Click the card below to follow, to prevent losing contact!

Add Uncle Ji’s private WeChat teufelsy, or QQ 24621756 with a note fan to join the private fan group

(Click the lower left “Read the original text” for more exciting columns)

Author’s Bio: A former naval veteran from the diplomatic front, has published works such as “Sanqu Youxi” and others. On the 24th, the Financial Times reported that the U.S. is pressuring Malaysia to strengthen regulations on high-end chips and other semiconductors to prevent AI chips from flowing into China.Domestic media cited this report, stating that the U.S. suspects many chips have ended up in the hands of Chinese users, although it did not specify who is smuggling NVIDIA’s high-end chips. However, the U.S. is now pressuring Malaysia, claiming that the country’s market behavior violates U.S. export regulations, clearly targeting the Malaysians.Why is the U.S. focusing specifically on Malaysia?Because among its Asian peers, Malaysia has a solid foundation, having once been one of the Four Asian Tigers, with rich mineral resources and a highly advanced manufacturing sector, particularly in electronics and petrochemicals, second only to China, and closely linked to Singapore’s industrial chain.Manufacturing accounts for one-third of its GDP, especially in satellite electronic system manufacturing, which is highly competitive globally.Another unique aspect is that Malaysians tend to be more stable in character, with 23% being ethnic Chinese, and they rarely switch sides between China and the U.S., making them relatively well-connected.Due to its high-end manufacturing in satellite computers and modular communication, Malaysia has become the fastest-growing market for data centers globally, with a significant demand for high-performance chips.Tech giants like NVIDIA, Microsoft, and ByteDance have established a presence in Johor, southern Malaysia, with investments exceeding $25 billion from these companies alone.The U.S. does not restrict their purchases but will track the flow of high-end chips, which is why they are focusing on Malaysia.Many people may not know that Malaysia is the sixth-largest semiconductor exporter in the world, with 23% of U.S. chips produced locally.For example,

On the 24th, the Financial Times reported that the U.S. is pressuring Malaysia to strengthen regulations on high-end chips and other semiconductors to prevent AI chips from flowing into China.Domestic media cited this report, stating that the U.S. suspects many chips have ended up in the hands of Chinese users, although it did not specify who is smuggling NVIDIA’s high-end chips. However, the U.S. is now pressuring Malaysia, claiming that the country’s market behavior violates U.S. export regulations, clearly targeting the Malaysians.Why is the U.S. focusing specifically on Malaysia?Because among its Asian peers, Malaysia has a solid foundation, having once been one of the Four Asian Tigers, with rich mineral resources and a highly advanced manufacturing sector, particularly in electronics and petrochemicals, second only to China, and closely linked to Singapore’s industrial chain.Manufacturing accounts for one-third of its GDP, especially in satellite electronic system manufacturing, which is highly competitive globally.Another unique aspect is that Malaysians tend to be more stable in character, with 23% being ethnic Chinese, and they rarely switch sides between China and the U.S., making them relatively well-connected.Due to its high-end manufacturing in satellite computers and modular communication, Malaysia has become the fastest-growing market for data centers globally, with a significant demand for high-performance chips.Tech giants like NVIDIA, Microsoft, and ByteDance have established a presence in Johor, southern Malaysia, with investments exceeding $25 billion from these companies alone.The U.S. does not restrict their purchases but will track the flow of high-end chips, which is why they are focusing on Malaysia.Many people may not know that Malaysia is the sixth-largest semiconductor exporter in the world, with 23% of U.S. chips produced locally.For example,

Infineon’s Kulim plant in Malaysia is the world’s largest power chip factory, specializing in silicon carbide chips;

Outsourcing’s Kulim plant is set to begin production by the end of 2024, specifically providing high-end semiconductor packaging substrates for AMD chips;

Companies like ASE, Amkor, Tongfu Microelectronics, Huada Semiconductor, Intel, Micron, Texas Instruments, STMicroelectronics, and NXP have all established packaging and testing factories in the Kulim Hi-Tech Park in Kedah.

Therefore, once the U.S. detects any suspicious activity, the Malaysians are the prime suspects.How did the U.S. come to suspect this?They suspect that some chips were transferred to another ship and have requested Malaysians to monitor the chips being shipped to Malaysia to ensure they reach the data centers.It’s not that Malaysians are using trade loopholes for smuggling; rather, the U.S. is simply not at ease, even more so than with their F-16 fighter jet customers.

