Source: Global IoT Observation

Author: Boone

IoT Think Tank Organized and Published

Please indicate the source and origin when reprinting

Introduction

For LoRa technology, industry insiders are no strangers; it is often compared with NB-IoT technology. As emerging technologies in low-power wide-area networks (LPWAN), both technologies have attracted significant attention.

Currently in China, due to the strong support from national policies, telecom operators, and major industry players, the development of NB-IoT technology is in full swing. In contrast, the previously quiet LoRa technology, due to frequency authorization issues, has remained relatively low-key.

However, recently, the news of Alibaba’s collaboration with China Tower and Tencent’s announcement to join the LoRa Alliance has injected a “shot of adrenaline” into the industry. With the support of internet giants like Alibaba and Tencent, LoRa technology may welcome another spring in China.

Alibaba Cloud claims it will connect 10 billion devices in the next five years. In April this year, Alibaba Cloud announced that its IoT platform based on LoRa devices and wireless RF technology has begun trial commercial use.

Tencent, on the other hand, has focused its investments on LoRaWAN technology and applications. In July 2018, Tencent announced plans to establish a LoRaWAN network in Shenzhen with partners to provide smart solutions for urban, financial, medical, retail, and industrial applications.

LoRa technology was originally developed by the French company Cycleo (founded in 2009) as a spread spectrum wireless modulation patent technology. In 2012, Cycleo was acquired by the American company Semtech for about 5 million USD. After the acquisition, Semtech initiated the establishment of the LoRa Alliance in February 2015, together with Actility, Cisco, IBM, and other manufacturers to promote the participation of other companies in the LoRa ecosystem.

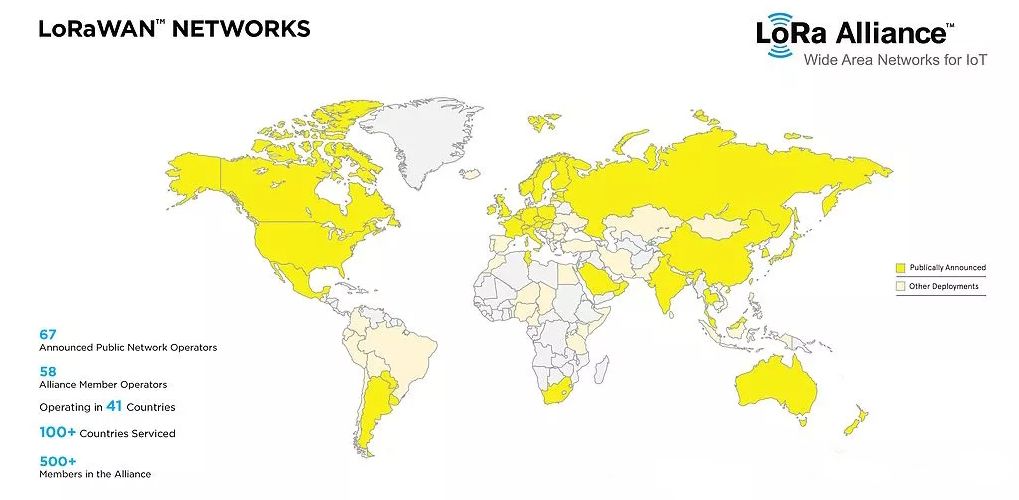

After more than three years of development, the LoRa Alliance now has over 500 members worldwide and has deployed LoRa networks in over 100 countries, including the United States, Canada, Brazil, China, Russia, India, Malaysia, Singapore, and more. In China, Alibaba has been an active promoter of LoRa technology, and now with Tencent’s participation, the development of LoRa technology in China will receive even more attention.

With the joint efforts of many LoRa Alliance members, the market development prospects of LoRa technology are also highly anticipated. According to data released by IHS Markit, by early 2018, the number of deployed LoRa-based gateways worldwide had exceeded 70,000, and it is expected to reach 200,000 by early 2019, with the number of terminal nodes reaching 80 million, of which over 40% are expected to be based on LoRa devices. By 2025, the number of machine-to-machine connections worldwide is expected to grow to 27 billion.

It is clear that LoRa technology has broad market prospects. At the same time, it raises curiosity about what “charm” LoRa technology possesses that allows it to stand out among many emerging IoT technologies?

-

Significant Technical Advantages

Firstly, from a technical perspective, compared to the higher cost and energy consumption of NB-IoT solutions, users can complete LoRa network deployment independently of operators, resulting in faster deployment and lower costs. In enclosed areas such as residential communities, farms, and industrial parks, especially in indoor and underground environments where NB-IoT signals are weak, LoRa technology has significant advantages.

Due to this “lightweight” construction advantage, the layout of LoRa solutions is actually broader. Currently, 350 cities in 41 countries, including the United States, France, and South Korea, have begun pilot deployments using LoRa networks, with 67 network operators providing services.

