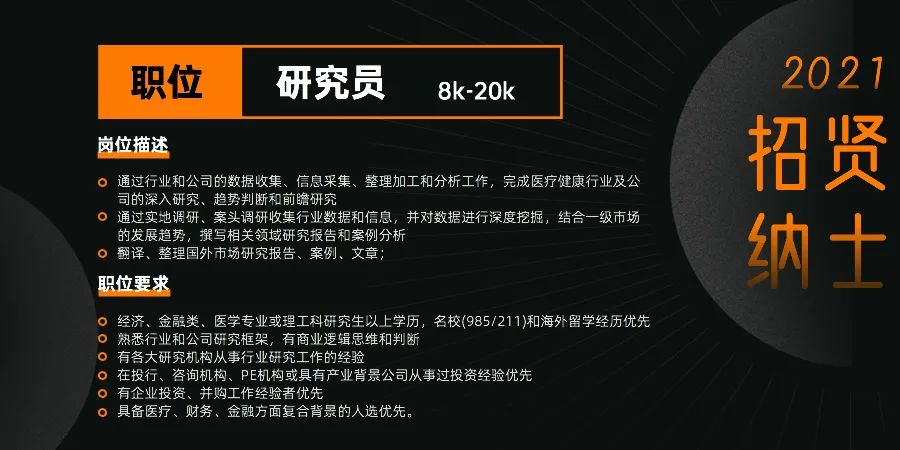

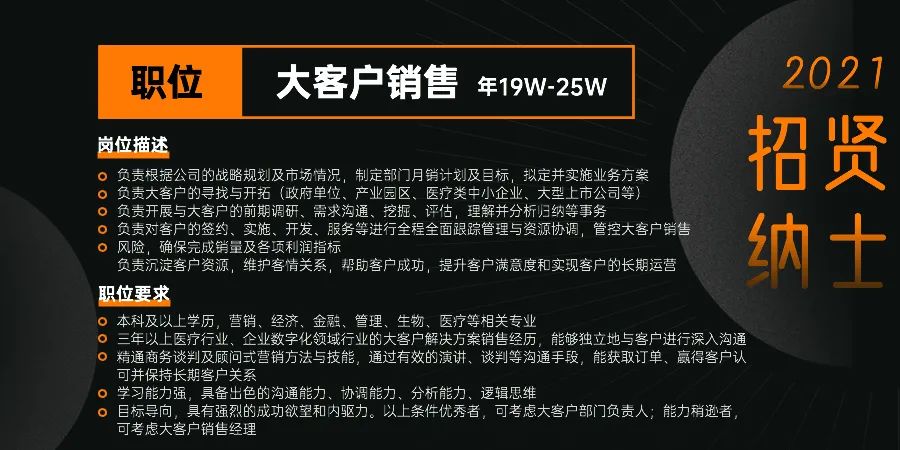

On October 1, 2020, the American medical device company Pulmonx went public on NASDAQ under the ticker symbol LUNG, with an offering price of $19, raising over $200 million. As of February 3, 2021, Pulmonx’s stock was over $58 per share, giving the company a total market capitalization of over $2 billion.

Founded in 1998, Pulmonx is a commercial-stage medical technology company. Currently, Pulmonx generates revenue primarily through the Zephyr Endobronchial Valve, an interventional device used for minimally invasive treatment of severe emphysema patients.

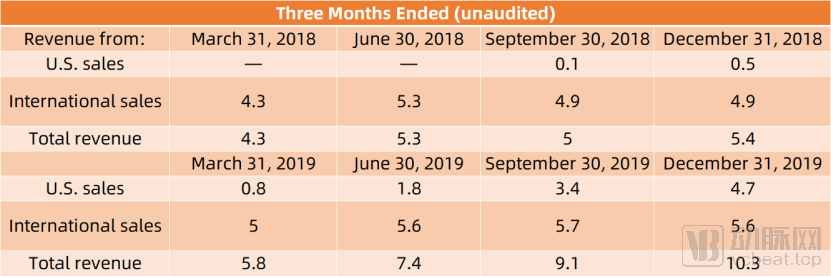

According to information from Pulmonx’s official website, its revenue was $20 million in 2018, with a gross margin of 61.4%, and $32.6 million in 2019, with a gross margin of 68.8%. In the first half of 2020, Pulmonx generated $12.29 million in revenue, slightly down from the previous year due to the pandemic.

