This article is approximately 5,900 words long, recommended for saving and reading.

This article is approximately 5,900 words long, recommended for saving and reading.

Author | Beiwai Nanchang

Produced by | Automotive Electronics and Software

On April 11, 2025, the China Semiconductor Industry Association issued an official notice regarding the “Rules for the Determination of the Origin of Semiconductor Products,” clearly stating:The origin of integrated circuits will be determined according to the “Change of Tariff Number” principle, using the “Wafer Fabrication Location” as the final origin. This adjustment not only directly applies to regulations such as the “Order No. 122 of the General Administration of Customs of the People’s Republic of China,” but also marks a significant advancement in the precision and sovereignty claims of China’s semiconductor industry chain regulation.

Using the “Wafer Fabrication Location” as the basis for origin determination. This regulation has sparked widespread attention in the industry, particularly impacting global IC design companies, packaging and testing manufacturers, and upstream and downstream supply chains. This article will systematically analyze the policy background, technical aspects, impact assessment, and response suggestions.

#01Policy Background and Key Points of the Rules

For a long time, the global semiconductor industry chain has been highly fragmented: design, manufacturing, packaging, testing, and sales are distributed across multiple countries and regions. The standards for determining origin have been vague, leading to legal and regulatory challenges in export tax rebates, import and export customs declarations, and assessments of industrial autonomy.

Especially in the current context of escalating geopolitical tensions and technological blockades, clarifying the “substantial manufacturing location” of semiconductors has become a common core demand for national regulation, industrial strategy, and corporate operations.

This new regulation of “using the wafer fabrication location as the origin” reflects the high level of attention from the policy level to the core aspects of manufacturing sovereignty, with the core logic being to anchor the determination of origin to the “process of achieving substantial structure and function”.

1.1 International Practices for Determining “Origin”

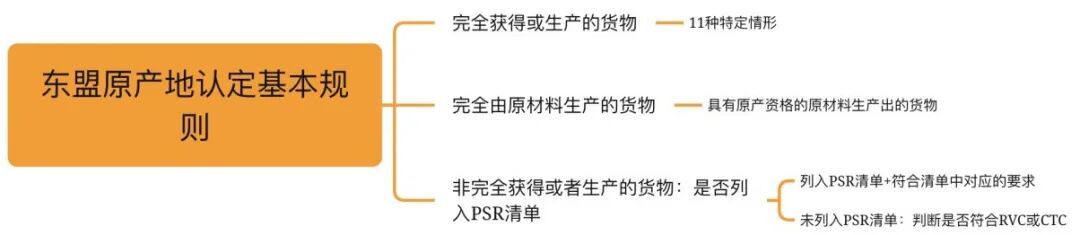

Origin (Country of Origin) is a core concept in international trade used to determine the tariff treatment, trade restrictions, and trade statistics of goods. Common standards for determining origin include:

-

Complete Origin Standard: Applicable to resource-based products or products fully obtained in one country;

-

Substantial Transformation Standard: If a key manufacturing step that imparts new characteristics or functions to the product is completed in a country, that country is considered the origin;

-

Change of Tariff Classification Standard (CTC): Determined by whether the first four digits of the customs tariff number change during the processing of the product.

1.2 Core Changes of This Regulation

-

Origin determination standard: Four-digit tariff number change principle;

-

Focus of determination: Integrated circuit wafer fabrication process;

-

Core determination method: Using the “wafer fabrication location” as the final origin;

-

Customs declaration requirements: Companies must provide procurement orders (PO) and other contractual materials for customs verification.

1.3 Analysis of Policy and Regulatory Connections

Relationship with the “Regulations on the Origin of Imported and Exported Goods of the People’s Republic of China”

The basis for determining origin is primarily governed by the “Regulations on the Origin of Imported and Exported Goods of the People’s Republic of China.” Article 3 of this regulation states:

“If imported goods are produced, manufactured, or processed in two or more countries (regions), the place of the last substantial change shall be considered the origin.”

In the semiconductor industry chain, “substantial change” has always been a focal point of controversy—design and packaging are complex but do not change the tariff attributes of integrated circuits (still classified as 8542), while the wafer fabrication process produces substantial structural characteristics and functional realization, thus being recognized by the state as the final origin.

