in proportion.

Market Size Forecast

According to the Wohlers Report, it is predicted that the global 3D printing market size will reach $85.3 billion by 2031, with a CAGR of 18.79% from 2021 to 2031. Furthermore, the current global non-metal 3D printing market size is significantly larger than the metal market. AM Power believes that before 2027, the growth rate of the metal market will be more than twice that of the polymer market, and the gap in market size between metal and polymer 3D printing will continue to narrow.

3.3 China’s Market Growth Rate Exceeds Global Average

Market Overview

According to statistics from the China Additive Manufacturing Industry Alliance, the total output value of China’s 3D printing industry reached 26.5 billion yuan in 2021, a year-on-year increase of 27.4%, maintaining high long-term growth rates. Structurally, 3D printing can be divided into three major segments: equipment, services, and materials. According to statistics from CCID Consulting, in 2019, equipment accounted for 45% of total output value, followed by services (29%) and materials (26%).

Equipment & Materials

Based on data from the China Additive Manufacturing Industry Alliance and CCID Consulting, we estimate that the total output value of China’s 3D printing equipment was approximately 11.775 billion yuan in 2021, a year-on-year increase of 26.6%, maintaining steady growth in recent years.

Based on data from the China Additive Manufacturing Industry Alliance and CCID Consulting, we estimate that the total output value of 3D printing materials in China was approximately 6.024 billion yuan in 2021, a year-on-year increase of 18.87%. By classifying metal and non-metal 3D printing materials, in 2019, the total output value of non-metal 3D printing materials in China was 2.538 billion yuan, accounting for 61.99%, while the output value of metal materials was 1.556 billion yuan, accounting for 38.01%.

Market Size Expectations

China places great importance on the development of the 3D printing industry and continues to increase investment in it. At the same time, the application degree of 3D printing in China is continuously deepening, and its applications in various industries are gradually expanding. In the coming years, the 3D printing market is expected to remain in a rapid growth phase. According to predictions by CCID Consulting, the compound annual growth rate of China’s 3D printing industry from 2021 to 2024 is expected to be 24.1%, with the industry scale rapidly growing to 50 billion yuan by 2024.

3.4 High Barriers for Equipment Manufacturers, Printing Efficiency is Key

We believe that 3D printing equipment manufacturers are the backbone of the entire industrial chain, and in future market competition, leading companies in the industry will emerge from these manufacturers first. Equipment manufacturers can connect with downstream customers to understand their actual needs, and based on this, they can develop equipment, products, and raw materials, matching and integrating research and development at all stages, thus providing comprehensive solutions tailored to customer needs, giving them strong market competitiveness.

Equipment Supplier Landscape

Based on the number of industrial-grade 3D printing equipment sold, the main suppliers of industrial-grade 3D printing equipment in 2021 were from the United States, with Stratasys being the largest seller, accounting for 12% of global total sales, followed by Formlabs and 3D Systems.

According to a survey by 3D Science Valley on domestic companies using 3D printing equipment brands, as of 2018, the main suppliers of 3D printing equipment in China were foreign companies such as Uniontech, Stratasys, and EOS. Among domestic 3D printing equipment manufacturers, Hunan Huashu High-Tech Co., Ltd. (6.6% market share) and Plustek (4.9% market share) lead in terms of the number of companies.

In industrial applications, metals and non-metals are the two main classifications of 3D printing materials, corresponding to different printing principles and technologies. U.S. companies tend to focus on non-metal materials, while European companies concentrate on metal materials. Leading international companies in the field of industrial-grade 3D printing equipment, such as Stratasys, Formlabs, and 3D Systems, primarily sell non-metal 3D printing equipment, while Uniontech, which holds a large market share in China, also focuses on non-metal devices. The leading international companies in metal 3D printing include Germany’s EOS, SLM Solutions, and the U.S. companies GE and 3D Systems, while domestic metal 3D printing is primarily led by Plustek and Huashu High-Tech, along with others like Xin Jing He (PBF & DED), Jiangsu Yongnian Laser (PBF & DED), Guangdong Hanbang (PBF), and Beijing Yijia Sanwei (PBF).

According to information disclosed on the official websites of various 3D printing equipment companies, the fastest printing speed in current SLM technology is achieved by SLM Solutions’ NXG XII 600 equipment and Additive Industries’ Metal FABG2 equipment, with maximum printing speeds reaching 1,000 cm³/h. In terms of printing size, domestic 3D printing equipment generally exceeds that of foreign counterparts, with Huashu High-Tech’s FS1521M equipment having a printing area of 1530x1530mm.