(Data source: Pulmonx official website)

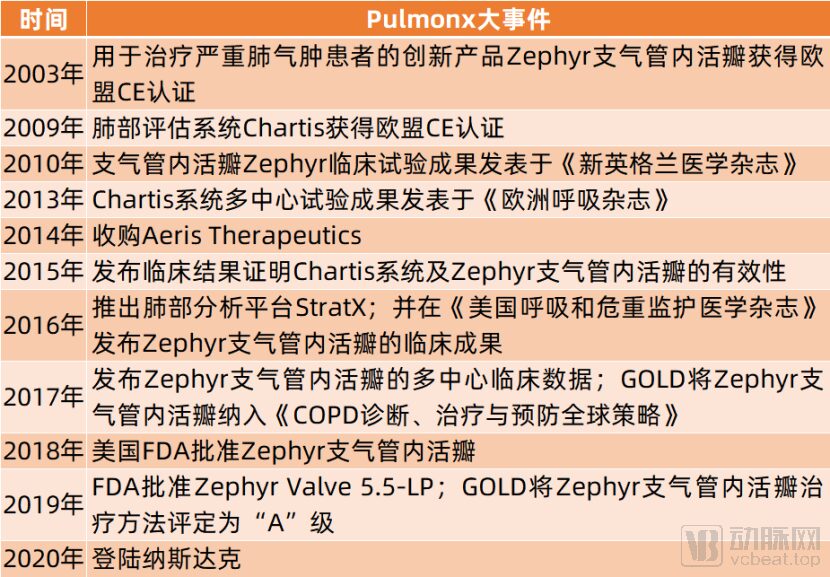

From its founding to its listing on NASDAQ, Pulmonx has gone through 12 years. During these 12 years, Pulmonx has focused on the research and promotion of the Zephyr Endobronchial Valve and has launched supporting lung assessment systems and lung analysis platforms.

Pulmonx Timeline:

(Source: Organized by Artery Network)

How did Pulmonx achieve over $30 million in revenue and a market value of over $2 billion with just one product? What is the industry in which Pulmonx operates? How does Pulmonx’s sales model work? How does Pulmonx conduct market promotion? How does Pulmonx capture the global market?

To address these questions, Artery Network has conducted an in-depth analysis of Pulmonx’s market, product features, sales strategies, promotional strategies, and development history, forming this article to provide insights for domestic entrepreneurs.

Core Insights

1. The minimally invasive treatment market for emphysema is approximately $12 billion, presenting significant market opportunities;

2. Minimally invasive interventional treatments are becoming a trend, with over a hundred clinical trials demonstrating safety and efficacy;

3. Promote market awareness through scientific journals, academic conferences, and relevant guidelines;

4. Mature markets profit through direct sales, while non-mature markets expand through distributors;

5. Focus on healthcare systems and insurance companies to reduce patient costs and increase penetration;

Disruptive Innovation to Capture a $10 Billion Market

Emphysema refers to the reduction of elasticity in the airways at the distal ends of the lungs, such as the respiratory bronchioles, alveolar ducts, and alveoli, leading to excessive air retention and lung volume increase. Emphysema and chronic bronchitis are two manifestations of chronic obstructive pulmonary disease (COPD), with most COPD patients having both conditions.

Research shows that emphysema has a high prevalence and mortality rate, posing significant health risks. According to Pulmonx’s prospectus, in 2019, there were approximately 8.5 million patients with severe COPD in developed markets globally. Among patients with severe COPD, about 3.2 million have severe emphysema.

Pulmonx states: “Among the 3.2 million severe emphysema patients, approximately 1.2 million are suitable for the Zephyr Endobronchial Valve.” This represents a global market opportunity of about $12 billion.

