Reported by Jiwei Network In the era of diverse computing power, the development opportunities for server chips of different architectures have become broader. In the past two years, a wave of domestic RISC-V server chip startups has emerged, with representative companies such as Blu-ray Computing, Jindie Space, and Super Ray Technology.

Since Arm announced its entry into the server market in 2009, it has been fifteen years. From the early high opening and low running, to the entry of giants in the mid-term, and now to rapid growth, it has become the main architecture outside of X86, with ups and downs throughout the process. China is an important promoter and beneficiary of the Arm server chip industry. Reviewing these fifteen turbulent years helps grasp the context of the development and transformation of server architecture, providing reference for domestic technological innovation and industrial ecosystem construction, while also bringing more expectations for the golden decade of future development.

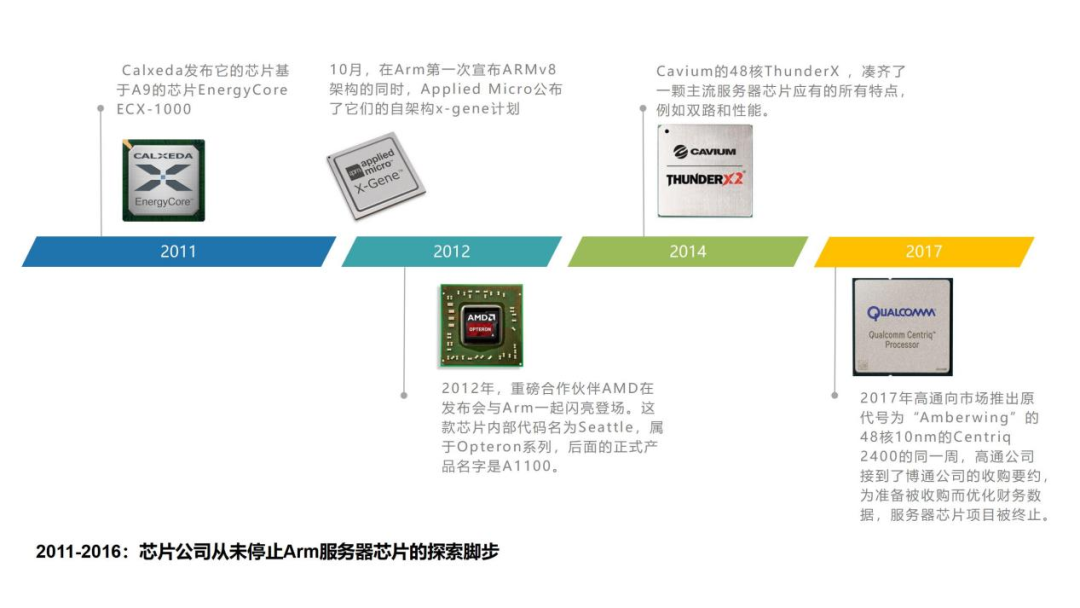

2011-2016: A Grand Entrance Followed by Decline

In 2008, chip shipments exceeded 10 billion units, and Arm, which was gaining momentum in the mobile phone market, began to brew its server chip plan.

Accompanying this was the big data generated by mobile apps, which gave rise to the initial emergence of cloud computing. Data centers began to face energy consumption challenges, and the industry urgently needed to find a solution that could handle a large number of parallel and lightweight loads with lower power consumption. The characteristics of the Arm architecture, which include multi-core, high parallelism, and low power consumption, just happened to meet this new demand from data centers.

In 2011, Arm launched its first 64-bit v8 architecture, achieving a combination of high performance and energy-efficient cores, thus starting the first wave of development for Arm server chips. In 2012, AMD launched the first Arm architecture-based 64-bit server chip, marking an important milestone for Arm server chips.

In the following years, numerous chip design companies such as Calxeda, AMCC, Broadcom, Cavium, Qualcomm, Samsung, and NVIDIA successively launched plans for Arm architecture server chips, with the market booming. Some optimistic predictions at the time suggested that by 2019, shipments of Arm server chips would account for 20% to 25% of the total market.

