The first computer, ENIAC, was undoubtedly a monumental achievement in human history. However, IBM, which made computers smaller and accessible to households, truly rewrote history. Generations of engineers have tried to make silicon chips, screens, and buttons smaller and smaller. Just like finely ground and tightly packed coffee, when soaked with 9 atmospheres of boiling water, it extracts a small cup of espresso that barely covers the bottom of the cup—humanity has also produced generations of overly concentrated “espresso computers,” which we now commonly refer to as “smartwatches.”

Smartwatches have existed for a long time. In 1985, shortly after Apple launched the groundbreaking Macintosh computer, Epson released the first wrist computer, the RC-20, equipped with a processor, cache, and screen that could be programmed to run specific applications. This watch already had simple applications such as schedule management and world clocks. Of course, versatile developers could also run applications from their computers on the watch and even play the simplest games on its small screen using a stylus.

As a product of the same era, computers became a sensation, while smartwatches faced numerous challenges, with the history of smartwatches filled with keywords like flashy technology, niche markets, and unrealistic demands. Among the experimental products were the Fossil Abacus, which ran Palm OS on the wrist, and the bizarre products from Samsung and LG that were essentially miniaturized Android phones strapped to the wrist.

It wasn’t until the 21st century that, thanks to companies like Jawbone and Fitbit, people who relied on smartphones finally understood the significance of this “plastic and circuitry” on their wrists—beyond just telling the time, it provided timely notifications and accurate, diverse health monitoring information. The smartwatch became the most common external sensor on the human body.

Since the 1980s, until today, the young people of that time have become the parents of today’s youth. Only now have smartwatches vaguely achieved commercial success. Why has the smartwatch developed so tortuously from its inception to practicality? In fact, the functions we desire have always been simple and straightforward. In a 2013 review of the Samsung Galaxy Gear smartwatch, some incredibly simple typical needs were mentioned:

Can the battery last me three days?

Does it have a classic, stylish appearance?

Can it operate independently without relying on a phone?

Is it simple enough for the elderly and children to enjoy?

These questions from a decade ago still seem relevant today. What appears to be simple demands has become the Achilles’ heel of smartwatches.

Essential Battery Life

With the Apple Watch having a “one charge a day” backdrop for seven consecutive generations, battery life has become the first differentiation point for domestic manufacturers. To extend battery life, domestic smartwatches have come up with various tricks. The most typical is the “power-saving mode,” which goes by different names among brands but generally involves shutting down the main system while retaining key functions like notifications, time, activity tracking, and sleep monitoring, effectively downgrading the watch to a fitness band. However, since we chose a fully functional smartwatch, this kind of clever software innovation feels more like a backup plan for users and cannot become the core experience of a smartwatch. Achieving full functionality with long battery life is much more difficult. The battery cannot be infinitely enlarged, and innovations in smartwatch battery life enter the deep waters of underlying hardware:

Low-power chips need to be manufactured with the most advanced processes.

Low-power screens that can achieve always-on display.

Making background functions more energy-efficient.

Therefore, the most noteworthy trend in the industry is the core upgrade. However, the chip replacement speed for smartwatches is much slower than for smartphones. Until July of this year, the core of Android watches was still the Qualcomm W4100 released in 2020, a 12nm chip.

Excitingly, Qualcomm’s recently launched W5 wearable platform has made significant strides, going from 12nm to 4nm, reducing power consumption by 40%. This chip was officially launched with the OPPO Watch 3 series earlier this month. Before its official release, Qualcomm and OPPO had already collaborated on tuning this chip for nearly a year, and the results were immediate—

5 days. The OPPO Watch 3 Pro has a battery life of 5 days in full smart mode, which is at the top tier level in the Chinese smartwatch sector. However, the more energy-efficient OPPO Watch 3 Pro maintains a significant advantage in size and weight: achieving the same 5-day battery life with only 37 grams and a 550mAh battery, compared to others that weigh 67 grams with a 790mAh battery.

