Source | Yiou. Yushi Capital Research Institute. Intelligent Connected Vehicles Network

Enterprise Layout Characteristics

The Upgrade of Computing Power Demand Drives Growth in the Automotive Computing Chip Market Scale

Growth, Industry Supply Chain Transformation is Quietly Brewing

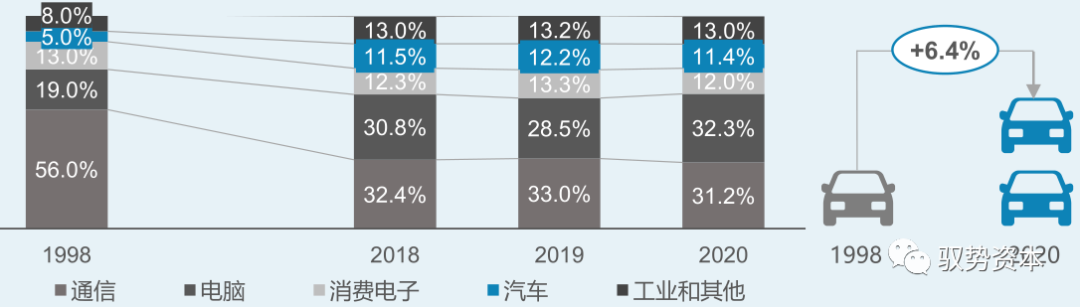

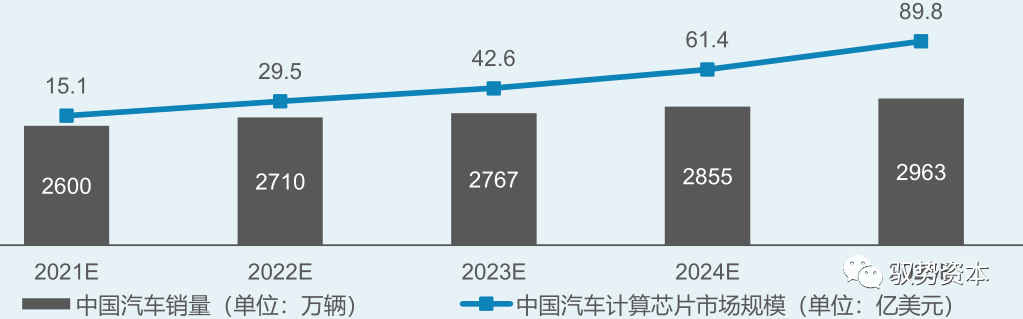

The upgrade of automotive intelligence drives the increase in the value of semiconductor components in vehicles, in 2020, the demand for chips in the automotive sector accounted for 11.4% of the global chip market, and the continuously rising demand for computing power will drive the growth of the automotive computing chip market scale, ushering in a period of rapid development. According to Yiou Think Tank’s calculations, the scale of China’s automotive computing chip market will reach $1.51 billion in 2021, and will rapidly grow to $8.98 billion by 2025. Automotive computing chips will become the core of value in the smart automotive industry.

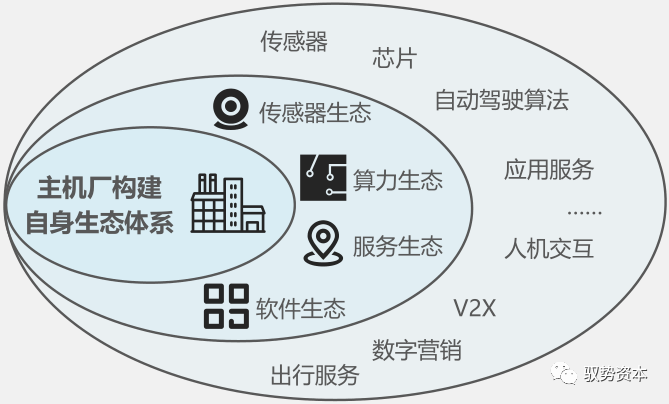

The vast market for automotive intelligence attracts multiple parties to enter, and the transformation of the industry supply chain is quietly brewing, forming a new supply ecosystem that is integrated and flat, with the computing power ecosystem being a crucial part.

Yiou Think Tank: Global demand-side chip market share from 1998 to 2020.

Yiou Think Tank: Forecast of China’s automotive sales and automotive computing chip market scale from 2021 to 2025.