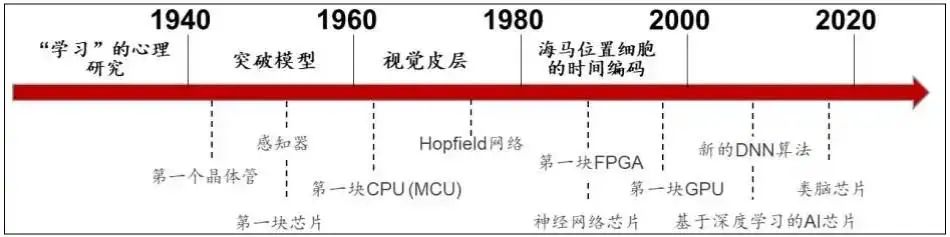

History of AI Computing Power ChipsAs early as early March, Malaysia was already under U.S. scrutiny, reportedly a batch of servers worth $390 million was sold to China via Malaysia. According to reports at the time, Singapore police intercepted this transaction, conducting raids at 22 locations and arresting 9 individuals, 3 of whom were prosecuted for allegedly violating regulations on the sale of servers containing NVIDIA chips.However, the report did not disclose the nationalities of these 3 individuals, only stating that Singapore requested assistance from the U.S. and Malaysia to investigate the flow of these servers.Malaysia’s Minister of Industry, Zafrul, stated that no evidence was found of these chips being sent to data centers, but he also did not know where they went. The U.S. suspects that these NVIDIA chips may have taken a detour in Malaysia and possibly entered the Chinese market.The U.S. is also unclear on which link in the chain went wrong, as NVIDIA, foundries, suppliers, trade agents, shipping, and buyers are all involved in the distribution of chips and servers, all of which are suspect. Who knows which link failed?Thus, the U.S. can only pressure the Malaysian government. Another reason, which I speculate, is that Malaysia’s semiconductor production capacity is too large, and neighboring Singapore is a super distributor, with 25% of the world’s chips sold by Singapore. One is responsible for production, and the other for sales, which is almost catching up with the performance of U.S. domestic distributors.Of course, the process is very complex, involving key areas laid out by U.S. companies.But it is also possible that the U.S. is using this as an opportunity to suppress these two, as any link in the semiconductor chain is something the U.S. government is trying to control at all costs.Since China publicly unveiled the AI model DeepSeek, the U.S. has gone crazy, with the Trump administration fully blocking high-performance chips to the Chinese market, even enacting various bizarre laws prohibiting sales and usage.Conversely, relying on smuggling a few chips from Southeast Asia is not very effective; at most, it would only be used by medium-level tech companies, and there is a risk of remote locking. The U.S. has often left backdoors in electronic devices, which poses significant risks.It’s like ten years ago when some people brought back a few gray market phones from Hong Kong; aside from making a little money, it didn’t really affect the market structure and didn’t significantly enhance personal usage value.Whether in a tech war or breaking through in tech competition, relying on smuggling a few chips is certainly not very useful; the only way is to rely on self-research and development.

Another reason, which I speculate, is that Malaysia’s semiconductor production capacity is too large, and neighboring Singapore is a super distributor, with 25% of the world’s chips sold by Singapore. One is responsible for production, and the other for sales, which is almost catching up with the performance of U.S. domestic distributors.Of course, the process is very complex, involving key areas laid out by U.S. companies.But it is also possible that the U.S. is using this as an opportunity to suppress these two, as any link in the semiconductor chain is something the U.S. government is trying to control at all costs.Since China publicly unveiled the AI model DeepSeek, the U.S. has gone crazy, with the Trump administration fully blocking high-performance chips to the Chinese market, even enacting various bizarre laws prohibiting sales and usage.Conversely, relying on smuggling a few chips from Southeast Asia is not very effective; at most, it would only be used by medium-level tech companies, and there is a risk of remote locking. The U.S. has often left backdoors in electronic devices, which poses significant risks.It’s like ten years ago when some people brought back a few gray market phones from Hong Kong; aside from making a little money, it didn’t really affect the market structure and didn’t significantly enhance personal usage value.Whether in a tech war or breaking through in tech competition, relying on smuggling a few chips is certainly not very useful; the only way is to rely on self-research and development. If we want to engage in supercomputing and large-scale AI training research activities, we must build our own hardware and software platforms.Currently, our domestic companies have mastered the mass production technology of 14nm chips, and the 7nm process is in the risk trial production stage. SMIC has completed wafer verification, and leading companies are tackling the technical challenges of advanced processes of 5nm and below.We cannot afford to wait idly; we are also exploring other technological routes, innovating substrate materials, and taking the lead in developing gallium nitride chips in the third-generation semiconductor field, while accelerating the research and development of EUV lithography machines.

If we want to engage in supercomputing and large-scale AI training research activities, we must build our own hardware and software platforms.Currently, our domestic companies have mastered the mass production technology of 14nm chips, and the 7nm process is in the risk trial production stage. SMIC has completed wafer verification, and leading companies are tackling the technical challenges of advanced processes of 5nm and below.We cannot afford to wait idly; we are also exploring other technological routes, innovating substrate materials, and taking the lead in developing gallium nitride chips in the third-generation semiconductor field, while accelerating the research and development of EUV lithography machines.

Appreciation