The most important information before the market opens:

The central bank: firmly supports the Central Huijin Investment Ltd. to increase its holdings in stock market index funds, and will provide sufficient re-lending support to Central Huijin when necessary, resolutely maintaining the stable operation of the capital market.

The big boss announces the next move!

Yesterday, the US stock market was similar, opening with a significant drop, but a rumor helped pull the index up. However, I believe this rumor is definitely not baseless; opinions within Trump’s cabinet are starting to diverge. At least, Mr. Ma’s opinion on this matter is definitely not in favor, as he directly clashed with trade advisors online. Speaking of “reciprocal tariffs,” it completely misrepresents the concept, absurdly pulling up an Excel sheet to calculate the corresponding tax rates. After the White House issued a denial, the index quickly fell back, but it did not break the low point, indicating that there is still some spontaneous market strength. A big player working in the US said that at this position, many people on the street are eager to try, not because they think they can win this time, but because the logic is that he will eventually have to admit his mistakes. This is why everyone believes in the rumor of a 90-day pause. The big player said that traders next to him think they should sell CDs, as Trump can last at most until October.

As ordinary people, the pressure on the American public is immense. There have been news reports on Weibo about people rushing to supermarkets; at first, I didn’t believe it, but the big player told me it was true. Wow, what era is this? I believe that many cargo ships departing from China and Europe have already stopped sailing because they can’t make the customs deadline on the 9th. Those who managed to get in before are already in, while those who didn’t are just waiting to see what happens. Negotiations are needed between governments, but businesses need them even more. Suppliers will reconsider pricing, and discussions about tariff burdens with importers will also take place. If they can’t reach an agreement, they might just hold off for a while. We can only let the bullets fly for a bit. Our problem lies in economic growth and unemployment, while theirs is that there might really be no goods in supermarkets. The people of Shanghai should have a deep impression of this; when they see empty shelves, the psychological pressure and anxiety are palpable. If the community group buying didn’t keep up back then, how long could Shanghai hold out? Their problems can’t be solved by group buying.

It is precisely because of these reasons that the Fed’s statement last night was hawkish, contrary to what our mother just said. They are aware of the public’s anxiety and still want to implement the 2% inflation target. To put it bluntly, the inflation pressure is enormous, and lowering interest rates is not feasible. Last night, the yield on the 10-year US Treasury rose by 14 basis points.