After the high opening came the low running. At the end of 2013, the pioneering startup Calexda collapsed first due to funding issues. In 2016, AMCC divested its Arm server business. AMD quietly abandoned Arm servers, refocusing its strategy on X86 and GPU. After being acquired by Broadcom, Broadcom terminated the Arm server project Vulcan. In 2017, Qualcomm terminated the Arm server chip Centriq to prepare for its acquisition by Broadcom.

Despite the strong technical and business logic for the existence of Arm server chips at the time, and the ongoing attempts by chip design companies to develop server chip products based on the Arm architecture, unfortunately, these efforts ultimately did not achieve the expected success in the market.

Arm’s rapid development in the mobile field benefited from the support of two top giants, Apple and Google, with Apple as its direct customer, and Google paving the way for its other direct customers with the Android software ecosystem.

In contrast to the mobile terminal market ecosystem, the players in the data center server market are completely different. Chip companies alone cannot drive the market; the involvement of super users and system vendors is necessary to change the situation.

2017-2022: Giants Entering the Scene and Turning the Tide

In 2017, the big names in the server industry began to enter the scene one after another.

In 2017, Rene James, former president of Intel and head of the data center business, founded Ampere, obtaining heavy strategic investments from database and cloud computing giant Oracle, creating a closed loop of “if you can do it, I want to use it”.

