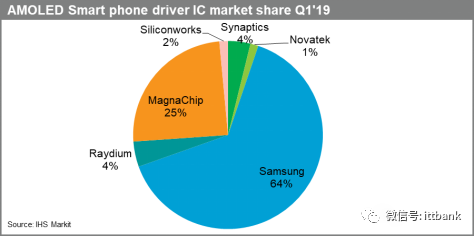

Currently, Samsung Display dominates the supply of AMOLED displays, but it does not allow its driver chip suppliers, Samsung Semiconductor and MagnaChip, to release AMOLED driver chips to other panel manufacturers. As the capacity of Chinese AMOLED panels grows, non-Korean driver chip manufacturers are beginning to emerge. Raydium, Novatek, and MediaTek are the major driver chip suppliers for Chinese AMOLED panel manufacturers. For example, starting in 2018, BOE used Novatek’s driver chips to supply the Huawei Mate 20 Pro model, and in the first quarter of 2019, BOE used MediaTek’s driver chips to supply the Huawei P30 Pro model. Raydium has also maintained a significant market share alongside Huayi and Visionox.

Previously, Nubia released the Z20 model, featuring dual-sided flexible screens, supplied by BOE, with sizes of 6.42” FHD+ and 5.1” HD+. The 6.42” FHD+ uses driver chips from Beijing Yiswei ESWIN, while the 5.1” HD+ uses driver chips from Raydium. Beijing Yiswei ESWIN is a mainland China driver chip design company, with strategic investment from BOE, focusing on semiconductors and materials.

In addition to Beijing Yiswei ESWIN, there are other driver chip design companies in mainland China developing AMOLED driver chips, notably Zhongying Electronics (subsidiary Xinying Technology), Beijing Jichuang Northern, Geko Micro, Xinxiang Micro, Jingmen Technology, Shenzhen Yunying Valley, Shenzhen Jidis, and Guangdong Shenghe Micro.

Zhongying Electronics (subsidiary Xinying Technology)

Zhongying Electronics collaborated with Huayi Optoelectronics to develop AMOLED driver chips as early as 2015, achieving the first domestic mass production of AMOLED driver chips. Xinying Technology Co., Ltd. was established in 2016, invested by Zhongying Electronics, and originated from the display driver chip R&D team under Zhongying Electronics, focusing on the R&D and design of display driver chips.

Since 2000, they have developed multiple STN and TFT LCD driver chips through commissioned R&D from 2004 to 2016, they launched several PM-OLED display driver chips for Kunshan Visionox, Rebao, Zhijing, and Xinyi. The R&D team of Xinying Technology began designing AMOLED display driver chips in 2011 and gradually launched HD and FHD hard screen AMOLED display driver chips in 2013, starting mass production in December 2014. From 2011 to 2016, they customized and developed multiple AMOLED display driver chips for leading manufacturers like Huayi Optoelectronics and BOE. Currently, Xinying Technology has achieved mass production of AMOLED mobile panel driver chips and is one of the main PMOLED driver chip suppliers globally.

Beijing Jichuang Northern Technology Co., Ltd.

In November 2016, Jichuang Northern acquired iML, a power management IC design company under Exar. After integrating with iML, Jichuang Northern’s solution portfolio in the display panel field will be further enriched. For twelve years, Jichuang has focused on display ICs, maintaining a leading position in LED display ICs and ranking among the top for display power in domestic panel manufacturers. Since last year, TV and monitor-sized display driver ICs have gradually increased in volume, with explosive growth expected in the second half of this year following breakthroughs in TDDI brand customers. Jichuang Northern’s display-related layout is solid and comprehensive, with long-term investments and efforts entering a harvest period. Looking ahead, Jichuang Northern continues to invest and follow new technologies and directions, preparing for next-generation display trends like silicon-based OLED and Micro LED.

Geko Microelectronics (Shanghai) Co., Ltd.

Geko Micro’s main business includes the R&D, design, and sales of CMOS image sensors and display driver chips. According to research data from Frost & Sullivan, based on shipment volume in 2019, the company ranked second among global CMOS image sensor suppliers and second among LCD display driver chip suppliers in the Chinese market.

In addition to its well-known CIS business, Geko Micro’s display driver business has also propelled the company’s growth. According to its prospectus, the display driver chip products employ self-developed designs without external components, image compression algorithms, and other core technologies, significantly reducing the number of external components used in display modules, minimizing chip area, and highlighting cost-performance advantages. Additionally, the issuer’s original COF-Like design achieves simultaneous improvements in frame rate and screen ratio at a lower cost. Currently, the issuer is actively developing TDDI chips, AMOLED driver chips, and other products, aiming for further expansion of its product line in the future.