Coordinated Impact with the “Export Control Law” and “Regulations on the Administration of Technology Import and Export”

-

Changes in origin may affect whether integrated circuits are re-identified by countries with export restrictions;

-

If the IC wafer fabrication location is in the United States or Japan, its products may be subject to EAR (U.S. Export Administration Regulations) or MITI (Japanese Ministry of International Trade and Industry regulations) when exported to China;

-

Compliance declarations (End User Statement) must accurately report the wafer fabrication location to avoid compliance risks.

1.4 Scope of Application and Typical Scenario Analysis

Scope of Involved Products

-

All tariff numbers 8542.31, 8542.32, 8542.39 (covering MOS, bipolar, analog mixed, etc.) integrated circuits;

-

Including logic chips, SoCs, analog ICs, MCUs, memory chips, etc.

Examples of Typical Scenarios

|

Company TypeScenario Description |

Origin Attribution |

|

|

Company A designs chips and entrusts TSMC for wafer fabrication in Taiwan |

Wafer fabrication in Taiwan |

Origin: Taiwan |

|

Company B designs chips in the U.S. and has SMIC’s Shanghai factory perform wafer fabrication |

Wafer fabrication in Shanghai |

Origin: China |

|

Company C completes wafer fabrication and performs packaging and testing in Malaysia |

Wafer fabrication completed |

Origin: Wafer fabrication location, not transferred by packaging and testing |

#02

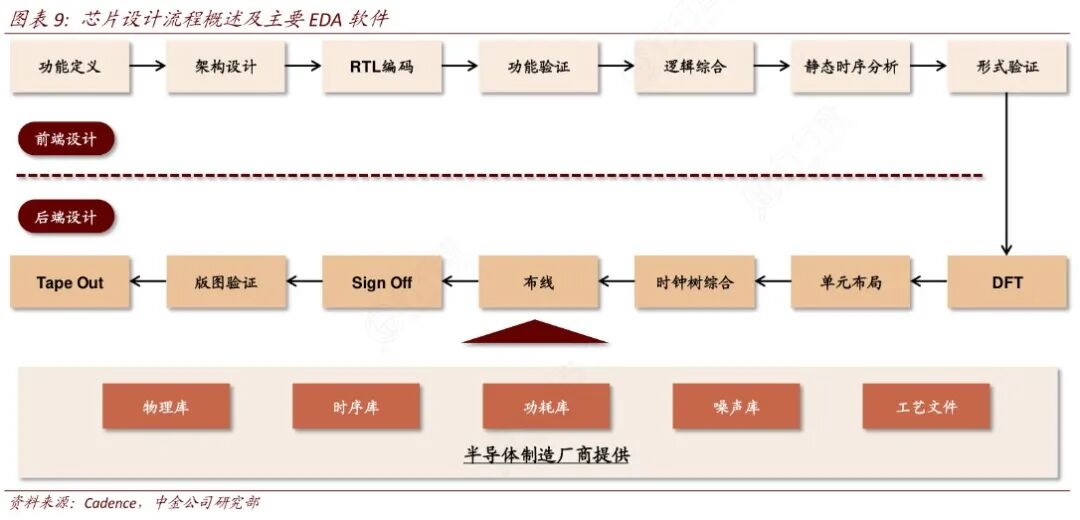

Analysis of Wafer Fabrication Process and Its Technical Weight in Origin Determination

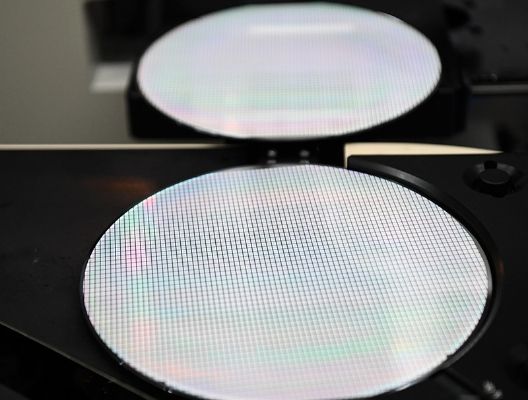

2.1 Definition of Wafer Fabrication

“Wafer fabrication” refers to the process of manufacturing a physical wafer from a verified IC layout through photolithography and other processes, which is a core part of semiconductor manufacturing. It includes the following key processes:

-

Wafer Fabrication: includes doping, thin film deposition, photolithography, etching, metallization, etc.;

-

Process node realization (such as 28nm, 14nm, 7nm, etc.);

-

After the front-end processes of the chip are completed, they are handed over to the back-end for cutting, packaging, and testing.

