This article is from the WeChat public account:Semiconductor Industry Observation (ID: icbank), Author: Du Qin DQ, Original Title: “This Country’s Bold Bet on AI Chips”, Cover Image from: Visual China

When mentioning South Korea’s semiconductor industry, one can hardly find another internationally renowned chip company besides Samsung and SK Hynix in recent decades. Especially in the Fabless design sector, South Korea has almost no presence. Statistics show that the top 30 Fabless companies globally occupy about 90% of the market share, while South Korean Fabless companies account for only about 1% of the total market.

However, the emergence of ChatGPT has given a shot in the arm to South Korea’s Fabless industry. As the global semiconductor industry is embroiled in fierce competition for AI chips, the South Korean AI chip startup scene has also become vibrant, with a wave of talent from large tech companies or semiconductor firms starting their own AI chip startups. Meanwhile, in a generally cold investment environment, the AI chip sector in South Korea presents a different picture. Even Sam Altman, the founder of ChatGPT, expressed interest in investing in South Korean startups during his meeting with the South Korean president last year.

Looking at the entire AI chip startup market, there are approximately over 190 companies in the field of artificial intelligence processors, according to incomplete statistics. Notable examples include SambaNova, Cerebras Systems, Graphcore, Groq, Tenstorrent, Hailo, and Mythic, among others. These AI chip companies find it difficult to shake the dominance of industry giants like NVIDIA. What does the future hold for South Korean AI startups?

The Wave of AI Chip Startups in South Korea is Unstoppable

In recent years, South Korean AI chip startups have rapidly emerged like mushrooms after rain. They attract the attention of investors and the market with innovative technologies, disruptive products, and strong teams.

Founded in 2020, Rebellions produces a neural processing unit (NPU) called the ATOM chip, targeting the generative AI inference market and directly challenging NVIDIA. Reports indicate that ATOM’s AI chip performs 1.4 to 3 times better than competitors like NVIDIA and Qualcomm in Global Benchmark tests, garnering widespread attention.

The company’s CEO and co-founder, Park Sung-hyun, previously worked at Samsung’s U.S. research division, Intel, and SpaceX. Rebellions is seen as the most promising competitor to NVIDIA in the field of AI inference in South Korea. According to the South China Morning Post, Rebellions has captured a 30% share of the inference task market in South Korea’s LLM market and holds at least 3% to 5% globally.

Rebellions has received support from several major players in South Korea’s tech industry, including Samsung, KT, and Kakao. The company produces ATOM prototypes through Samsung’s foundry’s “multi-project wafer service,” utilizing Samsung’s 5nm process. It is reported that the chip will also use Samsung’s high-end HBM3E memory chips. ATOM will be the first domestically produced chip in South Korea to support language models at a mass production level. KT, South Korea’s second-largest telecom operator and largest data center company, will be the first customer for Rebellions after ATOM goes into mass production. Park Sung-hyun believes that telecom companies are the ideal customers for AI chips.

Sapeon, a subsidiary of South Korea’s largest telecom company SK Telecom, was spun off from SK Telecom Co. in April 2022 to design AI chips for data centers. Sapeon claims that its X220 is South Korea’s first artificial intelligence processor for data centers. Last year, Sapeon launched the X330 chip, designed specifically for large language models, using TSMC’s 7nm process, which is expected to enter mass production in the first half of this year.

The AI gold rush has also spurred demand for DPU chips. In 2022, Professor Kim Jang-woo from Seoul National University’s Electrical and Computer Engineering department founded the AI chip startup MangoBoost Inc after hiring top engineers from Samsung, Naver, Intel, and Microsoft.

MangoBoost is a data processing unit (DPU) and AI server infrastructure company. The DPU is a favorable market that has emerged during the booming AI market, as AI development has exacerbated device overload and data bottlenecks, and DPUs have great potential in offloading and accelerating servers. With over a decade of DPU research results from university labs, the company quickly gained recognition in the server and data center industry. In November of last year, MangoBoost raised $55 million in Series A funding, which they plan to use to accelerate the development of various DPU products.

