Source: Semiconductor Industry Observation

Original Author: Gong Jiajia

More than twenty years ago, Microsoft’s Windows operating system and Intel’s X86 chips formed a “duopoly” that dominated the computer market until they encountered Apple. Apple’s rise caused cracks in the once unbreakable Wintel alliance, and “Windows + X86” was no longer the only option; you could also choose “macOS + X86.” By 2020, the release of the M1 chip brought the ARM architecture into this battle, introducing a new competitor to X86.

Today, can ARM challenge X86 in the PC chip domain?

X86 VS ARM

It is well-known that ARM and X86 are two major computing architectures with fundamental differences, previously representing the mobile and PC camps respectively.

For X86, it is a familiar name, regarded as the most successful CPU architecture ever, including the Intel 8086, 80186, 80286, 80386, and 80486 series, which are based on CISC architecture (Complex Instruction Set Computer), focusing on completing required computing tasks with a minimal number of machine language instructions.

The strength of the X86 architecture lies not in itself but in the vast array of programs built around its instruction set. However, as the computer industry developed, the number of integrated instructions on X86 increased in pursuit of higher performance, which imposed a greater burden on hardware, inadvertently increasing power consumption and design complexity.

In contrast, ARM significantly simplifies its architecture, retaining only the necessary instructions, allowing for a more streamlined processor with small size and high efficiency.

The ARM architecture was originally designed and launched by ARM Holdings plc, which was established in 1990 by Acorn Computers, Apple, and VLSI Technology. Initially, ARM stood for Acorn RISC Machine, later changed to Advanced RISC Machine. ARM Ltd develops the ARM architecture and licenses its IP, allowing licensees, partners, and customers to build chips into their designs and products.

As its name suggests, ARM is based on RISC (Reduced Instruction Set Computer) architecture, which differs from CISC processors by focusing on reducing instruction complexity and executing at high clock speeds within a single cycle. In short, RISC emphasizes the efficiency of each instruction cycle, while CISC emphasizes the efficiency of each program instruction, making RISC more efficient.

The advantages of the ARM architecture are clear. First, it is cost-effective and typically does not require expensive equipment; second, it has a simpler and more compact design; third, its low power consumption means higher stability, lower heat dissipation costs, longer battery life, and the potential for smaller product sizes; fourth, it offers high flexibility, allowing for technological integration with other IP company solutions as long as the core license is purchased.

The high cost-performance ratio and low energy consumption give ARM a competitive edge in the mobile market over Intel, with products like Apple’s A-series, Qualcomm’s Snapdragon series, and Huawei’s Kirin series all developed based on ARM architecture. If X86 is the most successful CPU architecture in the PC domain, then ARM has achieved absolute victory in the mobile ecosystem.

This stable situation of “using ARM for mobile and X86 for PCs” was disrupted by the M1 chip. With Apple’s entire Mac product line transitioning to ARM-based chips, the market share of ARM chips, which previously held a small portion of the personal computer chip market, rapidly increased.

A small spark has gradually spread into a prairie fire.

The Growing Influence of ARM

Before the ARM-compatible M1 Mac began sales, ARM’s market share in PC chips was only 2% in the third quarter of 2020. More than a year later, according to Mercury Research’s data for the first quarter of 2022, the estimated market share of ARM in the PC client segment (including Chromebooks and Apple Macs based on M1, as well as X86 desktop and mobile CPUs in total client size estimates) was 11.3%, up from 10.3% in the previous quarter and more than double the 5.9% from a year ago.

Dea McCarron, chief analyst at Mercury Research, confirmed that the growth of ARM’s PC market share is primarily due to strong sales of Macs. IDC data shows that Apple’s Mac business continued to grow in the first quarter of 2022, with cumulative shipments of Mac and MacBook reaching 7.2 million units, a 4.3% year-on-year increase from 6.9 million units in the first quarter of 2021. Even in the context of a shrinking market, Apple’s share in the PC market rose from 8.1% to 8.9%. The growth of ARM’s share in the PC sector can be largely attributed to Apple’s efforts.

In November 2020, Apple unveiled its first self-developed computer chip based on the ARM architecture, the M1, along with three PC products featuring the M1 chip. The launch of the M1 chip not only marked the end of Apple’s 15-year “relationship” with Intel but also showcased the immense potential of the ARM architecture in the PC domain.

Previously, the ARM architecture was not favored by PC manufacturers due to its high RAM requirements and, more importantly, compatibility issues with the Windows operating system.

