The United States First Entered the Sensor Era

Technology has continuously expanded the capabilities of humanity. If we say that machines extend human physical strength and computers extend human intelligence, then ubiquitous sensors greatly extend human perception.

As early as the 1980s, the United States proclaimed that the world had entered the sensor era. In the early 1980s, the U.S. established the National Technology Group (BGT) to assist the government in organizing and leading the development of sensor technology in large corporations, state-owned enterprises, and institutions. Among the key technologies that protect the quality advantage of U.S. weapon systems, eight are passive sensors. In 2000, the U.S. Air Force listed 15 key technologies that would enhance the capabilities of the Air Force in the 21st century, with sensor technology ranking second.

The U.S. development model follows a path of first military application and then civilian use, with a focus on improvement before widespread adoption, characterized by significant:

(1) Emphasis on the research of sensor functional materials;

(2) Emphasis on the development of sensor technologies. Honeywell’s solid-state sensor development center invests $50 million annually in equipment and currently possesses the most advanced complete sets of equipment and production devices, including computer-aided design, single crystal growth, processing, graphics generators, step repeat photography, automatic spraying, etc. New production lines are updated approximately every three years, such as glue and photolithography, plasma etching, sputtering, diffusion, epitaxy, evaporation, ion implantation, chemical vapor deposition, scanning electron microscopy, packaging, and shielding dynamic testing. Only in this way can the leading level of technology be ensured.

(3) Emphasis on process research: The principles of sensors are not difficult and are not confidential; the most confidential aspect is the process (manufacturing). Many evaluations indicate that sensors are not just ordinary industrial products, but rather perfect craft masterpieces. In the U.S., there are about 1,300 manufacturers producing and developing sensors, as well as over 100 research institutes and colleges.

Sensors are not a new term like KOC, but a very traditional and commonly used vocabulary, easily found in the Xinhua Dictionary. In English, they are called Sensor or Transducer. The term “sensor” is defined in the New Webster Dictionary as: “a device that receives power from one system and usually sends power to a second system in another form.” According to this definition, the role of sensors is to convert one form of energy into another, so many scholars also refer to “sensors” as “transducers.”

In simple terms, sensors are detection devices usually composed of sensitive elements and conversion elements, capable of measuring information and allowing users to perceive that information. By transforming the data or value information in sensors into electrical signals or other required forms of output, they meet the requirements for information transmission, processing, storage, display, recording, and control.

The Three Historical Stages of Sensor Technology Development

“Sensors are like the five senses of humans.” Li Xinxin, director of the Institute of Micro Systems at the Chinese Academy of Sciences, stated that in the era of computers, humans solved the problem of simulating the brain, which is equivalent to digitizing information using 0s and 1s, and solving problems using Boolean logic; now, in the post-computer era, we are beginning to simulate the five senses.

Sensors (transducers, sensors) are often referred to as transducers, and their function is to convert other information into electrical signals. They are typically composed of sensitive elements and conversion elements, capable of converting detected information into electrical signals according to certain rules to satisfy the requirements for information transmission, processing, storage, display, recording, and control. It can be said that sensors give objects tactile, taste, and olfactory senses, making them come to life.

The development of sensors was initially driven by industrial automation.

To improve efficiency, industrial production began to be controlled from a central control room, monitoring parameters at various production nodes, including the four major parameters of flow, level, temperature, and pressure, which spurred the development of sensors. This trend began in the 1970s and remains one of the most prevalent forms of sensor application today.

Professor Dong Yonggui from Tsinghua University’s Precision Instrument Department stated that before the concept of sensors “emerged,” early measuring instruments actually contained sensors, albeit as a component within a complete instrument. Thus, before 1980, textbooks introducing sensors in China were titled “Non-electric Quantity Electrical Measurement.”

The emergence of the concept of sensors is actually a result of measuring instruments gradually moving towards modularization. Subsequently, sensors were separated from the complete instrument system and studied, produced, and sold as standalone functional components.

The development of sensors has gone through three stages:

The first generation is structural sensors, which utilize changes in structural parameters to sense and convert signals. For example: resistance strain sensors, which convert electrical signals by measuring the change in resistance of metallic materials during elastic deformation.

The second generation of sensors began to develop in the 1970s and is known as solid-state sensors. These sensors are composed of solid components such as semiconductors, dielectrics, and magnetic materials and are made using certain material properties. For instance: thermoelectric sensors, Hall effect sensors, and light-sensitive sensors are all products of utilizing thermoelectric effects, Hall effects, and light-sensitive effects, respectively.

In the late 1970s, with the development of integration technology, molecular synthesis technology, microelectronics technology, and computer technology, integrated sensors emerged. Integrated sensors include two types: integration of the sensor itself and integration with subsequent circuits. Examples include charge-coupled devices (CCD), integrated temperature sensors AD 590, and integrated Hall sensors UG 3501. These sensors mainly feature low cost, high reliability, good performance, and flexible interfaces. Integrated sensors are developing rapidly and now account for about two-thirds of the sensor market, advancing towards low prices, multifunctionality, and serialization.

The third generation of sensors is the intelligent sensors that emerged in the 1980s. Intelligent sensors are defined as those that have certain detection, self-diagnosis, data processing, and adaptive capabilities in response to external information, being a product of the combination of microcomputer technology and detection technology. In the 1980s, intelligent measurement primarily centered around microprocessors, integrating sensor signal conditioning circuits, microcomputers, storage, and interfaces onto a single chip, endowing sensors with certain artificial intelligence. In the 1990s, intelligent measurement technology further improved, achieving intelligence at the sensor level, enabling self-diagnosis, memory, multi-parameter measurement, and network communication functions.

Currently, there is a lack of established international standards and norms, and no authoritative sensor standard types have been formulated. They can only be roughly categorized into simple physical sensors, chemical sensors, and biological sensors.

