Guanghe Technology recently announced its 2024 annual report, benefiting from industry recovery, with revenue, profit, and cash flow all showing improvement. However, the latest annual report not only conflicts with previous disclosures but also contains contradictory items such as the guarantee deposits for commercial acceptance bills. The report’s response regarding whether related transactions exceeded the transaction limits can be described as “inconsistent.”

Source: Shetu Network

The annual report shows good performance, but many data points seem inconsistent.

The annual report indicates that Guanghe Technology (001389.SZ) is a significant supplier of printed circuit boards (PCBs) in the global big data and cloud computing industries. In 2024, the PCB market inventory significantly improved, mainly due to sustained high demand in the AI and automotive electronics sectors, with demand in downstream consumer electronics also showing improvement.

Benefiting from the industry recovery, Guanghe Technology achieved operating revenue of 3.734 billion yuan in 2024, a year-on-year increase of 39.34%, with about 70% coming from overseas. The net profit attributable to the parent company was 676 million yuan, and the net profit excluding non-recurring gains and losses was 678 million yuan, representing year-on-year increases of 63.04% and 55.83%, respectively. The net operating cash flow also increased by 50.95%.

Although the annual report shows overall good performance, some disclosed data raises questions.

Guanghe Technology’s sales model is divided into direct sales and non-direct sales. The 2024 annual report discloses the situation of industries, products, regions, and sales models that account for more than 10% of the company’s operating revenue or operating profit. The revenue from direct sales of printed circuit boards in this period was 3.3664316 billion yuan, with a corresponding operating cost of 2.3608681 billion yuan, resulting in a gross profit margin of 29.87%, with year-on-year changes of 33.76%, 46.17%, and -5.96 percentage points, respectively.

In the 2023 annual report, the company disclosed that the revenue, operating cost, and gross profit margin for direct sales of printed circuit boards were 2.3757093 billion yuan, 1.6151106 billion yuan, and 32.02%, respectively. Based on this, the year-on-year changes for the above indicators in 2024 were 41.70%, 46.17%, and -2.15 percentage points, respectively, which are significantly different from the data disclosed in the 2024 annual report.

In addition to conflicting with previous disclosures, the company’s annual report seems to contain two contradictory situations.

Firstly, the section on “cash and cash equivalents not included in cash and cash equivalents” shows that as of the end of 2024, Guanghe Technology had 85.9304 million yuan of restricted other monetary funds, which are guarantee deposits for bank acceptance bills.

Combining with the beginning balance of 81.7860 million yuan, it can be calculated that this item increased by 4.1444 million yuan in 2024, meaning that the guarantee deposits paid by the company should exceed the amount recovered by 4.1444 million yuan. However, according to the cash flow from financing activities disclosed in the audit report, the company received and paid 4.9884 million yuan for acceptance bill guarantees in 2024.

Secondly, the section on “changes in liabilities arising from financing activities” shows that the beginning balance of long-term payables was 34.8418 million yuan, and the ending balance was 11.0752 million yuan. However, the section “long-term payables classified by nature” shows that including long-term payables due within one year, the beginning and ending balances of long-term payables were 34.6673 million yuan and 11.0752 million yuan, respectively.

The ending balance of long-term payables disclosed in these two sections is the same, but the beginning balance differs by 174,500 yuan.

Related transactions are “inconsistent”.

Xiao Hongxing and Liu Jinchang are the actual controllers of Guanghe Technology, indirectly controlling the company through Zhenyun Investment.

According to the 2023 annual report, Xiao Hongxing, Liu Jinchang, and Zhenyun Investment acted as guarantors, providing a guarantee of 150 million yuan for Guanghe Technology, with a due date of February 21, 2025, which had not yet been fulfilled at that time. However, in the related guarantee situation disclosed in the 2024 annual report, there was no mention of a guarantee provided by Xiao Hongxing, Liu Jinchang, and Zhenyun Investment for the listed company.

Even more perplexing is that the 2024 annual report disclosed a guarantee with both the start and end dates of March 29, 2023, with the guarantors being Xiao Hongxing and Liu Jinchang, and the guarantee amount being 97.0848 million yuan, stating that this guarantee had not yet been fulfilled.

Xiu Bo Electronics and Guanghua Environmental Protection are both companies controlled by Xiao Hongxing and Liu Jinchang and are related parties of Guanghe Technology. During the IPO reporting period, Guanghe Technology procured solutions from Xiu Bo Electronics and waste liquid recovery services from Guanghua Environmental Protection. Related procurement continued after the company went public.

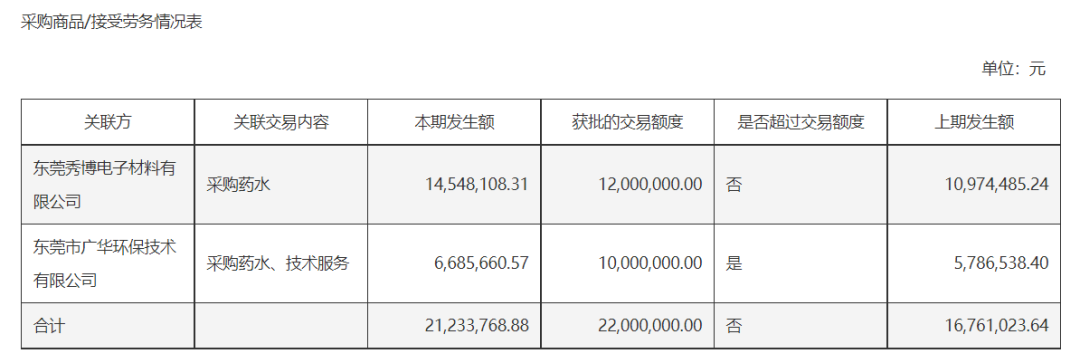

In 2024, Guanghe Technology had related procurement of 14.5481 million yuan from Xiu Bo Electronics, exceeding the approved transaction limit of 12 million yuan by 2.5481 million yuan, but the annual report stated “no” in the section on “whether the transaction limit was exceeded.” At the same time, the company procured 6.6857 million yuan from Guanghua Environmental Protection, which was 3.3143 million yuan lower than the approved transaction limit of 10 million yuan, yet the annual report stated “yes” in the section on “whether the transaction limit was exceeded.” Strictly speaking, both of these instances should be considered obvious errors, and the company should issue a correction announcement.

Source: Guanghe Technology 2024 Annual Report

Currently, Guanghe Technology has five subsidiaries. Dongguan Guanghe is engaged in drilling processing and provides machining support for Guanghe Technology.

According to the summary table of non-operating fund occupation and other related fund transactions disclosed by Guanghe Technology for 2024, the parent company provided loans and advances to Dongguan Guanghe amounting to 11.1357 million yuan, generating interest of 356,800 yuan, while recovering 5.1171 million yuan. Therefore, the other receivables from Dongguan Guanghe increased from 9.0195 million yuan to 15.3949 million yuan. Since Dongguan Guanghe only repaid 5.1171 million yuan in this period, it can be calculated that at least 3.9024 million yuan of the balance at the end of the period has an aging of over one year.

However, the section on “notes to major items in the parent company’s financial statements” in the annual report discloses that the top three items of other receivables at the end of the period are all related party loans, with the third item corresponding to a balance of 15.3949 million yuan, but all aging is within one year, which is clearly in conflict with our calculated data.