Searching for “beautiful waste” on social media, smartwatches consistently rank high. They are expensive, and aside from their superficial “beauty,” they lack practical value, yet they provide significant emotional value, serving as a “digital treat” for contemporary youth.

At first glance, “beautiful waste” seems like a derogatory term. However, upon closer inspection, it can be seen as the highest praise for a terminal product.

Those who complain are often the buyers. If potential consumers are unable to resist and go to great lengths to find discounts, resulting in genuine “impulse purchases,” it indicates that the premium on smartwatches beyond functionality is being recognized by the market, making them irreplaceable by many “cost-effective products,” “national watches,” or “practical goods.”

As the public’s willingness to consume smartphones has weakened and the replacement cycle has lengthened, smart wearable IoT devices have become the latest focus for major terminal manufacturers.

As 2023 comes to a close, the smartwatch market has also ushered in a new atmosphere. The Apple Watch SE9 once again showcases Apple’s ability to integrate “smart + fashion,” while Huawei has launched the “Extraordinary Master” endorsed by Andy Lau, packed with cutting-edge materials, Beidou satellites, and micro-health checks. The smartwatches recently released by vivo and Xiaomi are the first to feature their self-developed Blue River BlueOS and Surge OS. OPPO’s flagship smartwatch, the OPPO Watch 4 Pro, has been dubbed the “Android Watch King” by many users.

It is easy to foresee that next year’s smartwatches will engage in an even fiercer “tiger and dragon fight.” From “beautiful waste” to “beautiful goods,” in which directions will smartwatches evolve next?

Beautiful Waste

Isn’t Necessarily a Bad Thing

The term “beautiful waste” indicates that the hardware of smartwatches has matured, while the software still needs improvement.

On the hardware front, the convergence of smart technology and fashion items has occurred.

Over the past decade, smartwatches have flourished, with three mainstream directions of hardware innovation represented by smart tech watches like the Apple Watch and HUAWEI Watch, fashion watches like the Moto 360 and Fossil, and hardcore sports watches like Fitbit and Garmin.

In recent years, smart terminal manufacturers have continuously innovated in design, components, and supply chains, achieving a level of fashion that rivals that of fashion brands. The optimization of Apple Watch bands balances wearing comfort, sensor sensitivity, and clothing matching needs, while Huawei’s deep collaboration with supply chain partners has allowed the “Extraordinary Master” to integrate antennas into a highly integrated case using nanotechnology, and the use of liquid metal technology gives smartwatches the exquisite appearance valued by high-net-worth individuals.

Overall, tech manufacturers’ smartwatch products have gradually developed extremely high product engineering capabilities, successfully incorporating the exquisite aesthetics of traditional watches into smart wearable devices.

As supply chain partners grow and mature, the cost of advanced craftsmanship and new materials continues to decline. In 2023, Xiaomi and vivo launched price-friendly “national-level watches,” which are expected to bring this beauty to every consumer’s wrist.

At the same time, it must be acknowledged that the software capabilities of smartwatches are still not convincing enough.

This is particularly evident in that only leading brands’ smartwatches can leverage brand influence to compel users to make purchases without considering compatibility with ecosystems of smartphones, headphones, and other products, and are unaffected by “cost-effective products” or “low-priced alternatives.” In contrast, terminal manufacturers with insufficient brand power find that relying solely on existing smartphone users does not drive smartwatch sales.

While the software may be “useless,” the hardware must be truly beautiful to evoke mixed feelings of love and hate from consumers.

In this context, enhancing software capabilities to improve the overall experience of smartwatches is both a challenge for leading brands to “turn waste into treasure” and a focal point for second- and third-tier watch brands to break the deadlock.

Step One: From Sports Data Monitoring

To Scientific Health Management

Is there any distrust among consumers regarding wearable devices? A professor from the General Hospital of the People’s Liberation Army raised this question at a digital health salon.

Sports data monitoring is a basic function that almost all smart wearable devices possess, but the collected data is “dead,” unusable, and cannot be analyzed, which was a “useless” point of the previous generation of wearable devices.

This professor’s research found that while the health monitoring capabilities of wearable devices are credible, there are “traps” in interpreting the data and conclusions. These traps include whether device manufacturers use the same standards, the accuracy and reliability of the data itself, and how to reasonably explain the correlation between data and health characteristics.

Health monitoring based on rigorous scientific research is the core competitiveness of leading smartwatch manufacturers. There are two competitive points:

First is quality.

The data collected by smartwatches and the health management capabilities they provide must have scientific explanations, possess medical device qualifications, and genuinely help users effectively intervene in their health, which directly determines the quality of health services provided by smartwatches.