3.5 days. The OPPO Watch 3 Pro is the first smartwatch in the industry to achieve 3.5 days of battery life with an always-on display, thanks to its innovative screen—the OPPO Watch 3 Pro is the first smartwatch in China to introduce LTPO screens, with a minimum refresh rate of 1Hz and a maximum brightness of 1000 nits, allowing for a full-screen always-on display with reasonable battery loss, providing users with an excellent experience.

Can we rest easy with just the first chip and high-spec screen? Certainly not. In the consumer electronics field, rapid technological advancements by suppliers are a boon for the entire industry, but they do not constitute a competitive advantage for a terminal brand. The real differentiation lies in self-developed underlying technologies. “Without core underlying technology, there can be no future; flagship products without core underlying technology are castles in the air.” When the Mariana chip was launched in 2021, OPPO’s founder and CEO Chen Mingyong publicly emphasized the importance of underlying technology to OPPO for the first time.

What is this underlying technology for smartwatches? As a device that operates 24 hours a day, how to minimize power consumption in “standby” mode is the key to improving battery life, and this is precisely the most critical innovation of the OPPO Watch 3 series: dual-engine hybrid technology.

In fact, the big and small core heterogeneous architecture has produced many notable works over the past few years. On computers, there are Intel’s 12th generation Core and Apple’s M1 chip. On smartwatches, the Apple Watch 3 was the first to feature the W2 co-processor, a high-performance wireless communication chip.

What about smartwatches in the Android world?

Qualcomm once provided a “power-saving mode” solution: the Qualcomm Wear 3100 series wearable platform already included a tiny core to run power-saving mode, which is also the underlying reason why smartwatches began to adopt power-saving modes in 2019.

Different from the solutions from Apple and Qualcomm, OPPO’s underlying innovation and exclusive technology—UDDE dual-engine hybrid technology—aims to reduce the power consumption of the watch in normal mode.

In fact, creating a “dual-core” for smartwatches began with the first generation OPPO Watch. When OPPO first ventured into smartwatches, it used two SOCs, with the small core primarily serving the light smart mode, achieving a long battery life of 16 days. Therefore, the standard battery life of the first-generation OPPO Watch was only 40 hours—adequate but not impressive.

A year after the launch of the first watch, the OPPO Watch 2 became the first smartwatch to feature practical “UDDE dual-engine hybrid technology.” It combines two systems—when running large applications, it activates the main system based on Android AOSP, powered by the robust Qualcomm wearable platform; while for always-running functions like sensor monitoring and notification reminders, it operates on an embedded lightweight system. The UI of the two systems is consistent and responds instantly, automatically switching in full smart mode.

Thus, for the first time, smartwatches achieved seamless integration of full functionality and efficiency, with the OPPO Watch 2 achieving a single charge battery life of 3 to 4 days.

In the latest OPPO Watch 3 series, the UDDE technology has been upgraded to UDDE 2.0. On the more power-efficient 4nm Qualcomm W5 wearable platform, OPPO has further optimized the current and power consumption for different scenarios, and for the Apollo 4 plus small core, OPPO has endowed the lightweight system with more functions and scenarios, such as voice wake-up and dynamic watch faces, etc. To this day, UDDE’s big and small core hybrid remains OPPO’s exclusive technology, making OPPO Watch stronger, lighter, and smaller.

Are smartwatches now useful?

Today’s smartwatches have made significant progress in battery life; just like the battery life challenge, many things we once thought smartwatches couldn’t achieve, which were once “Achilles’ heels,” have now been excellently resolved.

For example, independent operation. A decade ago, we might have doubted whether smartwatches would always be an accessory to phones, but today, going out for a run without needing to take a phone has become one of the classic scenarios for smartwatches. The realization of this demand is primarily based on the popularization of cellular network functionality. As mentioned earlier, the Apple Watch’s W2 co-processor was primarily designed to support cellular networks and independent operation of the watch, while Android smartwatches have long possessed capabilities like eSIM cards and Bluetooth headset connections.

Also, usability. After years of exploration, today’s smartwatches have discovered operation methods suitable for wrist interactions: touch screens, physical knobs or buttons, voice input, etc., have all become industry standards. However, to achieve a better experience, there is still much innovative work to focus on. Huawei’s smartwatches, for instance, have redesigned a 3D rotating crown to help users quickly complete complex operations like confirmation, exit, and selection without obstructing the touch screen.

Moreover, more comprehensive functions and more accurate data. The most difficult functionality for wrist devices to replace is health monitoring—ranging from the earliest step counting and sleep tracking to today’s smartwatches flourishing in health pursuits. In terms of activity monitoring, more automation, precision, and coverage of more sports have become common goals for manufacturers. For this reason, Amazfit once acquired a sports sensor company, Zepp, to enhance its sports data capabilities. The OPPO Watch 3 series, which includes automatic monitoring for six types of activities like running and walking, a heart rate guardian function that provides timely alerts for elevated heart rates, and specially customized algorithms for tennis, are all positive attempts in the sports domain.

Finally, the appearance of smartwatches—the keyword “design” has been intertwined throughout the watch’s several hundred years of history. Manufacturers are pursuing a balance between appearance, performance, and functionality. Apple has always focused on developing a “small square” design; while Huawei, Samsung, and others delve into the information display and interaction of round dials. New players in the smartwatch market, like OPPO, are at a critical stage of establishing their design language. The OPPO Watch 3 Pro adopts an “arm growth” design, becoming the first mainstream smartwatch to use a curved large screen, emphasizing a closer fit and a more natural experience, creating a differentiated design from existing smartwatches.

What exactly is still lacking in smartwatches?

It can be said that smartwatches are devices that are “difficult to return once used.” However, today, the penetration rate of smartwatches is still significantly low, with shipments only 1/15 of that of smartphones.

Are smartwatches really “just a breath away”? In the past, smartwatches may have indeed had issues with battery life, performance, and usability, but with the efforts of brands like Huawei, Apple, OPPO, and Amazfit over the past two years, smartwatches today have resolved previously “fatal” product flaws in terms of practicality regarding battery life, usability, and comprehensive functionality.

We believe that the resistance to the market explosion of smartwatches today will no longer be a hardware or software capability issue, but rather a matter of consumer demand and ecosystem.

First, let’s talk about consumer demand. The functions of smartwatches may not yet cover every consumer, while the functionalities of smart bands, which serve as lower-tier alternatives, have been increasing year by year.

This is somewhat akin to the competition between smartphones and increasingly sophisticated feature phones at the dawn of smartphones. Even though, at the end of the competition, feature phones could last a month, while smartphones needed a charge every day, the battery life issue did not hinder the progress of history.

The premise for pursuing an increase in penetration rate remains the practicality of smartwatches.

Now, let’s discuss the ecosystem. As part of the smartphone ecosystem, smartwatches may still face a “glass ceiling”—the market share of smartphones themselves. This has two different impacts: first, even if a smartwatch has significant flaws, such as the Apple Watch’s one-charge-a-day limitation, it remains almost the only option for Apple phone users; second, even if domestic smartwatches are excellent, they are unlikely to become choices for users of other brands due to the limitations of the smartphone market, making it extremely difficult to serve users across brands.

One phenomenon is that there is no shortage of well-known third-party smartwatch manufacturers in the market, including large tech companies like Google and traditional sports watch players like Garmin. Ultimately, smartwatches have become the playground of smartphone giants, where the key point lies in the IoT led by smartwatches, which is an art of product interconnection, scenarios, refinement, and optimization. For third parties, deeply penetrating an IoT ecosystem is indeed not easy.

