Author: Zhao Xiaofei

Internet of Things Think Tank Original

Ten years ago, Low Power Wide Area Network (LPWAN) entered the industry’s view, initiating a competitive landscape. Although various technologies emerged, the 3GPP camp and the LoRa camp ultimately dominated, covering most low-power wide-area connection scenarios. The former includes representative technologies such as NB-IoT and LTE-M, while the latter provides services to users through the LoRaWAN specification launched by the LoRa Alliance and various manufacturers’ proprietary LoRa protocols.

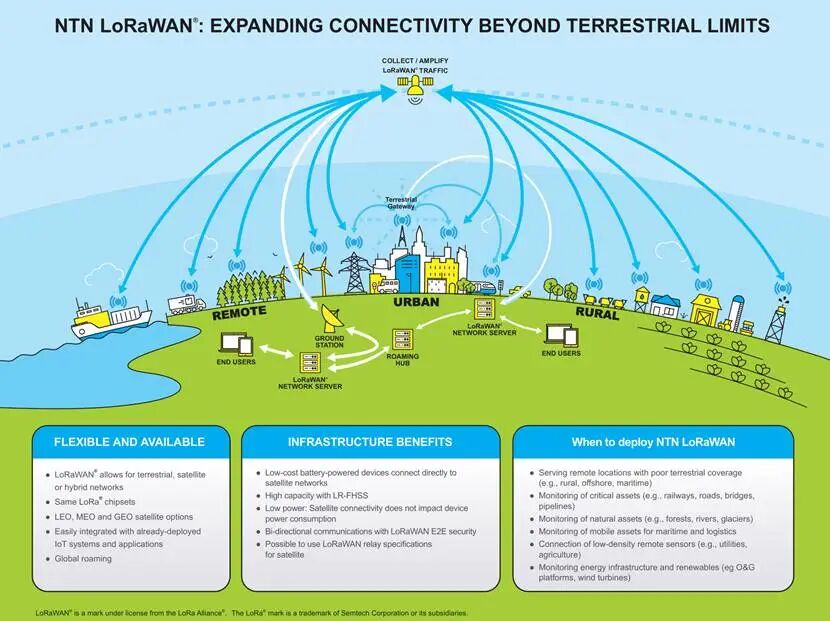

Today, non-terrestrial networks (NTN), represented by satellite communication, have become a hot area for the Internet of Things. Through satellite IoT, ubiquitous connectivity solutions are provided to previously underserved areas. During the development of satellite IoT, the 3GPP camp and the LoRa camp meet again, continuously advancing commercialization with their respective technical systems. Currently, satellite IoT is still in its infancy, with no other LPWAN camps joining this time, mainly focusing on the competition between NB-IoT and LoRaWAN in the sky.

The LoRa Camp’s Long-standing Expansion into Satellite IoT

As early as 2018, supporters of the LoRa camp were exploring the possibilities of using LoRa for satellite IoT applications. In a verification test, a LoRa receiver captured signals from low Earth orbit satellites. At that time, LoRa technology received widespread global support and had performed outstandingly in dozens of LPWAN technology competitions. The successful verification of satellite IoT boosted the confidence of the LoRa camp to further expand its influence.

In February 2022, the LoRa Alliance announced that the LoRaWAN protocol supports LR-FHSS (Long Range Frequency Hopping Spread Spectrum) functionality. At the same time, LoRa chip manufacturer Semtech announced that LoRa chips support LR-FHSS, significantly enhancing network capacity and anti-interference capabilities through software upgrades of LoRa chips and gateways, enabling low-power, reliable direct communication from sensors to satellites.

In 2024, three members of the LoRa Alliance have begun commercializing NTN LoRaWAN, namely EchoStar Mobile, Lacuna Space, and Plan-S.

Lacuna Space was the first to evolve LoRaWAN from a terrestrial technology to NTN technology, achieving large-scale coverage of LoRaWAN satellite IoT and forming commercial services. A typical case is the service provided for the pollution monitoring project of the River Taff in Wales, where the river spans 120 kilometers, passing through many villages and valleys, with several areas lacking terrestrial communication coverage. The use of satellite IoT can fill this gap.

EchoStar Mobile provides IoT and mobile satellite services in Europe and plans to offer related services in the United States. The company has shared cases of asset tracking, precision agriculture, maritime connectivity, wildfire detection, and critical infrastructure monitoring, among which wildfire detection has achieved real-time data triggering immediate action. One of the company’s clients won a significant award at this year’s Mobile World Congress for its wildfire prevention solution, recognizing it as the best mobile innovation for climate action. EchoStar also provides seamless connectivity through dual-mode services, allowing IoT devices to automatically switch between networks based on availability in both satellite and terrestrial bands.

Plan-S, a company based in Turkey, collaborated with a Turkish energy company on a smart meter monitoring case, reading smart meters in remote areas with poor GSM coverage, reducing meter reading costs by 25% and lowering the total carbon footprint by 50%. Reducing field visits also enhances worker safety by decreasing the likelihood of accidents in remote areas.

The LoRa Alliance has multiple committees and working groups to support NTN LoRaWAN, with its technical committee, satellite working group, and regulatory working group continuously working to enhance and advocate for LoRaWAN capabilities to support satellite connectivity.