Physical sensors apply physical effects to convert minute changes in the measured signal into electrical signals, such as piezoelectric effects, magnetostrictive phenomena, ionization, polarization, thermoelectric, photoelectric, and magnetoelectric effects.Chemical sensors are based on phenomena such as chemical adsorption and electrochemical reactions.In recent years, biological sensors utilizing various biological characteristics have emerged to detect and identify chemical components within biological organisms.

For example, physical sensors include: sound, force, light, magnetic, temperature, humidity, electricity, radiation, etc.; chemical sensors include: various gas-sensitive, acid-base pH, ionization, polarization, chemical adsorption, electrochemical reaction phenomena, etc.; biological sensors include: enzyme electrodes and intermediary bioelectricity, etc. In the product applications and causal relationships formed during the process, it is difficult to strictly categorize them into physical or chemical classes.

Additionally, the classification and naming methods for sensors are mainly divided into the following types:

(1) By conversion principle: physical sensors, chemical sensors, and biological sensors.

(2) By the information detected by the sensor: sound-sensitive, light-sensitive, heat-sensitive, force-sensitive, magnetic-sensitive, gas-sensitive, humidity-sensitive, pressure-sensitive, ion-sensitive, and radiation-sensitive sensors.

(3) By power supply method: active or passive sensors.

(4) By output signal: analog output, digital output, and switch sensors.

(5) By materials used in sensors: semiconductor materials; crystal materials; ceramic materials; organic composite materials; metal materials; polymer materials; superconducting materials; fiber optic materials; and nanomaterials.

(6) By energy conversion: energy conversion sensors and energy control sensors.

(7) By manufacturing processes: mechanical processing processes; composite and integration processes; thin-film and thick-film processes; ceramic sintering processes; MEMS processes; electrochemical processes, etc.

However, “simulating human senses” is just a metaphor for sensors. The technology of sensors that has developed relatively maturely is still the physical quantities commonly used in industrial measurement, such as force, acceleration, pressure, and temperature. As for real human sensations, including vision, hearing, touch, smell, and taste, from the perspective of sensors, most are still not very mature.

“Vision and hearing can be considered physical quantities, relatively better; touch is somewhat lacking; as for smell and taste, due to the complexity of measuring biochemical quantities, the working mechanisms are quite complex, and they have not yet reached a mature technological stage,” he said.

The sensor market is actually driven by applications. For instance, in the chemical industry, the market for pressure and flow sensors is quite large; in the automotive industry, the market for speed, acceleration, and other sensors is also very significant. The demand from the automotive industry for MEMS-based accelerometers is indispensable.

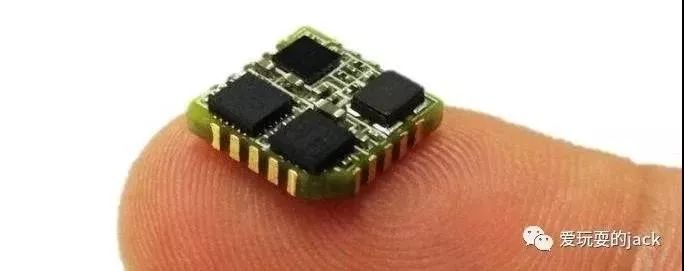

MEMS (Micro-Electro-Mechanical Systems) refers to miniaturized devices or systems that can be mass-produced, integrating micro-mechanical structures, micro-sensors, micro-actuators, and communication.They are small, lightweight, low-cost, low-power, and highly reliable, suitable for mass production, easy to integrate, and can achieve functions that traditional mechanical sensors cannot.

Common Basic Processes and Three Major Trends in Technological Innovation

It is well known that due to differences in sensing mechanisms and materials, along with the complexity of industrial site environments, usage scenarios, and the complex requirements of the detected media and individual parameters, sensors have long been in a state of small-batch production of various types. Coupled with the decentralization and complexity of process technology and the high costs of equipment and devices, the industry refers to its production process as manufacturing “industrial craft products.” Engineers and technicians around the world have been collaborating to integrate and innovate in process technology, focusing on product standardization, performance normalization, functional integration, structural standardization, and the industrialization of process equipment and tooling.

In Silicon Valley, around the sensor field, various sensor product innovations based on MEMS process technology have been ongoing for nearly 25 years, creating a wide array of sensor products with diverse structures and expanding applications, gaining wide recognition and acceptance across various industries.

As Dennis, the founder of MEMS process technology in Silicon Valley, once said: “For over 20 years, sensor products in Silicon Valley have been centered around MEMS chips based on silicon materials and market application demands from various industries, engaging in competition and innovation with different structural forms of packaging.” Therefore, MEMS process technology is regarded as the common basic process technology for various sensor types and is considered the source of sensor innovation in the industry. In 2011, the U.S. industry concluded that MEMS technology had matured and could be widely promoted and applied, establishing and forming the sensor industry around two major directions of MEMS process technology and application innovation and breakthroughs:

First, innovation in sensing mechanisms and breakthroughs in processes. It has improved the fundamental theories and application levels of MEMS process technology in materials and process structures, such as in crystalline and amorphous materials, and various semiconductor material applications; in silicon-silicon bonding processes, silicon thin film processes, and metal thin film processes, among others, greatly enhancing the industrial foundation for miniaturization, low cost, composite, and integration of product production.

Second, the improvement of intelligence levels and application innovations. Innovations and breakthroughs have been formed in multifunctional integration, modular frameworks, embedded capabilities, and network interfaces. This has significantly improved the contradictions of production and application difficulties, building bridges and technical channels between manufacturing and market applications, breaking through the long-standing technical barriers and development bottlenecks in the industry. It has also enhanced the autonomy of product selection and application design capabilities across various industries, greatly stimulating application demand and expanding market space.

