ASIC Chips Leading the Way in AI: Beneficial Directions

If large models are the engine of this AI surge, then ASIC chips are the core power source of that engine. As global tech giants bet on custom chips, where is this game headed? What investment secrets are hidden behind it? Let me explain.

How big is the AI chip market?Research institutions predict that by 2027, the global AI chip market will exceed $150 billion, with a compound annual growth rate of over 40%. This is not a small number, but a huge market capable of changing the entire semiconductor industry landscape.

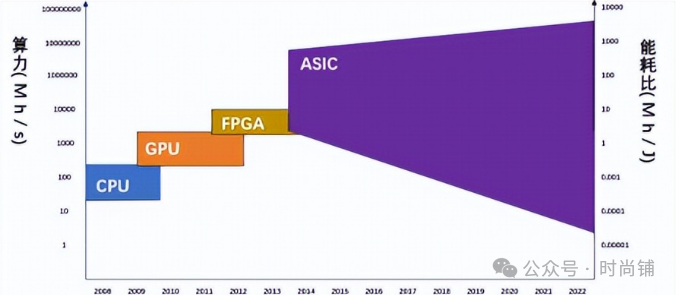

Currently, the AI chip market is primarily dominated by NVIDIA’s GPUs.However, with the diversification and specialization of AI application scenarios, general-purpose GPUs, while flexible, show significant shortcomings in energy efficiency.It’s like using a Swiss Army knife to cut vegetables; it works, but it’s not as efficient as a professional chef’s knife.

What are the core advantages of ASIC chips?In simple terms, it’s about “tailoring to fit.” It customizes circuit structures for specific AI tasks, achieving the best balance in performance, power consumption, and cost compared to general processors.

Interestingly, large tech companies are increasingly enthusiastic about ASIC chips:

- Google’s TPU is optimized for TensorFlow and is 30 times faster than GPUs for certain AI training tasks.

- Amazon has launched Trainium and Inferentia chips, optimized for its cloud services.

- Meta recently announced the launch of the MTIA chip, designed for its recommendation system.

Why are giants developing their own ASIC chips?The core reason is control. Having self-developed chips means no longer being constrained by suppliers, allowing for flexible adjustments to chip architecture based on business needs. It’s like moving from renting a house to building your own; although the initial investment is high, it is more economical in the long run.

In terms of development, ASIC chips can be categorized into three tiers:

- First tier: Tech giants with complete self-development capabilities, such as Google, Amazon, and Meta.

- Second tier: Professional ASIC design companies, such as Graphcore, Cerebras, and SambaNova.

- Third tier: Companies providing ASIC design and manufacturing services, such as Xilinx, TSMC, and SMIC.

For investors,which directions are worth paying attention to?

Chip design toolchain suppliers will become one of the biggest winners. Just like the merchants who sold shovels during the gold rush made the most money, companies providing EDA tools and IP cores will benefit from the ASIC chip design boom.

The importance of foundries is self-evident. Regardless of who designs the chip, it ultimately needs a foundry for production. High-end process capabilities will become a scarce resource.

The chip packaging and testing phase cannot be overlooked. As chip designs become increasingly complex, advanced packaging technology becomes a key way to enhance performance.

Platform companies that can provide ASIC chip customization services will play an important role in the AI implementation process for small and medium enterprises. They are like the “fast fashion” of the chip industry, making customization more accessible.

This information is quite substantial, isn’t it? But even more interesting trends are yet to come.

Have you ever thought about what would happen when every company has the ability to customize its own AI chips? This will trigger a wave of computational power democratization.In the future, ASIC chips may become as ubiquitous as today’s cloud services, becoming standard tools for enterprise digital transformation.

From an investment perspective, focus on companies with mature products in the short term, plan for design toolchains and manufacturing in the medium term, and in the long term, pay attention to innovative companies that can lower the barriers to ASIC design.

The wave of technology always comes in waves. When ASIC chips become mainstream, the next revolutionary technology may already be in the making. It could be photonic computing, quantum chips, or some entirely new architecture we have yet to imagine. But one thing is certain—whoever controls the chips will control the initiative in the AI era.

Let us wait and see how this chip revolution will reshape the AI industry landscape and what new opportunities it will bring to investors.

Like

Share

View

Comment