2.2 Technical Key Points in Origin Determination

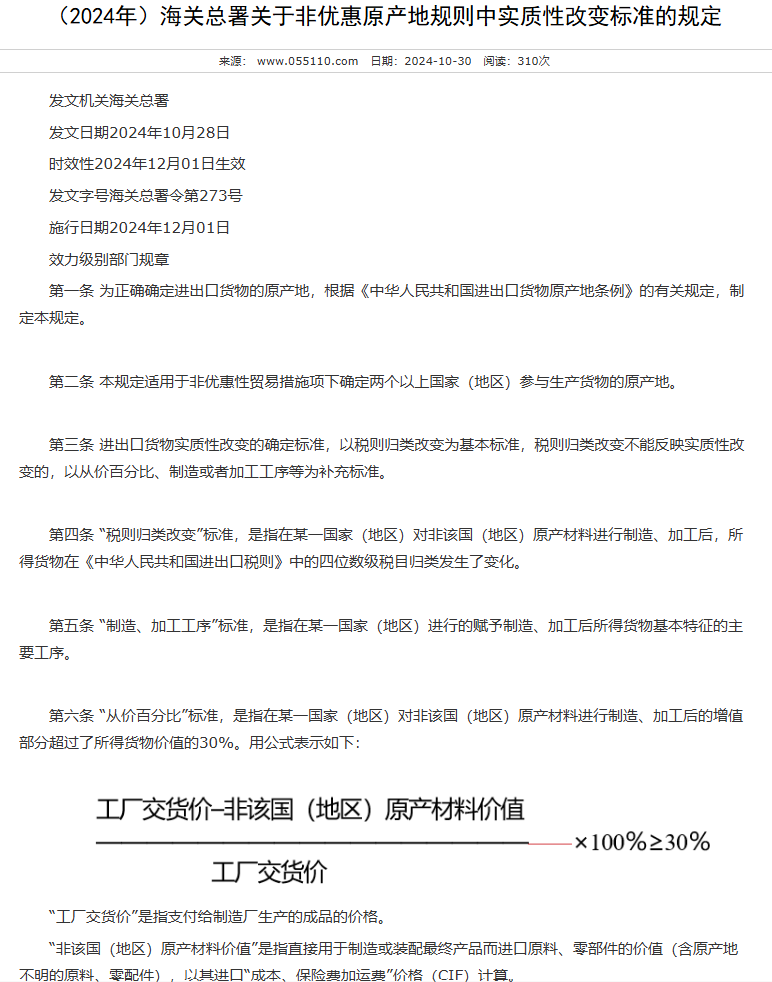

According to the “Order No. 122 of the General Administration of Customs of the People’s Republic of China” (revised in 2018), the determination of the origin of goods can be based on the following three categories of substantial change standards:

|

Type of Substantial ChangeCore Content |

Standard for Change of Tariff Number |

|

Standard for Change of Tariff Number |

If the processing action leads to a four-digit level change in the customs tariff number (i.e., a change in the “tariff item”), it is recognized as a substantial change. |

|

Value Proportion Standard |

If the added materials or value proportion after processing reaches a certain threshold (e.g., 40%), it can be recognized as a substantial change. |

|

Production/Processing Procedure Standard |

If the processing action itself has sufficient technical or structural changes, it can be regarded as a substantial change. |

This new regulation clearly bases its determination on the first type: the standard for change of tariff number. According to the “Change of Tariff Number” principle, if a certain stage in the manufacturing process leads to a substantial change in product attributes and causes a change in the tariff code, the country where this stage occurs can be recognized as the origin.

China adopts the “Import and Export Tariff” system, structured as follows:

|

LevelDigits |

Meaning |

|

|

Chapter |

First two digits |

Major categories, such as85 chapter for“Electrical and Electronic Equipment” |

|

Tariff Item |

First four digits |

Subcategories of goods, such as8542 for“Integrated Circuits” |

|

Sub-item |

First six digits |

Specific types |

|

Item |

Eight or ten digits |

Detailed description for import and export management |

The core of the “Change of Tariff Number” principle is: If the first four digits (tariff item) of the product change after processing, it is considered a substantial change, and the processing action is recognized as creating a new origin.