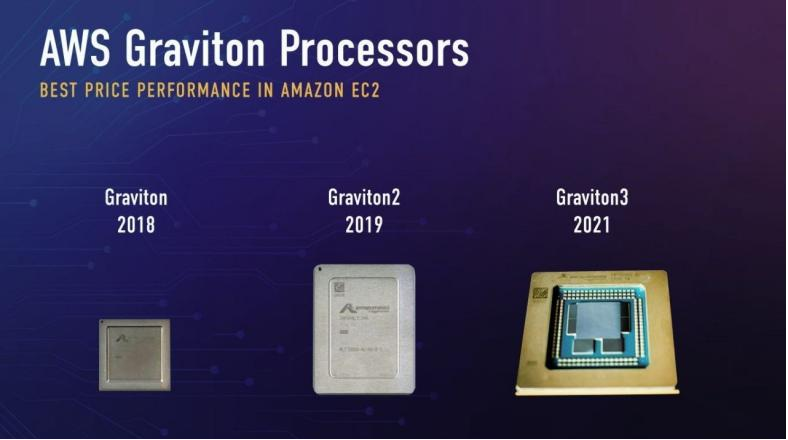

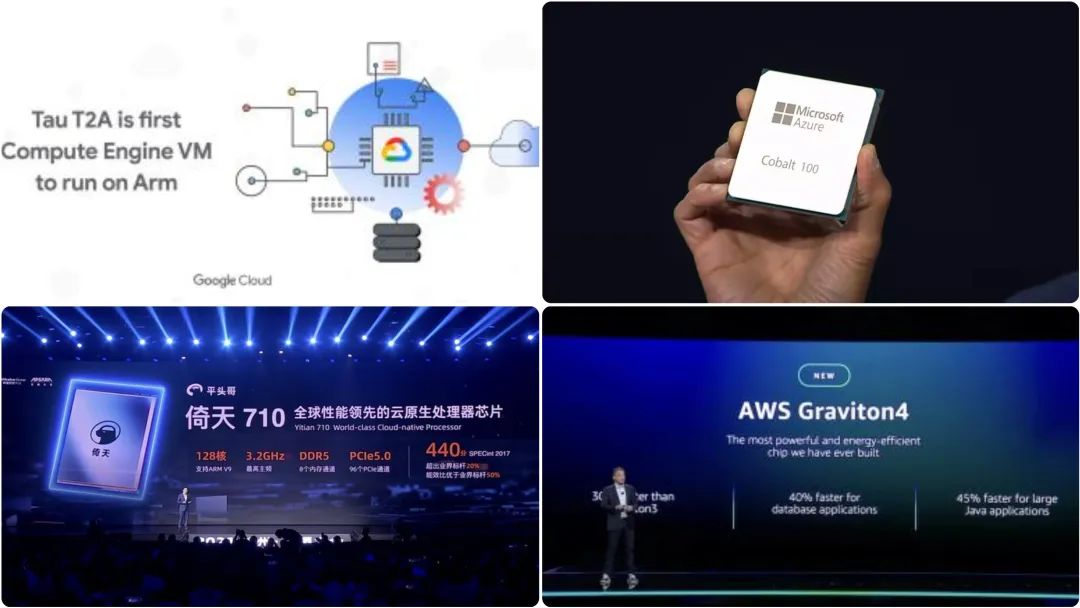

In 2018, Amazon released the Graviton chip and deployed it in its own AWS, creating a new situation for the large-scale deployment of Arm servers. Since then, the Graviton series has been updated every two years, and it has now developed to the fourth generation, rapidly increasing its proportion of AWS deployments. In recent years, Google, Microsoft, and others have also successively announced their plans for deploying self-developed Arm architecture server CPUs, aiming to improve the energy efficiency and TCO of cloud services to counter AWS’s advantages.

In early 2019, Huawei announced the launch of the industry’s highest performance Arm architecture server chip—Kunpeng 920, along with three TaiShan servers based on Kunpeng 920 and Huawei’s cloud services, setting a new record for computing performance. Alibaba Cloud also joined the ranks of Arm server chip manufacturing. In 2021, Alibaba’s T-head launched its first ARM architecture server chip, Yitian 710, and stated that it would quickly deploy it on Alibaba Cloud.

In just a few years, with the entry of cloud service providers and system vendors, telecom operators and industry users have continuously increased their procurement ratio of Arm servers. The CPU of Arm architecture servers has begun to show a high growth trend, with the average annual compound growth rate of the market exceeding 20% according to statistics.

The personal involvement of super users is a decisive factor, and the collaborative efforts of multiple roles in the software ecosystem and supply chain have promoted the real landing and rapid development of Arm server chips. At the same time,the advantages of Arm architecture servers have begun to magnify.

Firstly, as the scale of data centers continues to increase, space and volume, energy consumption and operation and maintenance mean more capital investment. TCO has become an important measurement indicator. Arm architecture servers have advantages in energy efficiency.

Secondly, the software ecosystem environment is becoming increasingly complete. The continuous promotion of Arm over the past 15 years, in collaboration with numerous industry chain partners including software companies, chip companies, device suppliers, complete machine manufacturers, and cloud computing vendors, has integrated software and hardware adaptation, reducing procurement and deployment difficulties.

Thirdly, after Intel entered the 14nm process, the pace of iteration of its process technology has significantly slowed down. After 2019, Arm server chip partners based on TSMC’s 7nm process have gone into mass production, and the current designs have developed to 5nm and 3nm processes, which have outpaced Intel in process technology. This means that the advantages of Arm server CPUs in terms of power consumption and cost will become even more prominent.

The Arm server ecosystem is maturing, coupled with the backdrop of domestic production, between 2020 and 2021, many domestic Arm server chip design startups have emerged. For example, companies like Yuxian Micro, Hongjun Micro, and Qilingxin, which design and sell server chips based on Arm Neoverse-N series CPU cores, have successively completed several rounds of financing worth hundreds of millions. In 2023, Borui Jingxin, which entered the public eye, has developed its own CPU cores based on ARM architecture authorization and has received significant attention in the market.

2023-2032: Harvest Season, Who Will Reap the Benefits?

Looking at the characteristics of global Arm server chip design companies, they can generally be divided into three main categories.

The first islarge-scale cloud service providers and system device manufacturers, who design chips and optimize software and hardware solutions based on their self-operated data centers or complete machine solutions, aiming to reduce costs for their vertical businesses, build stable supply chains, and attempt to form differentiated competitiveness visible to end users. They do not sell chips or motherboards externally; they only provide cloud services or complete machines to serve the needs of their vertical businesses.