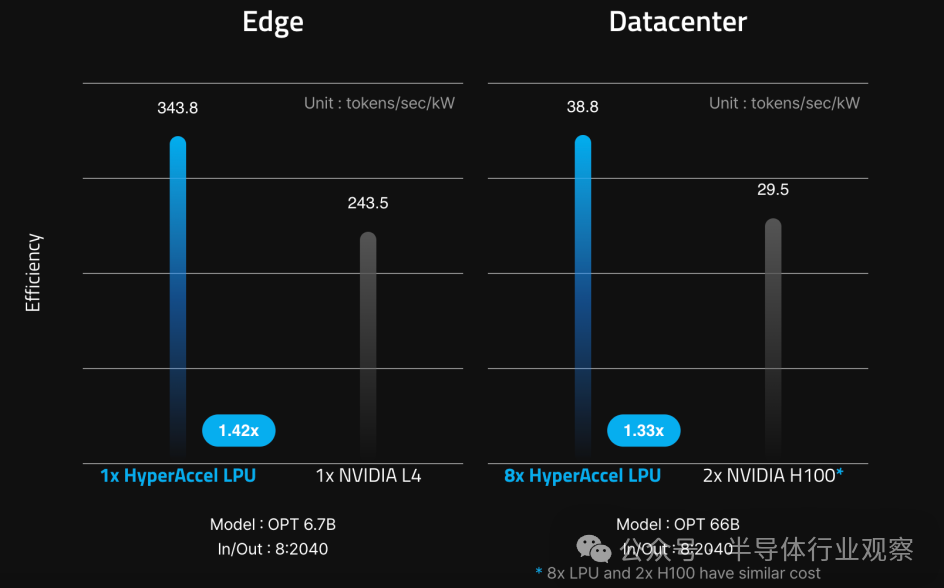

HyperAccel, established in January 2023, primarily develops latency processing units (LPU), which are specifically designed for AI chips based on transformer models. As the name suggests, LPUs are designed to reduce system latency. The company has developed a model parallel technology that efficiently allocates LLMs across multiple LPUs and has developed its own networking technology for data synchronization between LPUs.

Efficiency analysis of HyperAccel LPU compared to GPU platforms (from HyperAccel’s official website)

Efficiency analysis of HyperAccel LPU compared to GPU platforms (from HyperAccel’s official website)

Mobilint is South Korea’s first company to develop smart semiconductor edge-type neural processing units (NPU), founded in April 2019. Within just a year, Mobilint participated in the global AI semiconductor benchmark “MLPerf” and achieved the best results in South Korea, making its technology known worldwide and collaborating with Samsung Electronics, Intel, Google, Microsoft, and NVIDIA to become a founding member of MLCommons (the MLPerf operational community).

In December 2022, they launched their first commercial NPU, “ARIES,” and developed two products equipped with ARIES, “MLA100” and “MLX-A1.” In January of this year, the company secured 20 billion KRW in Series B funding, which will be used for the mass production of the Mobilint AI semiconductor ARIES and the development of the next-generation chip REGULUS. ARIES is about to enter mass production and will serve as Mobilint’s entry into the global AI semiconductor market.

DEEPX is also a South Korean NPU chip startup founded by CEO Lokwon Kim in 2018, who has previously worked at Apple, Cisco Systems, IBM Thomas J. Watson Research Center, and Broadcom. The company recently raised $80 million in Series C funding in early May, more than eight times the $15 million raised in Series B, bringing its valuation to $529 million. This funding will be used for the mass production of the company’s first products DX-V1, DX-V3, DX-M1, and DX-H1. However, the startup currently does not have any customers but is collaborating with over 100 potential clients and strategic partners, including Hyundai Kia Automotive Robotics Lab and South Korean IT company POSCO DX, to test DEEPX’s AI chip capabilities.