As early as 2012, Microsoft attempted to launch the Surface RT, which was powered by the ARM-based Nvidia Tegra 3 processor. As an early attempt at Windows on ARM, the Surface RT ended poorly, running slowly, being incompatible with the Windows 8 version, and unable to run legacy X86 Win32 applications except for Microsoft pre-loaded apps and “Metro” apps in the Windows app store.

In 2016, Microsoft released Windows 10 for ARM, but it wasn’t until 2019 that the first Surface Pro X was truly available to users, which had numerous limitations, such as only supporting ARM64 drivers; certain games relying on OpenGL or proprietary DRM could not run; and no support for the ARM Hypervisor platform, etc., leading to poor user reviews.

Microsoft’s series of failed attempts led many to believe that using ARM chips as a PC platform was an impractical idea, but clearly, the situation has changed dramatically.

On one hand, Apple’s ARM-based processor technology, Apple Silicon, has demonstrated performance that rivals Intel’s X86 chips. To date, Apple has launched several high-performance chips based on ARM architecture, such as the M1 Pro, M1 Max, and M1 Ultra, with detailed introductions available in “Apple Releases M1 Ultra with 114 Billion Transistors: 34 Self-Developed Processors in 12 Years.” More importantly, following a series of performance innovations announced for its self-developed M-series products and Mac OS, Apple has significantly lowered the prices across its entire MacBook line, providing the biggest cost-performance improvement in recent years.

Although the anticipated M2 chip was not revealed at the spring launch event, recent reports from Bloomberg indicate that renowned Apple leaker Mark Gurman pointed out that Apple is testing four different M2 chips across at least nine Mac models, suggesting that the M2’s release is getting closer.

On the other hand, Microsoft and Qualcomm, who previously stumbled with Windows on ARM, have begun to catch up.

Microsoft not only launched Windows 11 ARM, which brought 64-bit application emulation to ARM but also announced plans to develop its own ARM-based processors. Last October, the Microsoft Surface division released a job requirement seeking a SoC architect, indicating that Microsoft may begin developing its own PC chips for Surface devices.

Earlier this year, Microsoft directly hired senior Apple engineer Mike Filippo to develop server chips in the Azure team. Bloomberg analysts noted that this move indicates Microsoft is accelerating its self-developed chip process to power Azure cloud computing services.

Qualcomm, as the only ARM chip supplier since Microsoft’s announcement of the WOA strategy, announced its first chip set specifically designed for PCs, the Snapdragon 8cx, in 2018, followed by the Snapdragon 8cx Gen 2 chip in 2020, which, aside from enhancing AI performance and supporting new Wi-Fi and Bluetooth standards, did not change the processor itself.

The biggest issue with the Windows on Snapdragon platform is actually app compatibility. In December 2021, Qualcomm launched the Snapdragon 8cx Gen 3, which improved GPU performance by 60%. It remains to be seen whether this significant performance boost will also resolve app compatibility issues.

In addition to research and development on the Snapdragon 8cx series, Qualcomm also acquired Nuvia, a company founded by three engineers from Apple’s former A-series processor team, last January. Qualcomm’s CEO Cristian Amon stated that the Nuvia team has made progress in ARM-based processors, and laptops powered by Nuvia are expected to be available to users by the end of 2023. Furthermore, there have been rumors about Qualcomm investing in ARM.

It can be said that Qualcomm is determined to succeed in the PC chip field, but by 2023, the yet-to-be-released chip will likely face off against Apple’s M2 chip, which will not be an easy victory.

Meanwhile, ARM itself released the Cortex-X1 architecture based on the ARMv8.2 instruction set in 2020, reaching a new level of performance. By the end of March 2021, it also released the new ARMv9 instruction set, which boasts stronger computing power and is no longer limited to the mobile market, but will also target new markets such as PC, HPC high-performance computing, and deep learning.

Additionally, Samsung, MediaTek, China’s Phytium and Rockchip, and startups like this chip are eyeing this market.

Samsung has been rumored since 2020 to be developing the Exynos 1000 processor, which may also be used for Windows PCs. While Samsung’s Exynos series chips are primarily developed for mobile devices, they have appeared multiple times in Samsung’s own 2-in-1 laptops or Google’s Chromebooks, such as the 2012 Samsung Series 3 and the 2014 Samsung Chromebook 2 11.6. This indicates Samsung’s eagerness to enter the Windows on ARM field. Recently, Sammobile reported that Samsung is developing the next-generation flagship processor, Exynos 2300, which is codenamed “Quadra,” raising questions about whether it will appear in other laptops in the future.