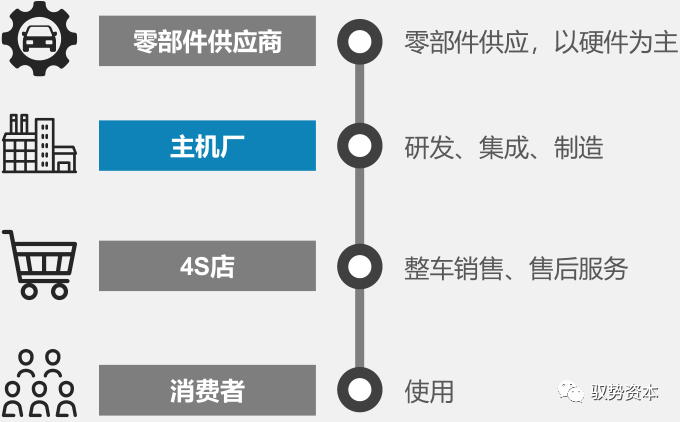

Traditional Automotive Vertical Supply Chain:

-

The traditional automotive supply chain presents a vertical chain structure, matching resources according to different responsibilities between upstream and downstream;

-

The traditional automotive supply chain is a ToB layered value transmission structure, ultimately delivering products to users through 4S stores by the OEM.

Integrated and Flat New Supply Ecosystem:

-

The OEMs will build an integrated and flat ecosystem, with blurred role boundaries and reduced intermediate links, forming a symbiotic and win-win relationship with suppliers;

-

The new automotive supply ecosystem takes user experience and needs as the driving force, extending the value cycle.

Consumer Electronics Chip Giants Seize the Next Decade,

Gain Market Advantage Through Mergers and Acquisitions

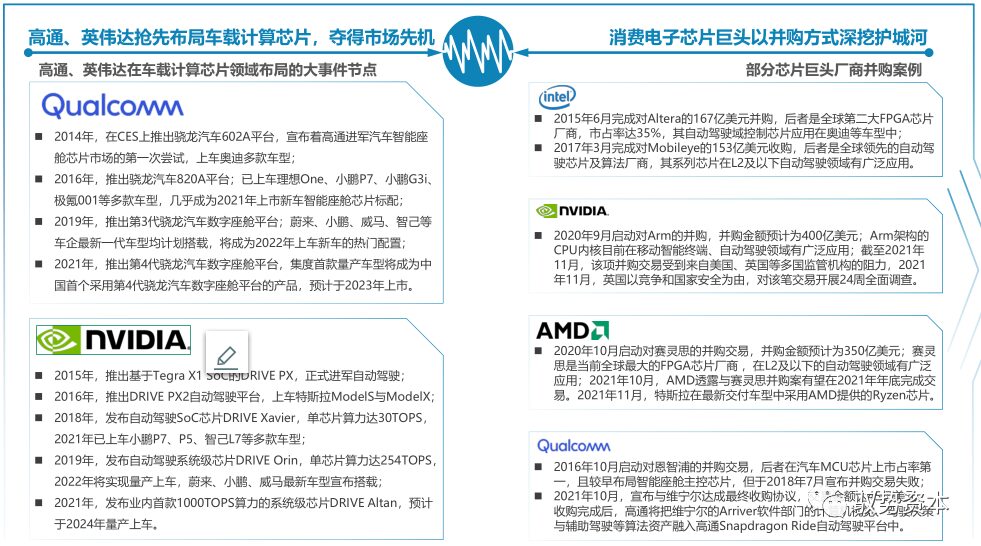

As the penetration rate approaches saturation, the smartphone market is slowly entering a bottleneck period. The high growth and high profits brought by the smartphone chip market are difficult to sustain, and consumer electronics chip giants urgently need to find new market opportunities to expand their profit margins. Giants always have a keen sense. Since 2014, Qualcomm and NVIDIA, two major consumer electronics chip giants, have taken the lead in the layout of smart automotive computing chips, gaining market advantage.

The chip market is always a winner-takes-all game, and manufacturers with more advantages in the early market will continue to gain momentum. Therefore, consumer electronics chip giants are competing to enhance their AI computing chip advantages through mergers and acquisitions, completing automotive chip capabilities and resources, and building and digging deep into the moat of automotive computing chips.

Analysis of Reasons for Consumer Electronics Chip Giants’ Entry:

-

The smartphone market has shifted from incremental to stock, with global smartphone shipments declining for three consecutive years, and the smartphone market is slowly entering a bottleneck period. The high growth and high profits of the smartphone chip market are difficult to maintain in the long term.

-

For consumer electronics chip giants, there is an urgent need to find new market opportunities to expand profit margins. The high computing power demand of smart cockpits and smart driving brings new market opportunities.

Analysis of Reasons for Mergers and Acquisitions by Consumer Electronics Chip Giants:

-

The chip industry relies on high R&D investment, achieving economies of scale through mass production to flatten costs; thus, manufacturers with more competitive advantages in the early market will gain cost advantages once mass production is achieved.

-

Consumer electronics chip giants have abundant financial advantages, enabling them to acquire excellent startups to continuously enhance their AI computing chip advantages and complete automotive chip capabilities and resources.

Emerging Chip Technology Companies Rapidly Rise Amidst Domestic Production Trends,

Actively Explore Industry Positioning and Build Ecosystems

Emerging chip technology companies represented by Horizon, Chipone Technology, and Black Sesame Intelligence are leveraging their AI computing advantages to enter the blue ocean market of automotive computing chips. The increasingly complex and unstable international relations have continuously exposed the pain points of “chip shortages”; the pandemic has brought a chip shortage crisis, creating a window for domestic substitution in automotive chips. Emerging chip technology companies are rapidly rising amid domestic production trends, gradually becoming the objects of cooperation sought by OEMs and Tier 1 suppliers in the automotive industry ecosystem, and have also grown into popular targets for capital in the capital markets, even unicorns.

As new players in the industry, emerging chip technology companies are actively exploring their industry positioning and building automotive industry ecosystems by providing a product service model of “chip + algorithm reference + toolchain”.

Reasons for the Rise of Emerging Chip Technology Companies:

-

The automotive computing chip market is in its early development stage, with few available products and a huge potential market; emerging chip technology companies are entering with algorithm and IP advantages;

-

Chip localization is a key part of the supply chain for critical components in smart vehicles;

-

The chip shortage crisis has made OEMs realize the importance of supply chain resilience, creating a window for domestic substitution of automotive chips.

Analysis of Industry Positioning of Emerging Chip Technology Companies:

-

Compared to traditional automotive chip manufacturers, emerging chip technology companies have greater advantages in AI algorithms and computing, with more comprehensive product and technical capabilities to provide a product service model of “chip + algorithm reference + toolchain”;

-

Emerging chip technology companies are closer to OEMs in the automotive industry supply ecosystem, transforming the traditional chain relationship among OEMs, Tier 1 suppliers, and chip manufacturers into a triangular relationship.

OEMs Seek Soul Habitat Through Self-research, Joint Ventures, Investments, and Collaborations

To Seek More Dominance

As OEMs continue to enhance their capabilities in self-research software algorithms, improving the efficiency of the combination of software and chips becomes the key for OEMs to enhance their technological and product advantages. The chip shortage crisis has heightened OEMs’ focus on the resilience of chip supply, hoping to establish a more direct and close cooperative relationship with chip manufacturers to improve the stability and controllability of their supply chains.

In the era of smart vehicles, OEMs are keen to find the best “soul habitat” for their software algorithms through self-research, joint ventures, investments, and collaborations, seeking more dominance in industry cooperation.

Analysis of Reasons for OEMs’ Layout in Automotive Chips:

-

In the era of smart vehicles, the value of software and chips is amplified. OEMs hope to grasp more R&D dominance by laying out automotive chips and improve their product and technological advantages by enhancing the efficiency of the combination of software and chips;

-

The increasingly complex international relations and the chip shortage crisis brought by the pandemic have made OEMs further focus on supply chain resilience. By laying out the automotive chip industry, OEMs can gain more say in the supply chain.

Four Ways for OEMs to Lay Out Automotive Chips:

-

Self-research method: Self-researching chips can fully combine with the algorithm needs of OEMs, fully exploring chip capabilities, but it requires certain technical accumulation and a large amount of resource investment, making it difficult; new force car manufacturers with leading advantages in software algorithms have more willingness for self-research;

-

Joint venture method: Establishing a chip company through joint ventures with mature chip manufacturers to jointly explore smart automotive computing chips, but joint venture products face difficulties in external supply and are difficult to form economies of scale;

-

Investment: Completing the layout of automotive chips through industrial investment, establishing deeper relationships with emerging chip technology companies;

-

Cooperation: Establishing strategic cooperation with emerging chip technology companies in their early development stages, daring to be the “first to eat crabs”.

The Blue Ocean Market for Automotive Computing Chips Attracts Multiple Parties, Forming

Four Major Camps, Reshaping the Automotive Chip Market Structure

The traditional automotive chip market has long been dominated by traditional automotive chip manufacturers such as Texas Instruments, NXP, Renesas, and STMicroelectronics, with few opportunities for outsiders to enter. The blue ocean market for automotive computing chips brought by the development of automotive intelligence attracts multiple parties to enter, forming four major camps of consumer electronics chip giants, emerging chip technology companies, traditional automotive chip manufacturers, and OEM self-research/joint venture chip manufacturers, reshuffling the automotive chip market structure.

In the field of intelligent driving computing chips, NVIDIA and Mobileye, backed by Intel, are in the first echelon, while Huawei HiSilicon, Horizon, and Qualcomm are in the second echelon, with an upward momentum that cannot be underestimated. In the field of intelligent cockpit computing chips, Qualcomm has an absolute leading advantage in product strength and high-end market share, followed closely by Samsung, Intel, and Renesas, while NXP and Texas Instruments dominate the mid-to-low-end vehicle market. In the Chinese market, emerging chip technology companies represented by Huawei HiSilicon, Horizon, and Chipone Technology are accelerating their entry into the market.