At the launch of the OPPO Watch 3 series, OPPO’s assistant president and head of the IoT business group, Li Kaixin, introduced that “OPPO’s IoT business has covered over 50 countries and regions in three years, achieving at least 120% high growth across various categories; at the same time, the Heythings ecosystem has reached nearly 300 million installations, exceeding a four-digit product scale.” Alongside the release of the OPPO Watch 3 series, a series of smart home devices were also launched, ranging from cameras to fully automated cat litter boxes, offering a variety of choices that appeal to young people as modern devices.

Due to the existence of brand and ecosystem barriers, we cannot expect any single smartwatch to achieve a “unified market,” but the work of compatibility and adaptation remains essential. In the OPPO Watch 3 series, we can also see the proactive efforts OPPO has made: testing compatibility with over 100 phone models and 100 headsets, and special optimizations for iOS scenarios. According to OPPO’s published data, the OPPO Watch now boasts over 80 apps, the highest number in the domestic Android smartwatch camp.

Ultimately, the “just a breath away” issues that consumers have long criticized in smartwatches have largely been resolved by 2022.

What is the future of domestic smartwatches?

In fact, the Chinese smartwatch industry did not start late. Even before the launch of the Apple Watch, several startup teams in Shenzhen had already introduced their products. Although they were immature and lacked ecosystem support, they expressed their understanding of wearable devices. The earliest batch of smartwatch entrepreneurs in China, such as Zhiqi and Geek Watch, have long faded away, replaced by manufacturers like Huawei, OPPO, and Xiaomi, who continue to delve into this field, driving innovative upgrades in underlying technologies.

In the ten years of industry struggles and ample market competition, the product points that consumers are increasingly hesitant and concerned about have become the most important technological challenges for Chinese manufacturers. The once-criticized issues of durability and false demand in smartwatch products have now been addressed one by one by industry giants; the products that were once thought to be “just a breath away” no longer need to be viewed with rigid stereotypes—4nm chips, LTPO screens, smartwatches are rapidly catching up with the most advanced technologies available in the market, breaking the “impossible triangle” of smartwatch battery life, all of which are positive signals in the industry.

Huawei, Apple, and OPPO, with their distinctive smartwatch products and large smartphone activation base, have become the “HAO” triad in the smartwatch field. Market research firm GFK believes that Apple, Huawei, and OPPO lead the development paths of Watch OS, Harmony OS, and Android smartwatches, respectively, with pioneering competition in configuration and functionality becoming key competitive factors in the wearable sector. Apple’s ECG, Huawei’s blood oxygen measurement, and OPPO’s unique dual-engine hybrid architecture and first adoption of curved large screens are all at the forefront of category competition.

The OPPO Watch 3 series was born against this backdrop, a powerful stimulant delivered by a major smartphone manufacturer and supply chain giant: we can see that with the rapid development of smartwatch hardware supply chains, the refinement and optimization of big and small core designs, and more functional scenarios, ultimately serving more users and IoT products, will become a strong driving force for the new generation of domestic smartwatches to open new markets.