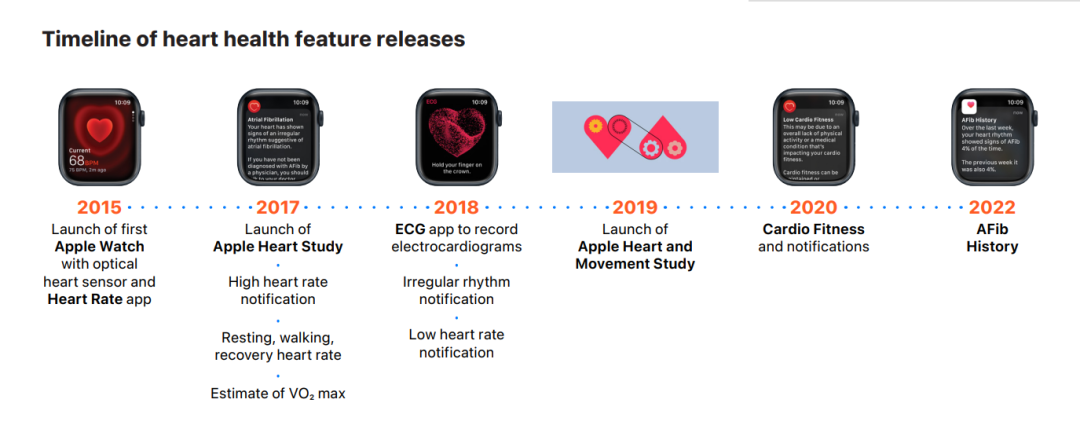

Traditional smartwatches often fail to monitor effectively, lacking the integration of corresponding sensors. For example, up to 40% of atrial fibrillation patients are asymptomatic and can only be diagnosed through an ECG at the hospital, leading to a high rate of missed diagnoses. Therefore, the health value monitored by smartwatches is significant. Currently, both Apple and Huawei have provided atrial fibrillation screening capabilities on their watches, enabling the identification and tracking of early risks of atrial fibrillation and timely correction of abnormal lifestyle behaviors in at-risk populations.

Secondly, the inability to explain. For instance, when a smartwatch detects an increased heart rate, there could be many underlying reasons, such as anxiety, dehydration, anemia, lung infection, or even pregnancy, all of which can lead to an increased heart rate. Previously, smartwatches could only provide data to users without understanding the underlying principles and offering relatively accurate health advice.

Currently, the number of digital health capabilities based on scientific research is increasing. For example, the recently updated “Guidelines for the Prevention and Treatment of Hypertension in China” promotes professional wearable products into a sequence recognized by medical experts. A study published in “Nature Medicine” showed that by collecting PPG signals (photoplethysmography) from the index fingers of 60,000 subjects and using AI deep learning to analyze whether users have diabetes, the model reported sensitivity and specificity of 65.4% and 75.0%, respectively, indicating that it is feasible to identify diabetes through PPG signals collected from the wrist by smartwatches.

In summary, this type of effective health monitoring based on rigorous scientific research, high quality, and high returns allows smartwatches to maintain their fashionable attributes while also possessing professional capabilities, revitalizing the product’s vitality and becoming a standard for many middle-aged and high-risk young individuals.

Second is quantity.

The types of wearable devices that can provide health monitoring are numerous, but the number of effective functions integrated into a single device directly determines the perceived value of the product.

For example, some TWS earbuds can also provide temperature monitoring, but that is all they can do, which overlaps significantly with smartwatches and makes them easily replaceable. Some terminal manufacturers have not invested enough in digital health, resulting in limited data and algorithms, and thus can offer fewer hardcore health monitoring functions, making them less competitive against “multi-functional warriors.”

Among them, both Apple and Huawei possess many advanced health management capabilities. The Apple Watch and iPhone currently offer features focused on 17 health and fitness areas, from heart health and sleep to mobility and women’s health. Additionally, Apple supports over 10,000 locations and more than 800 medical institutions for patients to use Apple Health records as available medical data.

After the launch of the “micro-health check” feature in the Huawei WATCH 4 series, it received significant recognition from consumers, with its core capability being “one watch, sixty seconds, ten indicators tested at once,” greatly improving efficiency and portability compared to traditional health check-ups. To schedule eight algorithms and five sensors within 60 seconds to complete multi-modal testing and provide health advice based on professional theoretical foundations is no easy feat.

At HDC 2023, I saw a media person experience the “cough sound detection for lung infection” feature, which seemed to open a new world.

In summary, health is the strongest and most enduring driving force for consumers’ purchases, and artificial intelligence, as a new software technology, allows smartwatch manufacturers to rediscover the value of data and provide users with professional health solutions. Therefore, smartwatches have the potential to leverage the large health industry.

Step Two: From Being an Extension of the Phone

To Becoming the Key to Interacting with Everything

Previously, limited by computing power, storage space, and other inherent constraints, smartwatches could only serve as extensions of smartphones, taking on a portion of reduced functions, such as answering calls and playing music.

In terms of user habits and experience, smartwatches could not compete with smartphones, and even due to overlapping functions, they formed a competitive relationship, which is a major reason for their perception as “waste.”