Of course, NTN LoRaWAN also faces various challenges, one of the most significant being radio frequency. LoRaWAN technology operates in unlicensed ISM bands, and when introducing LEO (Low Earth Orbit) satellites, satellite communication also operates in unlicensed bands. One of the main advantages of unlicensed ISM bands is easy access and low cost, but there are also many drawbacks, a typical drawback being susceptibility to interference. Additionally, licensed bands are still subject to regulatory constraints, such as restrictions on downlink usage in some countries. One of the tasks of the LoRa Alliance’s satellite working group is to focus on achieving interoperability between unlicensed and licensed bands, advocating for the inclusion of licensed bands to address the needs for reliable, large-scale satellite IoT deployment.

The 3GPP Camp Builds a Strong Ecosystem for 5G IoT NTN

Organizations within the 3GPP camp continue to promote the formulation and commercialization of NTN standards, achieving significant results, and the supporter base of the 3GPP camp is growing.

As early as the R15 standard research phase, NTN was included in the research scope, and 3GPP released a technical report exploring the feasibility of NR supporting NTN, defining deployment scenarios and related network architectures for NTN, and conducting preliminary research on communication models including supported frequency bands and terminal devices. In the R16 phase, 3GPP organized research on NTN system solutions, including requirements for core networks, access networks, and terminal capabilities, defining NTN networking architecture and discussing enhanced requirements for various protocols and interface protocols, laying the foundation for development.

In the R17 phase, 5G NTN made substantial progress, with 3GPP officially launching the formulation of NTN specification versions based on previous research accumulation, achieving version freeze in June 2022. The R17 research on NTN covers standard formulation in aspects such as radio access networks, bearer networks, core networks, and terminals, forming two directions: NR NTN and IoT NTN for broadband access and narrowband IoT scenarios, marking the official start of the integrated development of NTN and 5G.

In the R18 phase, 3GPP is promoting further enhancements to NTN, particularly for IoT NTN, employing mobility enhancement technologies to study improvements in access and mobility management functions to support discontinuous coverage. The R19 version research focuses on on-board regeneration modes, enhancing research on new satellite communication scenarios.

After the R17 freeze, many satellite communication operators quickly embraced 3GPP standards and launched related services. Innovative satellite operators such as Globalstar, Skylo, Sateliot, and OQ Technology are supporters of the 3GPP camp’s IoT NTN, while established satellite manufacturers like Iridium have also initiated IoT NTN projects.

In February 2024, five well-known satellite operators, including ViaSat, Terrestar Solutions, Ligado Networks, Omnispace, and Yahsat, launched the Mobile Satellite Services Association, which will focus on building unified global standards and rules. Notably, this association has specifically mentioned 3GPP standards on multiple occasions, indicating that 3GPP NTN standards have become the most focused global unified standard for the organization. For example, in a press release, the association stated that it would promote the expansion of 3GPP standards to cover mobile network operators and OTT service providers, also mentioning that its spectrum has certain advantages, including the ability to promote existing satellite networks to immediately provide NB-IoT services and advance 5G NR services, fostering a D2D ecosystem composed of solution providers.

Additionally, Starlink, owned by Elon Musk, plays an important role, as its technology roadmap will significantly impact satellite IoT. According to Starlink’s official website, the company announced that it will launch IoT services in 2025, which will not require hardware changes and will be compatible with existing LTE Cat 1, LTE Cat 1 bis, and LTE Cat 4 modules. This service from Starlink stems from the company’s collaboration with U.S. operator T-Mobile in the cellular network space, allowing Starlink to leverage T-Mobile’s LTE bands without requiring changes to LTE terminals.

Satellite communication services using 3GPP camp technology will be able to leverage the large ecosystem of standardized products and components in the cellular communication field, providing technology suppliers with opportunities for rapid expansion and compatibility among devices. At the same time, it can effectively utilize the cellular communication industry chain and user base to quickly expand the user base of space-based networks, thereby spreading the costs of building, maintaining, and promoting integrated terrestrial and space networks. The 3GPP camp has promoted the global proliferation of mobile communications for many years, possessing a broad “mass base” that is unmatched by other communication technology camps, relying on this advantage to expand its influence in the NTN field.

The author previously stated in the article “Satellite IoT: A Luxurious Business, Limited Connectivity, Crowded Track” that the number of satellite IoT connections accounts for only 0.1% of the total IoT connections. Although the value of each satellite IoT connection is high, the limited number of connections keeps the market size of this field at a certain level. IoT Analytics predicts that by 2026, the annual market size of satellite IoT will reach $1 billion, which will be divided among many operators providing satellite IoT connection services, making this track seem somewhat “crowded”.

However, we must fully recognize that satellite IoT is an indispensable field in the IoT market, with many application services yet to be explored beyond connectivity and communication. Satellite IoT connectivity and communication are fundamental, while the various data obtained through it have unique value, and various scenarios can expand richer services. Therefore, both the 3GPP camp and the LoRa camp are resolutely investing various resources to layout NTN business, and perhaps in the future, innovations targeting satellite IoT data and scenario services will form new business models. This time, the competition between NB-IoT and LoRa is in the “sky”; we look forward to seeing what kind of market structure will emerge in the future.