Xinxiang Microelectronics (Shanghai) Co., Ltd.

Founded in 2005, Xinxiang has become a leading domestic design company in the LCD driver chip industry, with products successfully integrated into the supply chains of domestic G5, G6, and G8 panel production lines, achieving over 20KK/month in various IC shipments. Its products include TFT-LCD, LTPS, AMOLED driver chips, TCON, fingerprint recognition ICs, etc., widely used in TVs, monitors, notebooks, tablets, and smartphones. Xinxiang has established a complete industrial chain from wafer production to packaging and testing, forming strategic partnerships with upstream and downstream companies such as BOE, Tianma, Hisense, SMIC, Huahong NEC, TSMC, and Nanjing Maosong Technology. Xinxiang will continue to work on building a more efficient and convenient customer service system to support the localization of high-generation driver chips.

Jingmen Technology Co., Ltd. (Solomon)

In 2013, Visionox and Jingmen Technology successfully developed the first AMOLED driver chip in mainland China. Jingmen Technology acquired part of Microchip’s technology along with maXTouch semiconductor products in November 2016. Currently, Jingmen Technology’s PMOLED products hold over 50% market share, making it a leader in the segmented market.

Beijing Yiswei Computing Technology Co., Ltd.

Founded on September 24, 2019, Beijing Yiswei primarily produces DDIC for OLED panels. DDIC is a key component of OLED, controlling the pixel to enhance image quality. DDICs are widely used in OLED TVs, smartphones, smartwatches, tablets, etc. Yiswei’s legal representative is Wang Dongsheng, a leading figure in China’s semiconductor industry, who founded BOE in 1993, leading it to become a global leader in the semiconductor display industry, with over a quarter of the world’s displays coming from BOE. Previously, according to the South Korean Times, Chang Won-kie, former president of Samsung Electronics’ LCD panel division, joined Yiswei as vice chairman. Industry observers believe that with Chang’s nearly 40 years of experience at Samsung, his joining Yiswei will strengthen China’s OLED capabilities.

Shenzhen Yunying Valley Technology Co., Ltd.

Founded in May 2012, Shenzhen Yunying Valley focuses on the R&D of display technology, IP licensing, and the production and sales of display driver chips/circuit boards. Currently, the company’s timing control chips (TCON), AMOLED driver chips, and silicon-based OLED are under development, targeting consumer electronics markets such as smartphones, laptops, TVs, and AR/VR. The company has attracted investments from several VCs and leading companies in the semiconductor display field, rapidly expanding its business scale.

Shenzhen Jidis Electronic Technology Co., Ltd.

Founded in July 2015, Shenzhen Jidis focuses on the design and R&D of next-generation display control chips, being a leader in display control chips for flexible smartphones AMOLED, notebook TED, and AR (augmented reality) glasses silicon-based OLED light source chips. The company possesses internationally leading smart display chip technology and is one of the earliest teams to develop commercial AMOLED display control chips in China. In the second quarter of 2016, they were the first to mass-produce HD rigid screen AMOLED display control chips; in September 2018, they partnered with leading domestic foundry SMIC to officially mass-produce 40nm QHD flexible AMOLED smartphone panel driver chips, the only mass-produced flexible AMOLED display control chip in China.

Guangdong Shenghe Microelectronics Co., Ltd.

Guangdong Shenghe Microelectronics is also a high-tech enterprise specializing in the R&D, consulting, and service of AMOLED driver chip technology. Its products mainly include AMOLED driver chips for smart wearables and mobile phones. In March 2018, it officially settled in Zhaoqing, Guangdong, with the first batch of 25 experts starting work in May. In July of the same year, the first wearable driver chip successfully passed reliability and quality testing. Subsequently, mobile driver chip series products were produced and validated by end customers. In 2019, Shenghe Microelectronics achieved mass production of the SH880X series mobile driver chips and obtained ISO9000 and ISO14000 certifications.

Shenghe Microelectronics employees average over 19 years of experience in the display industry, with the team responsible for numerous LCD/OLED product customization projects, bringing rich practical experience. Shenghe Microelectronics is expanding its technical capabilities in line with the future display industry through the small entry of OLED drivers, fully promoting the development of the domestic OLED driver chip industry.

———— / END / ————

Note:Please correct any omissions or errors, contact us as follows:

Submission Email: [email protected]

ITTBANK Customer Service Hotline: 25839333

Disclaimer: Please indicate the source when reprinting!