MediaTek directly expressed its determination to enter the Windows on ARM platform at last November’s Executive Summit, with its Vice President of Enterprise Sales and Business Development, Eric Fisher, stating, “Apple has already shown the world that this is possible. The long-standing Wintel partnership will inevitably face some pressure, and once this relationship is under pressure, companies like ours will have the opportunity. However, this plan is still in the early stages, and when it will be commercially available is still unknown.

In mainland China, Phytium primarily focuses on ARM architecture server CPUs; Rockchip released its flagship RK3588 ARM PC overall solution at the end of last year; and startup This Chip is dedicated to developing compatible ARM general-purpose computing systems, providing chip products and one-stop solutions for general computing, with news indicating that its chip products have entered the engineering design stage as of February this year.

Overall, the future strength of ARM architecture in the PC chip field should not be underestimated.

X86 Facing Strong Rivals

In contrast to the flourishing ARM side, the X86 side is much simpler, with only two companies capable of designing X86 CPUs: Intel and AMD. In fact, before the 80386, there were over a dozen manufacturers producing X86 CPUs, but as Intel’s dominance grew, along with the expiration of licenses and continuous performance upgrades, the other manufacturers faded into history, leaving AMD, which survived through self-developed AMD64 and cross-licensed compatibility with Intel X86-64, ushering in the 64-bit era of X86.

This indicates that in the chip industry, where technology reigns supreme, only innovation and mastery of technology can truly make one a winner; of course, that is a side note.

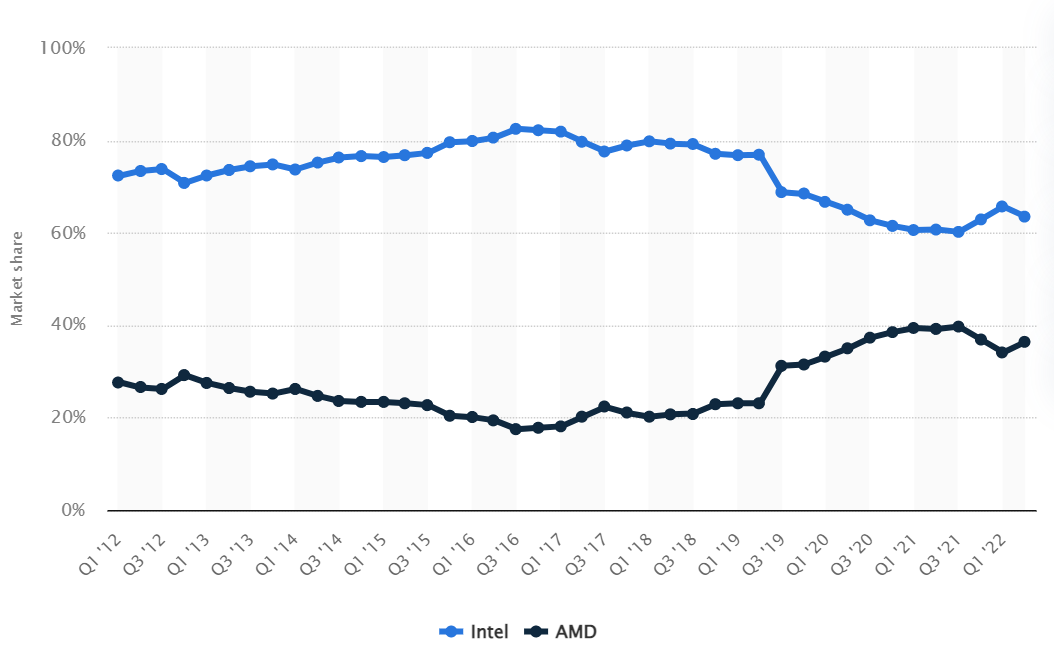

The global market share of Intel and AMD X86 computer processors from 2012 to 2022.

Image Source: Statista

As shown in the image above, Intel still holds a dominant position among X86 processors, but in recent years, AMD has been catching up rapidly, seemingly poised to compete with Intel. However, since Pat Gelsinger took over as CEO last year, Intel appears to be ramping up efforts to reclaim its throne.