FuriosaAI was founded in 2017 by engineers from Samsung, Apple, Qualcomm, AMD, Google, and Amazon, focusing on producing AI inference accelerators. To date, FuriosaAI has attracted over $100 million in investment.

In 2021, the company released its first-generation chip WARBOY (Samsung 14nm) for computer vision and became the first AI chip startup to surpass NVIDIA in MLPerf inference that same year. Their advantage lies in the joint development of hardware and software, and the company has received support from major clients, including South Korea’s largest internet company Naver, with ASUS servers also utilizing their WARBOY cards. In 2024, the company will release its second-generation chip for large language model inference, RNGD, which uses TSMC’s 5nm process and incorporates HBM3, offering eight times the performance of the first-generation AI chip Warboy.

In July 2022, FuriosaAI appointed former Intel Vice President Bill Leszinske as a senior advisor. Leszinske has over 30 years of experience in product planning and marketing, including a key role in driving revenue growth for Intel’s SSD business. After leaving Intel, he also joined the AI chip startup Groq.

It is evident that most of South Korea’s AI chip startups are targeting the generative AI market. These companies are innovating in various fields, from neural processing units to latency processing units, from data center design to smart semiconductor edge processors, each exploring new boundaries for AI chip applications, aiming to carve out a place in the AI market.

Opportunities and Challenges: Can South Korean AI Chip Startups Break Through?

It must be said that the establishment of these AI chip startups presents significant market opportunities. We are currently at the peak of AI development, and customers do not want to be monopolized by a single AI chip company; both traditional chip companies and startups want to share the pie.

Deloitte predicts that the market for dedicated chips optimized for generative artificial intelligence will exceed $50 billion by 2024, accounting for two-thirds of all AI chip sales that year. Deloitte also forecasts that total AI chip sales will account for 11% of the projected global chip market size of $576 billion in 2024. By 2027, along with other AI-supporting chips, they may account for half of the total semiconductor sales value.

AI development is still in its infancy, and currently, all training and almost all generative AI inference are completed using the same data center generative AI chips. However, over time, a significant portion of generative AI inference may be completed on edge processors. These could be smaller GPUs, CPUs, or new dedicated integrated circuits, potentially from existing generative AI chip companies or new entrants to the market, thus providing development opportunities for startups.

Government support is also a crucial aspect. In the context of AI and electrification development trends, the South Korean government has begun to pay attention to Fabless companies and is striving to develop a local industrial chain. In terms of AI chips, South Korea aims to increase the market share of domestic AI chips in local data centers from nearly zero to 80% by 2030, achieving localized supply.

Semiconductors are a vital pillar of South Korea’s export-oriented economy. In March, chip exports reached a 21-month high of $11.7 billion, accounting for nearly one-fifth of the country’s total exports. South Korea aims to surpass memory chips and become one of the top three AI countries globally. Therefore, the South Korean government announced plans to invest $6.94 billion in the AI sector over the next three years by 2027. Additionally, the government stated it would establish a 14 trillion KRW (approximately $10 billion) fund to help domestic AI chip manufacturers develop. It is clear that South Korea is making a significant bet on AI.

Not only in the generative AI field, but according to South Korean media BusinessKorea, the South Korean government is actively promoting new R&D projects, including the development of AI chips for autonomous vehicles, aiming to surpass American semiconductor giant NVIDIA. The “Second Strategic Planning and Investment Committee,” composed of representatives from research institutions and universities, has approved 62 new R&D projects for 2025, including flagship projects and roadmaps across more than 11 fields. South Korea is developing autonomous driving chips with performance ranging from tens to 300 TOPS.

Although many AI chip startups have emerged in South Korea, they still face numerous challenges:

First, AI chip R&D requires substantial financial investment, which poses a significant challenge for startups. Although these AI chip companies have secured some funding, the chip industry is capital-intensive, as evidenced by several well-known AI chip companies in the industry.

