Automotive chips are the core components of automotive electronic systems and are an important foundation for the transformation and upgrading of the automotive industry. With the rapid development of the new energy vehicle industry, technologies such as intelligence and connectivity are accelerating their integration and application in the automotive field. The technological advancement, product coverage, and application maturity of automotive chips in China are continuously improving. Driven by multiple factors such as policy support, market demand, and technological innovation, the demand for automotive chips in China is expected to continue to rise, and the industry has broad development prospects.

Part.01

Industry Chain Overview

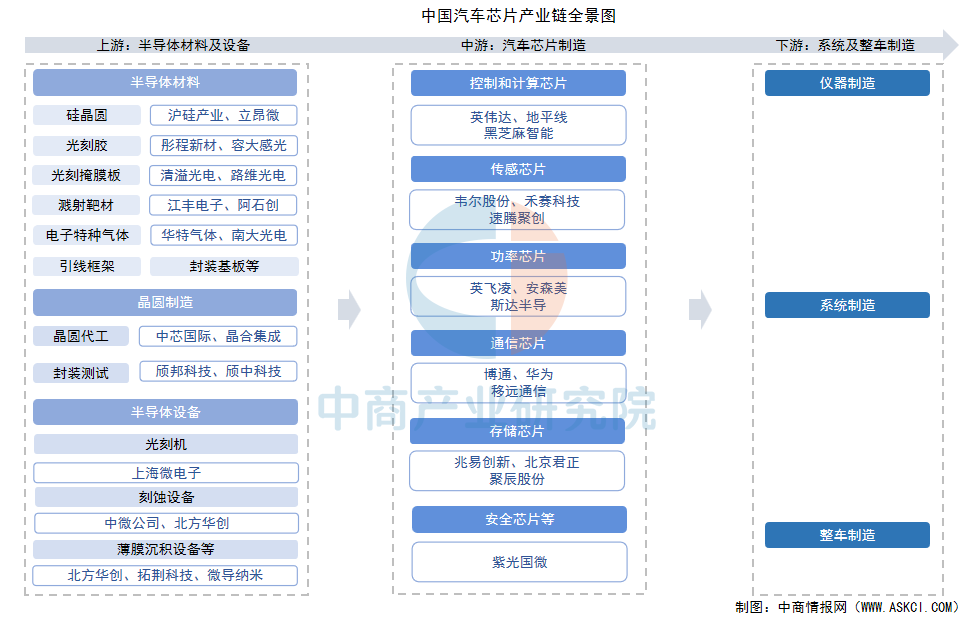

The upstream of the automotive chip industry chain in China includes semiconductor materials, wafer manufacturing, and semiconductor equipment; the midstream involves automotive chip manufacturing, which includes various categories such as control chips, computing chips, sensor chips, power chips, communication chips, storage chips, and security chips, depending on the functions they perform; the downstream includes onboard systems and complete vehicle manufacturing, involving vehicle networking, automotive cockpits, HUDs, central control instruments, and smart vehicles.

Source: Organized by the China Business Industry Research Institute

Part.02

Upstream Analysis

1. Semiconductor Materials

(1) Semiconductor Silicon Wafers

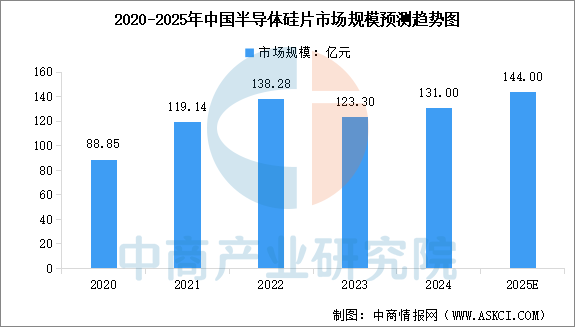

Semiconductor silicon wafers are key materials for producing integrated circuits, discrete devices, sensors, and other semiconductor products, positioned at the upstream critical material segment of the semiconductor industry chain. According to the “2025-2030 Global and China Semiconductor Silicon Wafer Industry Development Trend Analysis and Investment Risk Forecast Report” released by the China Business Industry Research Institute, the market size of China’s semiconductor silicon wafers decreased to approximately 12.33 billion yuan in 2023 due to weak demand in the end market, but is expected to rebound to 13.1 billion yuan in 2024. Analysts predict that the market size of China’s semiconductor silicon wafers will reach 14.4 billion yuan in 2025.