In addition, low cost is another advantage of LoRa compared to NB-IoT technology. Although the development momentum of NB-IoT technology has been strong in recent years, it still has significant limitations in terms of cost. Although the price of NB-IoT modules is expected to drop below 5 USD in the future, the price of chips supporting Bluetooth, Thread, and ZigBee standards is around 2 USD, while chips supporting only one of these standards cost about 1 USD. The significant price difference undoubtedly raises concerns for enterprises deploying NB-IoT, which is why the NB-IoT market has not quickly developed.

Of course, LoRa technology also has a fatal flaw that prevents it from achieving deep coverage. From the current perspective, the NB-IoT technology, which emphasizes unified standards and ultra-high reliability, and the LoRa technology, which pursues personalized deployment and meets scenario-based needs, are complementary. Industry insiders believe that there is no absolute superiority between these two technologies; they each have their pros and cons and serve different needs at different stages.

-

Diverse Application Scenarios

If simple deployment and low cost are one of the advantages of LoRa technology, then the diversity of application scenarios is another advantage that cannot be overlooked. Currently, LoRa technology can achieve rapid and flexible deployment in smart cities, smart water and electricity meters, smart parking lots, and dedicated applications for industries and enterprises.

LoRa technology has always been favored by government and enterprise users. Many government and enterprise users prefer self-controlled dedicated networks due to their business characteristics, and LoRa technology and LoRaWAN specifications have become the preferred choice for many non-operator users in China due to their flexible and low-cost deployment advantages. For example, LoRa sensors can monitor anomalies in underground water pipeline networks and comprehensive pipeline construction, giving LoRa technology a highly competitive advantage.

Moreover, in smart city applications, if there are smart street lights on both sides of the road, the usage of bulbs can be transmitted through the LoRa network to promptly notify the relevant units for maintenance, repair, and replacement of bulbs;

In smart parking lots, LoRa technology can save significant construction costs due to its flexible deployment characteristics, and a single LoRa gateway can manage hundreds of parking space LoRa sensors, monitoring parking space usage in real-time;

In smart tracking, the battery life of the terminal is crucial for tracking or positioning, as the cost of tracking systems and battery life must be considered, making LoRa technology quite suitable for tracking;

In smart water and electricity meters, installing corresponding LoRa modules on water and electricity meters not only saves labor costs but also allows for remote, real-time monitoring of water and electricity usage, avoiding waste;

In addition to the numerous application scenarios mentioned above, LoRa technology can also achieve flexible deployment in smart agriculture, intelligent fire protection, and other application fields, and in the future, even more unexpected application scenarios will be developed.

-

Large Industry Ecosystem

From a technical perspective, LoRa is a physical layer modulation technology that can be used in different protocols, such as LoRaWAN protocol, CLAA network protocol, LoRa private network protocol, and LoRa data transmission. With different usage protocols, the final product and business forms will also vary.

Among them, the LoRaWAN protocol, promoted by the LoRa Alliance, is a low-power wide-area network protocol, and the LoRa Alliance has standardized LoRaWAN to ensure that LoRa networks in different countries can interoperate. As of now, the LoRaWAN standard has established a complete ecosystem chain of “LoRa chips-modules-sensors-base stations or gateways-network services-application services”.

LoRa chips occupy a core position in the entire industry chain, and their importance is self-evident. It is noteworthy that Semtech is currently the core supplier of LoRa chips, holding the core patents of LoRa underlying technology. Semtech’s customers mainly fall into two categories: semiconductor companies that have obtained Semtech LoRa chip IP authorization and manufacturers that directly use Semtech chips to produce SIP-level chips, including Microchip.

According to conservative industry estimates, three years from now, LoRa chip sales will exceed 100 million units annually, and the LoRa application market will also attract significant attention. So what role do internet giants like Alibaba and Tencent play in this?

In March this year, Alibaba Cloud announced its full entry into the IoT field, establishing a comprehensive ecosystem layout from cloud to cloud, pipe, edge, and terminal. Due to its optimism about the prospects of wide-area networks in unlicensed spectrum, Alibaba Cloud developed the LinkWAN IoT platform that supports the LoRa protocol, and can also provide a rich array of LoRa products, including LoRa node devices and LoRa gateways. In addition, Alibaba’s investments in chip companies like ASR and Zhongtianwei are also noteworthy. To promote the expansion of LoRa in China, Alibaba has already built LoRa networks in Hangzhou and Ningbo this year and is ready for commercial use.

Although Tencent’s layout cannot compare with Alibaba’s comprehensive strategy, its joining of the LoRa Alliance undoubtedly injects a “shot of adrenaline” into the industry. To support the further development of the LoRaWAN ecosystem, Tencent has announced plans to establish a LoRaWAN network in Shenzhen with local partners to provide integrated solutions for various IoT applications and end users (such as government public services).