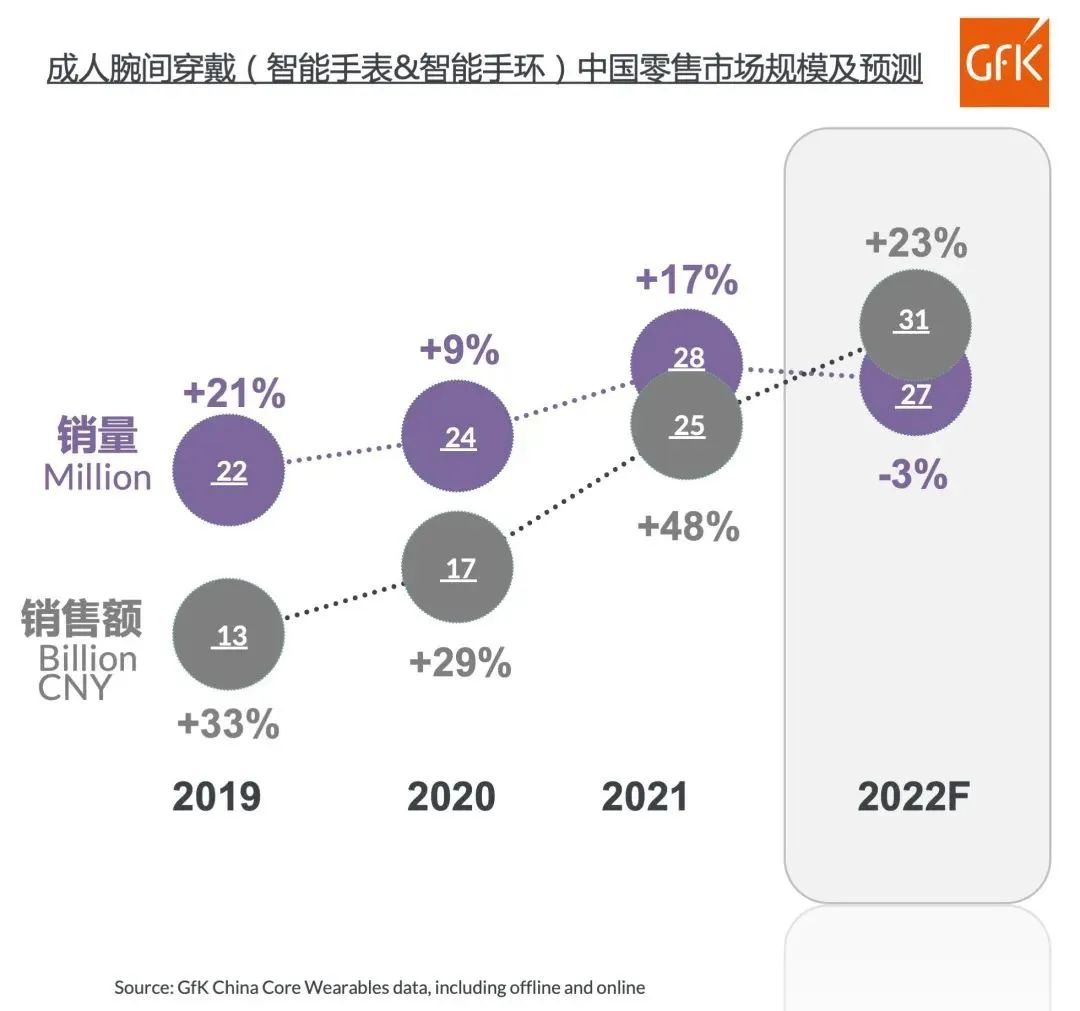

As domestic smartwatches fill their gaps, they are finally becoming the mainstay of wearable devices. According to GFK’s prediction, this year, smartwatches (excluding children’s communication watches) are expected to surpass fitness bands in terms of shipment volume. This result is inseparable from the contributions of differentiated competition from the “HAO” triad and other enterprises.

Source: “China’s Adult Smart Wearable Market—Domestic Brands’ Entry and Push,” GfK China

Similarly, Digitimes Research believes that the global smartwatch shipment growth rate will remain close to 30% since the pandemic, and will exceed 150 million units in 2023.

Since the first watch was born in 1806, the wrist has been able to carry the function of conveying information. The devices we use to process information have evolved from mainframes and PCs to today’s smartphones, and perhaps tomorrow’s XR. Wrist devices, due to their lightweight and 24-hour wear characteristics, still have the potential to continue serving as personal information terminals—the race is still long, and battery life, display, and architecture optimization are all long-term topics; today’s research will not go to waste.

The market is promising, and perhaps it’s time for more people to try domestic smartwatches.

Special Planning