Data Source: Organized by the China Business Industry Research Institute

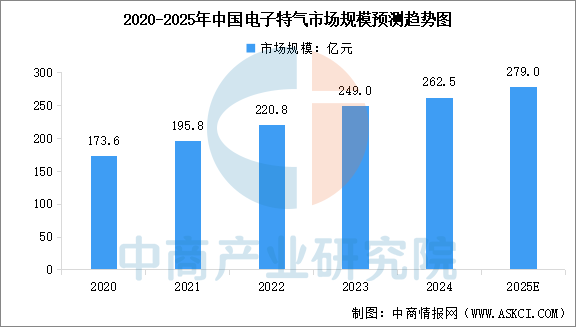

(2) Electronic Specialty Gases

Electronic specialty gases are an important branch of specialty gases, widely used in the production of ultra-large-scale integrated circuits, flat panel display devices, solar cells, and other electronic industries. In recent years, the market size of electronic specialty gases in China has continued to grow. The “2025-2030 China Electronic Specialty Gases Special Research and Development Prospects Forecast Report” released by the China Business Industry Research Institute shows that the market size of electronic specialty gases will reach 26.25 billion yuan in 2024, a year-on-year increase of 5.42%. The growth rate of China’s electronic specialty gases market is significantly higher than the global growth rate, indicating substantial future development space. Analysts predict that the market size of electronic specialty gases in China will exceed 27 billion yuan in 2025.

Data Source: SEMI, Organized by the China Business Industry Research Institute

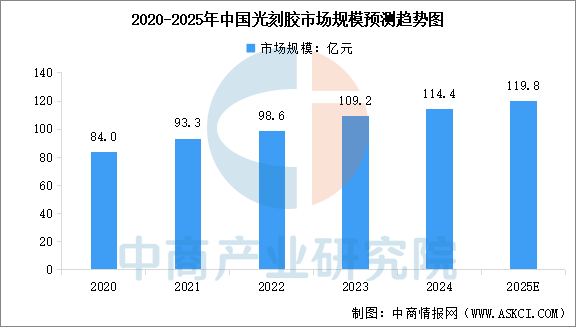

(3) Photoresists

China’s photoresist industry chain is gradually improving, and with the gradual expansion of downstream demand, the market size of photoresists has significantly increased. The “2025-2030 Global and China Photoresist and Photoresist Auxiliary Materials Industry Development Status Research and Investment Prospects Analysis Report” released by the China Business Industry Research Institute shows that the market size of photoresists in China will be approximately 11.44 billion yuan in 2024, a year-on-year increase of 4.76%. Analysts predict that the market size of photoresists in China will reach 11.98 billion yuan in 2025.

