“LCD will never be a slave!”

Whenever I recommend OLED products to friends, they always reply with this line. This not only expresses their persistence towards LCD but also indirectly reflects a fact: LCD has completed its historical mission and is gradually being replaced by more advanced display technologies like OLED.

The use of organic light-emitting materials is where LCD and OLED diverge, and it is for this reason that these two technologies have been labeled as traditional and revolutionary, respectively.

LCD and OLED have been battling in the television market for a long time, but amidst their back-and-forth skirmishes, QLED, stacked screen technology, and even the future-oriented MicroLED technology have entered the fray, leading to a dazzling display technology market that has entered the most prosperous era in history.

So, under the stimulation of various new technologies, will these technologies unify the market like Qin Shi Huang, or will they maintain the current fragmented situation? For users, how should they choose the best solution?

Technology has similarities and differences

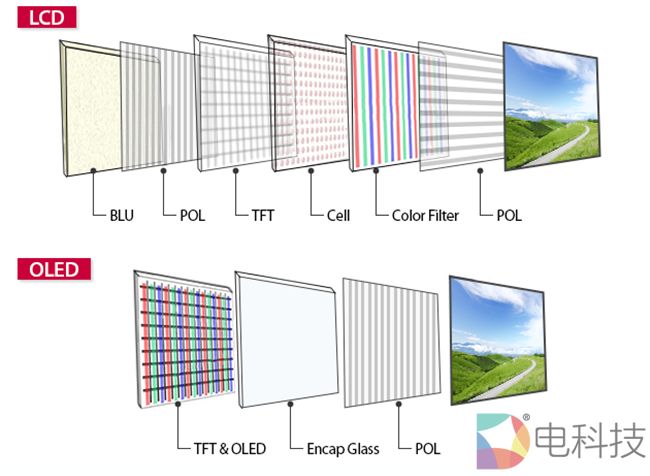

We are very familiar with LCD televisions, which have already entered thousands of households. In simple terms, its principle is based on a backlight layer, which changes the arrangement state of liquid crystals by applying voltage, combined with polarizers to output light, and using color filters to present different colors.

OLED is called revolutionary because it uses self-emitting materials, thus eliminating the need for the traditional backlight layer and liquid crystal layer of LCDs, allowing OLED TVs to be thinner. Additionally, OLED’s single pixel emission allows it to turn off directly when displaying black, achieving a higher contrast ratio.

MicroLED shares a lineage with LCD in terms of materials, but further miniaturizes the backlight LEDs (light-emitting diodes) of LCD to the micron level, connecting these MicroLEDs to a substrate and achieving self-emission through driving circuits. MicroLED also does not require a liquid crystal layer, thus providing greater flexibility in terms of thinness.

QLED’s innovation over traditional LCD lies in the introduction of new quantum dot materials that can self-emit light based on photonic and electronic effects, which is somewhat similar to OLED. However, due to the significant impact of heat and moisture on quantum dot materials, current processes struggle to achieve mature electroluminescence. Therefore, QLED TVs primarily apply quantum dot materials to quantum dot films, using backlight-induced photonic emission to enhance picture performance, essentially still falling under the LCD category.

The recently launched stacked screen technology upgrades LCD by incorporating a black-and-white liquid crystal layer between the traditional liquid crystal and backlight layers, specifically for light control, thus achieving more precise zoned light control to enhance contrast. However, adding an additional liquid crystal layer theoretically makes the TV thicker and slows down picture display, while the collaborative processing of dual liquid crystals requires manufacturers to invest more effort in TV computing power solutions.

OLED, the common opponent of other technologies

Although the technological solutions differ, the goal of several major technologies is to enhance the display effects with higher contrast and more vivid colors, but this easily leads us to overlook other drawbacks brought by technological advancements.

LCD naturally needs no further explanation, as its display performance is relatively poor, for example, black easily shows color cast, and its inherent limitations in thinness make it difficult to expand, thus becoming the target for replacement by various companies.

Currently, QLED is still largely limited to improvements on LCD and has not escaped the limitations of photonic emission, so its picture performance does not fully unleash its potential. However, in the transitional period, QLED TVs remain a decent choice, though they have not established a price advantage compared to other technologies in the same price range.

Stacked screen technology, as another direction of LCD improvement, exchanges low cost for display effects similar to OLED. However, all of this is built on price advantages, and if its price approaches that of OLED, it will clearly struggle to attract more users.

Compared to the above two solutions, MicroLED’s innovativeness is more pronounced. However, MicroLED still needs to solve two major problems to achieve large-scale production: one is the “mass transfer” technology, and the other is manufacturing costs. Last year, Samsung introduced a 146-inch MicroLED TV with an expected price of $100,000. This means that while MicroLED is promising, it still requires patience.

From the perspective of technological characteristics and industrial maturity, OLED, with its thinness and high contrast display effects, has become the new darling of the panel industry. For example, in the small-screen smartphone sector, OLED panels have already become the mainstream configuration for high-end products.

OLED will rule the world

From the existing production capacity, OLED has the highest probability of unifying the market. This can be gleaned from the production line layouts of manufacturers.

In August of this year, LGD’s 8.5G production line in Guangzhou is about to start production, primarily targeting ultra-high-definition OLED TV large panels with a substrate size of 2200×2500mm, planned monthly capacity of 60,000 pieces. Huaxing Optoelectronics has also set up an 11G production line in Shenzhen, with a planned monthly capacity of 20,000 OLED substrates, which also includes plans for inkjet printing OLED technology capacity.

Currently, large-size OLED production lines are still in the layout and ramp-up phase, resulting in insufficient capacity, which has also led to the high prices of OLED products in the TV sector. In contrast, LCD production lines, due to years of skilled processes and layout, currently have some overcapacity.

In comparison, under conditions of overcapacity, LCD’s price advantage will still allow it to maintain its mainstream market position, extending its lifespan through technologies like quantum dots and stacked screens, allowing LCD to continue for another three to five years without issue. Meanwhile, OLED, limited by capacity, has been making frequent moves in the high-end market, but how to bring product prices down to the mid-range market for accelerated popularity is the most important task for all OLED manufacturers in the future.

On the surface, LCD and OLED are still in a stable tug-of-war pattern, but in reality, the balance of victory has long shifted away from LCD, as all companies are gearing up with new technologies while LCD has almost run out of cards to play. For instance, the inkjet printing OLED technology capable of large-scale production will land next year, with an expected capacity increase of 12 times; Samsung has also announced that MicroLED large-size products are expected to enter the market in 2020. New technologies are continuously advancing, which is good news for the market. For users, in the coming time, how to choose TV products has become very clear—if on a tight budget, stick with LCD TVs for now; if pursuing a high-end experience, bring home OLED immediately.

Undoubtedly, the real showdown in display technology has already begun.