-

Consumer Electronics Chip Giants Camp: With deep chip technology reserves and abundant funds, they can support high R&D investments for advanced support and high computing power chips; they have a good software ecosystem; automotive computing chip technology is leading, with widespread applications in the mid-to-high-end vehicle and new force vehicle markets;

-

Emerging Chip Technology Companies Camp: They have unique product advantages in AI algorithms and computing, with more comprehensive capabilities compared to traditional manufacturers, providing a product service model of “chip + algorithm reference + technical support”; they still need to improve their automotive-grade and large-scale mass production capabilities, with products mainly applied to self-owned brand vehicles;

-

Traditional Automotive Chip Manufacturers Camp: They have an almost monopolistic position in the traditional automotive chip field, with a complete product line and deep relationships with Tier 1 and OEMs; they have deep technical capabilities to meet automotive-grade requirements, but lack advantages in AI computing chips; their products are mainly used in mid-to-low-end vehicles;

-

OEM Self-research/Joint Venture Chip Manufacturers Camp: Self-research/joint venture chips can achieve deep integration with OEMs’ algorithms, fully exploring chip computing capabilities, but their product openness is poor, and due to competitive relationships, joint venture chips are more likely to meet the needs of OEMs themselves, making it difficult to supply externally and achieve economies of scale.

The New Pattern of Automotive Chip Market Under the Influence of Computing Power

Tier 1’s Voice Power Weakens, Giants Actively Transform to “Self-Rescue”

The reshaping of the overall product definition of vehicles brought by software-defined vehicles and the transformation of OEM software organization forms are driving changes in the cooperative relationship among OEMs, Tier 1 suppliers, and chip manufacturers in the new pattern of the automotive chip market. OEMs hope to gain more dominance in product definition and development by directly communicating and cooperating with chip manufacturers.

Under the new cooperation model, the voice power of Tier 1, which previously held a high dominance in the supply chain, is gradually weakening, and the excess profits brought by strong supply chain voice power are gradually disappearing. Under pressure, international giants like Bosch are accelerating their own intelligent software and hardware technology and product construction, actively transforming to “self-rescue”.

Traditional Software Organization Forms of OEMs:

-

Presenting a siloed software and hardware development and procurement model divided by domain; individual software functions are simple and singular, and software is only part of the distributed ECU engineering development, with software costs not separately priced but considered part of the hardware system costs.

The Traditional OEM-Tier 1-Chip Manufacturer Chain Cooperation Model:

-

OEMs are responsible for the overall vehicle architecture and product definition, as well as the integration and application work of component systems coupled with software and hardware from Tier 1; they are responsible for the final vehicle product; they do not directly communicate with chip manufacturers.

-

Tier 1 custom-produces components according to vehicle manufacturers’ needs, including traditional sensors, black-box ECUs, actuators, etc., relying on strong integration capabilities and standardized product production capabilities, holding strong voice and pricing power.

-

Chip manufacturers are generally positioned as Tier 2 or even further down the supply chain, rarely cooperating directly with OEMs, generally providing chip hardware and related development software support to upstream Tier 1 suppliers.

Traditional Tier 1 Business Model:

-

Responsible for software and hardware integration, delivering software in a black box format to OEMs, holding high decision-making power over Tier 2 procurement, with low transparency in material cost lists to OEMs, and a profit level higher than that of ordinary suppliers.

International Tier 1 Transformation Representative Case: Bosch.

-

Facing multi-faceted competitive pressure in the era of smart vehicles, Bosch, as the world’s largest automotive Tier 1 supplier, is accelerating its own intelligent software and hardware technology and product construction.

-

In January 2021, Bosch officially established the Intelligent Driving and Control Division, which will unify to provide software-intensive systems for future automotive architecture, with Bosch investing 3 billion euros annually in automotive software technology R&D.

New Software Organization Forms of OEMs:

-

The internal development and procurement chain of OEMs is divided into: software design and integration, hardware design and integration, hardware manufacturing; the organization form of software development and procurement is increasingly cross-domain and centralized, with software functions becoming more complex; software budgets are independent of vehicle projects.

The New OEM-Tier 1-Chip Manufacturer Network Cooperation Model:

-

OEMs are responsible for overall vehicle architecture and definition, leading most application layer algorithms and software development and integration work apart from the basic computing platform and basic software; directly participating in the selection and procurement of components such as computing chips, basic software, and functional applications.

-

OEMs require Tier 1 to open the underlying code and data algorithms of products through a service-oriented SOA architecture, deploying uniformly across various domains within the vehicle, gradually