Data Source: Organized by the China Business Industry Research Institute

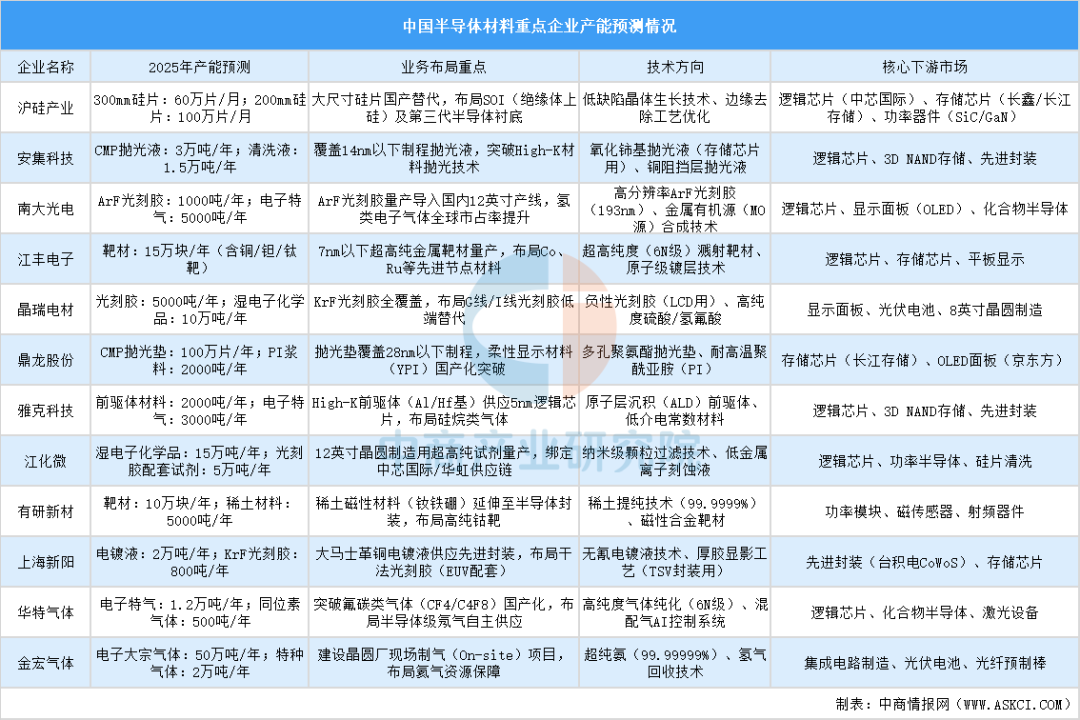

(4) Key Enterprises

As the core foundation of the modern electronics industry, semiconductor materials are widely used in chip manufacturing, communications, computers, and many other critical fields. They are an important force driving the digital and intelligent transformation of the global economy. The enormous market demand and technological innovation potential have led to the emergence of numerous semiconductor material enterprises, becoming a new force supporting economic growth and technological advancement.

Data Source: Organized by the China Business Industry Research Institute

2. Semiconductor Equipment

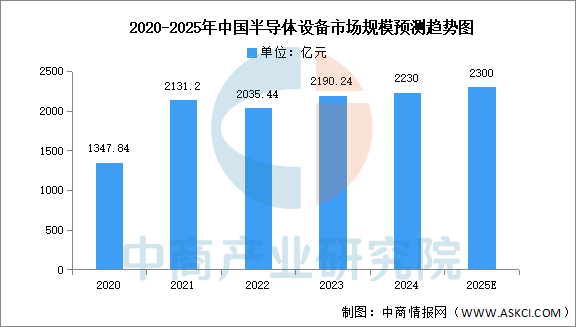

(1) Market Size

Semiconductor equipment mainly includes photolithography machines, etching equipment, thin film deposition equipment, ion implantation equipment, and coating and developing equipment. The market size of semiconductor equipment in China continues to expand. The “2025-2030 China Semiconductor Equipment Industry Market Supply and Demand Trends and Development Strategy Research Forecast Report” released by the China Business Industry Research Institute shows that the market size of semiconductor equipment in China was approximately 219.024 billion yuan in 2023, accounting for 35% of the global market share, and is expected to reach about 223 billion yuan in 2024. Analysts predict that the market size of semiconductor equipment in China will reach 230 billion yuan in 2025.

Data Source: SEMI, Organized by the China Business Industry Research Institute

(2) Key Enterprise Analysis

Semiconductor equipment is the leading and foundational industry of the semiconductor industry, characterized by high technical barriers, long R&D cycles, high R&D investment, and significant manufacturing difficulties. It is the most challenging yet crucial link in the semiconductor industry.