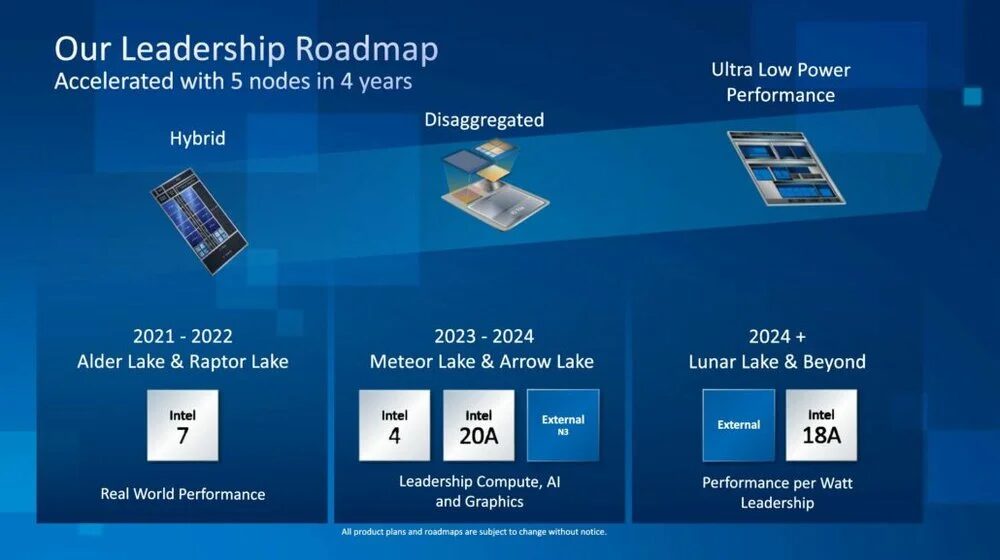

At Intel’s 2022 Investor Conference in February this year, Pat Gelsinger unveiled the CPU roadmap, expecting to launch the 13th generation Raptor Lake in the second half of this year. Reports indicate that Raptor Lake will bring double-digit performance improvements and enhanced overclocking capabilities, using Intel’s 7nm process technology and high-performance hybrid architecture, while being compatible with LGA 1700 / 1800 sockets.

Image Source: Intel

Meteor Lake is expected to ship in 2023 and will be built using Intel’s 4nm process. Arrow Lake will follow in 2024 as the first chip built using Intel A20 and external process technology. After 2024, Intel plans to release Lunar Lake and Nova Lake chips in 2025 and 2026, both expected to use improved 18A process nodes and feature MCM CPU, SoC, and GPU IP integrated in the same package.

On the other hand, AMD had previously allied with ARM a decade ago to launch low-power ARM servers, but it ultimately failed and returned to the X86 camp. Since launching its first Ryzen chip in 2017, AMD has entered an era of resurgence.

In November last year, AMD officially announced the successor to its 7nm Zen3 architecture – the 5nm Zen4 processor, marking the first use of 5nm in X86 desktop systems. In its Q1 2022 financial results, AMD revealed its adjusted roadmap for 2022-2023. AMD’s Zen 4 core architecture will be used in three processors: Raphael for high-end desktops, Dragon Range for high-end gaming laptops, and Phoenix for lightweight laptops.

Current information shows that Raphael is driven by the 5nm Zen 4 process and is expected to launch in the second half of 2022. Dragon Range, with a power consumption of only 55W, is set to launch in 2023. The Phoenix APU will utilize Zen 4 and RDNA 3 cores, support LPDDR5 and PCIe 5, and is expected to launch in 2023, likely at CES 2023.

From the above, it is clear that the future X86 camp’s PC processors are also poised for a strong offensive and should not be underestimated.

In Conclusion

It is impossible to determine who is better between ARM and X86, as both processor architectures have their own advantages and disadvantages. ARM’s excellent power efficiency and heat dissipation allow it to excel in specific scenarios. Meanwhile, Intel’s X86 CISC architecture can execute more complex instructions per clock cycle, resulting in faster and stronger computer performance, making performance expansion easier.

However, it is undeniable that X86 is no longer the only choice. With the efforts of major players like Apple, Qualcomm, and Microsoft, ARM is set to become an undeniable presence in the PC chip field.

*Disclaimer: This article is original by the author. The content represents the author’s personal views, and Semiconductor Industry Observation reprints it merely to convey a different perspective, without endorsing or supporting the views expressed. If there are any objections, please feel free to contact Semiconductor Industry Observation.

Editor: Mu Xin