The Core Competitiveness of Metal 3D Printing Equipment – Multi-Laser Technology

We believe that high production efficiency is the core competitiveness of current metal 3D printing. Increased production efficiency not only shortens production time but also reduces product quality issues caused by prolonged production times (such as warping). When printing speed increases, products can be completed before thermal stress causes damage, allowing them to be sent to the heat treatment furnace, thus improving yield and lowering costs. Additionally, the characteristics of 3D printing technology lie in its ability to produce customized products quickly; if the customization time is too long, its market competitiveness will be significantly weakened. During production, parts are formed by laser sintering metal powders, clearly indicating that the greater the laser power and the more lasers used, the faster the forming speed. However, achieving multi-laser technology presents various challenges and is not simply about increasing the number of lasers, which is also why many manufacturers experience slow forming efficiency in 3D printing. The challenges of multi-laser technology include: optical path system design, laser overlap, smoke removal, thermal management, laser calibration, and performance consistency.

Laser Overlap Issue: When using multiple lasers, each laser has its optimal printing area, and the collaborative work between different lasers must be considered. When printing parts, a part may span several laser work areas, and ensuring that the forming quality at the junction of laser areas is consistent with the center area is a major challenge of multi-laser technology. Currently, some equipment has not adequately solved this issue, resulting in visible seams at the junction of laser areas in printed parts.

Smoke Removal Issue: During printing, high-energy laser beams rapidly heat metal powders, with temperatures approaching the boiling point of metals. Metals evaporate to produce metal vapor, which subsequently condenses and oxidizes into small particles (usually less than 1 micron), forming the ‘black smoke’ – submicron metal condensates generated during printing. The black smoke formed after metal vapor condenses can consume laser energy to some extent, affecting forming performance. Moreover, this black smoke may directly adhere to the top lens, effectively reducing the laser power reaching the powder bed. Additionally, floating black smoke may fall into the unprinted powder area, forming impurities that lead to lower product density and thus affect part performance. Some metal 3D printing equipment on the market cannot effectively address the black smoke issue; while they can print for short periods, they cannot operate continuously for long periods. For example, continuous printing for four to five days may lead to a decline in product quality due to smoke adhering to the laser protector. Current methods for handling black smoke typically involve airflow, which blows away smoke, and various technologies exist for airflow; how to effectively solve the smoke removal issue is the core of airflow technology (mainly involving simulation and modeling computational technology).

Thermal Management Issue: 3D printing is a thermal processing technology, and the temperature during part formation is high. How to ensure stable temperatures in the molten pool, gas, and optical path system is a prerequisite for high precision and good performance of formed parts. When the optical path system temperature is high, lens drift may occur; when the gas temperature is high, beam deformation may happen, affecting laser forming accuracy. The drastic changes in molten pool temperature may produce thermal stress in formed parts, making them prone to cracking. Therefore, a precise and controllable thermal management system is also a prerequisite for the application of multi-laser technology. Other methods to enhance 3D printing efficiency include increasing layer thickness, optimizing optical system scanning parameters, and strengthening powder spreading and scanning coordination, with the main technical challenges being algorithmic issues. Additionally, ‘minimal support technology’ is also a technical challenge that various 3D printing equipment manufacturers are keen to overcome.

3.5 Industry Development Deduction

When Will the Civilian Market Reach ‘1’

Currently, the core limitation in civilian fields lies in costs. The ‘parity’ point of 3D printing depends on the progress of cost reduction on the design end. This process is almost irreversible; parts designed with 3D printing in mind are likely to be impossible to manufacture using traditional processing methods (or at too high a cost). This irreversible process not only provides significant assurance for the long-term application of 3D printing but also restricts the application of 3D printing processes in the short term: when traditional manufacturing processes have controllable costs, and downstream manufacturers can achieve profitability, the main manufacturers may prefer caution when attempting a new process that has not been validated in large-scale manufacturing. We believe that the irreversible characteristics of 3D printing processes bear similarities to the development of integrated die-casting technology, which is worth referencing. We believe that the rapid application of integrated die-casting technology with Tesla’s Model Y is primarily due to cost reduction effects. Compared to integrated die-casting manufacturing processes, 3D printing has advantages in manufacturing complexity and production flexibility; if it can achieve ‘parity’ with traditional processes, it will have promotional potential.