For ICs,

Design Location:

-

Although it has high technical content, it does not produce “physical goods”;

-

Cannot be classified under any tariff number;

-

Belongs to the “service stage” and does not meet the premise for origin definition.

Packaging/Testing Location:

-

Although it is a processing action, the tariff number before and after packaging remains unchanged (still 8542);

-

Cannot constitute a “change of tariff number”;

-

Does not have substantial structural/functional changes.

Only wafer fabrication possesses the decisive processing characteristics that construct the “integrated circuit physical structure,” making it the manufacturing activity that best represents the origin in the industry chain. Therefore, the wafer fabrication location is the tariff number generation location, and thus the origin.

According to the “China Import and Export Tariff (2024):”

-

8542: Integrated Circuits, covering wafers, packaged chips, etc.;

-

Design, testing, packaging, and other steps do not change the tariff number, and the product remains classified under 8542;

-

Only during the “wafer manufacturing (fabrication)” stage does the product first possess a complete circuit structure and function, thus changing from “non-goods” to “class 8542 goods.”

|

StageProcess Description |

Does it constitute a change of origin (technically) |

|

|

IC DesignRTL, circuit design |

No (does not change tariff code) |

|

|

Mask Production |

No (still belongs to design preparation) |

|

|

Wafer Fabrication |

Photolithography, ion implantation, metallization, etc. |

Yes (changes tariff code) |

|

Packaging Testing |

Assembly, functional verification |

No (function not substantially changed) |

Application Examples (using integrated circuits as an example)

Example 1: IC Design → Wafer Fabrication → Packaging Testing

-

IC Design: No physical form, does not generate a tariff number.

-

Wafer Fabrication: Produces 8542 class products;

-

Packaging Testing: Changes appearance and usage, but still classified as 8542.

Conclusion:

-

Packaging does not cause a change in tariff number (still 8542), does not constitute a change of origin;

-

Only the wafer fabrication process creates 8542 class products, thus the wafer fabrication location is recognized as the origin.

Example 2: Imported wafers packaged domestically

-

Wafer origin: United States;

-

Packaging location: China;

-

Tariff number before and after packaging is still 8542.

Conclusion:

-

Cannot be recognized as “originating from China” based on the packaging process;

-

Origin remains the United States.

|

ItemIC Design |

Wafer Fabrication |

Packaging/Testing |

|

Does it generate a tariff number |

Yes, first possesses commodity attributes |

Yes (but does not change tariff number) |

|

Does it change the tariff number |

Not applicable |

No (still 8542) |

|

Does it constitute a change of origin |

No |

Yes (substantial change) |

|

Can it be recognized as the origin |

No |

Yes (wafer fabrication location is the origin) |

Therefore, from the perspective of substantial change in tariff code, the wafer fabrication process is recognized as the point of “substantial transformation,” and that location is recognized as the product’s origin.

#03

Impact Analysis on the Industry Chain

3.1 IC Design Companies

-

Increased compliance sensitivity regarding wafer fabrication location selection;

-

Involves issues of export control, origin labeling, tax incentives, and applicability of trade agreements (such as RCEP);

-

If the design location differs from the wafer fabrication location, it is necessary to strengthen supply chain traceability and contract management.

3.2 Domestic Wafer Manufacturers

-

Enhances the strategic value of local wafer fabrication, attracting more domestic IC design backflow;

-

In the context of U.S.-China technological decoupling, strengthens the bargaining position of domestic manufacturing;

-

May become a key link in geopolitical policy games.

3.3 Packaging and Testing Manufacturers

-

Although not a key link in origin determination, it is necessary to strengthen the collaborative management of wafer fabrication location traceability information;

-

Enhance cooperation with IC design companies in origin identification and customs declaration.