In treatment, doctors can choose between medication or surgical options based on the severity of emphysema. Traditional medical treatment for emphysema mainly involves smoking cessation and inhaled medications, while severe emphysema patients may require bronchodilators and corticosteroids to alleviate dyspnea symptoms. However, some severe emphysema patients still experience breathlessness despite medical treatment, severely affecting their quality of life.

Surgical treatment refers to lung volume reduction surgery, where doctors remove severely emphysematous lung lobes to reduce lung volume in those areas, improving the elasticity of the remaining lung tissue and enhancing lung function. However, due to poor lung function, the 90-day postoperative mortality rate ranges from 3% to 19%, with a serious complication rate of 59%, and the surgery is invasive, making it difficult for patients to endure. Another surgical option is lung transplantation, but this carries high risks, low success rates, potential rejection, and a lack of suitable donors, making it difficult to popularize.

Therefore, there is an urgent clinical need for a safe and effective solution. After extensive research, Pulmonx has launched the Zephyr Endobronchial Valve. Clinical specialists can implant the Zephyr valve via the nasal or oral route using a bronchoscope into the hyperinflated lung tissue, allowing gas and secretions to be expelled while preventing gas inhalation, leading to the atrophy of hyperinflated lung tissue and effective function of healthy lung tissue.

Pulmonx explains that each severe emphysema patient typically requires four Zephyr valves to block the affected lung areas. Compared to surgical treatments for emphysema, this minimally invasive technique has fewer complications, faster recovery, and the Zephyr valve can be removed, making it safer.

(Image of Zephyr Endobronchial Valve, from Pulmonx official website)

Multiple clinical studies show that the use of the Zephyr Endobronchial Valve for treatment does not require surgery, has minimal trauma, allows for quick recovery, effectively reduces lung volume, and has fewer complications, making it a safe and effective disruptive solution. To identify suitable patients for the Zephyr valve, Pulmonx has developed the Chartis lung assessment system and the StratX lung analysis platform.

Pulmonx states: “The vast majority of our revenue comes from the Zephyr Endobronchial Valve, while the Chartis system generates little revenue, and the StratX platform is provided free to identify patients eligible for Zephyr valve treatment.”

As of now, Pulmonx has collaborated with clinical experts in various countries to publish over 100 articles in renowned journals such as The Lancet, New England Journal of Medicine, and American Journal of Respiratory and Critical Care Medicine, all demonstrating that compared to medication alone, patients treated with the Zephyr valve show statistically and clinically significant improvements in lung function, exercise capacity, and quality of life.

Based on relevant clinical results, the Zephyr Endobronchial Valve has been included in multiple emphysema treatment guidelines. The authoritative organization in the emphysema field, GOLD, included the Zephyr valve in its treatment guidelines in 2017 and updated it to Class A (best level) in 2020 based on clinical evidence.

In June 2018, based on Pulmonx’s innovation, the FDA approved the Zephyr Endobronchial Valve. Prior to that, the Zephyr valve had received CE certification in the EU in 2003. As of June 30, 2020, the Zephyr valve has been marketed in over 25 countries, with over 80,000 valves used to treat more than 20,000 patients.

Six Strategies to Expand Global Market: Lessons for Domestic Medical Device Export

As of now, Pulmonx has marketed the Zephyr Endobronchial Valve in over 25 countries, achieving over $30 million in annual revenue from a single product. Analyzing Pulmonx’s sales strategies will provide valuable lessons for domestic medical device exports.

First, Pulmonx compared the economic development and regulatory situations globally and initially registered the Zephyr valve in the EU, receiving approval in 2003. Subsequently, Pulmonx conducted extensive multi-center multinational clinical trials in the EU and leveraged clinical expert resources to publish impactful journal articles and participate in academic conferences to educate the market.

Second, Pulmonx entered various national or global emphysema treatment guidelines based on clinical data evidence and applied for medical device registration certificates in each country. Through global emphysema guidelines, Pulmonx’s Zephyr valve product became well-known among clinical doctors in various countries. At this point, Pulmonx collaborated with local clinical experts to conduct clinical trials and published the results in prominent medical journals, achieving a win-win situation while educating the market.