OEMs vs. 3D Printing Service Providers

Another point worth discussing is the division of labor between OEMs and 3D printing service providers. We believe that in the short term, due to the immaturity of 3D printing technology (mainly reflected in the need to adapt printing parameters for parts with different mechanical properties and materials), 3D printing service providers are more familiar with equipment and process parameters, while OEMs have a deeper understanding of part and material performance. Therefore, a collaborative model between service providers and OEMs will prevail. In the long term, as service providers and OEMs accumulate experience with process parameters and optimize part designs, the industry may evolve into two models: 1) Service providers participate in capacity peak regulation for OEMs; 2) OEMs are responsible for core components while low-value-added parts are produced by service providers. At that time, cross-industry production 3D printing service providers (applications with mold-free manufacturing capabilities) may emerge, gaining significant market share through mature processes and cost control.

4. Analysis of Major Companies in the Industry

4.1 Huashu High-Tech

4.1.1 Company Introduction

Hunan Huashu High-Tech Co., Ltd. has focused on the research and development, production, and sales of industrial-grade 3D printing equipment for over ten years, providing global customers with metal (SLM) 3D printing equipment and polymer (SLS) 3D printing equipment, along with 3D printing materials, processes, and services. The company has developed over 20 types of equipment and matched 40 specialized materials and processes, accelerating applications in aerospace, automotive, medical, mold, and other fields. The company is one of the few 3D printing enterprises in the world that possesses independent research and development and production capabilities for 3D printing equipment, materials, and software, ranking among the top in global sales scale and being a leading enterprise in industrial-grade 3D printing equipment in China.

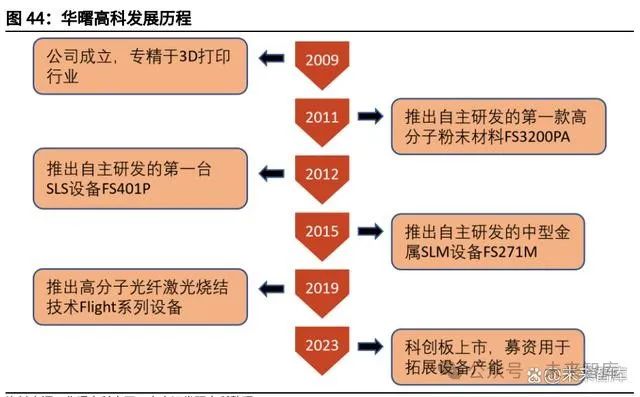

Development History

The company was founded in 2009, specializing in the 3D printing industry and making independent research and development the core of its development. In 2010, Huashu High-Tech formed a material R&D team and began independently developing polymer powder materials, breaking the monopoly of foreign giants; in 2012, the first self-developed SLS equipment was launched; in 2015, the first medium-sized metal SLM equipment was launched; and in 2019, the globally unique polymer fiber laser sintering technology, the Flight series equipment, was introduced. In 2023, the company successfully went public on the Sci-Tech Innovation Board, further expanding its production capacity in response to market demand.

Equity Structure

The company is actually controlled by Xu Xiaoshu and Xu Mu, who are father and son. As of September 30, 2023, they held 75% and 19.8% of the shares of Meina Technology, respectively, indirectly holding 40.07% of Huashu High-Tech through Meina Technology. The founder, Xu Xiaoshu, holds a doctorate in applied mathematics and materials science and is a leading figure and entrepreneur in powder bed 3D printing technology, with over 20 years of experience in 3D printing and having received world-class honors such as the R&D 100 Award (Outstanding Contribution Award in the Field of Applied Science) and the U.S. ‘Dinosaur Award’. Xu Xiaoshu went to the United States in 1986 for doctoral studies, joined a famous global 3D printing company as a technical director after graduation, and returned to China in 2009 to establish Huashu High-Tech, promoting the industrialization of domestic 3D printing technology.

Subsidiaries

Huashu High-Tech currently has six subsidiaries, including Shanghai Huashu, Shenzhen Huashu, Huashu New Materials, Changsha Industrial Research Additive Manufacturing, Huashu USA, and Huashu Europe, as well as a joint venture, Chongqing Huagang. It has also established a non-profit social organization, the Changsha 3D Printing Industry Technology Innovation Strategic Alliance.