Second, the AI or generative AI chip market is highly competitive, and there is a long way from product development to actual large-scale commercialization. South Korean AI chip startups need to gain advantages in technology, products, and costs to stand out in the competition.

Finally, talent is crucial; the semiconductor industry is plagued by a shortage of skilled workers. Currently, these AI chip startups in South Korea are all actively recruiting talent. The emergence of these AI chip startups will help attract the return of talent to South Korea. Although South Korea is a major player in memory chips, the country has a considerable number of AI talents.

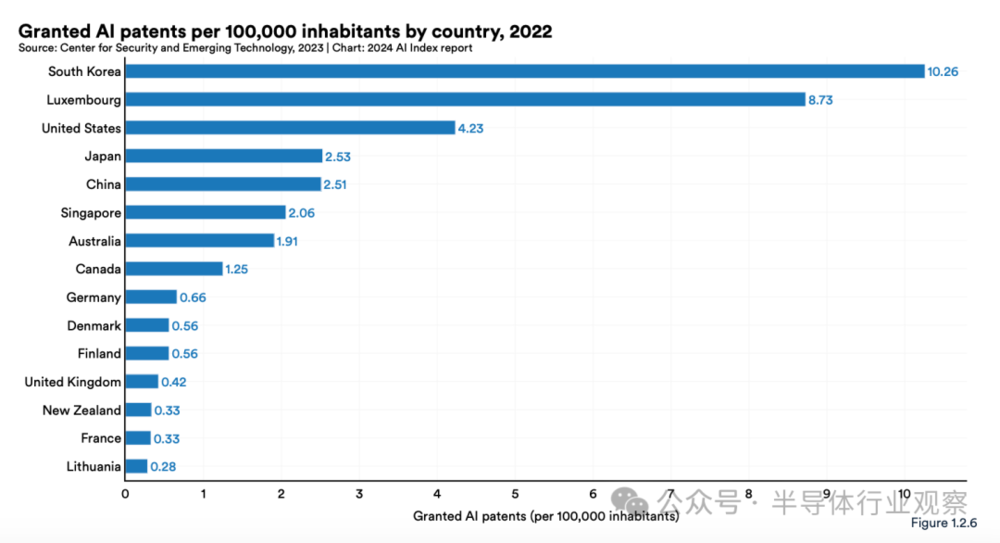

According to the “2024 AI Index” report released by Stanford University on April 15, South Korea leads the world with 10.26 AI-related patents per 100,000 people (Figure 2) and ranks third globally with a density of AI workforce at 0.79%. Despite these strong competitive indicators in the field of artificial intelligence, the country is facing the challenge of increasing talent outflow. According to 2023 data, South Korea has a net outflow of AI talent of -0.30 per 100,000 people (Figure 3), indicating that the number of AI talents leaving the region exceeds those entering.

Figure 2: AI patent authorizations per 100,000 residents in various countries in 2022, Source: 2024 AI Index Report, Stanford University

Figure 2: AI patent authorizations per 100,000 residents in various countries in 2022, Source: 2024 AI Index Report, Stanford University

Conclusion

South Korean President Yoon Suk-yeol stated: “Just as we dominated the world with memory chips over the past 30 years, we will write a new semiconductor myth with AI chips in the next 30 years.” Whether South Korea’s ambitions can be realized remains uncertain, but one fact is clear: the rise of these AI chip startups has injected new vitality into South Korea’s semiconductor industry.

This article is from the WeChat public account:Semiconductor Industry Observation (ID: icbank), Author: Du Qin DQ

This content represents the author’s independent views and does not reflect the position of Huxiu. Unauthorized reproduction is prohibited; for authorization matters, please contact [email protected]. If you have any objections or complaints regarding this article, please contact [email protected].

End

Want to gain knowledge? Follow Huxiu’s video account!