3.4 Impact Analysis of Origin Rules on Typical Semiconductor Business Models

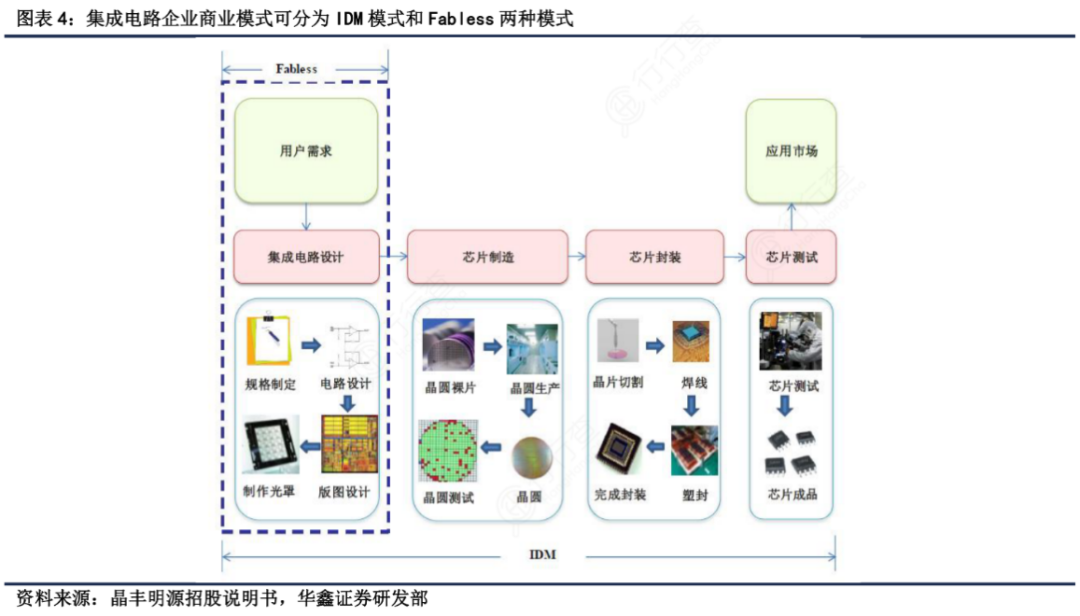

3.4.1 Fabless Model Companies (Design Companies without Wafer Fabrication)

Model Characteristics: Independently design chips, fabricate wafers at overseas foundries, and package domestically.

Origin Determination: If wafer fabrication occurs outside mainland China (e.g., TSMC, Samsung, GlobalFoundries), even if the company is a domestic legal entity, it will still be recognized as non-Chinese origin.

Risk Points:

-

Cannot apply for a Chinese certificate of origin;

-

If the target market imposes sanctions or additional tariffs on specific origins (e.g., the U.S. against Chinese/Russian products), it will affect export compliance;

-

When the overseas wafer manufacturing actions do not align with the final sales orders, customs may recognize it as “circumventing origin rules.”

Recommended Measures:

-

Establish a priority cooperation mechanism with domestic foundries (e.g., SMIC, Hua Hong Semiconductor, Yuxin);

-

Include an “Origin Determination Agreement” in the contract terms, specifying the attribution of wafer fabrication location and responsible parties;

-

If using overseas wafer fabrication, timely assess potential trade barrier risks and establish a repository of documentation (orders, POs, wafer fabrication contracts, logistics vouchers, etc.).

3.4.2 IDM Model Companies (Integrated Design-Manufacturing-Packaging)

Model Characteristics: Own wafer fabrication plants and perform wafer fabrication in China, while also conducting back-end packaging, testing, and sales.

Origin Advantages:

-

Wafer fabrication in mainland China meets origin determination requirements;

-

Can apply for a Chinese certificate of origin (e.g., tariff incentives under China-Korea FTA, RCEP);

-

Enhances customer trust and avoids restrictions in geopolitically sensitive markets.

Strengthening Recommendations:

-

Actively apply for “China Manufacturing Certification” and “China Origin Registration”;

-

Establish an automated “BOM-Tariff Number-Origin” mapping database to improve customs efficiency;

-

Combine with the “Trusted Manufacturing Chain” platform (e.g., Guangdong-Hong Kong-Macao Origin Data Platform) for data registration.

3.5 Module Integrators / End Manufacturers (including automotive-grade chip applications)

Model Characteristics: Procure ICs fabricated overseas, package, integrate, and sell/export in China.

Assuming a terminal product such as a mobile phone, router, or industrial equipment:

-

If its SoC chip is designed in Korea, fabricated in Taiwan, and packaged in China, with the final product exported from China;

-

The origin information chain needs to integrate the wafer fabrication contract, processing location, batch data, etc.;

If the whole machine claims to be “Made in China,” but the core chip is “wafer fabricated in Taiwan,” it may encounter customs scrutiny when exported to specific markets.