4.1.2 Steady Revenue Growth

In the first three quarters of 2023, the company achieved total revenue of 371 million yuan, a year-on-year increase of 35.15%, with a net profit attributable to the parent company of 72.82 million yuan, a year-on-year increase of 32.63%. The gross profit margin for the first three quarters of 2023 was 53.21%, showing a trend of gradual decline in recent years, possibly due to changes in the company’s product structure. The net profit margin for the first three quarters of 2023 was 19.62% (the net profit margin in 2021 was high mainly due to the impact of non-recurring gains and losses). In terms of expenses, the expense ratio for the first three quarters of 2023 was 33.06%, with a research and development expense ratio of 15.62%, a sales expense ratio of 12.92%, and a management expense ratio of 8.28%.

4.1.3 Dual Layout of Metal and Non-Metal Equipment

The company’s products can be mainly divided into: 3D printing equipment and accessories, 3D printing powder materials, after-sales services, and others. Equipment and accessories are the primary source of revenue for the company, accounting for 88.2% of total revenue in 2022, followed by powder materials, which accounted for 7.42%. The revenue share of metal equipment has gradually increased in recent years, becoming the most important part of the company’s revenue.

In terms of customer structure, based on the company’s sales of equipment and materials, the primary customers are from the aerospace sector (according to sales volume), accounting for 54.82%, followed by molds and processing services, which accounted for 24.83%.

Metal 3D Printing Equipment

The company started with the development of polymer equipment and then moved into the research and development of metal 3D printing equipment, utilizing Selective Laser Melting (SLM) technology. Its equipment is widely used in aerospace, molds, automotive, medical, and research education fields.

The company strategically focuses on metal 3D printing technology, continuously addressing the needs for efficient scale industrialization of 3D printing and high-end functional customization in specific scenarios, consistently making technological breakthroughs and product innovations, launching multiple series of self-developed SLM equipment such as FS1211M, FS811M, and FS721M.

The characteristics of the company’s metal 3D printing equipment include large forming sizes. The FS1521M equipment is specifically designed for the manufacture of ultra-large precision parts in high-end industries, with forming dimensions reaching 1530mm x 1530mm x 1650mm, placing it at an international leading level. Additionally, the maximum scanning speed of the FS301M series equipment can reach 15.2m/s, which is at the international advanced level; the increase in maximum scanning speed can effectively reduce laser scanning jump time and improve production efficiency. ‘Maximum forming size’ and ‘maximum scanning speed’ are key indicators of SLM equipment, and Huashu High-Tech’s equipment leads the industry in both aspects, demonstrating strong market competitiveness. At the same time, the company has a deep understanding of dynamic focusing and fixed focusing optical system technologies, allowing flexible configuration to meet user needs, with the technical difficulty and manufacturing efficiency of its equipment surpassing comparable domestic and foreign companies.

Polymer 3D Printing Equipment

The company’s self-developed polymer 3D printing equipment utilizes Selective Laser Sintering (SLS) technology. Due to the technical challenges of controlling the shape and properties of forming materials, SLS technology is one of the more complex technological routes. The company is one of the few global suppliers that master this core technology and has launched industrial-grade production equipment. The company also pioneered the Flight technology globally, enabling multi-laser configurations to print fine thin-walled parts, significantly enhancing production capacity and printing effects.

Raw Materials

The powder materials sold by the company mainly consist of self-developed polymer powder materials, with the sales of polymer powders accounting for 93.19% in 2021, while the remainder consists of metal powders. The company’s 3D printing powder materials can be used with its own equipment and also in equipment from other manufacturers. Over the years, the company’s powder materials have gained market recognition, with stable growth in sales.

The company has established a product system covering polyamide (PA), thermoplastic polyurethane (TPU), and polyphenylene sulfide (PPS) as substrates, with melting points ranging from 169°C to 295°C, adaptable to CO2 lasers and fiber lasers. In the field of nylon powder, which is most widely used in SLS technology, the company has successfully broken the monopoly of the chemical giant Evonik’s PA12 powder material, creating new powder formulations and preparation technology routes, innovating from the molecular design source and mastering all technical links of SLS nylon powder material, successfully developing domestically produced FS3200PA material and achieving scaled production, thus reversing the slow development of SLS technology applications due to high-priced raw materials and monopolistic business models.

After-Sales Services and Others

Huashu High-Tech provides services such as equipment failure recovery and preventive maintenance. Upon receiving customer requests, they organize remote and on-site services to help customers quickly resume production and provide various maintenance plans for equipment for customer selection.

