Click the top leftsmall earphonescan listen while watching! Welcometo follow and communicate,contact informationsee the end of the article!The space changes because of“you”! Move your fingerslike and share!

The Humanoid Robot Industry Chain

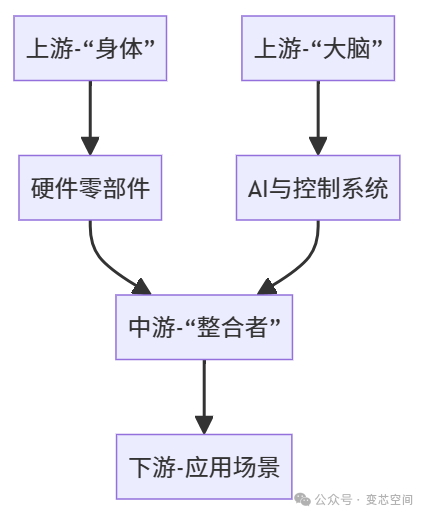

1. Industry Chain Overview: Three-Tier Structure and Core Modules

(1) Basic Infrastructure

Morgan Stanley Model + Industry Consensus

(2) Core Components and Value Proportions of Each Layer

| Level | Core Module | Technical Elements | Cost Proportion | Representative Companies |

|---|---|---|---|---|

| Upstream – Body | Bionic Joint Module | Harmonic Reducer + Frameless Torque Motor + Planetary Roller Screw | 40%-45% | Greentec Harmonic (China), Harmonic Drive (Japan) |

| Dexterous Hand System | Hollow Cup Motor + Micro Planetary Reducer | 8%-10% | Minzhi Electric (China), Maxon (Switzerland) | |

| Sensing Sensors | Force/Visual/Lidar | 12%-15% | Orbbec (3D Vision), Hesai Technology (Lidar) | |

| Energy System | High Energy Density Battery | 10%-12% | CATL (China), LG Energy (Korea) | |

| Upstream – Brain | Decision System | Generative AI Model + Multimodal Interaction Algorithm | 18%-20% | NVIDIA (USA), Baidu (China) |

| Control Center | Motion Control Chip + Real-Time Operating System | 10%-12% | Synopsys (USA), Huawei Ascend (China) | |

| Simulation Platform | Digital Twin + Virtual Training Environment | 5%-8% | Microsoft (USA), Tencent (China) | |

| Midstream – Integrators | Body Manufacturing | Structural Design + System Integration | 15%-20% | Tesla (USA), UBTECH (China) |

| Motion Control | Whole Body Coordination Algorithm + Dynamic Balance | 8%-10% | Boston Dynamics (USA), Yushun Technology (China) | |

| Downstream Applications | Industrial Scenarios | Automotive Manufacturing/Electronic Assembly | – | KUKA (Germany), Siasun Robot (China) |

| Consumer Scenarios | Home Services/Education Assistance | – | Xiaomi CyberOne (China), Sony (Japan) |

Note: Cost proportions are estimated for the mass production phase, currently the brain module accounts for over 30% during the R&D phase

2. Technology Chain Analysis: Hardware and Software Co-evolution

(1) Hardware Innovation Focus

1. Joint Drive Revolution

- Mechatronic Moduleintegrates reducer + motor + encoder, shortening the transmission chain (Tesla Optimus solution)

- Flexible Actuatoruses shape memory alloy to achieve muscle-like contraction (in laboratory stage)

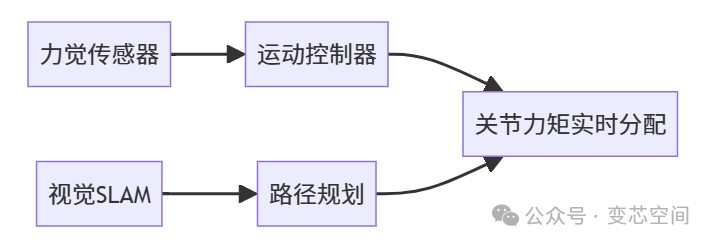

2. Perception-Control Closed Loop

Pain Point: Multi-sensor temporal synchronization error must be controlled within 0.1ms