From the perspective of the development of the U.S. sensor industry, several characteristics are evident:

First, efforts are made in common basic technologies, with a focus on the application of new technologies and process innovations to continuously improve quality.

Second, there is an emphasis on networked and intelligent node technologies, energy harvesting technologies, and collaborative innovation.

Third, core technologies are often subject to government control, support, funding, and promotion.

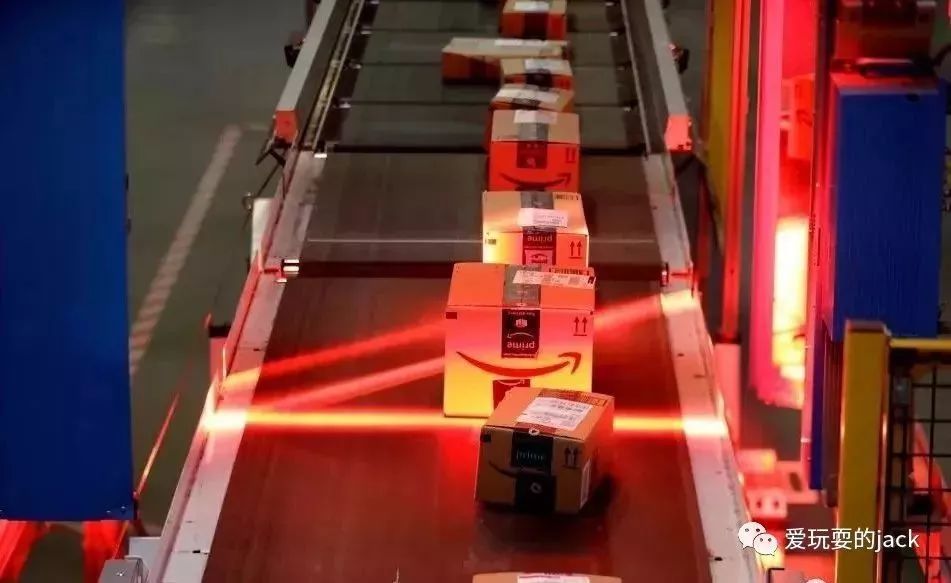

Fourth, there is a noticeable lead and driving effect in key promoted application areas, such as military industry, equipment manufacturing, logistics, ecological environment monitoring (forest prevention), mobile healthcare, and smart homes.

Industrial Ecological System and Environmental Construction

Leveraging common basic technologies and processes, establishing a production system that is flexible, standardized, and product standardized, and seeking compatible markets for products are crucial to fundamentally change the isolation and fragmentation of technology and markets in sensor industrialization. According to the characteristics of MEMS process technology and product market applications, seven major product types, including temperature-sensitive, sound-sensitive, force-sensitive, light-sensitive, gas-sensitive, magnetic-sensitive, and frequency sensors, align with the technological characteristics of industrialization and market scalability, enabling large-scale industrial production.

Additionally, sound-sensitive sensors represented by silicon microphones have formed ten mainstream characteristic brands and manufacturers domestically and internationally (including two domestic companies, AAC and Goer), achieving large-scale industrial production; temperature and humidity sensors have large-scale production capabilities in countries such as the U.S., Germany, Switzerland, Japan, and China. In future developments, temperature and humidity will be integrated with other physical quantity sensors, for example, force-sensitive and magnetic-sensitive sensors can simultaneously detect temperature and humidity parameters; frequency, including RF, millimeter-wave, and other common process technologies, can achieve industrialization within the same manufacturer despite significant differences in parameters, functions, and applications. Especially in applications such as mobile phones, intelligent transportation, and biological sensing, there is explosive growth potential and significant allure. RF devices are still dominated by European and American manufacturers, with no Asian manufacturers entering the market. To break the monopoly in the industry, this will become a focal point for future technological innovation and competition.

Compared to foreign countries, the slow development of China’s sensor industry is mainly due to a lack of awareness. There is a biased and one-sided understanding of sensors, and a lack of a high-level national strategic understanding. Due to the division of sensors across different industries and departments, there is multi-headed management, making it difficult to reach a consensus on development, resulting in chaotic management and insufficient policy support, leading to industry fragmentation and products failing to become serialized; over 95% of the more than 1,200 enterprises are small and micro enterprises, lacking adequate human, material, and technological resources; on the other hand, the high market entry barriers and lack of corresponding application development and technological innovation capabilities mean that the overall technical level and performance indicators of products, especially reliability and stability indicators, are 1-2 orders of magnitude lower compared to similar products abroad, failing to meet market demands for corporate qualifications and supporting capabilities. Third, there is a lack of leading enterprises and industry driving forces, a lack of international brands, market influence, competitive advantages, and foundational research capabilities, resulting in fewer than 3% of specialized enterprises within the industry; core chips largely rely on imports, with almost 100% of mid-to-high-end products imported. Overall, the level of process technology lags behind advanced countries by 10-15 years.

In light of the domestic and international industrial situation and existing problems, combined with the characteristics of sensor technology processes, the industry anticipates that in economically and technologically advantageous developed regions, a cluster or base of more than dozens of specialized sensor companies and research institutes will emerge, forming an industrial cluster with product technology features and industrialization scale advantages, as well as international market influence, achieving annual sales exceeding 100 billion RMB (15 billion USD) and growing at a rate of over 20% annually, forming an international sensor industry park with distinct industrial characteristics and geographical advantages—referred to as the “Sensor Valley.”

The Rise of Sensors and Current Industry Development Status

The unveiling of Apple’s new generation iPhone 6 and smart watch has given many Apple followers another reason to queue overnight. What endows the iPhone with increasingly powerful functions is not only the increasingly powerful chips but also the growing number and sophistication of sensors on the phone.