4.1.4 Company Highlights

(1) Dual Layout of Metal & Non-Metal

As a core supplier of 3D printing equipment, Huashu High-Tech started with polymer equipment and later expanded into metal 3D printing equipment with a global layout. According to AMPOWER REPORT 2023, the global output value of polymer 3D printing in 2022 was more than double that of metal 3D printing, and it is expected that by 2027, the output values of metal and polymer 3D printing will reach the same scale. Huashu High-Tech’s forward-looking dual layout provides ample market space for future growth.

(2) Overseas Layout, Participating in Global Competition

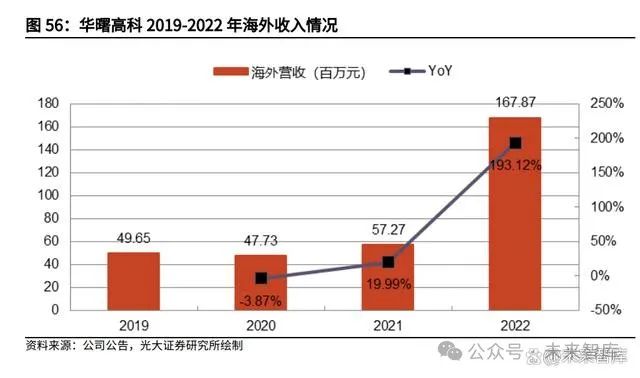

According to the Wohlers Report, in 2022, China’s 3D printing market output value accounted for only 11.5% of the global market, indicating a huge overseas market potential. Huashu High-Tech has established subsidiaries in Europe and the United States, deeply participating in global competition, and with excellent product strength, the company’s overseas revenue increased by +193% in 2022.

(3) Fully Autonomous Software Development

We believe that the core barrier of industrial-grade 3D printing equipment lies in the control software and data processing software. Huashu High-Tech’s layout of fully autonomous development of equipment software is beneficial for subsequent equipment iterations and the ability to respond quickly to customer customization needs.

4.2 Plustek

4.2.1 Company Introduction

Xi’an Plustek was established in July 2011, focusing on industrial-grade metal 3D printing, providing customers with a full set of solutions for metal 3D printing and remanufacturing technology, including equipment, printing services, raw materials, and technical services. As one of the early participants in the domestic 3D printing industry, the company has accumulated unique technological advantages through years of technological R&D innovation and industrial application, placing it in a leading position in the domestic and international metal 3D printing fields. The company’s products and services are widely used in aerospace, industrial machinery, energy power, research institutions, medical research, automotive manufacturing, shipbuilding, and electronics industries, particularly with a high market share in the aerospace sector, with major end customers including units under AVIC, CASC, and CAST, and has become a qualified supplier of metal 3D printing services for Airbus.

Development History

In 2011, Plustek was established in Xi’an, initially focusing on research in LSF and 3D printing repair technology; in 2012, the company recognized the advantages of SLM technology in forming complex precision parts and began R&D in SLM technology; in 2017, the company started developing metal 3D printing materials. The company went public on the Sci-Tech Innovation Board in 2019, beginning significant capacity expansion.

Equity Structure

The actual controllers of the company are Zhe Shengyang and Xue Lei. Xue Lei serves as the chairman and general manager of the company, holding a doctoral degree. She is a member of the Laser Processing Professional Committee of the Chinese Optical Society, a member of the Eighth Council of the Youth Working Committee of the Chinese Materials Research Society, vice-chairman of the China Additive Manufacturing Industry Alliance, a director of the Shaanxi Aerospace Society, and a director of the 3D printing technology innovation center for aerospace special components in the national defense science and technology industry, with many years of experience in the 3D printing industry, making her a core technical personnel of the company.

4.2.2 Rapid Business Expansion, High Revenue Growth

The company is in a period of rapid expansion, achieving revenue of 918 million yuan in 2022, a year-on-year increase of 66.32%. The net profit attributable to the parent company was 79.5 million yuan, turning around from a loss in 2021 (a net loss of 53.31 million yuan). After excluding stock payment expenses, the profit before tax was 242 million yuan, a year-on-year increase of 102.75%, with both revenue and profits maintaining high growth rates. In the first three quarters of 2023, the company achieved revenue of 742 million yuan and a net profit of 38.47 million yuan.