Data Source: Organized by the China Business Industry Research Institute

Part.03

Midstream Analysis

1. Automotive Chip Market Size

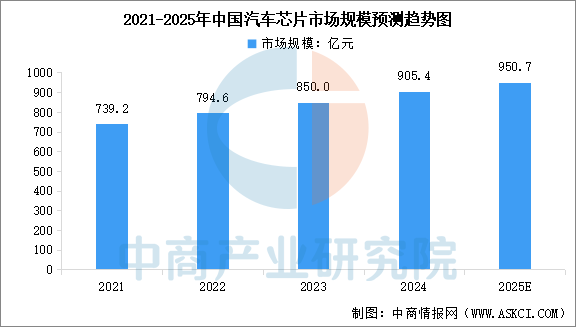

In recent years, as the global automotive industry accelerates its transition to electrification and intelligence, the market size of automotive chips in China has been continuously expanding. The “2025-2030 China Automotive Semiconductor Industry Market Outlook and Investment Strategy Research Report” released by the China Business Industry Research Institute shows that the market size of automotive chips in China will reach 90.54 billion yuan in 2024, an increase of 6.52% from the previous year. Analysts predict that the market size of automotive chips in China is expected to reach 95.07 billion yuan in 2025.

Data Source: Organized by the China Business Industry Research Institute

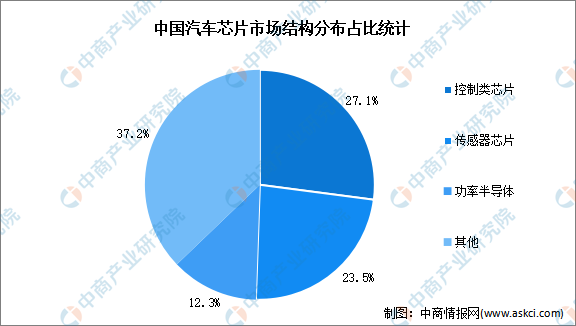

2. Automotive Chip Market Structure

From the perspective of the market structure of automotive chips in China, they are mainly divided into control chips, sensor chips, power semiconductors, communication chips, and storage chips. Among these, control chips and sensor chips have the highest market shares, accounting for 27.1% and 23.5%, respectively. Power semiconductors account for 12.3% of the automotive chip market.

Data Source: Organized by the China Business Industry Research Institute

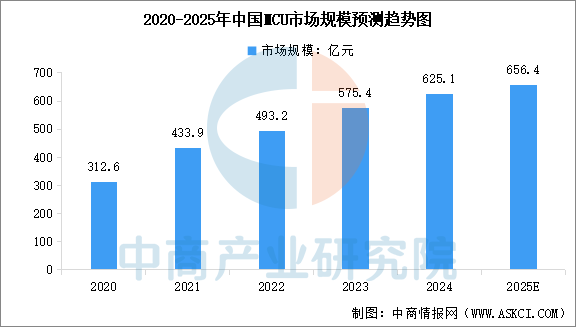

3. MCU Chips

In the context of “domestic substitution” and “chip shortages,” domestic companies are accelerating the R&D, manufacturing, and application capabilities of MCU chips, gradually completing the localization of mid-to-low-end MCU fields and continuously penetrating into high-end fields. The market competitiveness of China’s MCU industry is gradually improving. The “2025-2030 China MCU Chip Market Status Research Analysis and Development Prospects Forecast Report” released by the China Business Industry Research Institute shows that the market size of MCUs in China will reach 62.51 billion yuan in 2024, an increase of 8.64% from the previous year. Analysts predict that the market size of MCUs in China will reach 65.64 billion yuan in 2025.

Data Source: Frost & Sullivan, Organized by the China Business Industry Research Institute

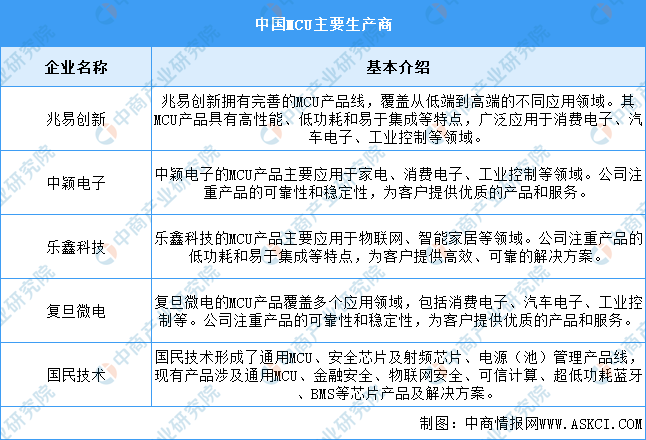

The key enterprises in China’s MCU market include Zhaoyi Innovation, Zhongying Electronics, Espressif Technology, Fudan Microelectronics, and Guomai Technology. These companies have a high market share and brand influence in the MCU field and are important forces driving the development of China’s MCU industry.