Years ago, when Jobs shook the iPhone to make it respond, the era of smartphone intelligence truly began. A few years later, the phone transformed from a communication tool into an indispensable companion for people.

The “magic” of the phone comes from various sensors such as touch screens, gyroscopes, and accelerometers.

The touch screen is a capacitive touch sensor. The gyroscope and accelerometer are used to sense the phone’s position and movement. When you answer a call and place your ear on the screen, the infrared proximity sensor dims the screen and disables the touch screen. The ambient light sensor automatically adjusts the screen brightness based on the surrounding light. Of course, there are also the “compass”—the magnetoresistive sensor used for navigation, and the camera made with photoelectric sensors.

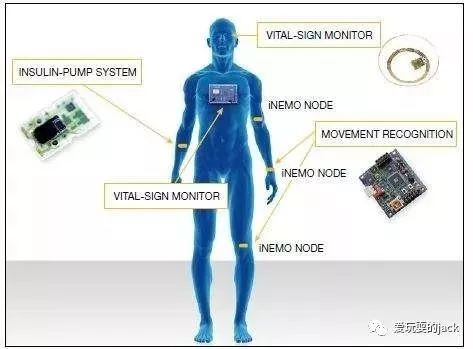

At the September 9 launch event, the biggest highlight was Apple’s breakthroughs in sensor applications. The iPhone 6 added an action co-sensor that integrates multiple sensors, a barometric pressure sensor for measuring altitude, and a near-field communication module and fingerprint sensor for fingerprint payments. The four ring sensors behind the iWatch operate by shining LED light onto the skin to reflect and determine the movement of blood vessels and detect the wearer’s pulse.

Not only in smartphones, but also in automobiles, home appliances, wearable devices, and industrial automation, an increasing number of sensors are becoming the “ears and eyes” of machines.

What the general public knows very little about is that the Internet of Things, which is about to bring greater changes to people’s lifestyles, has sensors as its most core foundational technology. Scientists predict that sensors will be as ubiquitous as “the five senses of the human body” in the future across various fields and spaces.

Currently, with the advent of the IoT era, various sensors are becoming ubiquitous neurons, and global demand for sensors is beginning to show explosive growth. However, on the eve of this feast, the industry is regretfully discovering that China seems to have fallen behind.

While sensor giants like Bosch in Germany and Honeywell and Freescale in the U.S. reap the benefits of their “thick accumulation and thin release,” how can Chinese companies share in this feast?

Foreign companies reap the rewards of their long-term investments.

The rapid development of sensors in terms of technology and functionality comes from both the advancement of computer and detection technologies and the drive of application field demands.

In 2004, Freescale Semiconductor was established after the semiconductor division of Motorola became independent from Motorola, designing and manufacturing embedded semiconductor products for automotive, consumer, industrial, networking, and wireless markets. In just a few years, Freescale became one of the world’s largest semiconductor companies.

The main reason for Freescale’s rapid success lies in its possession of thousands of patents from Motorola. Some of these patents may date back decades, but their substantial accumulation has finally led to recent breakthroughs.

Some of Freescale’s key products are various sensors, including accelerometers and magnetometers used for navigation and motion capture, which meet the high-precision electronic compass needs of medical devices, navigation devices, and mobile terminals.

In recent years, in the automotive sector, accelerometers used to detect changes in force due to falling, tilting, motion, positioning, vibration, and impact have been widely applied in airbag systems, electronic stability control systems, and electronic parking brake systems.

MEMS-based pressure sensors can measure atmospheric pressure as well as blood pressure and tire pressure, providing powerful solutions for home appliances, medical, consumer electronics, industrial control, and automotive markets.

Motion sensors combined with pressure sensors can monitor bedridden patients, measuring their breathing and heart rate, and even alerting nursing stations when patients attempt to get out of bed to seek assistance.

The application of MEMS sensors is not limited to smartphones; they can be found in laptops, cars, navigation systems, and even in electric irons and sports gear. For example, navigation devices can determine whether to follow an inertial trajectory in tunnels without satellite signals, laptops can automatically activate hard drive protection programs when dropped, and electric irons can cut off power when left flat at high temperatures.

“In 2008, Jobs shook his phone, which triggered an explosion in the accelerometer market,” said Zhang Yi, deputy general manager of Wuxi Ganxin Semiconductor, in an interview with Caixin. However, he believes that the market for pressure sensors will be even larger.

He stated that pressure sensors differ from other sensors in that their market applications are highly fragmented. Pressure sensors were developed as early as the 1970s and have been applied in various corners of the world for decades, but due to their distance from everyday life, they are not widely known. Pressure sensors are widely used in tire pressure monitoring, oil pressure monitoring, and some high-end household appliances, and will gain more applications in smart products in the future.

With technological advancements, the cost of pressure sensors is reduced sufficiently, allowing high-end sensors previously used in military and industrial applications to finally be applied to smart terminals.

“Many sensors that were once used in aircraft are now being used in smartphones, such as accelerometers, magnetometers, barometers, and gyroscopes,” Zhang Yi said. With the application of barometers in the iPhone 6 and iWatch, the market for pressure sensors has been opened up, and significant growth is expected in the future, with an incremental increase of over $1 billion in the next five years.

With barometers, the altitude of a person’s location can be accurately identified; for indoor navigation, it can facilitate floor identification; in automotive navigation, it can distinguish whether a car is on an overpass or below, and as more barometers enter mobile terminals, everyone can become a meteorological terminal, providing personalized weather forecasts.

With advancements in materials science, people can manufacture various new types of sensors. For example, temperature sensors can be made from polymer films, optical fibers can create pressure, flow, temperature, and displacement sensors, and ceramics can be used to make pressure sensors.