Third, Pulmonx identified high-demand regions and collaborated with leading hospitals to create a win-win marketing approach among hospitals, doctors, and patients: Pulmonx worked with emphysema doctors and hospitals to establish emphysema centers, guiding doctors in patient selection and treatment using the Zephyr valve. This way, patients receive better treatment options, doctors gain more growth opportunities, and hospitals obtain new revenue sources, achieving a three-way win. Additionally, Pulmonx collaborated with emphysema centers to establish referral pathways between primary hospitals, emphysema rehabilitation centers, and emphysema centers, providing accessible treatment options for patients in need and enhancing patient awareness of the Zephyr valve treatment through direct marketing efforts. It is important to note that the Zephyr valve treatment requires experienced physicians, and establishing emphysema centers helps train more doctors, expand the local market, and promote Zephyr valve sales.

Fourth, Pulmonx continuously educates the market, increasing awareness of the Zephyr valve among patients, doctors, media, medical associations, nursing institutions, and pulmonary rehabilitation centers. Additionally, Pulmonx has published clinical data in scientific journals and shared clinical results at industry conferences to educate the market.

Fifth, Pulmonx has built its own sales team, and when the Zephyr valve is included in local healthcare insurance, the sales team directly negotiates with hospitals for supply. Moreover, Pulmonx also collaborates with distributors to expand the global market, and when the market matures, Pulmonx’s direct sales team will replace the distributors. This approach is based on the consideration that distributors help expand international markets, while the direct sales team can maintain high profit margins. Pulmonx primarily focuses on direct sales, supplemented by distributors, achieving both high profits and rapid market expansion.

Sixth, Pulmonx is fully committed to integrating the Zephyr valve into healthcare and commercial insurance, reducing patient out-of-pocket costs and increasing the valve’s penetration. Currently, commercial insurance companies Aetna and Humana have included the Zephyr valve in their coverage, while United Healthcare is gradually recognizing the Zephyr valve treatment, and other insurance companies are progressively approving reimbursement for the Zephyr valve treatment costs. In international markets, the Zephyr valve has entered the healthcare systems of countries like Australia, South Korea, and the UK, reducing patient costs for using the product and helping to improve product penetration. Pulmonx estimates that approximately 75% of patients treated with the Zephyr valve benefit from healthcare or commercial insurance, of which 25% use commercial insurance and 50% use healthcare insurance.

Overall, Pulmonx’s strategies can be categorized into three directions: first, obtaining registration certificates through multi-center clinical trials and conducting preliminary market promotion; second, building a sales team and collaborating with distributor teams to achieve high profits while expanding the market; and finally, reducing product usage costs through healthcare and commercial insurance to improve product penetration.

After implementing this comprehensive approach, Pulmonx rapidly occupies the market.

Factors Behind Pulmonx’s Success and Insights for Domestic Entrepreneurs

Through comprehensive analysis, it can be observed that Pulmonx’s success stems from the following four points:

First, selecting an industry with vast market potential, addressing unmet clinical needs, innovatively developing disruptive products, and using clinical data to validate treatment outcomes, gaining recognition from doctors and patients. Additionally, continuous investment in research and development expands product indications or broadens the product line.

Second, leveraging the power of “win-win” collaboration with clinical experts and renowned hospitals, providing them with high-quality projects or additional revenue; incorporating experimental data into relevant disease treatment guidelines to promote market awareness, and continuously educating the market and training doctors; using a direct sales team to achieve high returns while employing distributor teams to expand the market.

Third, considering patients’ needs by integrating products into healthcare and commercial insurance, reducing usage costs and improving penetration.

Fourth, establishing a portfolio of intellectual property and patent strategies to enhance technical barriers.

For domestic enterprises, innovation and research and development are paramount; only by developing disruptive products can they break the existing interest patterns and capture the global market. The high factory price of products is not an issue, as commercial and healthcare insurance can help improve product penetration; establishing a direct sales team is also essential, as it will significantly enhance profit margins.

Finally, it is hoped that this article can provide some inspiration for domestic entrepreneurs.