The company’s gross profit margin has remained high, with a comprehensive gross profit margin of 46.69% in the first three quarters of 2023, while the net profit margin attributable to the parent company was 5.19%, primarily due to stock payment expense accrual. In terms of expenses, the total expense ratio for the first three quarters of 2023 was 44.12%, showing a gradual downward trend since 2022, mainly due to a decrease in management expense ratio (less stock payment expense accrual). Specifically, the sales expense ratio was 7.50%, the management expense ratio was 15.80%, and the R&D expense ratio was 18.31%.

4.2.3 Focus on Metal 3D Printing, Connecting Upstream and Downstream of the Industry Chain

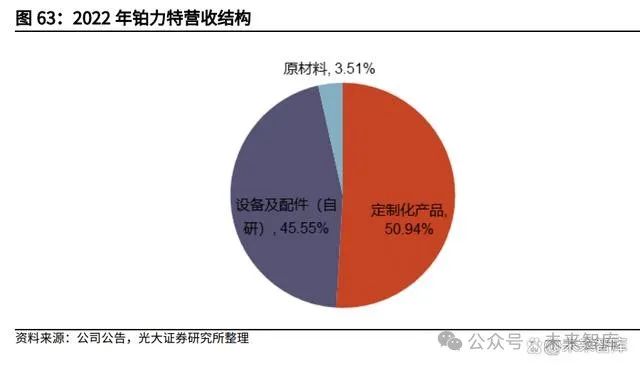

Plustek’s business scope covers metal 3D printing services, equipment, raw materials, process design development, and software customization products, forming a relatively complete industrial ecosystem for metal 3D printing. The company’s revenue can be divided into three major segments: customized 3D printing products, equipment and accessories, and raw materials, with customized products experiencing rapid growth in recent years, becoming the company’s primary source of revenue, accounting for 50.94% of revenue in 2022.

Customized 3D Printing Products

The company’s customized metal 3D printing products are based on customer product technical requirements and cost-driven, with product sizes ranging from millimeters to several meters. Customers can choose from SLM, LSF, and WAAM technologies, with forming materials covering titanium alloys, high-temperature alloys, aluminum alloys, copper alloys, stainless steel, mold steel, and high-strength steel, with high-temperature alloys and titanium alloys being the primary focus.

The customized metal 3D printing products produced by the company are widely used in aerospace, automotive, medical, mold, electronics, and energy power sectors. The company has undertaken multiple 3D printing research projects supported by the Ministry of Industry and Information Technology and the Ministry of Science and Technology, participating in the development and delivery of several national defense model projects and completing several 3D printing technology research tasks for the Equipment Development Department and the State Administration of Science, Technology, and Industry for National Defense. In March 2020, the company received certification results from Airbus’s component certification team for a 3D printed part manufactured by the company for the A330-NEO, meeting the installation requirements for Airbus civil aviation parts.

As of 2022, customized 3D printing products have become the company’s most important source of revenue, accounting for 50.94% of revenue, with a year-on-year growth of 68.26%. Customized 3D printing products are an important way for the company to connect with downstream customer needs, allowing better identification of product pain points and targeted solutions, which may become an important avenue for the company to expand market share in the future.

Self-Developed Equipment and Accessories

The company’s self-developed metal 3D printing equipment primarily consists of PBF technology and DED technology, with SLM (PBF) equipment being the main focus.

The company has developed over ten models of equipment, with different models corresponding to different niche markets, achieving leading shipment volumes and market shares in the domestic metal 3D printing equipment market, with some core parameters of the equipment reaching international advanced levels.

Raw Materials

The company’s core personnel in raw materials R&D have many years of experience in the development and application of specialized materials for metal 3D printing, accumulating rich experience in new material research methods, material property exploration, and applications, laying a solid foundation for the industrialization of the company’s specialized materials for metal 3D printing. The company’s powder preparation technology is mature and stable, with powder sphericity, hollow powder rate, impurity content, and special element content reaching industry advanced levels.

The company owns a dedicated powder production workshop, covering an area of 5,000 square meters, with multiple powder production lines capable of producing 400 tons of high-quality finished powder annually.

4.2.4 Company Highlights

(1) Equipment & Service Dual Drive, Building a Domestic Leader in Metal 3D Printing

The company has supported its rapid revenue growth through the layout of 3D printing equipment and 3D printing services. Judging from the expansion node, the application of new technologies will be accompanied by rapid growth in related equipment, thereby supporting the company’s high revenue growth. Furthermore, as the applications of 3D printing technology continue to expand, the business of 3D printing service providers will further assist the company in rapid growth.