Issues of Concern:

-

If the IC’s origin is non-Chinese, it will affect the origin traceability of the entire product;

-

For terminal products regulated by laws (such as automotive, medical, communication equipment), it may trigger customs compliance risks;

-

In some cases, it may lead to increased tariff costs.

Response Strategies:

-

Establish a “Component-Level Origin Identification System” and label it at the BOM level;

-

Require suppliers to provide “Origin Declarations + Wafer Fabrication Location Proof Materials”;

-

Utilize packaging processes within free trade zones (e.g., China-ASEAN Free Trade Area) to optimize origin attribution paths.

3.6 Response Suggestions and Compliance Operation Guidelines

Corporate Compliance Suggestions

-

Clarify the contract chain: Sort out the complete link of design – wafer fabrication – packaging – whole machine integration;

-

Retain key materials: such as wafer fabrication POs, mask submission orders, wafer processing contracts, etc.;

-

Systematically manage origin identification: especially for products with multiple categories and multiple countries of wafer fabrication;

-

Coordinate ERP and customs systems: Ensure that the customs system is consistent with the actual wafer fabrication location;

-

Respond cautiously to U.S.-China export controls or TAA agreement requirements.

|

Impact DimensionContent |

Compliance with Customs |

|

Customs Compliance |

Must declare origin based on wafer fabrication location, providing**procurement orders (PO)** and other evidence for customs verification; |

|

Export Control Compliance |

Origin information will affect whether it triggers export control or trade sanction regulations, especially critical for multinational supply chain companies; |

|

Tax Rebates and Tax Policies |

Origin determination relates to tax rebate amounts, issuance of certificates of origin, and treatment of origin countries in trade benefits; |

|

Data Management |

Companies need to enhance internal supply chain traceability, origin records, and data sharing mechanisms to ensure traceability and compliance; |

|

Strategic Layout Optimization |

For IC design companies and IDM enterprises, it may be necessary to adjust wafer fabrication location choices to avoid potential risks and gain origin advantages; |

Policy Response Suggestions

-

Domestic IC design companies should assess whether they can enjoy more favorable tariff treatment due to changes in origin;

-

Whole machine companies should confirm whether the chip’s origin affects the whole machine’s export labeling;

-

Pay attention to trade barrier risks: such as the U.S. “CHIPS and Science Act” restrictions on integrated circuits from “non-friendly origins.”

3.7 Future Trend Assessment and Corporate Response Directions

Future Trend Predictions

1. Origin rules are becoming more detailed and technical

-

The determination of the origin of integrated circuits will no longer rely solely on production line labels but will be based on technical transformation points;

-

More segmented products such as chiplets and packaging modules (SiP) may be included in the new determination logic in the future.

2. Global origin regulation is tightening

-

The U.S. is becoming more precise in identifying “Chinese products”; the EU, Japan, and others will strengthen tracking of “key raw materials/manufacturing locations”;

-

Origin fraud and circumvention will face higher legal risks.

|

Country/RegionRegulatory Laws and Regulations |

Enforcement Agency |

Scope of Regulation |

Regulatory Tools |

|

|

United States |

“2018 Export Control Reform Act”, “Export Administration Regulations”, “Arms Export Control Act”, “International Traffic in Arms Regulations”, etc. |

Department of Commerce Bureau of Industry and Security, Defense Trade Controls, Nuclear Regulatory Commission, Department of Energy, etc. |

Dual-use items, nuclear materials, nuclear equipment, nuclear-related items, etc. |

Commercial control lists, entity lists, etc. |

|

United Kingdom |

“2002 Export Control Act”, “2008 Export Control Regulations”, etc. |

Export Control Joint Working Group |

Dual-use items, technologies and products for torture or execution, strategic export control lists, etc. |

Strategic export control lists, etc. |

|

Germany |

“Foreign Trade Law”, “Foreign Trade Regulations”, etc. |

Federal Office for Economic Affairs and Export Control, etc. |

Dual-use items, etc. |

EU dual-use items and technology export control lists, etc. |

|

Russia |

“Export Control Law”, “Basic Principles of State Management of Foreign Trade Activities Law”, etc. |

Russian Federal Technical and Export Control Authority, etc. |

Dual-use items, etc. |

Dual-use item lists, weapons and military supplies lists, etc. |

|

Japan |

“Foreign Exchange and Foreign Trade Act”, “Export Trade Control Order”, “Foreign Exchange Order”, “Export Trade Management Regulations”, etc. |