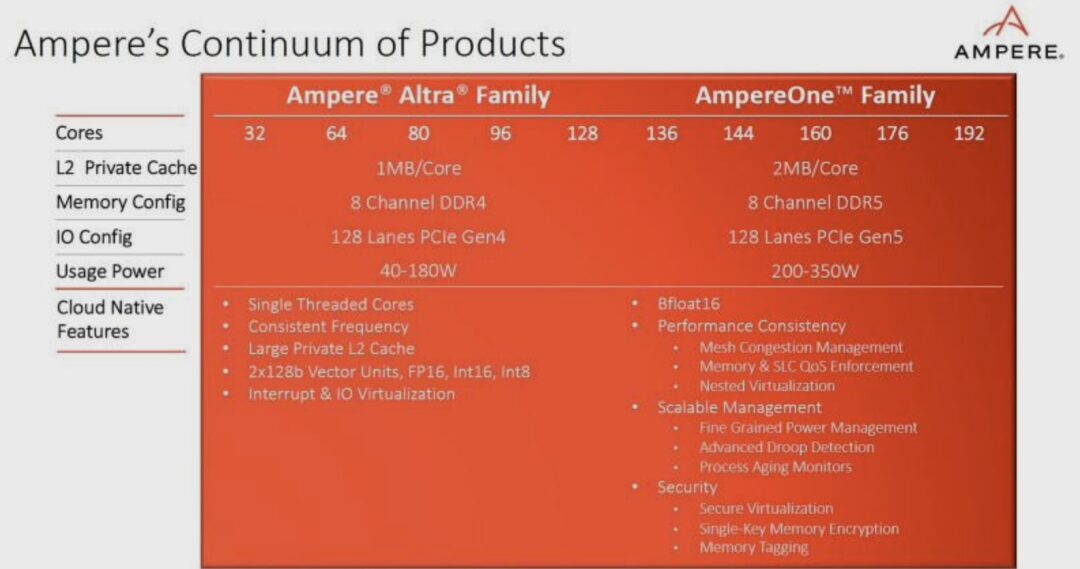

The second category includes independent manufacturers such as Ampere and Borui Jingxin, who achieve competitiveness through architecture-level self-research and innovation. This model has high requirements for technical capabilities and funding, enabling better product differentiation levels, while utilizing the convenience of the Arm ecosystem to meet the flexibility and customization requirements in the infrastructure field.

The third category consists of chip manufacturers that focus on SoC integration by purchasing Arm public version Neoverse-N series CPU cores and bus interconnect CMN. Starting with this model is easier for startups, but due to high reliance on Arm public versions, they lack design flexibility and deep optimization methods, which can meet the minor customization needs of SoC level for industry customers to a certain extent.

After fifteen years of ups and downs, we have finally welcomed certainty. With the improvement of the industrial ecosystem and the deepening of self-research and innovation, the Arm server industry is about to enter a harvest period.

Looking overseas, the core count, performance, and energy efficiency of Arm server chips are being pushed to new heights. In May 2023, Ampere launched the new AmpereOne series processors, self-researched core based on 5nm process node, with up to 192 single-threaded Ampere cores, the highest core count in the industry. In November, Amazon released its self-researched 96-core Graviton 4 data center processor; Microsoft announced the deployment of custom 128-core Arm server chips Microsoft Azure Cobalt…

In 2023, the tender documents of industry enterprises show a significant increase in the procurement of domestic Arm servers. In the domestic market,Feiteng, Kunpeng, and others have been cultivating for many years, and the startups established in the domestic market during 2020/2021 will gradually start producing or providing chips.It is reported thatthe first generation of products from Borui Jingxin is expected to be announced in the second half of this year, with plans to update every two years thereafter.Its chip design will build differentiation from the bottom up, including significant improvements in core count and frequency, as well as self-researched CPU cores, bus interconnect technology, low-power design solutions, etc., which are expected to provide customers with more energy-efficient and flexible design solutions, while helping high-end chip design carve out a path of localization.

Institutions predict that by 2030, the global share of Arm architecture servers will reach 30%, with China’s share expected to be higher than the global average. Amidst the wave of digital economy and digital transformation, it will strongly support the foundation of domestic computing power.

Editor: Ai Jiwei

Recommended Popular Articles:

-

Is Japan’s Semiconductor Industry Regaining Vitality? Domestic Manufacturers Rush to Japan

-

US Identifies Realtek and TCL for Patent Infringement

-

China Automobile Association: In 2023, China Sold 26.063 Million Passenger Cars, with Exports Up 63.7% Year-on-Year

-

Microsoft’s Market Value Surpasses $3 Trillion, Closing in on Apple to Rank Second Globally

To learn about the fastest and most comprehensive semiconductor investment information, please follow 【Semiconductor Investment Alliance】 WeChat official account

For more major news,

Please click to enterthe Ai Jiwei mini program to read

or download the Ai Jiwei APP to read

Click to follow 【Semiconductor Investment Alliance WeChat Official Account】

Open a new way to read semiconductor news: