Source: EEO Research Institute

The basic software of automobiles, as a core element of automotive software, is an important foundation for achieving the electronic and electrical architecture of the entire vehicle, and is a key underlying element for the intelligence and differentiated competition of automobiles. Recently, the EEO Research Institute released the “2022 China Smart Electric Vehicle Basic Software Research Report”, which analyzes the technical principles, market status, benchmark enterprises, and development trends of basic software for smart electric vehicles in China. The following content is excerpted from this report.

1. Background

1.1►

Intelligent Demand Drives Decoupling of Automotive Software and Hardware, SOA Software Architecture Achieves Software Reuse

Under the trend of intelligence, the traditional distributed electronic and electrical architecture is beginning to shift towards a domain centralized architecture, integrating a large number of ECUs with the same functions, which are managed and scheduled uniformly by domain controllers, allowing developers to be completely independent of the underlying hardware for the development of upper-layer software, further expanding the scope of software-hardware decoupling.

1.2►

Basic Software as a Core Element of Automotive Software: Key to Smart Vehicle Industry Development

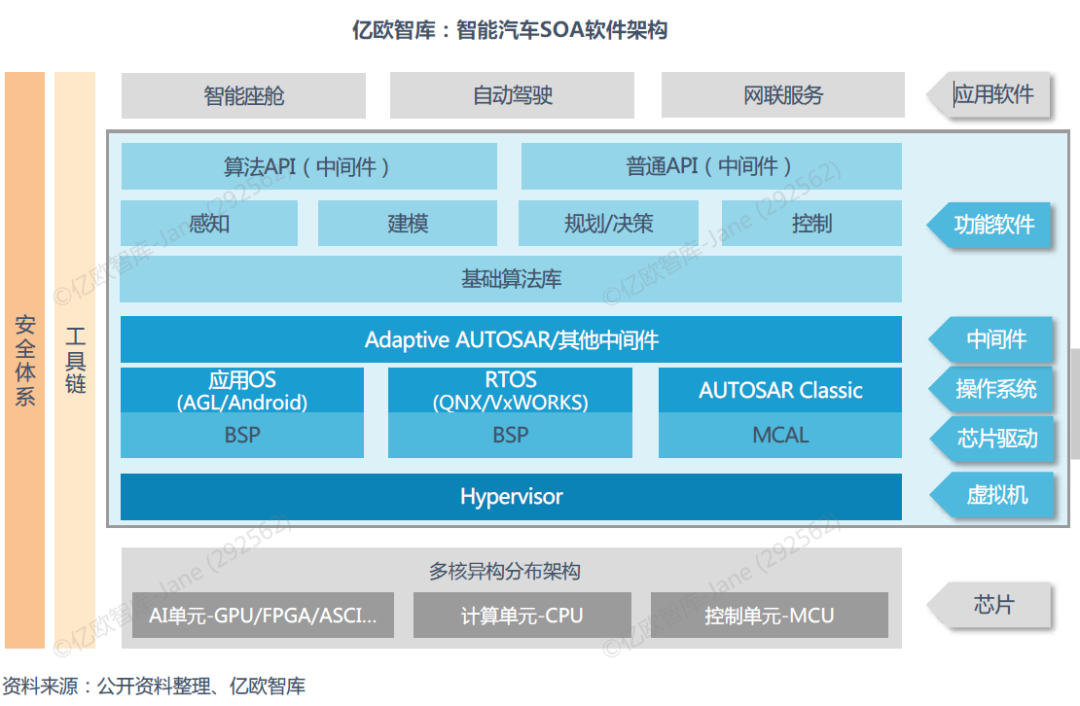

The SOA software architecture of intelligent vehicles consists of application software, functional software, middleware, underlying operating systems, in-car chip software (BSP), virtual machines (Hypervisors), and chips from top to bottom, where functional software, middleware, underlying operating systems, in-car chip software, and virtual machines form the basic software.

1.3►

Driven by Demand for Smart Electric Vehicles, Basic Software Market Size Experiences Rapid Growth

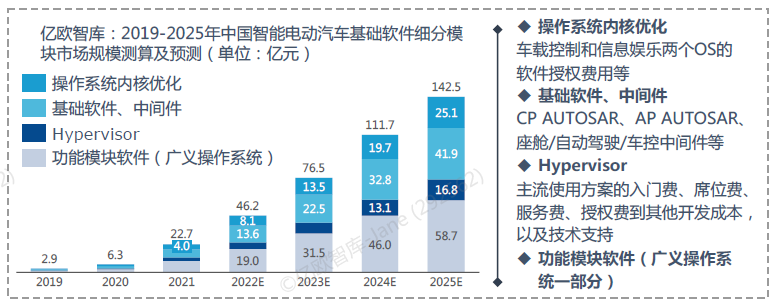

The Chinese automotive market has entered a stable development phase, with an expected market size of 4.62 billion yuan in 2022 and a potential economic benefit of 42.42 billion yuan. In the future, under large-scale applications, the per-vehicle cost of basic software is expected to decrease, but as the complexity of application functions increases, the usage of basic software per vehicle will also increase. Therefore, with the rise in total vehicle sales, the market size of automotive basic software is expected to reach 14.25 billion yuan by 2025.

2. Current Status

2.1►

Current Application Status of In-Vehicle Operating System Technology

▷ Domain Operating Systems Begin to Form, Underlying Operating Systems Become the Cornerstone of Software-Defined Vehicle Development

Under cross-domain integration solutions, domain operating systems are gradually forming, with traditional operating systems evolving from multiple independent systems to a few or a single operating system. From the perspective of functional implementation, intelligent vehicle operating systems can be roughly divided into vehicle control operating systems, autonomous driving operating systems, and intelligent cockpit operating systems, where vehicle control operating systems are mainly used for chassis control and power system control, autonomous driving operating systems are primarily for implementing autonomous driving functions, and intelligent cockpit operating systems are focused on in-vehicle entertainment information system functions and HMI-related functions.

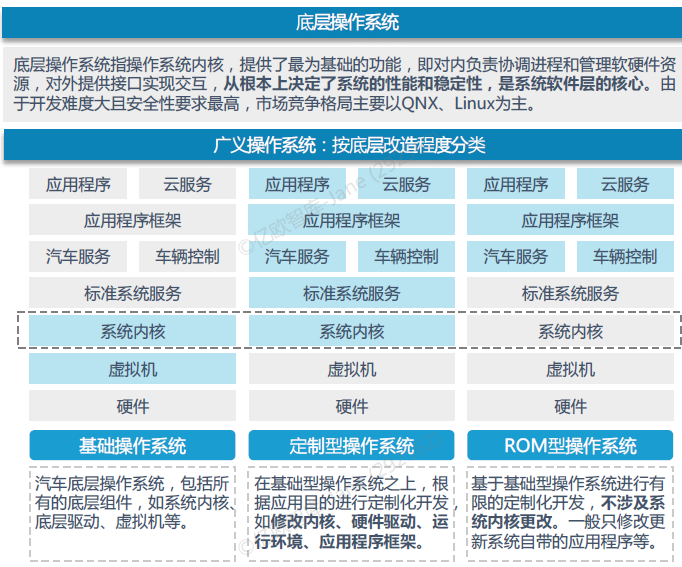

The operating systems include underlying operating systems and broad operating systems, with the underlying operating systems currently forming a stable market pattern dominated by QNX and Linux. Broad operating systems can be classified into basic operating systems, customized operating systems, and ROM-type operating systems based on the extent of modification to the underlying operating systems.

▷ Mass Production Application Node Arrives, Intelligent Cockpit Operating Systems Become a “Battlefield” for OEMs

Currently, the underlying operating systems for intelligent cockpits are mainly composed of QNX, Linux, and Android, forming a relatively stable market pattern. Among them, Linux and Android are widely used in in-vehicle infotainment systems due to their open-source nature, while QNX is primarily applied to in-vehicle dashboards due to its stability and security.

Most domestic OEMs choose to self-develop intelligent cockpit operating systems based on foundational OS, mastering independent OTA upgrades, while some technology companies opt for customized development of independent operating systems based on their software development capabilities and rich product ecosystems. It is predicted that the penetration rate of intelligent cockpits in the Chinese market is showing rapid growth, having officially entered a key node for mass production applications in 2022, making intelligent cockpit operating systems a “battlefield” for various players.