This year, however, Huawei’s HarmonyOS 4, vivo’s Blue River OS, and Xiaomi’s Surge OS have all been integrated into smartwatches, with these operating systems focusing on the Internet of Everything. The operating system serves as a bridge between applications and hardware, allowing smartphones and smartwatches to better share functional responsibilities, achieving some functional differentiation, enabling smartwatches to operate independently from smartphones, and providing a more natural and seamless interaction experience. After all, “raising the wrist” is much simpler than pulling out a phone to operate, making it more suitable for interaction with other IoT devices in mobile scenarios.

The interaction method centered around smartwatches is difficult to achieve on the original Android system, as security, data interaction, and application development are all limited by system characteristics. For example, HarmonyOS 4 supports atomic applications and adaptive development, allowing developers to create applications that automatically adapt to different screens such as phones, watches, and tablets with just one development effort. The Huawei WATCH 4 series has achieved scenario-based functional integration. For instance, the life card integrates applications for scheduling, navigation, WeChat, weather, etc. The “health dashboard card” consolidates health functions such as heart rate, blood oxygen, temperature, and sleep, presenting health data clearly.

The Blue River operating system supports complex intent recognition interactions and can present the most needed functions for users, such as travel scenarios, integrating flight information, high-speed rail information, hotel locations, etc., providing a shorter and faster interaction experience than smartphones.

In 2024, I believe major manufacturers will further explore the potential of wearable devices based on their self-developed operating systems, combined with new technologies like AI large models, to discover more applicable and resource-efficient human-computer interaction methods, rather than merely extending and repeating smartphone functions.

On the basis of domestic operating systems aimed at the Internet of Everything, the interaction experience of smartwatches will fundamentally change.

Step Three: From Single Hardware

To Life Assistant

To make “beautiful waste” worth the price, netizens have explored various “turning waste into treasure” functions, actively seeking applications that can be used on smartwatches. However, overall, it still requires effort from people to find services for the watch.

This affection for “beautiful waste” is touching, but is there a possibility that the watch can proactively provide services for people?

Shifting from “finding services for people” to “finding people for services,” the deep integration of large models and intelligent assistants with smartwatches may change this situation.

We know that large models, as foundational models, possess powerful data analysis and understanding generation capabilities, and the ability to schedule various AI model algorithms on a single foundation, while intelligent assistants can serve as the shortest service entry point for human-computer interaction. A minimal entry point combined with a powerful foundation will bring unprecedented intelligent experiences to smartwatches.

Currently, Apple has not announced any progress related to large models, while the Apple Watch SE2023 provides life services through the original Siri voice assistant, and its advanced capabilities remain to be seen. Domestic terminal manufacturers have launched their self-developed cloud-side and end-side large models and upgraded their intelligent assistants.

For example, the Huawei WATCH 4 series, upgraded with HarmonyOS 4, can directly call Xiaoyi, with stronger language understanding capabilities, requiring no precise commands, and can understand and execute natural spoken expressions. Many people find it a bit awkward to shout at a smart voice assistant on their phone, while the wrist-raising interaction method is more discreet and natural.

Additionally, based on large models’ user intent recognition and service recommendations, many leading domestic smartphone manufacturers have made significant explorations. They have introduced intelligent comprehensive sorting capabilities into smartwatches, which benefits users by allowing service information to be presented in a more reasonable manner on the relatively small smartwatch screen, ensuring that important information is not missed and users are not overwhelmed by excessive information and applications.

One More Thing

Previously, the flagship products that drove purchases in a smart terminal ecosystem were smartphones. Given the current completion level of smartwatches, with higher average transaction prices, greater innovation space, and practical applications in sports health, smartwatches are becoming increasingly suitable to take on this role, becoming a revenue tool that spans ecosystems.

Moreover, this market is still in a relatively early stage. Aside from the relatively stable positions of Apple and Huawei (built on a decade of digital health accumulation), other players are just beginning to sprint, leaving room for competition.

In 2023, some manufacturers have explored advanced capabilities for smartwatches, which are key to shedding the “waste” image and will be focal points for future competition.

At the algorithm level, there is still significant exploration space, whether in health management or interaction control. Further exploring the relationship between physiological indicators and health, multi-characteristic collaborative health management, and multi-terminal interactions involving people, machines, vehicles, and watches will allow users to perceive value.

On this basis, hardware (sensors, craftsmanship, materials) will also improve performance and precision driven by software and algorithms. Currently, the sensors in smartwatches have not yet utilized very advanced processes, leaving room for continuous development and improvement, which may exceed our imagination.

Beautiful yet not wasteful, smartwatches are about to enter a phase of software-led competition. Those who can better utilize data, algorithms, and large models as “basic conditions” and focus on “usability” through investment and exploration in software will become key players in the competition.

In 2024, the application of AI large models is expected to accelerate. It can be inferred that smartwatches have a great chance of changing the stereotype of being “beautiful waste,” so let’s wait and see.