Gao Xiaolong stated that we will now see sensors integrating more intelligence and requiring tighter integration with microcontrollers and digital network products. Sensors need more layered intelligence to solve issues of energy conservation, safety, and connectivity. With the impending wave of IoT applications, sensor systems will become more complex, with enhanced contextual and environmental awareness. “Fortunately, all of us involved will find it more interesting.”

Li Xinxin introduced that in terms of current sensor capabilities, some aspects still do not reach the level of human senses, but some capabilities can exceed them, such as sensors for monitoring explosives. From the perspective of sensor development trends, it is necessary to address issues of power consumption, size, cost, and lifespan, making sensors smaller, cheaper, and lower in power consumption, so that everyone can possess them in large quantities.

Currently, traditional electronic manufacturing giants such as Bosch, STMicroelectronics, Honeywell, Freescale, and Hitachi are considering sensors as a major growth point for future businesses. Currently, the annual output value of MEMS sensors is around $20 billion, but it is growing rapidly.

“Many companies are now interested in sensors; the most important thing is how to design a product and how to get users to accept the services that sensors bring,” he said.

“The replacement of industrial automation sensors occurs every year at a rate of 20%, which is not the greatest market.” He said the greatest market is one that has never existed in history, where no one expected that gyroscopes could be used in smartphones, which was previously considered a luxury. However, Apple achieved this, marking a more valuable initial success.

China’s Sensor Gap

Sensors, as cutting-edge technology in modern science, are regarded as one of the three pillars of modern information technology and are recognized as one of the high-tech industries with the most development potential both domestically and internationally.

However, while sensors are ushering in a springtime, the Chinese public seems to still be witnessing a feast dominated by foreign semiconductor giants.

Insiders believe that while the Chinese sensor market is developing rapidly, there is still a significant gap between domestic sensor technology and the global level.

This gap manifests itself in two ways: one is the lag in the ability of sensors to perceive information, and the other is the lag in the technology of sensors themselves in terms of intelligence and networking. Due to a lack of sufficient large-scale applications, domestic sensors are not only technologically inferior but also expensive, making it difficult to compete in the market.

Professor Dong Yonggui explained that China began to pay attention to sensor technology research around 1980. After years of efforts, significant progress has been made in sensor research. However, the technological advancements in productization have not been ideal; many sensor technologies have good research levels in domestic laboratories, but unfortunately, they have not been fully utilized and have not been transformed into mature products entering the market.

He stated that research in sensor technology requires a considerable amount of time investment, with the development of a sensor typically taking 6-8 years to mature, which is generally too long for Chinese companies to bear. Moreover, Chinese companies are less able to handle failures, and the risk of failure in sensor research is high.

According to Dong Yonggui’s observations during a visit to Japan, many research and development efforts supported by Japanese enterprises do not necessarily result in products; however, companies can afford it, as only 2-3 out of 10 projects need to turn into products.

“In contrast, many of our companies are preparing to take existing products from others,” Dong Yonggui said. This mindset is problematic, including our constant desire to introduce ready-made products from abroad and to bring in talent with existing projects. “We are not preparing to fish but rather to catch a single fish.”

Compared to larger instrument equipment, the investment required for sensors during productization is generally not very high, making it suitable for small enterprises to invest in. In this regard, China should have advantages. However, from another perspective, this is also a shortcoming.

A characteristic of the sensor industry is that while sensors themselves have high technical content, the price of individual sensors is generally not high. This characteristic leads to the result that despite the high added value of sensor technology, relying solely on sensors makes it difficult to form considerable output value.

According to Professor Dong Yonggui’s analogy, sensors are somewhat like the “drug carriers” in traditional Chinese medicine; their functions are crucial, but achieving scale requires reliance on the entire medicinal formulation. Many foreign sensor companies quickly develop related measuring instruments once they achieve breakthroughs in certain sensors.

Li Xinxin stated that our research is actually not far behind, but many problems arise in industrialization. Although many original innovations still lead us, the pace of industrialization is too slow. Technologically, China’s micro-manufacturing capacity is quite large and easily allows for mass production, but creativity is still lacking. If we can enhance our design capabilities, our production capacity can be better utilized.

Wuxi Ganxin Semiconductor mainly focuses on pressure sensors, and its manager Zhang Yi mentioned that while many companies produce similar products, only one or two have achieved a scale, as there are many product types, making testing quite challenging and requiring significant investment due to the long industrial chain; manual testing often fails to meet the demands of consumer electronics customers.

“To meet the demands of applications with high volumes, standardized testing equipment is essential, and the process must be exceptionally well-defined, which requires substantial investment,” Zhang Yi said.

Moreover, under China’s patent protection mechanism, key technologies painstakingly developed in sensors often take on a “know-how” nature and are easily copied, making it difficult to clarify ownership, and companies cannot afford lawsuits. Although there are MEMS sensor companies in China, they mostly rely on contract manufacturing, and if not managed well, the processing companies may take these products for their own use. Currently, the innovation system of enterprises has significant issues.

In 2012, a senior figure in the domestic sensor field remarked at a conference that the reason for the poor development of China’s sensor industry is the lack of leading figures capable of presenting to the State Council. This field requires long-term research, and its significance is often underestimated, as it involves small components based on physical phenomena discovered decades or even centuries ago.

This scholar pointed out that this research is indeed very challenging. For instance, an accelerometer used in the oil industry for seismic wave measurement relies on principles proposed decades ago in the Soviet Union, but it was only after this expert arrived in the U.S. after the Soviet Union collapsed that it was developed into a product for application.

“The more a field requires thick accumulation and thin release, the greater our gap becomes,” Dong Yonggui believes that this gap is likely to widen further.