▷ Autonomous Driving Operating Systems at Partial Certification Stage, Various Forces Co-Build Ecosystem

Operating systems in the autonomous driving field have passed partial automotive-grade safety certifications, but the industry is still in its early development stage. Compared to intelligent cockpits, autonomous driving requires the introduction of a large number of sensors, which increases the demand for openness in the underlying OS, while also needing to meet ISO 26262 ASIL D, leading to widespread application of Linux.

2.2►

Current Application Status of In-Vehicle Middleware Technology

▷ Driven by Advanced Autonomous Driving Demand, AP and ROS 2.0 Middleware Solutions Emerge

The intelligent and connected nature of automobiles has raised higher requirements for ECU communication rates and computing power. Data-centric “service-oriented” architectures are beginning to replace traditional message-centric “signal-oriented” communication architectures, driving the evolution of middleware solutions. Currently, the mainstream middleware solution in the market is AUTOSAR, which is relatively mature in the automotive industry.

Classic AUTOSAR (CP) solutions are applied to MCUs under distributed architectures and include an OS based on the OSEK standard, offering higher functional safety and real-time performance, suitable for traditional ECUs such as engine control and braking; to support advanced autonomous driving demands, the AUTOSAR alliance has launched Adaptive AUTOSAR (AP), alongside middleware solutions based on robotic software middleware, such as ROS(2.0).

▷ SOME/IP and DDS Each Have Their Own Strengths, Communication Middleware Solves the “Data Transmission” Dilemma

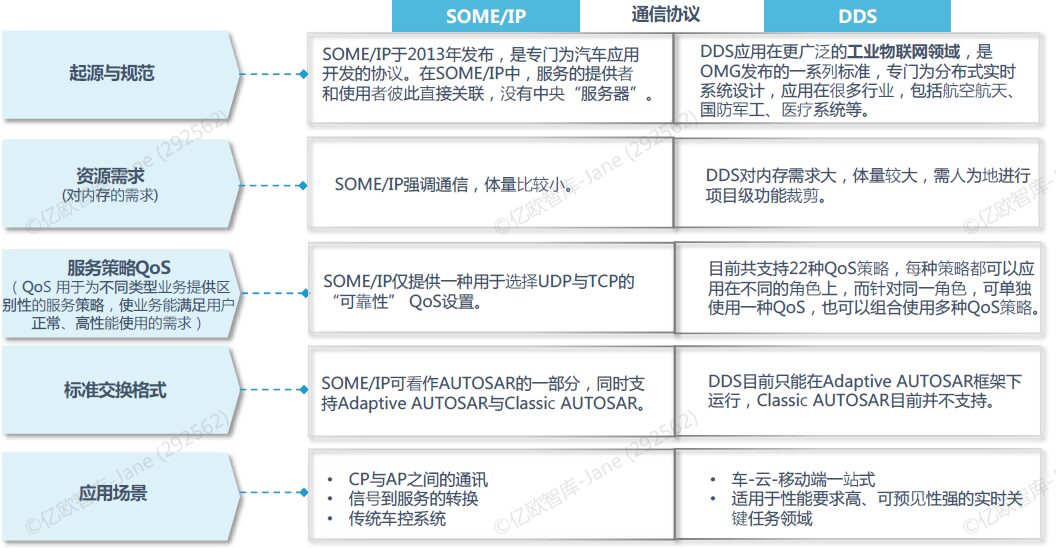

As the number of sensors increases and data sources multiply, the efficient and stable transmission of diverse heterogeneous data between chips and task processes requires the introduction of communication middleware. SOME/IP and DDS are service-oriented communication protocols that adopt a publish/subscribe model, achieving multi-dimensional loose coupling in time, space, and data communication between communicating parties, with differences in origin specifications, resource requirements, service strategies, standard exchange formats, and application scenarios.

Currently, both SOME/IP and DDS can coexist in AUTOSAR AP, each suitable for different application scenarios. SOME/IP is relatively closed source, while DDS can be used for open-source commercial applications. Current commercial versions of DDS include Connext DDS, (open-source) OPENDDS, (open-source) FAST DDS, etc., but most commercial versions of DDS are non-automotive-grade, requiring secondary development by enterprises for use in automotive products.

▷ Autonomous Driving and Intelligent Cockpit Middleware Solutions Flourish, Companies Accelerate Learning and “Trial and Error”

AUTOSAR CP is the mainstream middleware applied in the classic vehicle control field, with a significant accumulation of industry know-how and mature applications. Middleware in the fields of autonomous driving and intelligent cockpits is currently flourishing, with mainstream middleware solutions for autonomous driving including AUTOSAR AP, DDS, and ROS(2.0), allowing OEMs to engage in secondary development based on these. However, there is currently no established strict industry standard or mainstream solution for intelligent cockpits.

The domestic supply ecosystem is lacking, and the insufficient scale verification due to early-stage technology development limits the current development of domestic middleware solutions. However, as emerging technologies, autonomous driving and intelligent cockpits see companies in a learning and “trial and error” phase. The lack of ecosystem and mass production verification is a necessary path for technology to move towards mass production.

▷ Domestic Middleware Enterprises Welcome Development Opportunities, Catering to the Chinese Automotive Market with Customized Services

The flourishing period of in-vehicle middleware presents development opportunities for domestic enterprises. International leading manufacturers such as Vector, ETAS, Elektrobit, and Apex.AI have more mature middleware products and technologies. Domestic enterprises are taking a customized route to provide more distinctive and cost-effective middleware solutions for the Chinese automotive industry, but their technological research and development and innovation capabilities still need further enhancement.

2.3►

Current Application Status of In-Vehicle Virtualization Technology

▷ Virtual Machines Achieve Software Isolation, Supporting the Development of Intelligent Cockpits with “Single Chip and Multiple Screens”

The E/E architecture is transitioning from distributed to domain centralized, with automotive computing control units transforming from single ECUs to high-performance computers, creating a demand for software safety isolation. The concept of introducing virtual machines allows the hardware resources of physical servers, such as CPU, memory, and I/O, to be virtualized and scheduled by Hypervisors, enabling multiple operating systems to share hardware resources under the coordination of Hypervisors, while each operating system retains its independence.

Both autonomous driving and intelligent cockpits have requirements for Hypervisors. For example, in the cockpit domain controller, due to differing product attributes, different types of operating systems need to run, such as real-time operating systems like QNX for dashboard functions, while the central infotainment system prefers the ecosystem of Linux and Android operating systems, each with varying security level requirements. Thus, virtual machines have become an indispensable basic software system for cockpit electronics.

▷ High-Performance Chips and Domain Centralized Architecture Drive the Rise of Virtualization Technology

In addition to traditional virtualization technology (virtual machines), virtualization technology also includes container virtualization technology and hardware virtualization technology. Virtualization technology has emerged with the advent of high-performance chips and domain centralized architecture and is still in its early stages, with all three methods having their pros and cons, and enterprises will choose according to their needs.

In comparison, container virtualization technology offers a more lightweight virtualization solution, achieving process and resource isolation. Virtualization technology can support the virtualization of operating systems, enabling resource sharing of hardware, while hardware virtualization has superior reliability and determinism. Currently, all three methods are adopted by industry players.

▷ QNX Hypervisor Becomes Market Mainstream, Domestic Underlying Operating System Enterprises Begin Self-Development Process

Currently, common Hypervisors include QNX Hypervisor, Intel’s ACRN, Mobica’s XEN, and Continental’s L4RE. Both QNX Hypervisor and ACRN currently have support from domestic enterprises, making them common virtual machine solutions in China. Among them, QNX Hypervisor is the only management program that has passed ASIL D safety compliance and pre-certification levels, offering high cost-effectiveness and security advantages, thus becoming the market mainstream.

2.4►

Current Application Status of In-Vehicle BSP Technology

BSP is the interface layer between the operating system kernel and hardware, including Bootloader, HAL code, drivers, and configuration files, serving to encapsulate hardware-related code, provide a virtual hardware platform, and interact with the operating system. BSP is mostly provided by software companies (operating system companies, middleware companies) or jointly developed with chip companies.

2.5►

Reshaping the Intelligent Electric Vehicle Industry Ecosystem: Closer Cooperation Between Basic Software Enterprises and OEMs

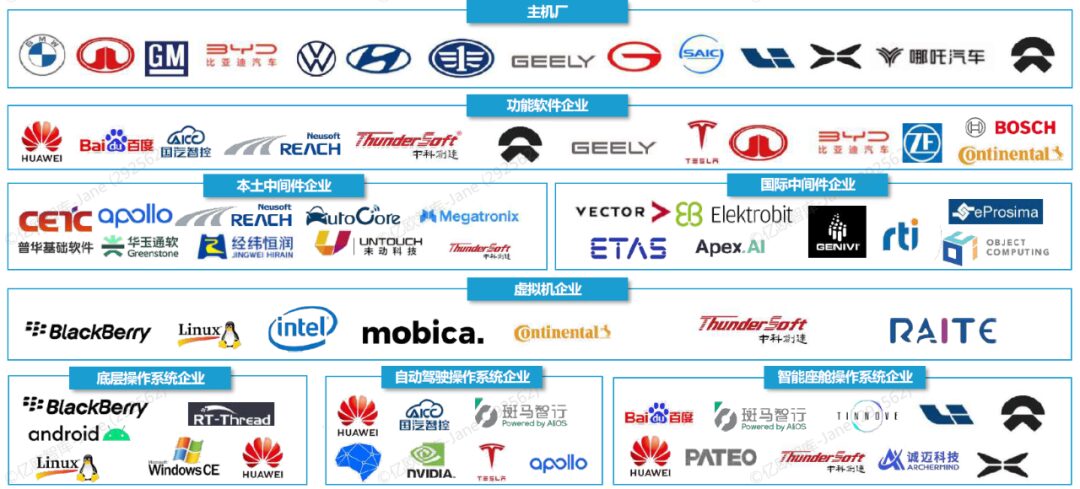

The basic software industry for smart electric vehicles includes operating system companies, virtual machine companies, middleware companies, and functional software companies, positioned upstream in the automotive industry chain.

Under the trend of software-hardware separation, OEMs are procuring hardware (chips) separately based on vehicle positioning and pricing planning, while collaborating with basic software companies, mainly including operating system vendors and middleware vendors, to build software architectures and adapt chips. The previously stringent chain supply model is gradually shifting towards a flatter “cooperation” model, with increasingly close cooperation between basic software and OEMs, and deeper binding with chip manufacturers.

Mass production cases, customization service capabilities, and chip adaptability are the primary considerations for OEMs when selecting a basic software enterprise. At the same time, in the current highly dependent foreign enterprise landscape, achieving independent research and development and proprietary rights can better align with national conditions and create a “Chinese solution” of its own, while meeting high safety standards is a basic requirement for any basic software enterprise.

3. Development Trends

3.1►

Technology: Under the Trend of Cross-Domain Integration, the Demand and Challenges for Automotive Basic Software Coexist

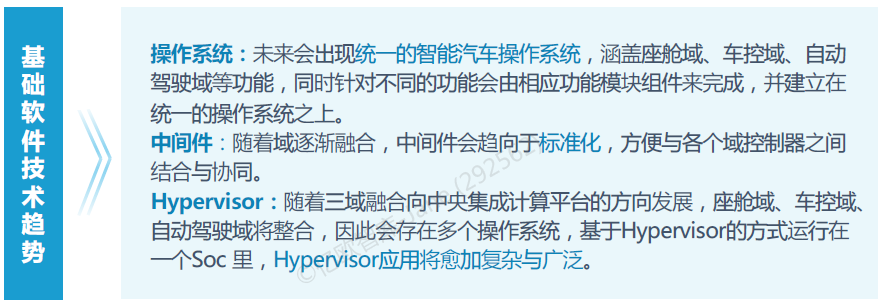

The transformation of electronic and electrical systems is accelerating, and cross-domain integration is becoming a trend. It is predicted that centralized E/E architectures for entire vehicles will become mainstream after 2030. At the same time, middleware will trend towards standardization, facilitating the integration and coordination of various domain controllers, while the application of Hypervisors will become increasingly complex and widespread. A unified intelligent vehicle operating system covering cockpit, vehicle control, and autonomous driving functions will emerge in the operating system field.

3.2►

Industry: Basic Software Will Trend Towards Standardization, Achieving “Software-Software Separation” in the Industry

OEMs’ choice to self-develop or outsource basic software depends on the degree of differentiation and maturity of the technology. As R&D capabilities gradually enhance, OEMs will independently define software architectures, build universal software platform architectures, and control the independent development of core application software, constructing models that optimize user behavior patterns, vehicle operating states, and external conditions, centering on users to achieve user lifecycle management.