Data Source: Organized by the China Business Industry Research Institute

4. Smart Cockpit Chips

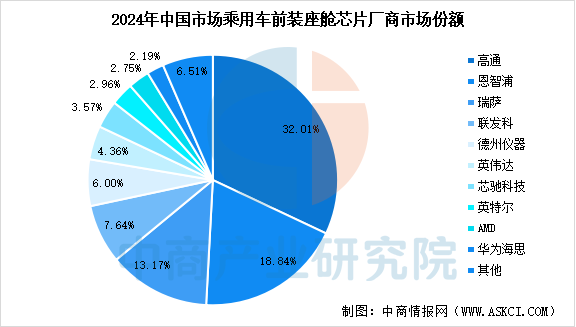

With the integration of domestic technologies such as artificial intelligence, 5G communication, and the Internet of Things, the Chinese smart cockpit market shows great potential. In terms of market share, the top three manufacturers of passenger car pre-installed cockpit chips in China are Qualcomm, NXP, and Renesas, accounting for 32.01%, 18.84%, and 13.17%, respectively. The highest market share among domestic manufacturers is held by Chipone Technology, with a share of 3.57%. Its X9 series chips have achieved full coverage from entry-level to high-end models. Huawei HiSilicon has a market share of 2.19% and is rapidly rising with the empowerment of the Harmony ecosystem.

Data Source: Organized by the China Business Industry Research Institute

5. Sensor Chips

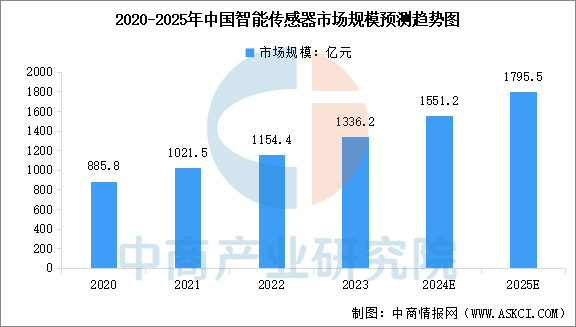

With continuous technological advancements and the expansion of application fields, the demand for smart sensors in China is rapidly growing. The “2025-2030 Global and China Smart Sensor Market Survey and Industry Outlook Forecast Special Research Report” released by the China Business Industry Research Institute shows that the market size of smart sensors in China was 133.62 billion yuan in 2023, with a compound annual growth rate of 15.96% over the past five years. Analysts predict that the market size of smart sensors in China will reach 179.55 billion yuan in 2025.

Data Source: Organized by the China Business Industry Research Institute

China has initially formed a competitive advantage in smart sensor enterprises, such as Weir Shares, Zhaoyi Innovation, China Resources Micro, Huazhong University of Science and Technology, and GoerTek, while other market participants are mainly small and medium-sized manufacturing enterprises.