Global Sensor Industry Related Companies

Precision Electronics– MEAS Sensors in the U.S. has mastered world-leading EMS manufacturing technology and specializes in producing various sensors. Their products are widely used in aerospace, national defense, military, machinery, industrial automation, automotive electronics, medical, and household industries. They were the first to achieve batch processing technology for silicon micro-electromechanical systems in industry and the first to commercialize LVDT and convert piezoelectric film technology into low-cost commercial sensors and life characteristics.

Main sensor products include pressure and dynamic pressure sensors, displacement sensors, tilt displacement sensors, Hall encoders, magnetoresistive sensors, accelerometers, vibration sensors, humidity sensors, temperature sensors, etc.

Honeywell International is a leading multinational company in technology and manufacturing. Founded in 1935, it joined Honeywell and the Honeywell Sensors and Controls Strategic Business Unit, becoming the world’s first developer of the STC3000 intelligent pressure sensor and a technology leader. It currently offers nearly 600,000 products across more than 20 series, serving 300,000 users. For nearly half a century, Honeywell’s Sensors and Controls Division has earned global recognition for its excellent product quality and reliability, as well as continuous technological innovation.

Main sensor products include diffusion silicon pressure sensors, transmitters, ceramic capacitive pressure transmitters, diffusion silicon ceramic capacitive level transmitters, digital pressure gauges, pressure calibrators, etc.

Emerson Electric Company was founded in 1890 in St. Louis, Missouri, initially as a manufacturer of motors and fans. After more than a century of effort, Emerson has grown from a regional manufacturer into a global technology solutions group. It is ranked among the Fortune Global 500 and is ranked first or second in the mid-to-long-term electronics industry.

Rockwell Automation is a large industrial automation company with a history of over a century, leading in global industrial automation power, control, and information technology solutions. It entered China in 1988 and has a production base in Shanghai. Rockwell Automation provides world-class products and solutions, service support, and technical training for Chinese manufacturing. Additionally, Rockwell Automation offers expert support to clients across various industrial fields including mining, cement, cranes and shipping applications, subways, semiconductors, water treatment and sewage treatment, tires, petroleum, etc.

Main sensor products include pressure sensors, temperature sensors, capacitive proximity sensors, inductive proximity sensors, photoelectric sensors, ultrasonic sensors, etc.

General Electric (GE) is a diversified technology, media, and financial services company and is also one of the world’s renowned sensor manufacturers. The company is committed to continuous innovation and reinvention to solve problems for customers. GE consists of four major business groups, each comprising multiple departments that develop synergistically. GE’s products and services range from aircraft engines, power generation equipment, water treatment and safety technology to medical imaging, commercial and consumer finance, media, and industrial products.

The American retail company is one of the world’s largest manufacturers of non-contact infrared thermometers. Its sales volume of infrared thermometers ranks first in the global industry, with 13 series of infrared thermometers, temperature sensors, and hundreds of varieties. The temperature measurement range includes: -50~3000°C. RAYTEK (retail) infrared thermometers are widely used in equipment fault diagnosis, metallurgy heat treatment, electricity, railways, food, and many other fields.

PCB is a world-renowned manufacturer of sensors and measuring instruments. Founded in 1967, the company focuses on the research, development, and manufacturing of piezoelectric measurement technology. Its first ICP sensor (integrated circuit charge amplifier) is renowned worldwide. Accelerometers, pressure, force, torque sensors, and corresponding measuring instruments are widely used in aerospace, shipbuilding, weapons, nuclear industry, petrochemicals, hydraulics, electricity, light industry, transportation, and vehicles.

Main sensor products include accelerometers, pressure, force, torque, impact, vibration, acoustic, modal, and underwater measurement sensors and supporting instruments.

Banner Engineering Corporation, headquartered in Minnesota, USA, is a world-class expert in automation technology and a comprehensive solution provider. After 40 years of development, innovation has been regarded as the driving force behind product applications and research and development.

It leads in the field of piezoresistive pressure sensors. The temperature range of this product can reach -40 to 150 degrees Celsius, providing high-performance solutions for various applications. The company is the largest and most powerful professional sensor manufacturer in the world, offering a wide range of conventional sensors and intrinsically safe (explosion-proof), anti-vibration weighing sensors, various weighing elements, display controllers, and various high-temperature (200-50°C) transmitters (including multi-level explosion-proof devices). The products have entered over 60 industrialized countries.

Germany prioritizes the development of military sensors. German sensors fully leverage the inherent advantages of an old industrial power, and then, relying on their brand reputation, technological research and development, and quality management advantages, integrate with German manufacturers, significantly enhancing the market competitiveness of their products. They focus on reducing raw material costs and investing in human capital, maintaining product technology leadership and a high market share.

Siemens has remained active in the Chinese market, leading in the fields of industry, energy, and healthcare. The company is committed to product development and manufacturing, designing and installing complex systems and engineering, and customizing a range of solutions. At the same time, it is also a world-renowned sensor manufacturer with excellent quality.

WIKA is a well-known company in the international pressure and temperature instrument market, with an annual turnover of nearly 500 million euros. Approximately 350 million measuring instruments produced globally are manufactured by WIKA, and the company also provides comprehensive solutions for customers and the overall process.

APC develops, manufactures, and sells electronic component modules and systems, focusing on rapidly growing cutting-edge technology markets, including automotive electronics, information and communication technology, industrial electronics, and consumer electronics. The products are leading in the global market.

First Sensor Technology Company was established in 1999, separating from the core research division of the Technical University of Berlin. With strong technical strength, innovative spirit, accurate grasp of customer needs, and a high sense of responsibility towards employees, it has become a leader in the pressure sensor technology market. Through research on pressure sensors, it has raised the maximum working temperature of products to 225 degrees Celsius, producing millions of pressure sensor chips annually, with 100,000 to 10,000 ultra-clean workshops.