(2) Continuous Expansion of Production Capacity through Fundraising

Since its listing, the company has continuously expanded its production capacity: after the follow-up implementation and production of the 2022 fundraising project, it will form a total of ultra-large equipment machine hours of 1.242 million hours/year, large equipment machine hours of 753,300 hours/year, and medium and small equipment machine hours of 1.1097 million hours/year; with a capacity of 1,400 units/year for metal 3D printing equipment and 1,200 tons/year for metal 3D printing raw materials. This positions the company to seize market share in advance as high-end product penetration increases and civilian applications expand.

(3) Stock Incentives to Motivate Core Employees

To further stabilize and motivate the core team, providing mechanisms and talent guarantees for the company’s long-term stable development, the company established a stock incentive plan in 2020. The stock incentive plan grants stocks accounting for 5% of the total share capital, mainly to senior management and core technical personnel, with four vesting periods, releasing 25% of the restricted stocks in each period upon achieving targets. The stock incentive is expected to motivate the core team to work actively and promote efficient business operations.

4.3 Youyan Powder Materials

The company focuses on the field of non-ferrous metal powder materials, primarily engaged in the research, production, and sales of copper-based metal powder materials, microelectronic tin-based electronic interconnection materials, and 3D printing powder materials and related powders. The company masters core technologies for non-ferrous metal powder preparation and possesses comprehensive research and development capabilities and integrated technical service capabilities, providing basic raw materials for multiple downstream industries and fields such as powder metallurgy, superhard tools, microelectronics interconnection packaging, friction materials, catalysts, electrical alloys, carbon products, conductive materials, thermal management materials, and 3D printing. Its end products are widely used in automotive, high-speed rail, machinery, aerospace, chemical, and electronic information fields.

In 2022, the company achieved revenue of 2.781 billion yuan, almost unchanged from 2021; it achieved a net profit attributable to the parent company of 55.44 million yuan, a year-on-year decrease of 31.75%. Among them, copper-based metal powder materials achieved revenue of 1.516 billion yuan, a year-on-year decrease of 9.36%; microelectronic tin-based solder powder materials revenue was 928 million yuan, a year-on-year increase of 14.22%; 3D printing powder materials revenue was 21.30 million yuan, a year-on-year increase of 114.72%, mainly due to expanded production capacity; electronic paste revenue was 25.73 million yuan, a year-on-year decrease of 1.48%; and other products generated revenue of 275 million yuan, a year-on-year increase of 8.69%.

The company, as a raw material producer, has relatively low gross profit margins. In recent years, the gross profit margin has continued to decline, possibly related to the impact of product delivery during the international public health event and fluctuations in raw material prices.

In terms of expense ratios, the company’s total expense ratio for the first three quarters of 2023 was 6.72%, with a sales expense ratio of 0.65%, a management expense ratio of 2.04%, a research and development expense ratio of 3.90%, and a financial expense ratio of 0.13%.

The company continues to focus on its core business of metal powder materials, maintaining and leveraging its competitive advantages in various niche industry fields. In the field of copper-based powder materials, it has seized international market opportunities, significantly increasing exports of electrolytic copper powder; at the same time, it actively expands new customers in friction, carbon, and catalyst fields, achieving bulk sales; in the field of tin-based powder materials, although the consumer electronics market is experiencing poor conditions, by developing key overseas customers and stabilizing major clients, it has leveraged product competitiveness, achieving a year-on-year increase of 5.5% in product sales, and steadily increasing the contribution of high-value-added products; in the field of 3D printing powder materials, it focuses on key products such as high-temperature alloys, aluminum alloy powder, and titanium alloy powder, rapidly expanding production capacity and improving operational efficiency, laying a solid foundation for leapfrog development in this segment. The company completed its IPO in 2021, with raised funds mainly directed towards the ‘Youyan Powder Technology Innovation Center Construction Project’, ‘New Powder Material Base Construction Project’, and ‘Thai Industrial Base Construction Project’.

Welcome all angel round and A-round enterprises in the automotive industry chain (including the power battery industry chain) to join the groupAround enterprises (will recommend to include top 800 automotive investment institutions at home);There are communication groups for leading sci-tech companies, automotive industry complete vehicles, automotive semiconductors, key parts, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, vehicle networking, and many other groups. To join the group, please scan the WeChat of the administrator (please indicate your company name)