Data Source: Organized by the China Business Industry Research Institute

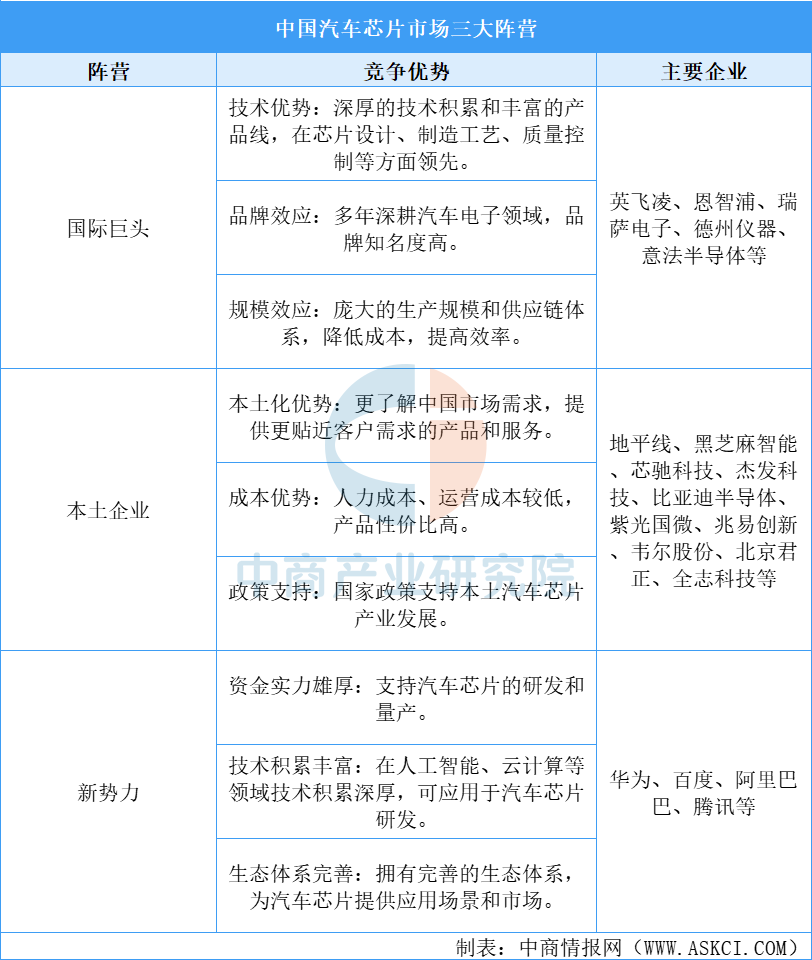

6. Layout of Key Automotive Chip Enterprises

There are many participants in the Chinese automotive chip market, and the competitive landscape is fragmented, mainly divided into three major camps: international giants, domestic enterprises, and new forces. International giants dominate the Chinese automotive chip market, especially in the high-end chip sector, due to their technological, brand, and scale advantages. Domestic enterprises are rapidly rising, relying on localization, cost advantages, and policy support, gradually forming competitiveness in the mid-to-low-end chip sector. New forces, including technology giants, are actively laying out the automotive chip field with their funding, technology, and ecosystem advantages, which may significantly impact the market structure in the future.

Data Source: Organized by the China Business Industry Research Institute

Part.04

Downstream Analysis

1. Smart Cockpit

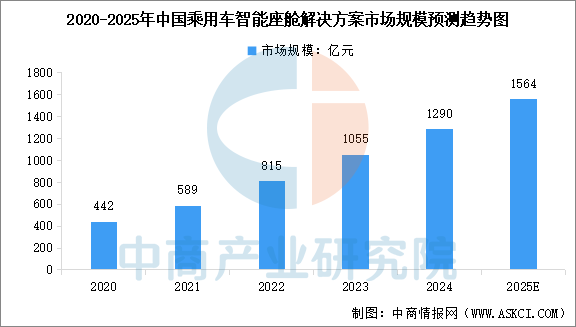

With the integration of domestic technologies such as artificial intelligence, 5G communication, and the Internet of Things, the Chinese smart cockpit market shows great potential. The “2025-2030 Global and China Smart Cockpit Market Status and Future Development Trends” released by the China Business Industry Research Institute shows that the market size of passenger car smart cockpit solutions in China will reach 129 billion yuan in 2024, an increase of 22.27% from the previous year. Analysts predict that the market size of passenger car smart cockpit solutions in China will reach 156.4 billion yuan in 2025.