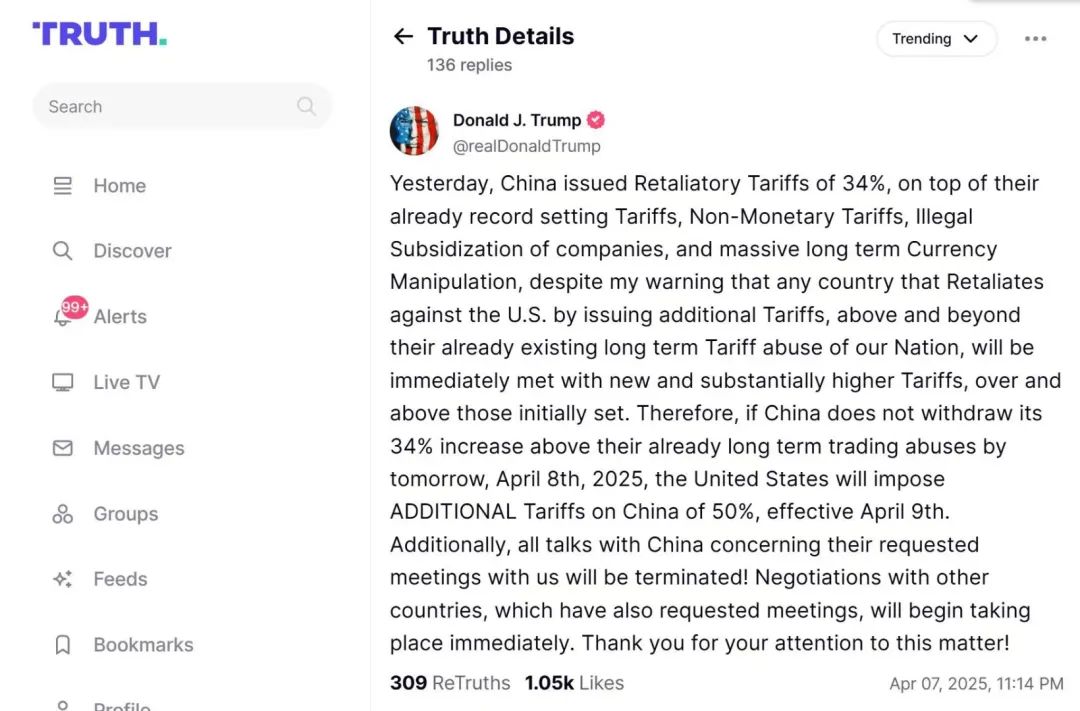

At 11:14, Trump tweeted again about governing the country.

If we do not withdraw the 34% today, we will add another 50% tomorrow. This decision itself is of no real use. The first two shots have already hit, and adding another shot is purely venting anger. The key point is in the last sentence: there will be no talks with China, but negotiations with other countries will start immediately. Well, the strategy of forming alliances, as learned from our ancestors, has begun.

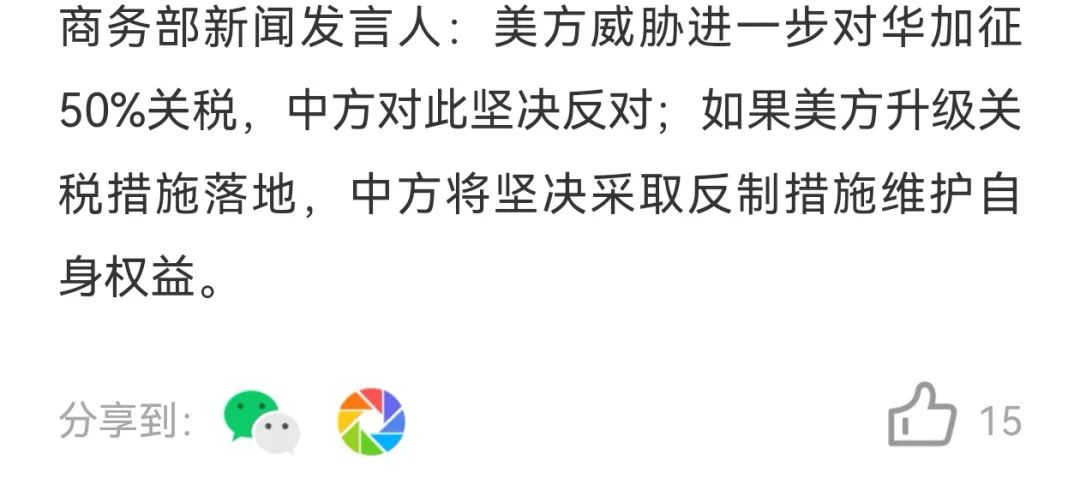

The focus is also on the last point: China will resolutely take countermeasures. It is estimated that the old routine will continue; whatever you add, I will add the same. Following the last approach, besides this, there are other measures. The only suspense is whether we will release the service trade card, which has been planned for more than half a year. I have always hoped that there would be policies to hedge the real economy, but it seems that now it might be a case of letting capital belong to capital and the real economy belong to the real economy.

The focus is also on the last point: China will resolutely take countermeasures. It is estimated that the old routine will continue; whatever you add, I will add the same. Following the last approach, besides this, there are other measures. The only suspense is whether we will release the service trade card, which has been planned for more than half a year. I have always hoped that there would be policies to hedge the real economy, but it seems that now it might be a case of letting capital belong to capital and the real economy belong to the real economy.