Ministry of Economy, Trade and Industry Trade Management Department, etc. |

Dual-use items, etc. |

Export Trade Control Order control lists, foreign trade order control lists, etc. |

|

South Korea |

“Foreign Trade Act”, “Foreign Trade Act Enforcement Order”, “Defense Procurement Act”, “Nuclear Safety Act”, etc. |

Ministry of Trade, Industry and Energy, Defense Acquisition Program Administration, Nuclear Safety Commission, etc. |

Dual-use items, nuclear technology and products, etc. |

Strategic materials lists, etc. |

|

European Union |

“2021 EU Dual-Use Items Export Control Regulation”, etc. |

EU Trade Directorate Dual-Use Coordination Group, etc. |

Dual-use items, etc. |

“EU Dual-Use Items Control List”, etc. |

3. China will build an origin traceability certification platform

-

Using blockchain and AI algorithms to establish a traceable, certifiable, and auditable origin data platform;

-

Helps domestic companies enhance customs transparency and credibility.

Corporate Response Directions

|

Response AreasRecommended Measures |

Compliance Management |

|

Compliance Management |

Establish an origin tracking system, clarifying the design, wafer fabrication, and packaging paths for each chip |

|

Contract Management |

Clarify the responsible party for wafer fabrication, the location, and tariff number attribution information, and reflect this in the contract |

|

Supply Chain Collaboration |

Establish a data sharing mechanism with foundries, packaging factories, and customers to ensure synchronization of origin information |

|

Digital System Support |

Introduce origin fields and automatic tracking capabilities in ERP or PLM systems to reduce human error in reporting |

|

Customs Training |

Enhance the understanding and response capabilities of customs, legal, and sales personnel regarding the new origin regulations |

Conclusion:

The new regulations recently issued by the China Semiconductor Industry Association clearly state that the origin of integrated circuits will be determined based on the “wafer fabrication location.” This policy adjustment not only reflects China’s refined progress in integrated circuit customs regulation but also signifies the country’s high regard for the core aspects of manufacturing sovereignty.

In the increasingly complex global semiconductor industry chain, this new regulation is both a proactive response to technological sovereignty and manufacturing capabilities, as well as a strategic layout to address international trade situations, geopolitical changes, and technological blockades. It directly relates to tax policies, export compliance, and origin management, and more deeply reshapes the logic of industry chain collaboration.

The determination rule of “using the wafer fabrication location as the origin” may seem like a technical detail in customs management, but it actually reflects the systemic reshaping of the global semiconductor industry under multiple factors such as geopolitical games, supply chain security, and regulatory compliance. This not only enhances the strategic position of China’s wafer manufacturing stage but also imposes higher requirements for data transparency and compliance governance on enterprises.

For domestic semiconductor companies, this is both a challenge and an opportunity. Only by accurately grasping the core of the policy and sorting out the internal data management system and supply chain structure can they effectively avoid origin disputes, seize policy dividends, and enhance bargaining power in the global market.

In the future, as China’s capabilities in wafer manufacturing continue to improve, this origin new regulation is expected to further enhance the international cooperation attractiveness of local wafer foundries, promoting a more robust and independent development of the domestic IC industry chain.

References:

-

China Semiconductor Industry Association issues urgent notice: Wafer fabrication location recognized as origin – Hardware – cnBeta.COM

-

Integrated circuit companies’ business models can be divided into IDM and Fabless models_Industry Research Database

-

Zhonglun Law Firm official website

-

Analysis of the evolution of foreign technology export control and response strategies

-

Provisions on the substantial change standard in non-preferential origin rules_General Administration of Customs_China Government Network

-

Regulations on the substantial change standard in non-preferential origin rules – Legal Inquiry – Lawyer Portal

-

Regulations on the Origin of Imported and Exported Goods of the People’s Republic of China_2019 Supplement 1 State Council Bulletin_China Government Network

-

General Administration of Customs Order No. 122 issued “Provisions on the Substantial Change Standard in Non-Preferential Origin Rules” – Customs Lawyer Network

Previous Articles Recommended: U.S. 25% Auto Tariff Takes Effect, Direct Impact on Detroit’s Big ThreeCan Electric Vehicle Fires Be Completely Prevented?Real-Life Survival Stories of Automotive Professionals