(2) Software System Breakthroughs

| Technology Stack | Core Breakthrough | Industrialization Progress |

|---|---|---|

| AI Training Framework | Virtual environment million times trial and error learning | Tesla has applied |

| Multimodal Interaction | Voice + Gesture + Eye Movement Coordination | UBTECH Walker X equipped |

| Autonomous Decision Making | Large model-driven task decomposition | GPT-5 integration testing |

Key Technical Indicator Comparison

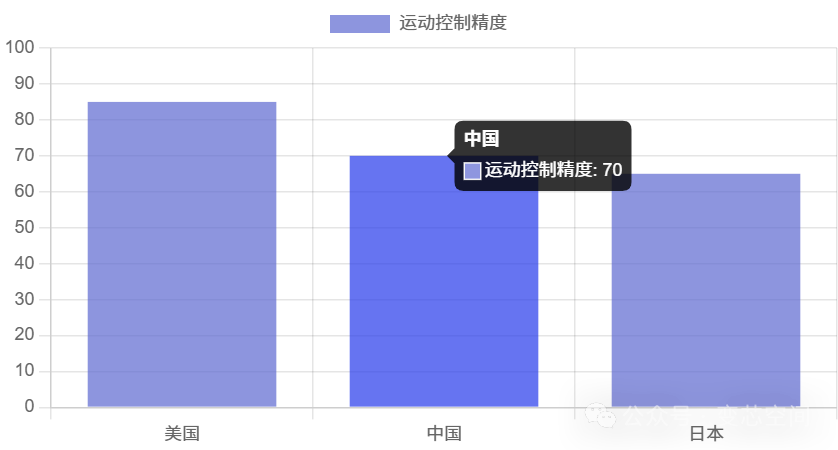

3. Regional Competitive Landscape: US-China Bipolar Dominance

(1) Comparison of Industrial Endowments in Three Countries

| Dimension | US Advantages | China Advantages | Japan/Europe Positioning |

|---|---|---|---|

| Brain Field | Basic AI Models (OpenAI), Chips (NVIDIA) | Scenario Data (1.4 billion population), AI Applications | Controllers (FANUC) |

| Body Field | High-end Sensors (Boston Dynamics) | Complete Supply Chain (Reducer/Motor/Battery) | Precision Reducers (Harmonic) |

| Integration Capability | System Innovation (Tesla Optimus) | Mass Production Cost Control (UBTECH unit price < $100,000) | Industrial Reliability (KUKA) |

(2) China’s Supply Chain Breakthrough Path

1. Domestic Hardware Substitution

- Harmonic ReducersGreentec Harmonic market share35% (global)

- Torque MotorsStep Science breaks overseas monopoly

2. Software Ecosystem Development

- Huawei Ascend AI Chipsadapted for robot OS

- Baidu PaddlePaddleopen-source motion control algorithms

4. Industrialization Process: Mass Production Timeline and Cost Curve

(1) Commercialization Milestones

2024-2025

Engineering Verification

Joint module cost < $2,000

2026-2028

Industrial Mass Production

Whole machine cost < $50,000

2030-2035

Consumer-Level Popularization

Home robot unit price < $5,000

(2) Cost Reduction Driving Factors

Cost reduction formula:

C_t = C_0 × (1 – α)^t × e^(-βS)

C₀: Initial cost (approximately $100,000 in 2025)α: Learning rate (hardware 15%/year, software 30%/year)β: Scale effect coefficient (25% cost reduction for every 100,000 units)S: Cumulative production volume

Forecast: When production exceeds1 million units, the whole machine cost will drop to $20,000

5. Core Contradictions and Breakthrough Paths

(1)Current Industry Pain Points

| Contradiction Type | Specific Performance | Constraint Level |

|---|---|---|

| Technical Gap | AI decision-making and motion control are disconnected (“brain-hand desynchronization”) | ★★★★ |

| Lack of Standards | Non-unified interface protocols increase integration difficulty | ★★★☆ |

| Cost Bottleneck | Precision reducers account for 18% of the total machine cost | ★★★★ |

(2) Breakthrough Strategies

1. Technology Integration

Establish a “neural-motion” joint training framework (NVIDIA + Boston Dynamics collaboration model)

2. Ecological Collaboration

Hardware: Promote standardization of joint modules (ISO 23218 in progress)Software: Build open-source robot middleware (ROS 3.0)