Germany’s Balluff company was founded in 1921 and is a world-leading sensor manufacturer. Its products include the complete electronic and electromechanical limit switch series BNS, photoelectric switches BOS, inductive proximity switches BES, capacitive switches, magnetic switches BMF, linear displacement sensors BTL, RFID identification systems, and various plug-in products. In the field of machinery, they provide innovative and experienced sensor applications for users.

The group was established in the early 1960s, with subsidiaries in the U.S., Switzerland, and China, and branches and offices in the UK, Netherlands, Belgium, Japan, and other countries and regions, developing into a professional multinational group.

Main sensor products include inductive, magnetic, capacitive proximity switches, photoelectric sensors, intrinsically safe isolation barriers, various industrial quick connectors, etc.

Bekaert is one of the most renowned and largest sensor companies in the world. Established in 1945, it introduced the revolutionary first generation of inductive sensors to the world in 1958, successfully applying them in the chemical and petroleum industries. From inductive sensors to ultrasonic sensors, from photoelectric sensors to corrosion sensors, from identification systems to fieldbus systems, and from level and material level sensors to safety screens, various sensors have dedicated research and high-quality products.

Main sensor products include inductive/capacitive/magnetic proximity switches, distance/level sensors, photoelectric sensors, encoders, vision sensors, imaging sensors, tilt sensors, ultrasonic sensors, etc.

Schneider Electric was established in 1946 and now has subsidiaries in over 40 countries worldwide, with a wide variety of sensors and excellent product quality, achieving over 700 million euros in sales in 2008.

Main sensor products include ultrasonic sensors, capacitive/inductive/electromagnetic proximity sensors, magnetic column sensors, color mark sensors, fluorescence sensors, color sensors, distance sensors, etc.

The company was established in 1986, certified by ISO 9001, introducing advanced automated ERP logistics warehousing management systems, adhering to the rigorous and practical style of German companies. The product quality is reliable, with 100% testing conducted, and substantial research and development funding has been invested, achieving multiple patent results. Products like UL photoelectric fire sensors have become standard products in the sensor industry.

Main sensor products include focusing/contrast/reflection sensors, programmable color label sensors, capacitive label sensors, inductive ring sensors, ring/angle fork light grid sensors, proximity switches, etc.

Sensortechnics is a well-known manufacturer of precision pressure sensors in Germany, now part of Augusta Technologies. The company can provide products ranging from 1 mbar to 1000 mbar. It develops and manufactures pressure sensors and sensor systems, level sensors and switches, as well as oxygen sensors and flow sensors. The company specializes in producing sensors and highly customized complex integrated remote sensing systems, providing OEM fluid control systems for customers.

Main sensor products include flow sensors, gas sensors, pressure sensors, analytical sensors, temperature sensors, etc.

Infineon Technologies AG is headquartered in Neubiberg, Germany, providing semiconductor and system solutions for three major technical challenges of modern society: energy efficiency, connectivity, and security. Infineon invests 17% of its sales in research and development annually and holds 22,900 patents globally. Infineon is one of the world’s leading semiconductor companies, producing high-performance semiconductor sensors.

The company was established in 1986 and is a leading manufacturer of thick film technology electronic devices. It has a wide range of business areas to meet the special needs of enterprises and users. Its customers cover the automotive, electronics, and pharmaceuticals industries.

Main sensor products include linear and rotary sensors, ceramic and stainless steel pressure sensors, metal foil sensors, etc.

Swiss Keller Measurement Technology Co., Ltd. is a world-famous manufacturer of diffusion silicon pressure sensors, with strong R&D capabilities and a complete product range, from low-cost industrial types to high-precision types, to meet laboratory requirements. Products are widely used in aviation, shipping, railways, automobiles, pressure measurement systems, engineering machinery, oil and petrochemical, power generation, environmental protection, metallurgy, and air conditioning.

Main sensor products include diffusion silicon pressure sensors, transmitters, ceramic capacitive pressure sensors, transmitters, diffusion silicon ceramic capacitive level transmitters, transmitters, digital pressure gauges, pressure calibrators, etc.

E+H Company was founded in 1953 and is headquartered in Switzerland. It has established large-scale production centers in industrial countries such as Germany, Switzerland, France, the United States, and Japan. The company has 70 independent subsidiaries around the world, and its quality management and quality assurance systems have reached ISO 9001 international standards.

For decades, Baumer Group has won a global reputation as an international leading sensor supplier. For a long time, it has provided innovative, high-quality sensor products for factory and process automation applications, with a rich standard product portfolio based on various sensor technologies.

Main sensor products include photoelectric sensors, inductive sensors, capacitive sensors, ultrasonic sensors, force/strain/pressure sensors, magnetic sensors, etc.

MEMSENS is a Swiss company specializing in the development and manufacturing of pressure sensors and pressure transmitters. Currently, the company has launched two products to the market: OEM pressure sensors and pressure transmitters. The technical services mainly involve sensor technology development and consulting. The company is located in Switzerland’s microelectronics and microfabrication technology center, surrounded by world-renowned universities and research institutions, with close ties and collaborations with them.

The company has been engaged in ceramic thick film technology for many years. In 1989, Microtel established a sensor department, capable of independently developing ceramic pressure sensors. Since the mid-1990s, Microtel has established European group companies focused on technological production. Microtel has branches in Germany, France, and Italy and is a member of the International Microelectronics and Packaging Society, participating in European research and development programs.

The Data Logic Automation Division is one of the world’s leading manufacturers of automatic identification systems in the industrial sector, providing customers with comprehensive automation solutions, including industrial sensors, industrial safety protection, automatic barcode scanning systems, machine vision systems, and RFID technology solutions. Its famous T., TL80, TL10, S60-W, S50-W color label sensor series products lead the world in the color label sensor industry.