At the end of last year, the Ministry of Industry and Information Technology released the “Technical Requirements for Micro-Power Short-Distance Radio Transmission Equipment (Draft for Comments)”, which temporarily obscured the commercial prospects of LoRa. However, more than half a year later, LoRa not only did not fade away but has become increasingly resilient, with many big players such as Alibaba, Tencent, China Unicom, the Broadcasting Group, and Google joining the LoRa camp, continuously strengthening the industry’s ecosystem.

The main IoT technology standard currently promoted in China is NB-IoT, and major operators have invested heavily in this standard, especially China Telecom, which is leading the application of NB-IoT domestically. Both NB-IoT and eMTC belong to international standards, while the other two are private standards.

The biggest difference between the two lies in the spectrum, which is also the most valuable asset of these IoT connection standards. Simply put, owning a spectrum is equivalent to having a legal parking space, while LoRa and Sigfox have inherent deficiencies in this regard.

In recent years, Huawei has been a strong advocate for NB-IoT, and in collaboration with well-known international companies like Qualcomm and Vodafone, officially proposed the concept of NB-IoT in 2015. In addition to Huawei, the three major operators also favor NB-IoT.

Because NB-IoT networks are built by operators, unlike LoRa networks which are independently built by enterprises, NB-IoT can be constructed with relatively low workload by modifying existing communication base stations. Then operators can control this data channel for charging, which increases the number of connected terminals, benefiting both performance and political achievements.

In this case, operators are naturally motivated to promote NB-IoT.

More importantly, the government also strongly supports the development of NB-IoT, and has introduced several relevant policies to support it. For example, on June 16, 2017, the Ministry of Industry and Information Technology officially released the “Notice on Comprehensively Promoting the Construction and Development of Mobile IoT (NB-IoT)”, which clearly outlines 14 measures to comprehensively promote the construction and development of NB-IoT, aiming to build 1.5 million NB-IoT base stations and develop over 600 million NB-IoT connections by 2020.

With government support from above, active deployment from operators in the middle, and strong backing from Huawei, it is difficult for NB-IoT not to thrive in China.

-

Advantages of NB-IoT

Currently, the NB-IoT standard has been frozen, and China is already in the stage of large-scale commercial use. NB-IoT has four main characteristics: wide coverage, low power consumption, large connectivity, and low cost.

In terms of power consumption, NB-IoT sacrifices speed for lower power consumption. By adopting a simplified protocol and a more suitable design, the standby time of terminals has been greatly improved; some NB terminals claim to have a standby time of up to 10 years.

In terms of signal coverage, NB-IoT has better coverage capability (20dB gain), ensuring that even if a water meter is buried under a manhole cover, it does not affect signal transmission.

In terms of connection quantity, each cell can support 50,000 terminals.

In terms of cost, it is a major highlight of NB-IoT, as the cost of communication modules is very low, with each module expected to drop below 5 USD and even lower, which is conducive to large-scale procurement and use. According to Moore’s Law, it can be concluded that within 40 months, costs can drop below 1 USD.

Conclusion

In the case of NB-IoT, operators have significant influence as they build networks, allowing owners to avoid concerns about base station deployment, but the network quality depends on the operators, and owners cannot control it, as data must go through operators, raising confidentiality issues, and operational data is also uncontrollable. On the other hand, NB-IoT can be easily constructed based on existing domestic base stations.

LoRa, on the other hand, allows owners (enterprises) to control network quality, enabling quick optimizations for network coverage; they can also operate independently, keeping operational data in their hands and expanding networks according to business needs, providing significant freedom. However, the construction of LoRa base stations can be troublesome, requiring site selection, power supply, and many other issues.

Powerful companies like Tencent and Alibaba value freedom and control. The three major operators prefer the NB-IoT standard. Once a standard is established, it is also conducive to the prosperity of the industry ecosystem, mass production of terminal module chips, price reductions, and unified platforms and applications, leading to a more focused development direction.

Previous Popular Articles (Click on the title to read directly):

-

“How Difficult Is It to Make Smart Locks for Shared Bicycles?”

-

“Cognitive Computing, Blockchain IoT, IoT Security… Those Who Understand Will Control the Future”

-

“[Heavy Release] 2017-2018 China IoT Industry Panorama Report – IoT Has Begun to Deeply Transform Industries”

-

“[Heavy] IoT Industry Panorama Report, The First Domestic IoT Industry Two-Dimensional Perspective Panorama”

-

“A Cartoon Explains: Besides WiFi and Bluetooth, What Can the Recently Popular NB-IoT Do?”

-

“A Cartoon Explains: What Is LoRa Behind the Popular NB-IoT?”