3. Policy Empowerment

China’s Ministry of Industry and Information Technology: EstablishHumanoid Robot Innovation Center (2024)US Department of Defense: FundDual-use Technology Development (2025)

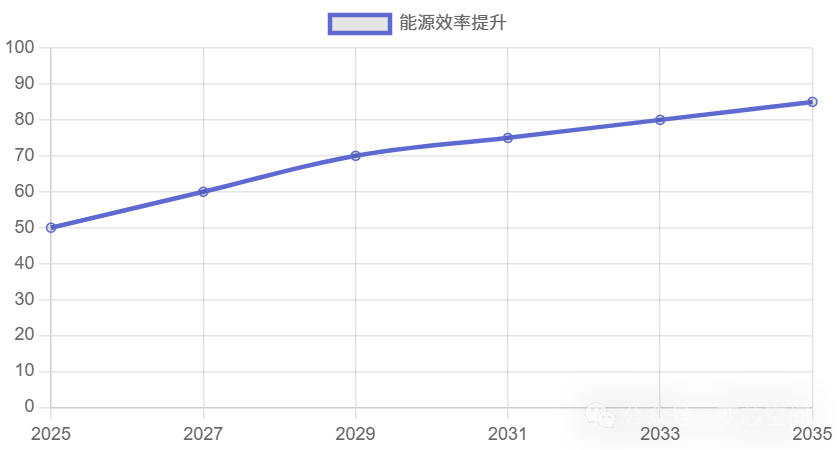

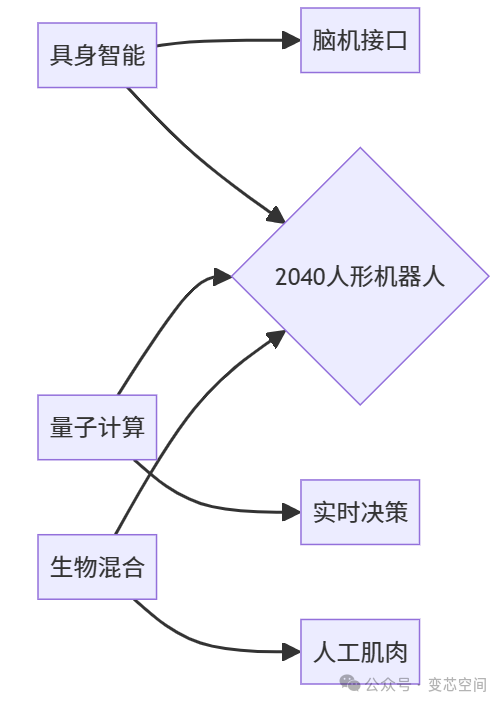

6. Evolution Trends in the Next Decade

(1)Technology Integration Directions

(2) Market Growth Forecast

| Application Field | 2030 Scale (Billion USD) | CAGR | Driving Factors |

|---|---|---|---|

| Industrial Manufacturing | 620 | 38% | Flexible production demand in automotive factories |

| Medical Rehabilitation | 280 | 45% | Aging population drives nursing robots |

| Home Services | 410 | 52% | Middle-class household penetration exceeds 10% |

| Total | 1,310 | 42% | – |

Note: Goldman Sachs predicts a market space of$154 billion by 2035 (ideal scenario)

Value High Ground of the Industry Chain

The ultimate competition of humanoid robots will focus on three major high grounds:

- Neuromorphic Chipsachieving energy efficiency ratio > 100 TOPS/W (NVIDIA Thor architecture)

- Ultra-Precision TransmissionReducer lifespan exceeds 20,000 hours (Japan Harmonic patent)

- Collective Intelligence CloudMillions of robots collaborate in learning (Tencent Cloud Robot Platform)

As Morgan Stanley asserts:

“Whoever controls the joints controls the costs, whoever controls AI sets the standards, and whoever controls the scenarios masters the ecology”

— In the next decade, 3-5 trillion-dollar robot companies will emerge globally.

Health means self-care and independence, doing everything possible to allow the elderly to maintain a normal living state.– Bianxin® Space | Smart Health and Elderly Care Services –

The space changes because of “you”!

Contact “Bianxin® Space”

Cooperation Communication: Please add zr18620222480

Partner Recruitment: 1638079312 (WeChat ID same)

Supply Links:Please send to [email protected]