Main sensor products include color label sensors, micro sensors, tubular sensors, reflective fluorescent sensors, color sensors, micro sensors, fiber optic color sensors, etc.

The Gefran Group is headquartered in Italy and has six manufacturing plants worldwide, having certain advantages in producing and applying melt pressure sensors.

Main sensor products include linear displacement sensors, tension sensors, melt pressure sensors, pressure sensors, temperature sensors, relative humidity sensors, etc.

Yokogawa Electric Corporation is a world leader in measurement, industrial automation control, and information systems. Since its establishment in 1915, it has been committed to providing advanced professional technologies to support customers in reforming commercial efficiency. The measuring instrument division is at the core of its measurement technology, offering high stability and reliability products and always leading measurement technology. It has expanded the production field of communication measurement instruments through a merger with Ando Electric Corporation and has fully developed cutting-edge technology in the field of information processing. Currently, medical imaging information systems are being applied in many hospitals, contributing to the informatization of the medical field.

Omron Group has dozens of products across various fields, including industrial automation control systems, electronic components, automotive electronics, social systems, and healthcare devices, making it a world-renowned manufacturer of automation control and electronic equipment. It possesses world-leading core sensing and control technologies.

Fujitsu Group maximizes the value of its business group by creating economic benefits, with contributions to society, shareholders, and investors as its basic management principle. To achieve this goal, it has implemented a pure holding company system since October, dividing all business into subsidiaries. In 2003, through rapid operations and self-funding, it formed the strongest professional company in the industry. The company’s silicon capacitive sensors and converters offer unique technical solutions, particularly in static pressure protection.

With the rapid development of industrial automation, KEYENCE, as a major supplier of sensors and measuring instruments, continuously develops and manufactures newer and more reliable products to meet the needs of various manufacturing industries, maintaining a leading position in its industry.

Main sensor products include fiber optic sensors, photoelectric sensors, digital laser sensors, contact sensors, RGB color sensors, proximity sensors, pressure sensors, etc.

Compared to advanced countries abroad, China’s sensor technology research and development is lagging by 10 years, and production technology is lagging by 15 years. In recent years, key research and development bases for sensor technology, micro/nano key laboratories, and robotics key laboratories have been established. Currently, there are 1,688 enterprises engaged in sensor production and research in China. Domestic sensor manufacturers are increasing varieties, improving quality, and investing heavily economically, aiming for economic benefits, accelerating the industrialization process of sensors, and striving to achieve a market share of 70-80% for domestic sensors and over 60% for high-end products.

In 1995, the National Sensor Engineering Research Center was approved by the National Development and Reform Commission and is located at the Shenyang Institute of Instrument Science. It is the only national institution engaged in sensor technology engineering research and production testing, specializing in MEMS technology, silicon microchips, mechanical thermal magnetic sensors, and related sensors. The company possesses a sensor CAD design center, sensor reliability testing center, specialized process equipment, and over 200 sets of instruments and supporting standard production sites and laboratory infrastructure, mastering and possessing core technologies and capabilities from sensor sensitive chips to sensors and related instruments and complete products for mass production. Main sensor products include force/thermal/magnetic sensors, transmitters, etc.

Shenzhen Tsinghua University Research Institute

In December 1996, the Shenzhen Municipal Government and Tsinghua University jointly established the Shenzhen Tsinghua University Research Institute based on complementary advantages and a strong alliance to explore a new model of integrated production, education, and research. Shenzhen Lihua High-tech Co., Ltd. (referred to as Tsinghua Lihua) is a high-tech enterprise founded by the Tsinghua University Research Institute, successfully realizing the industrialization of quartz resonant force sensors, which is a key scientific research project of the national Eighth and Ninth Five-Year Plans. In terms of property rights, it has been designated as a national high-tech industrialization demonstration base by the National Development and Reform Commission.

Tianjin Zhonghuan Thermometer Co., Ltd. is a manufacturer specializing in the production of industrial thermocouples, thermal resistors, and diaphragm pressure transmitters. It is a high-tech enterprise integrating product R&D, production, sales, and system engineering installation.

The company has a registered capital of 20 million yuan and has a Level 3 contracting qualification in electronic engineering. It is located in the national-level Tianjin Dongli Development Zone, covering an area of 20,000 square meters, with a standardized factory building of 14,000 square meters. The company has passed ISO 9001:2000 international quality system certification and NQA national quality system certification.

Today, industrialized countries such as Germany, Japan, the United States, and Russia remain active in the international market, where sensors are widely applied, and many manufacturers have achieved large-scale production, with some companies having an annual production capacity of tens of millions or even hundreds of millions. In contrast, China’s sensor applications are still relatively narrow, mostly remaining in the aerospace and industrial measurement and control fields. According to relevant data, the largest sensor company’s annual output value in China is only 55,000. Additionally, the markets for high-precision, precise sensors and new types of sensors are almost monopolized by foreign brands or joint ventures.

However, China’s sensors are currently facing the best historical period. There is huge market demand and national policy support. On one hand, many domestic companies are striving to develop their new technologies, and significant improvements have been made in corporate management models. On the other hand, support also comes from the international AMA and the German Sensor Association. The quality, price, and functionality of sensors will be the key areas for domestic companies to improve in the future. In the future, domestic sensors will undergo a process of transitioning from industrial process testing to functional transformation. Domestic enterprises will learn more effectively from their strengths and weaknesses to quickly stand on equal footing with foreign enterprises, moving towards miniaturization, networking, and standardization of sensor modernization. We look forward to significant achievements in the future of China’s sensors, although there is still a long way to go for China’s sensor enterprises.

Images and text sourced from Sensor Technology

Initial review: Tang Cuimei

Re-review: Huo Xiaoyin

Final review: Wang Xianfang