3.3►

Ecology: Ecological Co-Building Becomes Industry Consensus and Trend, the Five Elements of Basic Software Ecology Complement Each Other

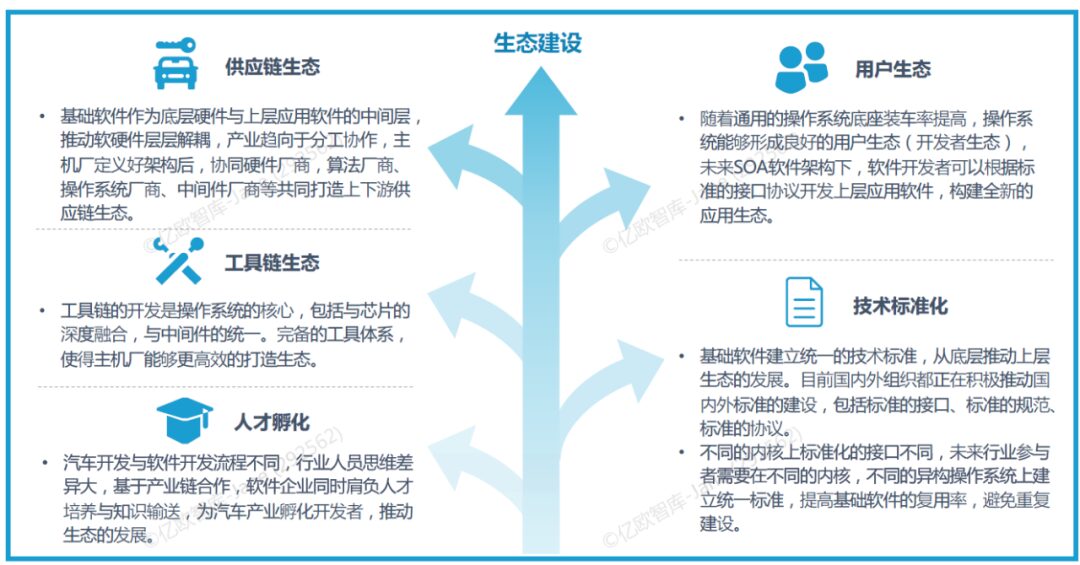

Industry collaboration and ecological co-building have become a consensus in the automotive industry. For basic software, the future construction of the automotive industry ecosystem needs to start from five dimensions, including the supply chain ecosystem under software-hardware decoupling, a complete tool system supply, software talent incubation and training, establishment of technical standardization, ultimately achieving a good user ecology.

3.4►

Localization: Basic Software Industry Standards Established in an Orderly Manner, Industry Collaboration Builds a “Chinese Solution” Moat

The preparation of the basic software white paper is promoting the industry’s ecological and technological development, and future releases of basic software-related white papers will accelerate the establishment of industry standards. AUTOSEMO, as the Chinese Automotive Basic Software Ecological Committee, is promoting the construction and planning of ASF group standards, and the establishment and unification of industry standards is accelerating. The “Chinese solution” is based on existing technologies, extending to create a “characteristic” solution suitable for Chinese OEMs, with implementation just around the corner.

The promotion of standards cannot be separated from the participation of domestic enterprises. In the future, domestic enterprises can build their core competitiveness through five aspects: complete automotive functional safety certification, collaborative mass production verification with OEMs, establishment of software talent reserves, strengthening ecological cooperation, and optimizing customized services, promoting the vigorous development of China’s basic software industry.

China’s smart electric vehicles are experiencing rapid development, bringing about innovation and updates in in-vehicle basic software. In the segmented field of in-vehicle basic software, autonomous driving operating systems, intelligent cockpit operating systems, and some middleware products provide OEMs with more differentiation, becoming a “battlefield” for domestic enterprises. OEMs, Tier 1, and software companies are all entering the scene, attempting to become the “leading force” in setting industry standards. The division of the market is yet to be determined, and as technology matures, the pattern of industry division of labor is expected to become increasingly clear.

The road ahead is long and arduous, but the standards for China’s automotive basic software are being established, and the construction of the ecosystem is further expanding. The “Chinese solution” is just around the corner.