Data Source: Organized by the China Business Industry Research Institute

2. Automotive Electronics

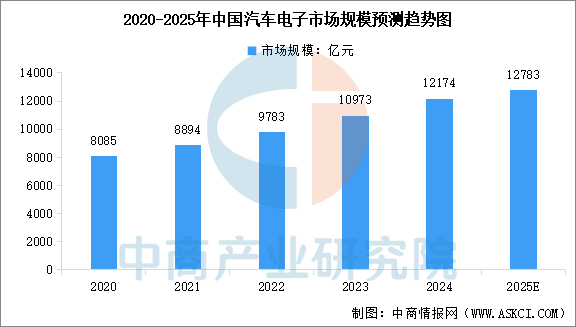

China is the world’s largest producer and consumer of automobiles and new energy vehicles. In recent years, China’s automotive electronics industry has developed steadily, and its industrial capacity has continuously improved. The “2025-2030 China Automotive Electronics Industry Development Status and Investment Strategy Research Report” released by the China Business Industry Research Institute shows that the market size of automotive electronics in China will be approximately 1.22 trillion yuan in 2024, an increase of 10.95% from the previous year. Analysts predict that the market size of automotive electronics in China will reach 1.28 trillion yuan in 2025.

Data Source: Organized by the China Business Industry Research Institute

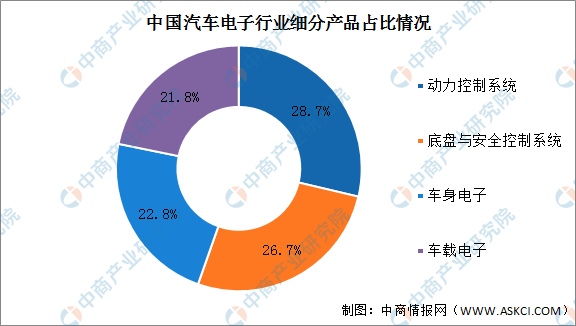

From the perspective of market share distribution in automotive electronics, the overall competition is quite fierce, with market shares being relatively close. The largest share is held by power control systems, accounting for 28.7% of the overall market. This is followed by chassis and safety control systems, accounting for 26.7%; body electronics account for 22.8%, and in-vehicle electronics account for 21.8%.

Data Source: Organized by the China Business Industry Research Institute

3. Automotive Industry

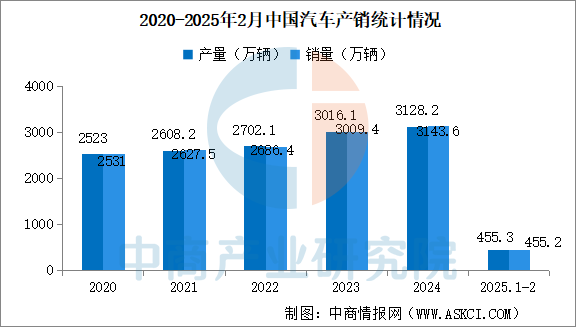

In recent years, China’s automotive industry has maintained a growth trend, with production steadily increasing. In 2024, automotive production and sales are expected to reach 31.282 million and 31.436 million units, respectively, representing year-on-year increases of 3.7% and 4.5%. In January and February 2025, automotive production and sales are expected to reach 4.553 million and 4.552 million units, respectively, representing year-on-year increases of 16.2% and 13.1%.

Data Source: Organized by the China Automotive Association and the China Business Industry Research Institute

For more information, please refer to the report released by the China Business Industry Research Institute titled“2025-2030 China Automotive Chip Market Research and Investment Strategy Consulting Report”, and the China Business Industry Research Institute also providesindustry big data, industry intelligence, industry research reports, industry white papers, industry position certificates, feasibility study reports, industry planning, industry chain investment maps, industry investment guidelines, industry chain investment inspections & recommendations, and the “14th Five-Year Plan” and other consulting services.

The above information is for reference only. If there are any omissions or deficiencies, please feel free to correct!

China Business Industry Research Institute

Founded in 2002, the China Business Industry Research Institute is a new type of industry think tank based in Shenzhen and serving the whole country. For more than twenty years, the institute has adhered to the development concept of “Bay Area Gene, Global Vision,” with “data + platform” as the core driving force, relying on the multidimensional linkage of “capital + resources + projects” to provide high-value industry consulting solutions for clients, assisting in industrial upgrading and high-quality development.